Elearning Authoring Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431457 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Elearning Authoring Tools Market Size

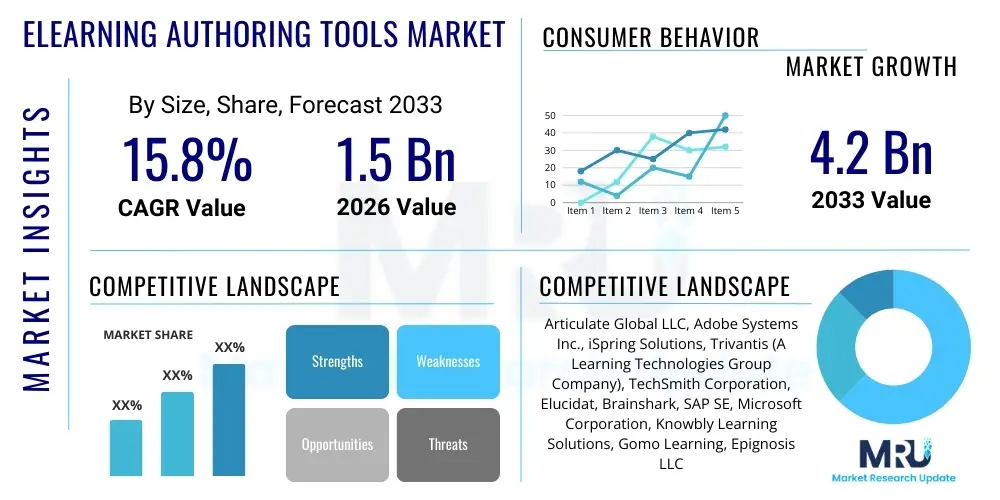

The Elearning Authoring Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033.

Elearning Authoring Tools Market introduction

The Elearning Authoring Tools Market encompasses software solutions designed to create, manage, and deploy digital learning content, ranging from simple interactive quizzes and simulations to complex, SCORM-compliant courses. These tools provide instructional designers and subject matter experts with the necessary functionalities to transform raw knowledge into engaging, multimedia-rich educational experiences without requiring extensive programming knowledge. The core function is to facilitate rapid content development and ensure compatibility across various Learning Management Systems (LMS) and devices, including desktops, tablets, and smartphones. This crucial ability to deliver responsive and universally accessible training materials is a primary driver of market adoption, particularly in corporate training and higher education sectors striving for efficient knowledge transfer at scale.

Product description highlights several key features, including drag-and-drop interfaces, built-in templates, media integration capabilities (video, audio, high-resolution graphics), and robust testing and assessment functionalities. Modern authoring tools often support advanced interactive elements like virtual reality (VR) simulations, gamification modules, and branching scenarios, enhancing learner engagement and knowledge retention. Major applications span across enterprise training, where they are used for onboarding new employees, compliance training, and professional development; and in academia, for developing blended learning curricula and massive open online courses (MOOCs). The flexibility and power of these tools allow organizations to rapidly update content in response to regulatory changes or technological advancements, mitigating the reliance on expensive, external content development agencies.

The primary benefits driving this market include significant reductions in training costs, improved learning outcomes due to highly personalized and interactive content, and accelerated time-to-market for new training initiatives. Key driving factors involve the global shift towards remote work and digital transformation across industries, making digital training mandatory rather than supplementary. Furthermore, the increasing complexity of regulatory environments necessitates continuous, trackable compliance training, which authoring tools excel at delivering. The demand for mobile learning (m-learning) capabilities and the imperative for organizations to retain highly skilled workforces through continuous professional development further cement the market's robust growth trajectory, pushing vendors towards integrating more sophisticated, cloud-native features.

Elearning Authoring Tools Market Executive Summary

The Elearning Authoring Tools Market demonstrates significant upward business trends, characterized by a rapid migration from desktop-installed software to cloud-based, subscription-model platforms. This shift is driven by the need for enhanced collaboration among geographically dispersed content creators and the requirement for real-time content updates and centralized asset management. Strategic mergers and acquisitions are prevalent, as larger vendors seek to integrate niche technologies, particularly those focused on artificial intelligence (AI) for content generation and personalized learning pathways, thereby consolidating market capabilities and offering more comprehensive ecosystem solutions. The growing adoption of microlearning strategies is also influencing product development, leading to tools that prioritize quick creation of short, focused, and easily digestible learning nuggets, catering directly to the attention spans of modern learners and the demands of just-in-time training.

Regionally, North America maintains market leadership, largely due to the presence of key industry players, high technological readiness, and extensive corporate investment in digital upskilling and compliance training across sectors like healthcare, finance, and technology. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive digital education initiatives undertaken by governments, the increasing penetration of high-speed internet, and the burgeoning demand for standardized, scalable training solutions in rapidly industrializing economies such as India and China. Europe also exhibits strong growth, particularly driven by multilingual content requirements and stringent data privacy regulations, pushing developers to ensure robust security and localization features within their authoring suites.

Segment trends reveal that the corporate segment continues to dominate the market share, recognizing authoring tools as essential infrastructure for talent development and operational efficiency. Within component segmentation, the software segment, particularly highly customizable, feature-rich platforms, accounts for the largest revenue, while the services segment (covering implementation, training, and maintenance) is expected to grow rapidly due to the complexity of integrating these tools within existing IT environments. Deployment segmentation strongly favors the cloud-based model, offering scalability and reduced infrastructural overhead, making it particularly attractive for Small and Medium-sized Enterprises (SMEs) seeking cost-effective access to premium content creation capabilities. The move towards AI-powered features, such as automated content translation and accessibility checks, represents the most critical trend influencing future market differentiation.

AI Impact Analysis on Elearning Authoring Tools Market

User inquiries regarding the integration of Artificial Intelligence (AI) in Elearning Authoring Tools primarily center on efficiency gains, content quality, and job displacement concerns. Users frequently ask: "How can AI automate content creation and reduce development time?" "Will AI personalization features truly improve learning outcomes?" and "What are the ethical implications and data privacy risks of using generative AI for training materials?" These questions reflect a dual expectation: high anticipation for automation capabilities, such as automated script generation, image tagging, and rapid translation, alongside a concern about maintaining the instructional integrity and human touch in complex learning design. Key themes emerging from this analysis include the potential for AI to dramatically democratize content creation by lowering the skill barrier for Subject Matter Experts (SMEs), and the critical need for tools that integrate AI for dynamic testing and adaptive learning pathways rather than simple static content generation. Users expect AI to handle tedious tasks, freeing up instructional designers to focus on complex pedagogical strategy.

- AI-driven Content Generation: Automates the drafting of quizzes, summaries, and introductory text based on source material, dramatically accelerating development cycles.

- Adaptive Learning Paths: Utilizes machine learning to analyze learner performance data in real-time and dynamically adjust the content sequence and difficulty level.

- Automated Accessibility Compliance: AI tools automatically check and correct content (images, transcripts, closed captions) to ensure adherence to global accessibility standards (e.g., WCAG).

- Enhanced Translation and Localization: Provides instantaneous, high-quality, and context-aware content translation for global deployment, reducing localization costs and time.

- Personalized Feedback Mechanisms: Implements AI chatbots or virtual tutors to provide immediate, customized feedback to learners during simulations and complex exercises.

- Predictive Analytics: Analyzes engagement data to predict learning bottlenecks or drop-off risks, allowing instructional designers to proactively modify course structure.

- Simulation and Scenario Generation: AI assists in building complex, realistic simulations and branching scenarios by managing variables and generating appropriate conditional logic.

DRO & Impact Forces Of Elearning Authoring Tools Market

The Elearning Authoring Tools Market is propelled by powerful drivers centered on the necessity for digital upskilling and continuous professional development across global enterprises, alongside robust restraints related to initial investment barriers and integration complexities, while simultaneously presenting expansive opportunities fueled by emerging technologies like extended reality (XR) and the burgeoning adoption of microlearning. The primary impact force accelerating market growth is the irreversible shift to remote and hybrid work models worldwide, which mandates accessible, high-quality digital training infrastructure. This global transition has elevated authoring tools from a specialized niche product to a fundamental necessity for business continuity and competitiveness. Conversely, the high cost associated with enterprise-level licenses and the steep learning curve for sophisticated tools act as significant restraints, particularly for smaller organizations or those in developing regions. Market opportunities are heavily concentrated in specialized content, such as immersive training simulations for high-risk industries (e.g., medical, aviation), and the utilization of authoring tools to create compliance-specific, localized content in emerging markets.

Key drivers include the imperative to reduce overall training expenditure, as authoring tools enable in-house development, eliminating recurrent costs associated with third-party vendors, coupled with the rising demand for mobile learning which necessitates content created using responsive design principles inherent in modern authoring suites. The rapid obsolescence of skills due to technological advancements further drives the continuous need for rapid course updates, a core strength of these tools. Restraints encompass challenges related to ensuring data security and intellectual property protection when content is hosted on cloud platforms, and the fragmentation of the LMS market, which often requires significant effort to ensure seamless content compatibility (SCORM, xAPI conformance). Additionally, resistance to change within traditional academic institutions can slow adoption rates, favoring conventional teaching methodologies over digital content creation.

The impact forces are fundamentally shaping the competitive landscape. Globalization necessitates tools that natively support multi-language translation and cultural adaptation, pushing developers to invest heavily in localization features. The growing emphasis on verifiable learning outcomes and data tracking (via LRS and xAPI) requires authoring tools to provide sophisticated data capture capabilities, moving beyond simple completion rates to detailed behavioral metrics. Furthermore, the opportunity to integrate advanced features such as virtual reality (VR) and augmented reality (AR) into standard courseware creation workflows represents a significant revenue stream potential, allowing organizations to create highly engaging, experiential learning modules that were previously cost-prohibitive. These impact forces—digital transformation, data accountability, and technological integration—ensure continuous innovation and expansion within the authoring tools domain.

Segmentation Analysis

The Elearning Authoring Tools market is meticulously segmented based on components, deployment type, end-user, and application, providing a granular view of revenue generation and growth potential across various operational models and consuming sectors. Understanding these segments is vital for vendors to tailor their product offerings and market entry strategies. The component segmentation differentiates between the core software platform and the associated professional services required for successful implementation and maintenance. Deployment options highlight the ongoing transition from traditional perpetual license models (on-premise) to flexible, scalable cloud-based subscriptions, which currently dominate new deployments. The application segmentation distinctly separates the extensive needs of the corporate sector—covering internal training, compliance, and product knowledge—from the academic requirements of educational institutions focusing on curriculum delivery and student engagement.

The analysis reveals significant variance in feature preference across end-user groups. Corporate clients typically prioritize enterprise features such as advanced security, seamless LMS integration, reporting capabilities, and collaborative editing functionality, whereas academic institutions often seek tools that emphasize multimedia creation, accessibility for diverse learners, and easy integration with established educational standards. The trend toward cloud deployment is universal, driven by the desire for lower Total Cost of Ownership (TCO) and rapid feature updates, yet highly regulated industries, such as government and financial services, occasionally retain a strong preference for on-premise solutions due to stringent data governance and security mandates. This layered segmentation allows for precise targeting and differentiation within a highly competitive technological landscape.

Furthermore, segmentation by type of authoring tool, such as those focusing on simulation development versus general content creation tools, highlights functional specialization. Specialized tools catering to specific needs—like VR content creation or detailed game-based learning environments—are experiencing accelerated growth, albeit from a smaller base, due to their ability to address complex training requirements that generic platforms cannot fulfill. This continuous differentiation ensures that the market remains diverse, accommodating both high-volume, general-purpose content creation and specialized, high-impact learning experiences, thereby sustaining demand across the entire spectrum of organizational needs.

- By Component:

- Software (Platform and Tools)

- Services (Consulting, Integration, Maintenance, Support)

- By Deployment Type:

- Cloud-based

- On-premise

- By Application/End-User:

- Corporate (SMEs and Large Enterprises)

- Academic Institutions (K-12, Higher Education)

- Government and Public Sector

- By Content Type:

- Video and Audio

- Text and Graphics

- Simulations and Game-based Learning

Value Chain Analysis For Elearning Authoring Tools Market

The value chain for Elearning Authoring Tools is characterized by five primary stages: content creation infrastructure, platform development, content delivery preparation, distribution, and end-user consumption. The upstream analysis focuses heavily on infrastructure providers, including cloud service platforms (like AWS, Azure, Google Cloud) that host the authoring software, and specialized technology suppliers providing APIs for multimedia rendering, generative AI engines, and accessibility checking tools. Software vendors must secure robust relationships with these upstream partners to ensure high availability, scalability, and integration of cutting-edge features. This stage is critical as the quality and functionality of the final authoring tool are directly dependent on the underlying technological stack and third-party integrations, pushing vendors towards sophisticated microservices architectures.

The core value creation lies in the platform development phase, where authoring tool vendors (e.g., Articulate, Adobe, iSpring) translate market requirements into intuitive user interfaces, robust coding engines, and standardized output formats (SCORM, xAPI). Efficiency here is measured by the ability to enable rapid course development, support complex interactive features, and maintain compatibility with evolving LMS standards. The distribution channel involves both direct sales, where large enterprises purchase licenses directly from the vendor, and indirect channels, predominantly involving reseller partnerships, Value-Added Resellers (VARs), and strategic alliances with LMS providers. The latter is becoming increasingly important as integration and bundle offerings provide synergistic value, particularly to SMEs seeking all-in-one solutions.

Downstream analysis involves the end-user deployment and consumption phase. This stage includes instructional designers, subject matter experts (SMEs), and corporate trainers using the tool to create learning content. The effectiveness of the value chain is measured by the ease of use, the quality of the resulting content, and the efficiency of content distribution via the client’s internal LMS or external platforms (MOOC providers). Direct channels offer vendors greater control over customer relationships, immediate feedback loops for product improvement, and higher margin capture, while indirect distribution expands market reach into diverse geographic locations and niche customer segments, relying on partner expertise for localized support and specialized implementation services.

Elearning Authoring Tools Market Potential Customers

Potential customers for Elearning Authoring Tools span a broad spectrum of organizations requiring scalable, efficient, and standardized methods for knowledge dissemination and skills development. The primary end-users are instructional designers and corporate training departments within large enterprises across highly regulated industries such as pharmaceuticals, financial services, and manufacturing, where mandatory compliance training, standardized onboarding procedures, and high-stakes performance development are paramount. These corporate buyers seek tools that offer advanced security, extensive customization, and robust tracking capabilities essential for auditing and regulatory adherence. The ability to create complex simulations for operational procedures or soft skills development makes these tools indispensable for maintaining quality control and reducing human error in complex environments. Furthermore, SMEs are increasingly adopting cloud-based solutions to professionalize their training delivery without massive capital outlay.

Academic institutions represent a rapidly expanding customer segment, encompassing K-12 schools, vocational training centers, and universities worldwide. Driven by the persistent need to shift toward blended and fully online learning models, educators and university media teams utilize authoring tools to convert traditional curricula into engaging digital formats. This segment values features such as accessibility compliance, integration with standard academic platforms (like Canvas or Moodle), and cost-effective licensing models tailored to large student bodies. The COVID-19 pandemic accelerated digital adoption in academia, cementing the reliance on authoring platforms for continuity of education.

Other significant customer groups include government and public sector organizations, particularly defense, healthcare agencies, and public safety entities, which require confidential, highly specific training modules that must be frequently updated based on policy changes. Consulting firms and content development agencies also constitute a vital customer base, using these tools as core infrastructure to deliver high-quality, customized elearning services to their clients. The diverse demand across these sectors confirms the tool's market versatility, ranging from simple information delivery to complex performance enhancement and behavioral change training, securing a stable and expansive customer base globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Articulate Global LLC, Adobe Systems Inc., iSpring Solutions, Trivantis (A Learning Technologies Group Company), TechSmith Corporation, Elucidat, Brainshark, SAP SE, Microsoft Corporation, Knowbly Learning Solutions, Gomo Learning, Epignosis LLC, dominKnow Learning Systems, Lectora (A Trivantis product), Allen Interactions, CoreAxis Consulting, E-learning Brothers, Paradiso Solutions, LearnUpon, Docebo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Elearning Authoring Tools Market Key Technology Landscape

The technological landscape of the Elearning Authoring Tools Market is rapidly evolving, moving beyond traditional desktop software towards highly collaborative, web-native platforms leveraging sophisticated cloud infrastructure. A fundamental technological requirement is adherence to interoperability standards, particularly SCORM (Sharable Content Object Reference Model) and, increasingly, xAPI (Experience API) and CMI5 (Computer Managed Instruction 5), which ensure that content accurately tracks detailed learner interactions and performance data when deployed across various Learning Record Stores (LRS) and LMS platforms. The shift to HTML5 output is near-universal, enabling content to be inherently mobile-responsive and accessible on any modern browser or device, eliminating reliance on deprecated technologies like Flash. This responsiveness is crucial for meeting the demands of the global mobile workforce and ensuring content universality.

The current technological frontier is dominated by the integration of Artificial Intelligence (AI) and Machine Learning (ML). AI is employed not just for generating preliminary content drafts or automatically summarizing video transcripts, but critically for adaptive testing and personalization engines. These ML algorithms analyze demographic and performance data to dynamically adjust the difficulty, pacing, and sequence of learning modules in real-time, creating highly customized learning pathways for each user. Furthermore, the incorporation of Extended Reality (XR) capabilities, including the ability to easily import and integrate 3D models and generate basic Virtual Reality (VR) or Augmented Reality (AR) scenarios using low-code visual editors, represents a significant leap in content richness, particularly valuable for technical and soft skill simulation training.

Security and infrastructure robustness are constant technological priorities. Modern tools must offer enterprise-grade security features, including advanced encryption, secure authentication (SSO), and compliance with international data protection regulations like GDPR and CCPA, particularly for cloud-hosted solutions handling sensitive employee data. Furthermore, the integration with external enterprise systems, such as HRIS (Human Resource Information Systems) and CRM (Customer Relationship Management) platforms, via secure APIs is becoming standard, facilitating automated enrollment, progress tracking, and performance correlation. The emphasis is on building interconnected ecosystems where the authoring tool is not an isolated application but an integrated component of a broader organizational talent management framework, ensuring centralized data management and streamlined workflows for instructional design teams.

Regional Highlights

- North America: Market Leader Due to Technological Maturity and Corporate Investment

- Europe: Focus on Multilingual Content and Data Privacy Compliance

- Asia Pacific (APAC): Fastest Growing Market Driven by Digital Education Initiatives

- Latin America (LATAM): Emerging Market with High Mobile Adoption

- Middle East and Africa (MEA): Strategic Investment in High-End Training

North America, encompassing the United States and Canada, holds the dominant share in the Elearning Authoring Tools Market. This leadership position is attributed to several factors: the presence of major technological innovation hubs, high penetration rates of digital learning technologies across corporate and academic sectors, and substantial annual budgets allocated to employee training and compliance. The United States, in particular, drives demand due to stringent regulatory requirements in finance, healthcare, and energy, necessitating mandatory and traceable elearning content. Furthermore, North American enterprises are early adopters of advanced features such as AI integration, VR simulations, and microlearning platforms, leading to high Average Selling Prices (ASPs) for premium authoring suites. The large concentration of established vendors and high technological literacy among instructional designers further cements the region's strong market position.

The maturity of the IT infrastructure facilitates the seamless transition to cloud-based subscription models, which are highly favored by both large corporations and the thriving ecosystem of SMEs. Demand is characterized by a preference for highly customizable, robust tools offering extensive xAPI capabilities for deep learning analytics. Competitive dynamics often revolve around the breadth of integrations with major LMS platforms and the quality of customer support and consultation services. High investment in software development and the continuous pursuit of educational technology patents ensure that North America remains the trendsetter for product innovation globally.

Europe represents a highly significant market, characterized by diverse linguistic requirements and a strong focus on data privacy regulations, primarily GDPR. The market is fragmented by country-specific education standards and professional development needs, leading to strong demand for authoring tools capable of supporting easy content localization and translation across numerous languages (e.g., German, French, Spanish, Italian). Corporate adoption is robust, particularly in the UK, Germany, and France, driven by large manufacturing, automotive, and financial services sectors prioritizing continuous vocational training and specialized skill development.

European customers prioritize authoring tools that offer strong security protocols and verifiable adherence to data protection mandates, often leading to a stronger, though diminishing, preference for on-premise solutions among highly sensitive public sector organizations. Nordic countries show high penetration in academic settings due to progressive digital education policies. The region's growth is spurred by EU-wide initiatives promoting digital skills, necessitating rapid content development tools for government-backed upskilling programs. Vendors focusing on customizable, template-driven designs optimized for multiple European accessibility standards gain a competitive edge in this technologically sophisticated yet regulatory-heavy environment.

The Asia Pacific region is forecast to exhibit the highest CAGR during the forecast period. This exponential growth is fueled by mass digital transformation across economies, increasing internet and smartphone penetration, and massive government investment in modernizing educational infrastructure, particularly in India, China, and Southeast Asian nations. The region’s large and expanding young population and the imperative for companies to train millions of new workers quickly and affordably make elearning authoring tools essential.

While the market is price-sensitive in many sub-regions, the growing presence of multinational corporations establishes a benchmark for quality, driving demand for enterprise-level tools. India and China are key revenue contributors, benefiting from the growth of online universities and tech-driven corporate training environments. Cloud-based solutions are particularly popular here due to the lack of pre-existing IT infrastructure in many organizations, favoring pay-as-you-go models. Vendors entering APAC must focus on scalability, affordability, and the ability to integrate efficiently with local technological ecosystems and payment structures.

Latin America is an emerging market characterized by rapid growth in mobile learning adoption, driven by high mobile device penetration even in areas with limited fixed broadband access. Brazil and Mexico are the primary markets, exhibiting increased corporate investment in elearning as a means of standardizing training across geographically diverse operations. The demand often focuses on practical, video-centric, and microlearning content suitable for consumption on mobile devices.

Challenges include fluctuating economic conditions and a generally lower IT spending per employee compared to North America, often requiring vendors to offer flexible pricing and robust localization into Portuguese and Spanish. However, the region’s increasing investment in digital literacy and government-supported educational reform presents significant opportunities for authoring tool providers focused on intuitive, low-bandwidth-optimized platforms that can address the foundational training needs of a rapidly professionalizing workforce.

The MEA market, while smaller, is growing steadily, primarily driven by strategic government initiatives aimed at diversifying economies away from oil dependency and investing heavily in sophisticated human capital development, notably in the UAE, Saudi Arabia, and Qatar. Investment often targets high-end, immersive training solutions, particularly VR/AR simulation creation tools for sectors like energy, defense, and aviation.

In Africa, growth is more nascent but accelerating, particularly in South Africa and Nigeria, driven by the need for scalable and accessible training solutions in the burgeoning telecommunications and financial sectors. Security and compliance are major concerns in the Middle East, leading to preference for robust, enterprise-level solutions. The region demands localized content and strong security features due to the confidential nature of many government and national industry training programs, favoring providers capable of delivering high-specification tools and local support services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Elearning Authoring Tools Market.- Articulate Global LLC

- Adobe Systems Inc.

- iSpring Solutions

- Trivantis (A Learning Technologies Group Company)

- TechSmith Corporation

- Elucidat

- Brainshark

- SAP SE

- Microsoft Corporation

- Knowbly Learning Solutions

- Gomo Learning

- Epignosis LLC

- dominKnow Learning Systems

- Lectora (A Trivantis product)

- Allen Interactions

- CoreAxis Consulting

- E-learning Brothers

- Paradiso Solutions

- LearnUpon

- Docebo

Frequently Asked Questions

Analyze common user questions about the Elearning Authoring Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of migrating from on-premise to cloud-based authoring tools?

Migrating to cloud-based authoring tools significantly enhances collaborative content creation capabilities, reduces the Total Cost of Ownership (TCO) by eliminating hardware maintenance, and ensures users always have access to the latest software features and security patches automatically, facilitating faster global deployment.

How are Elearning Authoring Tools integrating AI to improve content development efficiency?

AI integration is utilized to automate tedious tasks such as generating quizzes from existing text, summarizing long form content, optimizing images, and performing automated accessibility checks, thereby dramatically reducing the content development time required for instructional designers and SMEs.

Which technical standards are critical for ensuring content compatibility across different Learning Management Systems (LMS)?

The critical technical standards for LMS compatibility are SCORM (Sharable Content Object Reference Model), which remains the industry baseline, and the more advanced xAPI (Experience API), which is essential for capturing granular data on learner experiences outside of traditional LMS environments.

What are the key differences between the corporate and academic segments in terms of authoring tool requirements?

The corporate segment primarily requires enterprise-grade security, robust reporting for compliance, and HRIS integration; the academic segment prioritizes features supporting accessibility standards, multimedia creation for diverse curricula, and integration with academic platforms like Moodle or Canvas.

Which geographical region is expected to demonstrate the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) due to extensive government-led digital education reforms, increasing penetration of high-speed internet, and rapid corporate adoption of scalable digital training solutions across countries like India and China.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager