Elastomeric Coupling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434142 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Elastomeric Coupling Market Size

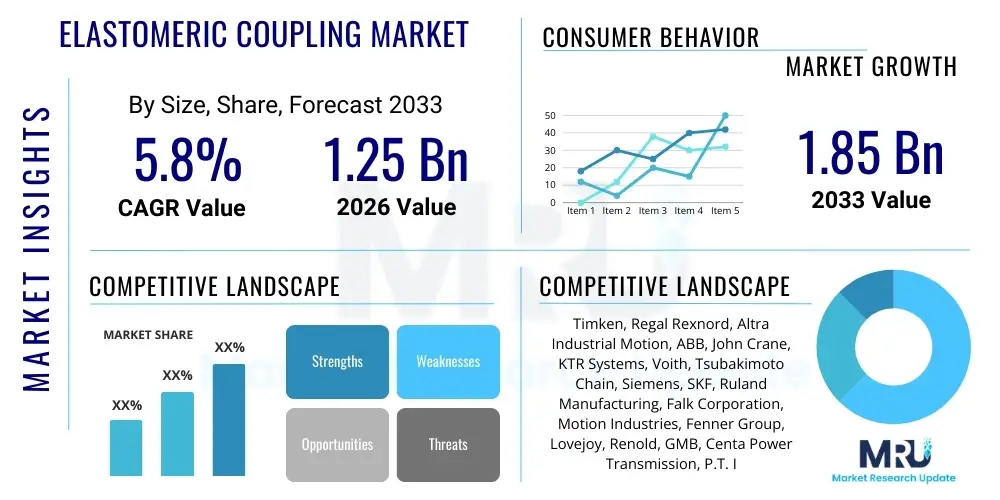

The Elastomeric Coupling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing automation and industrialization across developing economies, coupled with the persistent need for effective vibration dampening and shock absorption solutions in heavy-duty machinery across diverse sectors such as oil and gas, power generation, and manufacturing.

The resilience of the elastomeric coupling market is intrinsically linked to the performance requirements of rotating equipment, where misalignment, shock loads, and torsional vibrations are common operational challenges. Elastomeric couplings, leveraging materials like rubber, EPDM, and polyurethane, offer superior flexibility and maintenance-free operation compared to metallic alternatives, positioning them as essential components for reliability engineers seeking to reduce downtime and operational expenditure. The ongoing modernization of aging infrastructure in North America and Europe also contributes significantly, as replacement cycles often favor higher-performance, maintenance-light solutions like elastomeric systems.

Furthermore, the market expansion is supported by technological advancements, focusing on developing higher temperature and chemical-resistant elastomer compounds, broadening the applicability of these couplings in extreme environments, particularly within the chemical and petrochemical industries. The growing emphasis on energy efficiency and predictive maintenance in industrial operations further mandates the use of reliable power transmission components, solidifying the continuous demand for robust elastomeric coupling designs capable of handling high torque while minimizing transmitted loads to sensitive adjacent components.

Elastomeric Coupling Market introduction

The Elastomeric Coupling Market encompasses the global trade of flexible mechanical components designed to transmit torque between two shafts while compensating for angular, parallel, and axial misalignments. These couplings utilize an elastic element, often referred to as the "spider," "insert," or "sleeve," made from materials such as natural rubber, neoprene, or polyurethane, which provides excellent resilience, vibration isolation, and shock absorption. The primary function is to protect sensitive connected equipment, such as motors, pumps, and gearboxes, from damaging shock loads and torsional vibration inherent in industrial machinery operation, thereby extending the lifespan of the entire drive train system. Unlike rigid couplings, elastomeric types require little to no lubrication or maintenance, translating to lower total cost of ownership (TCO) for end-users.

Key applications of elastomeric couplings span across virtually every sector utilizing rotating machinery. In the Power Generation industry, they are crucial for connecting turbines to generators, ensuring smooth operation despite high rotational speeds. The Oil and Gas sector relies heavily on these components for connecting compressors and pumping units, where robustness against harsh environmental conditions and reliability are paramount. Furthermore, they are widely adopted in material handling equipment, HVAC systems, mining machinery, and water treatment facilities due to their effectiveness in dampening noise and vibration, which is increasingly critical in compliance with workplace safety and operational efficiency standards.

The inherent benefits driving market penetration include their maintenance-free nature, high torsional flexibility, electrical insulation properties, and the ability to operate effectively in environments characterized by moisture, dust, and minor chemical exposure. The increasing global focus on maximizing machine uptime and reducing maintenance costs acts as a significant driving factor. Moreover, the demand for modular and quick-assembly components in modern manufacturing lines further elevates the preference for easily installed elastomeric coupling designs, fueling sustained market growth globally, particularly in industrialized nations undergoing infrastructure renewal and maintenance cycles.

Elastomeric Coupling Market Executive Summary

The Elastomeric Coupling Market is characterized by steady growth, propelled by robust industrial output and critical infrastructure investments worldwide, notably in the Asia Pacific region. Business trends indicate a strong shift towards condition monitoring integration, where coupling manufacturers are incorporating smart sensors and materials for real-time performance tracking, enhancing predictive maintenance capabilities for end-users. Consolidation remains a key strategy among market leaders seeking to expand their technological portfolios, particularly focusing on developing elastomer materials that offer enhanced chemical resistance and thermal stability, addressing the stringent requirements of specialty chemical and extreme temperature applications. Furthermore, the push for standardization in high-volume industrial coupling types, such as jaw and tire couplings, is streamlining manufacturing processes and improving supply chain efficiency across major industrial hubs.

Regionally, the Asia Pacific (APAC) market is forecasted to exhibit the highest growth rate, fueled by massive investments in new manufacturing facilities, rapid urbanization, and significant government spending on power and water infrastructure projects, particularly in China and India. North America and Europe represent mature markets, where growth is predominantly driven by replacement demand, modernization of existing industrial assets, and strict regulatory requirements mandating energy-efficient and vibration-dampening machinery. The Middle East and Africa (MEA) region, bolstered by continuous upstream and downstream activities in the oil and gas sector, continues to be a crucial consumer base for heavy-duty, robust elastomeric couplings designed for harsh desert and offshore environments.

Segment-wise, the Jaw Coupling segment dominates the market due to its simplicity, ease of installation, and wide range of torque capabilities, making it the preferred choice for general industrial applications. However, the Tire Coupling segment is projected to experience accelerated growth, especially in large-scale applications requiring high misalignment tolerance and easy radial access without moving the connected equipment. Material segmentation highlights the increasing adoption of high-performance polyurethanes over traditional rubber in applications demanding higher torque density and improved resistance to oil contamination, reflecting a broader trend towards utilizing advanced polymer technology to optimize coupling lifespan and performance.

AI Impact Analysis on Elastomeric Coupling Market

User queries regarding AI's impact on the elastomeric coupling market predominantly revolve around three key themes: how AI integrates with predictive maintenance (PdM) systems, whether AI-driven design optimization can improve coupling lifespan and material usage, and the long-term potential for automated fault detection in power transmission systems. Users are keen to understand if AI algorithms can analyze vibration data collected from smart couplings to predict failures more accurately than traditional threshold-based systems, thereby maximizing machine uptime. There is also significant interest in AI's role in optimizing the production process, potentially reducing material waste and improving the consistency of high-performance elastomer compound manufacturing.

The influence of Artificial Intelligence is primarily channeled through the integration of advanced sensor technology within or adjacent to the elastomeric couplings themselves. AI algorithms are crucial for processing the high-frequency vibration, temperature, and torque data generated by these sensors, moving PdM from reactive or scheduled maintenance to highly accurate, proactive intervention. By detecting subtle deviations in coupling performance indicative of impending wear, misalignment, or material fatigue—often imperceptible to human monitoring—AI systems allow for timely replacement of the elastomeric element, preventing catastrophic equipment failure and associated financial losses. This transition is transforming couplings from mere mechanical components into intelligent nodes within the industrial internet of things (IIoT).

Furthermore, AI is beginning to impact the design and simulation phase. Generative design tools, powered by machine learning, allow engineers to rapidly test thousands of material compositions and coupling geometries against complex stress profiles, leading to optimized designs that maximize fatigue life and torque transmission capacity while minimizing material volume. This capability is particularly vital for developing specialized couplings for high-stakes industries like aerospace or high-speed manufacturing. The application of AI in material science also accelerates the discovery of novel elastomer compounds with superior durability and environmental resistance, directly addressing the evolving performance demands of heavy industry.

- AI algorithms enhance predictive maintenance accuracy by processing complex vibration signatures.

- Generative design tools, fueled by AI, optimize coupling geometry for increased torque capacity and reduced material use.

- Machine learning facilitates automated fault detection in power train systems, reducing reliance on manual inspection.

- AI improves supply chain efficiency by optimizing inventory and demand forecasting for specific coupling types.

- Smart couplings equipped with IIoT sensors transmit data analyzed by AI for real-time condition monitoring.

DRO & Impact Forces Of Elastomeric Coupling Market

The elastomeric coupling market is primarily driven by the expanding global industrial sector and the critical requirement for rotating machinery protection, countered by technological constraints related to high-temperature applications and the competitive threat from advanced metallic coupling designs. Opportunities are emerging through the integration of smart monitoring features and penetration into specialized high-growth sectors such as robotics and electric vehicle manufacturing components. These market forces collectively shape investment strategies, product development priorities, and geographical market expansion efforts across the entire coupling value chain, necessitating continuous innovation in elastomer material science and coupling modularity to maintain competitive advantage and meet evolving industrial demands.

Major driving forces include the non-lubricated nature and zero-maintenance requirement of elastomeric systems, which significantly reduce operational expenditures (OPEX) for end-users. Additionally, the increasing focus on sustainability and noise pollution reduction in industrial environments favors elastomeric couplings due to their inherent vibration dampening capabilities. However, market growth is restrained by the inherent limitations of standard elastomers at extremely high temperatures (above 150°C) and in highly corrosive chemical environments, where high-performance metallic couplings (e.g., disc or gear types) remain the necessary choice. Furthermore, the volatility in raw material prices for synthetic rubbers and polyurethanes presents a constant challenge to manufacturers' profit margins and pricing stability, particularly in regions with fluctuating currency exchange rates.

Significant opportunities lie in the adoption of advanced, customized elastomer compounds tailored for specific industrial fluids and temperature gradients, allowing market penetration into previously inaccessible niche markets. The ongoing development of IIoT-enabled smart couplings, which integrate sensors for temperature, vibration, and torsional load monitoring, represents a substantial growth avenue, aligning with the industry 4.0 paradigm and generating higher revenue per unit. Impact forces such as the rapid industrialization in Southeast Asia and Latin America create sustained demand for basic to mid-range coupling solutions, while increasing regulatory pressure on workplace safety and equipment reliability in mature markets ensures the continuous upgrade and replacement of older, less efficient coupling technologies.

Segmentation Analysis

The Elastomeric Coupling Market segmentation provides a granular view of market dynamics based on product type, material composition, and application across key end-use industries. Analyzing these segments is crucial for understanding specific consumer preferences, technological adoption rates, and regional demand patterns. Product segmentation, encompassing jaw, tire, and sleeve couplings, reflects varying requirements for misalignment tolerance, torque transmission, and ease of maintenance, with jaw couplings historically dominating due to their simplicity and cost-effectiveness in general power transmission tasks. Material segmentation highlights the shift toward advanced polymers, driven by the need for superior resilience and operational longevity in challenging industrial environments.

End-use industry analysis reveals that the Oil and Gas and Power Generation sectors are primary revenue generators, characterized by demand for large, robust, high-torque elastomeric couplings that can withstand continuous, heavy-duty operation and harsh conditions. Conversely, the General Manufacturing and HVAC sectors drive demand for smaller, standardized, and cost-efficient jaw and sleeve couplings, supporting mass production lines and building service equipment. The increasing automation and complexity of industrial machinery necessitate couplings capable of handling higher speeds and precise motion control, pushing innovation toward composite materials and optimized elastomer durometer hardness to balance flexibility and stiffness effectively.

Furthermore, regional segmentation is pivotal, demonstrating that mature economies focus on specialized, high-margin, replacement parts and smart coupling upgrades, while emerging economies prioritize volume and initial setup cost, leading to higher consumption of standard, basic coupling types. This segmentation framework allows manufacturers to tailor their product offerings, marketing strategies, and distribution channels to effectively capture market share within specialized verticals and rapidly expanding geographical zones, ensuring strategic resource allocation based on specific segmental growth forecasts and operational requirements.

- By Product Type:

- Jaw Coupling (Spider/Insert Type)

- Sleeve Coupling (Bushed/Pin Type)

- Tire Coupling (High Misalignment Tolerance)

- Grid Coupling (Semi-Elastomeric Hybrid)

- Flexible Coupling (Other Elastomeric Designs)

- By Material:

- Rubber (Natural Rubber, Neoprene)

- EPDM (Ethylene Propylene Diene Monomer)

- Polyurethane

- Hytrel (Thermoplastic Elastomer)

- By End-Use Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Power Generation (Thermal, Hydro, Renewables)

- Chemical and Petrochemical

- Water and Wastewater Treatment

- Mining and Mineral Processing

- General Manufacturing and Automotive

- Food and Beverage and Pharmaceutical

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Elastomeric Coupling Market

The value chain for the Elastomeric Coupling Market begins with upstream activities involving raw material procurement, dominated by suppliers of synthetic polymers, rubber compounds, and casting metals (aluminum, steel, and cast iron) necessary for the hubs and metallic elements of the couplings. Manufacturers must manage price volatility in petrochemical derivatives and ensure a stable supply of high-grade elastomers tailored for specific mechanical properties, such as high resilience or chemical resistance. Research and Development (R&D) activities at this stage focus heavily on material science, aiming to develop composite materials that offer lighter weight, higher temperature tolerance, and longer fatigue life, directly influencing the final product's performance and cost structure.

The midstream involves the manufacturing and assembly process, where core competencies include precision machining of coupling hubs, molding and curing of the elastomeric inserts, and quality control testing for balance and torque capacity. Vertical integration, where major players control both material formulation and final assembly, provides a significant competitive advantage by ensuring product consistency and reducing lead times. Downstream activities involve distribution and sales, utilizing a mix of direct sales channels for large, custom orders (e.g., in the power generation or specialized chemical sector) and extensive networks of independent distributors, wholesalers, and maintenance, repair, and overhaul (MRO) service providers for standardized, high-volume products.

The distribution channel landscape is highly fragmented for general-purpose couplings, relying on broad MRO networks to reach small-to-medium enterprises (SMEs). Conversely, highly engineered or specialized couplings often follow a direct sales model or use authorized, technical distributors who can provide specialized application support and integration services. The effectiveness of the indirect channel, particularly e-commerce platforms and digital marketplaces, is rapidly increasing, enabling end-users to quickly source standardized replacement parts. Ultimately, the value captured at the downstream stage relies heavily on post-sale services, technical training, and the provision of replacement elastomer kits, ensuring sustained revenue generation throughout the product lifecycle.

Elastomeric Coupling Market Potential Customers

Potential customers for elastomeric couplings represent a vast and diverse industrial landscape, predominantly comprising original equipment manufacturers (OEMs) who integrate these components into their new machinery, and end-users engaged in maintenance, repair, and overhaul (MRO) activities. OEMs, particularly those producing pumps, compressors, blowers, gearboxes, and industrial fans, require high-volume, consistent supply of standardized couplings that meet strict dimensional and performance specifications. Their purchasing decisions are driven by cost-effectiveness, reliability guarantees, ease of assembly, and the coupling's ability to protect the motor and driven equipment effectively against operational shocks and vibrations.

The end-user segment encompasses heavy industries such as Oil and Gas, where couplings are critical for crude oil pipelines and refining operations, demanding robust, API-compliant designs suitable for hazardous environments. Similarly, the Power Generation sector, including both fossil fuel and renewable energy plants, represents a significant customer base, requiring large-diameter couplings capable of handling high torques and severe misalignment issues in cooling tower fans and generator sets. For these MRO customers, the key purchasing factors include minimal inventory requirements, extended operational life of the elastomeric element, and quick availability of replacement parts to minimize non-scheduled downtime, placing a high value on coupling systems that facilitate fast, easy replacement of the flexible insert.

Furthermore, specialized industries like Food and Beverage and Pharmaceutical manufacturing require couplings made from FDA-approved or corrosion-resistant materials, capable of operating in frequent washdown environments while preventing contamination. Emerging customer segments include high-tech manufacturers utilizing robotics and automation, demanding compact, backlash-free elastomeric couplings for precision motion control applications. Across all sectors, the long-term cost benefit derived from reduced maintenance requirements and improved machine lifespan makes elastomeric couplings a compelling choice for any industrial operation involving rotational power transmission.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Timken, Regal Rexnord, Altra Industrial Motion, ABB, John Crane, KTR Systems, Voith, Tsubakimoto Chain, Siemens, SKF, Ruland Manufacturing, Falk Corporation, Motion Industries, Fenner Group, Lovejoy, Renold, GMB, Centa Power Transmission, P.T. International, Dodge. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Elastomeric Coupling Market Key Technology Landscape

The technology landscape for the elastomeric coupling market is primarily defined by advancements in materials science, focusing on developing elastomers with extended operational envelopes, and the incorporation of digital technologies for enhancing monitoring capabilities. In material technology, manufacturers are heavily investing in synthesizing advanced polyurethane and specialty fluorocarbon elastomers (e.g., FKM) that offer significantly improved resistance to aggressive chemicals, high temperatures, and abrasive wear, moving beyond traditional neoprene or natural rubber limitations. This focus allows couplings to be deployed in demanding environments, such as high-purity chemical processing or extreme offshore oil exploration, where traditional flexible couplings would fail prematurely. Furthermore, composite materials are increasingly being used for coupling hubs to reduce overall coupling mass, minimizing inertia and making them suitable for high-speed, dynamic applications while maintaining structural integrity.

The most transformative technological shift is the integration of Industrial Internet of Things (IIoT) components, leading to the emergence of "smart couplings." These systems incorporate miniaturized sensors—including accelerometers for vibration analysis, thermistors for temperature monitoring, and strain gauges for torque load measurement—directly into or adjacent to the coupling assembly. The data collected by these sensors is transmitted wirelessly, often via Bluetooth or Wi-Fi, to centralized diagnostic platforms where machine learning algorithms analyze patterns to predict component failure with high precision. This transition from passive mechanical components to active, data-generating assets is crucial for enabling Industry 4.0 maintenance strategies and justifying the higher capital cost of smart coupling solutions based on superior operational reliability.

Design and manufacturing technologies also play a crucial role. Advanced finite element analysis (FEA) and computational fluid dynamics (CFD) software are utilized during the design phase to accurately model the complex stress distribution within the elastomer under various misalignment and shock load scenarios, leading to optimized geometry that maximizes service life. Additionally, additive manufacturing (3D printing) is being explored for prototyping and producing highly customized or geometrically complex coupling hubs and specialized elastomer inserts in low volumes, offering faster time-to-market for unique application requirements, particularly in niche industrial machinery and specialized robotics systems demanding rapid iteration and material flexibility.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the fastest-growing market, primarily driven by massive government and private sector investments in infrastructure development, including power generation capacity expansion, high-speed rail networks, and establishment of large-scale manufacturing hubs in China, India, and Southeast Asian nations like Vietnam and Indonesia. The replacement cycle and ongoing capacity utilization expansion in existing manufacturing lines ensure sustained high demand for standard and medium-duty elastomeric couplings. Manufacturers are establishing local production facilities in this region to mitigate logistical costs and capitalize on favorable regulatory environments and lower labor costs, intensely focusing on high-volume production of jaw and sleeve couplings for general industrial use.

- North America: North America represents a mature, high-value market characterized by stringent industrial safety standards and a strong focus on minimizing unplanned downtime. Demand is driven predominantly by the maintenance and upgrade cycles within the oil and gas (especially fracking and midstream compression stations) and sophisticated manufacturing sectors (aerospace and automotive). The adoption rate of high-performance elastomeric materials and IIoT-enabled smart couplings is higher here compared to other regions, as businesses prioritize long-term reliability and data-driven predictive maintenance solutions, supporting premium pricing for technologically advanced products.

- Europe: The European market is stable and technologically advanced, with Germany, Italy, and the UK being key contributors. Growth is closely tied to the strong presence of the automotive, chemical, and heavy machinery manufacturing industries. Regulatory mandates concerning energy efficiency and noise reduction (particularly in urban industrial settings) favor the continuous replacement of older equipment with high-damping elastomeric solutions. European manufacturers are leaders in high-precision engineering and often focus on customized, modular coupling systems, emphasizing environmental compliance and long operational life, typically serving niche, high-requirement industrial applications.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) nations, fueled by massive upstream and downstream investments in the petrochemical and oil processing sectors. These applications demand exceptionally robust, corrosion-resistant couplings capable of operating reliably under extreme heat and abrasive dust conditions. Infrastructure projects related to water desalination and construction also contribute significantly. The demand profile is skewed towards heavy-duty tire and specialized high-torque flexible couplings requiring robust sealing and high tolerance to environmental factors.

- Latin America (LATAM): The LATAM market, led by Brazil and Mexico, exhibits steady growth linked to recovery in the mining, agriculture, and general manufacturing sectors. Economic stability influences investment decisions, with demand focused on cost-effective, durable solutions for basic industrial processes. While price sensitivity is generally higher, long-term infrastructure investments in sectors like water management and power distribution are gradually increasing the demand for reliable, medium-to-high-torque elastomeric couplings, fostering opportunities for local and international distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Elastomeric Coupling Market.- Regal Rexnord Corporation

- The Timken Company

- Altra Industrial Motion Corp. (now part of Regal Rexnord)

- ABB Ltd.

- KTR Systems GmbH

- John Crane (A Smiths Group Company)

- Voith Group

- Tsubakimoto Chain Co.

- SKF AB

- Siemens AG

- Lovejoy Inc. (A Timken Company)

- Renold plc

- Fenner Group (A Michelin Group Company)

- Ruland Manufacturing Co., Inc.

- Centa Power Transmission

- P.T. International Corp.

- GMB Corporation

- Boston Gear (Part of Altra Industrial Motion)

- Coupling Corporation of America

- Flender GmbH

Frequently Asked Questions

Analyze common user questions about the Elastomeric Coupling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an elastomeric coupling and how does it compare to metallic couplings?

The primary function is to transmit rotational torque while compensating for shaft misalignment (angular, parallel, axial) and absorbing operational shock loads and vibrations. Unlike metallic couplings (like gear or disc couplings) that rely on mechanical flexing or sliding of metal components, elastomeric couplings use a resilient polymer element, offering superior vibration dampening, requiring no lubrication, and typically offering electrical insulation between shafts.

Which elastomeric material offers the best performance in high-temperature and chemical environments?

While traditional neoprene and natural rubber are cost-effective for general use, EPDM (Ethylene Propylene Diene Monomer) offers better resistance to water and weather, and advanced polyurethanes provide superior torque density and oil resistance. For extreme chemical and high-temperature applications, specialty materials like Hytrel or high-grade fluoroelastomers (FKM) are required, though they are generally more costly.

What major factors are driving the growth of the elastomeric coupling market?

Key growth drivers include the massive expansion of the industrial and manufacturing sectors in APAC, the increasing global adoption of predictive maintenance strategies that favor reliable, low-maintenance components, and the continuous need to replace older, high-maintenance metallic systems across mature industrial economies to reduce operational expenditure.

How does the integration of IIoT technology affect elastomeric couplings?

IIoT integration transforms couplings into "smart components" by embedding sensors (vibration, temperature) that monitor real-time operating conditions. This data, processed by AI, enables highly accurate predictive maintenance, allowing users to replace the elastomeric element precisely before failure, thereby maximizing machine uptime and extending the lifespan of connected equipment.

What are the typical applications for Jaw Coupling versus Tire Coupling types?

Jaw Couplings (spider insert type) are widely used for general industrial applications like pumps, fans, and compressors requiring easy installation, medium torque, and moderate misalignment tolerance. Tire Couplings, conversely, are favored in heavy-duty applications such as crushers or large mixers, where exceptionally high radial and angular misalignment must be accommodated and where the elastomer element needs to be replaced easily without moving the connected driver or driven machinery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager