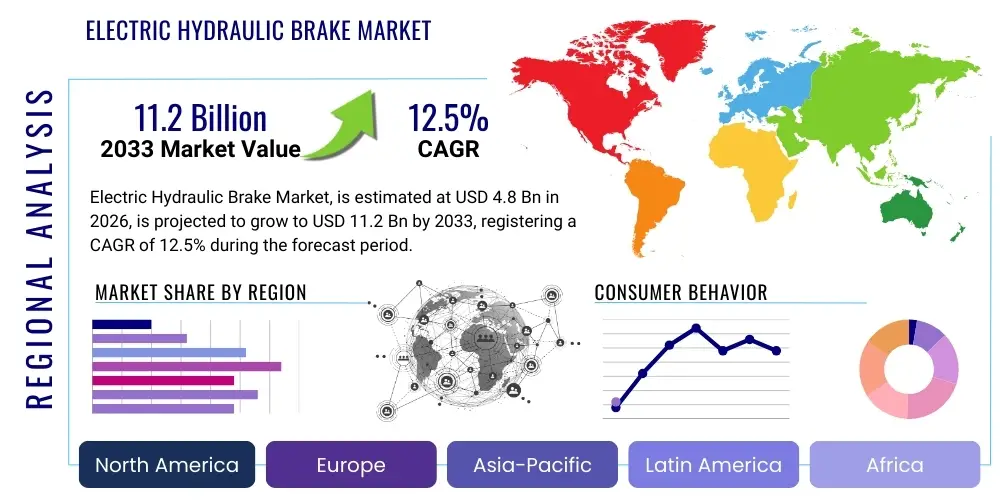

Electric Hydraulic Brake Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438386 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Electric Hydraulic Brake Market Size

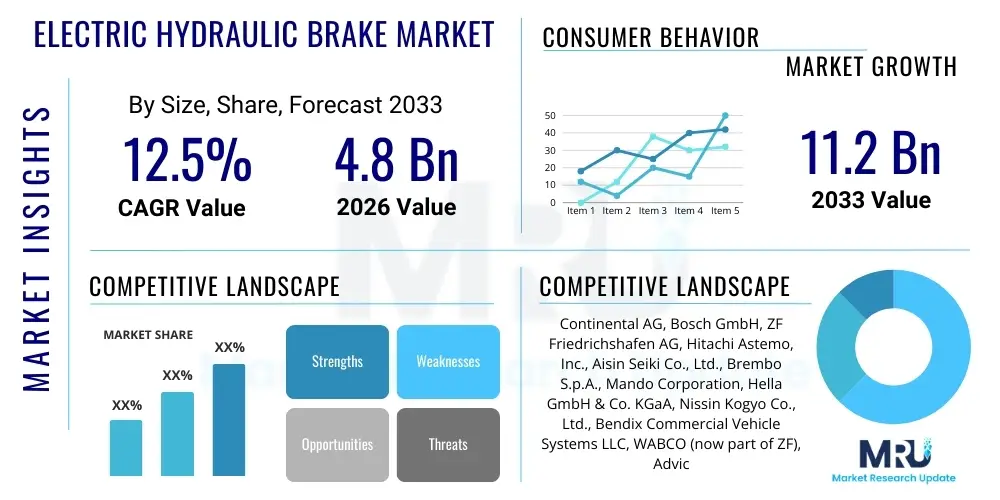

The Electric Hydraulic Brake Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $4.8 Billion in 2026 and is projected to reach $11.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated global transition toward electrified and autonomous vehicles, where traditional vacuum-assisted braking systems are being rapidly replaced by more efficient, responsive, and reliable electric hydraulic solutions. The increasing regulatory emphasis on enhanced vehicle safety standards and the critical requirement for seamless integration with Advanced Driver Assistance Systems (ADAS) further solidifies the market's high-growth trajectory across major automotive production hubs globally.

Electric Hydraulic Brake Market introduction

The Electric Hydraulic Brake (EHB) Market encompasses sophisticated braking systems utilizing electrical power and hydraulic pressure to achieve precise and instantaneous braking force, thereby eliminating the need for traditional mechanical linkage or vacuum assistance commonly found in older vehicle architectures. These systems are crucial components in modern vehicle platforms, particularly in electric vehicles (EVs) and hybrid electric vehicles (HEVs), where they facilitate critical functions such as regenerative braking efficiency maximization and precise brake-by-wire capability. EHB systems, often deployed as Electro-Hydraulic Brake Systems (EHBS) or integrated Electric Brake Boosters (EBB), provide superior braking performance, enhanced pedal feel customization, and significantly improved responsiveness, essential traits for safety critical applications in the automotive sector.

Major applications of electric hydraulic brakes span across Passenger Vehicles (PVs), heavy-duty Commercial Vehicles (CVs), and specialized Industrial Machinery, including material handling equipment and high-speed rail systems. In passenger vehicles, EHBs are instrumental in meeting stringent safety mandates by providing high-fidelity control necessary for ADAS functionalities like Automatic Emergency Braking (AEB), Adaptive Cruise Control (ACC), and Electronic Stability Control (ESC). The core benefit of adopting EHB technology is its capability to decouple the brake pedal input from the actual hydraulic actuation, allowing the electronic control unit (ECU) to manage optimal braking distribution and energy recovery, leading directly to extended battery range in EVs. This technological shift represents a major evolution from purely mechanical or pneumatic systems toward integrated electronic braking control.

The market is primarily driven by the exponential growth of the global Electric Vehicle (EV) fleet, which mandates regenerative braking for energy efficiency, a function seamlessly managed by EHB systems. Furthermore, the relentless global push toward higher levels of vehicle autonomy (Level 3 and above) necessitates fail-operational, redundant, and ultra-responsive braking mechanisms, which electric hydraulic solutions inherently provide. Regulatory bodies worldwide, particularly in Europe, North America, and key Asia-Pacific nations, continue to impose stricter safety standards, compelling Original Equipment Manufacturers (OEMs) to adopt advanced braking technologies. These factors collectively contribute to a robust demand environment for EHB components, positioning the market for sustained and significant expansion throughout the forecast period.

Electric Hydraulic Brake Market Executive Summary

The Electric Hydraulic Brake (EHB) Market is undergoing rapid transformation, propelled by seismic shifts in the automotive industry toward electrification and autonomous driving. Current business trends indicate a strong focus on modular and scalable EHB solutions that can be easily integrated across diverse vehicle platforms, ranging from entry-level electric sedans to high-performance heavy trucks. Strategic partnerships between established automotive suppliers (Tier 1s) and innovative software/AI companies are becoming commonplace, aimed at enhancing the control algorithms and predictive maintenance capabilities of these critical safety systems. OEMs are increasingly prioritizing total system efficiency, demanding EHB solutions that minimize power consumption while maximizing regenerative energy capture, thus creating intense competition in component efficiency and reliability.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, Japan, and South Korea, dominates consumption and production, driven by aggressive EV targets and favorable government subsidies promoting electric mobility adoption. Europe follows closely, characterized by stringent environmental regulations and high consumer demand for advanced safety features, leading to high penetration rates of EHB in new vehicle sales. North America exhibits significant growth potential, fueled by substantial investments in domestic EV manufacturing capacity and the rapid deployment of L2+ and L3 autonomous vehicles requiring sophisticated, fault-tolerant braking systems. The regional trends clearly show a positive correlation between government support for electrification and the subsequent adoption rate of advanced braking technologies.

Segment trends highlight the dominance of the Electro-Hydraulic Brake System (EHBS) segment over the traditional Electric Brake Booster (EBB) segment, primarily due to EHBS’s superior capability in managing blended braking (friction braking combined with regenerative braking) with higher precision and faster response times. By application, Passenger Vehicles (PVs) remain the largest revenue generator, but the Commercial Vehicle (CV) segment, particularly electric trucks and buses, is demonstrating the highest growth CAGR, driven by the need for robust stopping power and energy recuperation in heavy-duty applications. Furthermore, the trend toward integration of EHB systems with advanced telematics and predictive analytics software is creating a new segment focused on enhanced system diagnostics and cybersecurity measures for brake-by-wire interfaces.

AI Impact Analysis on Electric Hydraulic Brake Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Electric Hydraulic Brake Market frequently revolve around how AI enhances safety, optimizes regenerative braking, and manages the redundancy required for autonomous driving. Users are highly interested in the specifics of AI algorithms used for predictive brake failure analysis, real-time road condition adaptation, and the ability of AI to learn optimal braking strategies tailored to individual driver profiles or route types. Key concerns often include the cybersecurity vulnerabilities introduced by AI-driven electronic systems and the regulatory framework surrounding safety-critical AI implementation. The expectation is that AI will move EHB systems beyond reactive control toward proactive, predictive, and highly personalized braking performance. AI’s influence is seen as pivotal in enabling the transition from driver-assisted braking to fully automated, high-integrity deceleration control, essential for mass adoption of L4 and L5 autonomous vehicles.

AI's primary influence is on the control software layer of the EHB system, allowing for unprecedented optimization and predictive capabilities. Machine learning (ML) models are trained on vast datasets encompassing road friction coefficients, vehicle dynamics, driver input patterns, and weather conditions. This data-driven approach enables the EHB ECU to calculate the absolute minimum stopping distance in real time while simultaneously maximizing the energy recuperated through the motors, a delicate balance that deterministic algorithms struggle to achieve optimally. The integration of AI algorithms allows for dynamic recalibration of pedal feel and response based on driving modes (e.g., sport, eco, comfort) and prevailing external conditions, enhancing both safety and driver satisfaction. Furthermore, AI facilitates health monitoring, detecting subtle degradation in hydraulic pressure or electrical component performance long before a critical failure occurs, transitioning maintenance from scheduled to condition-based, thereby improving operational uptime and system reliability.

The shift towards brake-by-wire systems inherent in EHB architectures creates a data rich environment perfect for AI utilization. The continuous stream of sensor data, including wheel speed, yaw rate, steering angle, and master cylinder pressure, feeds into ML models which refine the braking decisions. For autonomous vehicles, AI is crucial for determining the necessary braking redundancy, ensuring fail-operational capability by monitoring and managing multiple parallel braking paths. This high level of software sophistication, powered by AI, transforms the EHB system from a mere actuator into an intelligent decision-making unit integral to vehicle motion control and overall safety architecture. Consequently, the competitive edge in the EHB market is increasingly shifting from hardware manufacturing prowess to software innovation and AI integration expertise, fostering a new era of intelligent braking systems.

- AI optimizes regenerative braking blending for maximum energy recovery efficiency.

- Predictive maintenance algorithms reduce system downtime and enhance reliability by forecasting component failure.

- Machine learning refines control logic for superior performance under diverse road and weather conditions.

- AI enables highly responsive, redundant control required for Level 4 and Level 5 autonomous driving safety.

- Enhanced cybersecurity measures are developed using AI to monitor and detect anomalies in brake-by-wire communication.

- Customization of braking feel and response based on driver preference and real-time vehicle dynamics is facilitated by AI.

DRO & Impact Forces Of Electric Hydraulic Brake Market

The Electric Hydraulic Brake market is profoundly shaped by a combination of powerful drivers, structural restraints, emerging opportunities, and competitive impact forces. The dominant driver remains the aggressive global transition to electric vehicles (EVs), where EHB systems are indispensable for maximizing regenerative braking efficiency and extending range, a critical consumer consideration. Concurrently, increasing global safety regulations, mandating features such as Automatic Emergency Braking (AEB) and requiring the sophisticated control afforded by EHB systems, act as a primary demand stimulant. However, significant restraints include the high initial cost of EHB systems compared to conventional vacuum boosters, particularly for budget-segment vehicles, and the complex software validation and integration challenges associated with safety-critical brake-by-wire architecture. Opportunities are abundant in industrial applications, commercial fleet electrification, and the development of lightweight, miniaturized EHB modules, while the intense pressure from established Tier 1 suppliers striving for standardized, cost-effective global platforms represents the primary impact force influencing pricing and technological standards.

Drivers:

- Rapid Global Electric Vehicle (EV) Adoption: EHB systems are essential for efficient regenerative braking, a key determinant of EV range.

- Implementation of Advanced Driver Assistance Systems (ADAS): ADAS features like AEB and ACC require the precise, fast response offered by EHBs.

- Stringent Global Safety Regulations: Mandates from regulatory bodies (e.g., UN R13-H, NHTSA) push for higher fidelity braking systems.

- Demand for Enhanced Vehicle Performance and Dynamics: EHB allows for optimized vehicle stability control (ESC) and customized pedal feel.

Restraints:

- High Initial System Cost: EHB systems are more expensive than traditional vacuum-assisted systems, potentially limiting adoption in cost-sensitive segments.

- Cybersecurity Vulnerabilities: Brake-by-wire architecture is susceptible to electronic attacks, requiring complex and costly defensive measures.

- Complexity in Software Development and Integration: The intricate safety-critical software requires extensive validation and robust certification processes.

- Dependence on High-Voltage Architecture: The system requires reliable high-power electrical supply, adding complexity to the overall vehicle electrical architecture.

Opportunities:

- Expansion into Commercial Vehicle and Off-Highway Markets: Electrification of heavy trucks, buses, and construction equipment opens new high-value applications.

- Development of Integrated Braking Modules: Consolidation of multiple functions (e.g., ABS, ESC, EHB) into a single, compact unit reduces cost and weight.

- Focus on Redundant Systems for L4/L5 Autonomy: Demand for fail-operational EHB systems will skyrocket as autonomous levels increase.

- Leveraging Data for Predictive Maintenance: Integrating EHB sensor data with AI for enhanced system diagnostics and service planning.

Impact Forces:

- Technological Convergence: Integration of braking systems with steering and powertrain control (vehicle motion domain controllers) intensifies competitive pressure.

- Standardization Pressure from OEMs: Major automotive manufacturers demand standardized, global EHB platforms to reduce supply chain complexity and cost.

- Intellectual Property (IP) Concentration: Control over key patents related to brake-by-wire algorithms limits market entry for smaller players.

Segmentation Analysis

The Electric Hydraulic Brake Market is systematically segmented based on technology type, application, and vehicle type, reflecting the varied requirements across the automotive and industrial sectors. This comprehensive segmentation allows market participants to accurately target specific needs, particularly the high-growth areas within electric mobility and commercial transport. The segmentation by Type, specifically distinguishing between EHBS and EBB, is crucial as it differentiates between full brake-by-wire capability (EHBS) and enhanced booster functionality (EBB), with EHBS gaining prominence due to its necessity in pure EVs and advanced ADAS integrations. Analysis of these segments confirms that the market trajectory is heavily weighted towards solutions that offer full electronic control and optimization capabilities rather than simple power assistance, driving investment in software and control algorithms across the board.

In terms of application, the dominance of Passenger Vehicles (PVs) stems from the high volume of production and rapid consumer acceptance of EVs in this segment. However, the Commercial Vehicle (CV) segment, including heavy-duty electric trucks and buses, presents a lucrative future growth avenue, driven by the substantial braking requirements and the critical need for regenerative braking to manage vehicle weight and operating range efficiently. Industrial machinery, although a niche segment, requires robust and reliable EHB systems for precise control in harsh operating environments, such as forklifts, automated guided vehicles (AGVs), and specialized factory automation equipment. Understanding these application specific nuances allows suppliers to customize product characteristics, such as durability, environmental sealing, and communication protocols, optimizing their offerings for high-demand vertical markets.

The segmentation by Vehicle Type clearly illustrates the market's dependence on the electrification trend, with Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) being the primary revenue drivers. While Internal Combustion Engine (ICE) vehicles still utilize EHB technology, particularly for luxury models incorporating advanced ADAS features, the fundamental growth is concentrated within the zero-emission vehicle categories. This trend reinforces the inseparable link between the success of the EHB market and the successful global adoption of electric propulsion technologies, emphasizing that EHB systems are not merely an upgrade but a foundational necessity for modern electric powertrains, delivering both safety and efficiency gains essential for mass adoption. This deep integration makes EHB suppliers indispensable partners in the EV value chain.

- By Type:

- Electro-Hydraulic Brake System (EHBS)

- Electric Brake Booster (EBB) / Integrated Power Brake (IPB)

- By Application:

- Passenger Vehicles (PVs)

- Commercial Vehicles (CVs) (Light, Medium, Heavy-Duty)

- Industrial Machinery and Equipment

- By Vehicle Type:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Internal Combustion Engine (ICE) Vehicles (Equipped with ADAS)

- By Component:

- Actuators and Control Units (ECUs)

- Sensors (Pressure, Position, Speed)

- Hydraulic Units and Calipers

Value Chain Analysis For Electric Hydraulic Brake Market

The value chain for the Electric Hydraulic Brake Market is complex, stretching from highly specialized raw material providers to end-user integration by automotive OEMs. The upstream segment involves the sourcing and processing of high-grade electronic components, specialized alloys for hydraulic units, and complex semiconductor chips essential for the Electronic Control Units (ECUs) and sensor arrays. Key upstream activities include the highly precise manufacturing of microprocessors capable of executing safety-critical, real-time control algorithms, often relying on specialized semiconductor manufacturers. The performance, reliability, and cost of these fundamental electronic and material components directly influence the final product quality and the overall system’s functional safety rating, demanding stringent quality control and secure supply chain logistics, especially given recent global semiconductor shortages.

Midstream activities are dominated by Tier 1 suppliers—major automotive system integrators like Continental, Bosch, and ZF—who design, assemble, and extensively test the complete EHB modules. This stage involves sophisticated system engineering, software development (including proprietary AI and control algorithms), and rigorous validation to meet ISO 26262 functional safety standards (ASIL C or D). The distribution channel, bridging the midstream to the downstream, is primarily Direct (OEM-to-Supplier), reflecting the highly technical, safety-critical nature of the components, requiring deep collaboration during the design and integration phases. Indirect distribution is minimal, typically involving aftermarket sales of replacement parts, which is a significantly smaller revenue stream compared to the highly structured OEM procurement contracts for new vehicle production. The reliance on direct integration necessitates long-term strategic agreements and tight quality assurance protocols between the OEM and the EHB manufacturer.

The downstream segment centers on Original Equipment Manufacturers (OEMs) who integrate the EHB systems into the vehicle chassis and ensure seamless communication with the overall vehicle network, including the powertrain, ADAS, and vehicle domain controllers. This integration requires significant calibration and tuning to achieve the desired vehicle dynamics and brand-specific pedal feel. End-users are the ultimate consumers—vehicle owners or fleet operators—who benefit from enhanced safety, improved energy efficiency (in EVs), and superior driving comfort. The efficiency of the entire value chain is currently being optimized through digitalization, leveraging digital twins and simulation tools to accelerate design cycles and validate complex software interactions before physical prototyping, thereby speeding up time-to-market for new braking innovations.

Electric Hydraulic Brake Market Potential Customers

The primary customers and end-users of Electric Hydraulic Brake systems are diverse, ranging from global automotive conglomerates to specialized industrial equipment manufacturers. The largest volume buyers are the Original Equipment Manufacturers (OEMs) specializing in passenger vehicles, including established players like Volkswagen Group, Toyota, General Motors, and emerging electric vehicle pure-plays such as Tesla, Nio, and Rivian. These customers prioritize high-volume supply, adherence to stringent safety certifications (ASIL D), cost optimization, and sophisticated software integration capabilities that support their unique ADAS and autonomous driving architectures. The shift toward modular EV platforms has made these OEMs seek suppliers capable of providing highly scalable and functionally reliable EHB solutions globally.

A rapidly growing segment of potential customers includes manufacturers of heavy-duty Commercial Vehicles (CVs), specifically those producing electric trucks, buses, and specialized vocational vehicles. Companies like Daimler Truck, Volvo Group, and BYD require EHB systems that can handle significantly higher braking forces and sustained regenerative loads, coupled with robust durability for continuous commercial operation. For these customers, maximizing uptime and achieving superior energy recovery are paramount, making the EHB system a critical determinant of total cost of ownership (TCO) for their electric fleets. The demand for industrial applications, encompassing material handling equipment manufacturers (e.g., forklift producers), automated guided vehicles (AGV) suppliers, and rail operators, also represents significant potential, where precise, reliable, and space-saving braking is essential for operational efficiency and localized safety standards compliance.

In essence, the market's potential customers can be categorized as any entity developing high-end vehicles or machinery that requires a transition away from vacuum-dependent or purely mechanical braking systems toward electronically controlled, energy-efficient, and highly responsive solutions. This includes not only traditional vehicle makers but also new mobility providers developing robotaxis and last-mile delivery autonomous platforms. The selection criteria for these buyers invariably focus on system integrity, cybersecurity resilience, ease of integration with central domain controllers, and the supplier's proven capability to meet high-volume, safety-critical production demands consistently across multiple geographical regions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.8 Billion |

| Market Forecast in 2033 | $11.2 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Bosch GmbH, ZF Friedrichshafen AG, Hitachi Astemo, Inc., Aisin Seiki Co., Ltd., Brembo S.p.A., Mando Corporation, Hella GmbH & Co. KGaA, Nissin Kogyo Co., Ltd., Bendix Commercial Vehicle Systems LLC, WABCO (now part of ZF), Advics Co., Ltd., AP Racing, Knorr-Bremse AG, Tenneco Inc., FTE automotive GmbH (now part of Valeo), Visteon Corporation, Magna International Inc., Delphi Technologies (now part of BorgWarner), Akebono Brake Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Hydraulic Brake Market Key Technology Landscape

The technological landscape of the Electric Hydraulic Brake Market is characterized by intense innovation focused primarily on software intelligence, miniaturization, and achieving ultra-high functional safety standards. The foundational technology is the "Brake-by-Wire" architecture, which replaces the physical linkage between the pedal and the master cylinder with electronic signals. This enables sophisticated control algorithms housed in the ECU to manage the braking process instantaneously. A major advancement is the Integrated Power Brake (IPB) or Electronic Brake Booster (EBB), which combines the vacuum booster, master cylinder, and often the ABS/ESC controller into a single, compact, electro-mechanical unit. This integration reduces complexity, saves weight, and is crucial for creating the necessary packaging space within compact EV platforms. Furthermore, the use of robust sensor technology, including dual or triple redundancy pressure and position sensors, is essential to ensure the fail-operational capability demanded by autonomous driving systems, reflecting the market’s pivot towards systems engineering rather than purely mechanical design.

A critical technological thrust involves the optimization of regenerative braking efficiency, often referred to as "blended braking." This relies on sophisticated software that seamlessly determines the optimal distribution of deceleration force between the electric motor (for energy recovery) and the hydraulic friction brakes. Modern EHB systems utilize advanced control loop algorithms to manage this blending dynamically, ensuring a consistent and predictable pedal feel for the driver regardless of the regeneration load. This necessitates high-speed, reliable communication protocols, often leveraging automotive Ethernet or high-speed CAN networks, to interface with the battery management system (BMS) and the powertrain ECU. The continuous development of these proprietary blending algorithms is a major differentiator among Tier 1 suppliers, directly impacting the marketable range and efficiency of the final electric vehicle.

Looking ahead, the next generation of EHB technology focuses heavily on redundancy and cybersecurity. For Level 4 and Level 5 autonomous vehicles, braking systems must operate flawlessly even in the event of primary component failure (fail-operational design). This involves parallel hydraulic lines, redundant ECUs, and diversified power sources. Simultaneously, as braking systems become networked and controlled by complex software, the vulnerability to external cyber threats increases significantly. Technology development is therefore prioritizing hardware-secured modules (HSMs) and robust encryption methods embedded within the ECU firmware to protect the integrity of the brake-by-wire commands. These technological advancements—spanning hardware consolidation, software intelligence for energy optimization, and enhanced system security—are essential for meeting future regulatory and consumer demands for safety and reliability in advanced electric mobility.

Regional Highlights

The Electric Hydraulic Brake Market exhibits distinct dynamics across key geographical regions, with Asia Pacific (APAC) currently serving as the engine of both demand and manufacturing, while Europe and North America drive technological adoption and standardization, particularly concerning autonomous vehicle mandates.

- Asia Pacific (APAC): APAC, led by China, is the dominant market due to unparalleled volumes of electric vehicle production and sales, supported by robust governmental policies encouraging electrification. China’s aggressive pursuit of domestic EV market leadership, coupled with significant investments in battery and component manufacturing infrastructure, positions the region as the epicenter for high-volume EHB deployment. South Korea and Japan are key technological contributors, focusing on integrating EHB with advanced proprietary ADAS platforms. The region is characterized by high price sensitivity but also rapid scaling capabilities, favoring high-volume, cost-effective solutions.

- Europe: Europe is characterized by stringent emission regulations and high consumer demand for sophisticated vehicle safety technologies, making EHB penetration high, even in non-electric segments. Regulatory pushes towards mandatory ADAS features accelerate the adoption of EHB systems. Germany, in particular, remains a hub for high-end EHB system research and development, driven by major Tier 1 suppliers and premium vehicle OEMs. The emphasis here is on performance, functional safety (ASIL D certification), and seamless integration into luxury and high-performance electric vehicles.

- North America: North America presents a substantial growth opportunity, fueled by large-scale investments in domestic EV manufacturing capacity (especially in the US and Mexico) and the rapid commercialization of autonomous driving fleets. The market demands robust, heavy-duty EHB systems for its growing segment of large electric trucks and SUVs. The region is highly focused on integrating EHB systems with software-defined vehicle architectures and ensuring system redundancy to support emerging L3/L4 autonomous taxi and logistics operations.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions are emerging markets for EHB technology, primarily driven by the localized assembly of global vehicle platforms and the gradual introduction of hybrid and electric vehicles. While EV penetration is currently lower than in the tri-regional giants, future growth will be concentrated in major economic hubs and infrastructure projects that prioritize safety upgrades and fleet electrification initiatives, particularly for public transportation and logistics operations in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Hydraulic Brake Market.- Continental AG

- Bosch GmbH

- ZF Friedrichshafen AG

- Hitachi Astemo, Inc.

- Aisin Seiki Co., Ltd.

- Brembo S.p.A.

- Mando Corporation

- Hella GmbH & Co. KGaA

- Nissin Kogyo Co., Ltd. (now part of Hitachi Astemo)

- Bendix Commercial Vehicle Systems LLC

- WABCO (now part of ZF)

- Advics Co., Ltd.

- AP Racing

- Knorr-Bremse AG

- Tenneco Inc.

- FTE automotive GmbH (now part of Valeo)

- Visteon Corporation

- Magna International Inc.

- Delphi Technologies (now part of BorgWarner)

- Akebono Brake Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electric Hydraulic Brake market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Electric Hydraulic Brakes (EHB) and traditional vacuum brake boosters?

EHB systems replace the vacuum reliance of traditional boosters with an electric motor and integrated electronic control unit (ECU). This shift allows for instantaneous, precise braking control independent of engine vacuum, crucial for optimizing regenerative braking in EVs and providing the responsiveness needed for ADAS features.

How do Electric Hydraulic Brakes benefit Electric Vehicle (EV) range?

EHB systems enable highly efficient "blended braking," seamlessly distributing deceleration force between regenerative braking (recuperating energy back to the battery) and friction braking. This optimization maximizes energy recovery, directly translating to an increase in the vehicle's usable driving range and overall efficiency.

Are EHB systems considered essential for autonomous vehicles?

Yes, EHB systems are considered foundational for Level 3 and above autonomous vehicles. They provide the necessary brake-by-wire control, high responsiveness, and, crucially, the functional redundancy and fail-operational capability required to ensure safety without continuous human intervention.

What are the main challenges facing the adoption of EHB technology?

Key challenges include the higher initial unit cost compared to conventional systems, the necessity for stringent cybersecurity measures to protect the brake-by-wire communication, and the complex software validation required to achieve the highest automotive functional safety standards (ASIL D).

Which geographic region currently dominates the global Electric Hydraulic Brake market?

The Asia Pacific (APAC) region, primarily driven by China's extensive EV manufacturing capacity and high volume of electric vehicle sales, currently dominates the global Electric Hydraulic Brake market in terms of both production volume and revenue share.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager