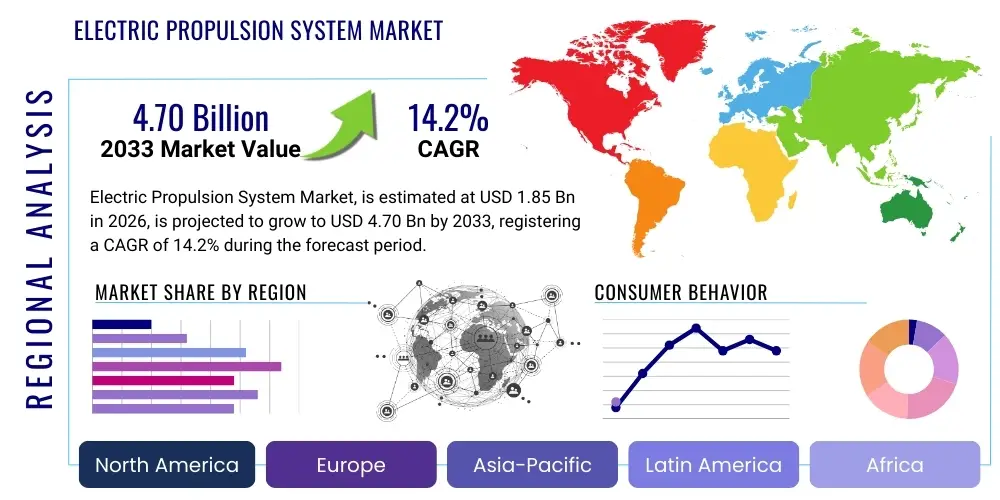

Electric Propulsion System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437596 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electric Propulsion System Market Size

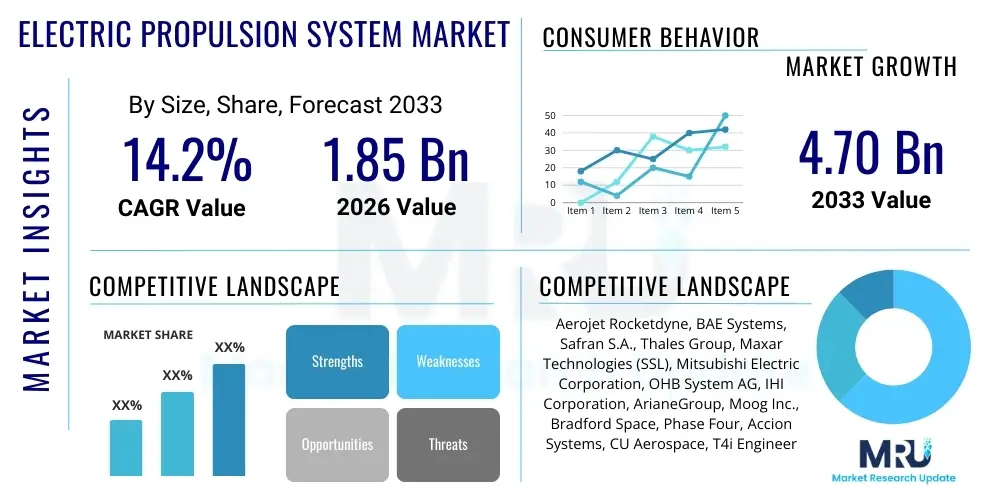

The Electric Propulsion System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.2% between 2026 and 2033. The market is estimated at 1.85 Billion USD in 2026 and is projected to reach 4.70 Billion USD by the end of the forecast period in 2033.

Electric Propulsion System Market introduction

The Electric Propulsion System (EPS) Market encompasses technologies used primarily in space applications, such as satellites and deep-space probes, to generate thrust using electrical power instead of purely chemical reactions. These systems are characterized by high specific impulse (Isp), meaning they use propellant much more efficiently than traditional chemical rockets, significantly reducing the mass required for propellant and enabling smaller, lighter, and more cost-effective spacecraft designs. The core principle involves accelerating ions or plasma to extremely high velocities using electric and magnetic fields, providing the necessary gentle but continuous thrust for orbital maneuvering, station keeping, and long-duration interplanetary missions.

Major applications of EPS span geosynchronous orbit (GEO) satellites, low Earth orbit (LEO) mega-constellations (for precise maneuvering and de-orbiting), and scientific missions requiring highly efficient, low-thrust navigation over years. The shift toward smaller, high-throughput satellites, combined with intense competition in the commercial space sector, has made high-efficiency EPS a fundamental requirement for modern spacecraft architecture. Furthermore, the integration of EPS is critical for extending the operational lifetime of satellites, maximizing the return on investment for operators, and enabling complex mission profiles that were previously unattainable with chemical systems alone.

Driving factors for this market include the global surge in satellite launches, particularly LEO constellations requiring constant station-keeping capabilities; increased government and private investment in deep space exploration programs (e.g., Artemis, Mars missions); and continuous technological advancements improving the thrust-to-power ratio and overall system reliability. The benefits of adopting EPS are manifold, including reduced launch costs due to lower mass requirements, extended mission duration, and enhanced maneuverability, positioning EPS technology as indispensable for the future of commercial and governmental space endeavors.

Electric Propulsion System Market Executive Summary

The Electric Propulsion System Market is undergoing rapid transformation, driven primarily by the commercialization of space and the deployment of massive satellite constellations in Low Earth Orbit (LEO). Business trends highlight intense competition among manufacturers to develop higher-power density systems, particularly Hall-Effect Thrusters (HETs) and Ion Thrusters, capable of faster orbit raising and increased thrust levels suitable for larger satellite buses. Strategic partnerships between traditional aerospace primes and specialized propulsion startups are defining the competitive landscape, emphasizing supply chain optimization and standardization of interfaces to meet the high-volume production demands of constellation operators. Furthermore, significant investments are directed towards developing non-toxic, innovative propellants, moving beyond traditional xenon to explore krypton, iodine, and water, aiming for reduced system complexity and operational costs.

Regionally, North America maintains its dominance due to the presence of key space agencies (NASA) and leading commercial satellite manufacturers (e.g., SpaceX, Maxar), coupled with substantial military expenditure focused on resilient space infrastructure. However, the Asia Pacific region, particularly China and India, is rapidly emerging as a high-growth market, fueled by burgeoning indigenous space programs and national initiatives aimed at expanding satellite communication capabilities. Europe continues to invest heavily in foundational technologies through the European Space Agency (ESA), focusing on miniaturization and high-performance system development to secure a competitive edge in advanced mission capabilities.

Segment trends underscore the criticality of the Hall-Effect Thruster segment, which currently dominates revenue due to its balanced performance metrics suitable for commercial GEO and LEO applications. Ion Thrusters, while offering the highest specific impulse, are gaining traction for long-duration deep-space and scientific missions where propellant efficiency is paramount. The increasing demand for in-orbit services and debris remediation also drives growth in smaller, highly maneuverable propulsion units, indicating a future market leaning toward diversified system architectures tailored precisely to specific mission parameters and longevity requirements.

AI Impact Analysis on Electric Propulsion System Market

Common user questions regarding AI's influence on the Electric Propulsion System Market frequently revolve around optimizing thrust control, predicting system degradation, and autonomous mission planning in complex environments. Users are primarily concerned with how AI can enhance the performance envelope of existing thruster technology, specifically in areas such as minimizing propellant consumption through real-time adjustments, diagnosing subtle hardware anomalies before catastrophic failure, and enabling fully autonomous satellite swarms or deep-space probes that must navigate without constant human intervention. The expectation is that AI integration will shift EPS from a reactive control system to a predictive and adaptive asset, dramatically increasing operational efficiency and mission reliability, especially as satellites become more numerous and interdependent.

The core theme summarizing user expectations is the demand for ‘Smart Propulsion.’ AI algorithms are anticipated to revolutionize the testing and validation phases by simulating complex plasma behaviors and optimizing electrode geometries far faster than traditional simulation methods, accelerating the design cycle for next-generation thrusters. Operationally, AI-driven health monitoring systems (Prognostics and Health Management - PHM) will use telemetry data to forecast remaining useful life (RUL) for critical components, allowing for timely preventative actions, which is essential for multi-year missions relying solely on high-efficiency electric thrust.

Furthermore, in the context of large LEO constellations, AI is fundamental for managing collision avoidance and precise formation flying. Autonomous navigation systems, powered by machine learning, will calculate optimal thrust vectors and schedules for thousands of concurrent maneuvers, ensuring minimal fuel use and preventing orbital congestion. This integration of AI not only reduces the reliance on ground operations teams but also unlocks novel mission concepts, such as distributed space systems and autonomous logistics missions, fundamentally changing the economics and technical feasibility of future space infrastructure.

- AI-powered optimization of thrust vectoring and propellant utilization for efficiency maximization.

- Predictive maintenance and health monitoring (PHM) using machine learning to forecast thruster degradation and failure.

- Accelerated design and simulation of novel thruster geometries and plasma physics using computational AI models.

- Autonomous navigation and orbital mechanics planning for large satellite constellations (swarms).

- Real-time anomaly detection and self-correction in deep space missions lacking instantaneous ground communication.

- Enhanced testing and quality control processes through automated data analysis and pattern recognition.

DRO & Impact Forces Of Electric Propulsion System Market

The Electric Propulsion System Market is fundamentally shaped by powerful synergistic forces: the urgent global demand for high-throughput connectivity (driving constellation deployment) and continuous technological breakthroughs enhancing system efficiency. The primary Drivers include the rapid decline in launch costs, making high-efficiency electric systems economically superior for LEO operators, and increasing governmental space budgets focused on long-duration, high-value missions. However, these drivers are tempered by significant Restraints, notably the inherent low thrust generated by EPS, leading to long orbit raising times compared to chemical propulsion, and the high upfront cost associated with specialized manufacturing and qualification processes necessary for space-grade hardware. The limited availability and high cost of traditional propellants like Xenon also pose constraints, pushing innovation toward alternatives.

Opportunities in the market are abundant, centered around the emerging needs of in-space logistics, satellite servicing, and the development of entirely novel mission architectures, such as lunar and Martian transport systems powered by high-power electric propulsion. The increasing focus on Space Situational Awareness (SSA) and Active Debris Removal (ADR) creates a strong secondary market for compact, rapidly responding electric maneuvering units. Moreover, the cross-sector application of electric propulsion technologies, specifically in the maritime industry for hybrid and fully electric ships, represents a massive potential area for market expansion and technology diversification beyond traditional space applications, leveraging accumulated expertise in high-efficiency power management and system longevity.

The Impact Forces are heavily skewed toward technological push and regulatory pull. Technological advancements (e.g., higher power processing units, miniaturization, and the shift to alternative propellants like Iodine) exert a strong upward force, continuously improving the viability of EPS across all mission profiles. Simultaneously, regulatory changes, particularly those mandating rapid satellite de-orbiting and minimizing space debris, act as a crucial pull force, making reliable EPS mandatory for compliance, thereby accelerating adoption across all new satellite programs globally. The confluence of these forces ensures sustained, high double-digit market growth over the forecast period, cementing EPS as the default choice for modern satellite platforms.

Segmentation Analysis

The Electric Propulsion System Market segmentation offers a granular view of the diverse technologies and application sectors driving market expansion. Segmentation is primarily based on the technology type, which defines the underlying physics used to generate thrust (e.g., Hall-Effect, Ion), the end-user base (governmental, commercial), and the application context (LEO, GEO, deep space). This structured analysis helps stakeholders identify specific growth pockets, understand the competitive dynamics within specialized niches, and tailor investment strategies toward the most rapidly evolving sub-segments, particularly those catering to the high-volume LEO constellation market and the demanding deep-space scientific missions.

The performance characteristics inherent to each technology type—specific impulse versus thrust level—dictate their ideal mission profile. Hall-Effect Thrusters (HETs) excel in efficiency for commercial applications requiring moderate thrust, dominating the current commercial market. In contrast, Gridded Ion Thrusters, offering the highest specific impulse, remain the preferred choice for long-duration, highly mass-sensitive scientific missions where mission lifetime extension is paramount. Future segmentation growth is anticipated in emerging technologies, such as Pulsed Plasma Thrusters (PPTs) and Field Emission Electric Propulsion (FEEP), which cater to the miniaturization trend in CubeSats and NanoSats, demanding extremely low power and compact systems.

- By Type:

- Hall-Effect Thrusters (HET)

- Gridded Ion Thrusters (GIT)

- Pulsed Plasma Thrusters (PPT)

- Arcjets

- Resistojets

- Others (FEEP, Magnetoplasmadynamic Thrusters - MPDT)

- By Application:

- Station Keeping

- Orbit Raising

- De-orbiting

- Deep Space Missions/Interplanetary Travel

- Maneuvering (In-Space Logistics)

- By End-User:

- Commercial

- Government & Military

- Scientific & Research

- By Power Range:

- Low Power (< 1 kW)

- Medium Power (1 kW – 5 kW)

- High Power (> 5 kW)

Value Chain Analysis For Electric Propulsion System Market

The value chain for the Electric Propulsion System market begins with highly specialized upstream activities centered around raw material sourcing and component manufacturing. This upstream segment is characterized by the production of high-purity propellants (e.g., Xenon, Krypton, Iodine), the fabrication of sophisticated magnetic components and electrodes, and the development of high-voltage Power Processing Units (PPUs) and advanced cathode technologies, which are critical, high-cost inputs. Suppliers in this segment require stringent quality control and high-level technical expertise, often operating in niche markets, leading to potential supply bottlenecks if global demand rapidly accelerates.

The midstream phase involves the integration and system assembly of the thruster units, where specialized propulsion manufacturers and established aerospace primes design, test, and qualify the complete EPS package. This phase is heavily capital-intensive and subject to long lead times due to rigorous testing requirements (thermal vacuum, vibration testing). Distribution channels are primarily direct, involving long-term contracts between EPS manufacturers and large spacecraft prime contractors (e.g., Boeing, Airbus Defence and Space, Maxar) or direct supply to government space agencies (e.g., NASA, ESA). Indirect sales through system integrators are less common but growing, particularly for standardized, smaller propulsion modules catering to CubeSat platforms.

Downstream activities focus on the operational deployment and in-orbit services. The end-users—commercial satellite operators (LEO/GEO), military space commands, and scientific research institutes—utilize the EPS for orbital maneuvers, station keeping, and mission longevity. The increasing importance of post-launch support, telemetry analysis, and potential in-orbit maintenance suggests future value will shift toward data analytics and propulsion performance optimization services. This highly technical value chain requires continuous investment in R&D to maintain competitiveness, with control often concentrated among companies capable of producing both the thruster and the highly complex PPU, ensuring optimal system compatibility and performance.

Electric Propulsion System Market Potential Customers

Potential customers for Electric Propulsion Systems span three primary sectors: the commercial satellite industry, governmental and defense organizations, and the scientific research community. The largest and fastest-growing customer base is the commercial sector, dominated by companies deploying massive LEO mega-constellations for global broadband internet access. These operators require reliable, mass-producible HETs for efficient orbit raising and cost-effective station keeping throughout the satellite's operational life. The crucial need for efficient propellant use to minimize launch mass makes EPS the propulsion system of choice for these high-volume, cost-sensitive customers, influencing manufacturing toward scalable, standardized production lines.

Government and military organizations represent another critical customer segment, often demanding highly customized, high-reliability propulsion systems for high-value strategic assets in GEO or highly elliptical orbits. These customers prioritize mission assurance, system redundancy, and stealth capabilities, often investing in specialized ion thrusters for deep-space surveillance or precise orbital adjustments. Defense procurement drives innovation in specialized propellants and higher-power systems necessary for rapid maneuvering, contributing significantly to R&D funding for advanced EPS technologies capable of surviving harsh radiation environments.

The third major segment encompasses scientific research institutes and international space agencies focused on deep space exploration. These customers require propulsion systems with the absolute highest specific impulse, making Gridded Ion Thrusters indispensable for missions like planetary probes, asteroid sample returns, or solar system mapping, where journey durations span years and minimal propellant expenditure is vital. Furthermore, emerging customers include in-space logistics providers and active debris removal companies, which require modular, highly maneuverable electric tugs for moving assets between orbits, establishing a new commercial market for propulsion services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1.85 Billion USD |

| Market Forecast in 2033 | 4.70 Billion USD |

| Growth Rate | 14.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aerojet Rocketdyne, BAE Systems, Safran S.A., Thales Group, Maxar Technologies (SSL), Mitsubishi Electric Corporation, OHB System AG, IHI Corporation, ArianeGroup, Moog Inc., Bradford Space, Phase Four, Accion Systems, CU Aerospace, T4i Engineering, VACCO Industries, Enpulsion, SITAEL, ThrustMe, Beijing Shenzhou. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Propulsion System Market Key Technology Landscape

The technology landscape of the Electric Propulsion System market is characterized by a mature foundation in electrothermal and electrostatic technologies, rapidly evolving toward enhanced thrust capabilities and propellant diversification. Hall-Effect Thrusters (HETs) and Gridded Ion Thrusters (GITs) represent the dominant technologies. HETs utilize an annular channel where electrons are trapped by a radial magnetic field, ionizing the propellant and accelerating the ions, balancing high efficiency with moderate thrust—making them the workhorse for most commercial satellites. GITs, in contrast, use electrostatic grids to accelerate ions generated in a discharge chamber, achieving the highest known specific impulse, ideal for minimizing propellant mass on long-duration missions.

Significant technological advancements are focusing on overcoming the traditional limitations of electric propulsion, primarily the low thrust-to-power ratio and dependence on expensive Xenon propellant. This includes the development of high-power HETs (operating above 10 kW) to significantly decrease orbit raising times for large satellite buses, which directly addresses a major constraint. Simultaneously, there is intense research into alternative propellants, such as Iodine and Krypton, which are cheaper, more readily available, and often allow for simpler, lighter propulsion systems due to their solid state (Iodine) or lower pressure requirements (Krypton), revolutionizing logistics and operational safety.

Furthermore, miniaturization technologies, driven by the burgeoning CubeSat and NanoSat market, are fostering growth in micro-propulsion systems like Pulsed Plasma Thrusters (PPTs), which use small bursts of propellant (often Teflon) to provide highly precise, low-impulse maneuvering. Field Emission Electric Propulsion (FEEP) technology is also gaining relevance for fine attitude control due to its extremely low power consumption and high precision. The intersection of these hardware advancements with smart Power Processing Units (PPUs)—featuring integrated digital control and AI capabilities—is creating propulsion systems that are not only more efficient but also significantly smarter, enhancing autonomy and reliability in orbit.

Regional Highlights

- North America: North America, led by the United States, is the primary market driver and technology leader for Electric Propulsion Systems, accounting for the largest market share. This dominance is underpinned by robust government spending through NASA and the Department of Defense, coupled with the global headquarters of major commercial space players like SpaceX, Maxar, and Boeing. The region is characterized by high investment in advanced, high-power EPS systems necessary for next-generation military satellites and the operational demands of massive LEO constellations. The regulatory environment is highly supportive of commercial innovation, facilitating rapid product qualification and deployment. The U.S. remains at the forefront of R&D for advanced propellants (e.g., iodine) and high-thrust Hall thrusters, securing a competitive advantage in both technology and deployment volume.

- Europe: Europe represents a significant and technologically sophisticated market, driven by the European Space Agency (ESA) and major defense contractors like Thales Alenia Space and Airbus Defence and Space. The region is a key innovator in developing both Hall-Effect and Gridded Ion Thrusters, often focusing on high reliability and long operational life suitable for GEO satellites and scientific missions (e.g., BepiColombo utilized European Ion Propulsion). European initiatives emphasize sustainable space operations, including advanced de-orbiting capabilities, which inherently favor efficient electric propulsion methods.

The European Union's Horizon programs and specific space sector funding initiatives actively support the development of flight-proven, standardized EPS components, aiming to reduce dependence on external suppliers, particularly for critical technologies like Power Processing Units. The market here is growing steadily, propelled by national defense space strategies and the need to replace aging satellite fleets. Collaboration across member states often leads to shared resource pooling for large-scale R&D projects, solidifying Europe's position as a critical, though more regulated, market segment.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for Electric Propulsion Systems, fueled primarily by ambitious national space programs in China, India, Japan, and South Korea. China, in particular, is witnessing explosive growth in both governmental and private space enterprises, driving substantial demand for reliable EPS for its extensive satellite communication networks and increasingly sophisticated deep-space exploration missions (e.g., lunar missions). India’s ISRO is also a significant consumer, focused on utilizing electric propulsion for its GSLV and PSLV payloads to maximize mass efficiency.

The growth in APAC is characterized by a rapid buildup of domestic manufacturing capabilities, often leveraging international partnerships while simultaneously cultivating indigenous technology development to achieve self-reliance. This region's focus on building massive communication and remote sensing constellations for domestic needs ensures a sustained high demand volume. Increasing competition among Asian satellite operators and the deployment of new commercial launch services further accelerate the integration of high-performance electric propulsion across various mission classes.

- Latin America, Middle East, and Africa (LAMEA): The LAMEA region represents an emerging market segment, with growth primarily tied to government investments in secure communications and national sovereignty satellites. Countries in the Middle East, such as the UAE and Saudi Arabia, are actively investing in space infrastructure and R&D, often procuring advanced GEO satellites that utilize mature EPS technologies for enhanced maneuverability and extended lifespan. In Latin America and Africa, the demand is mainly driven by the need for reliable, cost-effective satellite solutions to bridge connectivity gaps, often relying on imported satellites equipped with standardized electric propulsion.

While local manufacturing remains limited, the region acts as a crucial end-user market, influencing global supply chains through procurement decisions. The emphasis here is on reliable, proven systems rather than cutting-edge R&D, making established Hall-Effect thrusters a popular choice. Future growth in this region is linked to increased funding for domestic space agencies and the broader integration of satellite services into economic infrastructure planning, gradually driving up the regional market share.

The U.S. government’s emphasis on maintaining technological superiority in space, often through initiatives promoting domestic manufacturing and supply chain resilience, ensures continued investment in EPS capabilities. Furthermore, the commercial sector's commitment to deploying and maintaining thousands of satellites mandates high-efficiency EPS, particularly for orbital transfer and precise station keeping, driving volume production contracts. The region’s established ecosystem of universities, national labs, and specialized propulsion startups fosters continuous innovation, attracting global talent and capital.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Propulsion System Market.- Aerojet Rocketdyne

- BAE Systems

- Safran S.A.

- Thales Group

- Maxar Technologies (SSL)

- Mitsubishi Electric Corporation

- OHB System AG

- IHI Corporation

- ArianeGroup

- Moog Inc.

- Bradford Space

- Phase Four

- Accion Systems

- CU Aerospace

- T4i Engineering

- VACCO Industries

- Enpulsion

- SITAEL

- Exotrail

- TrustMe

Frequently Asked Questions

Analyze common user questions about the Electric Propulsion System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Electric Propulsion Systems over traditional chemical propulsion?

Electric Propulsion Systems (EPS) offer significantly higher specific impulse (Isp), meaning they use propellant much more efficiently than chemical rockets. This efficiency translates directly into lower propellant mass requirements, substantially reducing launch costs and allowing for longer mission durations, often extending the satellite's operational life by several years. While thrust is lower, the accumulated impulse is critical for sustained orbital maneuvers and station keeping.

How is the reliance on Xenon propellant impacting the Electric Propulsion Market?

Xenon has historically been the ideal propellant due to its high molecular weight and inert nature, but its high cost, scarcity, and specialized storage requirements are major restraints. This limitation is actively driving innovation toward cheaper, more abundant alternatives like Krypton and Iodine. The shift to alternative propellants is lowering system complexity and cost, making EPS more accessible for high-volume LEO constellations and promoting global supply chain diversity.

Which type of Electric Propulsion Thruster currently dominates the commercial market?

Hall-Effect Thrusters (HETs) currently dominate the commercial market, particularly for geosynchronous (GEO) and low earth orbit (LEO) satellite applications. HETs provide a favorable balance of moderate thrust and high specific impulse, making them cost-effective and highly reliable for standard commercial satellite station keeping and orbit raising tasks. Ion Thrusters are typically reserved for specialized deep-space missions where maximum efficiency is paramount.

What role does Electric Propulsion play in the management of LEO mega-constellations?

Electric Propulsion is crucial for LEO mega-constellations, serving three primary functions: highly efficient orbit raising after initial deployment; precise station keeping to maintain constellation integrity and avoid collisions; and mandatory de-orbiting at the end of the satellite’s life to mitigate space debris. The requirement for reliable, efficient de-orbiting systems, often mandated by international regulations, makes EPS indispensable for constellation sustainability.

What are the major technological trends expected to shape the future of Electric Propulsion?

Future trends include the development of higher-power electric propulsion systems (5 kW+) to drastically reduce orbit transfer times; widespread adoption of non-traditional propellants like Iodine, which are simpler to store and handle; and the integration of advanced AI-driven Power Processing Units (PPUs) for real-time thrust optimization, predictive maintenance, and autonomous mission execution, enhancing overall system reliability and performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electric Hub Drive and Electric Propulsion System for Combat Vehicle Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Electric Propulsion System Market Statistics 2025 Analysis By Application (Nano Satellite, Microsatellite), By Type (Gridded Ion Engine (GIE), Hall Effect Thruster (HET), High Efficiency Multistage Plasma Thruster (HEMPT), Pulsed Plasma Thruster (PPT), Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager