Elderly nutrition Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435963 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Elderly nutrition Market Size

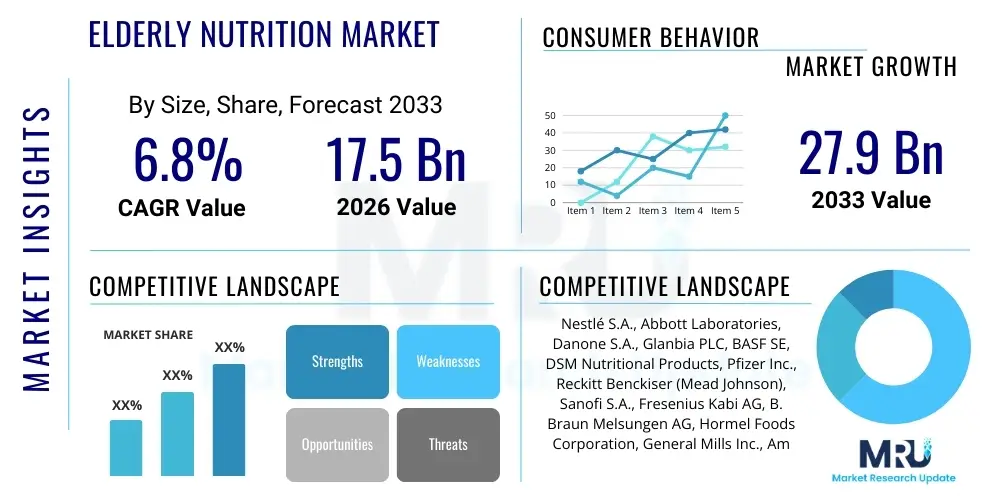

The Elderly nutrition Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $17.5 Billion in 2026 and is projected to reach $27.9 Billion by the end of the forecast period in 2033.

Elderly nutrition Market introduction

The Elderly Nutrition Market encompasses a diverse range of specialized food products, dietary supplements, and medical nutrition formulations designed to meet the unique physiological and metabolic needs of the aging population, typically defined as individuals aged 65 and above. These products address prevalent issues in geriatrics such as sarcopenia, osteoporosis, compromised immune function, chronic disease management (like diabetes and cardiovascular conditions), and age-related changes in appetite, digestion, and nutrient absorption. The primary objective of elderly nutrition products is to maintain nutritional adequacy, enhance quality of life, prevent malnutrition, and support recovery from illness or surgery, thereby reducing overall healthcare expenditure associated with age-related decline.

Key product categories include high-protein powders, specialized liquid nutritional drinks, fiber-rich supplements, vitamins (especially D and B12), minerals (calcium and iron), and functional foods enriched with omega-3 fatty acids and probiotics. Major applications span clinical settings, including hospitals and nursing homes for disease-specific nutrition support, as well as consumer retail channels for proactive health maintenance and nutritional gaps filling. The market is fundamentally driven by global demographic shifts, particularly the rapid increase in the centenarian and older adult populations in developed and emerging economies, coupled with growing awareness among consumers and healthcare providers regarding the critical role of targeted nutrition in healthy aging.

Elderly nutrition Market Executive Summary

The Elderly Nutrition Market exhibits robust growth propelled by increasing life expectancy and the subsequent rise in chronic disease prevalence among seniors, necessitating targeted nutritional interventions. Current business trends highlight a significant shift toward personalized nutrition solutions leveraging genetic and microbiome data to optimize efficacy, alongside the development of palatability-enhanced formulations to address age-related issues such as dysphagia and loss of taste sensitivity. Furthermore, strategic alliances between pharmaceutical companies and nutrition giants are becoming common, focusing on clinical nutrition products prescribed for disease state management, thereby integrating nutrition deeply into the healthcare continuum. E-commerce platforms are emerging as pivotal distribution channels, offering convenience and access, particularly for direct-to-consumer nutritional supplements aimed at active seniors.

Regional trends indicate that North America and Europe currently hold the largest market shares due to well-established healthcare infrastructure, high healthcare spending, and advanced product development capabilities. However, the Asia Pacific region is forecast to register the highest CAGR, primarily driven by the colossal and rapidly aging populations in China, Japan, and India, combined with increasing disposable incomes and the adoption of Westernized dietary habits that incorporate supplements. Segment trends show that medical nutrition remains a high-value segment, especially formulations addressing cachexia and wound healing, while the functional food segment, focusing on preventative health benefits like cognitive and bone health, is experiencing accelerated consumer uptake. Innovation is concentrated on clean-label ingredients, plant-based proteins, and sustainable sourcing to appeal to the health-conscious younger cohort of the elderly demographic.

AI Impact Analysis on Elderly nutrition Market

User queries regarding the impact of Artificial Intelligence (AI) on the Elderly Nutrition Market center around optimizing personalized dietary recommendations, improving supply chain efficiency for specialized perishable products, and enhancing diagnostic tools for early detection of malnutrition in clinical settings. Key themes emerging include the feasibility of using machine learning (ML) algorithms to analyze diverse health data (wearable technology metrics, electronic health records, genomic profiles) to formulate truly individualized nutrition plans that adjust dynamically based on activity levels and biometrics. Concerns often revolve around data privacy, the regulatory approval process for AI-driven health recommendations, and ensuring equitable access to these advanced technologies, particularly for vulnerable, low-income senior populations. Expectations are high regarding AI's potential to dramatically reduce guesswork in geriatric nutritional therapy, leading to improved patient outcomes and reduced readmission rates related to nutritional deficiencies.

AI's role is transformative, extending from ingredient discovery and supply chain logistics to direct patient care. In ingredient formulation, ML is used to predict the stability and bioavailability of novel compounds tailored for elderly metabolism, speeding up R&D cycles. Furthermore, AI-powered diagnostic tools integrated into telehealth platforms can continuously monitor seniors’ eating patterns and physiological markers, triggering alerts for healthcare providers when malnutrition risk increases. This predictive capability allows for timely, proactive nutritional intervention rather than reactive treatment, significantly impacting the efficacy of dietary management in managing chronic diseases such as sarcopenia and diabetes, which require precise protein and carbohydrate management, respectively. The integration of Natural Language Processing (NLP) allows for simplified, customized health communication tailored to the varying digital literacy levels of the elderly population.

The financial impact of AI deployment is expected to streamline operational costs by optimizing inventory management of specialized medical foods, ensuring products with short shelf lives are utilized efficiently in institutional settings. Moreover, AI aids in the manufacturing process by monitoring quality control parameters, especially in complex nutritional formulas, ensuring high safety standards crucial for the immunocompromised elderly. The ultimate benefit is enabling large-scale personalization, moving away from one-size-fits-all dietary advice towards precise, data-driven nutritional support that maximizes health span and reduces the burden on aging healthcare systems globally. This technological leverage is paramount for scaling geriatric care efficiently.

- AI-driven personalized dietary plan generation based on genetic and microbiome analysis.

- Machine learning algorithms optimizing R&D for novel, highly bioavailable ingredients for seniors.

- Predictive analytics to identify and preemptively manage malnutrition risk in institutionalized elderly.

- Automation of inventory and supply chain management for temperature-sensitive nutritional products.

- Integration of telehealth platforms using AI to monitor eating habits and physical activity remotely.

- Enhanced quality control and formulation precision in manufacturing specialized medical foods.

- Natural Language Processing (NLP) applications for creating simplified, accessible nutritional educational content.

DRO & Impact Forces Of Elderly nutrition Market

The Elderly Nutrition Market is dynamically shaped by powerful drivers, systemic restraints, and significant opportunities, which collectively form its impact forces. The core driver is the global demographic shift toward an older population, characterized by escalating life expectancies and declining birth rates, creating a perpetually expanding consumer base dependent on specialized nutritional support. Coupled with this is the increasing prevalence of age-related chronic diseases (e.g., cardiovascular disease, diabetes, dementia), where nutrition plays a vital therapeutic and preventative role. Technological advancements, particularly in developing palatable and highly absorbable delivery systems (like nano-encapsulation), further fuel market expansion by enhancing product efficacy and consumer compliance. Strong government initiatives promoting healthy aging and preventative healthcare spending in developed nations also act as powerful tailwinds for market growth.

However, market growth faces notable restraints. High product costs, especially for specialized medical nutrition formulas, can limit affordability, particularly in lower-income demographics or regions without comprehensive healthcare subsidies. Regulatory hurdles associated with the classification and approval of functional foods and health supplements can slow product innovation and market entry, as regulatory bodies scrutinize health claims rigorously. Furthermore, the inherent challenge of ensuring consumer compliance and adherence to specialized dietary regimens among the elderly population—often hampered by cognitive decline or aversion to texture/taste—remains a persistent restraint that manufacturers must continuously address through improved formulation and flavor profiles. Misinformation and the proliferation of unverified health claims in the competitive supplement space also challenge consumer trust and informed decision-making.

Opportunities abound primarily in the realm of specialized and personalized nutrition. There is a vast untapped potential in developing highly targeted products for specific senior subgroups, such as products optimized for post-surgery recovery, renal health, or management of dysphagia. The rapid growth of the e-commerce sector presents a significant opportunity for expanding distribution channels, allowing direct access to isolated or rural senior populations. Investment in clinical trials to substantiate the efficacy of functional ingredients (such as specific probiotics or specialized proteins) will unlock premium market positioning. Ultimately, the successful integration of nutritional services with comprehensive geriatric care, treating nutrition as a crucial element of the therapeutic pathway rather than just a supplement, represents the most substantial long-term market opportunity.

Segmentation Analysis

The Elderly Nutrition Market is meticulously segmented based on product type, dosage form, distribution channel, and specific application areas to accurately capture diverse consumer needs and clinical requirements. This structure allows market players to tailor their R&D and marketing strategies to target high-growth niches, ranging from medically prescribed clinical formulas utilized in hospitals to over-the-counter functional beverages consumed for proactive wellness. The comprehensive nature of segmentation reflects the wide spectrum of nutritional challenges faced by the aging population, ensuring that nutritional solutions are precise, effective, and accessible through appropriate commercial channels.

- Product Type:

- Medical Nutrition

- Nutritional Supplements

- Functional Foods & Beverages

- Dosage Form:

- Powder

- Liquid/Ready-to-Drink (RTD)

- Tablets & Capsules

- Others (Gels, Bars)

- Distribution Channel:

- Institutional Sales (Hospitals, Nursing Homes, Clinics)

- Retail Sales (Pharmacies, Supermarkets, Hypermarkets)

- Online Channels (E-commerce, Company Websites)

- Application:

- Malnutrition & Weight Management

- Bone & Joint Health (Osteoporosis)

- Digestive Health (Probiotics & Fiber)

- Cognitive Health (Omega-3s, B Vitamins)

- Immunity Boosting

- Chronic Disease Management (Diabetes, Cardiovascular)

Value Chain Analysis For Elderly nutrition Market

The Elderly Nutrition Market value chain begins with sophisticated Upstream Analysis, focusing intensely on the sourcing and refinement of high-quality, specialized ingredients such as specific protein isolates (whey, soy, plant-based), micro-nutrients (e.g., highly bioavailable Vitamin D, specific B vitamins), and functional ingredients (probiotics, prebiotics, fish oils). The procurement phase is highly regulated, necessitating robust quality control, traceability, and often involves proprietary extraction or fermentation technologies to ensure purity and potency suitable for the sensitive elderly metabolism. Key suppliers include specialized chemical and ingredient manufacturers (like DSM and BASF) who cater specifically to the nutritional sector. Innovation in this segment centers on improving ingredient stability and absorption rates, reducing undesirable flavors, and optimizing nutritional density within small product volumes.

The mid-stream encompasses manufacturing, formulation, and quality assurance, where raw materials are transformed into finished products like powders, liquids, or tablets. This stage demands stringent adherence to Good Manufacturing Practices (GMP) and often requires specialized equipment for sterile packaging and stability testing, especially for liquid medical nutrition products. Manufacturing complexity is heightened by the need to balance palatability with maximum nutritional value. Distribution Channel analysis reveals a dual approach: Direct and Indirect. Institutional sales (hospitals, nursing homes) often utilize direct distribution or highly specialized medical distributors to ensure just-in-time delivery and adherence to clinical specifications. Retail sales leverage indirect channels, including mass merchandisers and pharmacies, requiring significant marketing investment to influence consumer choice.

Downstream analysis focuses on market access and the relationship with the end-users. The distribution network is bifurcated between high-touch clinical channels—where healthcare professionals (HCPs) like dietitians and doctors act as critical gatekeepers prescribing medical nutrition—and consumer retail, which is heavily influenced by branding, shelf placement, and online reviews. E-commerce platforms are increasingly vital, offering specialized subscription services and direct interaction. The final stage involves post-market surveillance and consumer feedback, crucial for continuous product improvement and maintaining brand trust, especially in a demographic sensitive to product efficacy and safety. Efficiency across the entire chain is crucial due to the premium nature and often specific storage requirements of elderly nutrition products.

Elderly nutrition Market Potential Customers

The primary consumers (End-Users/Buyers) of the Elderly Nutrition Market are diverse, ranging from institutional entities responsible for patient care to individual seniors focused on self-managed wellness. Institutional buyers, including large hospital networks, specialized geriatric care centers, and government-run nursing homes, represent a significant, high-volume customer segment, primarily purchasing medical nutrition products prescribed for treating diagnosed conditions such as malnutrition, post-operative recovery, or specific organ dysfunction. Procurement decisions in this segment are based on clinical efficacy, cost-effectiveness, bulk pricing, and regulatory compliance, often requiring long-term supply contracts with major clinical nutrition providers like Nestlé Health Science or Abbott Nutrition.

The largest volume of consumption comes from individual seniors and their caregivers. This group can be broadly divided into two sub-segments: the 'Active Healthy Aging' demographic, who proactively seek functional foods and supplements (like collagen, omega-3s, and cognitive boosters) through retail and online channels to maintain vitality and prevent decline; and the 'Chronic Disease Management' group, whose purchases are often guided by physician recommendations for managing conditions like diabetes (requiring low-glycemic formulas) or osteoporosis (requiring high calcium/Vitamin D supplements). Caregivers, whether family members or professional home healthcare aides, often act as the direct purchasers, prioritizing ease of preparation, palatability, and verified health benefits.

Furthermore, emerging customer groups include wellness-focused retail pharmacies and specialist dietetics clinics that stock a curated range of high-quality, specialized nutritional products, serving as key intermediaries. Given the global trend towards preventative healthcare and personalized wellness, the scope of potential customers is expanding beyond the strictly clinical setting into general retail, driven by seniors who view nutrition as a primary investment in their quality of life, emphasizing convenience, flavor, and scientifically backed efficacy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $17.5 Billion |

| Market Forecast in 2033 | $27.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Abbott Laboratories, Danone S.A., Glanbia PLC, BASF SE, DSM Nutritional Products, Pfizer Inc., Reckitt Benckiser (Mead Johnson), Sanofi S.A., Fresenius Kabi AG, B. Braun Melsungen AG, Hormel Foods Corporation, General Mills Inc., Amway Corp., Herbalife Nutrition Ltd., Ajinomoto Co. Inc., Kerry Group plc, Perrigo Company plc, Avena Foods, Arla Foods Ingredients. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Elderly nutrition Market Key Technology Landscape

The Elderly Nutrition Market is increasingly reliant on sophisticated technology, moving far beyond basic nutrient blending. A critical technological focus is on enhancing the bioavailability and stability of essential nutrients. This includes advanced formulation techniques such as nano-encapsulation, which protects sensitive compounds like omega-3 fatty acids and certain vitamins from degradation during processing and digestion, ensuring maximum absorption in the often compromised elderly gut. Furthermore, the development of specialized texture-modified foods and thickeners for managing dysphagia (swallowing difficulties) utilizes hydrocolloid technology and proprietary stabilizers, vastly improving the safety and compliance of nutritional intake for frail seniors. These innovations require precise rheology control and material science expertise to deliver products that maintain nutritional integrity while being easy to consume.

Another major technological driver is the integration of digital health and IoT (Internet of Things) devices. Wearable technology, smart kitchen appliances, and advanced monitoring systems are used to track caloric intake, energy expenditure, and hydration status in real-time. This data feeds into AI and ML platforms to provide dynamic, personalized nutritional adjustments, optimizing the diet based on real-time physiological needs. Tele-nutrition services, utilizing video conferencing and secure data transmission, are also rapidly expanding, allowing registered dietitians to manage complex patient cases remotely and deliver highly specialized dietary counseling, thereby overcoming geographic barriers and improving access to expert care.

In the manufacturing sector, technologies focused on sustainability and clean-label production are gaining traction. This includes precision fermentation to produce sustainable protein sources and minor functional ingredients, reducing reliance on traditional animal or crop-based sources. Moreover, aseptic processing and advanced packaging technologies are essential for extending the shelf life of liquid and ready-to-drink medical nutrition formulas without compromising flavor or nutrient content, a critical factor for institutional distribution and patient stockpiling. The continuous push for better-tasting, less chalky protein supplements also drives innovation in flavor masking and texture engineering, leveraging sensory science to improve adherence among the elderly population.

Regional Highlights

- North America: This region dominates the Elderly Nutrition Market share, driven by a high disposable income, established demand for specialized medical nutrition (covered extensively by insurance), and a robust regulatory environment that supports clinical nutrition innovation. The U.S. leads in R&D and consumer acceptance of dietary supplements, particularly in the Active Aging segment. The high prevalence of lifestyle diseases and the proactive management of conditions like sarcopenia and cognitive decline further boost market revenue. Innovation here is heavily influenced by rapid adoption of personalized nutrition technologies and the integration of dietary advice within primary care settings.

- Europe: Characterized by a highly aging population, especially in Western European countries (Germany, Italy, France), Europe represents a mature market. Strict food safety regulations and a strong institutional preference for specialized clinical nutrition (Fresenius Kabi, Danone) define the competitive landscape. Government-funded healthcare systems often cover or subsidize medical nutrition products, ensuring high market penetration. There is a strong emphasis on functional foods enriched with locally sourced ingredients, catering to consumers who favor natural, preventative nutritional approaches over supplements.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, fueled by demographic shifts in China, Japan, and South Korea, where the rate of aging is unprecedented. While Japan maintains a strong focus on advanced functional foods (FOSHU designation) and disease prevention, China is rapidly developing its domestic medical nutrition industry, supported by increasing healthcare investment and urbanization. Market growth is spurred by rising awareness of geriatric malnutrition and improving access to modern retail channels, though product preferences often remain rooted in traditional health concepts, leading to unique product adaptations incorporating traditional herbs and local ingredients.

- Latin America (LATAM): This region is characterized by fragmented but developing healthcare systems. The market for elderly nutrition is nascent but shows strong potential, particularly in urban centers of Brazil and Mexico, driven by increasing insurance coverage and a growing middle class. Nutritional supplements and basic fortification are currently the leading segments, though institutional demand for medical nutrition is steadily rising as healthcare infrastructure modernizes. Price sensitivity remains a significant factor influencing product selection and market penetration strategies.

- Middle East and Africa (MEA): The MEA market is largely dependent on imported specialized nutrition products, with growth concentrated in the Gulf Cooperation Council (GCC) countries due to high healthcare expenditure and advanced hospital infrastructure. Demand is primarily centered around clinical settings for acute and complex nutritional support. Market expansion is challenging outside of major urban centers due to lower awareness and distribution complexities, yet opportunities exist in addressing endemic micronutrient deficiencies and supporting rapid urbanization trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Elderly nutrition Market.- Nestlé S.A. (Nestlé Health Science)

- Abbott Laboratories (Abbott Nutrition)

- Danone S.A. (Nutricia)

- Glanbia PLC

- BASF SE

- DSM Nutritional Products

- Pfizer Inc.

- Reckitt Benckiser (Mead Johnson Nutrition)

- Sanofi S.A.

- Fresenius Kabi AG

- B. Braun Melsungen AG

- Hormel Foods Corporation

- General Mills Inc.

- Amway Corp.

- Herbalife Nutrition Ltd.

- Ajinomoto Co. Inc.

- Kerry Group plc

- Perrigo Company plc

- Avena Foods

- Arla Foods Ingredients

Frequently Asked Questions

Analyze common user questions about the Elderly nutrition market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Elderly Nutrition Market?

The market is primarily driven by the exponential growth of the global geriatric population, increased life expectancy, and the subsequent high prevalence of age-related chronic diseases that necessitate targeted dietary management and specialized nutritional support to improve health outcomes and reduce healthcare costs.

How is personalized nutrition impacting geriatric care?

Personalized nutrition, enabled by AI and genetic analysis, is revolutionizing geriatric care by moving away from generic dietary advice to highly specific, data-driven nutritional plans that account for individual metabolic rates, specific deficiencies, and genomic predispositions, maximizing efficacy and patient compliance.

What role does the Functional Foods segment play in elderly nutrition?

Functional Foods are critical in the preventative health subset of the market, offering benefits beyond basic nutrition, such as cognitive enhancement (via omega-3s) or improved digestive health (via probiotics). They are generally targeted at the 'Active Aging' demographic seeking proactive wellness maintenance rather than acute clinical intervention.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the rapidly aging demographic structure in major economies like China and India, coupled with increasing consumer awareness, rising disposable incomes, and expanding modern retail and healthcare access.

What key challenges restrict the expansion of the Elderly Nutrition Market?

Key challenges include the high cost of specialized medical nutrition products, regulatory complexities associated with substantiating health claims for supplements, and the difficulty in ensuring consistent compliance among elderly patients due to issues such as loss of appetite or dysphagia (swallowing difficulties).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager