Electric Order Pickers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438373 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electric Order Pickers Market Size

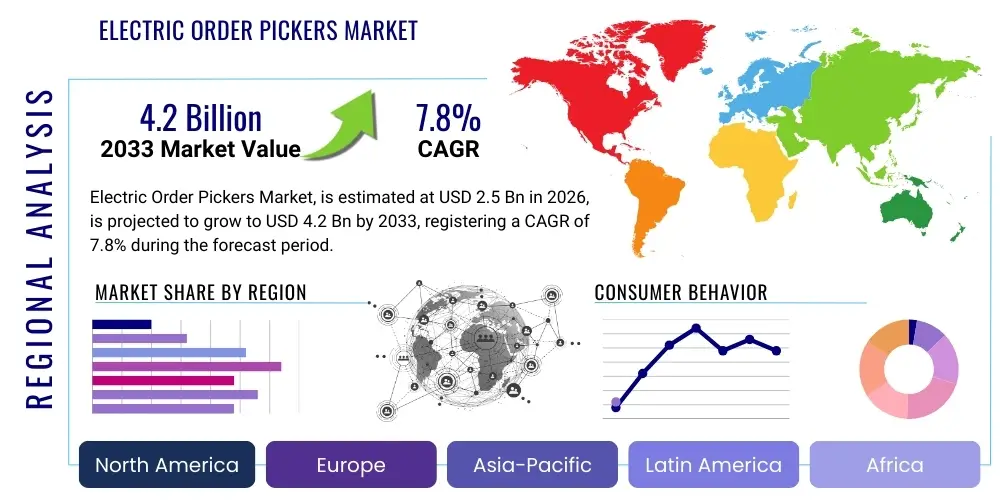

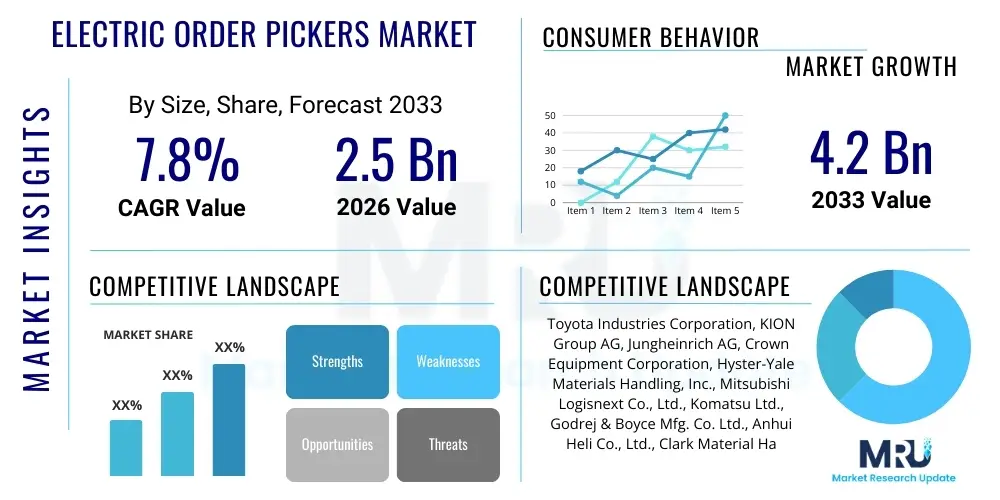

The Electric Order Pickers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033.

The substantial growth trajectory is underpinned by the accelerated development of e-commerce infrastructure globally, requiring advanced, efficient, and reliable material handling solutions within modern warehousing and distribution centers. Electric order pickers are vital components in optimizing intralogistics processes, particularly for high-density storage and selective retrieval operations. Their electric nature offers significant operational advantages, including lower running costs, reduced carbon footprint, and suitability for indoor environments where strict air quality regulations prevail.

Furthermore, increased automation mandates across various industrial sectors, coupled with mounting labor challenges in logistics, propel the demand for specialized equipment that maximizes pick efficiency and worker safety. The continuous technological integration, such as enhanced battery technologies (e.g., Li-ion) and sophisticated telematics systems, enhances the productivity and lifespan of these machines, making them a preferred investment over traditional internal combustion engine counterparts. Market expansion is also facilitated by supportive government policies in key regions aimed at promoting industrial electrification and sustainable logistics practices.

Electric Order Pickers Market introduction

The Electric Order Pickers Market encompasses the design, manufacturing, distribution, and utilization of specialized electric-powered material handling equipment engineered specifically for retrieving inventory items stored in racking systems. These machines, essential in modern warehousing, are categorized based on lifting height and operator positioning, primarily including low-level, mid-level, and high-level order pickers. The primary function is to elevate an operator to the required height to manually or semi-automatically retrieve products (cases, pieces, or items) from storage locations, facilitating fulfillment processes in e-commerce, retail, manufacturing, and third-party logistics (3PL) operations. Their design emphasizes maneuverability, energy efficiency, and ergonomic safety, critical factors for maximizing throughput in high-volume environments.

Key applications span diverse sectors, heavily concentrated in fast-moving consumer goods (FMCG), automotive parts distribution, pharmaceutical warehousing, and general merchandise retail. The core benefit derived from deploying electric order pickers is the substantial improvement in order accuracy and picking speed compared to manual methods utilizing rolling ladders or general forklifts. Driving factors for market acceleration include the exponential growth of online retail necessitating rapid fulfillment capabilities, the global shift towards electrifying warehouse fleets to meet sustainability goals, and advancements in automation technologies, such as integration with warehouse management systems (WMS) for optimized routing and task assignment. Moreover, the increasing complexity of SKU diversity requires flexible picking solutions that electric order pickers inherently provide.

The technological evolution within this segment, particularly regarding lithium-ion battery integration, has mitigated previous concerns related to operational downtime and charging infrastructure, making electric models even more attractive economically. The combination of regulatory pushes for cleaner industrial operations and the intrinsic need for operational efficiency positions electric order pickers as a critical investment for businesses aiming to maintain a competitive edge in the rapidly evolving logistics landscape. Manufacturers are increasingly focusing on telematics and safety features, such as proximity sensors and integrated weighing scales, further driving the adoption rates across mature and emerging economies.

Electric Order Pickers Market Executive Summary

The Electric Order Pickers Market is characterized by robust business trends driven by digitalization in logistics and the imperative for supply chain resilience. Key business trends include aggressive mergers and acquisitions among major material handling equipment suppliers to consolidate technology portfolios, particularly in autonomous navigation and energy storage. The shift from outright purchase models to leasing and rental agreements is gaining momentum, offering greater financial flexibility to end-users, especially smaller and mid-sized enterprises. Furthermore, there is a pronounced move towards offering integrated fleet management solutions, incorporating predictive maintenance analytics and utilization reports, transforming the product offering from a mere piece of equipment to a comprehensive intralogistics service package. Sustainability metrics are becoming integral to procurement decisions, favoring manufacturers who can demonstrate reduced environmental impact across the product lifecycle.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market due to rapid industrialization, massive investments in e-commerce infrastructure (particularly in China and India), and the establishment of large-scale manufacturing hubs requiring specialized warehousing equipment. North America and Europe, while mature, are focusing on fleet replacement cycles, driven by strict emissions standards and the adoption of advanced lithium-ion technologies to enhance productivity and reduce total cost of ownership. European regulations promoting worker safety and ergonomic design are pushing innovations in cabin design and control systems. Conversely, Latin America and the Middle East and Africa (MEA) are seeing steady growth, primarily fueled by urbanization and the expansion of modern retail distribution networks, often adopting slightly older or lower-cost models but rapidly moving toward high-level pickers for dense storage utilization.

Segment trends highlight the dominance of the low-level order picker segment in terms of volume, catering to fast-moving items handled near the ground, though the high-level picker segment is experiencing the highest growth rate due to the increasing adoption of very narrow aisle (VNA) and vertical storage solutions maximizing cubic utilization. Technology-wise, the lithium-ion battery segment is rapidly displacing traditional lead-acid batteries due to their superior lifespan, rapid charging capabilities, and zero maintenance requirements, fundamentally changing operational planning by minimizing battery swapping needs. The integration of semi-autonomous features, such as guided navigation systems, further distinguishes high-end segments, catering to highly automated fulfillment centers demanding precision and speed beyond human capacity.

AI Impact Analysis on Electric Order Pickers Market

User inquiries concerning AI's influence on the Electric Order Pickers Market frequently revolve around three core themes: operational optimization, predictive maintenance capabilities, and the path toward full autonomy. Users are keen to understand how AI algorithms can revolutionize picking routes, minimizing travel time and maximizing efficiency in dynamic warehouse environments. There is significant concern regarding the integration complexity and the required level of infrastructure upgrade (e.g., enhanced sensor arrays and connectivity) needed to support AI-driven decision-making. Expectations are high that AI will lead to machines capable of self-diagnosing faults, predicting component failures long before they occur, thereby slashing unplanned downtime and maintenance costs. Furthermore, the role of AI in safety—preventing collisions and ensuring ergonomic compliance for human operators in mixed-fleet environments—is a major point of interest. The consensus expectation is that AI will transition order pickers from manually operated machines to intelligent, context-aware assets within the smart warehouse ecosystem.

The deployment of machine learning models allows electric order pickers to analyze real-time data streams from WMS and onboard sensors, optimizing complex picking missions that traditional heuristic algorithms struggle with. This involves dynamic slotting, wave planning, and adaptive route generation that accounts for traffic congestion, priority orders, and operator performance. For instance, AI can learn peak picking times and automatically adjust speed restrictions or assign specific zones to available human operators based on skill levels and current fatigue metrics. This level of granular control dramatically boosts throughput, particularly during seasonal surges like the peak holiday shopping season, where minor delays can cascade into significant backlogs.

The most profound long-term impact of AI is its role in enabling truly autonomous order picking. While full autonomy is complex due to the variability and tactile nature of piece-picking tasks, AI is currently driving semi-autonomous functions, such as automated horizontal travel between picks and precise vertical positioning. This incremental automation reduces operator fatigue and allows them to focus solely on the high-value task of manual item selection and verification. The predictive capabilities extend to energy management, where AI models optimize charging schedules based on predicted workload and grid availability, maximizing battery life and ensuring continuous fleet readiness, thus transforming fleet management from reactive scheduling to proactive resource allocation.

- AI-Driven Route Optimization: Reduces travel distance and time by 15-25% through dynamic pathfinding algorithms based on current order queues and warehouse traffic density.

- Predictive Maintenance Analytics: Utilizes machine learning to forecast component wear and failure (e.g., motor strain, hydraulic leaks), cutting unplanned downtime by up to 40%.

- Autonomous Navigation and Positioning: Enables semi-autonomous functions, including automated horizontal travel and precise lift synchronization, enhancing picking accuracy and speed.

- Enhanced Safety Protocols: AI algorithms analyze real-time sensor data to detect potential collision risks with personnel or other equipment, dynamically slowing or stopping the machine.

- Intelligent Energy Management: Optimizes battery charging cycles based on anticipated workload, maximizing battery lifespan and minimizing peak demand charges.

- Ergonomic Monitoring and Operator Assistance: Tracks operator movements and fatigue levels, suggesting breaks or adjusting task assignments to improve safety and long-term productivity.

DRO & Impact Forces Of Electric Order Pickers Market

The market dynamics for Electric Order Pickers are shaped by a powerful confluence of drivers, restraints, and opportunities (DRO), which collectively define the impact forces influencing strategic decision-making across the industry. The primary drivers are rooted in the explosion of e-commerce, which mandates higher throughput and precision in fulfillment operations, alongside rigorous global sustainability mandates pushing companies away from fossil fuel-powered material handling equipment. However, significant restraints exist, notably the substantial initial capital investment required for electric fleets and the infrastructure needed to support advanced battery technologies, posing adoption challenges for small and medium enterprises. The major opportunity lies in integrating these pickers into fully automated systems (Warehouse Automation 4.0), utilizing their electric nature for seamless integration with smart grid technology and data analytics platforms.

Impact forces are strongest concerning regulatory shifts and technological leaps. Government incentives and taxation schemes favoring electric vehicles in logistics act as a major positive impact force, accelerating fleet conversion, especially in Europe and North America. Conversely, the high cost and complexity associated with advanced lithium-ion batteries and complex fleet management software introduce a negative impact force, potentially slowing the adoption rate among budget-constrained buyers. The continuous innovation in sensor technology, coupled with decreasing costs of processing power, positively impacts the market by making semi-autonomous and fully connected pickers economically viable, thereby increasing their value proposition in labor-intensive markets.

The market equilibrium is also impacted by the competition from alternative automation solutions, such as Automated Storage and Retrieval Systems (AS/RS) and Goods-to-Person (GTP) robots, which serve similar fulfillment needs but eliminate human intervention entirely. While GTP systems offer high density and throughput, they often lack the flexibility required for highly variable SKU inventories or non-standardized picking tasks, thus maintaining a defined space for operator-driven electric order pickers. Strategic alliances between equipment manufacturers and software providers (WMS/WES vendors) are crucial for mitigating restraints related to complexity and maximizing the opportunities presented by Industry 4.0 integration, ensuring that these machines remain central to human-centric automation strategies.

Segmentation Analysis

The Electric Order Pickers Market is highly fragmented and segmented based on operational characteristics, lift height capabilities, battery technology utilized, and the primary application sector. Analyzing these segments is essential for understanding purchasing behaviors and technological adoption trends across different geographical and industrial landscapes. The segmentation based on lift height—low-level, mid-level, and high-level—directly correlates with warehouse design and storage strategy; low-level pickers dominate markets focused on bulk picking and fast movers, while high-level pickers are crucial for modern, tall, narrow-aisle warehouses maximizing vertical storage space. The technology split, particularly between lead-acid and lithium-ion batteries, reflects the ongoing transition toward higher efficiency and reduced maintenance requirements across all segments.

Further segmentation by application highlights the dependency of market growth on sectors experiencing massive inventory fluctuations and demanding high throughput, primarily e-commerce and 3PL services. These sectors prioritize performance, connectivity, and reliability, driving demand for premium, technologically advanced pickers with integrated telematics. In contrast, manufacturing and wholesale distribution often favor rugged, durable models where operational uptime and longevity are prioritized over sheer speed, sometimes still relying on established, albeit less efficient, battery technologies for cost control. The market's complexity necessitates that vendors offer a modular and customizable product portfolio capable of meeting the varied and specific demands of diverse end-user operational profiles.

The differentiation across segments is also increasingly influenced by ergonomics and safety features, particularly in mature Western markets where labor regulations are stringent. The introduction of specific models designed for freezer or cold-storage applications represents a niche, yet vital, segmentation catering to the growing grocery and pharmaceutical cold chain logistics. These specialized segments require robust construction materials and enhanced battery performance to cope with extreme temperatures. Overall, the movement towards standardization in warehouse dimensions globally, coupled with the increasing emphasis on worker productivity and safety, continually refined the existing segments, ensuring that manufacturers innovate across the entire product line rather than focusing solely on high-end models.

- By Operating Level:

- Low-Level Order Pickers (Up to 1.5 meters)

- Mid-Level Order Pickers (1.5 meters to 5 meters)

- High-Level Order Pickers (Above 5 meters, often VNA guided)

- By Battery Type:

- Lead-Acid Batteries

- Lithium-Ion Batteries

- Other Advanced Batteries (e.g., Fuel Cells, though nascent)

- By Rated Load Capacity:

- Light Duty (Up to 1000 kg)

- Medium Duty (1000 kg – 2000 kg)

- Heavy Duty (Above 2000 kg)

- By End-User Industry:

- E-commerce and Retail

- Third-Party Logistics (3PL)

- Manufacturing and Automotive

- Food & Beverage (Including Cold Chain)

- Pharmaceuticals and Healthcare

- Wholesale Distribution

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Electric Order Pickers Market

The Value Chain for the Electric Order Pickers Market begins with the upstream segment, dominated by the procurement of essential raw materials and core components. Key upstream activities involve the sourcing of specialized steel for chassis construction, high-grade polymers for ergonomic components and casings, and, critically, advanced electronic components such as microprocessors, sensors, and controllers necessary for steering, lifting, and communication functions. The most strategically important upstream supply chain element is the battery manufacturing segment, particularly suppliers specializing in high-density lithium-ion cells. Dependencies on specific regions for these critical battery components can introduce supply chain risks, compelling major Original Equipment Manufacturers (OEMs) to forge long-term strategic supply agreements or pursue vertical integration to secure component supply and quality control.

The core manufacturing and assembly stage involves design engineering focused on safety, efficiency, and ergonomics, followed by large-scale production in highly automated facilities. Following assembly, the downstream segment encompasses distribution, sales, and comprehensive after-sales support. Distribution channels are typically a mix of direct sales forces handling key accounts (large 3PLs, major retailers) and an extensive network of independent dealer partners responsible for localized sales, service, and rentals. The success of the downstream segment relies heavily on the dealer network's capability to provide expert consultation, rapid deployment, and proficient maintenance services, ensuring minimal operational disruption for end-users. Aftermarket services, including spare parts supply and training, represent a high-margin revenue stream crucial for overall profitability.

Direct channels offer better control over pricing and customer relationship management, often utilized for highly customized or large fleet orders. Indirect distribution through dealerships provides broader market reach, crucial for penetrating regional markets and servicing smaller customers who require local expertise. The overall value chain is transitioning towards service-centricity; the focus is shifting from simply selling a machine to providing an integrated fleet solution (e.g., telematics, preventative maintenance contracts, and operational consulting). This shift emphasizes the importance of data integration throughout the chain, linking usage patterns collected downstream back to upstream design and manufacturing improvements, thereby creating a highly responsive and circular value chain structure focused on Total Cost of Ownership (TCO) reduction for the end-user.

Electric Order Pickers Market Potential Customers

Potential customers, or end-users/buyers, of Electric Order Pickers are concentrated primarily in sectors characterized by high inventory turnover, stringent fulfillment deadlines, and complex SKU management requiring reliable material handling at various vertical levels. The largest and fastest-growing segment of buyers is the e-commerce and retail distribution sector, which operates high-volume fulfillment centers and micro-fulfillment centers. These entities require both low-level pickers for floor-level item retrieval (e.g., in flow racks) and high-level pickers for maximizing vertical cubic storage, especially as they strive to optimize real estate utilization in dense urban areas. The increasing consumer demand for next-day or same-day delivery mandates investment in highly efficient and often semi-automated picking solutions.

Third-Party Logistics (3PL) providers constitute another critical customer base. 3PLs manage complex warehousing and distribution tasks for multiple clients across various industries (pharmaceuticals, apparel, automotive), demanding flexibility and scalability from their fleet. Their purchasing decisions are highly influenced by asset utilization rates and TCO, favoring models with high energy efficiency (lithium-ion) and robust telematics for fleet management optimization across multiple client operations. The rental and leasing market, which 3PLs often utilize, also represents a significant avenue for manufacturers, providing scalable fleet capacity without major capital expenditure.

Beyond logistics specialists, the manufacturing and automotive sectors are significant consumers. Automobile assembly plants, for instance, utilize order pickers extensively in sub-assembly areas and component warehouses (kitting operations) to ensure timely delivery of parts to the production line (Just-In-Time processes). Pharmaceuticals and food & beverage industries, especially those dealing with cold chain logistics, represent specialized potential customers who require order pickers built to withstand temperature extremes and adhere to strict hygiene standards. These buyers prioritize reliability and compliance, driving demand for specialized, high-specification equipment rather than general-purpose models, underscoring the necessity for sector-specific product development and certification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyota Industries Corporation, KION Group AG, Jungheinrich AG, Crown Equipment Corporation, Hyster-Yale Materials Handling, Inc., Mitsubishi Logisnext Co., Ltd., Komatsu Ltd., Godrej & Boyce Mfg. Co. Ltd., Anhui Heli Co., Ltd., Clark Material Handling Company, EP Equipment, Doosan Corporation Industrial Vehicle, Linde Material Handling (KION Group), Still GmbH (KION Group), Hangcha Group Co., Ltd., ZHEJIANG NOBLELIFT EQUIPMENT JOINT STOCK CO., LTD., Palfinger AG, TVH Group, Lonking Holdings Limited, Rocla Oy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Order Pickers Market Key Technology Landscape

The technology landscape of the Electric Order Pickers Market is rapidly evolving, driven primarily by advancements in power sources, connectivity, and autonomous capabilities. The definitive shift away from traditional lead-acid batteries toward Lithium-ion (Li-ion) technology represents the most crucial development. Li-ion batteries offer significant operational benefits, including maintenance-free operation, consistent power output throughout the discharge cycle, rapid opportunity charging capabilities, and substantially longer lifecycle, effectively minimizing required fleet size and maximizing asset utilization. This technological transition demands new charging infrastructure and management systems, favoring manufacturers who provide integrated energy solutions, not just the machinery itself.

Another major technological area is the integration of Industrial Internet of Things (IIoT) and telematics systems. Modern electric order pickers are equipped with embedded sensors and communication modules that capture vast amounts of operational data, including driving speed, lifting cycles, battery health, and collision events. This data is transmitted to cloud-based fleet management platforms, enabling real-time monitoring, utilization analysis, and the deployment of predictive maintenance strategies. Telematics is essential for maximizing efficiency in large, heterogeneous fleets and for demonstrating return on investment by providing granular visibility into operator performance and machine condition, critical elements for optimizing TCO.

Furthermore, the focus on operator ergonomics and safety technology is paramount. Innovations include shock-absorbing floors, intuitive control interfaces (often touch-screen based), and sophisticated safety features such as load weight sensors, mast deflection monitoring, and advanced driver assistance systems (ADAS). These ADAS technologies incorporate Lidar and camera systems to provide proximity warnings and automatic speed reduction when entering crowded zones or turning corners. The increasing sophistication of semi-autonomous features, such as wire or rail-guided navigation for high-level VNA (Very Narrow Aisle) pickers, ensures high precision and maximizes throughput within constrained warehouse footprints, paving the way for eventual, full automation in controlled environments.

Regional Highlights

Regional dynamics heavily influence the adoption rates and technological preferences within the Electric Order Pickers Market, driven by factors such as economic maturity, e-commerce penetration, and local labor and environmental regulations. North America and Europe currently represent the largest revenue generating regions, characterized by high automation maturity, stringent safety standards, and a strong regulatory push towards sustainable material handling fleets. In these regions, the demand is heavily concentrated on high-specification, lithium-ion powered models integrated with sophisticated telematics for maximizing operational efficiency and mitigating high labor costs. Replacement cycles in these mature markets are increasingly dictated by technological obsolescence (e.g., outdated battery chemistry or inability to integrate with modern WMS) rather than equipment failure.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, fueled by rapid industrialization, massive infrastructure development, and the unparalleled expansion of the e-commerce giants across countries like China, India, and Southeast Asia. These markets are investing heavily in establishing modern, large-scale distribution centers from the ground up, allowing for immediate adoption of advanced, high-level picking solutions to cope with dense storage requirements. While cost sensitivity remains a factor in certain emerging APAC economies, the sheer scale of logistics operations drives volume demand for all levels of electric pickers, often supplied by both global leaders and strong regional manufacturers who benefit from localized supply chains and competitive pricing strategies. Government initiatives supporting manufacturing and logistics modernization further accelerate market penetration.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets demonstrating steady growth, primarily driven by urbanization and the corresponding shift from traditional retail models to organized e-commerce and modern wholesale distribution. Adoption here is often focused initially on low- and mid-level pickers to address efficiency gaps in existing infrastructure. In the MEA region, particularly in the UAE and Saudi Arabia, large-scale logistics hub investments tied to global trade initiatives (e.g., Vision 2030 projects) are creating concentrated demand for high-end electric equipment, positioning these areas as future growth pockets. However, market growth in these regions is subject to macroeconomic stability and foreign investment influx, which determines the pace of large-scale infrastructure projects. Overall, global market growth remains inextricably linked to the continued expansion of logistics and supply chain robustness across all economic tiers.

- North America: Market leader in technology adoption, driven by large 3PLs and major retailers. Focus on Li-ion batteries, advanced safety features, and integrated fleet management software to combat high labor costs.

- Europe: Highly regulated market emphasizing safety and sustainability (Green Logistics). High demand for ergonomic designs and low-emission equipment, leading to rapid phase-out of internal combustion and older lead-acid fleets. Germany, UK, and France are key contributors.

- Asia Pacific (APAC): Fastest growing market driven by hyper-growth in e-commerce and manufacturing expansion in China, India, and Southeast Asia. Significant investment in new, high-density warehousing favoring high-level pickers.

- Latin America (LATAM): Steady adoption rate, primarily focused on optimizing existing distribution centers. Growth driven by modernization in Brazil and Mexico's retail and manufacturing sectors. Cost sensitivity often influences technology choices.

- Middle East and Africa (MEA): Growth tied to strategic logistics hub development and diversification of non-oil economies (e.g., UAE, Saudi Arabia). Emerging demand for premium, high-level pickers in new mega-distribution centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Order Pickers Market, analyzing their product portfolios, strategic initiatives, and market positioning.- Toyota Industries Corporation

- KION Group AG

- Jungheinrich AG

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- Mitsubishi Logisnext Co., Ltd.

- Komatsu Ltd.

- Godrej & Boyce Mfg. Co. Ltd.

- Anhui Heli Co., Ltd.

- Clark Material Handling Company

- EP Equipment

- Doosan Corporation Industrial Vehicle

- Linde Material Handling (KION Group)

- Still GmbH (KION Group)

- Hangcha Group Co., Ltd.

- ZHEJIANG NOBLELIFT EQUIPMENT JOINT STOCK CO., LTD.

- Palfinger AG

- TVH Group

- Lonking Holdings Limited

- Rocla Oy

Frequently Asked Questions

Analyze common user questions about the Electric Order Pickers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current high-level electric order pickers market growth?

The primary driver is the necessity for maximizing cubic warehouse utilization. As e-commerce requires massive inventories and real estate costs escalate, businesses are forced to build taller, very narrow aisle (VNA) facilities, making high-level electric order pickers essential for reaching products efficiently and safely above five meters, often utilizing guided navigation systems for precision.

How does the transition to lithium-ion batteries impact the Total Cost of Ownership (TCO) of electric order pickers?

The transition significantly reduces TCO primarily by eliminating the need for daily battery watering and specialized charging rooms, extending battery lifespan dramatically (often 3-4 times that of lead-acid), and enabling rapid opportunity charging during breaks, thus reducing downtime, labor costs, and the need for spare batteries or extensive fleet rotation.

What role does telematics play in optimizing electric order picker fleet management?

Telematics enables real-time monitoring of machine utilization, operator performance, and asset condition. This data allows fleet managers to implement predictive maintenance schedules, optimize routing, enforce safety regulations (e.g., speed limits), and ensure that assets are optimally deployed based on workload demands, resulting in higher operational efficiency and reduced accident frequency.

Which geographical region holds the highest potential for future market expansion, and why?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, holds the highest potential for future expansion. This growth is underpinned by unparalleled investment in modern logistics infrastructure, rapid growth of the domestic e-commerce sector, and a governmental push for supply chain automation and efficiency improvements to support vast urban populations and complex distribution needs.

What are the key safety innovations integrated into modern electric order pickers to protect operators?

Modern electric order pickers integrate sophisticated safety features, including advanced driver assistance systems (ADAS) utilizing Lidar/sensors for collision avoidance, automatic speed reduction based on turning angles or proximity to end-of-aisle limits, ergonomic operator compartments designed to reduce fatigue, and integrated safety harnesses and interlocking gate mechanisms for high-level operations, ensuring compliance with strict industrial safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager