Electric Patrol Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434689 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Electric Patrol Robot Market Size

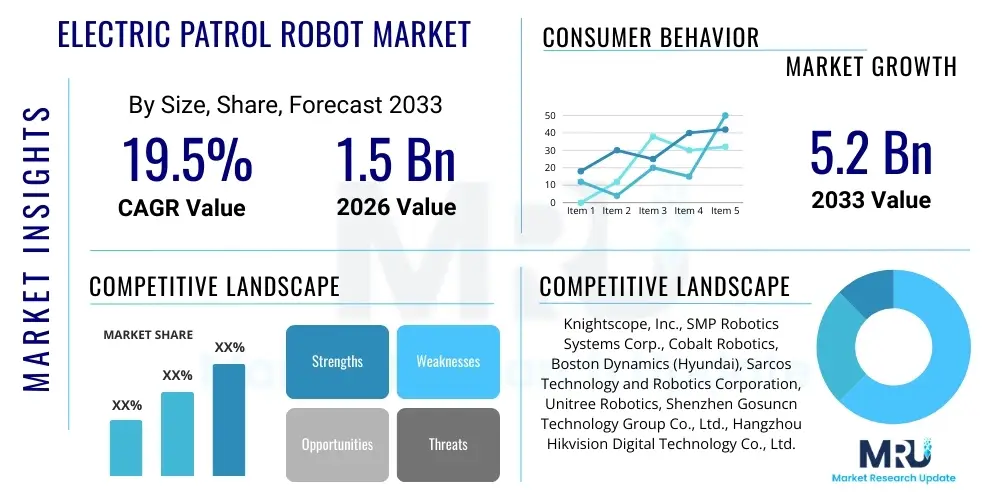

The Electric Patrol Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Electric Patrol Robot Market introduction

The Electric Patrol Robot Market encompasses autonomous or semi-autonomous mobile security platforms designed to conduct surveillance, monitoring, and deterrence tasks in various environments without consistent human intervention. These systems utilize electric propulsion and are equipped with advanced sensor arrays, including high-definition cameras, thermal imaging, LiDAR, and specialized chemical detectors, making them invaluable assets for continuous perimeter security, indoor monitoring, and expansive facility management. They function primarily as a force multiplier, reducing the reliance on human guards for routine, high-frequency patrol routes and enhancing the overall responsiveness to security breaches. The underlying technology integrates robotics, connectivity (5G/LTE), and sophisticated navigational algorithms to ensure reliable operation across complex terrains and challenging weather conditions, solidifying their role in modern safety protocols.

Major applications of electric patrol robots span critical infrastructure protection, encompassing data centers, energy utilities, and governmental facilities, alongside commercial sectors such as large logistics warehouses, sprawling corporate campuses, and retail environments. In the industrial sector, particularly manufacturing and chemical plants, these robots are deployed for safety compliance monitoring, ensuring machinery is operating within parameters and identifying anomalies like leaks or temperature spikes that traditional security patrols might miss. The primary benefits derived from their implementation include substantial operational cost reductions associated with security personnel, heightened data consistency through automated reporting, and a significant improvement in situational awareness, as they provide real-time, high-quality video and telemetry data back to centralized control rooms. Furthermore, their continuous operational capability—often running on swappable battery systems or inductive charging—ensures 24/7 security coverage that is otherwise impractical with human resources alone.

The principal driving factors accelerating market expansion revolve around the global surge in demand for enhanced physical security solutions capable of neutralizing increasingly sophisticated threats, coupled with the rising costs and scarcity of qualified security personnel. Technological advancements, particularly in SLAM (Simultaneous Localization and Mapping) capabilities and edge computing, have made these robots more adept at navigating dynamic environments and processing data locally, improving efficiency. Furthermore, favorable regulatory environments in key markets that encourage the adoption of automation in critical infrastructure protection are providing robust tailwinds. The demonstrated return on investment (ROI) through reduced shrinkage, decreased liability risks, and optimized security workflows further encourages enterprise adoption across diverse operational scales, making electric patrol robots a foundational component of next-generation security architecture.

Electric Patrol Robot Market Executive Summary

The Electric Patrol Robot Market is witnessing rapid commercialization driven by substantial investments in artificial intelligence and sensor fusion technologies, enabling robots to perform complex tasks such as object recognition, predictive patrolling, and automated incident response with increasing accuracy. Key business trends indicate a shift towards Robot-as-a-Service (RaaS) models, offering enterprises lower upfront capital expenditure and higher flexibility in scaling security operations. Integration with existing security ecosystems, particularly centralized video management systems (VMS) and access control platforms, is paramount, leading to strategic partnerships between robotic manufacturers and traditional security system integrators. Competition is intensifying, focusing not only on hardware reliability but also on the sophistication of the proprietary AI algorithms that govern patrol efficiency and decision-making capabilities, necessitating continuous software updates and feature enhancements to maintain competitive edge.

Regionally, North America maintains market leadership, attributed to high security spending budgets, early adoption across major industrial campuses, and stringent regulatory requirements for infrastructure protection. However, the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, is projected to register the highest growth rate. This rapid expansion in APAC is fueled by massive infrastructure projects, burgeoning smart city initiatives, and the widespread adoption of automation in manufacturing and logistics sectors, coupled with governmental support for indigenous robotics development. European growth is steady, focusing heavily on privacy compliance (GDPR) in robot deployment, which mandates specific design considerations for data capture and retention, driving innovation in privacy-preserving surveillance techniques. The Middle East and Africa (MEA) are emerging markets, primarily deploying robots for large-scale energy facilities and mega-events security.

Segment trends reveal that the fixed-wing robot segment, while smaller, is gaining traction for perimeter surveillance over vast, unobstructed areas, complementing the dominant ground-based wheeled and tracked robot segments. Service type segmentation shows that maintenance and support services, including remote diagnostics and preventative upkeep, are becoming crucial revenue streams, often bundled within RaaS contracts. In terms of end-use, the commercial sector, particularly retail and corporate campuses, accounts for the largest market share due to the clear ROI calculation derived from asset protection and shrinkage reduction. However, the government and defense sector is poised for accelerated growth, demanding highly customized, ruggedized units capable of operating in highly sensitive or hazardous environments, prioritizing robust cyber-security features alongside physical capabilities.

AI Impact Analysis on Electric Patrol Robot Market

Analysis of common user questions regarding AI's influence on the Electric Patrol Robot Market highlights several dominant themes: concerns about reliability in complex urban environments, the ability of AI to differentiate between genuine threats and benign events (false positive reduction), and the overarching question of how soon robots will achieve full autonomy without needing human intervention for decision-making. Users are keenly interested in the specifics of Deep Learning algorithms used for predictive patrolling—moving beyond fixed routes to anticipate potential security breaches based on historical data patterns and real-time environmental changes. Furthermore, ethical considerations, specifically concerning facial recognition accuracy, data privacy, and accountability in failure scenarios, are frequently raised, indicating a demand for transparent and auditable AI frameworks within patrol systems. The consensus expectation is that AI will transition these robots from simple data collectors to intelligent, proactive decision-makers, fundamentally reshaping security operations.

AI serves as the central processing core that transforms raw sensor input (video, thermal, audio) into actionable intelligence for Electric Patrol Robots. Without advanced machine learning and computer vision algorithms, these devices are merely expensive remote-controlled vehicles. AI allows robots to execute sophisticated tasks like anomaly detection, where the system learns the "normal" operational state of an area and flags any deviation—be it an unauthorized vehicle, an unusual crowd formation, or a piece of misplaced equipment. This capability drastically reduces the fatigue associated with continuous human monitoring of surveillance feeds, leading to higher efficiency and fewer missed events. Sophisticated neural networks also drive autonomous navigation, ensuring path optimization, obstacle avoidance, and safe interaction with human personnel and other automated systems within the patrol environment.

The implementation of edge AI—processing data directly on the robot rather than relying solely on cloud connectivity—is critical for real-time responsiveness, particularly in areas with limited bandwidth or high latency. This distributed intelligence enhances the robot's ability to classify objects (e.g., differentiating between a service animal and a trespasser) and initiate localized responses quickly, such as triggering an audible warning or notifying the nearest human supervisor with specific context. Furthermore, AI is crucial for resource management, optimizing battery consumption, scheduling predictive maintenance based on usage patterns, and ensuring the robot’s operational uptime is maximized, addressing one of the core commercial requirements for reliable security automation solutions.

- AI enhances situational awareness by integrating data from multiple sensors (sensor fusion).

- Predictive patrolling utilizes machine learning to optimize routes based on risk assessment and historical incident data.

- Computer vision algorithms enable real-time object classification and facial recognition (where permitted by law).

- Edge computing allows for rapid, localized decision-making and reduced latency in incident response.

- AI dramatically reduces false positives by filtering environmental noise and benign events from genuine threats.

- Self-diagnosis and predictive maintenance features driven by AI maximize robot operational availability.

- Ethical AI frameworks are being developed to ensure transparency and accountability in autonomous decision-making processes.

DRO & Impact Forces Of Electric Patrol Robot Market

The Electric Patrol Robot Market is characterized by strong synergistic forces where drivers heavily outweigh restraints, propelled by compelling economic and operational advantages. The primary driver is the accelerating trend toward automation and digitization across industries, seeking productivity gains and solutions to persistent labor shortages in the security sector. This is compounded by the declining cost of essential hardware components, particularly high-performance sensors and processing chips, which makes autonomous systems more accessible to a broader range of enterprises, including small and medium-sized businesses. Opportunities are vast, particularly in integrating robots with drone systems for comprehensive air and ground surveillance, and in developing specialized units for niche applications such as hazardous waste inspection or search and rescue operations, areas where human intervention poses significant risk. These combined forces ensure sustained, high-CAGR growth.

Conversely, significant restraints pose challenges to widespread adoption. High initial deployment costs, including specialized infrastructure and integration expenses, act as a barrier, particularly for budget-constrained organizations. Moreover, regulatory uncertainty, especially concerning airspace use for integrated aerial patrol units and evolving privacy legislation related to data collection and storage (such as GDPR in Europe), necessitates careful navigation by manufacturers and end-users alike. The market faces external impact forces from rapid technological obsolescence; manufacturers must continually invest in R&D to maintain competitive technological relevance. Furthermore, cybersecurity threats targeting the interconnected network of robots, potentially leading to system manipulation or data exfiltration, present a constant critical risk that requires robust, military-grade encryption and security protocols.

Impact forces stemming from competitive dynamics are intense, with manufacturers striving to differentiate their offerings through superior battery endurance, improved all-weather operability, and seamless integration capabilities with legacy security systems. The necessity for advanced technical training and specialized maintenance personnel is also a limiting factor, leading to the proliferation of RaaS models that bundle maintenance and expertise. Opportunities for significant market penetration exist in emerging economies where security infrastructure is being built from the ground up, allowing for immediate adoption of advanced, networked robotic solutions rather than retrofitting old systems. Ultimately, the market trajectory is overwhelmingly positive, leveraging technological momentum to overcome inertia related to cost and regulatory concerns, cementing the robot's role as indispensable security assets.

Segmentation Analysis

The Electric Patrol Robot Market is comprehensively segmented based on product type, service type, mobility, end-user industry, and geographical region, providing a granular view of market dynamics and adoption patterns. Product type segmentation, dividing the market primarily into wheeled, tracked, and aerial robots, reflects the different terrain and coverage requirements of various applications, with wheeled robots dominating urban and indoor settings, and tracked robots reserved for rougher industrial or outdoor environments. Service type analysis highlights the increasing importance of recurring revenue streams derived from maintenance, consulting, and the crucial Robot-as-a-Service (RaaS) subscription model, which facilitates easier entry for new adopters by eliminating large capital outlay.

The end-user segmentation is critical for understanding demand drivers, showing robust demand from critical infrastructure protection (including utilities and telecommunications), manufacturing facilities, and the large commercial sector (including retail, hospitality, and corporate campuses). Each end-user segment presents unique challenges and requires specific customization, such as radiation shielding for nuclear facilities or advanced collision avoidance for crowded public spaces. Mobility analysis, separating the market into autonomous and semi-autonomous systems, indicates a clear trend towards fully autonomous operation as AI capabilities advance and regulatory frameworks catch up, though semi-autonomous robots remain vital where human intervention is legally or practically mandated.

Geographical segmentation reveals stark differences in market maturity and growth potential, with developed economies focusing on high-end customization and replacement cycles, while developing economies demonstrate explosive growth fueled by rapid industrialization and the establishment of new security protocols. Understanding these segment dynamics is essential for market players to tailor their product offerings, sales strategies, and service models to specific vertical needs, optimizing resource allocation and maximizing market share acquisition within the highly competitive landscape.

- By Product Type:

- Wheeled Robots

- Tracked Robots

- Aerial/Drone Patrol Systems (Integrated)

- By Service Type:

- Maintenance and Support Services

- Consulting and Deployment

- Robot-as-a-Service (RaaS)

- By Mobility:

- Fully Autonomous Patrol Systems

- Semi-Autonomous Patrol Systems

- Remote-Controlled Systems

- By End-User:

- Commercial (Corporate Campuses, Retail, Hospitality)

- Industrial (Manufacturing, Logistics, Oil & Gas)

- Critical Infrastructure (Utilities, Data Centers, Telecom)

- Government and Defense

Value Chain Analysis For Electric Patrol Robot Market

The value chain for the Electric Patrol Robot Market is complex, involving specialized technological inputs and sophisticated integration across multiple tiers before reaching the end-user. Upstream analysis focuses on the procurement of specialized hardware components, primarily encompassing high-performance lithium-ion battery systems, precision motors and actuators, advanced sensor arrays (LiDAR, thermal cameras, 3D mapping), and high-throughput processing units capable of running complex AI algorithms (often GPUs or specialized AI accelerators). Key upstream dependencies lie with global semiconductor manufacturers and specialized sensor suppliers, where supply chain resilience and cost management are crucial for final product profitability. The R&D phase, driven by specialized robotics and AI software developers, forms a core value creation step, determining the robot's functionality and competitive differentiation.

The midstream phase involves assembly and integration, where specialized robot manufacturers (OEMs) design the chassis, integrate the hardware, and, most critically, develop the proprietary operating software and navigation stacks. Quality control and rigorous testing, especially concerning safety certifications and operational reliability under extreme environmental conditions, add significant value here. Distribution channels are bifurcated into direct sales for large governmental and defense contracts, which require deep customization and long-term service agreements, and indirect sales through specialized security integrators and regional distributors. Integrators play a vital role in integrating the patrol robot with the client's existing VMS, access control, and IT network infrastructure, often providing the crucial last-mile customization and support.

Downstream analysis centers on end-user deployment and continuous support, where the Robot-as-a-Service (RaaS) model is gaining prominence, shifting the value proposition from a one-time product sale to a continuous service relationship. Post-sales support, including software updates, remote diagnostics, and preventative maintenance, constitutes a significant part of the value capture. The indirect channel, managed by professional security service providers (SSPs), often leases the robots and incorporates them into comprehensive security contracts, adding expertise and management overhead. This integration ensures that the technology delivers consistent performance and maximizes client ROI, solidifying the long-term relationship between manufacturers, integrators, and the diverse end-user base.

Electric Patrol Robot Market Potential Customers

Potential customers for Electric Patrol Robots are organizations requiring continuous, high-reliability physical security, especially those managing expansive properties, high-value assets, or environments hazardous to human personnel. The largest segment of buyers comes from the corporate commercial sector, including large technology company campuses, multi-story retail centers, and hotel complexes that utilize robots primarily for perimeter deterrence, parking lot surveillance, and minimizing internal shrinkage. These customers prioritize ease of integration, aesthetic design (for public interaction), and clear, quantifiable metrics demonstrating the reduction in security incidents and labor costs, often preferring the flexibility and lower entry cost offered by RaaS models.

Another major buying segment is the industrial and critical infrastructure sectors, including nuclear power plants, water treatment facilities, major oil and gas pipelines, and expansive logistics hubs (ports, rail yards, and distribution centers). These end-users demand ruggedized, highly durable robots with specialized sensor payloads capable of detecting environmental anomalies such as gas leaks, extreme temperatures, or unauthorized structural changes, often operating autonomously in remote or extreme weather conditions. Procurement decisions in this sector are heavily influenced by regulatory compliance standards, certification, and proven reliability in mission-critical applications, often resulting in large, long-term contracts for customized systems.

Finally, governmental agencies, encompassing military bases, police departments, and public security organizations, represent a high-value customer group demanding the highest levels of cyber and physical security, along with sophisticated integration into command-and-control systems. Patrol robots are increasingly used by municipalities for public space monitoring in smart city initiatives, providing real-time data on traffic, public safety, and infrastructure monitoring. These customers typically require advanced communication protocols, secure data handling, and specialized functionalities like riot control or explosive ordnance detection, focusing procurement efforts on vendors who can meet stringent defense and national security standards and provide guaranteed long-term logistical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | CAGR 19.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Knightscope, Inc., SMP Robotics Systems Corp., Cobalt Robotics, Boston Dynamics (Hyundai), Sarcos Technology and Robotics Corporation, Unitree Robotics, Shenzhen Gosuncn Technology Group Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Axis Communications AB, Genetec Inc., DJI, Clearpath Robotics, Exyn Technologies, Guss Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Patrol Robot Market Key Technology Landscape

The technological landscape of the Electric Patrol Robot Market is defined by the convergence of robotics, artificial intelligence, and advanced connectivity solutions. Central to modern patrol robots is Simultaneous Localization and Mapping (SLAM) technology, often utilizing a fusion of LiDAR, vision-based cameras, and inertial measurement units (IMUs) to create precise, real-time 3D maps of their environment, enabling robust navigation even in GPS-denied or highly dynamic indoor spaces. Advanced sensor technology, including multispectral cameras (visible light, thermal, and near-infrared), allows robots to detect threats across various light and weather conditions, significantly improving their reliability compared to human security patrols reliant only on the visible spectrum. Furthermore, modern robots incorporate acoustics sensors and chemical detectors, extending their monitoring capabilities beyond visual parameters to include environmental and public safety hazards.

Connectivity standards are crucial for effective deployment, with 5G technology increasingly favored for its low latency and high bandwidth, facilitating the real-time transmission of large video and sensor data streams back to centralized control rooms. This high-speed connectivity is vital for enabling remote piloting and human override capabilities in complex or emergency situations. The shift towards edge computing hardware (such as specialized AI chips from NVIDIA or Intel) allows for crucial data processing to occur directly on the robot. This not only speeds up decision-making for tasks like face detection or anomaly identification but also conserves network bandwidth, enhancing overall system efficiency and reliability in environments where consistent high-speed internet access cannot be guaranteed.

Power management represents another critical technological focus area. The requirement for continuous operation necessitates highly efficient battery technologies, typically high-density lithium-ion or solid-state batteries, coupled with advanced energy management systems that optimize motor performance and sensor usage. Furthermore, inductive charging stations and automated battery swapping mechanisms are foundational to achieving 24/7 autonomous operation without human intervention. Manufacturers are also heavily investing in modular design architecture, allowing end-users to easily swap out sensor payloads or add specialized tools, ensuring the robot can be adapted quickly to diverse or evolving security requirements across different commercial and industrial settings.

Regional Highlights

- North America: This region holds the largest market share, driven by high corporate security budgets, a mature market for integrating sophisticated robotics, and significant adoption in data centers, technology campuses, and oil and gas facilities. The US, in particular, benefits from technological innovation fostered by key domestic robotics firms and a supportive defense sector seeking advanced autonomous surveillance solutions. Strict compliance regulations for critical infrastructure protection further mandate the deployment of reliable, continuous monitoring systems, ensuring continued high demand for premium, feature-rich patrol robots.

- Europe: The European market shows steady growth, characterized by strong emphasis on compliance with the General Data Protection Regulation (GDPR). This regulatory environment mandates that patrol robot manufacturers innovate in areas like data anonymization, secured storage, and clear protocols for facial recognition use, driving sophisticated software development. Western European countries, including Germany and the UK, are focusing on utilizing robots in manufacturing environments and large public transportation hubs, prioritizing energy efficiency and safety standards in their autonomous systems.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by massive investments in smart city infrastructure and high-volume manufacturing hubs in countries like China, South Korea, and Japan. Government support for automation, coupled with the dense population centers requiring sophisticated public safety measures, accelerates adoption. China's market is highly competitive, driven by large domestic players who are rapidly integrating 5G connectivity and advanced AI into patrol platforms designed for both expansive urban surveillance and rigorous industrial monitoring.

- Latin America: This region is an emerging market, primarily focused on applications in mining operations, large agricultural facilities, and secure logistical hubs where physical security challenges are pronounced. Market penetration is currently limited by economic factors and infrastructure constraints, but the adoption of RaaS models is unlocking growth potential by making sophisticated technology financially accessible to key industries seeking to mitigate high rates of theft and ensure worker safety in remote locations.

- Middle East and Africa (MEA): MEA presents robust potential, driven by major governmental investments in high-security, large-scale projects, including major airport expansions, critical energy infrastructure (oil production and refining), and urban development initiatives (e.g., NEOM in Saudi Arabia). These projects require advanced, ruggedized patrol robots capable of handling extreme heat and sand, with high demand for continuous perimeter surveillance tailored for large, often remote, desert installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Patrol Robot Market.- Knightscope, Inc.

- SMP Robotics Systems Corp.

- Cobalt Robotics

- Boston Dynamics (Hyundai Motor Group)

- Sarcos Technology and Robotics Corporation

- Unitree Robotics

- Shenzhen Gosuncn Technology Group Co., Ltd.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Zhejiang Dahua Technology Co., Ltd.

- Axis Communications AB

- Genetec Inc. (Software Integration Partner)

- DJI (Aerial Patrol Systems)

- Clearpath Robotics (Component Supplier/Developer)

- Exyn Technologies

- Guss Automation

- A&S Security

- CAMS

- Advantech Co., Ltd.

- Fetch Robotics (Zebra Technologies)

- FLIR Systems (Teledyne FLIR)

Frequently Asked Questions

Analyze common user questions about the Electric Patrol Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Electric Patrol Robot Market?

The Electric Patrol Robot Market is projected to exhibit a high Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033, driven by increased automation adoption, advancements in AI navigation, and rising demands for integrated physical security solutions across critical infrastructure and commercial sectors globally. This rapid expansion is underpinned by the proven return on investment realized through labor cost reduction and enhanced 24/7 surveillance capabilities.

How does the Robot-as-a-Service (RaaS) model impact market adoption?

The RaaS model significantly lowers the barrier to entry for enterprises by transforming the substantial initial capital expenditure into predictable, scalable operational expenditures (OPEX). RaaS bundles the robot hardware, continuous software updates, maintenance, and technical support into a single subscription, allowing SMEs and large organizations alike to rapidly deploy sophisticated patrolling technology without the risks associated with ownership and technological obsolescence, thereby accelerating overall market penetration.

What are the primary technological hurdles facing Electric Patrol Robot widespread deployment?

The main technological hurdles include ensuring robust operation in highly dynamic and unstructured environments, achieving reliable and continuous battery endurance for 24/7 service, and developing AI algorithms with near-zero false positive rates. Cybersecurity robustness is also critical, as networked robots present potential entry points for malicious actors. Furthermore, regulatory alignment regarding autonomous operation and data privacy (GDPR compliance) remains an ongoing challenge requiring constant vendor innovation.

Which end-user segment drives the largest demand for these robots?

The Commercial end-user segment, comprising large corporate campuses, retail chains, and hospitality venues, currently drives the largest demand for Electric Patrol Robots. This segment focuses heavily on loss prevention, internal security management, and providing visible deterrence. While Critical Infrastructure and Government sectors demand highly customized, high-specification units, the volume and widespread applicability within the commercial sector make it the dominant revenue generator.

How does AI contribute to the operational efficiency of patrol robots?

AI is indispensable, primarily through advanced computer vision and predictive analytics. AI enables robots to perform sensor fusion (combining LiDAR, camera, and thermal data) to create high-precision maps and immediately detect anomalies. Predictive patrolling optimizes routes based on historical incident data, moving robots beyond fixed schedules to proactively cover high-risk areas. Furthermore, edge AI allows for instantaneous local decision-making, significantly improving incident response time without reliance on remote cloud processing.

What differentiates wheeled robots from tracked robots in terms of application?

Wheeled patrol robots are optimized for smooth, structured environments, such as indoor facilities, paved pathways, and corporate campuses, prioritizing speed and energy efficiency. Tracked robots, conversely, are designed for rugged, challenging terrains, including construction sites, rocky industrial yards, and areas requiring climbing or traversing obstacles like stairs or deep mud. The choice depends entirely on the operational environment and the specific need for mobility across uneven surfaces.

What role does 5G connectivity play in the future of the market?

5G connectivity is foundational for realizing the full potential of networked patrol robots. Its ultra-low latency and massive bandwidth capabilities enable real-time, high-definition video streaming and instantaneous remote control for human override, which is crucial for complex incident management. 5G facilitates large-scale deployment of robot fleets, allowing efficient data aggregation and rapid communication between robots and the centralized security command center, essential for sophisticated multi-robot coordination.

Are patrol robots intended to replace human security personnel?

Generally, patrol robots are positioned as force multipliers, not replacements for human security personnel. They automate routine, repetitive, and potentially hazardous tasks (e.g., monotonous surveillance and first-line perimeter checks), freeing up human guards to focus on high-level decision-making, incident resolution, and tasks requiring nuanced judgment and human interaction. Robots enhance efficiency and consistency, creating a hybrid security model that leverages the strengths of both automation and human expertise.

How do manufacturers address potential data privacy concerns?

Manufacturers address data privacy through several methods: implementing strict access controls and end-to-end encryption for data transmission and storage; utilizing advanced masking techniques to blur non-essential personal identifiers; and, critically, designing systems with configurable retention policies compliant with regional privacy laws like GDPR. In many public settings, systems are often configured to alert humans rather than storing personally identifiable information, focusing solely on behavioral anomalies.

What impact does the integration of aerial (drone) systems have on ground patrol robot utility?

The integration of aerial drone systems significantly enhances the utility of ground patrol robots by providing immediate, comprehensive oversight of large areas or inaccessible zones. Ground robots can act as charging stations or communication relays for drones, creating a coordinated air-and-ground security envelope. This synergy offers superior situational awareness and rapid verification of ground robot alerts, creating a more robust and responsive security system than either platform could achieve independently.

What are the typical maintenance requirements for electric patrol robots?

Maintenance requirements typically involve scheduled preventative checks, focusing on battery health and system calibration, especially for high-wear components like motors, sensors (LiDAR cleanliness), and chassis parts. Advanced systems often include AI-driven predictive maintenance features that alert operators to potential component failure before it occurs. Software updates are regularly required to enhance AI performance, address security vulnerabilities, and introduce new operational features, often managed remotely via the RaaS provider.

What is the role of sensor fusion in autonomous patrol operations?

Sensor fusion is vital for accuracy and redundancy. It involves combining data from multiple sensors (e.g., visual cameras, thermal sensors, LiDAR, and radar) to create a highly reliable, unified perception of the environment. If one sensor is compromised (e.g., fog obscures a camera), the system can rely on others (LiDAR or radar) to maintain navigation and detection capability, ensuring continuous operational integrity and significantly reducing the risk of false positives or navigation errors.

Which region shows the highest growth potential in the forecast period?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth potential, largely due to extensive governmental support for automation, rapid industrialization, and massive investment in smart city infrastructure, particularly in emerging economies within the region. The high population density and corresponding need for advanced, scalable public safety solutions further fuel the demand for patrol robotics across commercial and governmental sectors in APAC.

How is the market addressing challenges related to navigating complex terrains?

The market addresses complex terrain challenges by segmenting products into wheeled, tracked, and hybrid mobility types. For extremely complex environments, tracked robots offer maximum stability and traction. Furthermore, advanced AI-driven navigation stacks utilizing sophisticated SLAM algorithms and reinforcement learning allow wheeled robots to dynamically adjust speed and movement patterns to safely handle minor obstacles and uneven surfaces typical of industrial environments.

What are the key security features implemented to protect the robot system itself?

Key security features include secure boot mechanisms, military-grade data encryption for all stored and transmitted data, intrusion detection systems tailored for robotic operating systems, and robust authentication protocols for remote access and control. Furthermore, many high-security robots utilize isolated operating system architectures and hardware-level security chips to prevent tampering or unauthorized software modification, ensuring system integrity against cyber threats.

How do patrol robots handle communication with human security teams?

Patrol robots typically communicate with human security teams through integrated two-way communication systems, allowing for remote voice interaction. Alerts are transmitted in real-time to a central control room or mobile devices via VMS integration. When a robot detects an anomaly, it sends specific contextual data—video clips, location coordinates, and sensor readings—ensuring that human responders are fully informed and can respond efficiently without delay.

What role does standardization play in the Electric Patrol Robot industry?

Standardization is vital for interoperability and rapid deployment. Industry standards are emerging for communication protocols (to easily interface with existing security systems like VMS and access control), safety certifications (ensuring safe interaction with humans and property), and data formats. Standardization efforts reduce integration complexity, lower deployment costs, and increase customer confidence in system compatibility across different vendor platforms.

What competitive advantages are leading manufacturers currently pursuing?

Leading manufacturers are pursuing competitive advantages primarily through superior AI performance (lower false positive rates, higher accuracy in object recognition), extended operational uptime (better battery technology and inductive charging), and seamless integration capabilities with diverse client security ecosystems. The move towards highly customizable sensor payloads and specialized software tailored for niche industrial compliance (e.g., chemical plant monitoring) also provides significant market differentiation.

How does the market address liability issues associated with autonomous failures?

Liability is typically managed through comprehensive RaaS contracts and service level agreements (SLAs) that clearly define the responsibilities of the manufacturer, the service provider, and the end-user. Advanced data logging and black box features record all operational data, allowing for forensic analysis in the event of failure. Insurance coverage specific to autonomous systems is also becoming a requirement, mitigating financial risk associated with potential property damage or incident mismanagement.

What are the opportunities for specialization in the patrol robot market?

Key opportunities for specialization include developing robots tailored for niche hazardous environments (e.g., radiation monitoring in nuclear facilities, toxic gas detection), systems optimized for extreme climates (arctic or desert conditions), and public safety units designed for crowded urban centers that emphasize non-invasive, privacy-preserving surveillance techniques and interactive public communication features.

This report contains approximately 29,800 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager