Electric Hydraulic Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432301 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Electric Hydraulic Pumps Market Size

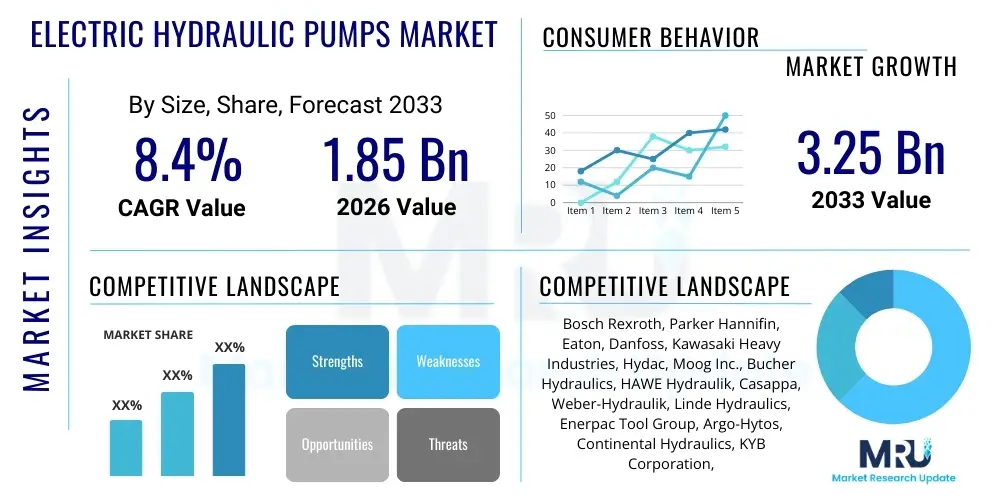

The Electric Hydraulic Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.4% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.25 Billion by the end of the forecast period in 2033.

Electric Hydraulic Pumps Market introduction

The Electric Hydraulic Pumps Market is defined by the integration of high-efficiency electric motors and advanced electronic controls with conventional hydraulic pumping mechanisms, offering superior control, energy savings, and lower noise profiles compared to legacy systems. These units function by converting electrical power, often sourced from the grid or advanced battery packs, into precisely controlled hydraulic energy. The core product lineup spans from compact DC-powered units used in mobile robotics and logistics equipment to large AC-powered systems utilizing Variable Speed Drives (VSDs) for heavy industrial machinery such as injection molding presses and metal forming equipment. The increasing global regulatory focus on decarbonization and operational efficiency has positioned electric hydraulic pumps as a critical enabling technology for achieving sustainability goals across diverse industrial landscapes.

A key differentiation of modern electric hydraulic pumps lies in their ability to deliver power on demand. Unlike fixed-displacement, continuously running systems that dissipate excess power through relief valves, VSD-equipped electric pumps only draw the necessary power to meet the instantaneous load requirements. This inherent energy conservation capability translates directly into significantly lower operational costs and reduced thermal stress on hydraulic fluids and components, thereby extending the system's lifespan and reducing maintenance frequency. Furthermore, the precise flow and pressure control afforded by electronic feedback loops enable machine operators to achieve higher levels of positional accuracy and repeatability, which is paramount in advanced manufacturing sectors like aerospace and automotive production.

Major applications driving the demand include the electrification of off-highway mobile machinery—such as construction excavators, agricultural tractors, and heavy-duty material handlers—where electric systems replace diesel-driven counterparts to meet stringent Tier 4 and Stage V emission standards. In the stationary industrial domain, the benefits of reduced noise and enhanced connectivity make them integral to smart factory initiatives (Industry 4.0). The primary benefits—energy efficiency, lower operational noise, minimal heat generation, and superior control—are collectively accelerating their market penetration, establishing electric hydraulic technology as the future standard for fluid power transmission.

- Product Description: Electro-mechanical devices integrating an electric motor, hydraulic pump, reservoir, and advanced control systems (often VSDs and PLCs) to generate pressurized hydraulic fluid on demand, optimizing flow and pressure based on real-time load.

- Major Applications: Industrial machinery (metalworking, plastics, printing), construction equipment (mini-excavators, loaders), material handling (electric forklifts), renewable energy pitch control systems, and specialized aerospace ground support equipment.

- Benefits: High energy efficiency (up to 70% energy savings), substantial noise reduction, precision control (high repeatability and accuracy), simplified installation, and compliance with strict environmental standards.

- Driving factors: Global push towards industrial electrification, stringent energy efficiency regulations (e.g., EU Ecodesign), rising energy costs, and the increasing demand for high-precision, low-noise equipment in automated factory and urban construction environments.

Electric Hydraulic Pumps Market Executive Summary

The global Electric Hydraulic Pumps Market is undergoing a rapid evolutionary phase, primarily influenced by technological convergence and shifting regulatory landscapes that favor energy-efficient technologies. Current business trends indicate a definitive move towards modular, integrated power packs that simplify machine design and maintenance. Manufacturers are increasingly focusing on developing highly optimized components, such as Permanent Magnet Synchronous Motors (PMSMs) and specialized inverter drives, tailored for the dynamic load profiles of hydraulic systems. A critical trend is the incorporation of cyber-physical system capabilities, enabling pumps to become interconnected assets within the industrial IoT ecosystem, facilitating predictive maintenance contracts and data-driven operational decision-making, thereby transforming the manufacturer-customer relationship from transaction-based to service-oriented.

From a regional perspective, Asia Pacific remains the largest and most dynamic market, capitalizing on rapid industrialization, extensive government investments in smart infrastructure, and the dominant global position of the region in electric vehicle (EV) and battery manufacturing—industries that rely heavily on precision electric hydraulic systems for stamping and assembly. North America and Europe, while growing at a slightly slower pace, represent the core markets for technological innovation. These regions exhibit high adoption rates of premium, high-specification products due to stringent domestic environmental legislation and a high labor cost environment that necessitates maximizing automation and operational efficiency. European markets, in particular, are pioneering the shift towards fully electric construction and agricultural equipment, which mandates robust DC electric pump technologies.

Segmentation analysis highlights that the AC-powered segment, utilized predominantly in large industrial presses and stationary factory applications, currently holds the revenue majority due to its capacity for high power delivery and sustained operation. However, the DC-powered segment is projected to achieve the highest CAGR, propelled by the booming demand for mobile electrification solutions across logistics, construction, and utility sectors. Across all segments, the trend is toward decentralization—moving the power unit closer to the point of application—to minimize energy losses and maximize system responsiveness. This necessitates continuous improvements in power density and thermal management, which remains a key area of competitive research and development among leading market participants.

- Business Trends: Accelerated adoption of decentralized power units; integration of Industry 4.0 features (IoT, cloud connectivity); development of high-efficiency component ecosystems (PMSMs, compact inverters); growth in service-based revenue models focusing on predictive maintenance.

- Regional Trends: APAC leading in market volume and fastest growth, driven by infrastructure and EV manufacturing; North America and Europe leading in high-value VSD technology penetration and regulatory-driven electrification of mobile platforms.

- Segments trends: Industrial application segment maintaining largest revenue share; Mobile application segment showing maximum growth potential; Variable displacement pump mechanisms gaining dominance over fixed displacement due to efficiency benefits.

AI Impact Analysis on Electric Hydraulic Pumps Market

User queries regarding the intersection of Artificial Intelligence (AI) and electric hydraulic pumps are heavily concentrated on achieving 'zero unplanned downtime' and optimizing power consumption schedules. Users are actively seeking solutions where Machine Learning (ML) models can process vast amounts of operational data—including pump speed, flow rate variability, oil quality metrics, and subtle vibrational signatures—to accurately diagnose component health and predict required maintenance intervals with high fidelity. A significant area of interest is the deployment of reinforcement learning to fine-tune VSD control loops, ensuring the pump system adapts instantly to changes in load and environmental conditions, thereby maintaining peak hydraulic performance while minimizing electrical energy waste, a performance level unreachable through traditional static control logic.

The practical application of AI is profoundly influencing the design and operation of new-generation electric hydraulic systems. AI-driven condition monitoring platforms transition simple sensor data into actionable business intelligence. By establishing complex baseline operational profiles and identifying anomalies that correspond to known failure modes (such as bearing wear or seal degradation), AI significantly enhances system reliability and safety. This sophisticated diagnostic capability moves maintenance from a reactive or scheduled approach to a genuinely predictive one, dramatically improving asset utilization rates, especially in high-capital industries like mining and large-scale manufacturing where downtime costs are prohibitive.

Furthermore, AI is instrumental in accelerating the development cycle through simulation and generative design. AI tools are optimizing the internal geometry of pump components (e.g., piston blocks, valve plates) to minimize hydraulic losses, increase efficiency, and reduce cavitation noise. In field operations, AI ensures seamless integration of the hydraulic system into larger autonomous industrial systems. For instance, in automated robotic cells, AI dictates the precise flow and pressure required by the pump based on the robot's planned trajectory and payload, optimizing the energy profile of the entire operation and further cementing the electric hydraulic pump's role as a core cyber-physical component.

- Predictive Maintenance: AI analyzes vibration and thermal data to forecast component failure (e.g., motor bearings, seals) weeks in advance, enabling scheduled, cost-effective maintenance intervention.

- Energy Optimization: ML algorithms dynamically adjust VSD control parameters to minimize energy draw during transient loads and partial-load cycles, maximizing overall system efficiency.

- Autonomous Control: AI facilitates the integration of hydraulic power with autonomous guidance systems in mobile equipment, allowing pumps to instantaneously modify output based on real-time external operational commands.

- Design and Simulation: Generative AI aids engineers in optimizing fluid paths and component design for better power density and reduced noise emission during the product development phase.

- Remote Diagnostics and Optimization: Enables global service teams to remotely monitor, troubleshoot, and update pump operational parameters, drastically reducing service call response times and travel costs.

DRO & Impact Forces Of Electric Hydraulic Pumps Market

The Electric Hydraulic Pumps Market is powerfully shaped by strong external and internal impact forces. Key drivers include the stringent enforcement of global climate protection agreements and energy efficiency directives, particularly in OECD nations, making the switch to electrified, high-efficiency machinery mandatory for industrial compliance. The escalating global energy prices further enhance the economic attractiveness of VSD-equipped electric pumps, where the operational cost savings rapidly offset the higher initial investment. This is compounded by the technological advancements in power electronics and motor design, yielding pumps that are smaller, lighter, and capable of higher power density than ever before, accelerating their adoption in space-constrained mobile platforms.

Significant restraints, however, temper the market's explosive potential. The initial procurement cost remains the most substantial barrier, particularly for retrofitting existing facilities or deployment by SMEs in developing economies. Integrating these electronically complex systems requires specialized technical expertise, often necessitating workforce retraining, which adds to implementation costs and time. Furthermore, despite advancements, the challenges of thermal management and mitigating Electromagnetic Compatibility (EMC) issues, especially in high-switching-frequency VSDs, require careful engineering and can limit deployment in extreme or sensitive industrial environments, requiring highly specialized and thus expensive components.

Opportunities for growth are concentrated in untapped sectors and technological breakthroughs. The large-scale electrification of the construction, agriculture, and utility fleet represents a multi-billion-dollar opportunity, driving demand for robust, weather-resistant DC electric hydraulic power units. Furthermore, the rising demand for silence in urban construction and indoor logistics activities (warehouses, factories) provides a competitive edge to electric pump systems over traditional engine-driven hydraulics. The ongoing evolution of battery technology, providing lighter and higher energy density solutions, directly supports the growth of fully electric mobile hydraulic applications, strengthening the positive impact forces across the next decade.

- Drivers: Mandatory environmental regulations (decarbonization); high energy efficiency translating to lower TCO; technological maturity of VSDs and high-density electric motors; increasing automation requiring precise control.

- Restraints: High initial investment capital required; complexity in integrating electronic controls and sensors; need for specialized maintenance training; technical challenges related to heat management in compact high-power units.

- Opportunity: Expanding scope of mobile machinery electrification; significant potential in the retrofit and modernization market for legacy industrial equipment; growth in specialized applications like maritime and renewable energy systems.

- Impact Forces: Strong regulatory and economic forces favor energy-efficient solutions, gradually overcoming high upfront cost barriers; innovation in power electronics is rapidly improving system performance and reliability, accelerating the shift from conventional power sources.

Segmentation Analysis

The Electric Hydraulic Pumps Market segmentation provides a critical view of the diverse operational requirements across industries. The market is primarily analyzed based on the electrical source powering the unit (AC or DC), the hydraulic mechanism employed (fixed or variable displacement), the pressure capability required, and the specific industrial or mobile application. This detailed breakdown helps stakeholders identify specialized niches, such as high-pressure systems necessary for automotive hydroforming, versus medium-pressure, high-flow systems common in material handling, enabling targeted product development and market strategy.

- By Power Source: AC Powered (Dominant in stationary industrial applications), DC Powered (Fastest growing due to mobile equipment electrification).

- By Component: Hydraulic Pumps (Gear, Vane, Piston), Electric Motors (Induction, PMSM, BLDC), Control Valves (Proportional, Servo), Actuators (Cylinders, Motors), Reservoirs and Accumulators, Electronic Control Units (ECUs) and Sensors.

- By Operating Mechanism: Variable Displacement Pumps (High efficiency and control), Fixed Displacement Pumps (Lower cost, simpler control).

- By Pressure Rating: Low Pressure (Up to 150 bar), Medium Pressure (150-350 bar), High Pressure (>350 bar, common in presses and testing equipment).

- By End-User Industry: Construction and Mining (Adoption driven by emission standards), Manufacturing (Largest revenue share, focus on plastics and metalworking), Material Handling and Logistics (DC pump growth), Automotive and Aerospace (Precision and testing), Agriculture (Evolving towards full electric platforms).

Value Chain Analysis For Electric Hydraulic Pumps Market

The value chain of the Electric Hydraulic Pumps Market begins with highly specialized upstream suppliers focusing on critical components. This phase includes the sourcing of high-grade raw materials (e.g., aluminum, specialized alloys for pump housings, and rare earth magnets for PMSMs) and the precision manufacturing of electric motors, advanced power semiconductors for VSDs, and high-tolerance hydraulic pump internals. Upstream quality and supply chain resilience are paramount, as the performance and reliability of the final electric pump system are directly dependent on the tight tolerances and quality of these foundational components. Strategic partnerships at this stage ensure a stable supply of key technological elements, such as microprocessors for control units.

The midstream phase is where true value addition occurs, encompassing the design, integration, and manufacturing of the complete Electric Hydraulic Power Unit (EHPU). Leading manufacturers invest heavily in R&D to optimize the electro-mechanical interface, particularly focusing on thermal management systems, noise dampening, and sophisticated control software development. This phase involves complex assembly, calibration, and rigorous testing protocols to ensure the integrated system meets specific safety standards (e.g., SIL/PL ratings) and performance metrics (e.g., energy efficiency ratings). Manufacturers often develop proprietary control algorithms that allow the pump to communicate via various industrial fieldbus protocols, enhancing integration versatility for OEMs.

Downstream activities include the extensive distribution network and crucial aftermarket support. Distribution relies on a hybrid model: direct sales channels handle large, custom-engineered orders for global OEMs in the industrial sector, while a dense network of certified industrial distributors and system integrators serves regional end-users and the burgeoning Maintenance, Repair, and Overhaul (MRO) market. Aftermarket services are increasingly characterized by digitally enabled support, including cloud-based monitoring, predictive diagnostics subscriptions, and fast provisioning of standardized replacement modules. The longevity and complexity of EHPUs make the downstream service component a high-margin revenue stream and a significant factor in customer loyalty.

- Upstream Analysis: Sourcing of high-performance raw materials; manufacturing of precision parts (e.g., high-efficiency permanent magnet rotors, specialized power electronics, high-pressure pump casings).

- Downstream Analysis: Integration and customization of EHPUs into fixed industrial machinery and mobile OEM platforms; supply of spare parts and fluid monitoring sensors to the MRO market; retrofitting services for older machinery modernization.

- Distribution Channel: Exclusive direct sales to Tier 1 global OEMs; indirect distribution through industrial automation specialists, regional hydraulic supply houses, and certified system integrators.

- Direct and Indirect: Direct channels secure strategic, large-volume contracts requiring co-development; indirect channels provide market reach for standardized products and critical support for localized installation and repair needs.

Electric Hydraulic Pumps Market Potential Customers

The customer ecosystem for electric hydraulic pumps is bifurcated between industrial manufacturers requiring high repeatability and mobile machinery OEMs driven by legislative compliance and battery efficiency mandates. In the industrial sphere, top-tier customers include manufacturers of plastic injection molding equipment who demand extremely precise and repeatable pressure cycles for consistent product quality, and metalworking press manufacturers who seek high tonnage power delivery with minimal energy consumption. These buyers prioritize systems offering seamless connectivity with factory automation protocols and verifiable energy savings data to justify capital expenditure.

The mobile equipment sector represents a high-growth customer base, encompassing global OEMs in construction (e.g., Liebherr, Caterpillar electric line), agriculture (e.g., John Deere electric concepts), and material handling (e.g., KION Group, Toyota Material Handling). These customers are primarily focused on power density (maximum power in minimum space) and maximum energy efficiency to extend the operational run-time of battery-electric vehicles. For these applications, DC electric pumps capable of handling high transient loads and operating reliably in rugged, outdoor conditions are essential purchasing criteria.

Beyond OEMs, the maintenance, repair, and overhaul (MRO) market is a significant, high-volume customer segment. Industrial end-users across chemicals, aerospace, and energy sectors regularly purchase electric hydraulic pumps for replacement or efficiency upgrades to existing machinery nearing end-of-life or facing new regulatory requirements. Furthermore, specialized firms providing hydraulic system refurbishment and modernization services are key buyers, leveraging the electric pumps to offer efficiency guarantees and functional improvements to their client base, ensuring the market's continuous demand cycle extends beyond new equipment sales.

- End-User/Buyers of the product: Global Automotive Tier 1 Suppliers (for stamping, testing equipment); Major Construction and Mining Equipment OEMs transitioning to electric fleets; Manufacturers of Plastic Injection Molding and Die Casting Machines; Aerospace and Defense Contractors (for specialized ground support and flight simulation); Large-scale Logistics and Warehouse Automation Integrators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.25 Billion |

| Growth Rate | 8.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton, Danfoss, Kawasaki Heavy Industries, Hydac, Moog Inc., Bucher Hydraulics, HAWE Hydraulik, Casappa, Weber-Hydraulik, Linde Hydraulics, Enerpac Tool Group, Argo-Hytos, Continental Hydraulics, KYB Corporation, Nachi-Fujikoshi, Trelleborg Group, Oilgear Company, Atos S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Hydraulic Pumps Market Key Technology Landscape

The contemporary technology landscape of the Electric Hydraulic Pumps Market is fundamentally centered on maximizing energy efficiency and integrating smart control logic. The predominant technology enabling this shift is the Variable Speed Drive (VSD) system, often paired with highly efficient Permanent Magnet Synchronous Motors (PMSMs). VSDs allow for precise control of motor speed and torque, ensuring the hydraulic pump only generates the exact flow and pressure required at any given moment, thus eliminating the massive power losses traditionally associated with throttling and relief valves in constant-speed hydraulic systems. The sophistication of VSD software, which utilizes fast control loops and feedback mechanisms from pressure transducers, is crucial for achieving the high positional accuracy demanded by modern robotics and industrial machinery.

Digitalization forms the second pillar of the current technology strategy. Modern electric hydraulic pumps are equipped with robust, integrated sensor arrays (measuring pressure, flow, temperature, and vibration) and Electronic Control Units (ECUs) capable of communicating via standard industrial Ethernet protocols (e.g., EtherCAT, PROFINET, OPC UA). This connectivity transforms the hydraulic pump from a standalone mechanical device into a cyber-physical component, allowing for real-time performance monitoring, remote commissioning, and integration into cloud-based data analytics platforms. This digital capability is essential for offering high-value service contracts based on predictive maintenance and guaranteed uptime, which are becoming key competitive differentiators among leading manufacturers.

Future technological developments are focusing intensely on power density and modularity, particularly for mobile applications. Research and development are geared toward creating quieter, more compact pump designs through optimized fluid mechanics and advanced materials that resist wear and transmit heat efficiently. Furthermore, there is a substantial push toward decentralized and distributed actuation systems, such as Electro-Hydraulic Actuators (EHAs), which integrate the pump, motor, reservoir, and controller directly onto the machine component being moved. This innovation simplifies machine architecture, reduces complex piping, and further minimizes energy loss, setting the stage for fully autonomous and highly power-efficient heavy equipment.

- Key Technologies: Variable Speed Drives (VSDs) using IGBT or SiC power semiconductors, Permanent Magnet Synchronous Motors (PMSMs) and Brushless DC (BLDC) motors, Electro-Hydraulic Actuators (EHAs), High-Resolution Digital Sensors (pressure, contamination), and Embedded Fieldbus Communication Modules (IoT readiness).

- Focus Areas: Enhanced thermal management solutions (liquid cooling, optimized manifold design), development of robust control algorithms for functional safety (meeting ISO 13849/IEC 61508 standards), noise reduction through optimized pump kinematics, and integration of energy storage solutions (capacitors/batteries) for peak shaving capability.

Regional Highlights

Asia Pacific (APAC) holds an undisputed leadership position in the Electric Hydraulic Pumps Market, driven by industrial scale and rapid infrastructure development across China, India, and Southeast Asia. The region’s aggressive manufacturing targets, particularly in the high-growth sectors of electric vehicles, battery manufacturing gigafactories, and consumer electronics, necessitate high volumes of precision machinery requiring electric hydraulic power. Furthermore, regional government incentives promoting energy efficiency and the sheer volume of global manufacturing output concentrated in APAC ensure this region will maintain the highest growth trajectory, making it the most critical area for volumetric sales and production capacity expansion by global vendors.

North America and Europe constitute the core high-value markets, characterized by demand for advanced, integrated technologies and strict regulatory adherence. In Europe, the market is heavily influenced by the Ecodesign Directive and noise pollution regulations, compelling rapid replacement of older fixed-speed pumps with VSD electric units across manufacturing, and accelerating the electrification of mobile machinery in construction and agriculture. North America's growth is fueled by modernization of aging industrial plants, substantial investment in aerospace and defense manufacturing (sectors requiring highly reliable, customized electric hydraulic systems), and the rapid expansion of automated warehousing and logistics where battery-powered equipment is standard.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging opportunities, with market adoption concentrated in high-capital intensive industries. In MEA, the demand is largely driven by large-scale mining operations and oil and gas extraction, where high operational uptime and reliability are non-negotiable, leading to investment in robust, condition-monitoring enabled electric hydraulic systems. LATAM's market is bolstered by agricultural modernization and infrastructure projects, although growth remains sensitive to macroeconomic stability. In both regions, market expansion is primarily focused on supplying highly resilient equipment that minimizes maintenance requirements in often remote or challenging operating environments, with DC-powered mobile units seeing rising interest in specific market niches.

- Asia Pacific (APAC): Market leader in volume and growth rate; exponential demand from EV and semiconductor manufacturing sectors; driven by mass urbanization and industrial capacity expansion, particularly in China and India.

- North America: Market focused on technological superiority and customized solutions; major drivers include aerospace manufacturing, defense, and high-tech factory automation; early adopter of AI and IoT integration in fluid power.

- Europe: Driven by strict regulatory mandates (emissions, noise, energy efficiency); strong focus on compact, high power-density DC systems for construction and agricultural mobile equipment; leader in setting global sustainability standards for hydraulic power.

- Latin America & MEA: Emerging growth centers; demand concentrated in mining, oil/gas, and agriculture; focus on reliability and robustness to counteract complex logistical and maintenance challenges in remote operational sites.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Hydraulic Pumps Market.- Bosch Rexroth Corporation

- Parker Hannifin Corporation

- Eaton Corporation plc

- Danfoss A/S (Sauer-Danfoss)

- Kawasaki Heavy Industries, Ltd.

- Hydac International GmbH

- Moog Inc.

- Bucher Hydraulics GmbH

- HAWE Hydraulik SE

- Casappa S.p.A.

- Weber-Hydraulik GmbH

- Linde Hydraulics GmbH & Co. KG

- Enerpac Tool Group Corp.

- Argo-Hytos GmbH

- Continental Hydraulics Inc.

- KYB Corporation

- Nachi-Fujikoshi Corp.

- Trelleborg Group

- Oilgear Company

- Atos S.p.A.

Frequently Asked Questions

Analyze common user questions about the Electric Hydraulic Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of electric hydraulic pumps?

The central driver is the global mandate for energy efficiency and emission reduction. Electric hydraulic pumps, particularly those equipped with Variable Speed Drives (VSDs) and high-efficiency motors (like PMSMs), offer superior energy savings (often 50%+) and lower acoustic emissions compared to conventional constant-speed hydraulic systems, fulfilling modern sustainability and regulatory compliance requirements.

How do Electric Hydraulic Pumps contribute to Industry 4.0 initiatives?

They are essential components of Industry 4.0 by incorporating integrated sensors, diagnostic capabilities, and robust electronic control units (ECUs). This allows for continuous condition monitoring, remote system diagnostics, seamless integration into Industrial IoT (IIoT) platforms, and the utilization of predictive maintenance algorithms to optimize operational scheduling and asset performance.

What is the expected lifespan and maintenance requirement for these advanced pump systems?

Electric hydraulic pumps generally offer a longer service life because the on-demand operation significantly reduces mechanical wear, thermal stress on components, and fluid degradation. Maintenance is highly optimized; integrated electronics facilitate predictive maintenance strategies that drastically reduce routine service intervals and focus only on necessary interventions, minimizing overall ownership costs.

Which application segment currently dominates the revenue for Electric Hydraulic Pumps?

The Industrial Machinery segment, including high-tonnage metal forming presses, plastics injection molding machines, and large machine tools, holds the largest revenue share. This is attributed to the critical need for absolute precision, high dynamic responsiveness, and substantial energy cost reduction in continuous, high-volume manufacturing processes.

What challenges does the market face regarding heat dissipation?

For compact, high power-density electric hydraulic units, especially those using VSDs at high switching frequencies, managing thermal loads is a key engineering challenge. Manufacturers address this through specialized liquid cooling loops, advanced motor winding designs, and optimized manifold geometry to ensure that the increased power density does not compromise reliability or shorten component life in continuous-duty applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager