Electric Ice Auger Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432853 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Electric Ice Auger Market Size

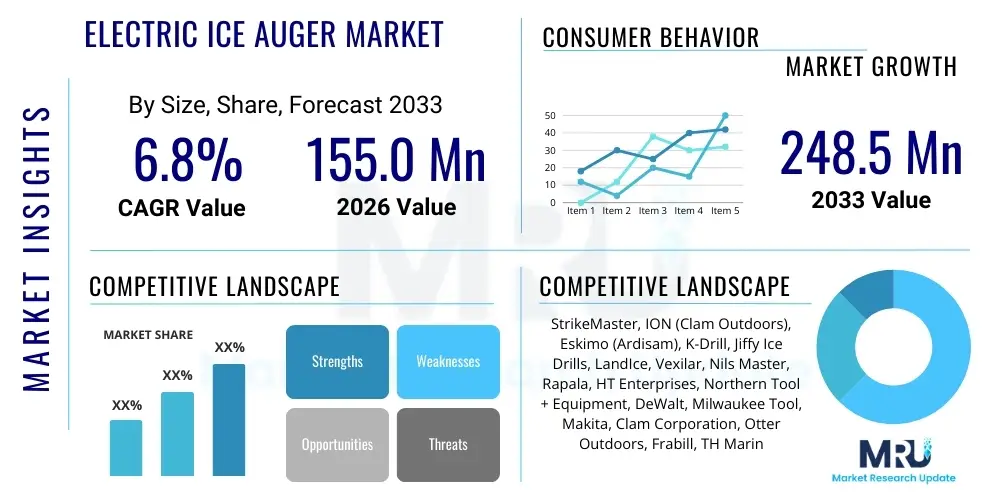

The Electric Ice Auger Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This growth trajectory is significantly fueled by the increasing popularity of ice fishing as a recreational activity across North America and Northern Europe, coupled with substantial advancements in battery technology, primarily lithium-ion power cells, which enhance product efficiency and portability. The shift away from traditional, heavy gasoline-powered augers towards quieter, cleaner electric alternatives is a definitive trend influencing market expansion.

The market is estimated at USD 155.0 million in 2026, benefiting from a strong consumer base prioritizing convenience and environmental sustainability in outdoor sports equipment. Key demographic factors, including rising disposable incomes in regions where ice fishing is prevalent and continuous product innovation resulting in lighter, more powerful drills, contribute positively to the market valuation. The reliability and reduced maintenance requirements of electric systems further solidify consumer adoption.

The market is projected to reach USD 248.5 million by the end of the forecast period in 2033. This forecast reflects the continuous introduction of sophisticated features, such as integrated depth finders and smart battery management systems, enhancing the overall user experience. Furthermore, the expansion of distribution channels, particularly robust growth in online retail platforms specializing in winter sports gear, ensures wider accessibility to high-quality electric augers globally, supporting this optimistic valuation.

Electric Ice Auger Market introduction

The Electric Ice Auger Market encompasses the global trade of battery-powered drilling devices specifically engineered for boring holes through frozen bodies of water, primarily for ice fishing and related scientific or commercial activities. These devices utilize high-torque electric motors powered predominantly by advanced lithium-ion battery packs, offering a clean, quiet, and user-friendly alternative to traditional gasoline-powered or manual augers. The core product provides enhanced portability, instant start functionality, and reduced environmental impact, positioning it as a preferred tool among modern ice anglers seeking efficiency and convenience.

Major applications of electric ice augers span recreational ice fishing, where ease of use and reduced noise are highly valued, commercial ice harvesting operations requiring efficient hole drilling, and specialized environmental research that necessitates precise and minimal disturbance to the ice surface. The primary benefits driving market penetration include zero direct emissions, minimal maintenance requirements, significantly lower operating noise levels compared to combustion engines, and consistent performance even in extremely cold temperatures, assuming the batteries are appropriately managed. These advantages collectively enhance the fishing experience and operational efficiency for professionals.

Driving factors for this market are multi-faceted, centered on the growing consumer focus on eco-friendly and quiet sporting equipment, rapid improvements in battery energy density and longevity, and increasing participation rates in winter outdoor recreational activities. Regulatory shifts favoring cleaner technologies in outdoor environments in key regions like North America and Europe also provide significant impetus. Furthermore, continuous design innovation leading to lighter materials and ergonomic designs makes these products accessible to a broader demographic, including elderly anglers and those prioritizing ease of transport.

Electric Ice Auger Market Executive Summary

The Electric Ice Auger Market is characterized by robust growth, driven primarily by technological substitution where environmentally conscious and convenience-seeking consumers are rapidly transitioning from internal combustion engine (ICE) augers to battery-powered units. Key business trends include aggressive mergers and acquisitions among core outdoor recreation equipment manufacturers aimed at consolidating market share and integrating advanced battery management systems into product lines. Manufacturers are heavily investing in lighter, modular designs that allow for easy transport and storage, focusing on optimizing efficiency between motor torque and battery drain to deliver maximum holes per charge, which is a critical consumer metric.

Regionally, North America, particularly the US and Canada, remains the largest and most mature market due to the deeply embedded culture of ice fishing and extensive freshwater resources. However, Europe, especially Scandinavian countries and Russia, is demonstrating accelerated adoption, supported by stringent environmental regulations and high consumer demand for high-performance winter gear. The Asia-Pacific region, while nascent, presents significant opportunities, particularly in markets like Japan and South Korea, where outdoor winter sports are gaining traction, although seasonal limitations pose a minor restraint.

Segmentation trends highlight the dominance of the Lithium-ion battery segment, favored for its superior energy density, low weight, and longer lifespan compared to traditional Lead-Acid alternatives. The recreational fishing application segment holds the largest share, constantly demanding higher specifications in terms of hole diameter versatility and drilling speed. Distribution is increasingly shifting towards hybrid models, where specialized outdoor retailers provide expert advice and fitting, while e-commerce platforms capture high volume sales due to competitive pricing and expansive geographical reach, catering to diverse consumer preferences effectively.

AI Impact Analysis on Electric Ice Auger Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Electric Ice Auger Market commonly revolve around themes of predictive maintenance, optimized performance management, and enhanced user experience through smart integration. Users frequently ask how AI can predict battery failure rates based on historical usage patterns, how optimal drilling torque can be autonomously adjusted based on real-time ice density readings, and if AI algorithms can integrate weather forecasting and ice condition data to recommend the best time and location for fishing. A central concern is whether smart augers will genuinely improve efficiency or merely add unnecessary complexity and cost. Expectations are high for AI to deliver proactive diagnostics and personalized performance optimization, making the drilling process safer, faster, and more energy efficient, thereby maximizing the usable time on the ice.

The practical application of AI in this specialized hardware market is focused less on generative capabilities and more on embedded machine learning for operational improvement. This involves analyzing massive datasets gathered from sensors within the auger—such as motor temperature, speed, resistance, and battery discharge rates—to create performance profiles. Such profiles enable the system to dynamically optimize power delivery. For instance, if resistance spikes, the AI can momentarily increase torque while monitoring internal temperature to prevent motor burnout, extending both the life of the tool and the duration of effective use per battery charge, a critical competitive advantage.

Ultimately, AI integration is expected to revolutionize the maintenance and reliability aspects of electric augers. Instead of manual checks, AI-driven diagnostics can alert users to potential issues, such as impending battery cell degradation or worn-out cutting blades, well before they lead to operational failure. This shift towards smart maintenance minimizes downtime during peak fishing season and enhances overall user trust in the equipment's longevity and consistency. This data-driven enhancement capability will differentiate premium product lines, justifying higher price points through superior reliability and optimized performance under varying environmental conditions.

- AI Impact on Electric Ice Auger Market:

- Implementation of Smart Battery Management Systems (BMS) utilizing machine learning to predict optimal charging cycles and prevent over-discharge, maximizing battery lifespan.

- Integration of predictive maintenance algorithms that monitor motor strain and vibration patterns to forecast component wear and schedule proactive servicing.

- Dynamic torque adjustment systems using embedded sensors and AI to optimize drilling speed based on real-time ice thickness and density, conserving battery life.

- Development of companion mobile applications powered by AI for personalized usage analysis, offering tips for efficient operation and maximizing hole count per charge.

- Potential for AI-enhanced navigation and mapping tools (when paired with GPS) to log successful fishing locations and optimal drilling parameters for future reference.

DRO & Impact Forces Of Electric Ice Auger Market

The Electric Ice Auger Market is driven by strong consumer preference for quiet and clean operation, coupled with significant technological improvements in lithium-ion battery technology, offering superior power-to-weight ratios and extended operational times. However, the market faces restraints primarily related to the high initial cost of electric units compared to traditional gasoline alternatives, and the performance degradation of batteries in extreme cold environments, which necessitates careful design and thermal management strategies by manufacturers. Opportunities lie in penetrating emerging international markets and developing multi-season, modular power tools that utilize the same battery platform, appealing to broader consumer segments interested in outdoor equipment integration. The interplay of these factors defines the market's current velocity and future trajectory.

Drivers: The primary driver is the pervasive trend toward electrification and environmental stewardship in outdoor sports, compelling anglers to abandon noisy, polluting gasoline motors. Furthermore, lithium-ion battery capacity has substantially increased, making electric augers powerful enough to compete with, and often surpass, the performance of smaller gasoline engines in terms of cutting speed and endurance. The ease of use, instant-start capability, and reduced physical strain are highly valued by the aging demographic participating in ice fishing, further accelerating adoption.

Restraints: Significant restraints include the substantial upfront investment required for high-end electric augers and their associated battery packs, which can be prohibitive for budget-conscious consumers. Additionally, the sensitivity of lithium-ion batteries to extreme sub-zero temperatures requires specialized insulation and careful management, adding operational complexity and potential performance anxiety for users unfamiliar with battery thermal dynamics. The market also suffers from regional seasonality, limiting demand primarily to winter months in specific geographical belts.

Opportunities: Key opportunities are found in expanding product lines to offer specialized augers for varying ice conditions—from soft spring ice to hard, early-season frozen layers—and focusing on interchangeable battery systems compatible across different outdoor tools (e.g., flashlights, sonar). Furthermore, utilizing lightweight, durable composite materials to reduce overall unit weight represents a significant competitive advantage. Developing rapid-charge capabilities and providing robust warranty support for high-cost battery components will foster greater consumer confidence and market expansion.

Impact Forces: The impact forces of substitution threat (gasoline augers) and supplier power (lithium-ion battery producers) are moderately high. While electric augers offer superior experience, the lower cost and proven reliability of older technology persist as a threat. However, increasing battery standardization and vertical integration by large outdoor equipment companies are mitigating supplier power risks over time. Buyer power is high due to the wide availability of competing brands and the cyclical nature of product upgrades. Regulatory forces, favoring clean energy, are strongly pushing the market forward.

Segmentation Analysis

The Electric Ice Auger Market segmentation provides a granular view of product offerings and consumer purchasing behavior, focusing primarily on power source, battery chemistry, application, and distribution channels. Analyzing these segments is essential for manufacturers to tailor product specifications, pricing strategies, and marketing campaigns to specific end-user requirements. The segmentation highlights the market's evolution from simple battery-powered tools to highly specialized, efficient drilling systems designed for maximum performance in harsh environments, ensuring that both recreational anglers and commercial users find optimal solutions for their needs.

The market is predominantly segmented by the type of power source, with cordless lithium-ion models dominating due to their unmatched portability and energy efficiency. Application segmentation clearly distinguishes between the high-volume recreational sector, which demands ergonomic design and longevity, and the smaller but critical commercial and research sectors, which prioritize reliability, power, and precise hole quality. Understanding these divisions allows market players to allocate research and development resources effectively, ensuring competitive product differentiation in core demand areas, particularly enhancing battery life and reducing overall unit weight, which are universally appealing metrics across all segments.

Furthermore, the analysis of distribution channels reveals a growing reliance on digital platforms. While traditional specialty sporting goods stores remain vital for high-touch sales and expert advice, the increasing prevalence of online retail ensures geographical reach and enables direct-to-consumer models, optimizing supply chain efficiency. This multifaceted segmentation approach ensures a comprehensive understanding of market dynamics, enabling strategic decision-making in product development and geographical expansion initiatives.

- Segmentation by Power Source:

- Cordless Electric Augers (Dominant Segment)

- Corded Electric Augers (Niche applications, research labs)

- Hybrid Systems (Rare, typically interchangeable with power tool batteries)

- Segmentation by Battery Type:

- Lithium-ion (Li-ion) Batteries (Market Standard)

- Lead-Acid Batteries (Declining, found in older or budget models)

- Other Advanced Battery Chemistries (Emerging)

- Segmentation by Application:

- Recreational Fishing (Largest Segment)

- Commercial Ice Harvesting/Preparation

- Scientific Research (Environmental monitoring, safety checks)

- Segmentation by Distribution Channel:

- Online Retail (E-commerce platforms, Direct-to-Consumer)

- Specialty Sporting Goods Stores (Expert advice, high-value sales)

- Mass Merchandisers (Budget-friendly models)

Value Chain Analysis For Electric Ice Auger Market

The value chain for the Electric Ice Auger Market begins with upstream activities focused on the sourcing and manufacturing of critical components, specifically high-density lithium-ion cells, high-torque brushless DC motors, and lightweight yet durable composite materials for the auger shaft and cutting head. Supplier consolidation and long-term contracts for battery cells are vital given the high dependence on specific Asian manufacturers for reliable Li-ion technology. Efficient upstream management directly influences the final product cost and performance metrics such as power output and operational life, which are key determinants of market success.

Midstream activities involve core manufacturing, including motor winding, integration of advanced electronic controls (like BMS), final assembly, and stringent quality assurance testing, particularly for cold weather performance and structural integrity against impact. Vertical integration, where major players manufacture their own auger blades and shafts, is common to ensure proprietary designs and material consistency. Efficient manufacturing logistics minimize production lead times, crucial for managing the highly seasonal demand characteristic of this market.

Downstream analysis focuses on distribution and sales. The distribution channel is bifurcated into direct channels (manufacturer websites and branded stores) and indirect channels (specialty retailers, mass merchants, and e-commerce giants). Direct channels allow manufacturers greater control over branding and pricing, while indirect channels provide essential retail visibility and localized customer service. E-commerce platforms are increasingly important for geographical expansion and reaching younger, digitally savvy consumers, requiring manufacturers to invest heavily in robust online presence and efficient last-mile logistics for large, bulky items.

Electric Ice Auger Market Potential Customers

Potential customers for Electric Ice Augers are primarily defined by their engagement level in ice-based recreational and commercial activities and their preference for modern, sustainable equipment. The largest segment comprises serious recreational ice anglers (hobbyists who fish frequently and require high performance and reliability) and casual anglers (seeking simplicity, light weight, and affordability). These end-users prioritize portability, quiet operation, and the ability to drill multiple holes quickly without the hassle of fuel mixing or maintenance.

The second major category includes commercial operators, such as professional fishing guides, resort owners, and ice harvesting companies. These buyers demand heavy-duty, high-endurance equipment capable of continuous operation in severe conditions. They prioritize maximum torque, durable construction, and quick battery swap capabilities to minimize downtime, often purchasing multiple units and battery packs to support intensive commercial use throughout the season.

A smaller, yet significant, customer base consists of government agencies and scientific researchers. This segment includes environmental monitoring teams, fish and wildlife departments, and academic research institutions that require precise, non-polluting tools for sampling or data collection on frozen waterways. Their purchasing decisions are driven by accuracy, minimal environmental footprint, and specialized requirements, such as unique auger diameter sizes or depth gauges, valuing reliability over cost efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 million |

| Market Forecast in 2033 | USD 248.5 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | StrikeMaster, ION (Clam Outdoors), Eskimo (Ardisam), K-Drill, Jiffy Ice Drills, LandIce, Vexilar, Nils Master, Rapala, HT Enterprises, Northern Tool + Equipment, DeWalt, Milwaukee Tool, Makita, Clam Corporation, Otter Outdoors, Frabill, TH Marine, Cold Snap Outdoors, Shappell, Stealth, NERO, Toro, Husqvarna. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Ice Auger Market Key Technology Landscape

The technological landscape of the Electric Ice Auger Market is primarily defined by continuous innovation in three core areas: battery chemistry and management, motor design, and material science for cutting efficiency. The adoption of high-amperage, large-capacity lithium-ion battery packs, often 40V or 80V systems, is standard, replacing older, heavier 12V lead-acid batteries entirely in premium models. Manufacturers are heavily focused on developing sophisticated Battery Management Systems (BMS) that incorporate thermal regulation and optimized power output to maintain performance in sub-zero conditions, which is essential for user confidence and maximizing the number of holes drilled per charge cycle.

Motor technology advancement centers on the use of Brushless Direct Current (BLDC) motors. BLDC motors are preferred because they offer higher efficiency, increased longevity, reduced heat generation, and greater torque compared to traditional brushed motors, all while being maintenance-free. These motors are paired with high-ratio gearboxes designed to deliver maximum cutting power while minimizing battery drain. Furthermore, electronic speed control (ESC) systems are being integrated, allowing users to select optimal drilling speeds based on ice type and thickness, thereby conserving energy and reducing physical fatigue.

Material science plays a critical role in both the auger flighting and the cutting blades. Newer designs utilize composite materials and specialized alloy steels, often featuring anti-stick coatings to prevent ice accumulation on the shaft, which can significantly increase drag and battery usage. Blade geometry is meticulously engineered for rapid penetration and efficient ice removal, with replaceable chipper and shaver blades being standard. The future of this technology landscape involves integrating smart sensors for real-time diagnostics and linking these features via Bluetooth to mobile devices for performance monitoring and firmware updates, enhancing the overall user technology ecosystem.

Current technological innovations also address the modularity challenge. Several major power tool companies are entering the market by offering adapters or specialized auger attachments that utilize their existing consumer battery platforms (e.g., DeWalt, Milwaukee). This strategy drastically reduces the entry cost for existing tool owners, expanding the consumer base. This cross-platform compatibility forces traditional auger companies to innovate rapidly, ensuring their proprietary systems offer superior power, balance, and ice-specific performance features that generic tool platforms might lack, driving a competitive technological arms race focused on weight reduction and cold-weather resilience.

The integration of digital technology is another key trend. Modern electric augers often include digital displays indicating remaining battery life, drilling depth, and potential fault codes, enhancing user insight and control. Furthermore, research is ongoing into developing self-cleaning or anti-icing mechanisms that utilize passive thermal techniques or specialized surface treatments, ensuring consistent drilling efficiency even after prolonged use in wet or slushy conditions. This continuous focus on performance under extreme conditions solidifies the market's reliance on high-tech engineering solutions.

Regional Highlights

Regional analysis reveals that market dominance is concentrated in areas with established ice fishing traditions and expansive frozen water bodies, coupled with high consumer spending power and supportive environmental regulations. North America (U.S. and Canada) holds the largest market share due to its vast network of lakes and long, severe winters, fostering a robust and highly competitive outdoor recreation industry. Manufacturers here focus heavily on high-voltage systems (40V+) and durability to meet the demands of serious recreational and commercial anglers in Minnesota, Wisconsin, and the Canadian provinces.

Europe represents the second-largest market, led by the Nordic countries (Sweden, Finland, Norway) and Russia. This region demonstrates high adoption rates, primarily driven by strong environmental consciousness and a preference for low-noise, zero-emission outdoor equipment. European consumers often prioritize lighter weight and compact designs for easier handling and transport across large territories. Regulatory frameworks promoting sustainable outdoor practices further accelerate the displacement of gasoline models across the continent.

The Asia Pacific (APAC) region is an emerging market, currently holding a smaller share but showing high growth potential, particularly in northern territories of China, Japan, and South Korea, where winter tourism and recreational fishing activities are expanding. Market penetration in APAC is primarily constrained by lower consumer awareness and shorter ice seasons in many areas. However, as disposable incomes rise and interest in Western-style outdoor sports grows, manufacturers are beginning to tailor smaller, more affordable electric auger models specifically for these markets. The Middle East and Africa (MEA) and Latin America currently contribute negligibly to the global electric ice auger market due to unsuitable climate conditions.

- North America (U.S. and Canada): Market leader; driven by high participation rates in ice fishing, severe winter climate, and demand for high-performance, high-voltage (40V/80V) units.

- Europe (Nordics, Russia): Strong growth owing to environmental regulations, preference for low-noise operation, and high consumer expenditure on quality outdoor gear; focus on compact designs.

- Asia Pacific (Japan, South Korea, China): Emerging high-growth potential, driven by rising disposable incomes and expanding interest in winter recreational sports; focus on localized marketing and entry-level products.

- Latin America and MEA: Negligible market presence due to climatic unsuitability, with market activity limited to highly specialized, localized cold regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Ice Auger Market, highlighting their product portfolios, strategic initiatives, and market positioning.- StrikeMaster

- ION (Clam Outdoors)

- Eskimo (Ardisam)

- K-Drill

- Jiffy Ice Drills

- LandIce

- Vexilar

- Nils Master

- Rapala

- HT Enterprises

- Northern Tool + Equipment

- DeWalt (via specialized attachments)

- Milwaukee Tool (via specialized attachments)

- Makita (via specialized attachments)

- Clam Corporation

- Otter Outdoors

- Frabill

- TH Marine

- Cold Snap Outdoors

- Shappell

Frequently Asked Questions

Analyze common user questions about the Electric Ice Auger market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of electric ice augers over gasoline models?

Electric ice augers offer significant advantages including zero emissions, substantially reduced noise levels, instant push-button starting without priming or pull cords, and require minimal maintenance, eliminating the need to handle fuel or oil mixtures. They are also generally lighter and more convenient for transport.

How many holes can a typical lithium-ion electric auger drill on a single charge?

The number of holes depends heavily on the battery voltage (typically 40V to 80V), amp-hour capacity, ice thickness, and ice type. High-end 8-inch augers with a 5 Ah battery can typically drill 50 to 100 holes through 15-20 inches of ice, offering sufficient capacity for most full-day recreational fishing trips.

Does cold weather negatively affect the performance and battery life of electric ice augers?

Yes, extreme cold temperatures reduce the efficiency and capacity of standard lithium-ion batteries. However, leading manufacturers incorporate advanced Battery Management Systems (BMS) and specialized casing to mitigate this effect. Keeping the battery insulated or in a warm location until use is the best practice to maintain optimal performance.

What is the current trend regarding battery voltage in the electric ice auger market?

The market trend is decisively shifting towards higher voltage systems, primarily 40V and 80V. These higher voltage systems deliver the necessary torque and speed to efficiently cut thick, hard ice while increasing the overall number of holes possible per charge, effectively matching or exceeding gasoline power.

Are specialized power tool battery platforms compatible with high-performance ice augers?

Many major power tool companies (e.g., Milwaukee, DeWalt) offer specialized adapter kits or auger attachments that allow their high-capacity batteries to be used for ice drilling. While convenient, dedicated ice auger brands often argue that their proprietary motors and gear ratios are better optimized for the unique resistance encountered during ice drilling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager