Electric Furnace Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433629 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Electric Furnace Transformer Market Size

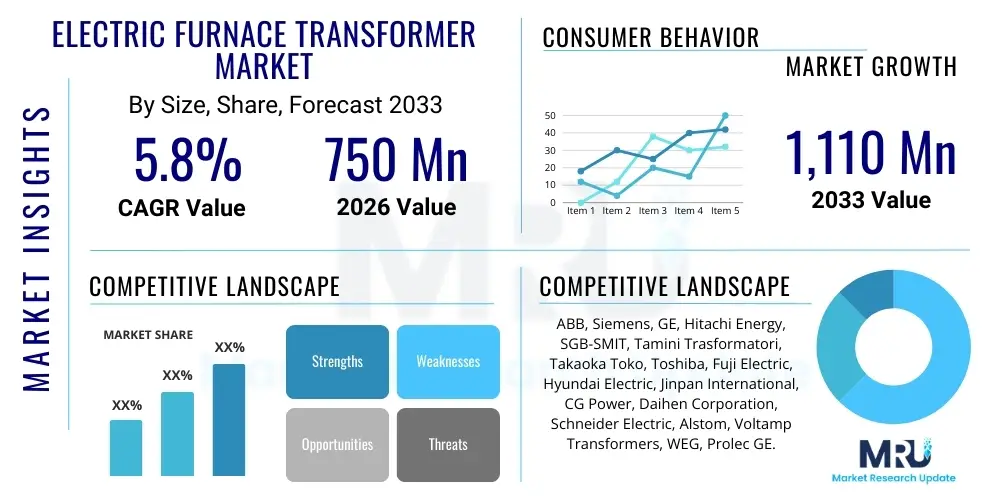

The Electric Furnace Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,110 Million by the end of the forecast period in 2033.

Electric Furnace Transformer Market introduction

Electric Furnace Transformers (EFTs) are specialized, high-power transformers designed to deliver large currents at very low voltages to various types of electric furnaces, primarily used in the metallurgical and refining industries. These transformers are essential components in Electric Arc Furnaces (EAFs) and Ladle Furnaces (LFs), providing the precise, controlled power required for melting scrap metal, refining liquid steel, and producing ferroalloys. Their robust design must withstand extreme operational conditions, including frequent short circuits, high harmonics, and significant temperature variations, which differentiate them significantly from standard power transformers.

The primary applications of EFTs are concentrated in the global steel industry, which relies heavily on EAF technology for sustainable steel production, minimizing reliance on blast furnaces. Beyond steel, EFTs are critical in the manufacturing of non-ferrous metals like copper and aluminum, as well as in chemical processes involving high-temperature reactions. The inherent benefits of utilizing EFTs in conjunction with EAFs include greater energy efficiency in melting operations, enhanced production flexibility, and reduced carbon emissions compared to traditional methods, aligning with global industrial sustainability goals.

Driving factors for the market expansion include the rapidly increasing global demand for recycled steel, especially in developing economies undergoing rapid infrastructure development and urbanization. Furthermore, technological advancements leading to ultra-high power (UHP) transformers, which improve melting times and overall efficiency, bolster market growth. Regulatory pressure to reduce industrial carbon footprints also pushes metallurgical companies toward EAF technology, thereby increasing the requirement for sophisticated and durable electric furnace transformers.

Electric Furnace Transformer Market Executive Summary

The Electric Furnace Transformer Market is witnessing robust growth driven by the sustained expansion of the global steel recycling infrastructure and technological mandates promoting energy-efficient metal processing. Business trends indicate a strong shift towards modular and smart transformers integrated with sophisticated monitoring systems for predictive maintenance, crucial for maximizing uptime in high-stress metallurgical environments. Key manufacturers are focusing on designing ultra-high-power (UHP) units capable of handling larger capacities and higher impedance variations, catering to modern, high-volume EAF operations. This strategic focus on efficiency and reliability defines the current competitive landscape, necessitating significant investment in materials science and winding technology.

Regionally, the Asia Pacific (APAC) market dominates the consumption and production landscape, primarily fueled by massive infrastructural projects and high scrap steel generation in countries like China and India, which are rapidly deploying new EAF capacity. Europe and North America, while having mature steel industries, are driving demand through the replacement and modernization of aging transformer fleets to meet stringent environmental and energy consumption standards. These regions prioritize digitalization and smart grid integration features within their new transformer procurements, impacting specification requirements across the market.

Segment trends highlight the dominance of Arc Furnace Transformers (AFTs) due to their integral role in primary steel production, though Ladle Furnace Transformers (LFTs) are also gaining traction as refining processes become more specialized and demanding. Furthermore, the oil-immersed segment maintains its market leadership due to superior cooling capabilities for high-power applications, yet the dry-type segment is experiencing accelerated growth in specific smaller, safety-critical foundry applications. The market is characterized by medium consolidation, with a few global giants controlling the high-end, custom-built UHP segment, while regional players compete vigorously in the standardized and refurbishment market sectors.

AI Impact Analysis on Electric Furnace Transformer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Electric Furnace Transformer market frequently revolve around how AI can optimize operational efficiency, predict equipment failure, and extend the lifespan of these critical assets. Users express keen interest in AI's role in predictive maintenance (PdM), seeking data on the integration of machine learning algorithms with sensor data (temperature, vibration, current harmonics) to move beyond traditional time-based maintenance schedules. Concerns also focus on whether AI integration will lead to entirely new transformer designs or primarily influence the monitoring and control stages, aiming to understand the investment required for retrofitting existing transformer fleets for enhanced digital capabilities. The overarching expectation is that AI will minimize costly unplanned downtime associated with transformer failures in the harsh EAF environment, improving overall metallurgical plant productivity and operational cost management.

- AI facilitates real-time monitoring and analysis of complex operating variables (e.g., thermal conditions, dielectric fluid quality, winding stress).

- Predictive maintenance algorithms use historical and real-time data to forecast incipient faults, reducing catastrophic failure risks and maximizing uptime.

- Optimization of tap changing operations using AI ensures optimal power delivery efficiency under fluctuating load conditions in the electric furnace.

- Enhanced energy management systems integrate AI to minimize reactive power consumption and optimize overall electricity usage during melting cycles.

- AI-driven simulation tools improve the design process, allowing manufacturers to create more resilient transformers that withstand high transient currents specific to EAF operation.

DRO & Impact Forces Of Electric Furnace Transformer Market

The market dynamics are defined by a confluence of powerful drivers and constraints, balanced by significant opportunities that shape strategic growth trajectories. Major drivers include the global push for decarbonization and the subsequent shift from basic oxygen furnaces (BOFs) to EAFs, which demand high-capacity, specialized transformers. Additionally, the replacement cycle for aging infrastructure in industrialized nations provides a consistent baseline demand. Conversely, the market faces restraints such as the high initial capital expenditure required for UHP transformers and the specialized manufacturing skills needed, leading to market concentration and potential supply bottlenecks. Furthermore, volatility in the pricing of core materials like copper and specialty steel adds complexity to manufacturing costs and final product pricing.

Opportunities for expansion lie primarily in emerging economies where new steel and metal processing plants are being constructed, particularly across Southeast Asia and Latin America. The advent of smart grid technologies and the integration of advanced sensors offer substantial avenues for product differentiation, allowing manufacturers to provide holistic power solutions rather than just hardware. The shift towards green steel production, potentially powered by renewable energy, necessitates transformers designed to handle intermittency and complex power quality requirements, opening a niche for specialized, high-performance designs. These forces combine to create a highly technical market where innovation in efficiency and reliability is paramount to achieving competitive advantage.

The key impact forces influencing procurement decisions are technological reliability and total cost of ownership (TCO). Given the mission-critical nature of these transformers in continuous industrial operations, operational resilience against short-circuit forces and thermal stress is a non-negotiable requirement, driving preference toward proven, high-quality vendors. Furthermore, stringent global energy efficiency regulations (e.g., EU Ecodesign directives) act as an indirect impact force, compelling end-users to invest in newer, more efficient models, thereby accelerating the replacement rate even for transformers that are still functionally operational but energy inefficient. Regulatory alignment with sustainable manufacturing practices strongly influences regional market penetration.

Segmentation Analysis

The Electric Furnace Transformer Market is meticulously segmented based on critical operational and design attributes, providing a granular view of demand patterns across the metallurgical industry. Segmentation by type differentiates between transformers optimized for the primary melting function (Arc Furnace Transformers) and those tailored for secondary refining and temperature homogenization (Ladle Furnace Transformers), reflecting the two major stages of modern steel production. Analyzing the market by application reveals the dominance of the steel and metal industry, although specialized foundry and ferroalloy sectors represent high-value niches requiring custom specifications. These segments are critical for understanding regional demand concentrations and tailoring product development strategies.

Further segmentation by cooling method distinguishes between oil-immersed and dry-type units. Oil-immersed transformers are favored for high-power, high-voltage applications due to their superior cooling efficiency and smaller footprint relative to capacity, making them standard in large EAF operations. Dry-type transformers, conversely, are preferred in indoor or densely populated areas where fire safety is a critical concern, despite their lower capacity limits. Finally, segmentation by phase (single-phase versus three-phase) relates directly to furnace design and power system architecture, influencing the final electrical specifications required by the end-user.

- By Type:

- Arc Furnace Transformer (AFT)

- Ladle Furnace Transformer (LFT)

- Other Heating Furnace Transformers (e.g., submerged arc furnace)

- By Application:

- Steel and Metal Industry (Primary Steel Production)

- Foundry and Casting

- Ferroalloy Production (Manganese, Silicon, etc.)

- Non-Ferrous Metals (Copper, Aluminum)

- By Cooling Method:

- Oil-Immersed (ONAN, ONAF, OFWF)

- Dry Type (Cast Resin)

- By Phase:

- Single Phase

- Three Phase

Value Chain Analysis For Electric Furnace Transformer Market

The value chain for the Electric Furnace Transformer market begins with the upstream procurement of specialized raw materials, including high-grade electrical steel (oriented silicon steel), copper or aluminum windings, and high-quality insulating materials (oil, paper, resin). Success at this stage relies heavily on securing stable supply contracts and implementing advanced inventory management to mitigate price volatility. Suppliers of these core components often possess highly specialized production processes, ensuring the necessary magnetic properties and mechanical strength required to withstand the severe operational stresses of EAF environments. Quality control and material traceability are critical upstream factors that directly influence the transformer's lifespan and efficiency.

The core manufacturing and assembly stage involves complex design, winding, and tank fabrication processes. Given that EFTs are largely custom-engineered products, significant value is added through sophisticated R&D, electrical modeling, and rigorous testing protocols to meet specific utility and furnace requirements. The distribution channel is typically direct or involves highly specialized engineering, procurement, and construction (EPC) firms acting as intermediaries. Direct sales are common for global powerhouses dealing with large-scale metallurgical corporations, ensuring continuous engagement from specification development through commissioning.

Downstream activities center on installation, commissioning, and long-term service and maintenance contracts. Because transformer failure is extremely costly in terms of lost production, the post-sales service component—including preventative maintenance, repairs, and modernization/retrofitting of older units—represents a crucial value segment and a significant revenue stream for manufacturers. Direct channels emphasize long-term service agreements (LSAs) and advanced condition monitoring systems to maximize asset performance. Indirect distribution, often through EPCs, primarily focuses on the initial project deployment phase, transitioning maintenance responsibility to the end-user or specialized service providers thereafter.

Electric Furnace Transformer Market Potential Customers

The primary customers for Electric Furnace Transformers are large-scale industrial operators within the metal production sector who rely on electrical heating processes for material transformation. These end-users are characterized by high energy consumption needs and stringent requirements regarding power quality and equipment reliability. Steel mills, particularly those utilizing Electric Arc Furnaces for scrap recycling and secondary steel production, form the largest demographic of potential buyers. Their purchasing decisions are driven by production capacity targets, energy efficiency metrics, and regulatory compliance regarding emissions.

A secondary, yet rapidly expanding, customer base includes specialized ferroalloy producers (such as manufacturers of ferromanganese and ferrochrome), foundry operations focusing on custom casting, and producers of non-ferrous metals like copper and aluminum via electrochemical reduction or melting processes. These buyers often require transformers with unique voltage and current profiles tailored to specific chemical reactions or thermal processes. The procurement process for these customers is typically long-cycle, involving detailed technical specification matching and competitive bidding among a limited pool of highly specialized global vendors capable of meeting stringent performance criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,110 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, GE, Hitachi Energy, SGB-SMIT, Tamini Trasformatori, Takaoka Toko, Toshiba, Fuji Electric, Hyundai Electric, Jinpan International, CG Power, Daihen Corporation, Schneider Electric, Alstom, Voltamp Transformers, WEG, Prolec GE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Furnace Transformer Market Key Technology Landscape

The technology landscape in the Electric Furnace Transformer market is defined by a relentless pursuit of higher power density, enhanced efficiency, and superior mechanical robustness to cope with the extreme electrical and thermal stresses inherent in furnace operation. Ultra-High Power (UHP) transformer technology is the prevailing trend, allowing for faster melting cycles and increased throughput in modern EAFs. UHP design requires sophisticated optimization of winding geometries, magnetic core materials, and cooling systems (often forced-oil circulation and water-cooled heat exchangers) to manage high heat flux and minimize losses, ensuring maximum power transfer capability while maintaining operational integrity. The development of advanced insulation systems capable of resisting high short-circuit forces is also a continuous area of technological refinement.

Digitalization and smart transformer technology represent another crucial element of the current landscape. This involves integrating sensors for continuous monitoring of key parameters such as partial discharge, winding hotspots, dissolved gas analysis (DGA) in the oil, and vibration levels. The data collected by these sensors is processed using embedded systems or cloud platforms to provide Condition-Based Monitoring (CBM). This technological shift moves the industry from reactive maintenance to proactive, predictive maintenance, significantly extending transformer life and reducing catastrophic failures. Manufacturers are increasingly offering plug-and-play digital interfaces compatible with plant-wide supervisory control and data acquisition (SCADA) systems.

Material science innovation also plays a vital role. The utilization of amorphous metal cores is being explored in smaller and medium-sized units to reduce no-load losses, though silicon steel remains dominant for UHP applications due to magnetic saturation limits. Furthermore, efforts are concentrated on designing environmentally friendly components, such as utilizing ester fluids (natural or synthetic) instead of traditional mineral oil. Ester fluids offer higher flash points, better biodegradability, and superior moisture tolerance, enhancing both safety and environmental compliance, thus influencing technological adoption in environmentally sensitive regions like Europe.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by extensive new capacity additions in the steel and ferroalloy industries, particularly in China, India, and Southeast Asian nations. High urbanization rates, massive infrastructure projects, and increasing domestic scrap availability necessitate continuous investment in EAF technology and corresponding UHP transformers. The region focuses heavily on volume production and achieving scale efficiencies.

- Europe: Europe is characterized by a strong emphasis on modernization, replacement, and adherence to strict environmental regulations, notably the EU Ecodesign directives concerning energy efficiency (Tier 1 and Tier 2 standards). Demand here is focused on highly efficient, often digitally enhanced, and ecologically safer transformers (using ester liquids), reflecting a mature, quality-driven market prioritizing sustainability and low TCO.

- North America: The market is dominated by the modernization of existing steel mills and a strategic shift toward cleaner steel production (minimills). Demand is stable, driven by the need to upgrade aging electrical infrastructure and a strong focus on advanced monitoring and control systems (smart grid compatibility) to ensure reliability in highly automated industrial settings.

- Latin America (LATAM): Market growth is moderate but consistent, tied to the development of regional resource processing capabilities. Brazil and Mexico are key contributors, investing in EAF technology for both domestic steel consumption and export markets. Price competitiveness and robust mechanical design capable of handling varying grid stability are key purchase criteria.

- Middle East and Africa (MEA): This region is an emerging market, driven by ambitious plans for industrial diversification and the establishment of local primary metal processing facilities, reducing reliance on imports. Significant oil and gas revenue allows for large-scale, greenfield investments in high-capacity metallurgical plants, translating to high-demand potential for new, complex transformer installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Furnace Transformer Market.- ABB

- Siemens

- GE

- Hitachi Energy

- SGB-SMIT Group

- Tamini Trasformatori

- Takaoka Toko Co., Ltd.

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- Jinpan International Ltd.

- CG Power and Industrial Solutions Ltd.

- Daihen Corporation

- Schneider Electric SE

- Alstom

- Voltamp Transformers Ltd.

- WEG S.A.

- Prolec GE

Frequently Asked Questions

Analyze common user questions about the Electric Furnace Transformer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Electric Furnace Transformers?

The foremost driver is the global transition towards sustainable steel production, characterized by the increasing adoption of Electric Arc Furnaces (EAFs) over traditional coal-intensive methods, coupled with rising demand for recycled steel worldwide. This necessitates the installation of new, high-efficiency transformers.

How do Electric Furnace Transformers differ fundamentally from standard power transformers?

EFTs are designed to handle extremely high secondary currents (up to 150 kA) at low voltages and must withstand frequent, severe short-circuit mechanical forces, high harmonic content, and rapid load changes, unlike standard power transformers which operate under more stable conditions.

Which technology segment dominates the Electric Furnace Transformer market?

The Oil-Immersed segment, specifically forced-oil cooled units (OFAF/OFWF), dominates the market share, primarily because their superior cooling capacity is essential for managing the heat generated by Ultra-High Power (UHP) applications required in large-scale modern EAFs.

What role does digitalization play in the operation of modern Electric Furnace Transformers?

Digitalization, through smart sensors and integrated monitoring systems, enables Condition-Based Monitoring (CBM) and Predictive Maintenance (PdM). This allows operators to analyze real-time operational data, forecast potential failures, optimize efficiency, and significantly reduce costly unplanned downtime.

Which region offers the most significant growth opportunities for EFT manufacturers?

The Asia Pacific (APAC) region, driven by continuous infrastructure development in nations like India and key Southeast Asian economies, offers the largest growth potential for new unit sales due to widespread investment in new metallurgical plant capacity and modernization efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager