EGR Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432958 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

EGR Valve Market Size

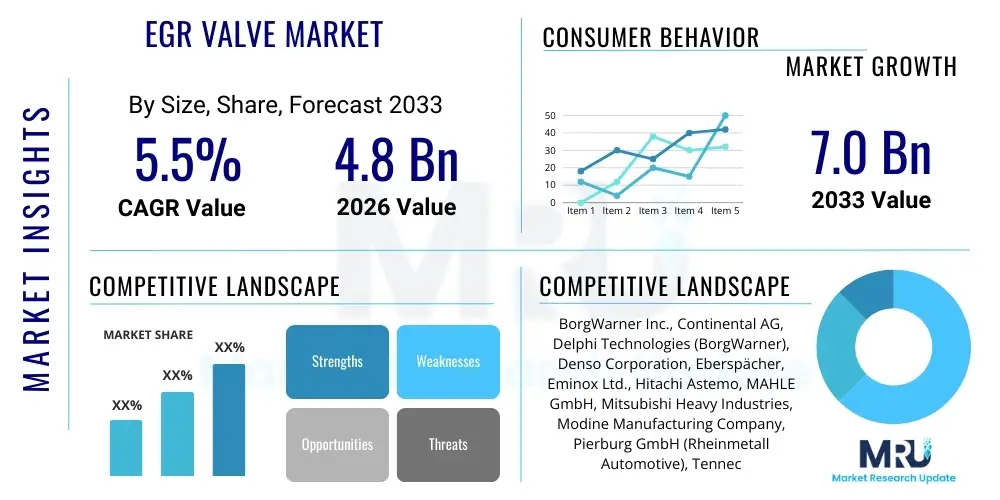

The EGR Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033. This growth trajectory is underpinned by the increasing complexity of emission control systems required globally, offsetting the eventual transition to electric propulsion in certain light-duty segments. The valuation reflects the high cost associated with advanced electronic and cooled EGR systems necessary for modern high-efficiency internal combustion engines.

EGR Valve Market introduction

The Exhaust Gas Recirculation (EGR) Valve Market serves as a critical nexus within the global automotive industry’s ongoing effort to mitigate environmental pollution stemming from internal combustion engine (ICE) operations. EGR technology functions as a primary, in-cylinder NOx reduction strategy by introducing cooled exhaust gas back into the intake air charge. This deliberate recirculation effectively reduces the concentration of oxygen and absorbs heat during combustion, consequently lowering peak cylinder temperatures below the threshold required for the substantial formation of Nitrogen Oxides (NOx). The increasing stringency of global regulatory frameworks, including the phased implementation of Euro 6d, EPA Tier 3 standards, and equivalent protocols in Asia Pacific, establishes the mandatory foundation for sustained market demand. EGR systems are now fundamental components in both Compression Ignition (Diesel) and increasingly in Spark Ignition (Gasoline Direct Injection or GDI) engine platforms, reflecting the technology's versatile application in achieving multi-faceted performance and emission targets.

EGR valve systems are differentiated by their design, ranging from simple vacuum-operated mechanical valves, now largely obsolete in new vehicles, to sophisticated electronic solenoid and stepper motor-controlled units. Modern electronic valves offer unparalleled precision, allowing the engine control unit (ECU) to modulate exhaust gas flow with microsecond accuracy based on real-time parameters such as engine speed, load, air mass, and temperature. This precision is vital for maximizing NOx reduction while avoiding negative side effects like combustion instability or excessive particulate matter formation. Furthermore, the market encompasses the ancillary components crucial for system efficacy, most notably the EGR cooler, which is integral to the process, ensuring the recirculated gas is sufficiently cooled before re-entry, thereby maximizing the density of the charge and enhancing the temperature reduction effect in the combustion chamber. The demand for robust, highly efficient coolers designed to withstand extreme thermal gradients and corrosive condensates significantly influences market valuation.

Major applications of EGR systems are concentrated in high-volume vehicle segments: light-duty passenger vehicles (especially those employing GDI technology or diesel powertrains), heavy-duty commercial trucks and buses, and off-highway machinery utilized in construction, agriculture, and marine sectors. Key benefits include the achievement of mandatory NOx limits, which is non-negotiable for vehicle certification and sale, along with indirect advantages such as minor improvements in specific fuel consumption under certain cruising conditions. The market's driving factors extend beyond mere regulation; they include advancements in turbocharging and engine downsizing, which inherently increase combustion pressures and temperatures, necessitating more aggressive and reliable EGR solutions. The expanding global vehicle parc and the corresponding growth in the aftermarket for replacement components further reinforce the market’s stability against the backdrop of long-term automotive evolution.

EGR Valve Market Executive Summary

The global EGR Valve Market demonstrates a resilient growth pattern, primarily navigating the short-term mandates of rigorous emission standards against the long-term threat of vehicle electrification. Business trends reveal a concentrated effort by leading Tier 1 automotive suppliers to consolidate expertise in mechatronics, focusing on developing fully integrated EGR modules that incorporate the valve, cooler, and associated sensing and control electronics into a single, optimized package. There is a perceptible move toward standardizing modular components for global platforms to achieve economies of scale, even as regional regulatory variations require specific calibration adjustments. Strategic investments are heavily directed towards material science research aimed at developing corrosion-resistant alloys for coolers and anti-fouling coatings for valves, directly addressing the key reliability concerns that drive aftermarket failure rates and warranty claims for OEMs.

Geographically, the market presents a dichotomy of mature, highly technologically advanced markets (Europe and North America) and rapidly expanding, high-growth volume markets (Asia Pacific). Europe continues to dictate the pace of technological development, particularly for diesel engine solutions, owing to the stringent Euro 7 preparatory measures which demand highly efficient and reliable low-pressure EGR systems alongside robust thermal management capabilities. North America, while experiencing a slower transition in passenger vehicles, maintains a steady, substantial market driven by the heavy-duty truck segment, where compliance with EPA standards necessitates exceptionally durable, high-flow EGR assemblies. This region also contributes significantly to the aftermarket sector due to the long operational lifespan of commercial vehicles.

In terms of segmentation, the shift in focus towards Gasoline EGR (G-EGR) technology represents a crucial trend. Historically dominated by diesel applications, the passenger vehicle segment is increasingly adopting G-EGR to meet evolving particulate matter and NOx standards for GDI engines. The commercial vehicle segment (Heavy-Duty Vehicles or HCVs) remains the most critical revenue stream in terms of value, as these components are larger, more complex, and subject to higher operational demands, resulting in premium pricing and specialized component design. The aftermarket segment is expanding due to the increasing mechanical and thermal stress placed on modern EGR systems, leading to more frequent failure and replacement cycles, thereby providing a vital secondary revenue channel for component manufacturers.

AI Impact Analysis on EGR Valve Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) techniques is poised to fundamentally transform the functionality and service lifecycle of EGR valve systems, addressing historical pain points related to reliability and real-time control. User inquiries frequently explore how AI can move beyond simple threshold monitoring to implement true predictive maintenance, allowing vehicle owners and fleet managers to replace components based on degradation probability rather than reactive failure. There is a high interest in understanding how advanced ML models can leverage massive datasets of operational parameters—covering driving cycles, altitude, temperature extremes, fuel quality, and engine behavior—to develop highly optimized control maps. These maps could instantaneously adjust EGR flow rates to maintain the most efficient balance between NOx reduction and fuel economy under dynamic, real-world driving conditions, a capability far exceeding static, map-based ECU programming.

A central expectation among industry stakeholders is that AI will significantly mitigate the persistent problem of EGR system fouling caused by carbon and oil residue. By analyzing sensor drift and correlation patterns, AI algorithms can identify the onset of material buildup well before flow restriction becomes significant, prompting the engine management system to initiate preventive actions, such as temporary flow adjustments or thermal cycling strategies designed to burn off deposits. Furthermore, AI tools are accelerating the research and development pipeline. Generative design and optimization algorithms are being utilized to simulate thousands of potential valve geometries and cooler matrix designs, quickly identifying the most thermally efficient, weight-optimized, and durable solutions that would be prohibitively time-consuming to achieve through traditional iterative engineering methods. This ensures that the next generation of EGR components meets the ultra-tight tolerances mandated by future Euro 7 and equivalent regulations.

The overall impact of AI is highly strategic, moving EGR components from standard mechanical devices with electronic control to smart, self-monitoring, and self-optimizing subsystems within the powertrain. This capability reduces warranty costs for OEMs, improves engine longevity for end-users, and maximizes the environmental performance required for stringent emissions certification. Fleet managers are particularly interested in the telematics integration, where AI-processed EGR data can be aggregated across an entire fleet to identify systemic component weaknesses or fuel/operational dependencies affecting reliability, thus improving procurement and operational planning significantly.

- AI-powered Predictive Maintenance: Machine learning algorithms analyze sensor data (temperature, flow rate, pressure differentials, actuator currents) across thousands of operational hours to develop highly accurate models for predicting potential valve sticking, fouling severity, or mechanical failure, enabling just-in-time component replacement.

- Real-time Optimization of Control Strategy: Advanced AI models, leveraging deep learning and reinforcement learning, adjust EGR flow rates dynamically based on immediate combustion requirements, ambient atmospheric atmospheric conditions, and inferred fuel quality (e.g., biodiesel blends) to precisely maintain the optimal trade-off between NOx reduction and engine performance/fuel efficiency.

- Enhanced Component Design and Material Selection: Artificial intelligence is employed in generative design to rapidly simulate and optimize the thermal performance and mechanical stress resistance of EGR coolers and valve assemblies, leading to lighter components that better withstand high operational temperatures and corrosive exhaust gases.

- Advanced Fault Isolation and Diagnostic Accuracy: AI frameworks improve the diagnostic capability of onboard systems by analyzing complex, correlated sensor inputs to accurately distinguish between sensor malfunction, carbon buildup blockage, and actual mechanical failure, drastically reducing time spent on troubleshooting and incorrect part replacement.

- Operational Efficiency in Commercial Fleets: Telematics combined with AI allows fleet operators to monitor the performance and health of EGR systems across hundreds of vehicles simultaneously, identifying trends in component degradation tied to specific routes or driver behaviors, optimizing fleet maintenance schedules.

DRO & Impact Forces Of EGR Valve Market

The EGR Valve Market is fundamentally propelled by powerful legislative drivers that ensure the technology remains integral to the automotive ecosystem for the foreseeable future, despite electrification trends. The most critical driver is the continuous tightening of global emission standards, particularly the move towards stricter limits on NOx emissions under Real Driving Emissions (RDE) testing protocols. Regulatory bodies are demanding that vehicles maintain low emissions not just under standardized laboratory conditions, but across a wide range of operational and environmental variables (e.g., varying altitude, load, and temperature). This legislative pressure compels OEMs to invest heavily in highly robust, quick-acting, and thermally efficient electronic EGR systems capable of maintaining precise control under transient conditions, thereby escalating the complexity and consequently the market value of the components.

However, the market faces two primary, formidable restraints. Firstly, the exponential investment and policy push toward battery electric vehicles (BEVs) represents a structural long-term threat, as EVs entirely eliminate the need for EGR components. Although the ICE phase-out timeline varies significantly by region and vehicle segment (with heavy-duty remaining ICE-reliant longer), the overall reduction in the addressable market for new installations beyond 2035 poses a significant long-term constraint. Secondly, the intrinsic operational reliability issues of EGR systems, primarily stemming from carbon fouling, corrosion, and associated high maintenance costs, restrain market growth. These reliability concerns often lead to adverse consumer perception and drive manufacturers to seek alternative, potentially more expensive, non-EGR based NOx reduction strategies (e.g., highly optimized Selective Catalytic Reduction (SCR) systems or advanced catalyst technology).

Opportunities for market players are concentrated around technological differentiation and strategic service provision. The most significant opportunity lies in the burgeoning global aftermarket for replacement components, driven by the sheer volume of aging vehicles equipped with first- and second-generation EGR systems that are now failing due to operational stress or mileage accumulation. Manufacturers specializing in durable, high-quality replacement units that offer superior resistance to fouling and corrosion are well-positioned. Another key opportunity involves capitalizing on the need for Gasoline EGR (G-EGR) technology, developing bespoke solutions optimized for GDI engines to meet combined NOx and Particulate Matter (PM) reduction targets. The primary impact forces influencing the market are regulatory mandates (acting as a consistent upward pressure), technological innovation focused on component durability (a stabilizing force), and the disruptive impact of electrification (a long-term downward pressure).

Segmentation Analysis

A detailed segmentation of the EGR Valve Market provides essential insights into the diverse demands and varying technological requirements across different automotive applications globally. Segmenting by Vehicle Type reveals that while passenger cars constitute the highest volume of installations, the Commercial Vehicle (HCV) segment offers the highest value per unit due to the necessity for larger, more complex, and heavily cooled EGR modules designed for sustained, high-load operation. The rapid implementation of emission standards in previously under-regulated commercial sectors, particularly in emerging markets, ensures that HCVs remain a critical focal point for EGR innovation and revenue generation, demanding specialized product lines that emphasize robustness and thermal resilience over compactness.

Analyzing the market by Component highlights the shift towards integrated modules, which often include both the electronic valve and the water-cooled heat exchanger, optimizing system performance and reducing assembly complexity for OEMs. The segment dedicated to EGR Coolers is growing notably, driven by the fact that cooling efficiency is paramount for NOx reduction, and the coolers themselves are prone to failure due to thermal cycling stress and corrosive exhaust condensate. Furthermore, the segmentation by Fuel Type underscores the market's evolution, with the Diesel segment historically dominating due to high NOx formation, but the Gasoline segment (G-EGR) demonstrating the highest proportional growth as GDI engines become standard and face new NOx and PM regulatory pressures, requiring specialized EGR architectures compatible with gasoline combustion characteristics.

- By Vehicle Type:

- Passenger Cars (Light-Duty Vehicles) – Focus on compactness and G-EGR integration.

- Commercial Vehicles (LCVs, HCVs) – Focus on high flow capacity, durability, and robust cooling systems for diesel applications.

- Off-Highway Vehicles (Construction, Agricultural) – Focus on extreme durability, resistance to vibration, and specialized temperature management.

- By Component:

- EGR Valves (Electronic, Solenoid-actuated, Stepper Motor)

- EGR Coolers (High-efficiency Water-cooled Heat Exchangers, Air-cooled systems)

- EGR Sensors & Modules (Temperature, Flow Rate, and Position Sensors integrated into control packages)

- By Fuel Type:

- Diesel Engines – Dominant segment; primarily uses HP-EGR and LP-EGR dual loops.

- Gasoline Engines – Fastest-growing segment; utilizes G-EGR to reduce pumping losses and NOx.

- By Sales Channel:

- Original Equipment Manufacturer (OEM) – Largest segment, driven by new vehicle production mandates.

- Aftermarket – High-margin replacement segment, driven by component failure and regulatory inspection requirements.

Value Chain Analysis For EGR Valve Market

The EGR Valve Value Chain commences with highly specialized upstream suppliers providing critical raw materials and sub-components. This includes sophisticated metallurgical companies that supply specialized stainless steel alloys (such as high-nickel content variants) crucial for the EGR cooler's heat exchanger core, which must resist high-temperature oxidation and acid corrosion prevalent in diesel exhaust. Concurrently, electronic component manufacturers supply the high-precision actuators (stepper motors or solenoids) and robust sensors required for electronic valve control. The emphasis at this stage is on material quality and consistency, as component failure is often traceable back to micro-structural deficiencies in the raw materials used in critical sealing and heat exchange surfaces. Strong collaborative relationships between Tier 1 manufacturers and material suppliers are essential for achieving continuous improvements in thermal performance and durability.

The core manufacturing stage is dominated by Tier 1 suppliers who perform high-precision assembly, welding (especially vacuum or laser welding for cooler cores), and rigorous calibration and testing. Due to the component's critical role in meeting regulatory standards, quality control is exceptionally strict. Products are then distributed predominantly through direct channels to automotive OEMs globally. This direct channel requires complex logistics and highly coordinated Just-In-Time (JIT) supply chain management to feed high-volume engine assembly lines. The specifications for OEM supply are bespoke, tied to individual engine model requirements, making the entry barrier high and favoring established global players with extensive R&D capabilities and existing supply contracts.

The indirect channel, comprising the aftermarket, handles the distribution of replacement parts. This channel flows from Tier 1 manufacturers or specialized aftermarket distributors to wholesale parts providers, authorized service networks, and independent garages. Profit margins can often be higher in the aftermarket, incentivizing manufacturers to develop robust aftermarket strategies, including packaging, branding, and comprehensive parts catalogs. Downstream, the value chain focuses on maintenance and repair, driven by the operational lifecycle of vehicles. Effective service and diagnostic tools are essential, as incorrect installation or failure to address underlying causes (e.g., turbocharger oil consumption) can lead to immediate recurrence of EGR system issues. The overall chain is characterized by high technical barriers, stringent quality requirements, and complexity driven by the need to cater simultaneously to high-volume OEM demand and high-variety aftermarket needs.

EGR Valve Market Potential Customers

The primary customer base for the EGR Valve Market is fundamentally segmented into organizations that purchase the product for new vehicle production (OEMs) and organizations responsible for vehicle maintenance and repair (Aftermarket channels). Global Automotive and Engine Original Equipment Manufacturers (OEMs)—including major passenger vehicle manufacturers (e.g., Volkswagen Group, Ford, Toyota) and heavy-duty engine makers (e.g., Cummins, Daimler Trucks)—represent the largest volume purchasers. Their procurement strategies prioritize technical integration, global quality assurance, and the supplier's ability to demonstrate compliance with the most recent and future emission regulations, making long-term supply agreements the norm. OEMs require valves and coolers that are optimized for their specific engine architecture to pass stringent certification tests, driving customization and technical partnerships with Tier 1 suppliers.

The second major category involves large Fleet Operators and Managers, particularly those running substantial fleets of commercial vehicles (freight haulage, municipal transit, waste management). For these operators, the EGR system is a critical operational component; its failure results in vehicle downtime and potential regulatory fines. They are key purchasers in the aftermarket, seeking high-durability replacement parts and often favoring components supplied directly by the original Tier 1 manufacturer or certified alternatives. Their purchasing criteria heavily emphasize Mean Time Between Failures (MTBF) and overall TCO, requiring parts that withstand continuous, high-mileage operation and challenging duty cycles, such as constant stop-start urban driving that exacerbates fouling issues.

Finally, the broad network of Independent Aftermarket Service Providers, authorized dealerships, and spare parts wholesalers forms the tertiary but highly profitable customer base. These entities require immediate availability of a wide variety of EGR components covering different model years and regulatory standards across various vehicle brands. Their success depends on accurate diagnostics and reliable parts supply. The increasing complexity of electronic EGR systems also necessitates specialized diagnostic equipment and training for technicians within this service sector, which manufacturers often provide as part of their value-added offering, cementing customer loyalty and ensuring correct installation procedures are followed.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BorgWarner Inc., Continental AG, Delphi Technologies (BorgWarner), Denso Corporation, Eberspächer, Eminox Ltd., Hitachi Astemo, MAHLE GmbH, Mitsubishi Heavy Industries, Modine Manufacturing Company, Pierburg GmbH (Rheinmetall Automotive), Tenneco Inc., Sogefi Group, Weifu High-Technology Group, Cummins Inc., Valeo, Schaeffler AG, Faurecia (FORVIA), Hanon Systems, Korens Co., Ltd., Calsonic Kansei (Marelli), Keihin Corporation, IHI Corporation, Mikuni Corporation, Standard Motor Products, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EGR Valve Market Key Technology Landscape

The contemporary technological landscape within the EGR Valve Market is defined by the necessity for extreme precision, integration, and resistance to environmental degradation. The core technology centers on fully electronic control, utilizing high-speed stepper motors or Pulse Width Modulated (PWM) solenoid actuators to achieve near-instantaneous and continuous modulation of exhaust flow, which is non-negotiable for meeting RDE (Real Driving Emissions) requirements. These electronic controls rely heavily on sophisticated embedded software and sensor technology, including high-accuracy flow meters and rapid-response temperature and position sensors, which provide the essential feedback loop to the ECU for maintaining target NOx levels across fluctuating engine loads and temperatures. The trend is moving away from simple on/off mechanical operation towards continuous, highly controlled flow proportional to engine demand.

Advanced thermal management solutions represent another pivotal technological focus. With modern turbocharged engines operating at increasingly higher exhaust gas temperatures (EGT), the effectiveness and durability of the EGR Cooler are paramount. Leading manufacturers are deploying proprietary heat exchanger designs, often featuring highly convoluted micro-channel structures made from specialized stainless steel or exotic alloys, specifically designed to maximize heat transfer efficiency within a constrained physical volume. Critical advancements include anti-corrosion coatings and improved welding techniques to prevent leaks caused by thermal cycling stress and the highly corrosive acidic condensate generated during cooling. Furthermore, the integration of by-pass valves within the cooler module allows the ECU to intentionally reduce cooling under cold-start conditions, accelerating catalyst warm-up and improving system efficiency before full cooling is required.

Looking forward, key technology development is concentrated on mitigation strategies for component fouling. This includes researching and deploying catalytic coatings on the internal surfaces of both the valve and cooler to inhibit carbon and soot adhesion. Furthermore, the increasing adoption of Low-Pressure EGR (LP-EGR), which draws cleaner exhaust gas downstream of filtration devices (like the Diesel Particulate Filter or Gasoline Particulate Filter), is a major technological shift. LP-EGR requires complex piping and sometimes a dedicated compressor or pump to overcome pressure differentials, but its benefits—reduced fouling, improved fuel economy, and better thermal efficiency—make it the preferred route for high-compliance engine architectures. The entire system is becoming increasingly networked, relying on high-speed CAN bus communication to integrate seamlessly with turbochargers, variable valve timing, and post-treatment systems.

Regional Highlights

Regional market consumption and technological trends in the EGR Valve Market are highly variable, directly mirroring local regulatory implementation and the structure of the local vehicle fleet. This geographic variance necessitates tailored manufacturing and supply strategies for global vendors.

- Asia Pacific (APAC): APAC commands the leading position in market volume due to the robust manufacturing bases in China, India, and ASEAN nations. The rapid implementation of China VI and India's BS VI standards, which align closely with Euro 6, has forced mass adoption of advanced electronic and cooled EGR systems, especially in the rapidly expanding commercial vehicle segment. The high volume, coupled with the ongoing regulatory harmonization, ensures APAC's dominance in terms of new vehicle installation demand over the forecast period.

- Europe: This region is characterized by the highest technical requirement per unit. Driven by the stringent Euro 6d RDE framework and anticipated Euro 7 proposals, the market demands complex, highly integrated dual-loop (HP and LP) EGR systems, particularly in diesel engines where NOx reduction targets are exceptionally challenging. European OEMs prioritize suppliers who can offer compact, lightweight, and extremely durable solutions, leading to higher average component value in this region compared to others.

- North America: North America presents a highly differentiated market. The heavy-duty trucking sector (Class 8) drives significant value, requiring large, robust EGR components to meet demanding EPA standards for high-mileage diesel operations. The passenger vehicle segment has stable demand, focusing on replacement components and new installations in pickups and SUVs. The regulatory focus on long-term compliance mandates component longevity, making the aftermarket in North America particularly significant.

- Latin America: This region is progressing steadily toward modern emission standards (e.g., Euro V and Euro VI equivalents). The market is characterized by a gradual replacement of older mechanical EGR systems with electronic variants. Demand is increasing, driven by economic development and the modernization of commercial fleets, although market complexity is lower than in Europe or China.

- Middle East and Africa (MEA): Growth in MEA is highly localized, often driven by government efforts in certain GCC countries or South Africa to adopt higher standards. The market primarily relies on imported vehicles and engine technology, meaning demand follows the specifications dictated by global OEMs. The aftermarket is particularly important here due to challenging operating conditions (high dust, extreme temperatures) that accelerate component wear.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EGR Valve Market.- BorgWarner Inc.

- Continental AG

- Delphi Technologies (A BorgWarner Company)

- Denso Corporation

- Eberspächer

- Eminox Ltd.

- Hitachi Astemo, Ltd.

- MAHLE GmbH

- Mitsubishi Heavy Industries, Ltd.

- Modine Manufacturing Company

- Pierburg GmbH (Rheinmetall Automotive)

- Tenneco Inc.

- Sogefi Group

- Weifu High-Technology Group Co., Ltd.

- Cummins Inc.

- Valeo

- Schaeffler AG

- Faurecia (FORVIA)

- Hanon Systems

- Korens Co., Ltd.

- Calsonic Kansei (Marelli)

- Keihin Corporation

- IHI Corporation

- Mikuni Corporation

- Standard Motor Products, Inc.

Frequently Asked Questions

Analyze common user questions about the EGR Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an EGR Valve and why is it mandatory?

The primary function of the Exhaust Gas Recirculation (EGR) valve is to reduce harmful Nitrogen Oxide (NOx) emissions. It achieves this by routing a measured portion of inert exhaust gas back into the combustion chamber, which lowers the peak combustion temperature. Regulatory bodies worldwide mandate EGR systems in internal combustion engines (ICE) to comply with stringent emission standards like Euro 6 and EPA Tier 3, making it a critical component for environmental compliance and vehicle certification.

How is the adoption of electric vehicles (EVs) impacting the long-term outlook of the EGR Valve Market?

The long-term outlook for the EGR Valve Market faces structural restraint from the accelerating global policy shift towards Battery Electric Vehicles (BEVs), which completely eliminate the need for EGR systems. However, in the mid-term (2026-2033), the market remains robust, sustained by continuous growth in the commercial vehicle, heavy-duty truck, and hybrid vehicle (HEV) segments, all of which continue to rely on complex, highly regulated ICEs, ensuring stable OEM and aftermarket demand.

What technological advancements are addressing the common problem of EGR valve fouling and clogging?

The persistent issue of fouling caused by soot and carbon is being addressed through several technological advancements. Key solutions include the increased adoption of Low-Pressure EGR (LP-EGR) which utilizes cleaner exhaust gas, development of anti-fouling coatings (such as ceramic or specialized polymer coatings) on internal valve surfaces, and the implementation of advanced AI-based diagnostic algorithms that predict and attempt to mitigate buildup before system blockage occurs.

Which segmentation segment is driving the highest proportional growth in the EGR Valve Market?

The Gasoline Engines segment (G-EGR) is experiencing the highest proportional growth. Historically dominated by diesel applications, the rise of Gasoline Direct Injection (GDI) engines requires G-EGR systems to comply with modern particulate matter (PM) and NOx standards. This expansion into high-volume passenger car platforms represents a significant new revenue stream for component manufacturers, expanding the overall addressable market.

Why is the EGR Cooler component becoming increasingly critical in modern EGR systems?

The EGR Cooler is becoming critical because modern engines run at higher efficiencies and thus generate hotter exhaust gases. For EGR to be effective in reducing NOx, the recirculated gas must be cooled significantly. The cooler must be extremely efficient and robust, utilizing high-grade materials to withstand immense thermal stress and corrosive acidic condensate, making it a high-value, high-failure-rate component driving significant R&D investment and replacement demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager