EHS Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432481 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

EHS Software Market Size

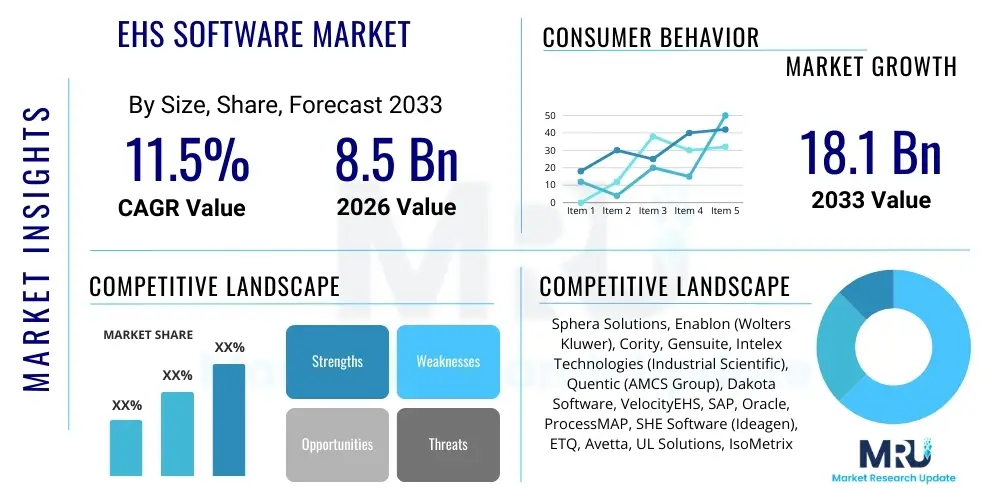

The EHS Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.1 Billion by the end of the forecast period in 2033. This robust expansion is fueled by increasingly stringent global regulatory environments, demanding that enterprises adopt comprehensive digital solutions to manage environmental risks, occupational health, and safety protocols efficiently. The transition from traditional, manual data collection methods to integrated, real-time software platforms is a pivotal factor driving this valuation increase.

EHS Software Market introduction

The Environment, Health, and Safety (EHS) Software Market encompasses integrated software solutions designed to help organizations manage regulatory compliance, minimize operational risks, and foster a safer, more sustainable working environment. These specialized platforms centralize data related to incident management, occupational health, compliance reporting, audit management, and sustainability metrics. The product category ranges from modular systems focused on specific EHS domains, such as industrial hygiene or chemical management, to comprehensive, enterprise-wide suites offering interconnected modules for holistic risk governance. Key applications span high-risk sectors like manufacturing, energy, construction, and chemicals, where regulatory adherence and operational safety directly impact business continuity and reputation. The primary benefits include reduced administrative burden, improved compliance certainty, decreased incident rates through proactive risk identification, and enhanced data visibility for strategic decision-making regarding sustainability goals. Market growth is principally driven by mandatory government regulations (e.g., OSHA, EPA, REACH), the global emphasis on Corporate Social Responsibility (CSR) and ESG (Environmental, Social, and Governance) reporting, and the necessity for digital transformation across operational domains.

EHS Software Market Executive Summary

The EHS Software Market is characterized by accelerating digitalization across industrial sectors, pushing organizations toward cloud-based and SaaS models for flexible, scalable deployment. Current business trends indicate a strong focus on merging EHS data with operational technology (OT) data, enabling predictive analytics for hazard prevention rather than reactive incident response. Strategic mergers and acquisitions are frequent among major vendors aiming to consolidate niche capabilities, particularly in areas like chemical regulatory compliance and advanced sustainability reporting tools. Geographically, North America currently dominates the market, largely due to strict federal and state regulatory mandates and high technological adoption rates. However, the Asia Pacific region is poised for the highest growth trajectory, driven by rapid industrialization, increasing governmental pressure on environmental accountability in countries like China and India, and significant foreign direct investment requiring adherence to international safety standards. Segment trends highlight the rising prominence of the Services component, specifically consulting and implementation services, which are crucial for integrating complex EHS solutions into existing enterprise resource planning (ERP) systems. Furthermore, the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies is transforming the software landscape, shifting emphasis towards mobile functionality and real-time risk assessment.

AI Impact Analysis on EHS Software Market

Common user questions regarding AI's influence on the EHS Software Market revolve around its practical application in predicting incidents, automating compliance checks, and managing massive streams of sensor data generated by IoT devices. Users frequently inquire about the reliability of AI algorithms in complex operational environments, the required investment in data infrastructure to support machine learning models, and how AI can move EHS beyond simple reporting to true, proactive risk mitigation. The prevailing concerns address data privacy, algorithm bias in safety protocols, and the need for specialized training for EHS professionals to leverage these advanced tools effectively. The consensus is that AI is transformative, primarily by enhancing the speed and accuracy of risk identification, moving the industry toward a zero-incident culture through predictive maintenance and behavioral analysis. Key themes emphasize AI’s role in automating tedious tasks, such as regulatory mapping and documentation, freeing up EHS professionals to focus on high-value strategic safety initiatives rather than manual data entry and compliance auditing.

- AI-driven Predictive Analytics: Utilizing machine learning algorithms to analyze historical incident data, operational logs, and environmental conditions to forecast potential safety hazards and environmental breaches before they occur.

- Automated Compliance Monitoring: Employing AI and Natural Language Processing (NLP) to continuously scan regulatory updates globally and automatically map changes to internal organizational policies and controls, ensuring dynamic compliance adherence.

- Computer Vision for Safety: Implementing image and video analysis (via drones or fixed cameras) to detect non-compliance behaviors, misuse of Personal Protective Equipment (PPE), and restricted area breaches in real time.

- Optimized Resource Allocation: Using machine learning to determine the most effective schedule and location for safety inspections, audits, and training based on real-time risk scores and resource availability.

- Enhanced Incident Root Cause Analysis: Applying AI to swiftly process and correlate disparate data sources—witness statements, sensor logs, maintenance records—to accurately identify the underlying causes of accidents and formulate precise corrective actions.

DRO & Impact Forces Of EHS Software Market

The market dynamics of EHS software are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all contributing to substantial Impact Forces influencing market adoption and growth. Key drivers include increasingly stringent domestic and international regulatory frameworks, which impose heavy penalties for non-compliance, thereby necessitating robust software solutions for centralized documentation and reporting. Furthermore, global investor and consumer pressure regarding corporate ESG performance compels large enterprises to prioritize sustainability and safety, leveraging EHS software to transparently measure and report their environmental footprint and social impact. The digital transformation wave sweeping across industries accelerates the adoption of integrated EHS platforms that connect fragmented safety data across global operations. The convergence of these drivers creates a powerful impact force centered on mandatory compliance and reputational risk management, transforming EHS from a cost center into a strategic operational advantage.

However, significant restraints temper the market's explosive growth potential. High initial investment costs associated with purchasing, customizing, and deploying comprehensive EHS software suites, particularly for small and medium-sized enterprises (SMEs), pose a substantial barrier to entry. Moreover, the complexity of integrating new EHS systems with legacy IT infrastructure and disparate operational technology (OT) systems within established industrial environments often leads to prolonged implementation cycles and data migration challenges. The lack of standardized data formats and definitions across different industrial sectors further complicates interoperability. These restraints manifest as an impact force related to integration friction and budget constraints, demanding that vendors offer flexible, modular, and cloud-native solutions (SaaS) to mitigate deployment complexity and shift expenditure from CAPEX to OPEX.

Opportunities for expansion are primarily concentrated in the deployment of advanced technologies such as Industrial IoT (IIoT), wearable sensors, augmented reality (AR) for training, and blockchain for supply chain transparency and carbon tracking. The sustained shift toward cloud-based delivery models (SaaS) provides scalability, accessibility, and lower total cost of ownership (TCO), significantly widening the potential customer base, especially in emerging markets. Additionally, the growing focus on occupational health and wellness, extending beyond traditional physical safety to include mental health and ergonomic assessments, creates a lucrative opportunity for specialized EHS software modules. These opportunities drive an impact force focused on innovation and customization, compelling market participants to rapidly evolve their product offerings to incorporate real-time monitoring, predictive modeling, and enhanced mobile accessibility for frontline workers.

Segmentation Analysis

The EHS Software Market is segmented based on component, deployment model, enterprise size, and end-use industry, reflecting the diverse requirements of the global market. Component segmentation distinguishes between the core software platform itself and the associated professional services necessary for successful implementation, customization, integration, and ongoing support. Deployment models primarily separate traditional on-premise solutions, favored by organizations with stringent data security requirements, from the highly flexible and scalable cloud-based (SaaS) solutions, which currently hold the dominant market share due to their ease of deployment and lower maintenance overhead. End-use industries represent the largest variation in functional demands, with sectors like Oil & Gas requiring specific process safety management tools, while manufacturing demands robust chemical inventory and industrial hygiene modules. Analyzing these segments provides a clear pathway for vendors to tailor their marketing strategies and product development roadmaps to address specific vertical market needs and regulatory pressures.

- By Component:

- Software (Platform and Modules)

- Services (Implementation, Consulting, Training, Support & Maintenance)

- By Deployment Model:

- On-Premise

- Cloud-Based (Software-as-a-Service - SaaS)

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-Use Industry:

- Manufacturing (Process and Discrete)

- Construction and Engineering

- Energy and Utilities (Oil & Gas, Power Generation)

- Chemicals and Materials

- Mining

- Healthcare and Pharmaceuticals

- Government and Public Sector

- Telecom and IT

- Food & Beverage

Value Chain Analysis For EHS Software Market

The value chain of the EHS Software Market begins with the upstream activities involving R&D and intellectual property creation, where vendors focus on developing robust features, integrating new technologies like AI and IoT, and ensuring alignment with global regulatory standards. This phase requires heavy investment in skilled software architects and domain experts specializing in occupational safety and environmental management. Upstream market participants include specialized software developers, database providers, and core technology firms providing foundational platforms. The subsequent stage involves the core software development, configuration, and quality assurance processes, focusing heavily on user experience (UX) and compliance mapping capabilities. A critical component in the middle of the value chain is the professional services segment, including consulting and integration partners, who are essential for customizing and deploying the software within complex client IT ecosystems, ensuring seamless data flow and process alignment. Due to the highly specialized nature of EHS data and compliance requirements, these integration services often command a significant portion of the total contract value.

The downstream segment focuses on market delivery and client support. Distribution channels are primarily direct, especially for large enterprise contracts where complex negotiation and customization are required, utilizing the vendor's internal sales and account management teams. However, indirect channels, involving channel partners, value-added resellers (VARs), and strategic alliances with large system integrators (e.g., Accenture, Deloitte), are increasingly crucial for reaching international markets and specific SME segments. These indirect partners often provide localized support and regional compliance expertise, enhancing the software's localized relevance. Post-sales support and ongoing maintenance form the final critical link in the chain, ensuring platform stability, rapid adaptation to regulatory changes, and continuous user training, which is particularly important in a SaaS environment where recurring revenue models rely heavily on customer retention and satisfaction. Efficiency across this value chain is paramount; vendors must continuously optimize R&D while ensuring swift, compliant, and cost-effective deployment through their distribution network to maintain competitive advantage.

EHS Software Market Potential Customers

Potential customers for EHS software are predominantly organizations operating in highly regulated, high-risk, or asset-intensive industries where safety, environmental performance, and regulatory compliance are non-negotiable operational requirements. This encompasses a broad spectrum of end-users, ranging from multinational corporations managing hundreds of global sites to mid-sized manufacturers seeking to streamline their compliance documentation. Key buyers include EHS Directors, Chief Operating Officers (COOs), Sustainability Officers, Risk Management executives, and Compliance officers, who are responsible for mitigating legal liabilities and ensuring workforce protection. In industries such as Oil & Gas and Chemical Manufacturing, customers prioritize sophisticated process safety management (PSM) and industrial hygiene modules. Conversely, in the construction and engineering sector, the demand is skewed toward mobile-enabled incident reporting, contractor safety management, and permit-to-work systems. The common thread among all potential customers is the need to move away from disparate spreadsheets and paper-based systems toward an integrated digital platform that provides real-time visibility into operational risks, facilitates rapid response to incidents, and provides robust auditing trails necessary for demonstrating regulatory adherence to external bodies and stakeholders, including investors and insurers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.1 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sphera Solutions, Enablon (Wolters Kluwer), Cority, Gensuite, Intelex Technologies (Industrial Scientific), Quentic (AMCS Group), Dakota Software, VelocityEHS, SAP, Oracle, ProcessMAP, SHE Software (Ideagen), ETQ, Avetta, UL Solutions, IsoMetrix, KPA, EcoOnline, Optial, Medgate (Cority) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EHS Software Market Key Technology Landscape

The EHS Software market is undergoing rapid technological innovation, moving beyond conventional desktop applications towards highly mobile, interconnected, and intelligent platforms. Cloud computing, particularly the Software-as-a-Service (SaaS) model, forms the foundational backbone of the modern EHS landscape, enabling automatic updates, global accessibility, and superior scalability critical for multinational organizations. This shift has democratized access to sophisticated tools, reducing reliance on internal IT resources. Furthermore, mobility is paramount; EHS platforms now feature dedicated mobile applications that allow frontline employees to perform inspections, log incidents, access safety data sheets (SDS), and complete training modules directly from the field, leading to immediate data capture and reduced reporting delays. The integration capabilities of these platforms are also vital, utilizing APIs and robust data connectors to synchronize EHS data with core enterprise systems like ERP (SAP, Oracle), HR systems, and maintenance management platforms, ensuring data consistency across the organization.

The most transformative technologies are centered around data acquisition and predictive capabilities. The Internet of Things (IoT) plays a crucial role, utilizing smart sensors, wearable devices (for monitoring worker fatigue, posture, and environmental exposure), and interconnected machinery to feed real-time operational and environmental data directly into the EHS software. This massive data influx fuels machine learning and Artificial Intelligence (AI) models, which are used for advanced risk modeling, predictive maintenance planning, and anomaly detection. For instance, AI algorithms can analyze thousands of near-miss reports to identify systemic weaknesses that human analysis might miss, dramatically enhancing proactive safety measures. Moreover, technologies such as Augmented Reality (AR) are being leveraged for immersive, risk-free safety training, allowing employees to practice complex safety procedures in a simulated environment, thereby improving knowledge retention and reducing on-site training risks. The competition among vendors is increasingly focused on who can most effectively integrate these advanced technologies to deliver actionable, real-time intelligence and minimize the latency between risk identification and mitigation.

Regional Highlights

Regional dynamics significantly influence the adoption and functional requirements of EHS software globally, primarily driven by the stringency of local regulatory bodies and the level of industrial maturity. North America, encompassing the US and Canada, remains the largest market share holder, attributed to the rigorous enforcement of safety standards by organizations like OSHA and EPA, coupled with early and widespread technological adoption across high-value sectors such as oil and gas, manufacturing, and pharmaceuticals. High awareness regarding corporate liability and the strong emphasis on risk management documentation necessitate robust, complex EHS management systems. Furthermore, North American enterprises are often the first to invest in cutting-edge solutions like AI-driven predictive safety and advanced SaaS platforms, maintaining the region's technological leadership.

Europe represents the second-largest market, characterized by mature regulatory frameworks, particularly the European Union's environmental directives, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), and a strong cultural commitment to workplace safety and sustainability. European adoption is primarily driven by the need for meticulous compliance with cross-border regulations and the strong push for ESG transparency. The market here is fragmented, with many local vendors providing specialized solutions catering to country-specific linguistic and regulatory nuances. The swift transition towards cloud computing, particularly in Western European economies like Germany and the UK, is a key growth accelerator in this region.

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the projection period. This explosive growth is fueled by rapid industrialization, massive infrastructure development, and increasing governmental initiatives in populous nations like China, India, and Southeast Asia focused on reducing industrial pollution and improving occupational safety standards. While initial adoption was slow, driven by price sensitivity, the shift toward multinational manufacturing operations setting up shop in APAC mandates the implementation of global standard EHS practices. This region presents substantial opportunities for SaaS providers offering scalable, cost-effective, and mobile-friendly solutions tailored for rapid deployment across large, distributed workforces. Latin America and the Middle East and Africa (MEA) are emerging markets, where growth is highly dependent on commodity prices (especially Oil & Gas and Mining sectors) and evolving environmental legislation, driving localized demand for incident management and regulatory reporting modules.

- North America: Dominant market share due to stringent governmental regulations (OSHA, EPA), mature industrial sectors, and early adoption of AI, predictive analytics, and enterprise-wide EHS integration.

- Europe: High adoption driven by EU directives, strong ESG focus, and established occupational safety culture, requiring highly customizable solutions for multi-lingual and multi-jurisdictional compliance (e.g., REACH compliance).

- Asia Pacific (APAC): Highest expected growth rate, driven by rapid industrialization, increasing government enforcement of safety and environmental laws, and significant foreign investment requiring adherence to international EHS benchmarks.

- Latin America (LATAM): Growth centered on mining and energy sectors, with increasing focus on environmental management and emissions tracking due to evolving national regulations.

- Middle East & Africa (MEA): Growth tied heavily to large energy and infrastructure projects; demand is focused on robust operational risk management, safety permits, and chemical management in harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EHS Software Market.- Sphera Solutions

- Enablon (Wolters Kluwer)

- Cority

- Gensuite

- Intelex Technologies (Industrial Scientific)

- Quentic (AMCS Group)

- Dakota Software

- VelocityEHS

- SAP SE

- Oracle Corporation

- ProcessMAP

- SHE Software (Ideagen)

- ETQ

- Avetta

- UL Solutions

- IsoMetrix

- KPA

- EcoOnline

- Optial

- Medgate (Cority)

- Capriza

- SiteHawk (Verisk 3E)

- Enviance (Cority)

Frequently Asked Questions

Analyze common user questions about the EHS Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating EHS software from on-premise to a cloud-based (SaaS) model?

The primary benefit is reduced Total Cost of Ownership (TCO), enhanced scalability, and immediate access to automatic regulatory updates. SaaS models eliminate the need for extensive internal IT infrastructure, simplify deployment, and ensure global accessibility for distributed workforces, which is crucial for real-time risk reporting.

How does EHS software assist companies with achieving ESG (Environmental, Social, and Governance) targets?

EHS software centralizes ESG data collection, offering modules for emissions tracking, resource consumption monitoring, incident frequency analysis (safety metrics), and sustainability reporting. This centralization provides the necessary transparency and verifiable data required to meet investor and regulatory ESG disclosure standards, improving corporate reputation.

Which technology integration is currently driving the most significant change in EHS software functionality?

The integration of IoT (Internet of Things) and AI (Artificial Intelligence) is most transformative. IoT sensors provide real-time operational and environmental data, which AI algorithms analyze to perform predictive risk modeling, enabling organizations to transition from reactive incident management to proactive hazard prevention.

What is the biggest challenge faced during the implementation of new EHS software?

The most significant challenge is data integration and standardization, particularly when merging data from diverse legacy systems (OT, HR, ERP) across multiple global sites. Successful implementation requires extensive consulting services to map existing workflows and ensure seamless migration without disrupting operational continuity.

Which industry segment is expected to show the highest adoption rate for EHS software in the coming years?

The Asia Pacific (APAC) manufacturing and construction sectors are expected to show the highest growth in adoption. This is driven by rapid industrial expansion, escalating government enforcement of environmental and safety regulations, and the need for standardized safety protocols imposed by multinational corporations operating in the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager