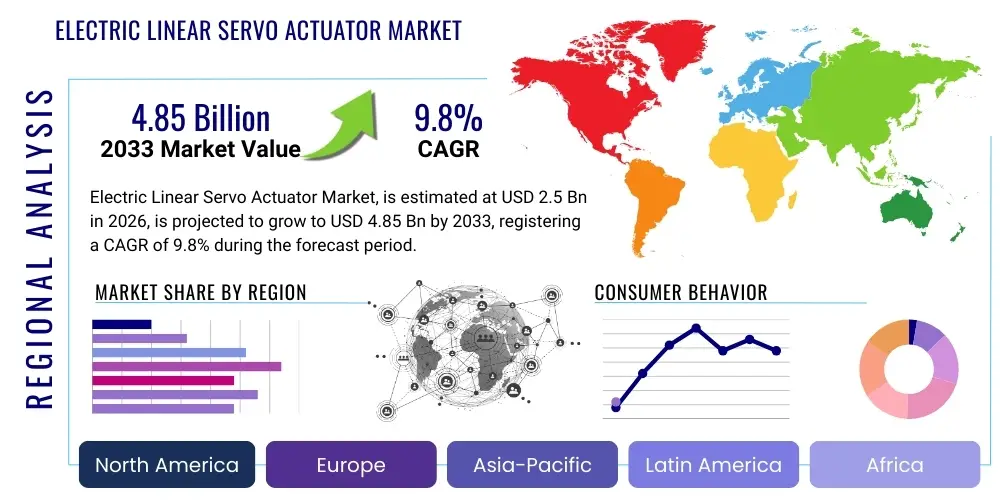

Electric Linear Servo Actuator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439145 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electric Linear Servo Actuator Market Size

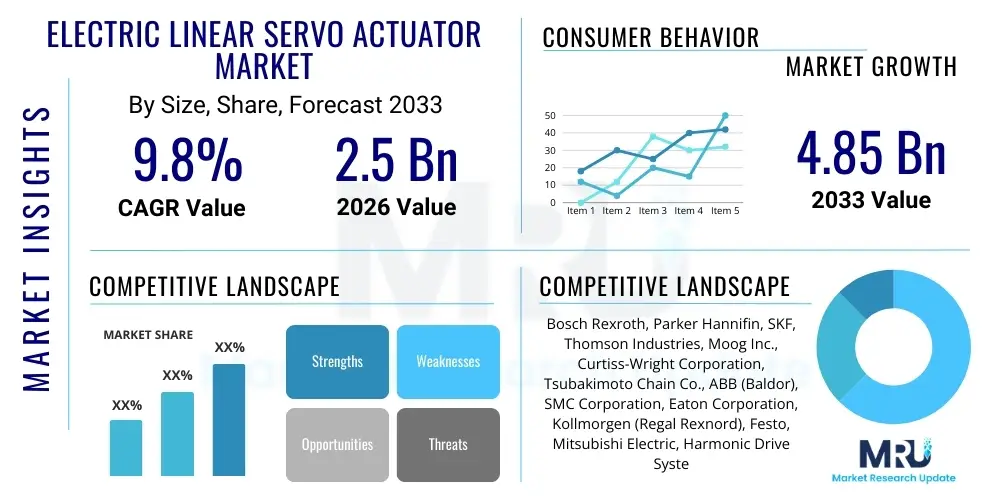

The Electric Linear Servo Actuator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.85 Billion by the end of the forecast period in 2033.

Electric Linear Servo Actuator Market introduction

Electric Linear Servo Actuators represent sophisticated electro-mechanical devices designed to convert rotational motion from a servo motor into precise linear motion, offering superior control over position, velocity, and force. Unlike traditional hydraulic or pneumatic systems, these actuators deliver high efficiency, repeatability, and closed-loop feedback capabilities, making them indispensable in applications requiring extreme accuracy and dynamic response. This technology integrates advanced servo control mechanisms, often utilizing ball screws, roller screws, or belt drives, housed within a compact structure, allowing for seamless integration into modern automated machinery.

The primary applications driving the adoption of electric linear servo actuators span across high-tech manufacturing, medical devices, automotive production, and packaging industries. In high-speed pick-and-place operations and robotic systems, their programmability and energy efficiency offer significant operational advantages, reducing maintenance burdens and improving throughput. Key benefits include enhanced precision and stiffness, reduced noise levels, cleanliness (absence of hydraulic fluids), and the ability to operate in complex, synchronized multi-axis systems, which is critical for Industry 4.0 environments.

Major driving factors fueling market expansion involve the global push toward factory automation and the pervasive implementation of smart manufacturing principles. Increased labor costs and the demand for higher quality assurance standards necessitate the replacement of manual processes or less accurate fluid power systems with reliable electric servo technology. Furthermore, the rapid growth in specialized fields like semiconductor manufacturing and clinical laboratory automation, where micron-level precision is essential, solidifies the market trajectory for these advanced linear motion solutions.

Electric Linear Servo Actuator Market Executive Summary

The Electric Linear Servo Actuator Market is currently experiencing robust growth, primarily driven by accelerated industrial automation trends across developed and emerging economies. Key business trends indicate a shift towards highly integrated systems, where actuators are equipped with embedded diagnostics and predictive maintenance capabilities, moving beyond simple mechanical function to becoming smart components within a larger industrial internet of things (IIoT) framework. Manufacturers are focusing on developing high-force density models and miniaturized actuators for specialized applications, such catering to the soaring demand from the electric vehicle (EV) production sector and sophisticated surgical robotics. Strategic partnerships focused on software integration and cybersecurity are becoming increasingly common among leading market players to offer holistic motion control packages rather than just hardware components.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, largely due to massive investments in manufacturing expansion, particularly in China, South Korea, and Japan, which house global hubs for automotive, electronics, and machinery production. North America and Europe maintain significant market shares, characterized by early adoption of high-end, customized solutions and stringent regulatory requirements that favor precise electric systems over traditional methods. These regions lead innovation in areas such as aerospace testing and clinical instrumentation, demanding actuators with specialized materials and extreme reliability specifications. The ongoing reshoring of manufacturing operations in Western nations, often accompanied by modernization initiatives, further stimulates demand for advanced servo actuators to achieve competitive efficiency.

Segment-wise, the market is segmented primarily by actuator type (e.g., Rod Style, Rodless Style), application (e.g., Robotics, Material Handling, Assembly), and end-use industry. The Rodless Actuator segment is witnessing significant traction due to its space-saving design and suitability for long-stroke applications in automated storage and retrieval systems (AS/RS). The end-use segments, particularly General Industrial Machinery and Automotive Manufacturing, remain the largest consumers, though the Medical and Healthcare segment is exhibiting the highest growth rate, fueled by the complex requirements of diagnostic equipment and precision drug delivery systems. The trend across all segments is a move toward higher speeds, increased load capacities relative to footprint, and tighter integration with fieldbus communication protocols like EtherCAT and PROFINET, streamlining industrial communication architectures.

AI Impact Analysis on Electric Linear Servo Actuator Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electric Linear Servo Actuator Market predominantly revolve around three core themes: predictive maintenance effectiveness, optimization of motion control algorithms, and the integration of autonomous decision-making in robotic applications. Users are concerned about how AI can extend actuator lifespan, reduce unscheduled downtime, and what level of computational power is being embedded at the edge (the actuator controller itself). The expectation is that AI will move actuators from reactive components to proactive, self-optimizing system elements, drastically improving Overall Equipment Effectiveness (OEE) and minimizing total cost of ownership (TCO).

The immediate impact of AI is centered on data analytics derived from actuator performance parameters such as motor current, temperature, vibration, and positioning error. Machine learning models analyze these vast datasets in real-time to detect subtle deviations indicative of mechanical wear, lubrication degradation, or component failure long before a catastrophic event occurs. This shifts maintenance strategy from time-based or reactive methods to highly accurate condition-based monitoring, maximizing uptime and optimizing parts inventory management. Furthermore, AI contributes significantly to complex trajectory planning in multi-axis robotic arms where servo actuators are crucial; deep reinforcement learning can be used to teach robots optimal paths, reducing cycle times and minimizing energy consumption during operation.

Looking forward, the influence of AI will enable true autonomy in manufacturing cells. Actuators equipped with enhanced controllers will utilize machine learning to instantaneously compensate for external disturbances, load variations, or changes in material properties without explicit reprogramming. This adaptive control capability is vital for industries like customized packaging and 3D printing where processes are highly variable. The integration of AI also standardizes the commissioning process; self-tuning algorithms allow actuators to automatically determine optimal PID parameters based on the mechanical load profile, drastically reducing setup time and the need for specialized engineering expertise, thereby accelerating market penetration into smaller enterprises.

- AI-driven Predictive Maintenance: Enhances monitoring of mechanical health (wear, friction, temperature) leading to maximized uptime and reduced component failure rates.

- Optimized Motion Control: Machine learning algorithms refine servo loop tuning and trajectory planning, yielding faster cycle times and improved energy efficiency.

- Autonomous System Adaptation: Actuators use AI to self-compensate for load changes and external disturbances in real-time, ensuring consistent precision.

- Simplified Commissioning: Self-tuning features utilizing AI reduce complex manual setup, allowing quicker deployment across various industrial environments.

- Data Integration and IIoT: AI processes large volumes of sensor data generated by actuators, integrating performance insights into broader plant-level dashboards for holistic OEE tracking.

DRO & Impact Forces Of Electric Linear Servo Actuator Market

The dynamics of the Electric Linear Servo Actuator market are shaped by a powerful confluence of driving forces stemming from industrial transformation, regulatory restraints concerning traditional power sources, and ample opportunities presented by emerging technological applications. The core driver is the pervasive global trend toward Industry 4.0, demanding connectivity, precision, and efficiency, which electric actuators inherently provide better than pneumatic or hydraulic counterparts. Conversely, the market faces significant restraints related to the initial high capital investment required for these sophisticated systems and the inherent complexity of integrating them into legacy manufacturing environments, demanding specialized engineering expertise. The competitive landscape is defined by the impact forces of product differentiation through specialized features such as extreme temperature operation and high-force capabilities, while the consistent push for miniaturization and cost reduction exerts ongoing pressure on manufacturers' profit margins and development cycles.

Drivers (D): The primary catalysts for growth include the increasing adoption of robotics and automated guided vehicles (AGVs) in material handling and assembly lines, where servo control is non-negotiable for synchronized movement. Furthermore, the stringent quality control standards mandated in highly regulated sectors, such as pharmaceutical production (requiring cleanroom operation) and semiconductor fabrication (requiring nano-scale precision), necessitate the use of electric servo technology. Energy efficiency mandates and sustainability goals worldwide also favor electric systems, which consume power only when motion is required, significantly reducing operational energy expenditures compared to continuously running hydraulic pumps or pneumatic compressors. The rising penetration of electric vehicles (EVs) creates a massive specialized demand for actuators used in battery manufacturing, welding, and high-precision inspection lines.

Restraints (R): Despite clear technological superiority, the high upfront cost of electric servo actuator systems—including the motor, controller, drive, and feedback mechanism—compared to basic pneumatic cylinders presents a substantial barrier to entry for Small and Medium Enterprises (SMEs). Technical complexity also acts as a restraint; integrating and programming multi-axis servo systems requires specialized training and expertise, which can be scarce, especially in developing regions. Furthermore, certain heavy-duty applications demanding exceptionally high force density, such as metal forging or extremely fast cycle times with significant inertia, still rely on hydraulic systems where electric actuators may require a significantly larger footprint or higher power consumption, limiting electric system applicability in niche high-force scenarios.

Opportunities (O): Significant growth opportunities exist in the burgeoning markets of specialized medical robotics, including surgical assistance and rehabilitation devices, which require silent, precise, and highly reliable linear motion. The proliferation of additive manufacturing (3D printing) systems demanding multi-axis, highly dynamic positioning control represents another major opportunity. Moreover, developing fully integrated, plug-and-play smart actuators with embedded intelligence and cloud connectivity provides manufacturers with a competitive edge, simplifying system integration and offering lucrative after-market service revenues derived from data analytics and condition monitoring subscriptions. The migration of oil and gas exploration equipment toward electric actuation for safer and more efficient operation also presents a long-term opportunity for robust, heavy-duty linear servo technology.

Impact Forces: The bargaining power of buyers is high, driven by the standardized nature of interfaces (e.g., motor mounts, communication protocols) and intense competition, compelling manufacturers to continually innovate on price and performance specifications. The threat of new entrants is moderate; while the core technology (servo motors and mechanics) is established, the expertise required for manufacturing high-precision roller screws and sophisticated closed-loop control algorithms creates a high barrier to entry. Supplier power is generally moderate, as component sourcing (magnets, bearings, electronics) is diversified, but specialized component suppliers for high-precision mechanics (e.g., planetary roller screw manufacturers) possess higher leverage. The threat of substitutes, primarily hydraulic and pneumatic systems, persists in low-precision, high-force, or low-cost applications, although electric superiority in precision segments is unchallenged. Technological innovation remains the defining force, constantly pushing performance envelopes concerning speed, force density, and miniaturization.

Segmentation Analysis

The Electric Linear Servo Actuator Market is comprehensively segmented based on mechanical design, operational characteristics, required power, and end-use application, allowing for targeted product development and strategic market penetration. Segmentation by actuator type is critical as it defines the functional capabilities, stroke length, and force characteristics, ranging from rod-style units designed for pushing and pulling heavy loads to compact rodless units optimized for lateral movement in restricted spaces. Further differentiation occurs based on the mechanism used for motion conversion, such as ball screws offering high efficiency and moderate speed, or roller screws providing exceptional force transmission and durability for demanding industrial cycles.

Analyzing the market through the lens of end-use industry segmentation reveals the sectors driving current demand and future innovation. The Automotive and Electronics industries, characterized by high-volume, repetitive assembly tasks, are foundational consumers, demanding highly reliable, fast actuators. Conversely, sectors like Aerospace and Defense, and Medical Devices, require actuators with stringent material specifications, extreme reliability under harsh conditions, and certifications for high-stakes, life-critical applications. This segmentation highlights the need for market players to tailor products not just technically, but also concerning compliance and lifecycle support.

The final significant segmentation criterion involves application type, such as material handling, general assembly, testing and simulation, and robotics. This segmentation illustrates the specific functional requirement fulfilled by the actuator, such as high-speed indexing in packaging (material handling) versus precise force control in pressing or testing (general assembly). Understanding these nuanced requirements is vital for manufacturers to allocate research and development resources effectively, focusing on enhancing features like environmental sealing (for washdown applications) or incorporating advanced fieldbus interfaces (for seamless integration into plant networks).

- By Type:

- Rod Style Linear Servo Actuators

- Rodless Linear Servo Actuators (Belt Driven, Screw Driven)

- Integrated Servo Actuators (Motor and drive embedded)

- By Mechanism:

- Ball Screw Actuators

- Roller Screw Actuators (Planetary, Inverted)

- Leadscrew Actuators (Lower speed/duty)

- Belt/Rack and Pinion Actuators

- By Force/Load Capacity:

- Low Force (Under 5 kN)

- Medium Force (5 kN to 20 kN)

- High Force (Above 20 kN)

- By End-Use Industry:

- Automotive Manufacturing

- Industrial Machinery & Robotics

- Packaging and Material Handling

- Medical and Healthcare

- Aerospace and Defense

- Electronics and Semiconductor

- Food and Beverage

- Testing, Simulation, and Lab Automation

Value Chain Analysis For Electric Linear Servo Actuator Market

The value chain for Electric Linear Servo Actuators begins with upstream activities focused on the procurement of highly specialized raw materials and precision components. This includes the acquisition of high-grade steel alloys for screws and rods, rare-earth magnets for servo motors, specialized bearings for load support, and advanced microprocessors and power semiconductors for the integrated drives and controllers. Key upstream suppliers include manufacturers of precision-machined mechanical components (roller screws, ball screws) and suppliers of advanced electronic components (encoders, resolvers, and drive electronics). The competitive advantage at this stage often lies in securing high-quality, reliable, and cost-effective mechanical and electronic inputs, which directly influence the final actuator’s performance and lifespan.

The core manufacturing stage involves design, assembly, and testing. Manufacturers invest heavily in R&D to optimize motor design (linear motors or rotary-to-linear conversion), thermal management, and dynamic control algorithms. Precision assembly, often performed in controlled environments, is critical for ensuring the longevity and accuracy of the screw mechanism. Downstream activities involve distribution, system integration, and end-user support. Distribution channels are typically segmented into direct sales (for large OEMs and customized solutions) and indirect sales through industrial distributors, value-added resellers (VARs), and system integrators who incorporate the actuators into complete automation solutions.

Direct distribution channels are prevalent for high-value, highly technical projects in sectors like aerospace or specialized robotics, allowing manufacturers to maintain tight control over quality and application engineering support. Indirect distribution, leveraging extensive distributor networks, facilitates penetration into the broad general automation market and provides localized support and inventory management for standard products. System integrators play a crucial role by bridging the gap between component manufacturing and complex end-user requirements, providing critical engineering, programming, and commissioning services. After-sales service, including predictive maintenance agreements and spare parts supply, constitutes a significant long-term revenue stream and is essential for customer retention in this capital equipment market.

Electric Linear Servo Actuator Market Potential Customers

Potential customers for Electric Linear Servo Actuators span virtually all sectors involved in automated manufacturing, precision handling, or high-stakes testing, driven by the need for enhanced control and repeatability. The largest consumption segments, acting as key buyers, are Original Equipment Manufacturers (OEMs) of industrial machinery, particularly those building automated packaging lines, CNC machine tools, and advanced assembly robots. These buyers prioritize integration ease, longevity, and adherence to specific industrial communication standards (e.g., EtherCAT compatibility) to minimize their time-to-market and maximize system reliability for their own end-users. Specialized OEMs in the medical field, developing laboratory automation platforms (e.g., automated liquid handlers) and diagnostic imaging equipment, represent high-value customers focused on certifications, cleanliness, and micron-level precision.

Beyond the OEM market, large multinational manufacturers across the automotive, aerospace, and food and beverage sectors constitute significant end-users who purchase actuators directly or through system integrators for retrofitting or expanding their existing production facilities. Automotive companies utilize these actuators extensively for welding, gluing, pressing, and critical testing procedures, demanding high durability and force capabilities. The increasing demand from the aerospace sector involves specialized applications in structural testing, flight simulation, and the precise assembly of composite materials, requiring custom-engineered, robust solutions that can withstand high duty cycles and variable environmental conditions.

Emerging buyers include small and medium-sized enterprises (SMEs) entering or upgrading their automation capabilities, particularly in regions where government incentives promote digitalization and manufacturing efficiency. While SMEs might be constrained by initial cost, the increasing availability of modular, lower-complexity integrated servo actuator solutions is making precision automation accessible. Finally, research institutions and universities represent crucial niche customers, utilizing these actuators in advanced R&D and simulation environments where the highest levels of programmable control and data feedback are essential for scientific experimentation and prototyping advanced technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.85 Billion |

| Growth Rate | CAGR 9.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, SKF, Thomson Industries, Moog Inc., Curtiss-Wright Corporation, Tsubakimoto Chain Co., ABB (Baldor), SMC Corporation, Eaton Corporation, Kollmorgen (Regal Rexnord), Festo, Mitsubishi Electric, Harmonic Drive Systems, Rollon Group, Tolomatic, Venture Manufacturing, HIWIN Corporation, Linak A/S, Duff-Norton. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Linear Servo Actuator Market Key Technology Landscape

The technological landscape of the Electric Linear Servo Actuator market is rapidly evolving, driven by the convergence of mechanical excellence and advanced digital control. A core technological advancement centers on the refinement of the motion conversion mechanisms, particularly the shift toward planetary roller screws. These mechanisms offer significantly higher load capacity, longer operational lifespan, and improved stiffness compared to traditional ball screws, making them ideal for high-duty cycle applications like robotic spot welding or heavy-duty pressing. Innovations in materials science also contribute, including the development of advanced coatings and self-lubricating components that enhance efficiency and reduce maintenance requirements, crucial for operation in harsh industrial environments or sensitive cleanrooms.

On the electronic and control side, the focus is heavily on integration and connectivity, aligning with IIoT standards. Modern actuators are increasingly supplied as integrated units, where the servo motor, drive, and control electronics are housed in a single, compact package. This integration simplifies wiring, reduces installation footprint, and minimizes electromagnetic interference (EMI). Key technological milestones include the adoption of high-speed industrial Ethernet communication protocols (such as EtherCAT, Sercos III, and PROFINET) which enable deterministic control and synchronization across multiple axes at microsecond precision. Furthermore, the integration of high-resolution absolute encoders (e.g., optical or magnetic) ensures precise position feedback even after power cycling, enhancing safety and operational accuracy.

Another area of intense technological focus is the optimization of thermal management and energy recovery. Advanced servo drives incorporate sophisticated power electronics (often based on Silicon Carbide or Gallium Nitride technology) to minimize heat generation and maximize efficiency. Regeneration capabilities allow the actuator to return energy to the power source during deceleration, significantly reducing overall system energy consumption in highly dynamic applications. The development of specialized linear motor actuators, which eliminate the need for rotary-to-linear conversion mechanics entirely, offers infinite life and superior speed capabilities, targeting ultra-high-speed, clean applications in sectors like semiconductor pick-and-place, albeit typically at lower force outputs compared to screw-based systems.

Regional Highlights

The global Electric Linear Servo Actuator market exhibits significant regional disparities in terms of maturity, growth drivers, and application focus. North America, encompassing the United States and Canada, represents a mature market characterized by early technology adoption, a strong focus on high-precision and highly customized solutions, and substantial demand from the aerospace, defense, and medical device sectors. The region’s growth is driven by manufacturing reshoring initiatives focused on high-automation processes and heavy investment in R&D, particularly concerning advanced robotics and specialized testing equipment. Actuators in North America often require compliance with rigorous quality and safety standards, favoring highly certified suppliers. The dominance of large integrators and sophisticated end-users means demand leans towards integrated smart actuators capable of complex diagnostics and predictive maintenance functionalities, facilitating compliance with stringent operational effectiveness metrics.

Europe, driven primarily by Germany, Italy, and Scandinavia, maintains a strong position owing to its robust industrial base in automotive, complex machinery, and advanced manufacturing (Industry 4.0). European manufacturers place a premium on energy efficiency and system durability, aligning with strict environmental regulations and long-term TCO optimization strategies. Germany, as a global leader in mechanical engineering and factory automation technology, acts as a major innovation hub, driving demand for actuators compliant with advanced fieldbus standards like PROFINET and Sercos. The region shows strong growth in automated logistics (warehousing and sorting systems) and the food and beverage industry, necessitating solutions with high Ingress Protection (IP) ratings for washdown environments. Market trends here emphasize modularity and interoperability across different manufacturers' platforms.

Asia Pacific (APAC) is currently the fastest-growing and largest market globally, propelled by immense manufacturing capacity expansion in China, South Korea, and Southeast Asian nations. China’s "Made in China 2025" strategy, focusing on upgrading manufacturing processes through automation and robotics, is the single largest driver of demand for medium-to-high force actuators in the electronics, general assembly, and rapidly expanding EV battery manufacturing sectors. While initial purchasing decisions in emerging APAC countries may be price-sensitive, there is a swift movement toward quality and precision, mirroring Western standards, particularly in high-tech zones in South Korea (semiconductors) and Japan (precision machinery). This region represents a massive volume market where local and international suppliers compete fiercely on cost-performance ratios, leading to accelerated technological transfer and localized production capabilities.

Latin America and the Middle East & Africa (MEA) represent emerging markets for electric servo actuators. In Latin America, demand is concentrated in the automotive manufacturing hubs (Brazil, Mexico) and the resource processing industries, often tied to modernization efforts funded by foreign direct investment. MEA exhibits nascent growth, predominantly in infrastructure projects and oil and gas sector modernization, where electric actuators are replacing older hydraulic equipment for improved efficiency and environmental compliance. These regions are characterized by reliance on imported technology and tend to prioritize robust, simple-to-maintain solutions. Growth here is dependent on stable economic conditions and continued industrialization, offering long-term potential for market penetration in basic industrial machinery and localized packaging operations, often utilizing standard, rather than highly customized, actuator models.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by China's manufacturing upgrade, semiconductor production (South Korea, Taiwan), and automotive/EV expansion. Focus on volume and rapid industrial robotics adoption.

- North America: Mature market; leader in high-precision, customized solutions for Aerospace, Defense, and Medical applications. Strong emphasis on IIoT integration and advanced diagnostics.

- Europe: High adoption driven by Industry 4.0 initiatives in Germany and Italy; strong demand from specialized machinery OEMs, focused on energy efficiency, precision engineering, and adherence to PROFINET/EtherCAT standards.

- Latin America: Emerging market; growth tied to automotive industry modernization (Mexico, Brazil) and general industrial automation upgrades. Price sensitivity often balances against the need for durable solutions.

- Middle East & Africa (MEA): Nascent market; driven by oil and gas sector automation, infrastructure investments, and increasing awareness of energy efficiency benefits in localized manufacturing operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Linear Servo Actuator Market.- Bosch Rexroth

- Parker Hannifin

- SKF

- Thomson Industries

- Moog Inc.

- Curtiss-Wright Corporation

- Tsubakimoto Chain Co.

- ABB (Baldor)

- SMC Corporation

- Eaton Corporation

- Kollmorgen (Regal Rexnord)

- Festo

- Mitsubishi Electric

- Harmonic Drive Systems

- Rollon Group

- Tolomatic

- Venture Manufacturing

- HIWIN Corporation

- Linak A/S

- Duff-Norton

Frequently Asked Questions

Analyze common user questions about the Electric Linear Servo Actuator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using an electric linear servo actuator over hydraulic or pneumatic systems?

The primary advantage is superior precision, repeatability, and programmability. Electric servo actuators offer closed-loop control over position, speed, and force, provide better energy efficiency, and are cleaner, eliminating the maintenance associated with fluid power systems, making them ideal for high-accuracy and cleanroom environments.

Which end-use industry is expected to show the highest growth rate for electric linear servo actuators?

The Medical and Healthcare sector is projected to exhibit the highest growth rate, driven by the increasing complexity of surgical robotics, diagnostic automation equipment, and rehabilitation devices that require high reliability, precise force control, and quiet operation for patient safety and clinical accuracy.

How does AI impact the lifespan and maintenance of linear servo actuators?

AI significantly enhances lifespan and maintenance through predictive maintenance. By analyzing real-time data (vibration, temperature, current), AI algorithms can anticipate mechanical failures, allowing for condition-based maintenance scheduling, reducing unplanned downtime, and optimizing operational cycles.

What are the key technological differentiators in the current servo actuator market?

Key technological differentiators include the use of planetary roller screws for higher load capacity and durability, integrated smart actuator designs (motor and drive in one unit), and the incorporation of high-speed industrial Ethernet protocols (like EtherCAT) for deterministic, synchronized multi-axis control.

Is the high initial cost of electric servo actuators still a major restraint for market adoption?

Yes, the high initial capital investment remains a significant restraint, particularly for small and medium-sized enterprises (SMEs). However, the superior energy efficiency, reduced long-term maintenance costs, and increased productivity typically provide a strong return on investment (ROI) over the actuator's extended lifecycle, mitigating the initial cost concern for many industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager