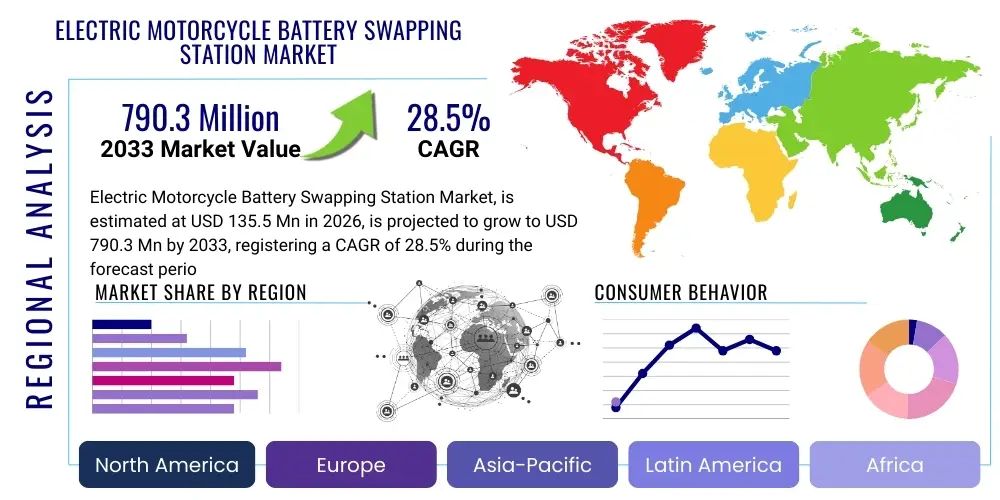

Electric Motorcycle Battery Swapping Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437162 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Electric Motorcycle Battery Swapping Station Market Size

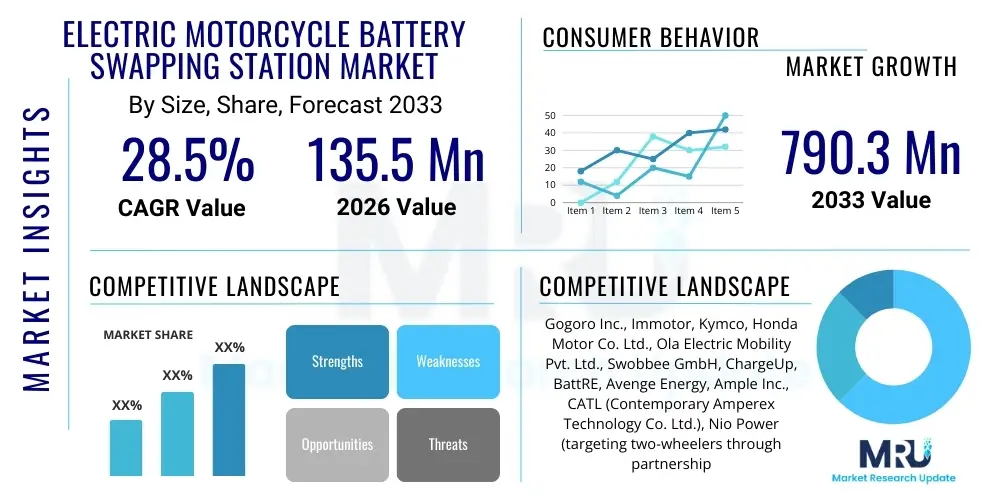

The Electric Motorcycle Battery Swapping Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 135.5 million in 2026 and is projected to reach USD 790.3 million by the end of the forecast period in 2033.

Electric Motorcycle Battery Swapping Station Market introduction

The Electric Motorcycle Battery Swapping Station Market is defined by the infrastructure and service networks designed to facilitate the rapid exchange of depleted electric vehicle (EV) batteries for fully charged counterparts, primarily targeting two-wheeled vehicles such as electric motorcycles and scooters. This infrastructure solution directly addresses the critical limitations associated with traditional EV charging, namely range anxiety and prolonged charging times, which are significant impediments to mass EV adoption in dense urban environments, particularly across Asia-Pacific economies where two-wheelers dominate personal transportation. The fundamental product involves standardized battery packs, automated or semi-automated swapping cabinets, sophisticated battery management systems (BMS), and connected IT platforms that manage inventory, payment processing, and battery health diagnostics.

Major applications for battery swapping stations span urban logistics, last-mile delivery services, and personal commuting, offering unparalleled convenience and operational efficiency for high-utilization fleets. For commercial operators, the ability to execute a full "refuel" in under two minutes translates into maximized vehicle uptime and optimized fleet management schedules. Furthermore, the concept supports grid stabilization efforts by allowing station operators to strategically manage charging cycles off-peak, turning the battery storage network into a distributed energy resource (DER). The market development is intrinsically linked to establishing widely accepted industry standards for battery dimensions, voltage, and communication protocols, minimizing friction for both manufacturers and consumers.

Key benefits driving market expansion include substantial time savings compared to traditional charging, reduced capital expenditure for individual vehicle owners (as the battery cost is often excluded and bundled into a subscription service), and enhanced safety through centralized battery monitoring and maintenance. The primary driving factor remains stringent government regulations promoting zero-emission mobility and offering significant financial incentives and subsidies for developing swapping infrastructure, particularly in high-density markets like China, India, and Southeast Asia. The standardization initiatives led by industry consortia and regulatory bodies are pivotal for accelerating infrastructure rollout and ensuring interoperability across different vehicle brands.

- Product Description: Infrastructure network facilitating rapid exchange of depleted standardized EV batteries for electric motorcycles and scooters.

- Major Applications: Last-mile delivery, urban logistics fleets, personal commuting, and shared mobility services.

- Benefits: Elimination of range anxiety, charging time reduction to under two minutes, lower total cost of ownership (TCO) for consumers.

- Driving Factors: Government incentives, regulatory push for standardization, rapid urbanization, and high utilization rates of commercial fleets.

Electric Motorcycle Battery Swapping Station Market Executive Summary

The Electric Motorcycle Battery Swapping Station Market is experiencing robust acceleration, fueled by the imperative to decarbonize urban transportation and overcome the infrastructure constraints of slow charging. Current business trends indicate a strong move toward third-party interoperable networks, moving away from closed-loop systems proprietary to single Original Equipment Manufacturers (OEMs). Strategic partnerships between energy companies, technology providers (IoT/AI), and traditional motorcycle manufacturers are defining the competitive landscape, aiming to establish dense network coverage in megacities. Furthermore, the model is shifting towards a 'Battery as a Service' (BaaS) subscription structure, separating the vehicle and battery ownership, which lowers the entry barrier for consumers and ensures superior battery lifecycle management by the service providers.

Regional trends highlight the undeniable dominance of the Asia Pacific (APAC) region, driven primarily by regulatory mandates and enormous existing two-wheeler populations in countries like India, China, and Indonesia. These nations are treating battery swapping as a national priority infrastructure project, leading to rapid deployment and policy support for standardization. Europe and North America, while having slower initial adoption rates due to lower motorcycle usage relative to cars, are focusing on niche applications, such as professional courier services and utility fleet management, leveraging high-efficiency urban hubs. The Middle East and Africa (MEA) are emerging as growth pockets, particularly in shared mobility sectors and areas lacking robust fixed charging infrastructure, offering battery swapping as a resilient, flexible alternative.

Segment trends underscore the supremacy of the Automated Swapping Station segment, which offers reliability, security, and integration with digital payment and inventory systems, critical for high-volume commercial use. Service providers are increasingly categorized into vehicle OEMs (offering integrated solutions) and independent third-party operators (focusing on interoperability across brands). The segment focused on electric scooters and mopeds currently captures the largest market share, given their high volume in APAC and their primary use in dense urban centers, making short-distance rapid swapping highly valuable. Future growth is anticipated in heavy-duty electric motorcycles used for logistics, once standardization accommodates higher energy density packs.

- Business Trends: Shift towards interoperable, multi-OEM battery networks and robust 'Battery as a Service' (BaaS) subscription models.

- Regional Trends: APAC maintains market leadership due to massive two-wheeler base and strong governmental support; nascent growth in high-utilization European and North American fleets.

- Segments Trends: Automated stations dominate technological advancement; focus on standardized battery packs suitable for commercial electric scooters/mopeds.

AI Impact Analysis on Electric Motorcycle Battery Swapping Station Market

User queries regarding AI in the battery swapping market primarily center on optimization, efficiency, and safety. Common questions explore how AI can ensure that fully charged batteries are available exactly where and when they are needed (demand forecasting), how it optimizes the complex logistics of redistributing batteries (fleet management), and how AI monitors the health and safety of individual battery packs to prevent failures or degradation. These concerns reflect a recognition that the success of swapping networks relies not just on physical infrastructure but on intelligent, real-time management of thousands of geographically dispersed assets.

The key themes emerging from this analysis confirm that Artificial Intelligence and Machine Learning (ML) are foundational technologies transforming battery swapping from a simple infrastructure deployment into a sophisticated, optimized energy service. AI algorithms are crucial for dynamic network planning, utilizing real-time telematics data, historical usage patterns, and external variables like weather or local events to predict micro-level demand fluctuations across a city. This predictive capability minimizes instances of station downtime due to empty inventories and prevents unnecessary energy costs incurred from overcharging batteries in low-demand areas. Furthermore, AI enables dynamic pricing models, adjusting subscription rates or swapping fees based on current network load and time of day, thereby incentivizing efficient consumer behavior and smoothing peak demand across the energy grid.

AI's role extends significantly into battery life cycle management and safety assurance. Machine learning models analyze charging and discharging profiles, temperature anomalies, and impedance data for every single battery pack in the network. By identifying subtle deviations indicative of potential cell degradation or thermal runaway risks far earlier than standard BMS, AI enhances overall fleet safety, prolongs asset life, and optimizes charging strategies to slow down capacity fade. This data-driven approach is essential for maintaining the financial viability of the BaaS model, where the lifespan and reliability of the battery asset pool directly impact profitability and user trust in the service provided.

- Demand Forecasting: AI models predict swapping needs based on historical data, traffic patterns, and events, optimizing inventory distribution across stations.

- Network Optimization: Real-time routing algorithms minimize logistics costs for transporting depleted batteries to charging hubs and charged batteries back to high-demand stations.

- Predictive Maintenance: ML analyzes battery health indicators (BMS data) to identify and flag degraded or unsafe battery packs before critical failure occurs, improving safety and asset utilization.

- Dynamic Pricing: AI adjusts swapping fees based on current network congestion, time-of-day tariffs, and battery state-of-charge, balancing demand and supply.

- Energy Management: Optimizing the bulk charging schedule of centralized hubs to leverage off-peak electricity prices and participate in vehicle-to-grid (V2G) services.

DRO & Impact Forces Of Electric Motorcycle Battery Swapping Station Market

The market is predominantly influenced by strong governmental support and the inherent efficiency advantages of swapping over plug-in charging, counterbalanced by complex technical standardization issues and high upfront capital expenditure requirements. Drivers include national mandates for electric vehicle adoption, particularly in densely populated urban centers, coupled with significant subsidies targeting infrastructure development and fleet electrification. The rapid proliferation of last-mile delivery services globally, which depend heavily on maximizing vehicle uptime, acts as a commercial accelerator. These powerful drivers emphasize convenience and operational continuity, making swapping a highly attractive proposition for commercial fleets seeking guaranteed turnaround times.

Restraints primarily revolve around technological fragmentation and economic hurdles. The lack of a universally accepted, mandatory standard for battery sizes, connectors, and communication protocols complicates interoperability, forcing consumers and operators to commit to specific proprietary networks, thereby limiting market competition and consumer choice. Furthermore, the high initial capital investment required for automated swapping stations, specialized battery packs, and sophisticated back-end charging infrastructure represents a substantial barrier to entry for smaller players. Safety concerns related to handling and transporting high-density lithium-ion batteries also necessitate stringent regulatory compliance and advanced thermal management systems, adding to the operational complexity and cost.

Opportunities for market growth lie in strategic industry consolidation, technological innovation in battery chemistries (e.g., solid-state batteries), and geographical expansion into previously untapped rural and semi-urban markets where grid infrastructure is unreliable. Establishing robust partnerships between automotive OEMs, utility companies, and third-party logistics firms can create synergistic value chains, accelerating network deployment and acceptance. The development of modular, multi-chemistry compatible swapping stations presents a significant opportunity to future-proof investments against evolving battery technology. The primary impact force is regulatory alignment; successful regional markets are those where governments have effectively mandated or strongly incentivized technical standardization, thus unlocking mass infrastructure investment and consumer confidence.

Segmentation Analysis

The Electric Motorcycle Battery Swapping Station Market is meticulously segmented based on the operational technology of the station, the type of entity providing the service, and the category of two-wheeler being served. This segmentation allows stakeholders to target infrastructure development and service offerings precisely to specific user needs, optimizing capital deployment and maximizing operational efficiency. The structure of the market reflects the diverse needs ranging from high-volume, automated services required by logistics fleets to simpler, manual stations suitable for smaller, local operations or emerging markets with lower labor costs. Understanding these segments is critical for developing tailored business strategies, whether focusing on technological integration or mass-market deployment.

The segmentation by Station Type—Automated vs. Manual—highlights the technological disparity in market offerings. Automated stations, leveraging robotics and advanced IoT systems, cater to reliability and high throughput, dominating established and technologically advanced markets. Conversely, the segmentation by Service Provider—OEMs vs. Third-Party Operators—defines the competitive boundaries, with third-party providers often leading the charge toward true interoperability, thus appealing to a wider customer base. The most commercially significant segmentation remains Vehicle Type, where the sheer volume of electric scooters and mopeds across Asia dictates segment size, although high-performance electric motorcycles represent a segment with growing revenue potential due to higher battery capacity requirements and usage patterns.

Strategic analysis of these segments reveals that future growth will be concentrated in Automated Stations managed by Third-Party Operators who achieve brand-agnostic compatibility. This combination offers scalability and standardization, attracting larger governmental or municipal contracts aimed at comprehensive urban electrification. Furthermore, while scooters form the base load, advancements in battery energy density will likely drive the adoption of swapping for larger, higher-powered electric motorcycles used in specific commercial roles, gradually diversifying the revenue base of swapping service providers across the globe, moving beyond just light-duty commuter vehicles.

- Station Type: Automated Swapping Station, Manual Swapping Station.

- Service Provider: Original Equipment Manufacturers (OEMs), Third-Party Service Providers.

- Vehicle Type: Electric Scooters and Mopeds, Electric Motorcycles.

Value Chain Analysis For Electric Motorcycle Battery Swapping Station Market

The value chain for the Electric Motorcycle Battery Swapping Station Market is complex and highly integrated, stretching from raw material sourcing for battery manufacturing to the end-user logistics and data monetization. The upstream segment involves the suppliers of critical components, including lithium-ion cell manufacturers, battery pack assemblers, and providers of Battery Management Systems (BMS) and thermal management systems. Robust quality control and cost efficiency in this upstream segment are crucial, as the standardized battery pack is the central, high-value asset in the entire ecosystem. Key strategic partnerships at this stage focus on securing long-term supplies of high-quality, high-energy-density cells.

Midstream activities primarily encompass the development, deployment, and operation of the swapping infrastructure itself. This includes the manufacturers of the swapping cabinets (hardware providers), the system integrators responsible for IT and communication infrastructure (telematics, cloud platforms, AI optimization), and the logistics firms that manage the transportation and redistribution of charged/depleted batteries between the swapping station and centralized charging hubs. The distribution channel is bifurcated into direct channels, where OEMs deploy proprietary stations primarily for their own vehicle sales, and indirect channels, where third-party service providers offer open-standard swapping services through partnerships with municipalities, gas stations, or local retail chains. Indirect distribution channels are gaining traction due to their potential for faster network saturation.

Downstream activities focus on the end-user experience and service monetization. This involves direct interaction with customers through mobile applications for station location, payment processing, and subscription management (BaaS). Key elements here include customer relationship management (CRM), securing fleet contracts (especially with last-mile logistics providers), and data monetization, where anonymized usage data is utilized for future network planning and sold to third-party entities for urban planning insights. Successful players in the downstream segment focus relentlessly on network reliability, accessibility, and integrating value-added services such as guaranteed battery health maintenance and flexible subscription tiers to secure customer loyalty and high utilization rates.

Electric Motorcycle Battery Swapping Station Market Potential Customers

The primary customer base for the Electric Motorcycle Battery Swapping Station Market consists of entities and individuals whose operational efficiency and daily mileage are critically dependent on rapid energy replenishment. The most significant segment of end-users are commercial fleet operators, particularly those involved in last-mile delivery services, food delivery, and e-commerce logistics. For these businesses, the economic viability of their operations hinges on maximizing vehicle uptime and minimizing driver waiting times, making the two-minute battery swap highly attractive compared to hours of charging. These B2B customers typically sign large-volume, long-term BaaS contracts, providing stable revenue streams for infrastructure providers and driving the need for dense, high-throughput station networks.

Another crucial customer segment includes shared mobility providers and rental services that operate fleets of electric scooters and motorcycles in urban centers. Companies offering short-term rentals require constant operational readiness, often necessitating on-demand battery swaps managed by dedicated logistics teams or utilizing public swapping networks. The convenience and standardized access offered by swapping networks reduce the internal operational burden of managing diverse charging requirements, allowing these providers to scale their services rapidly across different urban areas. Geographic density and standardization are paramount for attracting and retaining these fleet customers who seek reliability above all else.

Individual commuters, especially those living in high-rise apartments or urban areas lacking private parking or easy access to fixed charging points, represent the substantial consumer segment. For these buyers, the swapping model effectively decouples vehicle purchase from battery purchase, dramatically lowering the upfront cost of the EV and replacing it with a predictable, usage-based subscription fee. This structure addresses both range anxiety and charging inconvenience, significantly lowering the barrier to entry for personal EV adoption. Targeting this segment requires high visibility, extensive network coverage near residential and commercial hubs, and straightforward mobile application integration for ease of use and payment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 135.5 million |

| Market Forecast in 2033 | USD 790.3 million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gogoro Inc., Immotor, Kymco, Honda Motor Co. Ltd., Ola Electric Mobility Pvt. Ltd., Swobbee GmbH, ChargeUp, BattRE, Avenge Energy, Ample Inc., CATL (Contemporary Amperex Technology Co. Ltd.), Nio Power (targeting two-wheelers through partnerships), Hero MotoCorp, Bounce Infinity, Vingroup (VinFast), Yadea Group Holdings Ltd., Suzuki Motor Corporation, Yamaha Motor Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Motorcycle Battery Swapping Station Market Key Technology Landscape

The technological landscape of the Electric Motorcycle Battery Swapping Station Market is defined by the convergence of robust hardware and sophisticated digital intelligence required to manage dispersed high-value assets efficiently. Central to the hardware is the Battery Management System (BMS), which is integrated into every swappable pack. Modern BMS units must not only monitor State of Charge (SOC) and State of Health (SOH) but also communicate real-time thermal data securely to the swapping station and centralized monitoring platforms. This integration requires standardized communication protocols and connectors designed to withstand repeated mechanical insertions and withdrawals, ensuring reliability and long-term durability in high-utilization environments.

Furthermore, IoT (Internet of Things) and telematics are essential for the operation of the swapping network. Every swapping cabinet is an IoT device, equipped with sensors, cameras, authentication mechanisms (RFID, QR codes, or facial recognition), and network connectivity (4G/5G) to report inventory levels, transaction data, and physical security status instantaneously. This real-time data stream feeds into the central cloud platform where advanced analytics and AI algorithms perform demand forecasting and logistics optimization. Secure payment gateways and robust authentication are also paramount, ensuring that the expensive battery asset is only exchanged with authorized users who have an active subscription or verified payment method, thereby mitigating theft and misuse risks.

Innovations in charging technology and cooling systems are also defining the competitive edge. Central charging hubs increasingly utilize smart charging technology that optimizes energy intake based on grid prices and battery chemistry specifications, enhancing asset longevity. Advanced thermal management within both the battery pack and the swapping cabinet (often involving liquid or phase-change materials) is critical, particularly in tropical climates prevalent in key APAC markets, to maintain optimal battery performance and safety during both charging and swapping processes. The move toward modular battery designs that can stack or adapt to varying vehicle power needs, while adhering to core standardization parameters, represents the next frontier in hardware flexibility.

Regional Highlights

The Electric Motorcycle Battery Swapping Station Market exhibits profound regional variations in terms of adoption pace, regulatory framework, and technological preference. Asia Pacific (APAC) stands as the undisputed global leader, accounting for the vast majority of deployed stations and transaction volumes. This dominance is intrinsically linked to the immense volume of two-wheelers used for daily commuting and commercial logistics across markets like China (where government support is heavy), Taiwan (home to pioneers like Gogoro), and India (which has launched national policies promoting battery swapping as a standardized solution). Infrastructure providers in APAC focus heavily on ultra-dense networks and high-throughput automated stations to handle the sheer scale of demand.

Europe represents a niche but rapidly expanding market, driven by environmental mandates and the popularity of electric mopeds and shared scooter services in major cities such as Paris, Berlin, and London. European market growth is characterized by a strong emphasis on sustainability and adherence to stringent safety and quality standards (e.g., CE marking). While network density is currently lower than in APAC, the market is highly receptive to innovative business models like BaaS, and regulatory efforts are underway to establish common technical standards that facilitate cross-border interoperability, particularly targeting professional delivery fleets and public transport integration zones. Providers here often seek synergies with existing energy and utility infrastructure.

North America, characterized by lower general two-wheeler adoption compared to APAC, sees the battery swapping model primarily applied to highly specific commercial use cases, such as specialized urban logistics or postal services. The market remains fragmented, with pilot projects focusing on testing feasibility and utility grid integration capabilities. While overall growth is slower, there is significant interest from utility companies viewing swappable batteries as potential decentralized energy storage assets, creating opportunities for large-scale B2B partnerships focused on energy resilience and load balancing rather than purely consumer convenience. Standardization efforts, influenced by global trends, are crucial for future scalability in this region.

- Asia Pacific (APAC): Dominant market driven by regulatory mandates, extensive existing two-wheeler population, and leadership from countries like China, India, and Taiwan. Focus on density and volume.

- Europe: Emerging market focused on shared mobility, last-mile logistics, and stringent safety standards. Growth tied to European Union environmental directives and standardization efforts.

- North America: Nascent market focused on niche commercial applications and exploring the integration of battery swapping networks with utility smart grid programs for energy storage.

- Latin America and MEA: Significant opportunity in areas with poor charging infrastructure reliability; high growth potential in rapidly urbanizing regions adopting shared mobility solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Motorcycle Battery Swapping Station Market.- Gogoro Inc.

- Immotor

- Kymco

- Honda Motor Co. Ltd.

- Ola Electric Mobility Pvt. Ltd.

- Swobbee GmbH

- ChargeUp

- BattRE

- Avenge Energy

- Ample Inc.

- CATL (Contemporary Amperex Technology Co. Ltd.)

- Nio Power

- Hero MotoCorp

- Bounce Infinity

- Vingroup (VinFast)

- Yadea Group Holdings Ltd.

- Suzuki Motor Corporation

- Yamaha Motor Co., Ltd.

- Sun Mobility

- Lithium Urban Technologies

Frequently Asked Questions

Analyze common user questions about the Electric Motorcycle Battery Swapping Station market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Battery as a Service (BaaS) and how does it affect ownership costs?

Battery as a Service (BaaS) is a business model where the customer purchases the electric motorcycle without owning the battery, instead paying a regular subscription fee for access to the battery swapping network. This significantly lowers the upfront purchase price of the EV and shifts battery maintenance and degradation risks to the service provider, resulting in a lower Total Cost of Ownership (TCO) for the user.

Is there a global standard for electric motorcycle battery swapping?

Currently, there is no single global standard, leading to proprietary systems (like Gogoro's) and regional consortia efforts (like those in India and Japan) attempting to mandate interoperability. Lack of universal standardization remains a primary challenge, but industry and regulatory bodies are actively working towards establishing open standards to accelerate market scaling and consumer choice.

How quickly can a battery be swapped at a typical station?

The process of swapping a depleted battery for a fully charged one at a modern, automated swapping station typically takes less than two minutes. This rapid turnaround time is the core value proposition of the system, crucial for maximizing operational efficiency for commercial fleets and eliminating the long waiting periods associated with conventional charging.

What role does AI play in optimizing the swapping station network?

AI is essential for network optimization, primarily through sophisticated demand forecasting, which predicts exactly where and when batteries will be needed based on real-time data and historical patterns. AI also manages logistics routing for battery redistribution and performs predictive maintenance on battery packs to ensure optimal health and safety across the entire asset fleet.

Which region currently dominates the Electric Motorcycle Battery Swapping Station Market?

The Asia Pacific (APAC) region currently dominates the market. This leadership is driven by the massive existing two-wheeler market, rapid urbanization, strong government subsidies, and regulatory push for EV adoption in major economies such as China, India, and Taiwan, where battery swapping is viewed as a critical public infrastructure solution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager