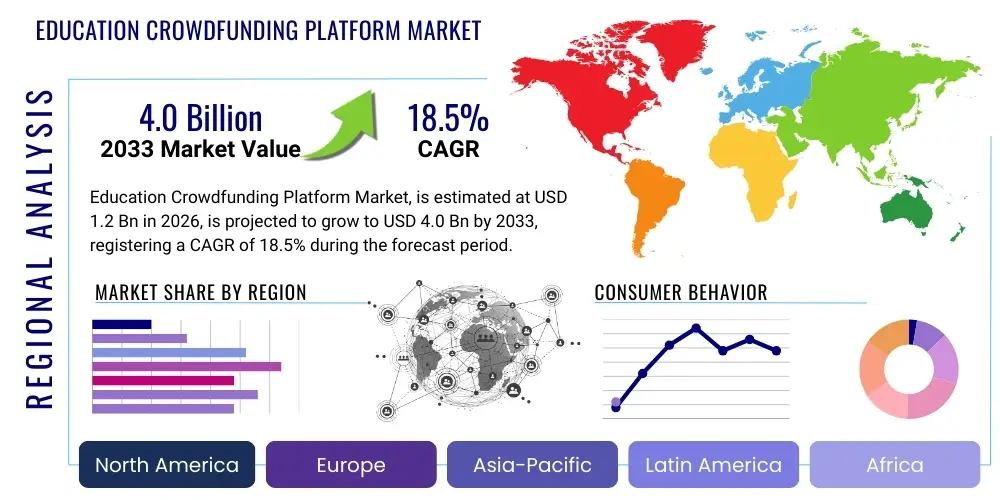

Education Crowdfunding Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436353 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Education Crowdfunding Platform Market Size

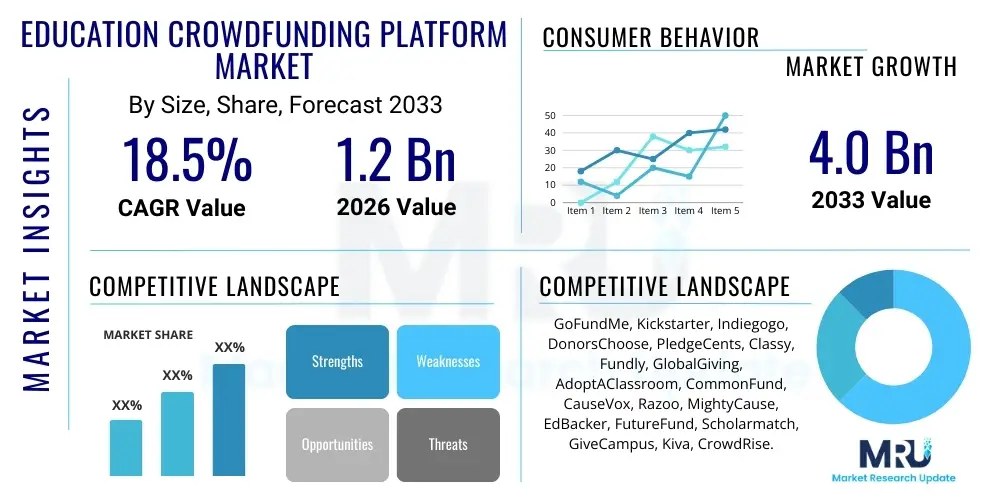

The Education Crowdfunding Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Education Crowdfunding Platform Market introduction

The Education Crowdfunding Platform Market encompasses specialized digital platforms designed to connect students, educators, schools, and educational projects with donors, investors, and community funders. These platforms facilitate financial resource mobilization for various educational needs, ranging from tuition and scholarships to classroom supplies, technology upgrades, and infrastructure development. The primary product offering is a secure, transparent, and user-friendly digital marketplace that streamlines the fundraising process, leveraging social networks and digital payment gateways to maximize reach and efficiency. The core functionality includes campaign creation tools, payment processing, donor management systems, and accountability mechanisms, often utilizing storytelling and multimedia elements to maximize funding success. The inherent structure of these platforms fosters community engagement and democratizes access to educational funding, bypassing traditional, often complex, bureaucratic financing routes.

Major applications of these platforms span across K-12 schooling, higher education institutions (universities and colleges), and vocational training centers. In K-12, platforms are heavily utilized by teachers for classroom projects, materials, and field trips, whereas in higher education, they primarily support student scholarships, research initiatives, and specialized department equipment. The versatility of the funding models—which often include reward-based, donation-based, and increasingly, equity-based models for education-tech startups—drives their widespread adoption. These digital environments provide verifiable impact tracking, offering donors clear visibility into how their contributions are being utilized, thus fostering sustained trust and commitment within the funding ecosystem. The increasing reliance on digital financial solutions and the global rise in education costs have positioned these platforms as critical supplementary funding avenues.

Key benefits driving the market growth include enhanced financial accessibility for underserved communities, increased transparency in fund allocation, and the ability for small, localized projects to gain global exposure. The platforms reduce the financial barriers to education for students facing economic hardship and enable institutions to quickly pilot innovative educational technologies or curriculum changes without lengthy capital planning cycles. Furthermore, these platforms serve as powerful marketing tools for institutions, strengthening alumni relations and community ties through shared investment in educational outcomes. The market is propelled by strong socioeconomic drivers, including rising student debt levels globally, the rapid digital transformation of academic institutions, and supportive governmental policies encouraging private sector and philanthropic involvement in education financing.

Education Crowdfunding Platform Market Executive Summary

The Education Crowdfunding Platform Market is undergoing a rapid evolutionary phase, characterized by significant business model diversification and heightened focus on niche educational verticals. Business trends indicate a shift towards hybrid funding models, integrating traditional donation campaigns with impact investing and microloan features, particularly within the higher education sector for workforce development programs. Key market players are prioritizing partnerships with corporate entities and foundations (B2B2C model) to secure larger, recurring funding pools, enhancing platform stability and scalability. Geographically, while North America and Europe currently dominate the market share due to robust digital infrastructure and established philanthropic cultures, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by large, unmet educational funding needs and widespread mobile penetration, necessitating localized language and payment solutions. Platform differentiation is increasingly achieved through the deployment of advanced data analytics tools that help project creators optimize their campaigns for specific donor demographics, thereby improving success rates and overall platform efficacy, a crucial factor in maintaining user loyalty and competitive advantage.

Regional trends highlight distinct funding priorities: North America emphasizes K-12 classroom projects and student debt relief initiatives, whereas European platforms focus significantly on research grants and cross-border academic mobility programs, often aligning with EU funding directives. In developing economies within APAC and MEA, the primary emphasis remains on basic infrastructure—such as access to digital devices and fundamental schooling supplies—and scholarships tailored for economically disadvantaged students. Segment trends reveal that the P2P (Peer-to-Peer) model remains the most prevalent, especially for individual student funding, though institutional crowdfunding platforms are registering the fastest revenue growth as universities seek efficient ways to fund capital projects and endowment goals. Technology integration, specifically incorporating blockchain for enhanced transactional transparency and AI for personalized donor matching, is becoming a prerequisite for market leadership, signaling a maturation of platform technologies from simple donation portals to complex financial management ecosystems.

The overall market trajectory is highly optimistic, supported by sustained high demand for education globally and the proven effectiveness of digital fundraising methods. Challenges persist, notably regulatory inconsistencies across different jurisdictions concerning financial transactions and donor protections, but these are being mitigated by proactive industry self-regulation and standardized vetting processes. The market structure remains fragmented, offering significant opportunities for specialized platforms that cater to underserved markets, such as vocational training or specialized STEM education funding. Strategic imperatives for stakeholders revolve around establishing trust through stringent vetting, offering diverse payment options including cryptocurrency, and providing sophisticated reporting mechanisms that demonstrate tangible educational impact. This sustained innovation across business models, geographic scope, and technological integration underscores the market's strong potential for exceeding current growth projections throughout the forecast period.

AI Impact Analysis on Education Crowdfunding Platform Market

User inquiries regarding AI's impact on the Education Crowdfunding Platform Market predominantly center on efficiency, personalization, and security. Common questions involve how AI can improve campaign success rates, whether machine learning can accurately predict funding feasibility, and how AI-driven tools ensure ethical donor engagement and minimize fraudulent campaigns. There is a strong expectation that AI should revolutionize donor-project matching, moving beyond basic demographic data to contextualized behavioral insights, thereby increasing conversion rates and donor retention. Users are keenly interested in the deployment of automated verification systems (for student/institution status) and personalized communication tools that maintain the human element essential for philanthropic appeals while leveraging algorithmic efficiency. The underlying theme is leveraging AI to scale trust and transparency within a highly personalized and emotion-driven fundraising domain.

- AI-Driven Campaign Optimization: Utilizing machine learning algorithms to analyze historical campaign data, identifying optimal funding targets, duration, and persuasive language for specific educational niches, significantly improving success prediction accuracy.

- Personalized Donor Matching: Implementing AI to segment donors based on philanthropic history, stated interests, and real-time social media activity, enabling hyper-personalized outreach and suggesting highly relevant projects, maximizing donation conversion.

- Fraud Detection and Vetting: Deploying natural language processing (NLP) and behavioral analytics to flag suspicious campaign narratives, inconsistent financial claims, or unusual donation patterns, enhancing platform security and maintaining donor trust.

- Automated Content Generation: Using generative AI to assist educators in drafting compelling, high-quality campaign narratives, summaries, and impact reports, reducing the burden on non-professional writers.

- Chatbot and Customer Support: Integrating AI-powered chatbots to provide instant responses to FAQs for both project creators and donors, streamlining the onboarding process and improving overall user experience 24/7.

- Dynamic Fee Structures: Analyzing market conditions and project viability using AI to implement flexible or tiered platform fee structures, potentially reducing costs for high-impact educational initiatives.

DRO & Impact Forces Of Education Crowdfunding Platform Market

The dynamics of the Education Crowdfunding Platform market are shaped by a potent combination of digital reliance and structural economic needs. The core drivers include the escalating global cost of education, which renders traditional financing inaccessible to vast populations, coupled with the ubiquity of digital payment systems and social media, which lower the barriers to entry for fundraising. Restraints primarily involve the inherent challenges associated with maintaining donor confidence, notably the risk of fraudulent campaigns and the high platform fees that can significantly reduce the net proceeds for educational projects. Opportunities are vast, focused on integrating specialized technologies like blockchain for immutable transparency and expanding into underserved regions (Africa and Latin America) where financial needs are acute but digital adoption is accelerating. These forces collectively dictate the pace of market expansion, requiring platforms to continuously innovate on security, user experience, and measurable impact reporting to sustain growth and overcome inherent financial trust issues.

The positive impact forces are heavily concentrated around the shift in educational philanthropy, moving away from large, centralized endowments towards decentralized, community-driven micro-donations. This democratization of funding allows for rapid response to localized educational needs—such as providing specialized equipment immediately after a school identifies a requirement—a speed impossible to achieve through governmental budgeting cycles. Conversely, powerful restraint forces include legislative uncertainty regarding digital asset handling and cross-border fundraising compliance, which imposes significant operational complexities on platforms attempting global reach. The market equilibrium is defined by the platforms' ability to navigate this regulatory landscape while simultaneously delivering a compelling, emotionally resonant, and verifiable fundraising experience that encourages recurring participation from a global donor base, proving that the transaction is not merely financial but centered on social impact investment.

In terms of opportunities, the market is poised to capitalize on the increasing trend of corporate social responsibility (CSR) programs looking for high-impact, traceable investment vehicles; crowdfunding platforms offer precisely this level of transparency and documentation. The integration of gamification elements and social sharing incentives further amplifies the organic reach of campaigns, functioning as a low-cost, high-return marketing mechanism. Impact forces such as rapid urbanization and the continuous global push for universal quality education ensure that the demand side remains robust. However, the market must constantly combat the inertia of traditional fundraising methods and overcome the "crowdfunding fatigue" experienced by donors exposed to a high volume of requests across various platforms. Success hinges on demonstrating unique value propositions, specialized educational focus, and a superior trust framework built on verifiable outcomes and clear financial accountability.

Segmentation Analysis

The Education Crowdfunding Platform market is systematically segmented based on Platform Type, Funding Goal, and End-User, providing a granular view of specific market dynamics and investment pockets. Analyzing these segments is crucial for stakeholders to identify high-growth areas, particularly the rapid adoption of institutional platforms by universities and the sustained dominance of the K-12 sector in terms of campaign volume. Platform Type segmentation highlights the shift from generic fundraising sites to specialized educational portals offering tailored features like curriculum integration tools and teacher-specific tax documentation. Funding Goal segmentation reveals the increasing focus on technology integration and specialized vocational training, indicating a shift from purely infrastructural needs towards skills-gap addressing initiatives. This structural differentiation allows market players to optimize their service offerings and pricing models according to the specialized needs of their target demographic, ensuring higher campaign conversion rates and stronger alignment with educational policy objectives.

- Platform Type:

- Peer-to-Peer (P2P) Crowdfunding

- Institutional Crowdfunding (University/School specific)

- Hybrid Platforms

- Donation-Based Platforms

- Equity-Based Platforms (primarily for EdTech startups)

- Funding Goal:

- Scholarships and Tuition Fees

- Classroom Projects and Supplies (K-12 focus)

- Technology and Equipment (STEM Labs, devices)

- Infrastructure and Capital Projects

- Research and Development Grants

- End-User:

- K-12 Institutions (Primary and Secondary Schools)

- Higher Education Institutions (Universities, Colleges)

- Vocational Training and Skill Development Centers

- Individual Students and Educators

Value Chain Analysis For Education Crowdfunding Platform Market

The value chain for Education Crowdfunding Platforms begins with upstream activities focused heavily on platform development and technological infrastructure. This phase involves software architects and developers creating secure, scalable, and user-friendly interfaces, integrating robust payment gateways, and developing proprietary algorithms for donor matching and fraud detection. Key upstream suppliers include cloud service providers (AWS, Azure), payment processors (Stripe, PayPal), and specialized cybersecurity firms. The quality and reliability of these upstream inputs directly influence the trust factor and operational efficiency of the platform. Successful upstream management involves securing resilient digital infrastructure capable of handling large volumes of transactions and traffic peaks during major funding drives, ensuring minimal downtime and regulatory compliance from the foundational level.

Midstream activities constitute the core value proposition: campaign management, marketing, and community building. Platforms invest heavily in content creation tools, multimedia support, and social sharing integration to amplify campaign visibility. Vetting processes for educational legitimacy and financial accountability are critical midstream operations, requiring expert human oversight alongside automated screening. The distribution channel is predominantly direct, utilizing proprietary web and mobile applications as the primary interfaces. Indirect channels involve partnerships with educational organizations, foundations, and educational technology aggregators who promote the platform to their networks, widening the pool of both project creators and potential donors. Efficient midstream execution hinges on balancing sophisticated technology with personalized community management and effective communication strategies.

Downstream activities focus on fund disbursement, impact reporting, and donor relations management—crucial elements for ensuring repeat donations. Once a campaign is successful, the platform facilitates the secure transfer of funds to the verified educational entity or individual. Accurate and timely reporting on the utilization of funds and the resulting educational impact is paramount, providing transparency that sustains the long-term viability of the platform. This downstream feedback loop, supported by CRM systems, solidifies the platform’s reputation as a reliable intermediary, completing the value cycle by turning one-time donors into loyal, recurring supporters committed to specific educational outcomes. Optimization across the entire value chain, from secure technology (upstream) to verifiable impact (downstream), is essential for sustained competitive advantage.

Education Crowdfunding Platform Market Potential Customers

The potential customer base for Education Crowdfunding Platforms is inherently diverse, spanning individual students seeking tuition assistance to major research universities aiming for multi-million dollar capital projects. The primary end-users or buyers fall into three main categories: institutional entities (schools, colleges, universities), individual educators (teachers, professors), and individual students/learners. Institutional customers leverage these platforms to supplement budgetary shortfalls, fund specific departmental needs, or launch targeted alumni engagement campaigns. Individual educators are often the most frequent users, primarily seeking funds for classroom necessities, field trips, or integrating innovative teaching technologies that are not covered by standard school budgets. The platform must cater to these varying needs by offering flexible campaign structures, tailored documentation requirements, and integrated tax receipt generation suitable for institutional, educator, and individual philanthropic donors.

A significant subset of potential customers includes specialized training organizations, vocational schools, and burgeoning EdTech startups. These entities utilize crowdfunding not just for funds but also for market validation and early adopter engagement, particularly when employing equity-based crowdfunding models. The donor base—the financial buyers—includes alumni networks, community members, philanthropic foundations, and corporate social responsibility (CSR) departments. Platforms must excel at targeting and converting these varied donor segments, recognizing that corporate donors require formalized, scalable partnership agreements and robust impact metrics, while individual donors seek emotional resonance and transparent, small-scale impact. Successful platforms act as sophisticated intermediaries, translating educational need into compelling investment opportunities for a global audience of philanthropists and social investors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GoFundMe, Kickstarter, Indiegogo, DonorsChoose, PledgeCents, Classy, Fundly, GlobalGiving, AdoptAClassroom, CommonFund, CauseVox, Razoo, MightyCause, EdBacker, FutureFund, Scholarmatch, GiveCampus, Kiva, CrowdRise. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Education Crowdfunding Platform Market Key Technology Landscape

The technological architecture underpinning the Education Crowdfunding Platform Market is multifaceted, relying primarily on advanced web and mobile application development frameworks combined with robust financial technology (FinTech) solutions. Essential technologies include secure API integration for connecting third-party payment processors, cloud computing infrastructure (SaaS model adoption) for scalable hosting, and advanced database management systems capable of handling large volumes of user data and transaction records while maintaining strict privacy standards (GDPR, CCPA compliance). User experience (UX) and user interface (UI) design focused on mobile responsiveness and intuitive campaign creation workflows are critical competitive differentiators. Furthermore, the reliance on social media APIs is pervasive, enabling seamless sharing and leveraging network effects to drive funding success, turning simple platforms into viral fundraising instruments embedded within the digital ecosystem.

Emerging technologies are rapidly shaping the future landscape, with blockchain technology being perhaps the most disruptive innovation. Blockchain integration addresses the primary market constraint: trust and transparency. By leveraging distributed ledger technology, platforms can provide immutable, verifiable records of every donation and subsequent expenditure, ensuring funds are used precisely as intended and dramatically reducing the scope for fraud. Smart contracts are being utilized to automate fund disbursement contingent upon predefined milestones, such as successful project completion or student enrollment verification. Additionally, the increasing deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is transforming operational efficiency, optimizing donor-campaign matching, personalizing outreach, and automating compliance checks, thereby maximizing the return on marketing spend and enhancing regulatory adherence across different global jurisdictions.

Data analytics remains a cornerstone technology, enabling platforms to provide deep insights into donor behavior, campaign performance, and regional funding disparities. Predictive analytics help institutions forecast fundraising potential, adjust their strategies in real-time, and identify potential high-value donors. Furthermore, specialized security technologies, including multi-factor authentication, advanced encryption standards (AES-256), and continuous monitoring systems, are vital given the sensitivity of financial and personal data handled by these platforms. The strategic adoption of these sophisticated technologies—from secure cloud hosting to transparent blockchain tracking—is crucial for maintaining a competitive edge and ensuring the long-term viability and growth trajectory of educational crowdfunding initiatives.

Regional Highlights

- North America (NA): NA maintains the largest market share, driven by a deeply ingrained culture of philanthropy, high digital adoption rates, and significant structural educational debt. The region benefits from established legal frameworks supporting charitable donations and high consumer trust in digital financial transactions. Key markets like the US dominate, focusing heavily on K-12 classroom funding (e.g., DonorsChoose model) and sophisticated platforms supporting university endowments and alumni giving (e.g., GiveCampus). Innovation centers around utilizing big data analytics for personalized alumni engagement and tackling the student debt crisis through specific crowdfunding initiatives.

- Europe: Europe represents a mature but segmented market, with varied growth rates influenced by national regulatory environments and differing public funding models for education. While public funding is robust in many EU nations, crowdfunding platforms thrive by supporting niche research projects, specialized arts and humanities initiatives, and transnational academic mobility programs. The focus is increasingly on institutional transparency and compliance with stringent data protection regulations (GDPR). The UK, Germany, and the Nordic countries are major contributors, exhibiting strong growth in impact investing linked to educational outcomes.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, characterized by a massive and largely unmet demand for accessible higher education, particularly in emerging economies like India, China, and Southeast Asia. Growth is fueled by rapid urbanization, soaring mobile internet penetration, and the rise of a digitally native population eager to support educational advancement. Platforms in this region prioritize scholarships, basic school infrastructure, and digital literacy initiatives. Challenges include navigating diverse regulatory landscapes and establishing trust in newly emerging digital financial systems, often necessitating strong local partnerships and mobile-first platform designs.

- Latin America (LATAM): The LATAM market is growing steadily, propelled by economic volatility and significant funding gaps in public education systems across countries like Brazil and Mexico. Crowdfunding platforms serve as a vital lifeline for vocational training, specialized skill development programs, and access to necessary educational technologies. The market is still nascent, requiring localization strategies that address currency fluctuations and often limited access to formal banking systems, which encourages the adoption of mobile money and local payment gateways.

- Middle East and Africa (MEA): MEA presents significant untapped potential, driven by demographic youth bulges and intense demand for quality education, particularly in STEM fields. Platforms often collaborate with NGOs and international aid organizations to fund large-scale humanitarian and educational projects in conflict-affected or underserved areas. Key barriers include low digital literacy in certain areas and political instability, making the integration of highly secure, resilient, and ethically compliant funding mechanisms paramount for sustainable market entry and operation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Education Crowdfunding Platform Market.- GoFundMe

- Kickstarter

- Indiegogo

- DonorsChoose

- PledgeCents

- Classy

- Fundly

- GlobalGiving

- AdoptAClassroom

- CommonFund

- CauseVox

- Razoo

- MightyCause

- EdBacker

- FutureFund

- Scholarmatch

- GiveCampus

- Kiva

- CrowdRise

- FundRazr

Frequently Asked Questions

Analyze common user questions about the Education Crowdfunding Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Education Crowdfunding Platform Market?

The Education Crowdfunding Platform Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033, driven by increasing digitization and global educational funding gaps, leading to significant market expansion.

How does blockchain technology enhance transparency in education crowdfunding?

Blockchain technology enhances transparency by creating an immutable, distributed ledger that records every donation and expenditure. This ensures verifiable financial accountability, drastically reducing fraud risks and building stronger trust between donors and educational recipients.

Which geographical region is expected to demonstrate the fastest growth in this market?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market due to rapid increases in mobile internet penetration, large unmet educational infrastructure needs, and the accelerating adoption of digital payment solutions across emerging economies.

What are the primary challenges faced by educational crowdfunding platforms?

Key challenges include navigating complex international regulations, combating donor fatigue, maintaining high trust and transparency standards against fraudulent campaigns, and managing the high transaction fees imposed by certain payment processors.

Beyond scholarships, what are the major funding goals supported by these platforms?

Major funding goals extend beyond scholarships to include essential classroom supplies for K-12, specialized STEM equipment, funding for academic research and development grants, and capital expenditure for school infrastructure improvements and technology upgrades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager