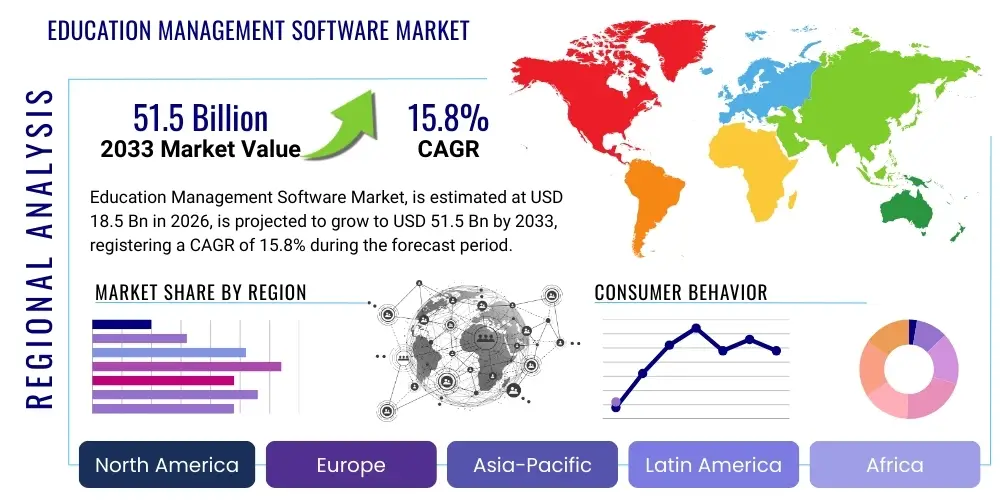

Education Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436789 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Education Management Software Market Size

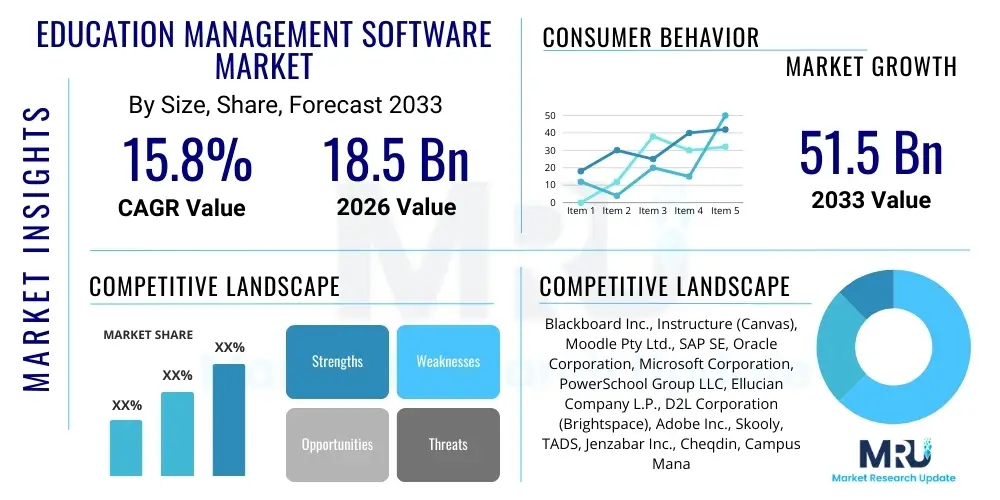

The Education Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 51.5 Billion by the end of the forecast period in 2033.

Education Management Software Market introduction

The Education Management Software (EMS) Market encompasses a diverse and increasingly sophisticated suite of digital tools and integrated platforms explicitly engineered to centralize and optimize operational, administrative, and pedagogical processes within educational institutions globally. These solutions transcend simple data storage, functioning as critical infrastructure that enables seamless digital campus management across K-12 schools, higher education universities, vocational training centers, and corporate learning environments. Core product offerings include comprehensive Student Information Systems (SIS) for managing student lifecycles, advanced Learning Management Systems (LMS) facilitating distance and blended learning modalities, and Enterprise Resource Planning (ERP) systems customized for academic financial and human resource management. The market is currently defined by the shift towards unified platforms that minimize data silos and provide a single source of truth for all institutional stakeholders.

Major applications of EMS extend across the entire educational value chain, encompassing essential functions such as automated course scheduling, complex financial aid disbursement tracking, standardized compliance reporting, and sophisticated student performance monitoring utilizing embedded data analytics. The recent and prolonged global reliance on remote and hybrid education models has served as an unparalleled catalyst, compelling institutions that previously utilized fragmented systems to invest heavily in integrated, resilient cloud-based EMS solutions. This infrastructural modernization aims to ensure business continuity, maintain high educational quality irrespective of physical location, and satisfy the growing expectation from students and parents for intuitive, digitally enriched educational experiences that mirror modern consumer technologies.

Driving factors are inherently tied to efficiency and accountability. Institutions face mounting pressure from accrediting bodies and government agencies to demonstrate operational transparency, necessitating EMS tools capable of generating detailed, auditable reports on resource allocation and academic outcomes. The undeniable benefits derived from adopting advanced EMS platforms include substantial reductions in manual administrative overhead, improved accuracy in institutional data, faster decision-making enabled by actionable insights, and ultimately, an enhanced capacity to focus educator resources on core teaching responsibilities. Furthermore, the industry is witnessing intense demand for personalized learning tools, where EMS acts as the engine for delivering highly individualized academic plans guided by artificial intelligence, thereby driving differentiation and improving learner success rates across diverse demographics.

Education Management Software Market Executive Summary

The strategic landscape of the Education Management Software Market is dominated by rapid technological convergence, characterized by the pervasive adoption of multi-tenant, cloud-native SaaS delivery models, which significantly lowers barriers to entry for smaller educational providers and accelerates vendor innovation cycles. Current business trends illustrate a strategic focus among major players on acquiring specialized vertical solutions—such as advanced assessment tools or alumni engagement platforms—to enhance the breadth and depth of their integrated ERP and SIS offerings. System interoperability remains a crucial competitive differentiator, as institutions demand platforms that can seamlessly communicate and share data with existing ancillary EdTech applications through open Application Programming Interfaces (APIs), thereby protecting prior technology investments and promoting a truly integrated digital learning ecosystem.

Regional market dynamics showcase a complex pattern of maturity and accelerating growth. North America retains its position as the market leader in revenue contribution, attributed to high institutional spending power, a large concentration of leading universities requiring complex academic management systems, and well-established mandates for advanced data security and reporting standards. Conversely, the Asia Pacific (APAC) region is emerging as the undisputed high-growth epicenter. Governments across APAC are actively prioritizing education modernization, often through massive, centrally planned digitalization projects, generating unprecedented demand for large-scale, cost-effective LMS and SIS solutions that are capable of supporting populations numbering in the tens of millions, driving the global CAGR forecast.

Segment-specific trends underscore the dominance of the Learning Management System (LMS) category within the application segment, reflecting the post-pandemic necessity for flexible, hybrid teaching modalities. Within deployment models, the cloud segment is exhibiting explosive growth, projected to capture the vast majority of new institutional spending due to its inherent advantages in agility, automatic updates, and disaster recovery capabilities, making on-premise deployments increasingly niche, typically reserved only for institutions with extremely restrictive security or regulatory environments. End-user analysis highlights accelerating demand from the K-12 sector, shifting from simple administrative tools to comprehensive platforms that integrate academic management with crucial parental outreach and student wellness monitoring components, mirroring the complex demands historically seen only in the Higher Education segment.

AI Impact Analysis on Education Management Software Market

User queries and institutional procurement discussions regarding Artificial Intelligence (AI) in Education Management Software are primarily driven by the search for measurable pedagogical improvement and tangible operational cost savings. A central concern is the transition of EMS from passive data repositories to active, intelligent systems that can guide educational strategy. Users frequently inquire about the reliability of AI algorithms in generating personalized learning pathways that genuinely cater to different cognitive styles and varying levels of background knowledge, moving beyond simple content recommendation. Furthermore, administrators are deeply interested in AI's capacity for workflow automation, specifically quantifying the amount of time saved by educators when routine tasks like marking multiple-choice exams, generating progress reports, or managing student enrollments are handled autonomously by machine learning models, thereby justifying the significant investment required for AI integration within core EMS platforms.

A second, crucial set of inquiries centers on ethical AI implementation, data governance, and the mitigation of algorithmic bias in educational settings. Institutions are cautious about deploying black-box algorithms that could inadvertently perpetuate socio-economic or racial biases in assessment or resource allocation decisions. Consequently, there is strong demand for EMS vendors to provide transparent, explainable AI (XAI) features, demonstrating how predictions regarding student outcomes are reached. The ultimate expectation is that AI integration will fundamentally transform the educator's role, shifting their focus from routine administration and simple instruction to complex mentorship, high-level curriculum design, and critical intervention strategies based on robust predictive data provided by the EMS platform.

- AI-driven personalization: Creation of highly granular, adaptive learning pathways and customized resource recommendations that dynamically adjust based on student interaction and mastery levels.

- Automated assessment and grading: Utilizing natural language processing (NLP) and machine learning for rapid, consistent scoring of open-ended and standardized assignments, significantly enhancing efficiency.

- Predictive analytics: Deployment of sophisticated algorithms to forecast student performance, identify high-risk students, and predict enrollment trends or resource needs with greater accuracy.

- Intelligent chatbots and virtual assistants: Providing 24/7, high-volume support for common academic and administrative inquiries, improving response times and freeing human staff.

- Enhanced data management: AI simplifies the processing, categorization, and contextualization of massive volumes of diverse educational data (structured and unstructured), improving the fidelity of regulatory reporting.

- Curriculum optimization: Machine learning models analyze collective student performance data to pinpoint systemic knowledge gaps, directly informing educators about necessary curriculum revisions and resource reallocation.

- Behavioral monitoring: AI tracks engagement patterns and learning tool usage to provide early warnings regarding potential student disengagement or retention risks.

DRO & Impact Forces Of Education Management Software Market

The Education Management Software Market's robust growth trajectory is primarily propelled by the worldwide necessity for educational institutions to embrace comprehensive digital transformation, driven by shifting pedagogical requirements and heightened operational complexities. Core drivers include extensive governmental support for EdTech investments aimed at expanding access to quality education, the continued proliferation of global distance and hybrid learning necessitating advanced LMS functionalities, and the institutional mandate for greater accountability through standardized data collection and real-time performance analytics. The competitive pressures within the higher education sector, particularly regarding student recruitment and retention, further necessitate investment in sophisticated EMS platforms that offer superior user experience and personalized engagement tools, thereby accelerating market demand for integrated solutions capable of managing the entire student journey from application to alumni status.

Significant restraints impeding market penetration and growth, especially in emerging economies, encompass the substantial initial capital outlay required for large-scale system implementation and the complexities associated with integrating new, sophisticated software with entrenched legacy systems that rely on proprietary, outdated data formats. Furthermore, pervasive concerns surrounding the security and privacy of sensitive student data, particularly in jurisdictions with strict regulations like GDPR and FERPA, necessitate significant compliance burdens on vendors, sometimes delaying adoption. Institutional inertia, characterized by faculty and staff resistance to learning and utilizing new technology platforms, remains a major non-financial barrier that vendors and institutions must address through extensive training and user-centric design approaches to ensure effective deployment and measurable ROI.

Opportunities for exponential market expansion are concentrated in strategic areas such as the rapid growth of the lifelong learning and corporate training segments, where organizations require specialized EMS for upskilling and compliance certification tracking, offering a less saturated revenue stream than traditional academic markets. Technological opportunities abound with the continuous refinement of AI for truly adaptive learning experiences and the integration of blockchain technology for secure, universally verifiable academic credentials, which promises to revolutionize transcript management and professional certification processes. Moreover, focusing on developing highly scalable, regionally compliant SaaS solutions tailored for high-growth, underserved APAC and LATAM markets represents a critical avenue for vendors seeking diversified revenue streams and accelerated long-term volume growth, provided localization requirements are meticulously addressed.

Segmentation Analysis

The segmentation of the Education Management Software market offers a nuanced framework for understanding distinct market demands and vendor specialization, categorized primarily by solution component, deployment methodology, target application, and institutional end-user type. This granular analysis reveals that market expenditure is increasingly bifurcated, focusing heavily on robust, feature-rich software licenses and equally essential high-value services, including complex system integration, data migration, and comprehensive change management consulting, which are critical for maximizing platform utility. The shift toward modular, service-oriented architectures allows institutions to adopt best-of-breed solutions for specific needs, such as dedicated assessment tools, which then integrate seamlessly into a foundational SIS or ERP, moving away from monolithic single-vendor approaches.

Deployment analysis confirms the overwhelming market preference for cloud-based solutions, driven by their superior attributes related to cost-effectiveness, automatic scaling, reduced latency, and rapid deployment cycles, making them the standard offering for virtually all new market entrants and major established vendors. Application segmentation emphasizes the strategic importance of the Learning Management System (LMS) segment, now indispensable for delivering instruction in the post-COVID educational landscape, followed closely by comprehensive Student Information Systems (SIS) which function as the central nervous system for academic and administrative data. The growing sophistication of assessment management tools, which now incorporate advanced analytics and adaptive testing mechanisms, also marks a significant growth area within the broader application spectrum.

- Component: Software (Core platform licensing, Subscription fees), Services (Implementation, Integration, Consulting, Training & Support, Maintenance and Managed Services)

- Deployment: Cloud (SaaS, Private Cloud, Public Cloud), On-Premise (Self-hosted infrastructure)

- Application: Student Information Systems (SIS), Learning Management Systems (LMS), Campus Management Systems (CMS), Student Assessment Management (SAM), Library Management Systems (LMS), Enterprise Resource Planning (ERP) Solutions for Education, Web-based Training and Collaboration Tools

- End-User: K-12 Institutions (Primary and Secondary Schools), Higher Education Institutions (Universities, Colleges, Vocational Schools), Corporate/Professional Training Providers (Businesses, Government Agencies, Non-profit Training Centers)

Value Chain Analysis For Education Management Software Market

The Education Management Software value chain commences with extensive upstream research and intellectual property creation, where vendors allocate substantial R&D budgets toward developing cutting-edge features, particularly in artificial intelligence, robust data security protocols, and mobile platform optimization. Key upstream inputs are derived from specialized technology partners providing cloud hosting infrastructure (IaaS/PaaS providers), advanced database technologies, and specialized content creation tools. Competitive advantage at this initial stage is secured by intellectual capital—the capacity to innovate rapidly, maintain technological leadership, and ensure compliance with stringent international data protection standards, which dictates the quality and foundational security of the final EMS product.

The central phase of the value chain involves core software development, customization, and complex integration services. This midstream activity is often handled by core EMS vendors and their certified, specialized implementation partners. Due to the high degree of customization required to align EMS with unique institutional workflows (e.g., specific grading schemes, regional regulatory mandates), successful deployment relies heavily on expert consultants who manage data migration and integration with ancillary systems like financial software or security access control tools. This stage often represents a significant portion of the total cost of ownership for the customer, emphasizing the necessity for efficient, streamlined implementation methodologies to accelerate time-to-value and minimize institutional disruption.

Downstream activities center on market delivery, distribution, and critical post-sales support. Sales channels are strategically segmented: direct sales teams engage with large universities and enterprise contracts, negotiating long-term enterprise licenses; meanwhile, channel partners, value-added resellers (VARs), and regional distributors handle sales to smaller K-12 districts and localized vocational schools, leveraging their deep understanding of local compliance and procurement processes. The emphasis in the downstream is increasingly shifting towards subscription renewal and customer retention, making proactive technical support, continuous platform updates, and responsive customer success management essential for generating sustained, predictable revenue streams in the highly competitive SaaS environment.

Education Management Software Market Potential Customers

Potential customers for Education Management Software span the entire spectrum of formal and informal educational providers, broadly categorized into K-12 institutions and Higher Education institutions, alongside the burgeoning corporate and professional development sector. K-12 clients (primary and secondary schools) are seeking user-friendly, highly integrated solutions focused on student safety, parental communication, and mandated reporting requirements. Their primary buying criteria center on ease of use, compliance with regional educational standards, and affordability of cloud deployment models that minimize internal IT infrastructure investment. These institutions typically prioritize Student Information Systems (SIS) and simple LMS functionalities that streamline daily teacher workflows and enhance home-school connectivity.

Higher education institutions, including universities, colleges, and community colleges, represent a highly complex customer segment due to their vast operational scope, encompassing research management, large-scale residential services, alumni relations, and diverse academic programs (undergraduate, graduate, professional). These buyers prioritize robust ERP systems, advanced Learning Management Systems capable of handling diverse modalities (synchronous, asynchronous, blended), and integrated financial aid and admissions management tools. Customization, scalability to handle peak enrollment periods, and seamless integration with existing campus technologies are non-negotiable requirements for this demanding segment, necessitating bespoke solutions that handle complex, multi-layered administrative processes with precision.

The corporate and professional training segment represents a rapidly expanding customer base driven by the need for continuous skill development and compliance training (e.g., healthcare, finance). These organizations require sophisticated Learning Management Systems (LMS) specifically tailored for corporate use, often featuring competency tracking, compliance auditing, and integration with human resource information systems (HRIS). This segment values modules that facilitate rapid content creation, mobile accessibility for training on-the-go, and detailed analytics on learning effectiveness and ROI, positioning them as a high-growth area for specialized EdTech vendors moving forward with targeted workforce solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 51.5 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blackboard Inc., Instructure (Canvas), Moodle Pty Ltd., SAP SE, Oracle Corporation, Microsoft Corporation, PowerSchool Group LLC, Ellucian Company L.P., D2L Corporation (Brightspace), Adobe Inc., Skooly, TADS, Jenzabar Inc., Cheqdin, Campus Management Group, Alma Technologies Inc., Focus School Software, Classe365, Educomp Solutions Ltd., iSAMS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Education Management Software Market Key Technology Landscape

The Education Management Software technology ecosystem is primarily defined by the mastery of scalable cloud infrastructure, fundamentally shifting software delivery and consumption models across the sector. Cloud computing, utilizing multi-tenant Software as a Service (SaaS) architecture, offers educational institutions unprecedented flexibility, speed of deployment, and cost efficiency, eliminating the need for expensive, dedicated on-premise hardware and specialized IT staff. This technological shift democratizes access to advanced EMS features, allowing smaller institutions and entire K-12 districts to deploy sophisticated systems rapidly. Furthermore, the reliance on platform-as-a-Service (PaaS) capabilities ensures that vendors can maintain continuous integration and continuous deployment (CI/CD) pipelines, pushing security updates and new features seamlessly to all users, thereby maintaining system modernity and resilience against evolving cyber threats.

Advanced integration technologies, specifically the use of open APIs (Application Programming Interfaces) and a microservices-based approach, are paramount for ensuring EMS platforms act as centralized hubs rather than closed ecosystems. Institutions possess a diverse array of specialized EdTech tools (e.g., lecture capture systems, virtual classroom environments, student counseling platforms), and the EMS must serve as the integration layer, facilitating seamless data flow and single sign-on capabilities. The maturity of data interoperability standards, such as Learning Tools Interoperability (LTI), is critical in this context, ensuring various educational applications can communicate effectively with the core LMS and SIS modules, protecting the integrity and currency of institutional data across all touchpoints.

The rapid incorporation of Artificial Intelligence (AI), Machine Learning (ML), and sophisticated data analytics constitutes the most disruptive technological force. These technologies empower EMS systems to move beyond simple record-keeping into strategic intelligence platforms, generating predictive models for student success, automating personalized interventions, and optimizing resource planning based on anticipated future enrollment and facility utilization. Additionally, blockchain technology is gaining serious consideration for applications related to digital identity management and the secure issuance of academic credentials and diplomas, offering verifiable, tamper-proof records that streamline hiring and higher education admission processes globally, representing a significant long-term technological trend that will shape the market's future security architecture.

Regional Highlights

North America maintains its dominant revenue position in the global Education Management Software Market, driven by a technologically mature infrastructure, significant institutional autonomy regarding technology expenditure, and a highly competitive higher education landscape that necessitates continuous investment in student success and operational efficiency tools. The demand profile in the US and Canada is characterized by a strong preference for comprehensive, full-suite ERP solutions that handle everything from academic planning and research grant administration to complex regulatory reporting, particularly concerning FERPA compliance. Early adoption of cloud infrastructure and advanced analytics by leading universities sets a high technological benchmark, ensuring vendors in this region continually push the boundaries of EMS functionality.

The Asia Pacific (APAC) region stands out for its unprecedented growth potential and is projected to surpass other regions in terms of new license installations, driven by large-scale government-backed initiatives focused on standardizing education quality and expanding digital access across vast, populous countries like India and China. While price sensitivity remains a factor, the sheer volume of users and the need for systems capable of rapid scaling to support massive national student populations ensures high demand for robust, mobile-centric cloud platforms. Vendors targeting APAC must focus heavily on localization, supporting diverse languages and integrating specific national educational frameworks, thereby necessitating tailored software deployment strategies quite distinct from Western markets.

Europe presents a stable yet demanding market, heavily influenced by the General Data Protection Regulation (GDPR), which necessitates robust, auditable data governance features within all EMS platforms. European institutions are keenly focused on solutions that facilitate cross-border academic collaboration and ensure compliance with regional data sovereignty laws. The market exhibits a balanced demand for both open-source solutions (leveraging Moodle widely) and specialized proprietary systems that excel in areas like institutional resource management and precise academic assessment, aligning with national educational objectives focused on skills development and digital literacy across member states. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging as high-potential growth zones, characterized by a leapfrogging effect—adopting modern SaaS platforms directly, often bypassing traditional expensive on-premise solutions entirely, benefiting from increasing digital connectivity and educational reform efforts.

- North America: Market leader by revenue; high adoption of advanced ERP systems in Higher Ed; demanding regulatory environment for data security (FERPA); focus on student retention analytics.

- Asia Pacific (APAC): Highest projected CAGR; fueled by significant state investment in K-12 digitalization; need for high-volume, mobile-first, and localized cloud solutions.

- Europe: Mature and stable market; strong adherence to GDPR and local data residency requirements; significant utilization of blended learning platforms and robust administrative tools.

- Latin America (LATAM): Accelerating SaaS adoption; driven by increasing government investment in public education modernization and improved regional internet infrastructure.

- Middle East & Africa (MEA): Rapid expansion in private education and specialized 'Education City' initiatives; preference for global best-in-class solutions and strong IT infrastructure investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Education Management Software Market.- Blackboard Inc.

- Instructure (Canvas)

- Moodle Pty Ltd.

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- PowerSchool Group LLC

- Ellucian Company L.P.

- D2L Corporation (Brightspace)

- Adobe Inc.

- Skooly

- TADS

- Jenzabar Inc.

- Cheqdin

- Campus Management Group

- Alma Technologies Inc.

- Focus School Software

- Classe365

- Educomp Solutions Ltd.

- iSAMS

Frequently Asked Questions

Analyze common user questions about the Education Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Education Management Software Market?

The primary driving force is the global imperative for educational institutions to achieve comprehensive digital transformation, coupled with the critical need for resilient infrastructure to support the proliferation of hybrid and distance learning models, which necessitates integrated Learning Management Systems (LMS) and centralized Student Information Systems (SIS) for optimized operations and improved student outcomes.

How is cloud computing impacting the deployment strategies for Education Management Software?

Cloud computing, specifically utilizing the SaaS architecture, is fundamentally redefining EMS deployment. It eliminates substantial upfront capital expenditure, drastically reduces institutional IT maintenance costs, and ensures superior scalability, mobility, and automatic feature updates, thereby accelerating mass adoption across educational sectors globally, including budget-sensitive K-12 segments.

Which geographical region is expected to exhibit the highest growth rate in EMS adoption?

The Asia Pacific (APAC) region is projected to experience the highest Compound Annual Growth Rate (CAGR). This exponential growth is underpinned by extensive governmental commitment to digital education infrastructure, the rapid establishment of new private education providers, and the sheer volume of users demanding high-scale, cost-effective digital learning and administrative platforms across key nations like China and India.

What are the key differences between Student Information Systems (SIS) and Learning Management Systems (LMS)?

The SIS functions as the central administrative hub, managing structured student data such as enrollment, transcripts, attendance, and financial aid. Conversely, the LMS is focused on pedagogical delivery, facilitating instructional content sharing, online assessments, collaborative learning activities, and the direct digital interaction required for academic course management.

What role does Artificial Intelligence (AI) play in modern Education Management Software?

AI integration is instrumental in transitioning EMS into proactive intelligence platforms. It enables granular personalization of academic content, automates labor-intensive tasks like grading and scheduling, and employs predictive analytics to identify students requiring early intervention, thereby significantly enhancing pedagogical effectiveness and optimizing institutional resource utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager