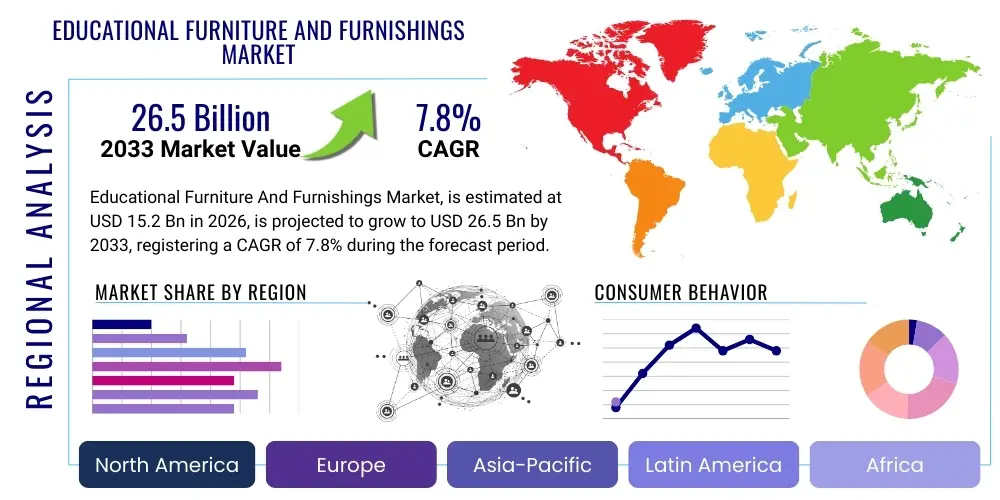

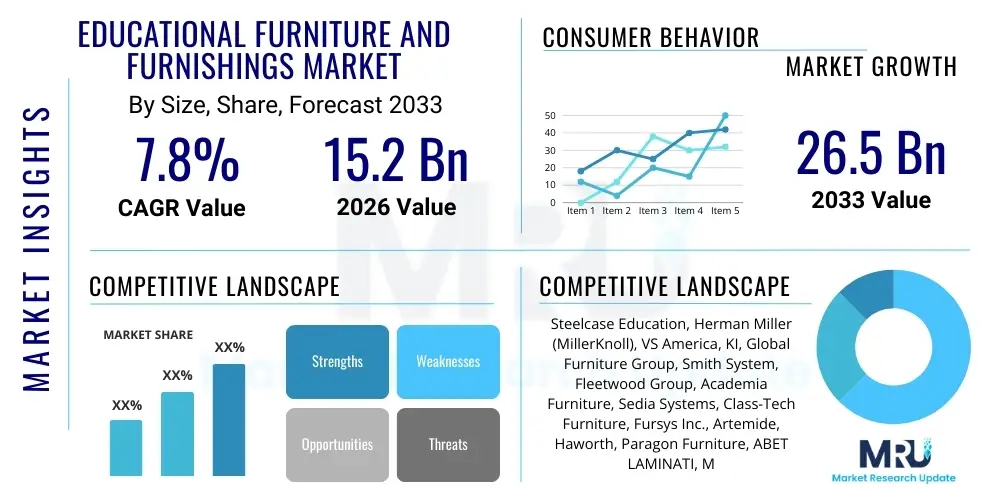

Educational Furniture And Furnishings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438642 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Educational Furniture And Furnishings Market Size

The Educational Furniture And Furnishings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 15.2 billion in 2026 and is projected to reach USD 26.5 billion by the end of the forecast period in 2033.

Educational Furniture And Furnishings Market introduction

The Educational Furniture and Furnishings Market encompasses the design, manufacturing, and distribution of specialized equipment tailored for various learning environments, spanning K-12 institutions, higher education facilities, and vocational training centers. These products range from standard classroom essentials like desks, chairs, and whiteboards to advanced, ergonomic, and technology-integrated solutions such as adjustable height desks, modular seating arrangements, and interactive learning stations. The primary objective of modern educational furnishings is to create flexible, safe, and engaging spaces that support diverse pedagogical approaches, including collaborative learning, individual focus, and project-based instruction. The transition away from traditional, rigid classroom layouts towards dynamic, multi-functional spaces is a key characteristic defining this market's evolution.

Major applications of educational furniture extend beyond primary classrooms to include specialized laboratories, libraries, administrative offices, dormitories, and common areas. Key benefits driving market demand include improved student concentration through ergonomic design, enhanced space utilization via modular systems, and increased adaptability to integrate new educational technologies, such as interactive flat panels and virtual reality tools. Driving factors for growth are primarily centered on increasing global enrollment rates, particularly in developing economies, coupled with substantial government and private sector investment in modernizing aging educational infrastructure across developed nations. Furthermore, the growing awareness among educational administrators regarding the correlation between physical learning environment quality and academic performance is fueling the adoption of premium, research-backed furnishing solutions.

Educational Furniture And Furnishings Market Executive Summary

The Educational Furniture and Furnishings Market is experiencing robust growth fueled by transformative shifts in pedagogy and substantial global infrastructure investments. Current business trends indicate a strong move toward customization, where manufacturers are offering bespoke solutions that cater specifically to project-based learning models and specialized STEM curricula. Sustainable materials and circular economy principles are rapidly gaining prominence, driven by institutional commitments to environmental, social, and governance (ESG) criteria. The integration of Internet of Things (IoT) sensors into furniture for asset tracking and usage monitoring is emerging as a critical competitive differentiator, allowing institutions to optimize space and maintenance schedules, thereby ensuring operational efficiency and maximizing infrastructure return on investment.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely due to high population density, rapid establishment of new educational institutions, and significant public spending on curriculum upgrades, particularly in countries like China and India. North America and Europe, while mature, maintain high market shares driven by replacement cycles, stringent ergonomic standards, and the consistent demand for technologically integrated furniture solutions for higher education and corporate training centers. Segment trends highlight the dominant position of the K-12 sector, though the higher education segment is showing accelerated growth in demand for flexible, collaborative spaces such that encourage interdisciplinary interaction. Furthermore, the seating and desk segment, particularly ergonomic and height-adjustable variants, continues to hold the largest product share, reflecting the foundational importance of individual student comfort and long-term health in the learning environment.

AI Impact Analysis on Educational Furniture And Furnishings Market

Users frequently inquire whether AI-driven educational software necessitates a complete overhaul of physical classrooms or if furniture design will evolve to actively facilitate AI integration. Common concerns revolve around the obsolescence of fixed furniture layouts when learning becomes highly individualized and adaptive through AI platforms, and the potential need for specialized furniture that supports advanced computational activities and prolonged use of digital devices. The key expectation is that AI will necessitate "smart" furniture—pieces that are not only flexible but also capable of data collection, environment sensing, and seamless connectivity, turning the physical classroom into an extension of the digital learning management system. Users are looking for assurances that future furniture investments will remain relevant in an increasingly AI-centric educational ecosystem.

The analysis indicates that AI will not render physical furniture obsolete but will fundamentally change its function and form factor. AI-driven personalized learning requires furniture that supports various modes of instruction simultaneously—from one-on-one tutoring (often screen-based) to small group collaborative problem-solving. This necessitates highly modular, lightweight, and easily reconfigurable furniture systems that can adapt in minutes, not hours. Furthermore, AI analytics focused on student engagement and movement (e.g., through wearable devices or embedded sensors) will inform optimal classroom layouts, driving demand for data-rich furniture that provides real-time feedback on utilization, acoustics, and environmental comfort, ultimately optimizing the learning experience based on empirical data derived through intelligent systems.

- AI drives demand for modular, lightweight, and easily reconfigurable furniture systems.

- Integration of IoT sensors into furniture supports AI-driven utilization tracking and space optimization.

- Furniture design shifts to accommodate specialized technology needs, such as enhanced cable management and power delivery for high-density computing devices.

- Predictive maintenance schedules for furniture and fittings become possible using AI analysis of wear and tear data collected via embedded sensors.

- AI analytics influence ergonomic design iterations, tailoring furniture specifications to improve student posture and focus based on extensive usage data.

DRO & Impact Forces Of Educational Furniture And Furnishings Market

The market dynamics are defined by a confluence of accelerating drivers and constraining factors, balanced by significant opportunities that shape strategic planning for manufacturers and distributors. A major driver is the increasing global emphasis on STEM (Science, Technology, Engineering, and Mathematics) education, which requires dedicated, specialized furniture like lab benches, maker-space tables, and sophisticated storage solutions for complex equipment. This emphasis is often backed by significant governmental funding initiatives focused on updating curricula and physical infrastructure to meet 21st-century workforce demands. Additionally, the replacement of traditional, aging inventory in established markets (North America and Western Europe) provides a sustained baseline demand, while emerging markets benefit from continuous greenfield investments in new schools and universities.

Restraints primarily include the high initial capital expenditure required for premium, ergonomic, or technologically integrated furniture, making adoption slow in budget-constrained public school systems, particularly in developing regions. Furthermore, the cyclical nature of public sector budgeting and procurement processes often leads to prolonged decision-making timelines and volatile demand. Opportunities, however, are abundant, particularly in the shift toward eco-friendly and sustainable products, where institutions are willing to pay a premium for certified materials and low-VOC (volatile organic compound) finishes. The impact forces are characterized by moderate supplier power due to standardized production processes for basic furniture but high buyer power, especially in large centralized purchasing consortiums. Competitive rivalry is intensifying as global players expand their geographic footprint and focus on innovation in flexible and smart furniture designs, differentiating themselves through superior durability, aesthetics, and technological integration capabilities.

Segmentation Analysis

The Educational Furniture and Furnishings Market is extensively segmented based on product type, material, end-user, and distribution channel, providing a granular view of market dynamics and specialized demand centers. The complexity of segmentation reflects the diverse needs across different educational levels and institutional requirements, ranging from kindergarten-appropriate durable plastic furniture to sophisticated, electrically controlled laboratory environments in research universities. Understanding these segments is crucial for manufacturers aiming to tailor their product offerings, marketing strategies, and material sourcing to maximize effectiveness within specific niche markets, such as specialized segments dedicated to special needs education or vocational training.

Segmentation is increasingly influenced by the concept of learning zones rather than just rooms, prompting product types like modular seating, mobile whiteboards, and integrated charging stations to gain prominence. By end-user, the K-12 segment dominates volume, driven by large enrollment bases, though the higher education segment leads in terms of complexity and average transaction value, due to the requirement for highly specialized and durable research-grade equipment and advanced collaborative spaces. Material segmentation shows a trend towards combining traditional wood/laminates with metals for structural integrity and high-grade plastics for mobility and reduced weight, all while adhering to stricter environmental and safety standards globally.

- By Product Type:

- Seating (Chairs, Stools, Benches, Collaborative Seating)

- Desks & Tables (Individual Desks, Collaborative Tables, Adjustable Height Desks, Lab Tables)

- Storage Units (Lockers, Shelving, Filing Cabinets, Cubbies)

- Specialized Furnishings (Whiteboards, Interactive Boards, Library Shelving, Dormitory Furniture)

- By Material:

- Wood and Wood-Based Composites

- Plastics and Polymers

- Metal (Steel, Aluminum)

- Others (Fabric, Glass)

- By End-User:

- K-12 (Primary and Secondary Education)

- Higher Education (Universities and Colleges)

- Pre-Schools and Day Care Centers

- Vocational Training and Corporate Learning Centers

- By Sales Channel:

- Direct Sales (Institutional Procurement)

- Distributors/Retailers (Online and Offline)

Value Chain Analysis For Educational Furniture And Furnishings Market

The value chain for educational furniture begins with upstream activities focused on raw material sourcing, predominantly timber, metal alloys, laminates, and various polymers. Efficiency at this stage is critical, with manufacturers increasingly prioritizing sustainable forestry certifications (e.g., FSC) and reliable supply lines for specialized components like electronic actuators for adjustable desks and high-durability surface materials. Key upstream challenges include managing commodity price volatility and ensuring compliance with regional safety and material standards, such as fire ratings and toxicity limitations. Strong relationships with specialized component suppliers, particularly for technologically integrated furniture, are essential for maintaining a competitive edge in product innovation and quality control.

Midstream activities involve core manufacturing, assembly, and quality assurance. This stage is characterized by investment in automated machinery to achieve economies of scale and sophisticated quality control processes to ensure products meet rigorous institutional durability and ergonomic requirements. The downstream segment focuses heavily on distribution and installation, which is complex due to the large scale of institutional orders, the need for customized layouts, and demanding installation schedules, often during school breaks. Distribution channels are generally bifurcated into direct sales for major public and private university projects and indirect channels utilizing authorized dealers and specialized educational supply retailers for smaller institutions or replacement orders. Effective logistics and specialized installation services are crucial differentiators in maintaining strong relationships with end-user institutions and securing repeat business within this value chain.

Educational Furniture And Furnishings Market Potential Customers

The primary customers in the Educational Furniture and Furnishings Market are institutional buyers who manage large-scale procurement cycles and adhere to specific budgetary and compliance requirements. These customers encompass public and private educational bodies across all levels, from early childhood to post-graduate studies. For K-12 institutions, the buying decision is often centralized at the district or governmental level, prioritizing durability, safety certifications, and standardized design for bulk orders. Conversely, higher education institutions, particularly research universities, prioritize specialization, technology integration, and flexible design to support advanced research and collaborative student living and learning spaces, often leading to higher specification and customization demands.

A significant emerging customer base includes corporate training centers and vocational schools, driven by the continuous need for workforce reskilling and specialized technical instruction, particularly in industries undergoing rapid technological change. These customers often seek commercial-grade furniture that mimics professional office environments while maintaining the adaptability required for instructional settings. Furthermore, residential dormitories and student housing developers constitute a specialized segment, requiring highly durable, space-saving, and aesthetically pleasing furniture solutions that balance student comfort with institutional maintenance ease. Manufacturers must tailor their sales pitches and product portfolios to address the distinct purchasing timelines, quality thresholds, and budgetary constraints unique to each customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 26.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Steelcase Education, Herman Miller (MillerKnoll), VS America, KI, Global Furniture Group, Smith System, Fleetwood Group, Academia Furniture, Sedia Systems, Class-Tech Furniture, Fursys Inc., Artemide, Haworth, Paragon Furniture, ABET LAMINATI, MooreCo Inc., Izzy Furniture, Biofit Engineered Products, SICO America, Scholar Craft. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Educational Furniture And Furnishings Market Key Technology Landscape

The technological evolution of educational furniture is rapidly moving beyond simple mechanical adjustments to incorporate sophisticated digital and electronic components, redefining the interaction between students, instructors, and the physical space. A primary technological trend involves the deployment of integrated power and data solutions, where desks and tables are equipped with seamless charging ports (both wired and wireless), integrated cable management systems, and built-in network connectivity hubs. This is essential for supporting the ubiquitous use of laptops, tablets, and specialized robotics equipment in modern classrooms. Furthermore, manufacturers are focusing on durable, non-porous, and anti-microbial surface technologies, leveraging advanced composite materials and innovative laminates to improve hygiene and longevity, crucial factors in high-traffic educational environments.

The emergence of "Smart Furniture" represents the cutting edge of technology integration. This includes the use of Internet of Things (IoT) sensors embedded within seating and desks to monitor usage patterns, occupancy levels, and ergonomic adjustments. This data is critical for facilities management to optimize room scheduling, energy consumption (by linking occupancy to lighting/HVAC systems), and understand the efficacy of different learning configurations. Another vital technology involves advanced actuator systems used in electric height-adjustable desks and modular wall systems, allowing quick, silent, and effortless transformation of learning spaces to switch between lecture, collaborative, and lab modes, maximizing the flexibility and utility of expensive educational real estate. These technological advancements position furniture as an active, rather than passive, component of the educational ecosystem.

Regional Highlights

- North America: North America holds a substantial share of the global market, characterized by high adoption rates of advanced, ergonomic, and technology-integrated furniture solutions, especially within higher education and well-funded private K-12 institutions. The region benefits from stringent ADA (Americans with Disabilities Act) compliance standards and a strong focus on student welfare, driving consistent demand for specialized and accessible furniture. Replacement cycles are critical here, often spurred by institutional rebranding initiatives and a continuous drive toward creating dynamic, flexible spaces that mimic corporate innovation hubs. Furthermore, significant investment in STEM and maker spaces across the United States and Canada drives demand for high-specification laboratory and industrial-grade furnishings, maintaining high average selling prices in this mature but innovation-focused market.

- Europe: The European market is defined by a strong emphasis on sustainability, durability, and superior Scandinavian design principles, particularly in Northern and Western Europe. Procurement decisions are heavily influenced by environmental certifications (e.g., EU Ecolabel) and long product lifecycles, favoring high-quality materials and modular design that can be easily repaired or repurposed. Germany, the UK, and France are the largest markets, driven by modernization projects in public schools and vocational training institutes seeking to align physical spaces with modernized curriculum delivery. The trend towards activity-based learning necessitates furniture that facilitates spontaneous collaboration and easy transition between individual work and group activities, ensuring high spatial flexibility.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, fueled by rapid urbanization, significant population growth, and substantial government investment in expanding educational infrastructure, particularly in countries like China, India, and Southeast Asia. The focus is on establishing new greenfield institutions, creating massive bulk purchasing opportunities for standardized, cost-effective, and durable furniture. While price sensitivity remains a factor, there is an increasing shift toward adopting international standards for ergonomics and technology integration, especially in tier-one cities and private international schools. The massive enrollment base, combined with efforts to introduce modern pedagogical models, ensures sustained high volume growth throughout the forecast period.

- Latin America (LATAM): The LATAM market is characterized by heterogeneity, with Brazil and Mexico leading in terms of market size and maturity. Growth is primarily driven by expansion in private education sectors and governmental initiatives aimed at improving literacy rates and vocational training accessibility. The demand profile focuses on robust, maintenance-friendly furniture built to withstand demanding usage, often prioritizing value over advanced technology integration, although smart furniture is gaining traction in elite private universities. Challenges include economic volatility and fragmented distribution networks, necessitating localized manufacturing and distribution strategies for global players seeking market penetration.

- Middle East and Africa (MEA): The MEA region exhibits high growth potential, particularly in the GCC countries (Saudi Arabia, UAE, Qatar) where massive infrastructure projects and the establishment of world-class universities require premium, customized, and technologically advanced furnishings. Demand is high for high-end collaborative learning environments, specialized laboratory equipment, and culturally sensitive design elements. In the African segment, growth is concentrated on essential, durable, and budget-friendly furniture solutions to accommodate rapidly increasing student populations, often supported by international aid and philanthropic organizations focused on basic infrastructure provision.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Educational Furniture And Furnishings Market.- Steelcase Education

- Herman Miller (MillerKnoll)

- VS America

- KI

- Global Furniture Group

- Smith System

- Fleetwood Group

- Academia Furniture

- Sedia Systems

- Class-Tech Furniture

- Fursys Inc.

- Artemide

- Haworth

- Paragon Furniture

- ABET LAMINATI

- MooreCo Inc.

- Izzy Furniture

- Biofit Engineered Products

- SICO America

- Scholar Craft

Frequently Asked Questions

Analyze common user questions about the Educational Furniture And Furnishings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the educational furniture market?

The market is primarily driven by global governmental investments in educational infrastructure modernization, particularly the emphasis on STEM and collaborative learning spaces. Additionally, the growing awareness of the positive correlation between ergonomic classroom environments and improved student engagement and performance fuels demand for specialized, high-quality furnishings. Demographic trends, including rising enrollment rates globally, especially in APAC, ensure sustained high volume demand for foundational furniture units.

How is technology influencing the design of modern classroom furniture?

Technology is necessitating the design of "smart furniture" equipped with integrated power, data ports, and IoT sensors for monitoring utilization and environmental conditions. Modern designs prioritize seamless cable management and structural adaptability to support devices, interactive displays, and swift reconfiguration required for fluid pedagogical models, moving away from static, fixed-desk setups to highly mobile and versatile modular systems.

Which end-user segment contributes most significantly to market revenue?

While the K-12 segment typically accounts for the largest volume of units sold due to massive student populations and standardized requirements, the Higher Education segment (universities and colleges) contributes significantly to overall revenue value. This is due to the higher average transaction value associated with specialized, durable, research-grade laboratory equipment, highly customized library furnishings, and technology-heavy collaborative learning environments required at the university level.

What sustainability trends are impacting educational furniture procurement?

Sustainability is a core trend, driven by institutional ESG goals and stricter regulations. Procurement officers increasingly favor furniture made from recycled, renewable, or locally sourced materials, particularly those certified by organizations like FSC. Demand is high for low-VOC finishes, products designed for long lifecycles, and modular components that facilitate repairability and eventual recycling, supporting the shift toward circular economy models within the education sector.

What is the competitive landscape like for educational furniture manufacturers?

The market is moderately fragmented but competitive, dominated by a few large global players like Steelcase and Herman Miller who offer comprehensive, high-end, and custom-designed solutions. Competition is intensifying through product differentiation, focusing on advanced ergonomics, integration of smart technology, and streamlined, direct-to-institution supply chain capabilities. Regional and local manufacturers often compete effectively in the highly price-sensitive K-12 and basic furnishing segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager