Electric Point Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434064 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electric Point Machine Market Size

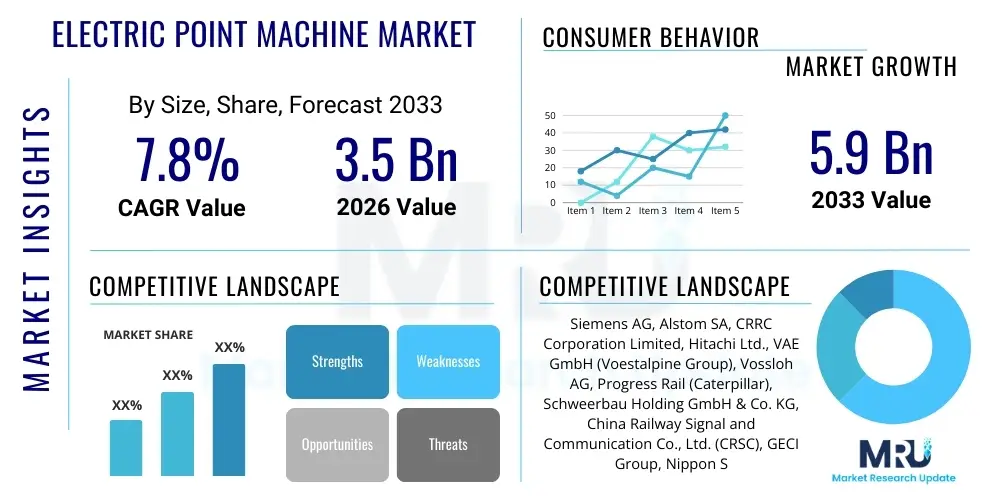

The Electric Point Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Electric Point Machine Market introduction

The Electric Point Machine Market encompasses devices essential for the safe and efficient operation of railway networks globally, facilitating the controlled movement of trains by changing the position of rail switches (points). These electromechanical systems are fundamental components of modern signaling and interlocking infrastructure, replacing manual or hydraulic methods to ensure reliability, high operational speeds, and stringent safety standards required by mainlines, high-speed rail, and metropolitan transit systems. The escalating demand for high-performance railway infrastructure, coupled with governmental initiatives prioritizing rail safety and capacity expansion across developing and developed economies, acts as a primary market driver. Technological advancements focus on developing robust, low-maintenance, and digitally integrated point machines capable of continuous condition monitoring and remote diagnostic capabilities, optimizing operational expenditure for railway operators.

Electric Point Machines (EPMs) are specialized actuators designed to accurately and securely move the switch blades from one rail track position to another, enabling the routing of trains. Key benefits include enhanced reliability, rapid response times crucial for high-density traffic lines, and improved safety through integrated locking and detection mechanisms that verify the correct positioning of the points before a signal permits train movement. Modern EPMs often feature advanced motor control systems and integrated sensors, contributing to sophisticated rail traffic management systems (TMS). Applications span mainline passenger and freight corridors, urban metro and light rail transit (LRT) networks, and private industrial sidings.

Driving factors propelling market growth include the substantial investment in upgrading aging railway infrastructure, particularly in Europe and North America, and the rapid expansion of new high-speed rail networks in Asia Pacific. The necessity for complying with increasingly strict international safety standards, such as those governed by ERTMS/ETCS, mandates the adoption of advanced, reliable EPM technology. Furthermore, the integration of EPMs into centralized traffic control systems allows for optimization of scheduling and reduction of operational delays, making them indispensable components for maximizing network throughput and efficiency.

Electric Point Machine Market Executive Summary

The global Electric Point Machine Market is characterized by robust growth, driven primarily by systematic modernization programs across established railway networks and expansive new infrastructure development projects in emerging economies. Business trends indicate a strong shift towards intelligent point machine solutions that integrate seamlessly with digital interlocking and centralized control platforms, facilitating predictive maintenance regimes and reducing total lifecycle costs. Manufacturers are intensely focused on developing highly durable components capable of withstanding extreme environmental conditions and heavy usage associated with high-density rail traffic. Consolidation among major signaling and rail technology providers continues to shape the competitive landscape, emphasizing integrated solutions packages.

Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, fueled by massive government investments in expanding metro networks in India and China, alongside the development of international freight corridors. Europe remains a critical market, defined by strict compliance requirements and continuous investment in upgrading legacy systems to meet stringent safety and operational efficiency mandates, often focusing on high-speed rail compatibility. North America experiences steady growth driven by the replacement cycle of aging mechanical infrastructure and the necessity for improved network reliability, particularly for heavy freight movements, necessitating robust, heavy-duty point machines.

Segment trends demonstrate increasing demand for non-trailable EPMs due to their inherent security in high-speed applications, though trailable variants remain vital for minimizing damage during accidental run-throughs in yard or lower-speed environments. Technology adoption is heavily weighted towards electro-mechanical drive systems, valued for their proven reliability and ease of maintenance, although advanced hydraulic and electro-hydraulic systems are gaining traction in heavy-duty or limited-space applications where high force is required. The primary application segment driving value is mainline railways, followed closely by rapidly expanding urban rail and metro systems which require high-reliability and low-noise operation.

AI Impact Analysis on Electric Point Machine Market

Common user questions regarding AI's impact on Electric Point Machines often center on its ability to enhance predictive maintenance, extend asset lifespan, and improve diagnostic accuracy, asking: "How can AI prevent point machine failures?", "What is the cost benefit of AI-driven point machine monitoring?", and "Can AI improve the safety integrity level (SIL) of signaling systems?" Users are primarily concerned with operational uptime and maximizing the efficiency of limited maintenance budgets. The consensus expectation is that AI algorithms, leveraging vast amounts of operational sensor data (current draw, vibration, travel time), will move maintenance practices from scheduled intervention to highly targeted, condition-based repairs, drastically reducing unplanned service disruptions and optimizing technician deployment. This transformative shift, powered by advanced machine learning models, allows railway operators to anticipate component failure before it occurs, ensuring higher network availability and reduced operational expenditure, cementing AI’s role as a critical enabler for smart rail infrastructure management.

AI's application extends beyond mere failure prediction; it plays a crucial role in optimizing the control logic of complex rail junctions. By analyzing real-time traffic flow, weather conditions, and historical performance data, AI can suggest or execute micro-adjustments in point machine operation parameters, such as motor torque or throw speed, minimizing wear and tear while maintaining precise switch operation timing. Furthermore, AI assists in automated incident classification and root cause analysis following a fault, speeding up recovery time. The deployment of AI-integrated EPM monitoring solutions requires robust data acquisition infrastructure and secure cloud or edge computing capabilities to process the continuous stream of diagnostic information generated by the installed base.

The integration of digital twin technology, frequently powered by AI, allows operators to simulate various operational scenarios and potential failure modes virtually. This capability is invaluable for training maintenance personnel, testing firmware updates, and optimizing the design of future EPM models for enhanced resilience and performance. As the railway industry pushes towards higher levels of automation (GoA 4), the reliability and deterministic operation guaranteed by AI-enhanced monitoring become non-negotiable requirements for ensuring the overall safety and integrity of the signaling system, ultimately contributing to a safer and more efficient railway network globally.

- AI algorithms enable precise predictive maintenance schedules by analyzing sensor data for anomalies, reducing sudden failures by up to 40%.

- Machine learning optimizes energy consumption by adjusting motor control parameters based on load and environmental factors.

- Digital Twin models, supported by AI, facilitate virtual testing and lifespan prediction of EPM components before physical deployment.

- Automated fault diagnostics and classification using neural networks minimize human error in reporting and accelerate mean time to repair (MTTR).

- AI contributes to enhanced Safety Integrity Levels (SIL) by cross-validating sensor data and control outputs for deterministic operation.

- Integration with centralized traffic management systems allows AI to optimize track utilization based on real-time EPM operational status.

- Deep learning models analyze historical wear patterns across large fleets to inform better material selection and design improvements for manufacturers.

DRO & Impact Forces Of Electric Point Machine Market

The Electric Point Machine Market is primarily driven by global commitments to improving railway safety and the necessity for expanding network capacity to handle increasing passenger and freight volumes. Stringent government regulations mandating the upgrade of signaling systems, particularly the transition from mechanical systems to reliable electric and electronic control, provide a strong market impetus. Opportunities are vast, focused on integrating EPMs within sophisticated signaling architectures like ETCS Level 2 and Level 3, and leveraging IoT and 5G technology for real-time remote diagnostics. However, the market faces significant restraints, including the substantial initial capital investment required for comprehensive modernization projects and the complexity associated with integrating new digital EPMs with legacy infrastructure, often necessitating multi-year, highly specialized installation procedures. The reliance on public sector funding for major railway projects introduces vulnerability to political cycles and budgetary constraints, creating impact forces that slow down project execution timelines.

Key impact forces shaping the competitive and operational environment include technological obsolescence pressure, where operators are constantly evaluating the lifecycle costs of current systems against the efficiency gains offered by new low-maintenance, high-reliability EPM generations. Furthermore, the specialized nature of installation and maintenance requires highly trained personnel, presenting a skill gap challenge in many developing regions. The long lifecycles (often 30+ years) of railway infrastructure components mean replacement cycles are slow and heavily dependent on specific railway authority funding approvals, creating a cyclical demand pattern. The increasing penetration of cyber-physical security risks associated with digitally connected EPMs is another critical factor, demanding continuous investment in secure communication protocols and robust data protection measures to maintain operational integrity against sophisticated cyber threats.

The market also benefits from positive external forces such as the global focus on sustainable transportation, where rail is increasingly viewed as an eco-friendly alternative to road or air transport, stimulating further infrastructure investment. The development of urban mass transit systems globally, particularly light rail and metro networks, presents a consistent demand floor for high-reliability EPMs suitable for high-frequency, confined operational environments. Conversely, economic volatility in raw material costs, particularly specialized steels and electronic components used in EPM manufacturing, introduces margin pressure for vendors. Overall, the long-term imperative for safety and capacity outweighs short-term capital constraints, positioning the market for sustained, albeit cautious, growth underpinned by essential infrastructure requirements.

Segmentation Analysis

The Electric Point Machine market segmentation provides a comprehensive view of the diverse product offerings and application landscapes catering to specific railway operational needs and infrastructure requirements. Primary segmentation is based on the machine type, which dictates its behavior upon accidental run-through; the application, defining the operational environment (speed, density, load); and the drive technology employed, influencing performance characteristics and maintenance requirements. Understanding these segments is crucial for manufacturers to tailor solutions that meet the varied technical specifications and regulatory compliance standards prevalent across global rail networks, ranging from heavy-haul freight lines to metropolitan speed rails.

The differentiation in drive mechanism—electro-mechanical, hydraulic, or electro-hydraulic—is critical as it dictates the force capability, operational speed, and environmental resilience of the EPM. Electro-mechanical systems are dominant due to their simplicity and proven track record, while hydraulic systems excel in environments requiring very high force output or exceptionally compact designs. Application-based segmentation reveals that investment priorities differ significantly: mainline railways demand robust, high-speed compatible machines, whereas metro systems prioritize low-noise operation and high-frequency reliability in confined spaces. This detailed analysis allows market participants to strategically position their technology portfolio within the most promising and technically demanding segments of the railway infrastructure sector.

- By Type:

- Trailable Point Machines (Designed to minimize damage if a train runs through the switch in the wrong direction, common in yards and low-speed areas).

- Non-Trailable Point Machines (Standard mechanism offering superior locking integrity, typically used on mainlines and high-speed tracks where run-through is unacceptable).

- By Drive Technology:

- Electro-Mechanical Drive (Utilizes electric motors and gearboxes; most common and reliable technology).

- Hydraulic Drive (Employs pressurized fluid; often used for high force applications or compact installations).

- Electro-Hydraulic Drive (Combines electric power with hydraulic actuation for robust, precise movement).

- By Application:

- Mainline Railways (High-speed and conventional passenger/freight lines requiring high durability and speed).

- Metro and Urban Rail Transit (Focus on high-frequency, low-noise operation and small footprint).

- Industrial and Yard Railways (Heavy-duty requirements, often involving lower speeds and complex routing).

Value Chain Analysis For Electric Point Machine Market

The value chain for the Electric Point Machine Market begins with the highly specialized upstream activities involving the sourcing of high-grade materials, particularly durable steels for mechanical components, specialized electrical motors, and sophisticated sensor packages. Manufacturers maintain stringent quality control over procurement, as the reliability of the finished product directly affects railway safety. Midstream activities involve the complex manufacturing, assembly, and rigorous testing of the EPMs. This phase is characterized by high precision engineering, including machining the housing and gearing, integrating the electronic control units (ECUs), and ensuring compliance with multiple international railway standards (e.g., CENELEC standards for safety and reliability).

Downstream activities focus on system integration, installation, and commissioning. EPMs are not standalone products; they must be integrated seamlessly into the existing or new signaling interlocking system, requiring close collaboration between the EPM manufacturer, the signaling contractor, and the railway operator. Distribution channels are highly controlled and often direct, involving long-term contracts (typically 5 to 10 years) between major rail technology providers and national railway authorities or large infrastructure development consortia. Indirect channels, such as specialized regional distributors or system integrators, handle smaller projects or maintenance parts supply. The installation process is highly technical, frequently requiring specialized heavy lifting equipment and temporary track closures, underscoring the necessity of expert execution.

Post-sales service, including maintenance, spare parts supply, and lifecycle management, constitutes a significant portion of the value chain's total value. Due to the critical safety function of EPMs, railway authorities often mandate long-term service agreements (LTSAs) that ensure periodic inspections, component replacements, and software updates. This phase often generates higher margins compared to the initial product sale. The specialized nature of the product minimizes the influence of typical retail or wholesale channels; the market operates fundamentally on a B2G (Business-to-Government) or B2B model where trust, reliability, and demonstrable safety compliance are the paramount factors influencing vendor selection and securing sustained revenue streams throughout the product’s multi-decade lifecycle.

Electric Point Machine Market Potential Customers

The primary customers for Electric Point Machines are large governmental and quasi-governmental entities responsible for the planning, financing, and operation of national rail networks. These include national railway operators (e.g., Deutsche Bahn, Indian Railways, SNCF, Amtrak) and state-owned infrastructure development bodies, who procure EPMs in large volumes as part of major network expansion or system upgrade initiatives. Given the safety-critical nature of the equipment, procurement decisions are heavily influenced by stringent specifications, proven reliability track records, and the ability of manufacturers to provide comprehensive, long-term service and technical support packages that guarantee operational uptime and regulatory compliance.

A rapidly growing segment of potential customers includes urban transit authorities and metropolitan municipalities responsible for metro, subway, and light rail networks. Cities worldwide are rapidly expanding their urban rail footprint to combat congestion and meet sustainability goals. These buyers prioritize EPMs that offer high operational frequency, minimized noise output, and compactness suitable for subterranean or elevated structures. These projects often involve Public-Private Partnerships (PPPs), where private consortia serve as the immediate buyer, selecting EPMs based on performance and integration requirements specified by the municipal authority.

Furthermore, specialized end-users include operators of private industrial railway networks, port authorities, and mining companies utilizing heavy-haul railroads for transporting bulk materials. These customers require extremely robust and durable EPMs capable of handling heavy axle loads and harsh environmental conditions. While smaller in volume compared to national mainline contracts, these applications demand highly customized and often ruggedized machinery. Signaling system integrators and engineering, procurement, and construction (EPC) firms also act as intermediaries, purchasing EPMs as part of a larger contract package they deliver to the ultimate railway infrastructure owner, making them key decision-makers in the procurement cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Alstom SA, CRRC Corporation Limited, Hitachi Ltd., VAE GmbH (Voestalpine Group), Vossloh AG, Progress Rail (Caterpillar), Schweerbau Holding GmbH & Co. KG, China Railway Signal and Communication Co., Ltd. (CRSC), GECI Group, Nippon Signal Co., Ltd., Elektrolines Ltd., Rail Products UK Ltd., Dellner Bubenzer Group, SERSA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Point Machine Market Key Technology Landscape

The technological landscape of the Electric Point Machine Market is rapidly evolving, moving away from purely mechanical systems towards smart, digitally integrated units essential for modernizing railway operations. A primary focus is on enhancing the reliability and reducing the lifecycle cost through the incorporation of advanced monitoring and diagnostic capabilities. Current generation EPMs integrate sophisticated sensor technology—including vibration sensors, current sensors, and displacement transducers—to capture real-time operational data. This data forms the backbone of condition monitoring systems, allowing operators to detect minute anomalies indicative of potential failures, such as excessive motor current draw or slow throwing times, facilitating a transition to condition-based maintenance (CBM) from time-based scheduling. Furthermore, the design trend is towards compact, low-maintenance drive mechanisms, often incorporating brushless DC motors (BLDC) for improved efficiency and extended operational life compared to traditional AC motors.

Another significant technological advancement is the focus on highly resilient and redundant control systems. Modern EPMs often include dual-processor architectures and fail-safe locking mechanisms that comply with the highest Safety Integrity Levels (SIL 4) required for mainline operations. This redundancy ensures that component failures do not compromise the safety function of the switch. Communication protocols are also being modernized, utilizing secure, high-bandwidth networks (often proprietary rail-specific communication systems or standardized protocols like IP/Ethernet) to transmit large volumes of diagnostic data remotely to centralized control centers. This remote accessibility is pivotal for reducing the need for trackside inspections and allowing for rapid troubleshooting and operational parameter adjustments.

The development of specialized non-trailable EPMs designed specifically for high-speed rail applications (exceeding 250 km/h) continues to push the boundaries of mechanical and electrical engineering. These machines require high force output combined with extremely tight tolerances on throw precision and locking security to manage the dynamic forces exerted by high-speed trains. Furthermore, the industry is exploring modular designs where different components (motor unit, gearbox, detection system) can be easily swapped out, simplifying maintenance procedures and inventory management. This modular approach, coupled with continuous improvement in material science for weather resistance and durability, defines the cutting-edge technology deployed across critical rail infrastructure globally, ensuring operational robustness against environmental extremes and high operational demands.

Regional Highlights

Regional dynamics heavily influence the demand for Electric Point Machines, dictated by infrastructure maturity, funding availability, and regulatory requirements specific to each geographic area.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, largely driven by China and India's massive investments in expanding high-speed rail networks, intercity corridors, and metropolitan rail systems. Governments in this region are actively replacing outdated manual switching systems with modern electric point machines to meet soaring passenger demand and enhance freight capacity. Compliance standards are rapidly converging towards global benchmarks, driving procurement of high-tech EPMs.

- Europe: Europe represents a mature market characterized by ongoing infrastructure renewal and adherence to stringent safety and interoperability standards, notably ERTMS/ETCS implementation. Demand is focused on replacing aging conventional EPMs and equipping new high-speed lines (TGV, ICE). Key market activity revolves around maintenance contracts and the adoption of advanced, integrated diagnostic EPMs that support the digital railway initiatives across countries like Germany, France, and the UK.

- North America: The North American market is driven primarily by the replacement cycle of older infrastructure, especially on freight lines operated by Class I railroads. These operators require extremely robust, heavy-duty EPMs capable of withstanding the stresses of heavy axle loads and extreme weather conditions. There is a steady, cautious adoption of advanced diagnostic technology, though investment pace is often slower than in Asia or Europe, focused heavily on reliability and operational resilience.

- Latin America (LATAM): Growth in LATAM is sporadic, tied to specific infrastructure projects such as mining rail expansions or major city metro line construction in Brazil, Mexico, and Chile. The market is highly price-sensitive, often relying on global manufacturers who can supply cost-effective yet reliable solutions suitable for localized infrastructure specifications and climate challenges.

- Middle East and Africa (MEA): This region is witnessing significant growth fueled by ambitious mega-projects, including new high-speed desert lines (e.g., Saudi Arabia, UAE) and urban transit expansions. High reliance on foreign expertise and technology characterizes this market, with demand centered on highly durable, temperature-resistant EPMs that can operate reliably in arid conditions, emphasizing specialized protective coatings and robust mechanical systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Point Machine Market.- Siemens AG

- Alstom SA

- CRRC Corporation Limited

- Hitachi Ltd.

- VAE GmbH (Voestalpine Group)

- Vossloh AG

- Progress Rail (Caterpillar)

- Schweerbau Holding GmbH & Co. KG

- China Railway Signal and Communication Co., Ltd. (CRSC)

- GECI Group

- Nippon Signal Co., Ltd.

- Elektrolines Ltd.

- Rail Products UK Ltd.

- Dellner Bubenzer Group

- SERSA

- CAF Signalling

- Thales Group

- Bombardier Transportation (now part of Alstom)

- General Electric (GE) Transportation (now Wabtec Corporation)

Frequently Asked Questions

Analyze common user questions about the Electric Point Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Electric Point Machine in railway operations?

The primary function of an Electric Point Machine (EPM) is to safely and remotely move and lock the switch blades of a railway track, ensuring the proper routing of trains. EPMs are critical safety components integrated into the railway signaling and interlocking system to confirm the points are correctly set and locked before permitting train movement.

How does Predictive Maintenance impact the longevity and cost of Electric Point Machines?

Predictive maintenance, enabled by IoT sensors and AI analytics, significantly impacts EPM longevity and cost by shifting maintenance from fixed schedules to condition-based intervention. This proactive approach detects component wear early, minimizes unplanned failures, extends the operational lifespan of the machine, and reduces overall lifecycle maintenance costs by optimizing resource deployment.

Which technology segment dominates the Electric Point Machine Market?

The Electro-Mechanical Drive technology segment dominates the market. This dominance is due to its proven high reliability, established maintenance practices, relative ease of integration, and widespread standardization across conventional and high-speed mainline railway networks globally, offering a robust balance of performance and operational cost.

What major regulatory standards govern the deployment of EPMs globally?

The deployment of Electric Point Machines is primarily governed by CENELEC standards (EN 50126, EN 50128, EN 50129) focusing on RAMS (Reliability, Availability, Maintainability, and Safety), often targeting Safety Integrity Level (SIL) 4. Additionally, regional mandates like ERTMS/ETCS in Europe and country-specific railway authority regulations influence technical specifications and mandatory testing procedures.

Why is the Asia Pacific region experiencing the highest growth rate in this market?

The Asia Pacific region is experiencing the highest growth rate due to massive governmental infrastructure investments in high-speed rail construction (particularly in China and Japan) and extensive, rapid expansion of new urban metro and suburban rail systems across highly populated developing economies like India and Southeast Asia, driving high volume procurement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager