Electric Brake Booster Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432117 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Electric Brake Booster Market Size

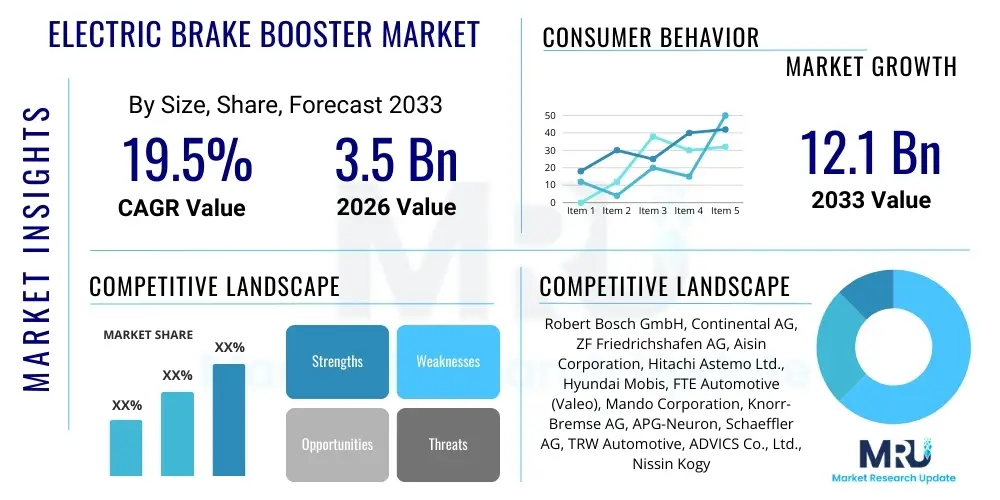

The Electric Brake Booster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 12.1 Billion by the end of the forecast period in 2033.

Electric Brake Booster Market introduction

The Electric Brake Booster (EBB), often referred to as Electro-Hydraulic Brake (EHB) systems or electromechanical brake boosters, represents a critical evolution in vehicle braking technology, replacing traditional vacuum-dependent boosters. This shift is primarily necessitated by the rapid growth of Electric Vehicles (EVs) and hybrid vehicles, which either lack a reliable vacuum source or require more efficient and precise braking energy regeneration capabilities. EBBs utilize an electric motor and integrated control unit to generate the necessary hydraulic pressure for braking, offering superior pedal feel decoupling, faster response times, and the capability to integrate seamlessly with advanced safety systems like Electronic Stability Control (ESC) and Anti-lock Braking Systems (ABS).

Major applications of EBB technology span across Passenger Cars (PC), particularly high-performance vehicles and all types of electric vehicles (BEVs, PHEVs, FCEVs), and increasingly, Light Commercial Vehicles (LCVs) that are adopting advanced driver assistance systems (ADAS). The core benefit derived from EBBs is their integral role in enhancing vehicle safety through increased braking redundancy and supporting Level 2 and above autonomous driving functions. Furthermore, these systems are vital for optimizing regenerative braking, allowing EVs to recover maximum kinetic energy, thereby extending battery range and improving overall energy efficiency, a key value proposition for end-users and manufacturers alike.

The market is predominantly driven by stringent global safety regulations, especially those mandating ADAS features such as Automatic Emergency Braking (AEB) and Adaptive Cruise Control (ACC), both of which rely on the fast and precise pressure control offered by EBBs. The accelerating global transition towards vehicle electrification is the most significant driving factor, as legacy vacuum boosters are technically obsolete in many EV architectures. However, continuous innovation focusing on reducing component cost and size while enhancing software reliability remains essential for sustained market penetration across mid-range vehicle segments.

Electric Brake Booster Market Executive Summary

The Electric Brake Booster (EBB) market is experiencing transformative growth, catalyzed by fundamental shifts in the automotive industry toward electrification and autonomous functionality. Business trends indicate a strong prioritization of integrated braking solutions (e.g., 'Brake-by-Wire') that combine boosting and hydraulic control into a single module, driving vertical integration among Tier 1 suppliers like Bosch and Continental. Key strategic investments are centered on software development and cybersecurity, recognizing that the EBB is a core component of the vehicle's electronic architecture. Furthermore, OEMs are increasingly seeking modular solutions that can be scaled across various vehicle platforms, pressuring suppliers to enhance manufacturing efficiencies and component standardization.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, largely due to China's dominant position in electric vehicle production and adoption, alongside significant market expansion in South Korea and Japan. Europe follows closely, driven by robust safety standards (e.g., Euro NCAP mandates for pedestrian detection and AEB) and aggressive targets for fleet electrification. North America contributes substantial revenue, characterized by high adoption rates in premium electric SUVs and trucks, where the performance and stopping power of EBBs are highly valued. These regional trends underscore a localized competitive landscape, where supply chain resilience and proximity to major EV manufacturing hubs are crucial for market success.

Segment-wise, the Passenger Car segment maintains the largest market share, with the Original Equipment Manufacturer (OEM) sales channel dominating due to the complex integration requirements of EBBs at the manufacturing stage. Technology trends emphasize the transition from the Single Stage EBB to the more robust Tandem Stage variants, particularly for larger vehicles or those requiring higher levels of redundancy for advanced autonomy. The long-term segmentation forecast suggests increasing penetration into the LCV and potentially the HCV segments as electrification efforts expand beyond passenger mobility, requiring highly durable and efficient pressure control systems tailored for heavier loads and regenerative braking capacity.

AI Impact Analysis on Electric Brake Booster Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Electric Brake Booster (EBB) market frequently revolve around its role in enabling high-level autonomy, optimizing system performance, and enhancing predictive safety mechanisms. Common questions center on how AI algorithms improve the 'feel' and responsiveness of the decoupled brake pedal, how machine learning can predict brake component failure before it occurs, and the necessity of AI for managing complex regenerative braking schedules in varied driving conditions. Users also express interest in AI's contribution to system redundancy, particularly in Level 3 and Level 4 autonomous driving architectures where instantaneous decision-making regarding brake application and pressure modulation is paramount, demanding real-time data processing far exceeding traditional control loops.

This user interest reflects a core market theme: EBBs transition from mechanical components to intelligent, software-defined actuators. AI is crucial for processing the vast stream of sensory data—from LiDAR, radar, cameras, and vehicle dynamics sensors—to determine the precise braking force needed in milliseconds, particularly during complex maneuvers like sudden stops or obstacle avoidance in ADAS applications. Furthermore, AI-driven predictive maintenance models analyze operational data (e.g., motor current draw, hydraulic pressure variances, temperature profiles) to schedule proactive service, significantly improving vehicle uptime and overall system reliability, thereby reducing warranty claims for OEMs and improving customer satisfaction.

The integration of deep learning techniques allows the EBB control unit to adapt the braking characteristics to individual driver behavior, road surface conditions, and vehicle load in real-time. This personalization enhances the driving experience and maximizes regenerative braking efficiency under variable conditions. While the EBB unit itself is a hardware component, its performance is entirely dependent on its embedded software; hence, the sophistication of AI algorithms dictates the market differentiation of competing EBB systems, solidifying AI as an enabling technology that defines the capability ceiling of modern braking solutions, especially in the context of advanced motion control and seamless merging of friction braking with regeneration.

- AI enables real-time adaptation of braking force based on sensor fusion data for superior ADAS performance.

- Predictive algorithms optimize regenerative braking strategy to maximize energy recovery and extend EV range.

- Machine Learning improves system diagnostics, anticipating component wear and enabling predictive maintenance scheduling.

- AI facilitates faster decision-making in autonomous emergency braking (AEB) scenarios, reducing reaction latency.

- Enhances brake pedal feel simulation by adapting decoupling parameters based on driver input history and contextual data.

DRO & Impact Forces Of Electric Brake Booster Market

The Electric Brake Booster (EBB) market is shaped by a powerful confluence of drivers, constraints, and opportunities, underpinned by significant external impact forces stemming from regulatory mandates and technological disruption. The primary driver is the accelerating penetration of Electric Vehicles (EVs) globally, which require EBBs for enhanced regenerative braking and the absence of engine vacuum. Coupled with this is the mandated incorporation of sophisticated ADAS features, such as Automatic Emergency Braking (AEB) and Adaptive Cruise Control (ACC), which demand the high dynamic pressure control and rapid responsiveness that EBB systems reliably provide. The opportunity landscape is vast, particularly in the development of fully redundant, 'brake-by-wire' systems necessary for achieving Level 4 and Level 5 autonomous driving, where mechanical linkage failure cannot be tolerated, positioning EBBs as foundational safety components.

However, the market faces notable restraints, chiefly related to the higher component cost of EBB systems compared to conventional vacuum boosters. This cost premium, driven by the inclusion of advanced electronics, motors, and complex control software, can impede adoption in budget and entry-level vehicle segments, especially in emerging markets. Technical complexity and system integration challenges also act as restraints; integrating EBBs requires extensive recalibration of the vehicle's entire chassis control software, demanding high expertise and long validation cycles from OEMs and Tier 1 suppliers. Furthermore, concerns regarding software reliability and the potential for cyberattacks on critical safety systems necessitate continuous investment in cybersecurity, adding another layer of cost and complexity.

Impact forces are predominantly driven by stricter governmental regulations concerning vehicle safety and emissions. For instance, enhanced safety ratings by organizations like Euro NCAP heavily incentivize the adoption of ADAS features, which rely on EBBs. The global shift toward zero-emission mandates indirectly boosts the EBB market by forcing the conversion of vehicle fleets to electric powertrains. The ongoing semiconductor shortage and fluctuations in raw material prices (like rare earth metals used in EBB motors) represent significant external impact forces that affect production stability and pricing power across the value chain, requiring suppliers to diversify sourcing and improve inventory management to mitigate operational risks effectively.

Segmentation Analysis

The Electric Brake Booster (EBB) market is structurally segmented based on crucial criteria including the technological design (Type), the application base (Vehicle Type), and the sales channel (Market Channel). Analyzing these segments provides strategic insights into areas of highest growth potential and technological maturity. The dominance of specific segments, such as Passenger Cars and the OEM channel, reflects current production methodologies and the foundational role of the EBB in modern vehicle design. Understanding the nuances between segments like Single Stage and Tandem Stage EBBs is critical, as Tandem systems are increasingly preferred for higher-weight or high-redundancy applications, indicating a future trend toward more robust and performance-oriented solutions.

The segmentation by Vehicle Type clearly illustrates the market's dependence on electrification trends. While Passenger Cars currently constitute the largest volume segment due to the mass production of EVs, the Light Commercial Vehicle (LCV) segment is anticipated to exhibit rapid growth over the forecast period. This acceleration is driven by the electrification of delivery vans and urban logistics fleets, which demand high efficiency and rapid deceleration capability, benefits intrinsically offered by EBB technology. The slower, yet steady, adoption in Heavy Commercial Vehicles (HCV) is linked to ongoing development cycles for electric semi-trucks and buses, where the technical challenge of handling massive loads requires custom-engineered EBB variants.

By sales channel, the OEM segment accounts for the overwhelming majority of EBB unit sales, which is typical for safety-critical, highly integrated components installed during vehicle assembly. The Aftermarket segment, though smaller, is poised for gradual growth, driven primarily by replacement needs as the installed base of vehicles equipped with EBBs ages. However, due to the electronic complexity and proprietary software integration, the replacement process usually requires specialized diagnostic tools and certified repair centers, ensuring that the OEM channel maintains its dominance in system supply, even for spare parts management.

- By Type:

- Single Stage

- Tandem Stage

- By Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Electric Brake Booster Market

The value chain for the Electric Brake Booster market is intricate, involving specialized upstream component suppliers, high-technology manufacturing and assembly, and highly concentrated downstream distribution channels. Upstream activities involve the sourcing of critical electronic components, including motor control units, high-performance microprocessors, pressure sensors, and specialized solenoid valves. Raw material suppliers provide metals for casings and rare earth magnets essential for the electric motor within the booster. Critical reliance is placed on high-quality electronics providers, emphasizing the sector's vulnerability to global semiconductor supply constraints and the necessity for robust supplier qualification processes to ensure system reliability and long-term durability under harsh operational conditions.

Midstream activities are dominated by Tier 1 automotive suppliers who integrate these components, develop the proprietary software, and perform precise electromechanical assembly. This stage demands significant capital investment in highly automated manufacturing facilities capable of producing safety-critical parts with zero defects. The core value addition at this stage is the system integration and rigorous validation of the EBB's performance, ensuring seamless communication with the vehicle's master electronic control unit (ECU) and compliance with stringent functional safety standards, notably ISO 26262. Tier 1 suppliers often maintain centralized Research and Development centers to continually refine control algorithms and miniaturize the overall system packaging.

Downstream distribution is predominantly direct, operating via the OEM channel. Electric Brake Boosters are typically delivered Just-In-Time (JIT) directly to the vehicle assembly lines of major automotive manufacturers globally. Indirect channels, represented by the aftermarket, handle replacement parts distribution through authorized service networks and certified spare parts dealers. Due to the safety-critical nature and integrated software, the aftermarket channel is tightly controlled by OEMs and Tier 1 suppliers, limiting the prevalence of independent distributors and ensuring that installation and calibration procedures adhere to manufacturer specifications, which is vital for maintaining vehicle integrity and warranty status.

Electric Brake Booster Market Potential Customers

The primary and most significant customers in the Electric Brake Booster market are global automotive Original Equipment Manufacturers (OEMs). These include established automotive groups transitioning their portfolios towards electrification, such as Volkswagen Group, Stellantis, Ford, and General Motors, alongside dedicated pure-play electric vehicle manufacturers like Tesla, Rivian, and emerging Chinese EV brands (e.g., BYD, Nio, Xpeng). OEMs are the direct buyers because the EBB must be integrated into the vehicle's architecture during the design and manufacturing phase, requiring deep collaboration with Tier 1 suppliers years before mass production commences. Their purchasing decisions are driven by factors such as system reliability, performance metrics (stopping distance, pedal feel), cost efficiency, and the supplier's capacity to deliver globally at scale while meeting stringent quality and functional safety requirements for ADAS integration.

A secondary, yet crucial, customer segment comprises fleet operators and commercial vehicle manufacturers. As urbanization increases and logistics fleets electrify, LCV and HCV manufacturers require EBB systems optimized for heavy duty cycles, high regenerative capacity, and sustained performance under frequent braking demands typical of city driving and long-haul transport. Companies managing large corporate fleets or public transport systems are also increasingly becoming indirect customers, influencing the specifications and maintenance standards for EBB systems through their procurement requirements for reliability and total cost of ownership (TCO). For these customers, component longevity and ease of serviceability are paramount considerations when selecting vehicle platforms equipped with EBBs.

Finally, the independent automotive service and repair industry, along with specialized performance aftermarket modifiers, represent the consumer base for replacement and specialized EBB units, although this volume is substantially smaller than the OEM market. These professional entities are concerned with the availability, cost, and standardized compatibility of replacement components. As the population of vehicles with EBBs grows, so too will the service market, requiring specific diagnostic tools and trained technicians to handle the complex electronic calibration necessary for safe installation. Ultimately, while the immediate buyer is the OEM, the technology's application is tailored to provide safety and efficiency benefits across the entire spectrum of vehicle ownership and operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 12.1 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aisin Corporation, Hitachi Astemo Ltd., Hyundai Mobis, FTE Automotive (Valeo), Mando Corporation, Knorr-Bremse AG, APG-Neuron, Schaeffler AG, TRW Automotive, ADVICS Co., Ltd., Nissin Kogyo (Honda Group), Brembo S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Brake Booster Market Key Technology Landscape

The Electric Brake Booster (EBB) market is fundamentally characterized by the continuous integration of mechatronics, advanced control software, and heightened cybersecurity protocols. A primary technological focus is on developing fully integrated electro-hydraulic braking systems, often referred to as 'integrated brake control modules,' which combine the booster, hydraulic control unit (HCU), and electronic stability control (ESC) into a single, compact unit. This integration reduces complexity, weight, and assembly time for OEMs, simultaneously optimizing the performance interface between friction braking and energy regeneration, a necessity for maximizing efficiency in battery electric vehicles (BEVs). The use of redundant electrical pathways and dual microprocessors (Dual-Core ECUs) is becoming standard to meet functional safety requirements (ASIL D) critical for autonomous driving applications.

Another crucial element of the technology landscape is the sophistication of the Human-Machine Interface (HMI), specifically how the system simulates the brake pedal feel. Since the EBB decouples the physical pedal input from the actual hydraulic pressure generation, advanced sensors and software algorithms are employed to provide drivers with consistent, natural, and responsive pedal feedback across all operating conditions, including emergency braking and regenerative transition. Innovations in sensor technology, such as highly accurate position and force sensors within the pedal box, coupled with rapid solenoid valve actuation systems, are vital for achieving this seamless integration. This focus on driver experience is a key competitive differentiator among Tier 1 suppliers seeking to enhance brand perception for OEMs.

The future technological trajectory is moving towards pure Brake-by-Wire (BBW) systems, where there is no longer a physical hydraulic or mechanical connection between the pedal and the actuator, relying solely on electronic signaling and multiple levels of redundancy. While EBBs currently represent an intermediate step, incorporating electromechanical actuation, the long-term trend involves miniaturization and the adoption of dry brake systems (eliminating hydraulic fluid) to further enhance efficiency and reduce maintenance requirements. Furthermore, robust over-the-air (OTA) update capabilities for the EBB's control software are essential, enabling performance improvements, bug fixes, and security patches post-sale, reflecting the EBB's transition into a high-level networked computing device within the vehicle architecture.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and the fastest-growing region, primarily driven by the massive scale of EV adoption and production in China. China’s aggressive new energy vehicle (NEV) mandates and supportive governmental subsidies have established it as the global manufacturing hub for EBB-equipped vehicles. South Korea and Japan are also major contributors, housing key Tier 1 suppliers (e.g., Hitachi Astemo, Hyundai Mobis) and pioneering advanced braking technologies. The strong regional presence of major EV battery manufacturers further accelerates the demand for EBB systems that maximize regenerative performance.

- Europe: Europe is characterized by stringent vehicle safety standards and ambitious emissions reduction targets, creating a high-demand environment for EBBs. Regulatory bodies like Euro NCAP strongly incentivize ADAS features like AEB, which necessitates EBB adoption. Countries such as Germany (home to Bosch and Continental) and France lead in both manufacturing expertise and high-end vehicle integration. The continent's rapid shift towards plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) ensures consistent market expansion, especially in the premium and luxury segments which were early adopters of the technology.

- North America: The North American market, particularly the United States, shows strong momentum driven by high consumer acceptance of premium electric trucks and SUVs, vehicles that often require Tandem Stage EBBs due to their weight and performance needs. Significant investment by both traditional automotive giants and new electric vehicle startups in manufacturing capacity across the region fuels localized demand. Furthermore, the push for developing Level 3 and Level 4 autonomous driving fleets, especially in logistics and ride-sharing, places a premium on the redundancy capabilities inherent in EBB architecture.

- Latin America (LATAM): The LATAM market remains relatively nascent for EBB adoption, constrained by lower EV penetration rates compared to developed regions. However, market growth is projected as local governments begin implementing stricter safety standards and as multinational OEMs introduce electrified models into key markets like Brazil and Mexico. The initial growth phase is expected to be concentrated in the higher-end passenger car segment and through imported vehicles.

- Middle East and Africa (MEA): EBB market penetration in MEA is currently low, largely dependent on imported vehicles from Europe and Asia. Future growth hinges on infrastructure development supporting EVs and the diversification efforts of key economies, particularly in the Gulf Cooperation Council (GCC) states, which are exploring sustainable mobility solutions. Demand is expected to be localized in wealthy urban centers and tied to luxury and high-performance vehicle imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Brake Booster Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Aisin Corporation

- Hitachi Astemo Ltd.

- Hyundai Mobis

- FTE Automotive (A part of Valeo Group)

- Mando Corporation

- Knorr-Bremse AG

- APG-Neuron

- Schaeffler AG

- TRW Automotive (A subsidiary of ZF)

- ADVICS Co., Ltd.

- Nissin Kogyo (Controlled by Honda Group)

- Brembo S.p.A.

- Tenneco Inc.

- BWI Group

- Autoliv, Inc.

Frequently Asked Questions

Analyze common user questions about the Electric Brake Booster market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Electric Brake Booster (EBB) and how does it differ from traditional systems?

An Electric Brake Booster (EBB) is an electromechanical device that generates braking pressure using an electric motor and control unit, replacing the vacuum reliance of traditional hydraulic boosters. This difference allows EBBs to function independently of the engine, making them essential for Electric Vehicles (EVs) and facilitating precise, rapid pressure control required for ADAS features like AEB.

Why are Electric Brake Boosters crucial for the growth of Electric Vehicles (EVs)?

EBBs are crucial for EVs because they provide the necessary braking pressure without a vacuum source (which combustion engines supply). More importantly, they enable superior regenerative braking control, maximizing the kinetic energy recovery back into the battery, thereby significantly improving the EV's driving range and overall energy efficiency compared to legacy systems.

How do Electric Brake Boosters support autonomous driving systems (ADAS)?

EBBs are foundational for ADAS and autonomous driving because they offer high redundancy, extremely fast response times, and the capability to instantaneously modulate hydraulic pressure based on electronic signals from the vehicle’s central computer. This precision is vital for safety functions such as Automatic Emergency Braking (AEB) and Adaptive Cruise Control (ACC), which require immediate, accurate, and repeatable braking interventions without driver input.

Which geographical region is leading the adoption of EBB technology?

The Asia Pacific (APAC) region is currently leading the adoption of Electric Brake Booster technology, primarily driven by the massive manufacturing and sales volume of Battery Electric Vehicles (BEVs) in China. Government policies supporting New Energy Vehicles (NEVs) and the high presence of local and global EV manufacturers make APAC the largest and fastest-growing market segment for EBBs.

What are the key technological trends defining the future of the Electric Brake Booster Market?

Key technological trends include the integration of EBBs into single, unified electronic brake control modules ('Brake-by-Wire' systems), increased focus on system redundancy to support Level 4/5 autonomy, and the use of sophisticated AI algorithms to optimize regenerative braking efficiency and enhance brake pedal feel simulation. Miniaturization and cybersecurity enhancements are also pivotal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager