Electric Motor Testing System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431935 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Electric Motor Testing System Market Size

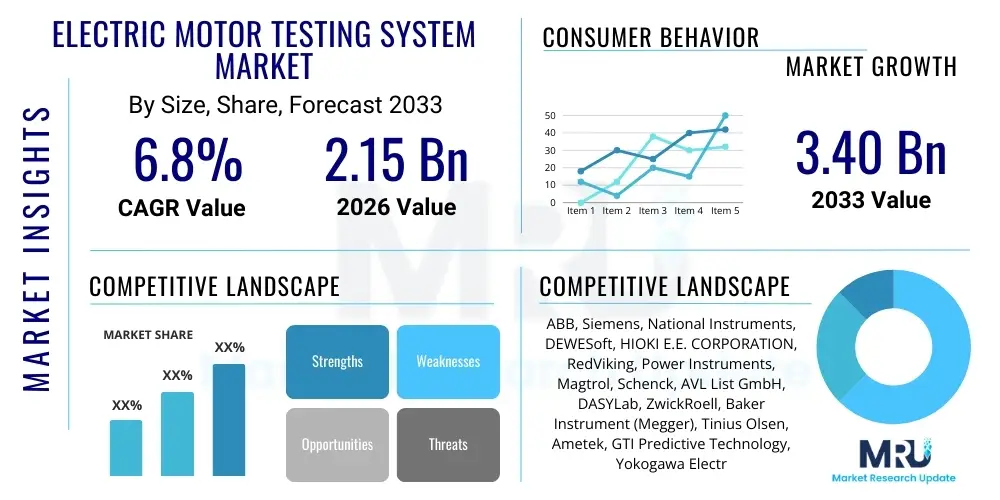

The Electric Motor Testing System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.15 Billion in 2026 and is projected to reach $3.40 Billion by the end of the forecast period in 2033.

Electric Motor Testing System Market introduction

The Electric Motor Testing System Market encompasses specialized equipment and software solutions designed to evaluate the performance, quality, and reliability of various types of electric motors, including AC, DC, synchronous, and asynchronous machines. These systems are crucial for validating manufacturing processes, ensuring compliance with industry standards, and performing failure analysis during maintenance cycles. The product description spans a range of sophisticated instrumentation, such as high-precision dynamometers for mechanical power measurement, surge testers for winding insulation integrity, and integrated systems capable of comprehensive stator and rotor analysis. Accuracy and repeatability are core functions of these systems, directly impacting the final quality and longevity of electric motors used across critical infrastructure and consumer goods.

Major applications of these testing systems are concentrated in high-growth sectors, notably automotive electrification, where rigorous testing of traction motors is mandatory for safety and efficiency, and industrial automation, where downtime due to motor failure is prohibitively expensive. Furthermore, the aerospace and defense industries utilize advanced testing equipment to certify mission-critical electric components under extreme environmental conditions. The increasing global focus on energy efficiency standards, driven by regulatory bodies, necessitates meticulous testing protocols, thereby driving demand for advanced testing solutions that can measure efficiency parameters like power factor and torque ripple with high fidelity.

Key benefits derived from implementing robust electric motor testing systems include enhanced product quality assurance, significant reduction in warranty claims, optimization of motor design, and streamlined maintenance schedules through predictive failure detection. Driving factors fueling market expansion include the exponential increase in electric vehicle (EV) production globally, the continuous integration of electric motors into diverse industrial machinery, and the trend toward Industry 4.0, which demands connected and highly accurate testing data for process optimization. The replacement cycle for outdated testing equipment with modern, digitized, and automated systems also contributes substantially to market growth, particularly in mature industrial economies.

Electric Motor Testing System Market Executive Summary

The Electric Motor Testing System Market is experiencing robust expansion, fundamentally underpinned by transformative business trends such as the pervasive adoption of Electric Vehicles (EVs) and the sustained push toward industrial automation and smart manufacturing practices. Business models are shifting towards integrated solutions combining hardware, specialized software for data analytics and reporting, and subscription services for predictive maintenance diagnostics. Manufacturers are increasingly seeking turnkey systems that offer non-destructive testing capabilities and seamless integration with production line Quality Control (QC) protocols, minimizing bottlenecks and maximizing throughput. Furthermore, globalization of manufacturing supply chains necessitates standardized testing procedures, driving demand for internationally compliant testing platforms.

Regionally, the market exhibits divergent growth trajectories. Asia Pacific (APAC) dominates the volume demand, primarily fueled by the massive automotive and industrial manufacturing bases in China, Japan, and South Korea, coupled with significant government investments supporting the EV infrastructure buildout. North America and Europe, while having lower manufacturing volume growth compared to APAC, lead in the adoption of high-precision, advanced diagnostic systems and research-intensive testing solutions, particularly those involving high-voltage testing protocols for heavy-duty commercial EVs and aerospace applications. Regulatory stringency regarding motor efficiency (e.g., IE4/IE5 standards) profoundly influences purchasing decisions across all regions, compelling manufacturers to invest in accurate efficiency testing equipment.

Segment trends reveal that the Dynamometers segment, particularly high-speed, high-torque regenerative dynamometers crucial for EV testing, commands a leading market share due to its foundational role in performance validation. The software and services segment is projected to experience the highest Compound Annual Growth Rate (CAGR), driven by the requirement for advanced data logging, machine learning (ML) integrated fault detection, and cloud-based data management services. Application-wise, the Automotive & Transportation sector remains the primary growth catalyst, followed closely by the Industrial Machinery segment, which is increasingly focused on integrating condition monitoring and in-situ testing capabilities to prevent unplanned operational outages across critical infrastructure such as pump stations and HVAC systems.

AI Impact Analysis on Electric Motor Testing System Market

User inquiries regarding AI's impact on electric motor testing predominantly revolve around automating complex diagnostic procedures, enhancing the accuracy of fault prediction beyond traditional spectral analysis, and reducing the dependency on highly specialized human expertise for interpreting multivariate test data. Common themes include the potential for AI algorithms to identify subtle, incipient failure modes that are currently missed by conventional tolerance checks, the integration of Machine Learning (ML) for optimizing motor design parameters based on real-world performance feedback, and the development of fully autonomous, self-calibrating testing environments. Users are highly concerned about data security and the necessary computational infrastructure required to deploy these sophisticated ML models effectively on production floors or in remote field testing environments.

The integration of Artificial Intelligence into Electric Motor Testing Systems is transitioning the industry from static quality assurance to proactive, predictive quality management. AI algorithms, particularly deep learning models, are being trained on vast datasets encompassing normal operation, various failure modes, and environmental variables. This allows the testing systems to move beyond simple pass/fail metrics, instead providing probability-based assessments of future motor longevity and recommending specific maintenance actions. This capability is invaluable in sectors like rail transportation and wind power generation, where operational continuity is paramount and failure diagnosis in the field is often challenging.

Furthermore, AI is instrumental in significantly optimizing the testing cycle itself. By learning optimal test parameters based on motor specifications and historical outcomes, AI systems can dynamically adjust voltage, load profiles, and duration, thereby accelerating the time-to-market for new motor designs while maintaining stringent quality control standards. This automated optimization reduces human error, improves repeatability, and allows test engineers to focus on interpreting high-level behavioral anomalies rather than managing routine data collection, resulting in substantial operational efficiencies and greater confidence in the quality of mass-produced motors.

- AI enables highly accurate predictive maintenance models by identifying subtle deviations in current signatures and vibration data.

- Machine Learning algorithms automate the interpretation of complex surge test waveforms, reducing diagnostic time and human expertise dependency.

- Generative AI assists in creating optimized synthetic test load profiles, mimicking diverse real-world operating conditions more effectively than standard fixed tests.

- AI integration supports autonomous calibration and self-correction in testing rigs, ensuring data integrity and minimizing downtime for system checks.

- Enhanced data analysis capabilities lead to iterative motor design improvements (Design for Quality) based on automated feedback loops from the testing floor.

- AI streamlines compliance and reporting by automatically correlating test results against global regulatory standards and generating comprehensive, audit-ready documentation.

DRO & Impact Forces Of Electric Motor Testing System Market

The Electric Motor Testing System Market is shaped by a confluence of powerful drivers (D), significant restraints (R), compelling opportunities (O), and dynamic impact forces. The primary drivers include the mandatory shift towards high-efficiency motors, accelerated by global climate initiatives and rising electricity costs, coupled with the phenomenal growth in the Electric Vehicle (EV) manufacturing ecosystem, demanding precise, high-speed testing solutions for traction motors and associated power electronics. These regulatory and technological imperatives compel continuous investment in state-of-the-art testing infrastructure across automotive OEMs and their Tier 1 suppliers. Furthermore, the relentless adoption of Industry 4.0 principles, integrating testing systems with centralized manufacturing execution systems (MES), increases the requirement for networked, real-time data acquisition and analysis tools.

However, the market faces notable restraints, particularly the high initial capital investment required for advanced testing systems, especially specialized dynamometers and high-voltage testing rigs necessary for aerospace or heavy-duty EV applications. This high cost often poses a barrier to entry for smaller manufacturers or independent repair shops. Another critical restraint involves the complexity and variability in international testing standards (e.g., IEC, NEMA, regional standards), which necessitate sophisticated systems capable of adapting to multiple protocol requirements, adding to the complexity of system design and operation. Additionally, a persistent shortage of highly skilled technicians trained to operate and maintain these complex, interconnected electro-mechanical and software systems limits the potential pace of adoption in certain emerging markets.

Opportunities abound, primarily driven by the ongoing shift towards non-destructive testing (NDT) methodologies, such as advanced partial discharge testing and specialized thermal analysis, offering greater insights without compromising product integrity. The burgeoning market for refurbished and remanufactured motors presents a substantial service opportunity for advanced diagnostic testing at repair centers. Furthermore, the development of cloud-based, centralized testing data platforms allows for global benchmarking and collaborative research, creating new revenue streams through software-as-a-service (SaaS) models focused on diagnostics and predictive analytics. The rapid expansion of specialized EV testing infrastructure, including battery simulation integration and complex transient testing requirements, represents a high-value niche market for solution providers.

The impact forces currently exerting the strongest influence include rapid technological obsolescence due to continuous innovation in motor design (e.g., Axial flux motors, Switched Reluctance Motors), forcing testing equipment vendors to constantly update their product lines. Regulatory forces, particularly the enforcement of stricter efficiency classes (IE5 and beyond), mandate higher measurement accuracy and expanded testing scope. Economic forces related to global supply chain volatility affect the pricing and availability of high-precision sensors and specialized electronic components necessary for system construction. Lastly, competitive forces push vendors towards vertical integration, offering complete end-to-end solutions that combine hardware, software, and consulting services to differentiate themselves in a crowded marketplace.

Segmentation Analysis

The Electric Motor Testing System Market segmentation provides a granular view of the diverse technologies, applications, and end-user requirements driving market dynamics. The primary segment classifications include the type of testing equipment (ranging from mechanical load simulation to electrical insulation analysis), the voltage level of the motors under test (Low, Medium, or High Voltage, critical for industrial and utility applications), the specific application sector, and the end-user profile. This structured breakdown is essential for vendors to target specific high-growth niches, such as the EV component testing segment or the specialized industrial repair segment. The intrinsic link between motor technology advancement and testing system sophistication ensures that segmentation remains dynamic, reflecting new product categories like specialized testing for Integrated Motor Assist (IMA) units and traction inverters.

The equipment Type segment, encompassing Dynamometers, Stator & Rotor testing equipment, and Partial Discharge testers, distinguishes testing methods based on whether they assess mechanical performance, electrical integrity, or winding health. Dynamometers, especially regenerative types capable of simulating real-world driving cycles, dominate value contribution due to their complexity and size. Conversely, Insulation Resistance and Surge Testers are high-volume products essential across all stages of motor manufacturing and maintenance. Furthermore, the Voltage segmentation reflects safety standards and power handling capabilities, with High Voltage (HV) testing systems being specialized tools required primarily by power generation utilities and major traction system manufacturers.

Analyzing the Application segment reveals strong demand heterogeneity. The Automotive sector requires high-speed and thermal testing capabilities, while the Industrial Machinery segment emphasizes continuous operational reliability and compatibility with standardized industrial protocols (e.g., EtherCAT). The Aerospace segment demands extreme precision and certified compliance, often involving customized test rigs designed for extreme altitude or temperature simulations. Understanding these varied requirements across different segments is crucial for strategic market positioning, ensuring that product development efforts align with the specific performance, regulatory, and budgetary constraints faced by different industrial verticals. The rapid evolution of motor technology requires testing systems to be inherently modular and scalable to accommodate future innovations effectively.

- By Type:

- Dynamometers (AC, DC, Eddy Current, Hysteresis, Regenerative)

- Stator & Rotor Testing Equipment (Core loss testers, Growlers, Bar-to-Bar resistance)

- Electrical Testing Equipment (Surge Testers, Insulation Resistance Testers, Winding Analyzers)

- Integrated Testing Systems (All-in-one test benches)

- Vibration and Noise Testing Systems

- Partial Discharge (PD) Testing Equipment

- By Voltage:

- Low Voltage (LV) Testing Systems (Up to 1 kV)

- Medium Voltage (MV) Testing Systems (1 kV to 35 kV)

- High Voltage (HV) Testing Systems (Above 35 kV, often used for utility-scale equipment)

- By Application:

- Automotive & Transportation (EV Traction Motors, Hybrid Systems)

- Industrial Machinery (Pumps, Compressors, Fans, Robotics)

- Aerospace & Defense (Actuators, Auxiliary Power Units)

- Power Generation (Turbine Generators, Wind Turbines)

- Consumer Electronics and Appliances (HVAC, White Goods)

- Research & Development and Education

- By End-User:

- Motor Manufacturers (OEMs and Tier 1 Suppliers)

- Repair & Service Centers (Motor winding and refurbishment shops)

- Component Suppliers and Integrators

- Independent Testing Laboratories

Value Chain Analysis For Electric Motor Testing System Market

The value chain for the Electric Motor Testing System Market begins with the highly specialized raw material and component sourcing phase, focusing on high-precision sensing technologies such as torque transducers, high-speed data acquisition boards, power analyzers, and specialized silicon carbide (SiC) and gallium nitride (GaN) power components necessary for modern regenerative test benches. Upstream analysis highlights the dependency on a concentrated group of global sensor manufacturers and specialized software developers providing proprietary calibration and analysis algorithms. Supply chain resilience in this segment is paramount, as disruptions in microchip or high-fidelity sensor supply can severely hamper the manufacturing timeline for integrated testing systems. The intellectual property associated with high-accuracy measurement and control systems forms a significant barrier to entry at this stage.

The core manufacturing and assembly phase involves the integration of mechanical components (like precision bearings and heavy-duty frame structures for dynamometers) with complex electrical systems and sophisticated software. System integrators play a crucial role here, customizing standard testing platforms to meet the unique specifications of large-scale motor manufacturers (e.g., specific torque-speed envelopes required for new EV models). Quality control and stringent calibration are integral steps, ensuring that the final testing system meets international traceability standards (e.g., ISO 17025). The transition towards modular, standardized components allows vendors to achieve economies of scale while retaining the flexibility required for customization, addressing the varied needs of industrial clients versus academic research centers.

Distribution channels in this market are predominantly direct for high-value, complex systems like large dynamometers, involving detailed consultation and installation support provided directly by the Original Equipment Manufacturer (OEM) or its certified local subsidiaries. This direct engagement ensures accurate specification matching and post-sales service integration. For standardized, lower-cost electrical testing equipment (e.g., surge testers), indirect channels utilizing technical distributors and specialized industrial sales representatives are common, leveraging their local market penetration and service networks. Downstream analysis focuses on installation, comprehensive training, ongoing software updates, and calibration services, which contribute significantly to the total revenue generated throughout the system’s lifecycle. The long-term service contract revenue is increasingly becoming a critical differentiator, especially with the introduction of complex, AI-enabled diagnostic software requiring continuous maintenance and updates.

Electric Motor Testing System Market Potential Customers

The primary end-users and buyers of Electric Motor Testing Systems are diversified across major industrial sectors but share a common imperative: verifying the performance, reliability, and regulatory compliance of rotating electrical machinery. Motor Manufacturers (OEMs), particularly those specializing in high-efficiency industrial motors (IE4/IE5), mass-market consumer appliance motors, and critical EV traction motors, represent the largest segment. These entities require high-throughput, automated, in-line testing systems to ensure every unit leaving the assembly line meets stringent specifications, often integrating these systems directly into their automated production processes for immediate feedback and quality gate enforcement.

A rapidly expanding customer base includes independent Motor Repair and Service Centers. As the installed base of industrial motors ages and the complexity of these motors increases (especially with VFD integration), sophisticated diagnostic tools capable of accurately locating winding faults, assessing insulation degradation, and verifying post-repair performance are becoming mandatory. These centers seek rugged, portable, and user-friendly testing equipment that facilitates quick, accurate field assessments and validates the quality of refurbishment work before reinstallation, thereby reducing service liabilities and increasing customer satisfaction through verified motor lifespan extension.

Furthermore, major industrial end-users, such as utility companies, petrochemical plants, and large-scale manufacturing facilities, serve as crucial customers, particularly for in-situ and condition monitoring testing solutions. These customers utilize the equipment, often integrated with Internet of Things (IoT) sensors and data platforms, not primarily for manufacturing, but for proactive asset management. Their purchasing criteria prioritize robustness, communication compatibility with existing plant control systems, and the ability to detect potential failures early to schedule maintenance precisely, minimizing catastrophic failures and maximizing operational uptime, highlighting the shift towards testing as a critical operational expense rather than purely a manufacturing quality cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion |

| Market Forecast in 2033 | $3.40 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, National Instruments, DEWESoft, HIOKI E.E. CORPORATION, RedViking, Power Instruments, Magtrol, Schenck, AVL List GmbH, DASYLab, ZwickRoell, Baker Instrument (Megger), Tinius Olsen, Ametek, GTI Predictive Technology, Yokogawa Electric, Votsch Industrietechnik, Sensor Technology, IMC Test & Measurement |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Motor Testing System Market Key Technology Landscape

The technology landscape of the Electric Motor Testing System Market is dominated by the convergence of high-precision mechanical load simulation and advanced electrical measurement techniques, heavily influenced by digital transformation. Modern systems utilize high-bandwidth data acquisition (DAQ) systems capable of simultaneous sampling across hundreds of channels, capturing data on torque, speed, vibration, temperature, current, and voltage with sub-microsecond precision. The shift from traditional absorption dynamometers to highly sophisticated, energy-recovering regenerative dynamometers is a critical technological trend, particularly in EV testing, as it allows power generated by the motor during braking simulations to be fed back into the grid, offering significant operational cost savings and sustainability benefits in high-volume testing facilities.

Electrical testing technologies have advanced significantly with the integration of complex waveform analysis algorithms. Key technological components include high-frequency surge testers (up to 40 kV) that accurately detect inter-turn winding faults and specialized partial discharge (PD) testing equipment that assesses insulation quality under simulated operating stresses. These PD testers are becoming vital for motors operating with Variable Frequency Drives (VFDs) where rapid voltage transients can accelerate insulation aging. Furthermore, the development of non-contact testing methods, such as advanced magnetic flux sensing and acoustic emission monitoring, provides reliable in-situ diagnostics without requiring the motor to be shut down or disassembled, enhancing the capabilities of continuous condition monitoring systems.

Software and networking represent the technological backbone enabling the transition to smart testing. Modern test systems incorporate modular software architectures allowing seamless integration of hardware components from different vendors. This software includes specialized Power Analyzer modules for accurate efficiency calculations, sophisticated data management platforms for cloud storage and collaborative analysis, and embedded Artificial Intelligence (AI) and Machine Learning (ML) toolkits for automated anomaly detection and reporting. Connectivity standards, leveraging industrial Ethernet protocols like EtherCAT and PROFINET, ensure high-speed, reliable communication between the test rig, the motor under test, and the centralized Manufacturing Execution System (MES), crucial for achieving the closed-loop quality control required in Industry 4.0 environments.

Regional Highlights

The regional analysis showcases the varying maturity and growth drivers across different geographical segments, highlighting distinct investment patterns in electric motor testing capabilities.

- Asia Pacific (APAC): Dominates the global market both in volume and installed base, primarily driven by China's colossal electric vehicle production targets and expansive industrial machinery manufacturing sector. South Korea and Japan are leaders in high-end precision motor manufacturing (e.g., robotics and premium automotive components), driving demand for sophisticated R&D and quality control testing systems. Government subsidies and favorable regulatory environments supporting new energy vehicles (NEVs) further accelerate investment in large-scale test facilities, particularly focusing on regenerative systems and high-throughput automated testing lines.

- North America: Characterized by high technological maturity and a strong focus on niche, high-value applications such as aerospace, heavy-duty commercial EVs, and specialized defense equipment. The US market demands extremely rigorous compliance and high-accuracy testing (e.g., certified calibration standards). There is significant adoption of integrated software solutions and AI-driven diagnostic platforms, driven by the push towards efficient factory operations and minimizing liabilities associated with high-stakes motor failures in critical infrastructure.

- Europe: Exhibits strong demand driven by stringent EU energy efficiency mandates (Ecodesign Directive) and a powerful commitment to automotive electrification, particularly within Germany, France, and the Nordic countries. The region is a pioneer in standardized testing protocols and is leading the adoption of modular and flexible testing systems suitable for small batch high-mix production. European manufacturers often prioritize long-term system reliability and adherence to safety norms, fostering a robust market for sophisticated Partial Discharge and insulation testing equipment.

- Latin America (LATAM): Represents an emerging market with growth tied to industrial modernization projects, particularly in Brazil and Mexico, focusing on upgrading aging industrial infrastructure with energy-efficient motors. Demand is typically cost-sensitive, leaning towards robust, reliable, and slightly less automated testing systems, but increasing adoption of predictive maintenance solutions in the mining and oil and gas sectors drives gradual demand for specialized portable testing gear.

- Middle East and Africa (MEA): Growth is primarily linked to large-scale infrastructure and industrial development projects, particularly in the GCC countries (Saudi Arabia, UAE) in the energy, petrochemical, and water desalination sectors. The demand centers around heavy-duty motors and associated testing equipment capable of withstanding harsh operating environments (high temperatures, dust). The adoption of condition monitoring testing systems for critical assets is a key area of investment for ensuring operational resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Motor Testing System Market.- ABB

- Siemens

- National Instruments

- DEWESoft

- HIOKI E.E. CORPORATION

- RedViking

- Power Instruments

- Magtrol

- Schenck

- AVL List GmbH

- DASYLab

- ZwickRoell

- Baker Instrument (Megger)

- Tinius Olsen

- Ametek

- GTI Predictive Technology

- Yokogawa Electric

- Votsch Industrietechnik

- Sensor Technology

- IMC Test & Measurement

Frequently Asked Questions

Analyze common user questions about the Electric Motor Testing System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-speed dynamometers in the current market?

The primary driver is the global proliferation of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). High-speed dynamometers are essential for simulating real-world driving cycles, measuring the torque, speed, and efficiency performance of EV traction motors under high-dynamic conditions, which require specialized high-frequency testing capabilities.

How is Industry 4.0 influencing the design and functionality of electric motor testing systems?

Industry 4.0 demands connectivity, automation, and data integration. It influences system design by requiring highly automated, networked testing platforms that can communicate seamlessly with Manufacturing Execution Systems (MES) and utilize cloud-based data analytics and AI for predictive fault detection and closed-loop process control.

What are the critical challenges associated with testing high-voltage motors used in utility and large industrial applications?

Critical challenges include ensuring operator safety during high-voltage surge and partial discharge testing, managing the increased energy dissipation during load testing, and maintaining extremely precise measurement accuracy across large voltage and power ranges, necessitating specialized shielding and robust insulation analysis equipment.

Which segment of the electric motor testing system market is expected to demonstrate the fastest growth over the forecast period?

The Software and Services segment is projected to show the fastest growth. This acceleration is driven by the increasing need for advanced data processing, centralized data management, specialized AI-enabled diagnostic algorithms, and predictive maintenance subscription models, moving testing systems beyond just hardware functionality.

Why is Partial Discharge (PD) testing becoming mandatory for modern industrial motors?

PD testing is crucial because modern motors are frequently controlled by Variable Frequency Drives (VFDs) that introduce high-frequency voltage spikes (transients). These transients accelerate the degradation of winding insulation, and PD testing is the most effective non-destructive method to detect and quantify incipient insulation failure before catastrophic operational failure occurs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager