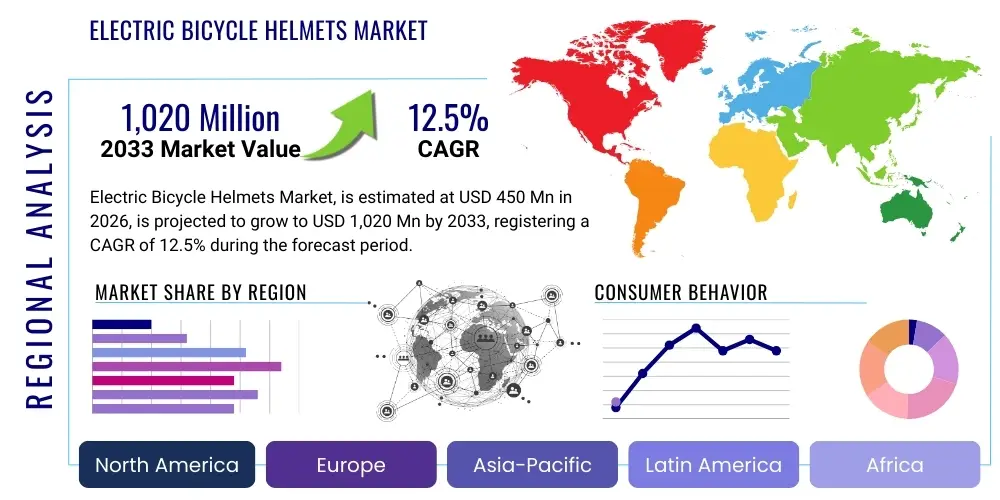

Electric Bicycle Helmets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437266 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Electric Bicycle Helmets Market Size

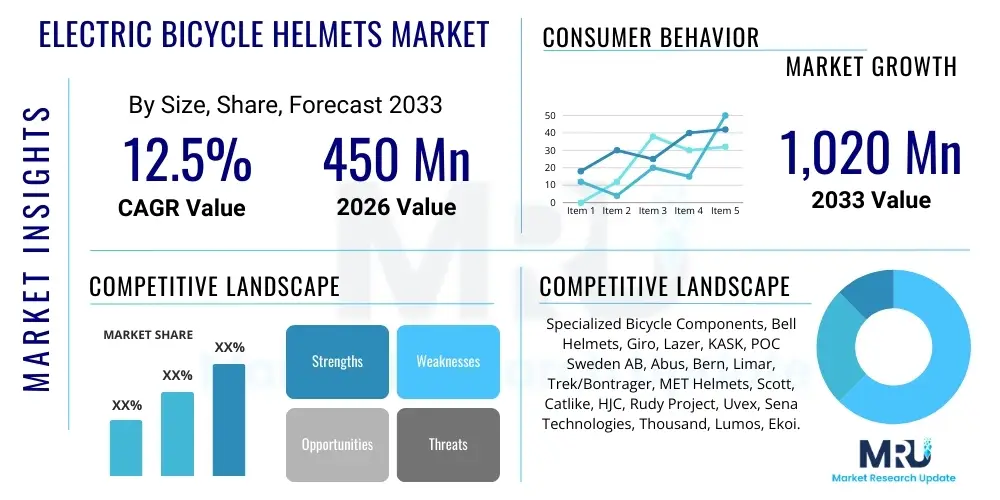

The Electric Bicycle Helmets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

Electric Bicycle Helmets Market introduction

The Electric Bicycle Helmets Market encompasses protective headgear specifically designed and certified for use with electric bicycles (e-bikes). E-bikes, particularly speed pedelecs (Class 3), often operate at higher average speeds than traditional bicycles, necessitating helmets that offer enhanced impact protection, coverage, and stability. These specialized helmets frequently meet stricter safety standards, such as NTA 8776 in Europe, which mandates greater coverage for the temples and back of the head, and superior dissipation of energy during high-speed impacts. The product category is driven by increasing regulatory scrutiny regarding e-bike safety and growing consumer awareness of the distinct risks associated with faster two-wheeled electric transport, distinguishing them from conventional bicycle helmets.

Major applications for electric bicycle helmets span across various e-bike user demographics, including daily commuters utilizing e-bikes for urban transport, recreational riders enjoying weekend trails, and professional delivery services relying on high-speed electric cargo bikes. The utility of these helmets is maximized in dense urban environments where the risk of collision is higher due to traffic complexity, and on high-speed cycling routes where maintaining aerodynamic efficiency and secure fit becomes paramount. Furthermore, integrating smart features like LED lighting, turn signals, and crash detection sensors enhances their functional application beyond mere physical protection, significantly improving rider visibility and emergency responsiveness.

The primary benefits driving market expansion include superior safety ratings compared to standard cycling helmets, increased comfort designed for longer durations of wear, and technological integration that addresses contemporary commuting needs. Driving factors fueling this market growth involve the exponential rise in e-bike adoption globally, spurred by sustainability initiatives and infrastructure improvements favoring cycling. Furthermore, favorable government regulations in key markets like the European Union and North America, mandating or strongly recommending certified helmets for faster e-bikes, provide a robust structural impetus for market expansion, ensuring steady demand for high-quality, specialized head protection.

Electric Bicycle Helmets Market Executive Summary

The Electric Bicycle Helmets Market is poised for significant acceleration, primarily driven by evolving regulatory landscapes and the rapid mainstreaming of electric mobility solutions across urban centers. Business trends indicate a strong move toward innovation, with manufacturers heavily investing in materials science to improve energy absorption capabilities (such as rotational impact protection systems like MIPS or WaveCel) while simultaneously reducing weight and enhancing ventilation. Strategic collaborations between helmet manufacturers and e-bike producers are becoming common, often leading to co-branded products or specialized designs tailored for specific e-bike segments (e.g., cargo bikes or off-road eMTBs). Mergers and acquisitions focused on acquiring proprietary smart technology platforms are also shaping the competitive structure, as companies seek to integrate advanced features like built-in communication systems and emergency tracking capabilities directly into their product offerings.

Regionally, Europe maintains its dominance due to early adoption of stringent safety standards (NTA 8776) and mature e-bike penetration, particularly in countries like Germany, the Netherlands, and Belgium. Asia Pacific, led by China and emerging markets in Southeast Asia, represents the highest growth potential, fueled by massive volume sales of affordable e-bikes and increasing disposable incomes leading to demand for premium safety gear. North America is experiencing robust growth driven by the burgeoning popularity of e-mountain bikes and the adoption of Class 3 speed pedelecs for long-distance commuting, prompting states and municipalities to reassess and often tighten cycling safety laws, thereby boosting specialized helmet sales.

Segment trends highlight a clear bifurcation between high-end smart helmets, which are increasingly sought after for their integrated technology (lighting, connectivity), and performance-focused specialized protection for eMTB and speed commuting. The In-mold helmet construction segment dominates due to its optimal balance of protection, lightweight design, and cost-efficiency, while the adoption of multi-directional impact protection systems (MIPS, Spherical) is rapidly becoming a standard feature across all mid-to-high price points. The online distribution channel is growing fastest, leveraging digital marketing and direct-to-consumer models, though specialized bike shops remain critical for providing fitting expertise and personalized safety consultations.

AI Impact Analysis on Electric Bicycle Helmets Market

User inquiries regarding AI's influence in the Electric Bicycle Helmets Market predominantly revolve around enhanced safety performance, customization, and integrated rider assistance. Key concerns focus on how AI algorithms can process real-time environmental data (such as traffic patterns or road conditions) to dynamically adjust helmet features, like visibility or impact preparation. Users frequently ask about the potential for AI-driven crash detection systems to achieve near-zero false positive rates and automatically notify emergency services with greater speed and accuracy than current smart helmet solutions. Furthermore, there is significant interest in how AI could optimize helmet design for specific head shapes and riding styles using generative design tools, moving beyond standard sizing matrices to offer truly personalized protection, thus summarizing the key themes of hyper-personalization, intelligent safety features, and reliability enhancement.

- AI-driven personalized fit optimization utilizing 3D scanning and generative design algorithms to maximize safety coverage.

- Enhanced crash detection accuracy via machine learning models processing inertial data, ambient noise, and impact force vectors, reducing false alarms.

- Predictive maintenance alerts for smart helmet components, utilizing AI to monitor battery life, sensor calibration, and structural integrity over time.

- Integration of advanced rider assistance systems (ARAS) through voice commands processed by onboard AI, managing navigation or communication without distraction.

- Optimization of ventilation patterns and internal padding structure using computational fluid dynamics (CFD) and AI modeling to improve thermal comfort during prolonged e-bike use.

- Development of adaptive lighting systems where AI adjusts LED intensity and pattern based on ambient light conditions, traffic flow, and rider speed to maximize visibility.

DRO & Impact Forces Of Electric Bicycle Helmets Market

The market is dynamically shaped by a confluence of accelerating drivers, structural restraints, and compelling opportunities, all operating under significant impact forces. Key drivers include mandatory or recommended regulatory compliance for e-bike use, especially in high-speed categories (e.g., European NTA 8776 standard), coupled with a growing consumer demand for advanced safety features like MIPS and integrated visibility tools. The rapid expansion of e-bike infrastructure and shared mobility services also catalyzes demand, creating a larger user base requiring appropriate head protection. These drivers collectively push the market toward premiumization and technology integration, establishing a baseline expectation for higher safety standards than those accepted in the traditional cycling market.

However, several restraints challenge market growth and expansion. The primary restraint is the higher cost associated with specialized e-bike helmets compared to conventional options, which can deter price-sensitive consumers, particularly in emerging markets where e-bike adoption is driven by affordability. Additionally, the lack of uniform international safety standards creates fragmentation, leading to confusion among consumers and complexity for manufacturers in achieving global compliance. A related restraint involves the perception that standard bicycle helmets are adequate for slower e-bikes (Class 1), slowing the adoption rate of specialized, higher-priced products among casual riders. These restraints necessitate substantial educational marketing efforts to justify the added value of specialized protection.

Opportunities for sustained market growth abound, centered on the integration of smart technology (connectivity, communication, safety tracking) that transforms the helmet from a passive protective device into an active safety hub. The expansion into niche segments, such as ruggedized helmets for e-cargo bikes and specialized aerodynamic models for speed commuting, presents profitable avenues. Furthermore, manufacturers have a significant opportunity to capitalize on the aftermarket customization and personalization trend, offering interchangeable visors, optimized internal padding, and color schemes that align with the aesthetics of modern e-bikes. Porter's five forces analysis indicates a moderate-to-high bargaining power of buyers due to numerous product options, high threat of new entrants due to technological accessibility, and moderate threat of substitutes from conventional helmets (though diminishing due to regulatory pressure).

Segmentation Analysis

The Electric Bicycle Helmets Market segmentation provides a granular view of consumer needs and technological adoption across various product categories, end-user applications, and geographical regions. The market is primarily segmented by Product Type (In-mold, Hard-shell, Others), Technology (MIPS/Rotational Protection, Integrated Lighting, Communication), End-User (Commuters, Recreational Riders, Off-Road/eMTB), and Distribution Channel (Online, Offline). This multi-dimensional segmentation is critical for manufacturers to tailor their R&D investments, ensuring compliance with segment-specific standards, such as NTA 8776 for commuting helmets or specialized ventilation requirements for eMTB riders. The dominance of the In-mold technology underscores its material efficiency and impact performance balance, while the rapid growth of the Integrated Lighting segment reflects the increasing focus on active safety and urban visibility.

- By Product Type: In-mold, Hard-shell/ABS, Others (e.g., Carbon Fiber shells).

- By Technology: MIPS and other Rotational Impact Protection Systems (e.g., WaveCel, Spherical), Integrated Lighting and Visibility Features, Smart/Connectivity Features (Bluetooth, Communication, Crash Detection).

- By End-User: Commuters and Urban Riders, Recreational and Leisure Riders, Off-Road and E-Mountain Bikers (eMTB), Delivery and Commercial Fleet Use.

- By Distribution Channel: Online Sales (E-commerce, Company Websites), Offline Sales (Specialty Bicycle Retail Stores, Sporting Goods Stores, Hypermarkets).

Value Chain Analysis For Electric Bicycle Helmets Market

The value chain for electric bicycle helmets begins with upstream activities focused on securing specialized raw materials, primarily high-density expanded polystyrene (EPS) foam, polycarbonate or ABS shells, and advanced rotational impact liners (e.g., MIPS components). Key upstream partnerships involve chemical companies for EPS production and specialized material suppliers for high-strength polycarbonate. Maintaining quality control at this stage is crucial, as the performance of the helmet is directly tied to the consistency and density of the impact-absorbing materials. Manufacturers often engage in vertical integration or long-term contracts with material suppliers to ensure supply stability and cost efficiency, especially for patented technologies like MIPS, which requires certified component sourcing.

The core manufacturing and assembly stage involves design, mold creation, in-mold bonding processes (for lightweight shells), and integration of complex electronics for smart helmets. Manufacturers like Bell, Giro, and Abus maintain proprietary design processes that focus on optimizing ventilation, fit systems, and aesthetics while meeting stringent NTA 8776 or equivalent safety standards. Midstream logistics involve rigorous testing and certification (e.g., CPSC, CE, NTA 8776) before distribution. The shift toward smart helmets necessitates specialized midstream component procurement for batteries, circuit boards, and communication modules, adding complexity and requiring expertise in consumer electronics manufacturing, differentiating this value chain from traditional cycling gear.

Downstream activities center on efficient distribution channels, encompassing both direct and indirect routes to the end consumer. Indirect channels, primarily specialized bicycle retail stores and large sporting goods chains, are vital because they offer expert fitting services—a crucial factor in helmet safety. Direct channels, leveraging e-commerce and branded online stores, facilitate global reach and higher margins, particularly favored by smart helmet brands like Lumos and Sena. Effective marketing emphasizes safety technology and regulatory compliance, targeting the informed e-bike consumer who is often willing to pay a premium for certified protection. Efficient inventory management and responsive after-sales support for electronics further define the successful downstream operations in this market.

Electric Bicycle Helmets Market Potential Customers

The primary end-users and potential buyers in the Electric Bicycle Helmets Market can be broadly categorized into distinct user profiles based on riding frequency, speed, and application. The largest and fastest-growing segment consists of urban and suburban e-bike commuters. These consumers prioritize helmets that offer maximum protection for higher average speeds (Class 3 speed pedelecs), comfort for daily long-duration wear, and integrated visibility features like brake lights and turn signals to navigate dense city traffic safely. Purchase decisions for this demographic are highly influenced by European safety standards (NTA 8776 compliance) and integration with smart devices, seeking a blend of high functionality and professional aesthetic.

Another significant customer segment includes recreational and leisure e-bike users, who typically ride slower e-bikes (Class 1 and 2) but are increasingly aware of the benefits of enhanced protection. While they may be more price-sensitive than commuters, they still value features such as superior ventilation, ergonomic comfort, and stylish, low-profile designs. This group often purchases through offline specialty stores where they can receive tailored advice on fit and style compatibility with their specific e-bike model. Additionally, this segment shows strong demand for versatile helmets suitable for multi-modal transport, including features that make the helmet easy to carry or store when not riding.

A high-value, niche customer base is formed by e-mountain bike (eMTB) enthusiasts and professional delivery fleet operators. eMTB riders demand rugged, full-coverage helmets with superior ventilation, often utilizing removable chin guards, and focused on impact energy management for off-road tumbles. Fleet operators, conversely, prioritize durability, high visibility, and integrated communication systems (often supplied by companies like Sena) that facilitate team coordination and mandatory safety protocols. For commercial use, the longevity of the product and bulk purchasing discounts are key purchasing criteria, often leading to procurement agreements directly with manufacturers or specialized B2B suppliers focusing on fleet management solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Bell Helmets, Giro, Lazer, KASK, POC Sweden AB, Abus, Bern, Limar, Trek/Bontrager, MET Helmets, Scott, Catlike, HJC, Rudy Project, Uvex, Sena Technologies, Thousand, Lumos, Ekoi. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Bicycle Helmets Market Key Technology Landscape

The technology landscape of the Electric Bicycle Helmets market is characterized by a dual focus: optimizing passive protection against impact forces and integrating active electronic features to enhance visibility and connectivity. Passive safety innovation is primarily driven by rotational impact protection systems such as MIPS (Multi-directional Impact Protection System) and competitive technologies like WaveCel, which are specifically designed to mitigate the rotational forces that occur during oblique impacts, a common scenario in cycling accidents. Furthermore, advanced shell materials, including high-impact polycarbonates and specialized EPS foam densities, are crucial for meeting the elevated energy absorption requirements of high-speed e-bike standards like NTA 8776, providing necessary structural integrity and dissipation capacity for higher-velocity crashes.

In terms of active technology, the integration of smart features represents the most dynamic area of innovation. This includes sophisticated integrated LED lighting systems (e.g., Lumos and Livall), often functioning as brake lights and turn signals, which significantly enhance rider visibility, especially in low-light urban commuting conditions. Connectivity is another cornerstone, utilizing Bluetooth technology for features such as hands-free communication, music streaming, and, most critically, automated crash detection and emergency alert systems that utilize accelerometers and gyroscope data to transmit the rider's GPS location to predefined emergency contacts or services in the event of a significant impact.

Further technological advancements include the refinement of fit systems and ventilation mechanisms tailored for e-bike use. Magnetic buckle systems (e.g., Fidlock) enhance ease of use, especially when wearing gloves, while highly adjustable retention systems ensure a secure and stable fit at high speeds. Ventilation channels are optimized using computational fluid dynamics (CFD) to maximize airflow while minimizing the aesthetic and structural impact on the helmet shell, addressing the user complaint of overheating during prolonged electric cycling. The convergence of these passive and active technologies dictates the competitive landscape, pushing manufacturers to continuously upgrade their product lines to offer comprehensive protection and advanced user experience features.

Regional Highlights

The global Electric Bicycle Helmets Market exhibits significant regional variations in growth rate, regulatory influence, and consumer preference, primarily driven by e-bike penetration and local safety mandates. Europe currently represents the most mature market, characterized by stringent safety regulations, notably the NTA 8776 standard in countries like the Netherlands and Germany, which has strongly segmented the market toward specialized, certified e-bike helmets. This has resulted in high adoption rates for premium brands and smart helmet technologies, cementing Europe’s position as a hub for both consumption and technological innovation. Government subsidies and dedicated cycling infrastructure further reinforce this market leadership.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by the vast volume of e-bike usage, particularly in China and Southeast Asia, where e-bikes are critical modes of personal transport rather than just recreational items. While price sensitivity remains a key factor, leading to higher consumption of basic, often non-certified protective gear, rising disposable incomes in emerging economies (India, Vietnam) are increasing demand for higher-quality, safer helmets that adhere to international standards. Urbanization and efforts to combat air pollution are driving regulatory changes that increasingly emphasize rider safety, creating substantial long-term growth opportunities for mid-to-high range specialized helmets in the region.

North America is experiencing robust growth, driven primarily by the high adoption rate of performance e-bikes, including Class 3 speed pedelecs and eMTBs. Unlike Europe, regulatory standards are fragmented at the state level, but consumer awareness regarding the need for enhanced protection at speeds up to 28 mph is high. The North American market shows a strong affinity for technologically integrated helmets, including those offering seamless compatibility with smartphones and advanced emergency features. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are projected to expand as e-bike infrastructure develops and governments implement urban mobility strategies that favor micromobility solutions.

- Europe: Dominant market share due to early regulatory adoption (NTA 8776) and high e-bike penetration; strong demand for high-end safety features and smart connectivity. Key countries include Germany, Netherlands, and Belgium.

- Asia Pacific (APAC): Highest projected CAGR due to massive installed base of e-bikes; increasing premiumization driven by rising incomes and urbanization in China, Japan, and Australia. Focus shifting from basic protection to certified safety gear.

- North America: Significant growth driven by eMTB and speed commuter segments; preference for technologically advanced helmets and rotational impact protection systems; market driven by consumer safety consciousness and varied state-level regulations.

- Latin America (LATAM): Emerging market driven by urban congestion solutions; focused on utility and affordability, with gradual integration of international safety standards as cycling infrastructure improves.

- Middle East & Africa (MEA): Smallest current share but promising growth potential tied to smart city initiatives and investment in sustainable transport infrastructure, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Bicycle Helmets Market.- Specialized Bicycle Components

- Bell Helmets (Vista Outdoor)

- Giro (Vista Outdoor)

- Lazer Sport (Shimano)

- KASK S.p.A.

- POC Sweden AB

- Abus August Bremicker Söhne KG

- Bern Unlimited

- Limar S.r.l.

- Trek Bicycle Corporation/Bontrager

- MET Helmets

- Scott Sports SA

- Catlike

- HJC Helmets

- Rudy Project

- Uvex Sports Group

- Sena Technologies, Inc.

- Thousand, Inc.

- Lumos Helmet

- Ekoi

Frequently Asked Questions

Analyze common user questions about the Electric Bicycle Helmets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a standard bike helmet and an electric bicycle helmet?

Electric bicycle helmets, especially those certified under standards like NTA 8776, are designed to offer enhanced protection and coverage for higher impact speeds (up to 45 km/h) compared to standard helmets (CPSC/CE, typically tested up to 20 km/h). They often feature deeper temple and occipital coverage, thicker EPS layers, and may include integrated smart technology specifically useful for e-bike commuting.

Is NTA 8776 certification mandatory for all e-bike use globally?

No, NTA 8776 is currently a European technical standard, primarily mandatory or highly recommended for speed pedelecs (Class 3 e-bikes reaching 45 km/h) in specific European countries like the Netherlands and Belgium. In North America and other regions, CPSC or CE standards suffice for Class 1 and 2 e-bikes, but NTA 8776 certified helmets are increasingly sought after by consumers desiring superior safety.

How does MIPS technology improve safety in e-bike helmets?

MIPS (Multi-directional Impact Protection System) is a rotational impact mitigation technology integrated within the helmet structure. It allows the head to move slightly relative to the helmet shell during an oblique impact, redirecting rotational energy and significantly reducing the risk of brain injury associated with angular acceleration, which is critical at the higher speeds of e-bikes.

What role do smart features like integrated lighting play in market growth?

Integrated smart features, such as LED lighting, turn signals, and automatic brake lights, significantly enhance the rider’s active safety by improving visibility to surrounding traffic, particularly crucial in complex urban commuting environments. This technological integration is a major driver of market growth, justifying the premium price points of modern e-bike helmets and satisfying consumer demand for convenient, all-in-one safety solutions.

Which regional market shows the fastest growth potential for electric bicycle helmets?

The Asia Pacific (APAC) region exhibits the fastest growth potential for the electric bicycle helmets market. This acceleration is driven by the massive volume of electric two-wheelers in countries like China and India, coupled with rising consumer awareness and increasing regulatory emphasis on mandated safety gear, leading to a rapid shift towards specialized and certified helmet products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager