Electric Buzzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437095 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electric Buzzer Market Size

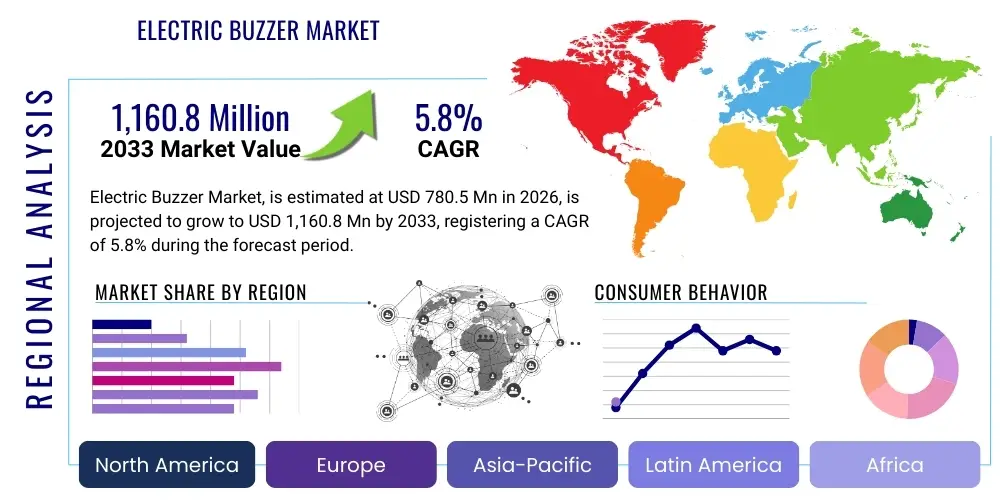

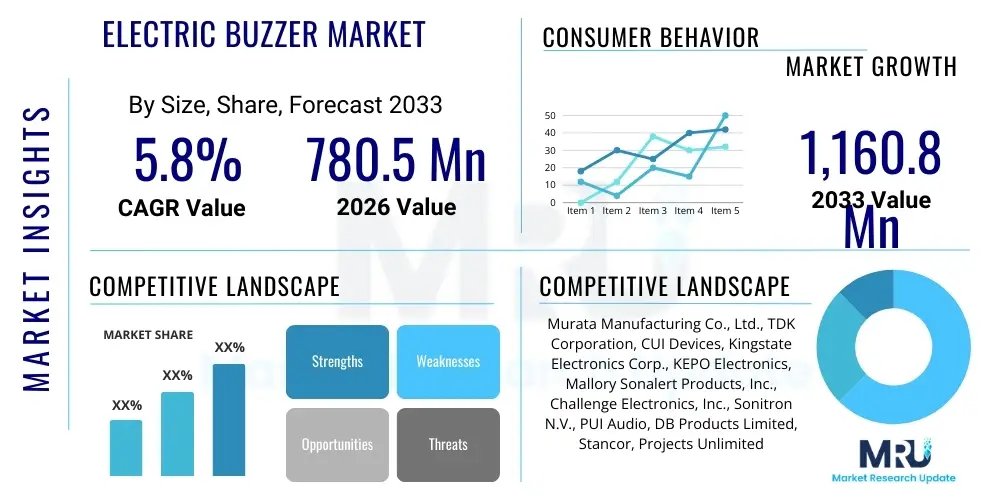

The Electric Buzzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 780.5 Million in 2026 and is projected to reach USD 1,160.8 Million by the end of the forecast period in 2033.

Electric Buzzer Market introduction

The Electric Buzzer Market encompasses the global production and distribution of electro-acoustic devices designed to produce sound based on electrical input, primarily used for signaling, alarms, and notifications. These essential components are integral to modern electronic systems across diverse sectors, including automotive safety systems, consumer appliances, industrial machinery, and medical devices. The underlying principle involves converting electrical signals into mechanical vibrations to generate audible alerts, leveraging technologies such as piezoelectric ceramics and electromagnetic coils. The increasing demand for safety features and notification systems in smart devices and critical infrastructure heavily influences market trajectory. Buzzer technology is continuously evolving towards miniaturization, higher efficiency, and integration capabilities with microcontrollers, driving adoption in highly space-constrained applications. Key applications span vehicle reverse sensors, home automation systems, fire alarms, and precision medical monitoring equipment, underscoring the ubiquity and critical function of these components in maintaining operational safety and user interaction. The robustness required in industrial environments and the compact footprint demanded by consumer products necessitate specialized component design and manufacturing precision, making quality control a critical competitive differentiator.

Electric buzzers are characterized by their simple operation, low power consumption, and reliability, making them a preferred alerting mechanism over complex speaker systems in many applications where a fixed, distinct tone is required. The product landscape includes various types, notably piezoelectric buzzers, which are highly favored for their low current draw, excellent stability, and extremely compact size, particularly suitable for battery-powered devices and portable medical equipment. Conversely, magnetic or electromagnetic buzzers, utilizing mechanical diaphragms actuated by an oscillating magnetic field, are highly sought after in applications demanding higher sound pressure levels (SPL) and a wider operational frequency bandwidth, such as industrial control panels and high-power vehicular warning systems. The choice between these core technologies often depends on the constraints of the end-use environment, including ambient noise levels, available power supply, and spatial limitations. Manufacturers are heavily investing in ceramic formulation research to enhance the performance metrics of piezoelectric components, seeking to achieve louder output without increasing physical dimensions, thereby maintaining market competitiveness against traditional magnetic designs.

The primary driving factors for market expansion include the exponential growth in global consumer electronics manufacturing, particularly within the IoT ecosystem, where billions of connected devices require reliable, low-power feedback mechanisms. Simultaneously, the rigorous standards in automotive original equipment manufacturing (OEM) for auditory warning systems, mandated by global safety organizations, significantly contribute to demand. The modernization of industrial control panels and the rapid adoption of automated systems requiring robust auditory feedback further secure market momentum. Benefits derived from deploying electric buzzers include enhanced operational safety by providing immediate, unambiguous auditory confirmation of critical statuses, cost-effective alarm integration compared to custom sound modules, and guaranteed long operational life with minimal maintenance. The ongoing necessity for fundamental Human-Machine Interface (HMI) feedback across virtually every electronic system ensures that the market for electric buzzers remains a foundational and resilient segment within the electronic components industry, poised for sustained growth throughout the forecast period due to continuous technological refinement and expanding application scope.

Electric Buzzer Market Executive Summary

The global Electric Buzzer Market is experiencing robust structural growth, significantly fueled by accelerating demand from the automotive sector, driven by mandated safety features in conventional vehicles and the integration of Acoustic Vehicle Alerting Systems (AVAS) in electric vehicles (EVs). Business trends indicate a strong, industry-wide pivot toward developing highly energy-efficient and miniaturized components, primarily focusing on Surface Mount Technology (SMT)-compatible piezoelectric buzzers. This shift is crucial for seamless incorporation into the densely packed circuit boards typical of modern IoT ecosystems, consumer wearables, and portable medical monitoring devices. Competitive strategies are increasingly focused on achieving vertical integration, securing stable supplies of specialized raw materials, and leveraging advanced automation in manufacturing processes to maintain cost leadership amid intense global competition, particularly across the Asia Pacific region. Furthermore, stringent regulatory environments concerning noise pollution and required decibel levels for safety applications are prompting manufacturers to innovate sound output profiles and reliability metrics, leading to a strong focus on high-quality component certification.

Regional dynamics clearly delineate Asia Pacific (APAC) as the epicenter of manufacturing and consumption, generating the largest revenue share, primarily driven by massive production volumes in China, South Korea, and Japan across both electronics and automotive industries. This region is critical for supplying the global consumer electronics supply chain. North America and Europe, while growing at a steadier pace, prioritize quality, compliance, and technological sophistication, focusing on customized buzzers for aerospace, high-end medical equipment, and stringent industrial safety systems. These mature markets set the global benchmarks for reliability and component certification, emphasizing durability and performance in critical infrastructure. The emerging economies of Latin America and the Middle East & Africa (MEA) are characterized by rising infrastructure spending, increasing penetration of basic telecommunication networks, and burgeoning local manufacturing, presenting significant untapped potential, albeit with challenges related to establishing robust distribution logistics and managing fluctuating import tariffs.

Segmentation analysis confirms that Piezoelectric Buzzers hold the majority market share, largely due to their inherent advantages in size, weight, and energy consumption, making them ubiquitous in low-voltage consumer electronics. This segment benefits directly from the exponential growth of IoT. However, Electromagnetic Buzzers are witnessing rapid expansion within the high-power, high-decibel segments, specifically within industrial process control and commercial vehicle warning systems where robust noise penetration is essential for safety. Among end-use sectors, the Automotive segment is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the irreversible trend toward connected vehicles and enhanced vehicle safety automation. The Consumer Electronics segment remains foundational, demanding continuous innovation in miniaturization and cost-effectiveness to support the massive, cyclical volume requirements associated with personal devices and smart home technology. Strategic efforts across all segments are centered on increasing operational temperature ranges and enhancing resistance to environmental stressors like humidity and dust to expand applicability.

AI Impact Analysis on Electric Buzzer Market

User inquiries related to AI’s impact on the Electric Buzzer Market frequently center on whether intelligent systems will render simple, dedicated audible components obsolete, or conversely, if AI will elevate the functionality and precision of acoustic signaling. The primary theme identified is the optimization of Human-Machine Interface (HMI) feedback. Users anticipate that AI-driven diagnostic and predictive systems will transition buzzers from being mere failure indicators to integrated, smart communicators. Instead of a buzzer sounding whenever a threshold is crossed, AI is expected to filter false alarms, analyze the context of an event (e.g., operational status, environmental variables, historical performance), and then trigger a buzzer only when immediate, critical human intervention is required, potentially modulating the tone or pattern to convey specific information complexity. This shift mandates that future buzzers must possess superior digital interfacing capabilities to accept complex signals from AI controllers, moving beyond simple on/off switches, requiring advanced internal circuitry.

A secondary, but highly relevant, concern among market participants is the application of AI in manufacturing. Market professionals are exploring how machine learning algorithms can be utilized for advanced quality inspection—analyzing minute acoustic characteristics and material defects during production that are imperceptible to human inspectors or standard test equipment. This use of AI promises to dramatically increase component reliability and consistency, particularly for high-stakes applications like medical monitoring and industrial safety alarms, where failure is unacceptable. AI systems can detect deviations in acoustic signature caused by subtle manufacturing flaws, leading to near-perfect component quality. Moreover, AI is expected to optimize supply chain logistics and inventory management for buzzer components, predicting demand fluctuations with higher accuracy based on global manufacturing forecasts for end-products like smartphones and automotive units, thus streamlining global distribution networks and reducing holding costs across the supply chain.

Ultimately, the consensus suggests that AI will transform the buzzer's role from a passive component to an active element in intelligent systems. For example, in smart factory environments, AI could utilize a buzzer's output as feedback data, analyzing the sound profile to detect degradation in the component itself or in the machine it is monitoring. This integration turns the simple buzzer into a sensory node. This enhanced requirement for reliability and intelligent integration is expected to drive research into integrated circuit designs within the buzzer housing itself, providing localized processing and digital communication protocols. The market anticipates a premium segment emerging for "smart buzzers" explicitly designed to interact robustly within AI-managed safety and control architectures, offering features like self-diagnostics and dynamic acoustic profile selection based on real-time operational context, securing their relevance in advanced technological systems.

- AI-driven Predictive Maintenance: AI models analyze operational metrics (e.g., current consumption, acoustic signature changes) of industrial buzzers and their host systems to proactively predict component degradation or operational anomalies, enabling preventative replacement before catastrophic failure and increasing system uptime.

- Contextual Alarm Management: AI integrates real-time data from various sensors (temperature, pressure, visual) to determine the criticality of an event, modulating buzzer output (frequency, volume, duration) to ensure auditory signals are proportionate to the threat level, dramatically reducing debilitating alarm fatigue in complex human-machine interfaces (HMIs), especially in control rooms and medical settings.

- Manufacturing Quality Assurance: Machine learning algorithms are employed in factory settings for non-contact acoustic analysis during the assembly process, rapidly identifying subtle structural or electrical defects in the buzzer components by analyzing sound wave anomalies, thereby enhancing quality and reducing yield losses.

- Optimization of HMI Feedback Selection: AI assists system designers in determining when an auditory buzzer signal is more effective than visual alerts or haptic feedback, optimizing the overall user experience and ensuring immediate recognition of critical status changes in devices like medical monitors and vehicle dashboards, contributing to enhanced safety.

- Energy Efficiency Management: AI systems dynamically manage power allocation to buzzers in battery-operated IoT devices, analyzing ambient noise and required alert duration to ensure the minimum required acoustic output is achieved, thereby maximizing battery life and operational duration of the host device.

DRO & Impact Forces Of Electric Buzzer Market

The trajectory of the Electric Buzzer Market is fundamentally determined by the interplay of powerful Drivers, Restraints, and Opportunities (DRO), underpinned by significant external Impact Forces. The primary driver is the pervasive and often legally mandated integration of signaling devices across critical infrastructure and safety applications, particularly in the rapidly expanding sectors of automotive electronics, including Advanced Driver Assistance Systems (ADAS), and external Acoustic Vehicle Alerting Systems (AVAS) for Electric Vehicles (EVs), and robust fire safety systems, where regulatory compliance ensures non-discretionary procurement regardless of economic fluctuations. This robust demand is further amplified by the unrelenting miniaturization trend in the Internet of Things (IoT) and wearable technology, necessitating compact, highly efficient piezoelectric buzzers capable of complex digital integration. The inherent reliability and cost-effectiveness of buzzers for providing immediate auditory feedback in industrial control systems and consumer devices provides a sustained, long-term foundation for market stability and growth.

However, the market faces structural restraints that limit explosive growth potential. Foremost among these is the intense, globalized price competition, driven predominantly by high-volume manufacturers in Asia, which exerts constant downward pressure on average selling prices (ASPs) and necessitates continuous optimization of manufacturing processes through heavy automation. Furthermore, technological substitution presents a restraint; in premium consumer segments and sophisticated industrial HMIs, simple buzzers are occasionally replaced by advanced micro-speakers or specialized audio chips capable of generating complex voice prompts or customizable soundscapes, limiting the buzzer's penetration into high-value audio output segments. Supply chain volatility, particularly concerning the specialized raw materials like magnetic alloys and high-purity piezoelectric ceramics—many of which are controlled by geopolitical factors—also poses a recurrent operational challenge, affecting lead times and cost stability across the component ecosystem.

Significant opportunities exist in the development of next-generation, high-performance buzzers tailored for new markets. This includes the massive expansion potential in precision agricultural technology, where ruggedized buzzers are used for equipment diagnostics and drone signaling, and in the burgeoning field of smart infrastructure, requiring weatherized, long-life signaling devices capable of remote monitoring. Innovation in digital interfacing—enabling programmable tone patterns, modulation control, and enhanced diagnostic capabilities—allows manufacturers to capture higher margins in specialized markets by offering "smart" components. Moreover, the increasing global emphasis on environmental sustainability provides opportunities for firms investing in lead-free piezoelectric components and circular economy practices, aligning with stringent directives like RoHS and REACh across major Western economies. Successful market navigation hinges on a manufacturer’s ability to balance cost-efficiency with highly customized, compliant technical specifications, ensuring adaptability to diverse global regulatory landscapes and technical requirements.

Segmentation Analysis

The Electric Buzzer Market segmentation provides a granular view of diverse demand profiles, enabling targeted strategic development across various technological and application requirements. Segmentation by Type, including Piezoelectric, Electromagnetic, and Mechanical technologies, reveals fundamental preferences driven by acoustic performance and power constraints. Piezoelectric buzzers consistently capture the largest volume share, favored for their minimal current draw, thin profile, and robust frequency stability, which are ideal characteristics for portable, battery-operated devices and alarms requiring sustained operation, like those in medical and wearable technology. The electromagnetic segment, conversely, capitalizes on applications where high sound volume (SPL) is non-negotiable, often at the expense of higher power consumption and larger physical size, proving indispensable in noisy factory floors and heavy machinery.

Segmentation by Voltage Rating is crucial for manufacturers catering to specific power environments. The 5V to 12V segment holds prominence, corresponding directly to standard operating voltages in consumer electronics, automotive accessory systems, and general industrial control boards, representing the market's core operational range. The Below 5V segment is critically important for the massive wearable technology and battery-powered IoT device market, demanding extreme energy efficiency and integration of advanced step-up voltage converters within the buzzer system itself to maximize sound output from low-voltage sources. Conversely, the Above 12V segment predominantly serves heavy industrial machinery, commercial vehicle fleets, and specialized telecom equipment, where higher voltage allows for louder output over long operational distances and requires components engineered for heightened thermal and electrical robustness and reliability.

The End-Use Industry segmentation highlights the diverse vertical drivers of demand. Automotive applications are the most dynamic segment, driven by regulatory mandates and the complexity of modern vehicle architectures, requiring components that meet stringent thermal and shock resistance standards (AEC-Q200). Consumer Electronics provides the highest volume, characterized by rapid product cycles and fierce price competition for surface-mount devices, focusing intensely on miniaturization and low power draw. Industrial and Manufacturing sectors prioritize durability, environmental sealing, and fail-safe operation, often requiring custom acoustic profiles for distinct signaling and compliance with hazardous area standards. Lastly, the Medical sector, though lower in volume, represents the highest value segment per unit, emphasizing impeccable reliability, non-magnetic interference, and compliance with strict FDA and international health standards, often utilizing advanced miniature piezoelectric solutions for portable patient monitors and diagnostic equipment where failure is critical.

- By Type:

- Piezoelectric Buzzer: Highest volume and efficiency; critical for portable electronics, medical devices, and low-power IoT applications due to energy efficiency and small size.

- Electromagnetic Buzzer: Dominates high SPL requirements; crucial for industrial safety systems, fire alarms, and heavy-duty automotive warning applications where acoustic penetration is necessary.

- Mechanical Buzzer (Declining Share): Used in specific legacy industrial and specialized alarm systems requiring mechanical resilience or extreme resistance to electromagnetic interference.

- By Voltage Rating:

- Below 5V: Essential for ultra-low power IoT devices, smart wearables, and portable consumer electronics dependent on battery longevity.

- 5V to 12V: Standard operating range for vast consumer appliances, general automotive accessory systems, and mid-range industrial control market segments.

- Above 12V: Utilized in heavy industrial machinery, commercial truck fleets, high-power safety, and centralized fire alarm and security systems requiring sustained loud output.

- By Mounting Type:

- Surface Mount Devices (SMD): Fastest growing segment driven by automated high-speed PCB assembly, crucial for miniaturization and cost reduction in electronics manufacturing.

- Pin Type (Through-Hole): Traditional format, still widely used for high mechanical stability, resistance to vibration, and specialized high-power industrial applications.

- Wire Type: Employed in customized assemblies and applications requiring flexible mounting, environmental isolation, or integration into existing wiring harnesses, common in automotive aftermarket.

- By End-Use Industry:

- Automotive (ADAS, EV Warning Systems, Interior Alarms): Highest CAGR segment driven by safety mandates, component ruggedization, and the shift to electric vehicle acoustic requirements.

- Consumer Electronics (Mobile Devices, Home Appliances, Wearables): Largest volume segment, characterized by high turnover, price sensitivity, and demand for ultra-miniaturized components.

- Industrial & Manufacturing (Control Panels, Machinery Alarms, Safety Systems): Prioritizes durability, environmental sealing (IP ratings), and compliance with industrial safety and hazardous location standards (e.g., ATEX).

- Telecommunications (Network Equipment, Modems): Focuses on reliability, long operational lifespan, and continuous alerting capability for network failure and maintenance status.

- Medical & Healthcare (Patient Monitors, Diagnostic Equipment): Highest focus on non-magnetic operation, accuracy, low noise floor, and stringent regulatory compliance for critical patient safety applications.

- Security & Safety (Fire Alarms, Intrusion Detectors): Driven by mandatory building codes, requiring high sound pressure levels and certified reliability for public and residential warning systems.

Value Chain Analysis For Electric Buzzer Market

The Electric Buzzer value chain commences with highly specialized Upstream Activities, where the procurement and processing of unique raw materials define potential product performance and cost structure. Key inputs include advanced magnetic alloys (Neodymium, Ferrite) for magnetic circuits, high-purity copper wire for coils, plastic resins (ABS, polycarbonate) for protective housing, and, most critically, specialized ceramic compounds (PZT and lead-free alternatives) for piezoelectric designs. The efficiency of this upstream phase is critical, as fluctuating commodity prices and geopolitical risks associated with rare-earth metals can severely impact manufacturing costs and component pricing stability. Strategic vertical integration or long-term exclusive supply agreements with specialized material vendors are often adopted by major manufacturers to mitigate these risks and ensure consistent quality, particularly for mission-critical components destined for automotive and medical sectors where material consistency is paramount for long-term reliability.

The Midstream component encompasses the high-precision manufacturing, assembly, and testing processes. Modern buzzer manufacturing relies heavily on automation, including automated coil winding, high-temperature ceramic sintering (for piezo), ultrasonic welding of housings to ensure environmental sealing, and sophisticated acoustic testing using calibrated anechoic chambers to verify precise sound pressure levels (SPL) and frequency response across production batches. Achieving miniaturization in Surface Mount Devices (SMD) requires exceptional process control and cleanroom environments to maintain tight tolerances and ensure reliable solderability onto high-density PCBs. Post-production, Distribution Channels play a pivotal role in market access. Large, global electronics distributors (indirect channel) provide crucial logistics, inventory buffering, financing, and technical support to thousands of smaller electronics assemblers, R&D labs, and repair shops globally. Simultaneously, high-volume Original Equipment Manufacturers (OEMs) often engage in Direct Sales relationships with buzzer manufacturers, allowing for customized technical specifications, large bulk discounts, and precise delivery schedules crucial for just-in-time (JIT) manufacturing protocols in highly efficient assembly lines like those found in automotive and major appliance manufacturing.

The Downstream Segment is defined by the integration and deployment of the buzzers into Final Products across the various End-Use Industries. System integrators and OEMs perform rigorous qualification processes, subjecting buzzers to extreme stress testing (thermal cycling, high humidity exposure, severe vibration profiles) to ensure compatibility with the host system's specific operational environment and expected lifespan. Successful penetration at this stage requires adherence not only to functional acoustic specifications but also to specific industry certifications (e.g., explosion-proof ratings for industrial use, stringent non-magnetic requirements for medical systems, and compliance with consumer electrical safety standards). The final consumption phase sees the component fulfilling its role as a safety or feedback mechanism. Overall value generation throughout the chain is increasingly influenced by intellectual property surrounding advanced acoustic design, integrated digital drive circuitry, and material science breakthroughs that yield higher acoustic output per unit of energy consumed, thus creating a crucial competitive edge beyond simple unit cost and protecting manufacturers from intense commodity pricing pressures.

Electric Buzzer Market Potential Customers

The Electric Buzzer Market serves an expansive ecosystem of potential customers, segmented primarily by the scale and criticality of their production processes and the regulatory environment they operate within. Tier-1 Automotive Suppliers and global vehicle manufacturers constitute a premium customer segment, representing immense volume and demanding the highest standards of quality assurance, component longevity, and environmental ruggedness. These buyers procure high-reliability electromagnetic buzzers for external warning systems (AVAS, parking sensors) and highly robust piezoelectric components for interior alerts (seatbelt reminders, diagnostic feedback). Their procurement mandates require adherence to rigorous standards such as AEC-Q200 and ISO/TS 16949 certification, making the sales cycle lengthy and complex, but the resulting contracts are typically highly lucrative and characterized by stable, long-term procurement schedules.

The high-volume Consumer Electronics OEMs, including manufacturers of global brands in smartphones, tablets, large home appliances (white goods), and smart home security systems, form the largest segment in terms of units purchased globally. This customer base is intensely focused on achieving the lowest cost per unit, coupled with maximum miniaturization and ultra-low power draw, predominantly utilizing high-volume SMD piezoelectric buzzers. Procurement decisions here are heavily influenced by global component pricing trends, the supplier's ability to maintain massive, scalable production capacity, and the assurance of extremely low defect rates in millions of units. This segment acts as a key driver for rapid product iteration and the adoption of the latest, most cost-effective mounting technologies to support fast-paced consumer product cycles.

Additionally, the Industrial, Manufacturing, and Safety Equipment sectors represent specialized, high-margin customers requiring highly customized solutions. This group includes manufacturers of Programmable Logic Controllers (PLCs), heavy construction and agricultural machinery, and regulatory safety alarm systems (e.g., commercial fire and gas detection). These customers prioritize component durability, superior ingress protection (high IP ratings), high acoustic output capable of overcoming factory noise, and broad, reliable temperature operating ranges. For critical safety applications, these buyers demand extensive third-party verification from organizations like Underwriters Laboratories (UL), Factory Mutual (FM), or equivalent international bodies, alongside specialized features like explosion-proof (ATEX) certification. Lastly, specialized R&D laboratories, defense contractors, and small-scale custom electronics manufacturers constitute a long-tail market, often purchasing smaller quantities through specialized electronics distributors, focusing on immediate technical support and rapid access to diverse component inventories for prototyping purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 780.5 Million |

| Market Forecast in 2033 | USD 1,160.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing Co., Ltd., TDK Corporation, CUI Devices, Kingstate Electronics Corp., KEPO Electronics, Mallory Sonalert Products, Inc., Challenge Electronics, Inc., Sonitron N.V., PUI Audio, DB Products Limited, Stancor, Projects Unlimited, Inc., Audiowell Electronics (Guangdong) Co., Ltd., Jameco Electronics, Nippon Ceramic Co., Ltd., Star Micronics Co., Ltd., Hosonic Electronic Co., Ltd., Huizhou Decheng Industry Co., Ltd., Vensik Electronics Co., Ltd., Hong Kong Tonly Electronics Holdings Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Buzzer Market Key Technology Landscape

The technological landscape of the Electric Buzzer Market is characterized by incremental innovation focused heavily on materials science, miniaturization, and enhanced digital integration capabilities. Piezoelectric technology remains the forefront of efficiency, with ongoing research dedicated to optimizing the chemical composition and sintering processes of lead-free ceramics (e.g., Bismuth Sodium Titanate, BNT-based materials) to match or exceed the acoustic performance previously achieved by traditional lead-based PZT components. This shift is critical for compliance with stringent global environmental directives, such as RoHS, while simultaneously improving the mechanical stability, temperature resilience, and resonance characteristics of the vibrating element. Furthermore, advanced packaging technologies, including Chip-Scale Packaging (CSP) and sophisticated electromagnetic shielding, are being deployed to dramatically reduce the physical footprint of piezoelectric buzzers, enabling their critical deployment in ultra-thin devices such as smart cards, compact remote controls, and sophisticated wearable medical patches where space is severely limited.

In the electromagnetic domain, technological advancements are centered on maximizing the magnetic circuit efficiency to enhance sound output. This involves the strategic use of high-energy-density rare-earth magnets, coupled with sophisticated computer-aided engineering and finite element analysis (FEA) modeling, which allows manufacturers to design smaller coils and diaphragms that produce significantly higher sound pressure levels (SPL) without requiring a proportionate increase in input power. A parallel and significant trend involves the integration of sophisticated drive circuitry, transforming passive buzzers into active, digitally controllable components. These integrated circuits (ICs) manage complex pulse width modulation (PWM) inputs, allowing the end-user system to precisely control not only the activation but also the frequency sweep, tone generation, and decay characteristics of the audible output, thereby elevating the buzzer's functionality closer to that of micro-speakers while firmly retaining the cost, durability, and reliability advantages of a dedicated signaling device.

An emerging technological frontier involves the application of Micro-Electro-Mechanical Systems (MEMS) technology to acoustic components. While MEMS-based actuators currently command a higher cost, they offer unprecedented levels of precision, uniformity, and extreme miniaturization, opening up new potential in highly specialized acoustic emitters for sophisticated consumer devices like augmented reality glasses, high-fidelity hearing aids, and specialized industrial non-contact sensing applications. Lastly, the focus on durability and environmental resilience is leading to innovations in housing materials and sealing techniques. Development of components with high Ingress Protection (IP) ratings (e.g., IP67 and above) is crucial for automotive exterior applications and maritime or outdoor industrial control systems. This necessitates the use of new, resilient polymer compounds that resist UV degradation, extreme temperature fluctuations, corrosive chemical exposure, and humidity, ensuring the component’s functional lifespan meets the increasingly demanding operational criteria of modern safety systems globally.

Regional Highlights

The global Electric Buzzer Market presents a mosaic of opportunities and challenges across its key geographical segments, with demand and manufacturing characteristics varying significantly by region. Asia Pacific (APAC), spearheaded by the immense manufacturing and technological powerhouses of China, Japan, and South Korea, sustains its position as the market leader both in terms of production capacity and consumption volume. China’s role is critical due to its dominance in global consumer electronics assembly and its rapidly maturing domestic automotive sector, which is aggressively adopting EV technology and mandated AVAS systems, driving the high-volume demand for low-cost, reliable components. This region drives the global trend toward cost optimization and mass-production scaling for surface-mount piezoelectric components, while Japanese and South Korean firms focus on high-precision, highly reliable components for advanced automation and medical equipment, setting key technical performance standards.

North America and Europe collectively represent mature markets where regulatory compliance, high-quality standards, and advanced component reliability are the paramount drivers of sustained demand. In North America, the market is characterized by strong procurement from the military and aerospace sectors, which require components meeting stringent MIL-specs, and from the sophisticated medical device industry, where component reliability is absolutely non-negotiable for patient safety. European market growth is robustly supported by stringent environmental and safety mandates, including the widespread rollout of certified fire safety systems and the mandatory fitment of pedestrian warning systems in Electric Vehicles (AVAS) across the continent. European manufacturers often emphasize sustainable practices, driving the demand for lead-free and highly energy-efficient components, positioning the region as a leader in technological compliance and high-value, low-volume specialized buzzer production.

The Latin America, Middle East, and Africa (LAMEA) region is evolving into a significant area of future growth, albeit starting from a lower market share base. Growth in Latin America is intrinsically linked to rising urbanization, increasing disposable income leading to higher consumption of home appliances, and the establishment of local assembly plants for electronics and vehicles, all demanding cost-competitive, readily available component supplies, often sourced indirectly through global distributors. The Middle East segment, particularly the Gulf Cooperation Council (GCC) countries, exhibits high demand fueled by substantial state-led investment in large-scale infrastructure, smart cities, and critical oil and gas sector safety systems, necessitating highly robust, explosion-proof (ATEX compliant) industrial buzzers. Africa’s market expansion, while gradual, is driven by increasing access to mobile telecommunications and foundational security system deployments. However, complex logistics, lack of standardized infrastructure, and import complexities remain key challenges that manufacturers must overcome with strategic localized partnership models.

- Asia Pacific (APAC): Market leader dominating both production and consumption; growth driven by Chinese electronics mass production, Indian automotive expansion, and Japanese/Korean high-precision component manufacturing. Focus is intensely on cost-effectiveness and SMD miniaturization for global supply.

- North America: High-value market focused on highly regulated sectors: medical, defense, and high-reliability industrial automation. Demand is dictated by stringent quality standards (UL, MIL-SPEC) and advanced technological sophistication in component integration.

- Europe: Growth sustained by strict regulatory compliance (RoHS, AVAS mandates), strong industrial machinery base, and a market preference for eco-friendly, energy-efficient component technologies and advanced, certified fire and security systems.

- Latin America (LATAM): Emerging market growth stimulated by rising consumer appliance assembly, infrastructure development, and increasing demand for commercial vehicle safety equipment, often supplied via extensive distributor networks.

- Middle East & Africa (MEA): Growth tied to significant government investment in smart infrastructure projects, oil and gas safety regulations, and expanding telecommunications network coverage, requiring robust, industrial-grade, environmentally protected components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Buzzer Market.- Murata Manufacturing Co., Ltd.

- TDK Corporation

- CUI Devices

- Kingstate Electronics Corp.

- KEPO Electronics

- Mallory Sonalert Products, Inc.

- Challenge Electronics, Inc.

- Sonitron N.V.

- PUI Audio

- DB Products Limited

- Stancor

- Projects Unlimited, Inc.

- Audiowell Electronics (Guangdong) Co., Ltd.

- Jameco Electronics

- Nippon Ceramic Co., Ltd.

- Star Micronics Co., Ltd.

- Hosonic Electronic Co., Ltd.

- Huizhou Decheng Industry Co., Ltd.

- Vensik Electronics Co., Ltd.

- Hong Kong Tonly Electronics Holdings Limited

Frequently Asked Questions

Analyze common user questions about the Electric Buzzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between piezoelectric and electromagnetic buzzers?

Piezoelectric buzzers utilize a ceramic disc that physically deforms and vibrates when voltage is applied, offering ultra-low current consumption, minimal component thickness, and high stability, making them ideal for battery-powered devices. Electromagnetic buzzers use a magnetic field to oscillate a metal diaphragm, yielding higher sound pressure levels (SPL) and a wider frequency output, typically favored for industrial alarms and high-volume automotive alerts where acoustic penetration is prioritized over slight power differences.

How is the Electric Buzzer Market addressing the rise of electric vehicles (EVs)?

The EV transition is driving substantial innovation in the market, particularly regarding external warning devices known as Acoustic Vehicle Alerting Systems (AVAS). Manufacturers are developing specialized, high-durability electromagnetic buzzers that are weather-resistant and capable of producing specific, regulated sound profiles (e.g., meeting UN ECE R138 standards) to alert pedestrians at low speeds, ensuring safety without excessive noise pollution while integrating seamlessly with complex vehicle electronic architectures.

Which mounting type is experiencing the fastest growth in the market?

Surface Mount Devices (SMD) are the fastest-growing segment, reflecting the pervasive trend of electronic miniaturization and automated manufacturing. SMD buzzers allow high-speed robotic placement onto printed circuit boards (PCBs), significantly reducing production costs and enabling extremely dense component placement, which is mandatory for modern devices such as wearables, IoT sensors, and miniature medical diagnostics, driving efficiency in the consumer supply chain.

What are the main regulatory standards impacting buzzer design and production?

Key regulatory impacts stem from environmental compliance (RoHS and REACh, driving the adoption of lead-free piezoelectric ceramics), safety standards (UL and CE markings for fire, security, and industrial alarms ensuring public safety), and automotive quality requirements (AEC-Q200 for component reliability under harsh vehicular conditions). Adherence to these complex standards dictates material selection, testing rigor, and market access, especially in highly regulated markets like North America and Europe.

How will the integration of AI change the function of buzzers in smart systems?

AI is transforming buzzers from simple "on/off" alarms into intelligent signaling components. AI-driven systems use contextual data analysis to minimize false positives and alarm fatigue. In a smart factory, for instance, AI determines the urgency of an event and triggers the buzzer with a specific, modulated tone or pattern proportionate to the threat, requiring the development of buzzers with integrated digital communication interfaces (digital addressability) to accept and execute complex modulation commands from central AI controllers.

What challenges do manufacturers face regarding global supply chain logistics?

Manufacturers face challenges related to the geopolitical stability of rare-earth magnet supplies and the volatility of commodity prices (copper, plastics). Furthermore, achieving global distribution efficiency requires managing complex logistics networks, adhering to diverse regional component certification standards (e.g., CE, UL, CCC), and mitigating risks associated with long lead times for highly specialized, custom components ordered by large OEMs in industries like automotive and medical device manufacturing.

In the industrial sector, what specific features are prioritized when selecting buzzers?

Industrial buyers prioritize durability, high Ingress Protection (IP) ratings against dust and moisture, resistance to extreme operating temperatures, and robust electromagnetic compatibility (EMC). High sound pressure levels (SPL) are essential to overcome ambient noise in factory environments, and many critical safety applications require ATEX or intrinsically safe certifications for deployment in hazardous or explosive environments, typically leading to the selection of magnetic or high-power industrial horns.

How does intense price competition affect market innovation?

Intense price competition, primarily driven by mass-volume Asian manufacturers, mandates continuous operational efficiency improvements and lean manufacturing practices. While it suppresses Average Selling Prices (ASPs), it paradoxically fuels innovation in process automation and material optimization (seeking cheaper, high-performance substitutes) to reduce input costs without sacrificing the fundamental acoustic performance required for safety certifications and competitive differentiation.

What role does material science play in current buzzer innovation?

Material science is crucial, especially in piezoelectric technology, where researchers are developing next-generation lead-free ceramic formulations (e.g., BNT or BZT-based) to maintain high acoustic output while ensuring environmental compliance. For electromagnetic buzzers, innovation focuses on high-grade magnetic alloys to enhance flux density, which allows for smaller, yet louder, components, critical for achieving high SPL within constrained physical dimensions and maximizing energy efficiency in the magnetic circuit.

Why is the Automotive sector expected to show the highest CAGR?

The Automotive sector’s high CAGR is driven by the regulatory mandate requiring more sophisticated safety features (e.g., parking assists, blind spot detection alerts, and interior system warnings) in traditional vehicles, combined with the explosive growth and specific acoustic requirements (AVAS) of the electric vehicle market. The mandatory fitment of these highly reliable systems in virtually all new vehicles produced globally ensures sustained, high-volume demand that scales directly with overall vehicle production figures, accelerating market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager