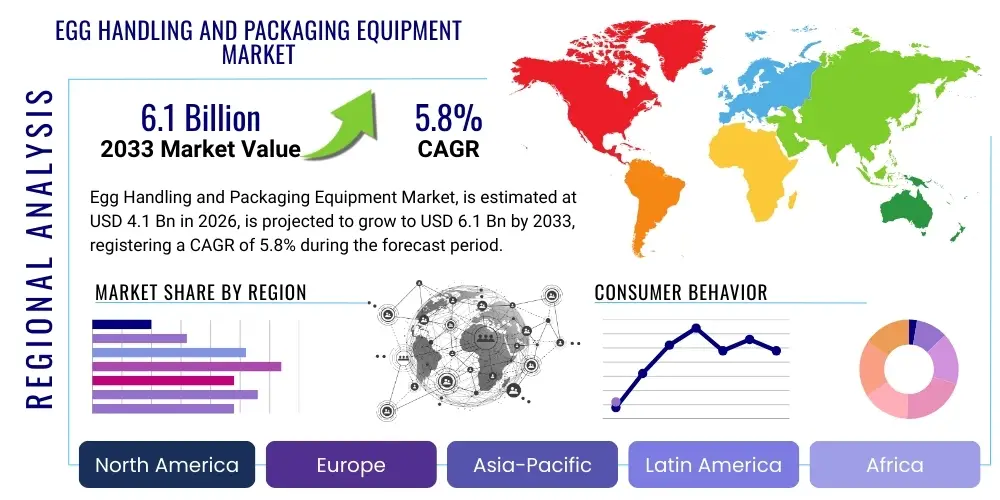

Egg Handling and Packaging Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438672 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Egg Handling and Packaging Equipment Market Size

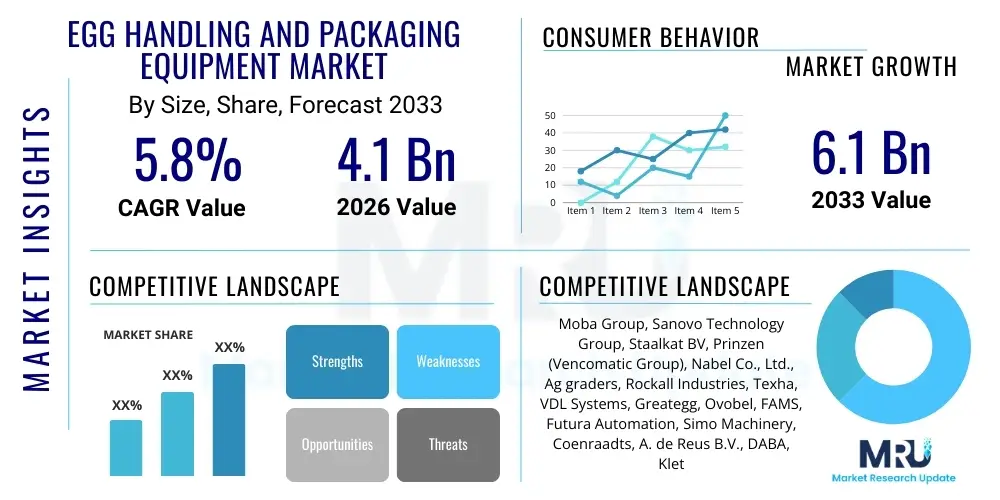

The Egg Handling and Packaging Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Egg Handling and Packaging Equipment Market introduction

The Egg Handling and Packaging Equipment Market encompasses machinery and automated systems designed for the efficient sorting, grading, washing, candling, and packaging of eggs from poultry farms to retail points. This equipment is critical for maintaining egg quality, ensuring food safety compliance, and streamlining high-volume production operations. Products range from sophisticated egg graders capable of processing tens of thousands of eggs per hour, featuring advanced detection technologies, to automated carton loading and palletizing systems. The primary applications span large-scale commercial egg producers, processing facilities, and distribution centers where speed, accuracy, and hygiene are paramount for business viability and consumer trust. Automation is the core driver, minimizing manual labor and reducing breakage rates, thereby directly impacting profitability.

The core objective of adopting modern egg handling technology is to meet the stringent global demands for food safety and traceability, driven by regulatory bodies and consumer awareness. Enhanced automation allows producers to handle increasing production volumes efficiently while adhering to precise weight and quality specifications required by modern supply chains. The benefits derived from these systems include reduced labor costs, significant improvements in operational throughput, minimized contamination risk through automated washing and sanitization, and superior presentation of the final product, which is crucial for market differentiation and shelf appeal. Furthermore, these integrated systems provide valuable data on production performance and quality metrics, facilitating continuous improvement in farming and processing techniques.

Key driving factors accelerating market expansion include the sustained growth in global egg consumption, particularly in developing economies, coupled with a fundamental shift towards larger, industrialized farming operations requiring high-capacity machinery. Regulations mandating higher standards for food safety and animal welfare also necessitate the adoption of automated, precision equipment. Technological advancements, such as the integration of sensor technology, machine vision systems for crack detection, and robotics for packaging, further enhance the efficiency and appeal of new equipment offerings, positioning automation as an indispensable tool for competitiveness in the global poultry sector.

Egg Handling and Packaging Equipment Market Executive Summary

The Egg Handling and Packaging Equipment Market is experiencing robust growth fueled by increasing global demand for processed and packaged eggs and the need for operational efficiency in large-scale poultry production. Business trends highlight a strong shift toward fully integrated, modular systems that offer scalability and flexibility, allowing producers to adapt quickly to varying demand cycles and diverse packaging requirements. Key market players are focusing heavily on developing equipment with advanced sanitation features and IoT connectivity for remote monitoring and predictive maintenance, positioning high-tech solutions as essential investments for future-proofing operations. Mergers and acquisitions remain a prevalent strategy, allowing larger firms to integrate specialized technology and expand regional service networks, particularly within emerging markets.

Regionally, Asia Pacific is anticipated to be the fastest-growing market, driven by rapidly expanding domestic egg production in countries like China and India, necessitated by population growth and improving dietary standards. North America and Europe, while mature, exhibit strong demand for sophisticated, premium equipment focusing on sustainability (reduced energy consumption) and enhanced welfare standards (handling specialized eggs like free-range). Regional segmentation trends also reflect varying degrees of automation, with Western markets prioritizing high-speed robotic packing, whereas emerging economies initially focus on basic, high-capacity grading and washing systems, gradually upgrading components as capital permits.

Segment trends underscore the dominance of the Grading and Sorting equipment segment due to its foundational role in egg processing. However, the Packaging and Palletizing segment is projected to show the highest CAGR, driven by the proliferation of diverse packaging formats—from pulp cartons to clear plastic—required by modern retail distribution. Technology-wise, automatic systems are quickly replacing semi-automatic solutions across all major poultry hubs, indicating a clear industry commitment to minimizing human interaction with the product to enhance hygiene and reduce labor dependency, solidifying the market's trajectory towards complete automation across the entire value chain.

AI Impact Analysis on Egg Handling and Packaging Equipment Market

Common user questions regarding the impact of AI on the Egg Handling and Packaging Equipment Market frequently revolve around the accuracy of defect detection, predictive maintenance capabilities, and the potential for optimizing complex logistical processes. Users are keenly interested in knowing if AI-driven vision systems can reliably surpass human capabilities in identifying subtle cracks, blood spots, or shell imperfections at high speeds. Concerns also center on the cost and complexity of integrating AI algorithms into existing machinery and the requirement for specialized technical staff to manage and train these sophisticated systems. The overarching expectation is that AI will significantly enhance yield, reduce waste, and provide granular data insights previously unattainable by conventional sensors.

The integration of Artificial Intelligence, particularly through machine learning (ML) and computer vision, is fundamentally reshaping the capabilities of modern egg handling equipment. AI algorithms enable grading machines to achieve unprecedented levels of accuracy in quality control, far surpassing traditional optical sorting methods. For instance, advanced vision systems can be trained on vast datasets of defective eggs to identify specific, complex patterns indicative of internal quality issues or micro-fractures undetectable by the human eye or standard sensors operating at speeds of over 100,000 eggs per hour. This enhanced precision minimizes product recalls and ensures that only premium-quality eggs reach the consumer, significantly boosting brand reputation and operational efficiency for large producers.

Furthermore, AI plays a crucial role in operational optimization and predictive maintenance. By analyzing real-time data streams from various sensors—including vibration, temperature, and throughput—AI models can predict equipment failure before it occurs, drastically reducing unplanned downtime. This capability shifts maintenance strategies from reactive or scheduled interventions to condition-based and predictive measures, maximizing machine uptime and extending the operational life of expensive assets. In the packaging domain, AI-driven robotics optimize packing patterns and speeds based on fluctuating supply and carton specifications, ensuring minimal breakage during the final stages of handling and efficient use of packaging materials.

- AI-Enhanced Vision Systems: Achieves superior accuracy in detecting cracks, internal defects (blood spots), and shell anomalies at high processing speeds.

- Predictive Maintenance: Uses ML to analyze sensor data, forecasting potential equipment failures and minimizing costly unplanned downtime.

- Yield Optimization: AI algorithms manage grading settings dynamically to maximize the percentage of premium-grade eggs processed from each batch.

- Robotics and Automation: Directs robotic arms for optimized, delicate, and high-speed packing and palletizing based on product flow.

- Process Traceability: Facilitates detailed tracking and reporting of individual egg quality and origin, meeting stringent regulatory requirements.

DRO & Impact Forces Of Egg Handling and Packaging Equipment Market

The market dynamics are driven primarily by the global imperative to automate food production processes, counteracting rising labor costs and shortages, especially in developed economies. Restraints include the high initial capital investment required for automated grading and packaging lines, which often poses a significant barrier to entry for small-to-mid-sized poultry farms, particularly in regions with limited access to capital financing. Opportunities are largely centered around developing sustainable and energy-efficient equipment, coupled with the expansion into customized packaging solutions tailored for specialty products (e.g., organic, omega-3 enhanced eggs). These forces collectively exert significant pressure on manufacturers to innovate continuously, focusing on modular designs that balance high throughput with affordability and operational flexibility to cater to a diverse global customer base.

The primary drivers are anchored in the necessity for food safety compliance and increasing efficiency demands. Regulatory bodies worldwide are implementing stricter hygiene standards, making automated washing, sanitizing, and UV-treatment equipment mandatory to prevent contamination. This regulatory push forces older operations to upgrade their machinery. Additionally, the industrialization of the poultry sector, especially in high-growth regions like Southeast Asia, necessitates high-capacity equipment capable of handling millions of eggs monthly. The global increase in disposable income further supports the market, as consumers demand consistently high-quality, attractively packaged eggs, prompting producers to invest in sophisticated packaging aesthetics and presentation.

Conversely, the major restraints involve technological complexity and the requirement for skilled labor to operate and maintain advanced machinery. While automation reduces unskilled labor needs, it creates a dependency on highly trained technicians, a resource that can be scarce in rural farming areas. Furthermore, currency volatility and fluctuating prices of raw materials (such as stainless steel and specialized plastics used in equipment manufacturing) can impact the final cost of machinery, making long-term capital planning challenging for purchasers. Overcoming these restraints requires manufacturers to offer comprehensive training, localized service support, and financing options to mitigate the initial investment burden.

Segmentation Analysis

The Egg Handling and Packaging Equipment Market is broadly segmented based on the type of equipment, level of automation, application, and processing capacity. Understanding these segments is crucial as they reflect the diverse needs across the global poultry industry, ranging from small, specialized farms to vast, integrated processing hubs. Equipment type dictates functionality, with graders and sorters forming the largest revenue share, while automation level reflects investment capability and labor market dynamics. The market structure is highly fragmented yet characterized by specialized offerings from major global machinery manufacturers who continuously strive to integrate more functions—such as washing, candling, and packing—into a single, high-efficiency line.

Segmentation by application clearly differentiates between equipment designed for traditional shell egg processing and those tailored for liquid egg processing (breaking and separating), with shell egg handling dominating the market value due to universal consumer preference. Capacity segmentation is vital for matching the machinery to the scale of the operation, categorizing equipment into low (under 30,000 eggs/hour), medium (30,000 to 70,000 eggs/hour), and high-capacity systems (over 70,000 eggs/hour), with the latter driving the highest growth due to industry consolidation. Geographic segmentation confirms regional maturity levels, with North America and Europe prioritizing replacement and technological upgrades, while APAC focuses on fundamental capacity expansion.

The evolution within these segments is heavily influenced by robotics and software integration. For instance, within the packaging segment, there is increasing differentiation between machines handling traditional materials like molded pulp and those specialized for high-end plastic or custom display packaging, reflecting retailer demand. Manufacturers are focusing on modular designs to allow farms to incrementally automate their processes, starting with grading and then adding complementary units like automatic palletizers or customized printing systems, thus making automation accessible across a wider spectrum of producer sizes.

- By Equipment Type:

- Grading and Sorting Equipment

- Washing and Drying Equipment

- Candling Equipment

- Packaging Equipment (Carton Erectors, Fillers, Closers)

- Palletizing and Conveying Systems

- By Automation Level:

- Automatic Equipment

- Semi-Automatic Equipment

- By Capacity:

- Low Capacity (Under 30,000 Eggs/Hour)

- Medium Capacity (30,000 – 70,000 Eggs/Hour)

- High Capacity (Over 70,000 Eggs/Hour)

- By Application:

- Shell Egg Processing

- Liquid Egg Processing (Egg Breaking and Separation)

Value Chain Analysis For Egg Handling and Packaging Equipment Market

The value chain for the Egg Handling and Packaging Equipment Market starts with the upstream sourcing of high-precision components, including specialized stainless steel, advanced sensors, robotic arms, and complex control systems (PLCs and software). Manufacturers in this segment maintain close relationships with technology suppliers, often co-developing customized vision systems and robotics tailored for delicate egg handling. Efficient inventory management and stringent quality control during manufacturing are critical upstream factors that influence the final reliability and speed of the equipment delivered to the market. The high cost of specialized components contributes significantly to the overall capital expenditure required for purchasing the final machinery.

Midstream activities involve the design, assembly, testing, and distribution of the finished equipment. Distribution channels are typically complex due to the size and bespoke nature of the machinery. Direct sales are common for high-value, integrated systems sold to major poultry conglomerates, allowing for direct consultation, installation, and post-sales service from the manufacturer. Indirect distribution utilizes regional distributors or agents, particularly in developing markets, who provide localized sales expertise and initial technical support, bridging the geographical gap between equipment makers (often based in Europe or North America) and end-users worldwide. This phase also includes providing extensive training and warranty services.

The downstream analysis focuses squarely on the end-users: commercial egg processing plants, large integrated poultry farms, and food service suppliers. The post-sales service—including parts availability, preventative maintenance contracts, and software updates—is a critical component of the downstream value proposition. Customer satisfaction hinges not only on the equipment's performance but also on the manufacturer's ability to minimize downtime through rapid support. The equipment’s life cycle usually spans 10–15 years, meaning long-term service relationships are often more profitable than the initial sale. The effectiveness of the equipment directly impacts the customer's production efficiency and ability to meet strict regulatory and retail demands.

Egg Handling and Packaging Equipment Market Potential Customers

The primary customers for advanced egg handling and packaging equipment are large-scale commercial poultry integrators and independent egg processing facilities globally. These entities operate high-volume grading and packing centers where automation is not merely an option but a requirement for economic viability and competitive scaling. Their purchasing decisions are driven by throughput capacity, hygienic design, operational longevity, and the ability to seamlessly integrate the machinery with existing farm logistics and Enterprise Resource Planning (ERP) systems for enhanced traceability and inventory control.

Secondary, yet significant, customer segments include smaller regional egg distributors and specialized farms focusing on premium or niche products, such as organic, free-range, or pasture-raised eggs. While these customers may opt for semi-automatic or lower-capacity automatic equipment due to limited capital, they prioritize features like gentle handling and specialized packing configurations suited for high-value products. Their growing demand drives innovation in flexible, modular machinery that can handle diverse carton sizes and materials efficiently, meeting the bespoke requirements of niche retail markets.

Furthermore, institutions involved in liquid egg production, such as bakeries, industrial kitchens, and large food manufacturers, represent an expanding customer base, specifically for egg breaking, separating, and pasteurization equipment. As the processed food industry continues to grow, the demand for high-capacity, highly sanitized equipment designed for processing liquid eggs becomes critical, focusing on maximizing yield from the breaking process while adhering to stringent health and safety regulations associated with liquid food products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moba Group, Sanovo Technology Group, Staalkat BV, Prinzen (Vencomatic Group), Nabel Co., Ltd., Ag graders, Rockall Industries, Texha, VDL Systems, Greategg, Ovobel, FAMS, Futura Automation, Simo Machinery, Coenraadts, A. de Reus B.V., DABA, Kletec, Henning GMBH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Egg Handling and Packaging Equipment Market Key Technology Landscape

The technological landscape of the Egg Handling and Packaging Equipment Market is defined by the convergence of advanced robotics, high-speed vision systems, and data analytics capabilities. Modern equipment relies heavily on high-resolution cameras and sensor technology combined with sophisticated image processing software to perform non-invasive candling and defect detection. This machine vision technology allows processors to identify internal faults, micro-cracks, and blood spots with accuracy and speed previously impossible, ensuring only flawless products enter the consumer supply chain. Furthermore, servo-driven mechanisms and specialized vacuum lifters are replacing conventional mechanical systems to provide gentler, faster handling, drastically reducing the rate of shell breakage during sorting and packaging processes.

Integration of Internet of Things (IoT) sensors and connectivity platforms is transforming operational management. Equipment now generates real-time data on throughput, efficiency, egg distribution patterns, and energy consumption. This data is leveraged via cloud-based platforms to provide farm managers and processing supervisors with immediate insights, facilitating rapid adjustments to production schedules and equipment parameters. This connected ecosystem also supports remote diagnostics and software updates, enabling manufacturers to provide better post-installation support and introduce feature upgrades without extensive on-site intervention, a major advantage in globally dispersed markets. Furthermore, the focus on modular and flexible system architecture allows producers to easily scale their operations or reconfigure lines to accommodate different egg sizes or packaging formats demanded by retailers.

A growing trend involves the implementation of sustainable technologies and hygiene innovations. Equipment manufacturers are incorporating materials that are easier to clean, resistant to corrosion from frequent chemical washdowns, and designed to minimize water usage during the washing phase. Energy efficiency is also a major technological focus, utilizing optimized motor controls and energy recovery systems to reduce the substantial power consumption associated with large-scale processing lines. Finally, advancements in automated sanitization and decontamination methods, such as enhanced UV treatment stations integrated within the conveyor belts, ensure that hygiene compliance meets or exceeds the most stringent international food safety standards, driving the replacement cycle of older, less sanitized machinery.

Regional Highlights

The global market exhibits distinct regional dynamics, largely dictated by the scale of local poultry production, consumer wealth, and the maturity of regulatory frameworks. North America and Europe represent mature markets characterized by high labor costs and stringent welfare and food safety regulations. Consequently, these regions prioritize investment in high-end, fully automatic machinery that emphasizes robotics, AI-driven quality control, and minimal human intervention to maximize hygiene and offset labor expenses. Demand in these regions is primarily driven by the need for replacement machinery and technological upgrades rather than basic capacity expansion, focusing on energy efficiency and systems capable of handling specific niche products like free-range and organic eggs efficiently.

Asia Pacific (APAC) is positioned as the dominant and fastest-growing region, fueled by massive population bases, rising per capita egg consumption, and the rapid industrialization of its agricultural sector, particularly in economies such as China, India, and Indonesia. The sheer volume of egg production required in these countries necessitates high-capacity, robust equipment. While price sensitivity remains a factor compared to Western markets, there is a clear, escalating trend toward adopting medium and high-capacity automatic grading systems to improve efficiency and meet the quality standards demanded by burgeoning domestic middle classes and export markets. Investment is concentrated on establishing integrated processing centers capable of handling newly commercialized farm outputs.

Latin America and the Middle East & Africa (MEA) represent emerging market opportunities, where the penetration of automated equipment is currently lower but increasing steadily. In Latin America, countries like Brazil and Mexico, major global poultry exporters, are investing in modern equipment to maintain competitiveness in international trade, driving demand for equipment that meets global export standards. The MEA region is experiencing growth spurred by government initiatives to enhance food security and modernize agricultural infrastructure. Equipment purchases here often involve simpler, reliable, semi-automatic systems initially, with gradual movement towards automation as farm consolidation and capital availability improve, focusing keenly on ease of maintenance and local serviceability.

European markets are particularly sensitive to animal welfare standards, leading to specialized equipment demand. Machinery must be optimized for handling eggs from non-cage systems, which are often more delicate and irregular in shape than those from conventional systems. This legislative pressure drives innovation in specialized handling mechanisms that ensure low breakage rates under specific welfare constraints. Furthermore, the regulatory environment in the EU, particularly concerning traceability and food safety (such as Salmonella control), makes advanced washing, candling, and tracking equipment essential, thereby sustaining high market value despite lower overall capacity growth compared to APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Egg Handling and Packaging Equipment Market.- Moba Group

- Sanovo Technology Group

- Staalkat BV

- Prinzen (Vencomatic Group)

- Nabel Co., Ltd.

- Ag graders

- Rockall Industries

- Texha

- VDL Systems

- Greategg

- Ovobel

- FAMS

- Futura Automation

- Simo Machinery

- Coenraadts

- A. de Reus B.V.

- DABA

- Kletec

- Henning GMBH

Frequently Asked Questions

Analyze common user questions about the Egg Handling and Packaging Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fully automated egg handling equipment?

The primary factor is the necessity to overcome high labor costs and skilled labor shortages, coupled with increasingly stringent global food safety regulations that require minimal human contact during the grading, washing, and packaging processes to ensure hygiene and consistency.

How does AI technology benefit egg grading and sorting operations?

AI significantly enhances quality control through high-speed computer vision systems that detect subtle defects, micro-cracks, and internal flaws in eggs with accuracy superior to human inspection, thereby maximizing the yield of premium-grade eggs and reducing waste.

Which geographical region is expected to exhibit the highest market growth rate?

The Asia Pacific (APAC) region is projected to show the highest Compound Annual Growth Rate (CAGR), driven by the rapid growth in commercial poultry farming, industrialization of food processing, and high domestic demand in countries like China and India.

What constitutes the high initial investment cost associated with modern egg handling machinery?

The high cost stems from specialized high-precision components, including robotics, advanced sensor technology, corrosion-resistant stainless steel for hygiene compliance, and sophisticated PLC and software control systems required for high-capacity, integrated operations.

What are the key advantages of modular egg handling system designs?

Modular designs offer poultry producers operational flexibility and scalability, allowing them to incrementally add components (e.g., palletizers, specialty packers) as their production volumes increase, reducing the initial capital expenditure and adapting easily to changing market needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager