Egg Wash Substitute Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437241 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Egg Wash Substitute Market Size

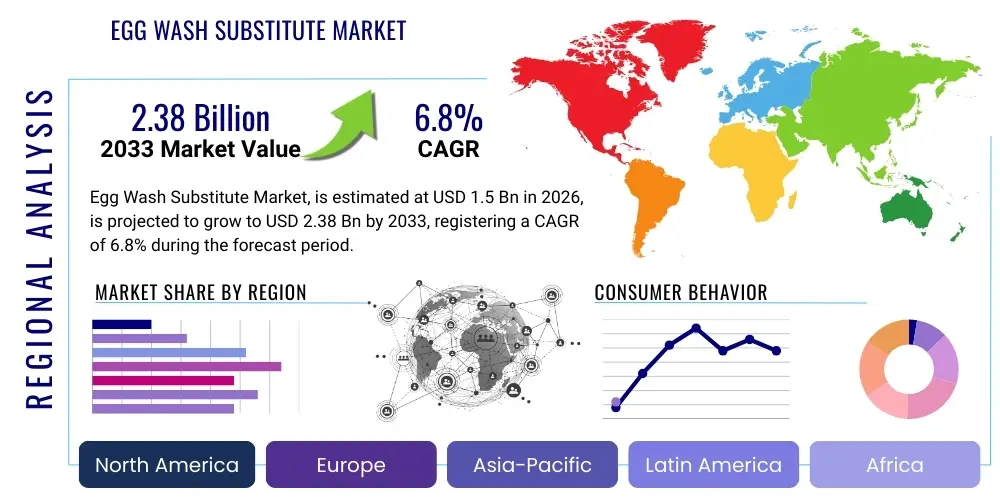

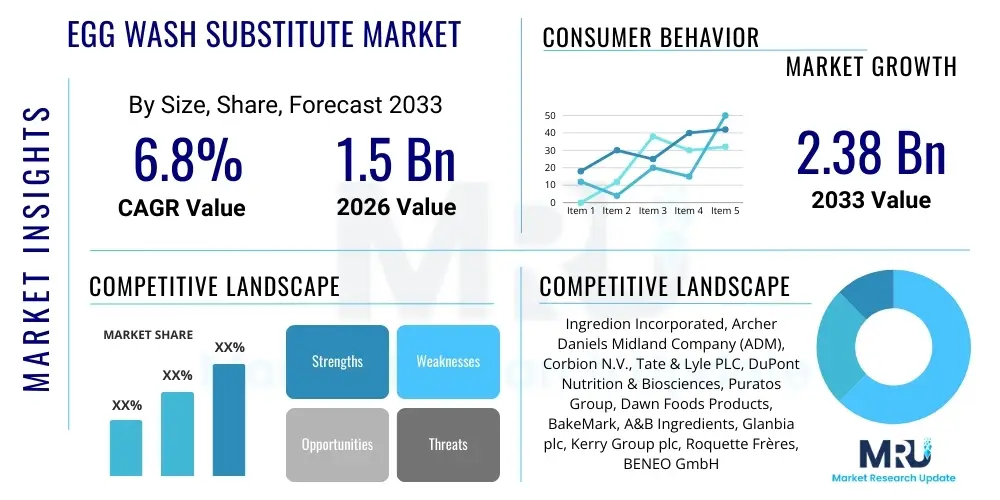

The Egg Wash Substitute Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033.

Egg Wash Substitute Market introduction

The Egg Wash Substitute Market encompasses a variety of products designed to replicate the functional properties of traditional egg washes—namely providing shine, color, and promoting adhesion (glazing) on baked goods and savory preparations—without using actual eggs. These substitutes are primarily developed using plant-based proteins, starches, hydrocolloids, and dairy derivatives, catering predominantly to the needs of vegan consumers, individuals with egg allergies, and industrial bakeries seeking cost stability and extended shelf life. Major applications include breads, pastries, savory pies, and coated snacks where a premium finish is essential. The primary driving factors for this specialized market include the rising global prevalence of plant-based diets, stringent food allergen safety regulations necessitating alternatives, and the volatile pricing associated with conventional egg commodity markets, which pushes commercial manufacturers toward more predictable, stabilized ingredient inputs.

Egg Wash Substitute Market Executive Summary

The global Egg Wash Substitute Market is experiencing robust expansion, fundamentally driven by shifts in consumer dietary preferences towards veganism and flexitarianism, coupled with technological advancements that allow substitutes to closely mimic the performance characteristics of conventional egg washes in terms of texture, browning, and sheen. Business trends highlight significant investment in R&D focusing on ingredients like potato protein, pea protein, and specialized starches to improve functionality and label clarity. Regionally, North America and Europe currently dominate the market due due to high awareness of allergen management and established vegan consumer bases, while the Asia Pacific region is anticipated to demonstrate the fastest growth rate, fueled by the rapid expansion of organized retail and Western-style bakery chains. Segment trends indicate that the plant-based protein category holds the largest market share, driven by its versatile application in both large-scale commercial baking and artisan production, confirming the market’s trajectory toward ingredient innovation and functional superiority over traditional methods.

AI Impact Analysis on Egg Wash Substitute Market

Common user questions regarding AI's impact on the Egg Wash Substitute Market often center on its role in optimizing ingredient formulation, predicting consumer acceptance of novel substitutes, and enhancing supply chain efficiency for specialized raw materials. Users frequently inquire how AI can accelerate the development cycle of plant-based alternatives, particularly concerning the replication of complex egg functionalities like emulsification and moisture retention. Key themes emerging from this analysis include the expectation that AI and machine learning will revolutionize R&D by simulating ingredient interactions and predicting optimal blending ratios for performance and flavor neutrality. Furthermore, there is significant interest in using AI-driven predictive analytics to manage ingredient sourcing volatility (e.g., starch prices, specialized protein availability) and optimize production scale-up, ensuring that substitute products maintain consistent quality across large industrial batches, addressing the industry's need for stability and cost control.

- AI accelerates new ingredient discovery and functional protein characterization through high-throughput screening simulations.

- Machine learning algorithms optimize substitute formulations, predicting texture, browning, and shine performance before physical trials, reducing R&D costs.

- Predictive analytics enhance supply chain resilience by forecasting demand fluctuations for specialized plant-based raw materials, minimizing stockouts.

- AI-powered quality control systems monitor viscosity and application consistency in real-time on production lines, ensuring high substitution efficacy.

- Generative design tools assist in creating novel hydrocolloid blends that achieve superior adhesion and gloss compared to existing alternatives.

DRO & Impact Forces Of Egg Wash Substitute Market

The trajectory of the Egg Wash Substitute Market is shaped significantly by compelling drivers, persistent restraints, and emerging opportunities, collectively defining the impact forces influencing industry growth. The principal driver is the exponential rise in demand for vegan and allergen-free food products, forcing commercial bakeries to adopt alternatives to comply with labeling requirements and cater to broadening consumer bases. Furthermore, the inherent price instability and logistical risks associated with shell eggs provide a strong economic incentive for large-scale food manufacturers to switch to industrialized, predictable, and consistently priced substitute inputs. However, the market faces restraints, primarily concerning the sensory perception of substitutes; achieving the exact golden-brown color, high gloss, and perfect adhesion properties of traditional egg wash remains a technological challenge that requires sophisticated ingredient engineering. These performance gaps sometimes lead to consumer resistance or require complex application adjustments by food producers.

Opportunities within this market are immense, particularly in the realm of high-functionality ingredient innovation. Manufacturers are increasingly focusing on creating proprietary blends of potato, rice, and algae proteins, as well as customized hydrocolloids that offer superior glazing without contributing undesirable off-flavors or textural anomalies. Furthermore, expanding the application scope beyond traditional baked goods into savory products like gluten-free doughs, processed meats, and specialized vegetarian coatings presents new revenue streams. Regulatory shifts, especially in Europe and North America, favoring transparent ingredient labeling and sustainable sourcing also present an opportunity for market leaders to position their substitutes as clean-label and environmentally responsible solutions, differentiating them from competitors.

The impact forces are predominantly high, driven by external factors such as commodity price volatility and rapidly evolving consumer ethics, which exert strong pressure on the industry to innovate rapidly. Economic sustainability, driven by the desire for reduced operational costs and stable ingredient sourcing, acts as a continuous accelerator for adoption in the commercial segment. Conversely, the technical challenge of perfect functional replication acts as a counteracting force, slowing the complete transition away from traditional eggs in highly sensitive applications. Successful navigation of these forces requires continuous investment in proprietary ingredient technology and robust supply chain management to ensure both performance and pricing competitiveness.

Segmentation Analysis

The Egg Wash Substitute Market is meticulously segmented based on ingredient type, application area, and physical form, reflecting the diverse needs across the food manufacturing landscape, from industrial bakeries to artisanal producers. Segmentation by ingredient highlights the dominance of plant-based proteins (such as soy, pea, and potato) due to their excellent functional similarity to egg proteins, particularly in forming glossy, adhesive films. Segmentation by application demonstrates that the bakery segment, including breads, rolls, and sweet pastries, represents the core demand, though savory applications are rapidly gaining traction. Understanding these segments allows manufacturers to tailor their R&D efforts, developing highly specific formulations—for example, a powder-based substitute optimized for long shelf life and easy mixing in large-scale dough preparation, or a liquid substitute designed for superior sheen on premium confectionary items.

- By Ingredient Type:

- Plant-Based Proteins (e.g., Pea, Soy, Potato, Rice)

- Hydrocolloids (e.g., Xanthan Gum, Guar Gum, Carrageenan)

- Dairy-Based (e.g., Milk Proteins, Whey Derivatives)

- Starches (e.g., Tapioca, Corn, Potato Starch)

- By Application:

- Bakery (Breads, Rolls, Pastries, Donuts)

- Confectionery (Sweet Goods, Biscuits, Cookies)

- Savory Items (Pies, Quiches, Coated Snacks)

- Processed Foods (Meat Substitutes, Vegan Coatings)

- By Form:

- Liquid

- Powder

- Paste/Concentrate

Value Chain Analysis For Egg Wash Substitute Market

The value chain for the Egg Wash Substitute Market begins with upstream analysis, focusing on the sourcing and primary processing of core ingredients, notably specialized agricultural products like peas, potatoes, and various starches. This stage is crucial as the quality and functional characteristics of the final substitute product are heavily dependent on the purity and specific protein content derived from these raw materials. Key activities here include advanced extraction, purification, and modification processes undertaken by major ingredient suppliers to ensure functional efficacy, such as high water-binding capacity and superior film formation. Price volatility in these commodity markets, coupled with sustainability certifications, significantly influences the cost structure and sourcing strategies of substitute manufacturers.

Midstream activities involve formulation, blending, and manufacturing, where specialized food technology firms combine various ingredients—proteins, starches, emulsifiers, and natural colors—to create the final proprietary substitute blends. This stage involves complex R&D to match egg functionality, requiring significant intellectual property around hydrocolloid and protein interaction. Distribution channels then move the finished products downstream, primarily catering to industrial food service companies (B2B). Direct channels often involve large contracts between specialized ingredient suppliers and multinational food manufacturers, ensuring consistent, high-volume supply tailored to specific production line requirements. Indirect channels utilize specialized food ingredient distributors who serve smaller bakeries, regional food processors, and catering services, often requiring technical support and customized small-batch solutions.

The downstream analysis focuses on the end-users—commercial bakeries, quick-service restaurants, and large packaged food producers—whose adoption rates are governed by factors such as ease of use, cost-effectiveness, and the regulatory environment regarding allergen labeling. The efficiency of the entire value chain is optimized through strong vertical integration, allowing key players to control the quality of raw materials and streamline production, ultimately offering predictable pricing and performance consistency, which are paramount for industrial buyers seeking reliable substitutes for volatile commodities.

Egg Wash Substitute Market Potential Customers

The primary consumers and end-users of egg wash substitutes are commercial entities spanning the large-scale food production industry, driven by necessities of cost control, ingredient standardization, and consumer demand for allergen-free options. The largest segment of potential customers includes industrial and wholesale bakeries that produce high volumes of products like buns, rolls, packaged pastries, and frozen doughs, where efficient, automated application and consistent product finish are critical to market appeal. These enterprises prioritize substitutes that offer long shelf life, ease of mixing (often in powder form), and highly predictable functional outcomes regardless of seasonal variations in raw ingredient quality, making reliability a key purchasing criterion.

Additionally, the food service industry, specifically catering companies, hotels, and quick-service restaurant (QSR) chains, represents a growing segment. QSRs are increasingly adopting substitutes for savory items like empanadas, chicken coatings, and specialized vegan appetizers to simplify kitchen operations, reduce cross-contamination risk, and expand menus catering to plant-based diets. Furthermore, manufacturers specializing in allergen-free and dedicated vegan food production are captive buyers, as substitutes form an intrinsic component of their product integrity and market positioning. These end-users demand rigorous allergen certification and transparent ingredient sourcing.

The purchasing decisions across these diverse customer segments are influenced not only by price and performance but increasingly by sustainability metrics and clean-label appeal. Manufacturers who can supply substitutes derived from sustainable, ethically sourced, and minimally processed ingredients, while guaranteeing superior technical performance, are positioned to capture the largest contracts, satisfying the dual requirements of modern industrial efficiency and evolving consumer consciousness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ingredion Incorporated, Archer Daniels Midland Company (ADM), Corbion N.V., Tate & Lyle PLC, DuPont Nutrition & Biosciences, Puratos Group, Dawn Foods Products, BakeMark, A&B Ingredients, Glanbia plc, Kerry Group plc, Roquette Frères, BENEO GmbH, CP Kelco, Fuji Oil Co., Ltd., Sonoco Products Company, Sensient Technologies Corporation, Cargill, Incorporated, The Bunge Limited, Greenyard NV. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Egg Wash Substitute Market Key Technology Landscape

The technological landscape in the Egg Wash Substitute Market is centered on advanced food chemistry and ingredient modification techniques designed to isolate, stabilize, and enhance the film-forming and binding capabilities of non-egg components. A primary focus is on developing high-functionality plant proteins, specifically those derived from pulses (like pea and lentil) and tubers (like potato), using proprietary extraction methods such as enzymatic hydrolysis and microparticulation. These technologies aim to optimize the molecular weight and structure of proteins to mimic the surfactant and emulsifying properties of egg proteins, which are critical for achieving both adhesion and a high-gloss finish. Success in this area determines whether a substitute can be utilized effectively on industrial high-speed production lines without compromising the final product’s appearance or texture.

Another crucial technological area involves the sophisticated application of hydrocolloids and specialized starches. Manufacturers are employing advanced blending technologies to create synergistic mixtures of gums (such as xanthan, guar, and methylcellulose) with modified starches. These blends are engineered to provide exceptional viscosity and moisture retention during the baking process, preventing premature drying and ensuring a uniform, appealing color upon removal from the oven. The technological challenge here is achieving high stability during storage and precise functionality upon hydration, particularly for powder-based substitutes that must perform consistently when mixed with water in varying industrial environments. Encapsulation technology is also emerging as a technique to stabilize fragile functional components and ensure controlled release during baking.

Furthermore, the integration of artificial intelligence and high-throughput testing systems (as noted in the AI analysis) represents a foundational technological shift. These systems allow R&D teams to rapidly screen hundreds of ingredient combinations, evaluating their performance against sensory and functional benchmarks, significantly compressing the time required for product commercialization. This data-driven approach allows for the fine-tuning of substitutes for specific applications, such as developing a blend optimized specifically for freezing and thawing stability on artisan sourdough bread, marking a move toward highly specialized and performance-guaranteed formulations rather than generalized substitutes.

Regional Highlights

-

North America: Market Maturity and Allergen Focus

North America currently holds a significant share of the Egg Wash Substitute Market, characterized by high consumer awareness regarding dietary restrictions, a strong presence of dedicated vegan and allergen-free food manufacturers, and stringent food safety regulations. The adoption rate among large commercial bakeries is exceptionally high, driven primarily by the need to stabilize input costs against the volatile US egg market and the strong retail demand for labeled vegan products. Key trends in this region include the rapid commercialization of potato and pea protein-based substitutes, benefiting from established agricultural supply chains. Moreover, technological advancements focusing on reducing sodium content and improving clean-label ingredients are key differentiators, positioning the region as a leader in functional ingredient innovation.

The competitive landscape is defined by major food ingredient corporations actively acquiring or collaborating with niche plant-based start-ups to enhance their portfolio of high-performance egg replacers. Regulatory bodies, particularly the FDA, influence market development by setting clear guidelines for allergen labeling, thereby encouraging food manufacturers to proactively adopt substitutes to simplify compliance and minimize recall risks. The high degree of operational sophistication among North American food processors also favors the adoption of concentrated, powder-form substitutes that integrate seamlessly into highly automated mixing and spraying systems, maximizing efficiency and minimizing labor inputs.

-

Europe: Regulatory Pressure and Sustainability Demand

Europe represents another dominant region, distinguished by its strong emphasis on sustainability, animal welfare, and rigorous food quality standards, particularly driven by countries like Germany, the UK, and the Netherlands. The strong European vegan movement, supported by favorable labeling laws and robust consumer ethics, has accelerated the adoption of egg wash substitutes. European food processors often prioritize ingredients that are locally sourced and environmentally certified, leading to greater innovation in proprietary grain and legume-based substitutes over imported alternatives. The regulatory environment is highly influential; the EU’s Farm to Fork Strategy and specific mandates on improving supply chain sustainability encourage the use of less resource-intensive ingredients like plant proteins.

Market growth in Europe is significantly bolstered by the expanding consumption of high-quality artisan baked goods and specialized gluten-free products where the functional performance of the substitute is rigorously tested. Demand is shifting towards functional starches and novel hydrocolloids that offer superior texture and shine without introducing known major allergens. Furthermore, key European ingredient suppliers are investing heavily in optimizing fermentation technology to produce next-generation plant proteins that offer enhanced functional attributes, ensuring the region remains at the forefront of ingredient science innovation and maintains its leading role in translating consumer ethical preferences into industrial food solutions.

-

Asia Pacific (APAC): Fastest Growth and Diversification

The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, primarily fueled by rapid urbanization, increasing Westernization of diets, and the surging popularity of packaged bakery products across densely populated markets like China, India, and Southeast Asia. While traditional diets in many APAC countries already incorporate plant-based ingredients, the adoption of specialized egg wash substitutes is driven by the emergence of organized retail, multinational QSR expansion, and the subsequent need for standardized food inputs at scale. The cost-effectiveness of substitutes compared to traditional eggs is a major appeal for local industrial manufacturers operating on tight margins.

Market segmentation in APAC often favors locally sourced substitutes, such as those derived from rice or tapioca starch, complementing regional ingredient availability and consumer familiarity. However, the rising middle class is demonstrating a growing demand for premium, imported bakery and confectionery items, pushing local producers to adopt high-performance, international-standard substitutes. The key challenge lies in educating local manufacturers about the technical benefits and proper application techniques of these specialized substitutes. Consequently, market leaders are establishing regional manufacturing hubs and technical support centers to drive adoption, positioning APAC as a critical long-term growth engine for the global egg wash substitute market due to its vast consumer base and rapidly evolving food processing infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Egg Wash Substitute Market.- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Corbion N.V.

- Tate & Lyle PLC

- DuPont Nutrition & Biosciences

- Puratos Group

- Dawn Foods Products

- BakeMark

- A&B Ingredients

- Glanbia plc

- Kerry Group plc

- Roquette Frères

- BENEO GmbH

- CP Kelco

- Fuji Oil Co., Ltd.

- Sonoco Products Company

- Sensient Technologies Corporation

- Cargill, Incorporated

- The Bunge Limited

- Greenyard NV

Frequently Asked Questions

Analyze common user questions about the Egg Wash Substitute market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functional benefits of using egg wash substitutes?

The primary functional benefits include achieving desirable shine, gloss, and golden-brown color on baked goods, promoting superior adhesion for toppings (like seeds or sugar), and enhancing moisture retention in the final product. Substitutes offer reliable, standardized performance compared to fluctuating egg quality.

How do plant-based egg wash substitutes compare to traditional egg wash in terms of appearance?

Modern plant-based substitutes, particularly those formulated with potato or pea proteins and specific hydrocolloids, are engineered to closely mimic the browning and high-gloss sheen of traditional egg wash. While historically substitutes lagged, continuous R&D has closed the performance gap significantly, making them virtually indistinguishable in many commercial bakery applications.

Which ingredient type is currently driving the largest growth in the substitute market?

Plant-based proteins, specifically derived from peas, potatoes, and lentils, are the primary drivers of growth. This growth is accelerated by strong consumer demand for certified vegan and allergen-free products, coupled with the functional versatility of these high-performance, cost-stable ingredients in industrial settings.

Are egg wash substitutes suitable for highly automated, large-scale commercial baking operations?

Yes, egg wash substitutes, particularly those in powder or highly concentrated liquid forms, are highly suitable for automated commercial baking. They offer superior consistency, predictable viscosity for spray application systems, reduced risk of microbial contamination, and extended stability required for high-speed production lines.

What is the main restraining factor hindering broader market adoption of egg wash substitutes?

The main restraining factor is the ongoing technical challenge of perfectly replicating the complex functional chemistry of whole eggs, particularly achieving optimal adhesion and natural browning across all diverse baked product types without altering the product’s flavor profile. Initial high formulation costs for proprietary blends can also pose a barrier to smaller producers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager