Electric Parking Brake System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433579 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Electric Parking Brake System Market Size

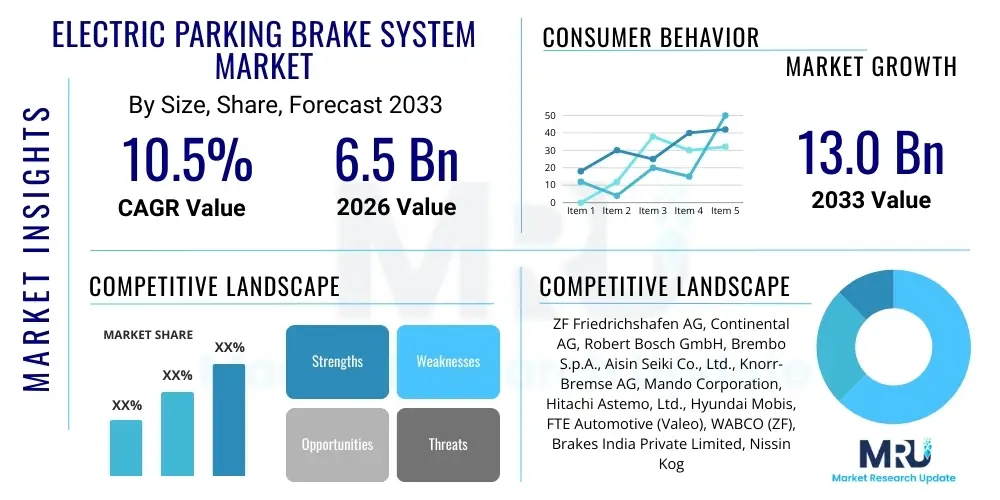

The Electric Parking Brake System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 13.0 Billion by the end of the forecast period in 2033.

Electric Parking Brake System Market introduction

The Electric Parking Brake (EPB) System Market encompasses the technologies and components utilized in modern vehicles to electronically engage and disengage the parking brake, replacing traditional mechanical levers and cables. EPB systems enhance vehicle safety, driver convenience, and interior aesthetics by integrating parking brake functions into the vehicle’s existing electronic architecture, often leveraging the Electronic Stability Control (ESC) unit. The primary applications include passenger cars, SUVs, and certain light commercial vehicles, driven by regulatory mandates for enhanced safety features and consumer demand for advanced driver assistance systems (ADAS). Benefits include automatic hill hold functionality, compact design, reduced cabin noise, and improved reliability compared to mechanical systems. Key driving factors propelling market expansion are the rising global production of passenger vehicles, the increasing penetration of advanced braking technologies, and the shift towards autonomous driving, where integrated electronic systems are paramount for safety redundancy and streamlined control.

Electric Parking Brake System Market Executive Summary

The global Electric Parking Brake System Market is characterized by robust business trends centered on technological miniaturization and integration into complex vehicle dynamics systems, moving away from standalone EPB units towards unified electronic control modules. Major automotive original equipment manufacturers (OEMs) are mandating EPB inclusion across mid-range and luxury segments, intensifying competition among Tier 1 suppliers like Continental, ZF, and Bosch to develop cost-effective, high-performance caliper-integrated solutions. Regionally, Asia Pacific, led by China and India, demonstrates the highest growth potential due to expanding automotive production and rapid adoption of safety standards, while Europe maintains dominance in terms of technology maturity and regulatory compliance, particularly regarding mandatory ESC integration which facilitates EPB deployment. Segment trends show a clear preference for caliper-integrated EPB systems over cable puller types due to superior performance and easier assembly. Furthermore, the rising demand for Electric Vehicles (EVs) is significantly impacting the market, as EPB systems offer crucial weight reduction benefits and seamless integration with electric powertrain regenerative braking systems, positioning the market for sustained double-digit growth through the forecast period.

AI Impact Analysis on Electric Parking Brake System Market

User queries regarding AI's influence on the Electric Parking Brake System Market primarily focus on enhanced predictive maintenance, optimization of system response times in critical scenarios (such as emergency braking), and the integration of EPB functionality within Level 3 and higher autonomous driving frameworks. Users are keenly interested in how Artificial Intelligence can improve the decision-making capabilities of the Electronic Control Unit (ECU) beyond standard inputs, particularly concerning terrain analysis, vehicle load sensing, and automatic engagement protocols based on predictive situational awareness. Concerns also center on cybersecurity vulnerabilities introduced by increasingly connected EPB systems managed by complex algorithms, and the reliability of AI algorithms in guaranteeing fail-safe operation under diverse driving conditions. The overarching expectation is that AI will transform EPB systems from simple driver aids into critical, intelligent components of the vehicle safety loop, requiring greater processing power and highly sophisticated sensing capabilities embedded within the braking infrastructure.

The application of Artificial Intelligence within the EPB ecosystem is poised to revolutionize system efficiency and safety protocols, particularly by enabling predictive engagement mechanisms. AI algorithms can analyze real-time data streams from multiple sensors—including vehicle speed, angle, acceleration, and GPS data—to anticipate scenarios requiring parking brake intervention, such as unintentional rolling or parking on steep inclines, far faster and more accurately than traditional rule-based systems. This shift towards smart EPB management ensures the system is not merely reactive but proactively integrated into the vehicle's dynamic stability and safety network. Furthermore, machine learning models are being deployed to optimize the force required for engagement, minimizing wear and tear on components and prolonging the lifecycle of the braking system by precisely adapting to varying environmental and vehicle conditions, thus directly impacting OEM warranty costs and long-term maintenance requirements.

A significant area of AI integration involves enhancing diagnostic capabilities and enabling over-the-air (OTA) updates for software calibration. AI-powered diagnostics can continuously monitor the performance of actuators, sensors, and the ECU, identifying subtle anomalies indicative of impending failure long before they manifest into operational problems, thereby facilitating true predictive maintenance. This capability reduces vehicle downtime and enhances driver confidence. For autonomous vehicles, AI is crucial for establishing safety redundancies; the EPB system can function as an independent, secondary braking mechanism in case of primary system failure, and AI ensures the seamless, safe transition to this mode, fulfilling rigorous safety requirements for Level 4 and Level 5 automation. This intelligent layering of safety controls solidifies the EPB as a foundational safety component for future mobility solutions.

- Enhanced Predictive Maintenance: AI algorithms analyze component stress and operational parameters to forecast failures, minimizing unexpected system malfunctions.

- Optimized Emergency Response: Machine learning models allow the ECU to determine optimal brake force and engagement timing during critical autonomous maneuvers.

- Improved Cybersecurity Measures: AI is utilized to detect and mitigate unauthorized access attempts and software tampering within the connected braking system.

- Autonomous Vehicle Redundancy: EPB functions as a crucial, intelligent secondary braking system, managed by AI for fail-safe operations in ADAS-enabled vehicles.

- Real-time Calibration Optimization: AI adjusts parking brake clamping force based on load distribution, incline, and temperature, extending component lifespan and improving reliability.

DRO & Impact Forces Of Electric Parking Brake System Market

The Electric Parking Brake System Market expansion is primarily driven by global governmental emphasis on vehicle safety standards, mandating features like Electronic Stability Control (ESC) and increasing consumer preference for convenience and sophisticated technology in vehicle operation, while restrained by the higher initial manufacturing cost compared to traditional manual brakes and challenges related to software integration complexities in diverse vehicle platforms. Opportunities emerge significantly from the rapid growth of the electric vehicle (EV) sector, where EPB systems offer crucial efficiency benefits and seamless integration with regenerative braking, along with the burgeoning trend towards fully autonomous vehicles which require electronic and redundant braking controls for operational safety. The market impact forces are strong and predominantly positive, characterized by high technological substitution pressure against conventional braking systems and intense competition among Tier 1 suppliers focusing on cost reduction and performance enhancements, ensuring a continuously innovative and expanding market landscape.

Key drivers center on regulatory push and technological pull. Regulatory bodies across major economies, particularly the European Union (EU) and the United States, have enforced stricter safety mandates, including mandatory fitment of ESC, which provides the necessary computational infrastructure for EPB functionality. Furthermore, EPB systems inherently offer benefits like automatic release when driving off and hill-hold assist, significantly enhancing driver convenience and safety on inclined surfaces, which resonates strongly with consumers, especially in densely populated urban environments. This convergence of regulatory necessity and consumer utility fuels sustained market penetration, driving OEMs to standardize EPB inclusion across broader vehicle portfolios, migrating the technology from premium vehicles down to mass-market segments.

However, the market faces significant restraints, chiefly the higher unit cost associated with the electronic components, actuators, and sophisticated ECUs required for EPB operation compared to simple mechanical systems. This cost barrier can slow adoption in highly price-sensitive emerging markets or entry-level vehicle segments. Additionally, the complexity of software development and integration, particularly ensuring robust cybersecurity and functional safety (ISO 26262 compliance), presents technical hurdles for smaller manufacturers and necessitates substantial investment in electronic expertise. Opportunities, conversely, are vast, particularly within the commercial vehicle sector (light trucks and buses) where EPB systems are beginning to replace traditional air brakes, promising enhanced reliability and space efficiency. The shift towards xEVs (HEV, PHEV, BEV) provides a lucrative pathway, as electronic braking is foundational to managing energy recovery and providing smooth, quiet braking performance critical for the electric driving experience.

- Drivers (D):

- Increasing adoption of advanced driver assistance systems (ADAS) requiring integrated electronic braking.

- Mandatory safety regulations, such as Electronic Stability Control (ESC) fitment, providing the EPB infrastructure.

- Enhanced convenience features, including hill-hold assist and automatic engagement/release.

- Rising global production of passenger vehicles, especially SUVs and premium cars.

- Restraints (R):

- Higher initial manufacturing and installation cost compared to traditional cable-operated systems.

- Complexity and reliability concerns regarding software integration and cyber risks.

- Need for specialized maintenance tools and expertise in the aftermarket sector.

- Opportunity (O):

- Rapid growth in electric vehicle (EV) production, where EPB facilitates regenerative braking integration.

- Expansion into light commercial vehicles and emerging markets with stringent safety standards.

- Development of modular EPB systems compatible across various vehicle platforms.

- Impact Forces:

- Technological Substitution: High pressure from advanced EPB systems replacing mechanical systems entirely.

- Competitive Rivalry: Intense competition among Tier 1 suppliers to achieve cost leadership and integration capabilities.

- Bargaining Power of Buyers (OEMs): Strong, demanding high reliability, functional safety, and competitive pricing for volume procurement.

Segmentation Analysis

The Electric Parking Brake System Market is comprehensively segmented based on technology, component, application, and sales channel to provide granular insights into market dynamics and growth trajectories. The technology segment differentiates between caliper-integrated systems, which offer superior packaging and performance by directly linking the electric motor to the brake caliper, and cable-puller systems, which are often utilized for cost-sensitive applications or vehicles undergoing platform conversion. Component analysis focuses on the core electronic and mechanical parts, highlighting the crucial role of the Electronic Control Unit (ECU) as the intelligence hub. Vehicle type segmentation clearly delineates the dominance of the passenger vehicle category, while sales channel analysis emphasizes the overwhelming volume generated by OEM installation during vehicle manufacturing, providing a stable foundation for revenue generation in the forecast period.

- By Type:

- Caliper Integrated EPB

- Cable Puller Integrated EPB

- By Component:

- Caliper

- Electronic Control Unit (ECU)

- Actuator/Electric Motor

- Wires & Connectors

- Switches & Sensors

- By Vehicle Type:

- Passenger Vehicles (PV)

- Hatchbacks

- Sedans

- SUVs & MPVs

- Commercial Vehicles (CV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Passenger Vehicles (PV)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Electric Parking Brake System Market

The value chain for the Electric Parking Brake System Market is characterized by a high degree of integration between specialized component suppliers and dominant Tier 1 automotive suppliers, who act as system integrators before delivery to Original Equipment Manufacturers (OEMs). Upstream analysis involves suppliers providing critical raw materials (metals, specialized plastics) and sophisticated electronic components, particularly semiconductors for the ECU and high-torque electric motors for the actuators. Key upstream challenges include managing the complex sourcing of microprocessors and ensuring supply chain resilience against geopolitical disruptions impacting semiconductor manufacturing. The core value addition occurs during the manufacturing and assembly phase by Tier 1 players, involving rigorous testing for functional safety (ASIL compliance) and system integration tailored to specific vehicle platforms.

The primary downstream stage involves the direct sale of the completed EPB system to the automotive OEMs, who integrate the system into the vehicle assembly line. This channel, representing the vast majority of market revenue, is governed by long-term contracts, stringent quality assurance processes, and extensive collaborative engineering efforts to ensure compatibility with the overall vehicle braking and stability systems. Distribution channels are predominantly direct (OEM sales), characterized by just-in-time delivery models. The indirect channel, the aftermarket, consists of a smaller but growing segment focused on replacement parts, specialized repair kits, and occasional retrofitting services, typically flowing through authorized distributors and independent workshops. Pricing power in the downstream segment heavily favors the OEM, who demand high reliability and competitive pricing, forcing Tier 1 suppliers to achieve significant scale and operational efficiency.

The interaction between direct and indirect channels is critical for market stability and supplier profitability. Direct distribution ensures high-volume, reliable revenue based on vehicle production forecasts. Indirect distribution, while lower volume, provides margin protection through the sale of proprietary replacement components, particularly actuators and ECUs that require specialized sourcing. Furthermore, the increasing complexity of EPB maintenance necessitates continuous training and specialized diagnostic tools for the aftermarket, creating new service revenue streams for Tier 1 suppliers and authorized service centers. Successful companies in this market must excel at both system innovation upstream and efficient, high-volume manufacturing midstream, while also supporting a highly technical downstream service and replacement network to maintain product lifecycle integrity and brand trust.

Electric Parking Brake System Market Potential Customers

The primary end-users and buyers of Electric Parking Brake Systems are global Original Equipment Manufacturers (OEMs) spanning the entire spectrum of vehicle production, from mass-market passenger car producers to luxury automotive brands and light commercial vehicle manufacturers. OEMs are the decisive customers as they specify the technology, volume, and integration parameters during the vehicle design cycle, requiring Tier 1 suppliers to meet exacting standards related to functional safety (ISO 26262), weight reduction, and seamless integration with existing ADAS infrastructure. The purchasing decision is heavily influenced by factors such as system reliability, cost per unit, geographical support capability, and the supplier's technical ability to co-develop platform-specific solutions, making the relationship between supplier and OEM highly interdependent and strategic.

A secondary, yet increasingly important, customer base consists of the aftermarket service providers, including authorized dealerships, independent automotive repair shops, and specialized maintenance centers. These customers purchase EPB components (such as replacement calipers, actuators, and ECUs) for repair and maintenance purposes throughout the vehicle's lifespan. While this segment generates significantly lower volume than the OEM channel, it provides crucial profitability, driven by the need for genuine, high-quality replacement parts that often require electronic reprogramming or calibration. The growth of the aftermarket segment is directly correlated with the global vehicle parc equipped with EPB systems and the average age of these vehicles, indicating a stable, long-term revenue stream for component manufacturers.

The emerging category of potential customers includes specialized vehicle developers focused on advanced mobility solutions, such as autonomous shuttle manufacturers and dedicated electric vehicle startups. These buyers prioritize EPB systems due to their inherent electronic control, which is essential for redundant braking pathways and precise computer-controlled actuation required for driverless operation. For these innovative customers, purchasing criteria revolve less around incremental cost savings and more around advanced safety features, robust connectivity, and the integration potential with highly sophisticated vehicle operating systems. Successfully targeting these new mobility players requires suppliers to offer modular, high-performance EPB solutions certified for next-generation electronic architectures and functional safety levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 13.0 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Continental AG, Robert Bosch GmbH, Brembo S.p.A., Aisin Seiki Co., Ltd., Knorr-Bremse AG, Mando Corporation, Hitachi Astemo, Ltd., Hyundai Mobis, FTE Automotive (Valeo), WABCO (ZF), Brakes India Private Limited, Nissin Kogyo Co., Ltd., APG-Braking, TRW Automotive (ZF), GKN Driveline (Melrose Industries), Magna International Inc., Sumitomo Electric Industries, Tenneco Inc., HELLA GmbH & Co. KGaA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Parking Brake System Market Key Technology Landscape

The technology landscape of the Electric Parking Brake System Market is dominated by electro-mechanical actuation, primarily categorized into caliper-integrated and cable-puller systems, with a strong current emphasis on achieving higher integration levels and functional safety across the vehicle's electronic architecture. Caliper-integrated EPB systems, which feature the electric motor directly attached to the brake caliper piston (Motor on Caliper - MoC), represent the cutting edge of the technology, offering maximum efficiency, compact packaging, and superior performance characteristics, making them the preferred choice for new vehicle platforms globally. Technological advancements are focused on miniaturizing the actuator components while increasing torque output and reducing energy consumption, crucial factors especially for battery electric vehicles (BEVs) where every gram and milliampere matters for range extension.

A significant technological shift involves the continuous evolution of the Electronic Control Unit (ECU) and the underlying software architecture. Modern EPB systems rely on sophisticated, high-speed microcontrollers that manage not only the parking function but also hill-hold assist (HHA), dynamic braking support, and critical diagnostic functions, adhering strictly to automotive safety integrity level (ASIL) standards, typically ASIL C or D. Furthermore, the integration trend is moving towards combining the EPB ECU functionality directly into the existing Electronic Stability Control (ESC) or Anti-lock Braking System (ABS) controller, creating a centralized vehicle dynamics module. This consolidation reduces hardware complexity, wiring, and overall system cost while enhancing communication speed and computational power for advanced features like automated parking and remote vehicle operations.

Future technological developments are geared towards Brake-by-Wire (BBW) systems, where mechanical linkages are fully replaced by electronic signals, paving the way for truly autonomous braking control. While full BBW remains complex and expensive, the EPB system acts as a stepping stone and a crucial redundancy mechanism. Innovations also focus on improving cybersecurity measures, as connected EPB systems present potential attack vectors. Suppliers are implementing hardware security modules (HSMs) and robust encryption algorithms within the ECU firmware to protect against unauthorized access and manipulation, ensuring that the electronic braking functions remain impervious to cyber threats, a mandatory requirement for mass deployment in connected and autonomous vehicles (CAVs).

Regional Highlights

The global Electric Parking Brake System Market exhibits distinct regional dynamics driven by varying regulatory environments, consumer preferences, and automotive manufacturing output. Asia Pacific (APAC) is currently the fastest-growing market, propelled by soaring vehicle production in China and India, coupled with increasing governmental pressure to adopt advanced safety features in these nations. The region benefits from both established local OEM demand and the influx of foreign manufacturers standardizing global specifications, leading to immense opportunities for suppliers establishing localized manufacturing capabilities.

Europe holds a substantial market share and leads in technological maturity. The early adoption of mandatory ESC legislation provided a fertile ground for EPB systems, and the strong consumer preference for premium, highly equipped vehicles ensures continuous high penetration rates, particularly in Germany, France, and the UK. European market expansion is further driven by the early and aggressive push towards electrification, where EPB systems are integral to EV architecture.

North America remains a strong and stable market, characterized by high demand for SUVs and light trucks, segments rapidly adopting EPB systems for convenience and safety benefits. Regulations in the US and Canada favor technology integration, and the high average transaction price of vehicles in this region allows OEMs to easily absorb the added cost of EPB systems, maintaining a steady, high-value demand for Tier 1 suppliers.

- Asia Pacific (APAC): Dominates in growth trajectory due to high volume automotive production (China, Japan, South Korea) and increasing regulatory enforcement of safety technologies. High adoption rate driven by consumer shift toward mid-to-high segment vehicles.

- Europe: Market leader in technology penetration and maturity, driven by stringent safety mandates and high consumer acceptance of premium features. Significant growth linked to the rapid electrification of the vehicle fleet.

- North America: Stable, high-value market primarily driven by large-scale demand in the SUV and light commercial vehicle segments. Focus on integration with sophisticated ADAS platforms and convenience features like automated parking.

- Latin America (LATAM): Emerging market demonstrating moderate growth, primarily centered in Brazil and Mexico. Adoption is accelerating as global OEMs localize production and export safety-standardized vehicles.

- Middle East & Africa (MEA): Represents the smallest, yet rapidly developing market. Growth is localized in affluent Gulf Cooperation Council (GCC) countries, driven by import of luxury vehicles and localized assembly operations adhering to international safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Parking Brake System Market.- ZF Friedrichshafen AG

- Continental AG

- Robert Bosch GmbH

- Brembo S.p.A.

- Aisin Seiki Co., Ltd.

- Knorr-Bremse AG

- Mando Corporation

- Hitachi Astemo, Ltd.

- Hyundai Mobis

- FTE Automotive (Valeo)

- WABCO (ZF)

- Brakes India Private Limited

- Nissin Kogyo Co., Ltd.

- APG-Braking

- TRW Automotive (ZF)

- GKN Driveline (Melrose Industries)

- Magna International Inc.

- Sumitomo Electric Industries

- Tenneco Inc.

- HELLA GmbH & Co. KGaA

Frequently Asked Questions

Analyze common user questions about the Electric Parking Brake System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Caliper Integrated and Cable Puller EPB systems?

Caliper Integrated EPB (Motor on Caliper) is the advanced type, featuring the electric motor directly connected to the caliper piston, offering superior performance, faster response, and better packaging efficiency. Cable Puller systems use an electric motor to pull the existing brake cables, often employed in older platform conversions for lower cost, but they offer less precise control and are generally bulkier.

How does the Electric Parking Brake System contribute to vehicle safety beyond standard parking?

EPB systems significantly enhance active safety through features like Hill Hold Assist (HHA), preventing rollback on inclines, and Emergency Brake Functionality, which can engage the parking brake dynamically in certain failure situations or during high-speed ADAS interventions, improving overall vehicle control and accident prevention.

Which geographical region is expected to show the highest growth rate for EPB systems through 2033?

The Asia Pacific (APAC) region, driven primarily by high volume automotive manufacturing in emerging economies like China and India and increasing safety feature penetration in mass-market vehicles, is projected to register the fastest compound annual growth rate in the Electric Parking Brake System Market during the forecast period.

What role do EPB systems play in the electric vehicle (EV) market?

For EVs, EPB systems are crucial as they are lighter and integrate seamlessly with complex regenerative braking systems and battery management electronics. Their electronic nature supports the required communication protocols for EV control units, contributing positively to energy efficiency and vehicle range compared to heavy mechanical linkages.

What are the key components of a typical Electric Parking Brake System?

The core components of an EPB system include the Electronic Control Unit (ECU), which serves as the brain; the electric Actuators (motors) attached to the brake calipers; specialized Wiring and Connectors for power and data transmission; and the in-cabin Switch used by the driver to engage and release the brake.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager