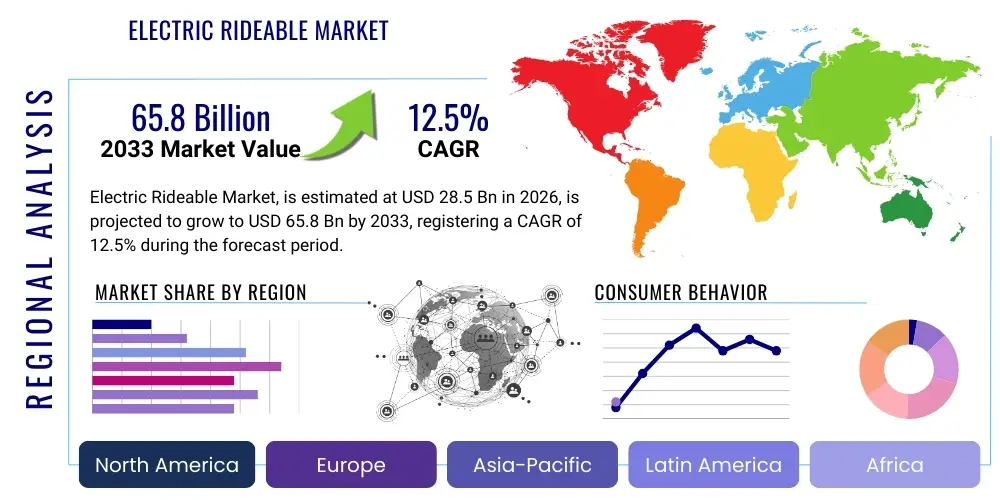

Electric Rideable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436405 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electric Rideable Market Size

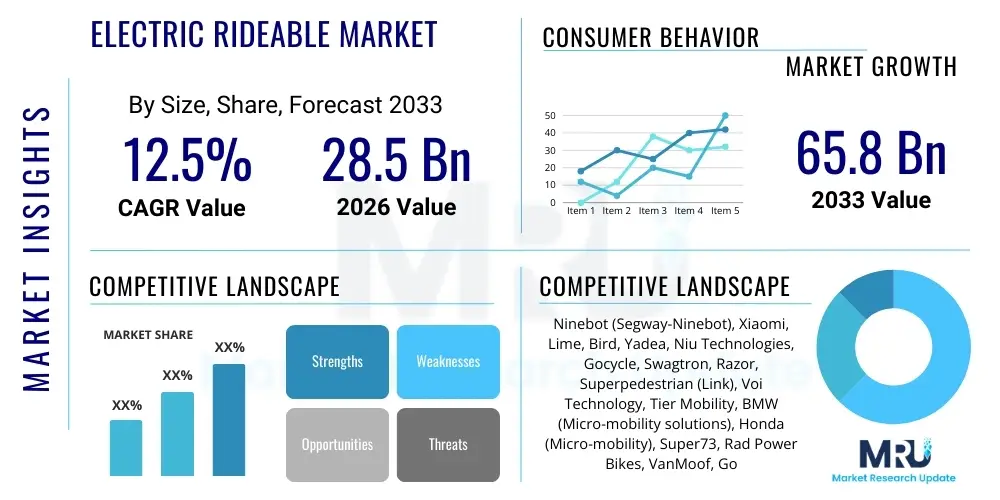

The Electric Rideable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $28.5 Billion USD in 2026 and is projected to reach $65.8 Billion USD by the end of the forecast period in 2033.

Electric Rideable Market introduction

The Electric Rideable Market encompasses a diverse range of lightweight, electrically powered personal transportation devices designed primarily for urban and short-distance mobility. This sector includes products such as e-bikes, e-scooters, hoverboards, and electric skateboards, all characterized by their rechargeable battery systems and compact design. The fundamental purpose of these products is to provide efficient, sustainable, and cost-effective alternatives to traditional transportation methods, particularly addressing the pervasive issue of "last-mile connectivity" in densely populated metropolitan areas. The market expansion is intrinsically linked to global urbanization trends and increasing consumer awareness regarding carbon emissions, positioning electric rideables as essential components of future smart city infrastructure. These devices often integrate with digital platforms, enhancing user experience through GPS tracking, mobile locking/unlocking, and performance monitoring, thereby solidifying their role in the modern multimodal transit ecosystem.

Key applications of electric rideables span across personal use, shared mobility services, and commercial operations such as food and parcel delivery. For personal use, these devices offer commuters a flexible way to navigate traffic congestion and access areas poorly served by public transport. The shared mobility model, pioneered by companies like Lime and Bird, has dramatically increased accessibility and visibility, making rideables a ubiquitous feature in many global cities. Furthermore, benefits include zero tailpipe emissions, reduced operational noise, and minimal spatial requirements for parking compared to cars. These attributes are highly attractive to local governments aiming to achieve sustainability goals and alleviate urban density pressures. The continuous innovation in battery technology, focusing on increased range and faster charging capabilities, is central to sustaining consumer adoption and operational efficiency in high-utilization environments like fleet sharing.

The market is significantly driven by supportive governmental policies, including subsidies, tax incentives for electric vehicle purchases, and the development of dedicated micro-mobility infrastructure, such as bike lanes and protected scooter routes. Regulatory clarity, particularly concerning speed limits and mandatory safety features, is crucial for fostering consumer trust and ensuring the sustainable integration of these devices into the existing traffic framework. Additionally, the rising cost of fuel and increasing parking difficulties in urban centers naturally push consumers toward more economical and convenient alternatives. The demographic shift towards younger generations who prioritize sustainable, technologically advanced, and flexible transportation options further accelerates market growth, making the electric rideable sector a dynamic and high-growth component of the broader sustainable transportation industry.

Electric Rideable Market Executive Summary

The Electric Rideable Market is experiencing robust growth fueled by transformative business trends, supportive regional initiatives, and sustained segment diversification. Business operations are increasingly dominated by sophisticated fleet management systems utilizing IoT and cloud connectivity to optimize deployment, maintenance, and dynamic pricing strategies for shared micro-mobility services. A major trend is the shift from purely consumer sales to a service-based model (MaaS – Mobility as a Service), where large corporations partner with municipalities to manage extensive shared fleets. Furthermore, manufacturers are focusing heavily on enhancing durability and modular design to withstand the harsh usage cycles of shared environments, thereby reducing total cost of ownership (TCO) for operators and improving the overall lifespan of the asset. Consolidation among major players and strategic partnerships with public transit agencies are defining the competitive landscape, leading to standardized safety protocols and improved integration with existing transit networks, making the service more seamless for end-users.

Regionally, the market exhibits divergent maturity levels. Asia Pacific, particularly China and India, represents the largest volume market, primarily driven by high personal e-bike and e-scooter ownership due to cost efficiency and high urban population density. Europe is characterized by stringent environmental regulations and proactive policy support for micro-mobility infrastructure, making it the fastest-growing market for shared services, especially in Western European capitals where eco-consciousness is high and city centers are often restrictive to conventional vehicles. North America, while having significant shared fleet penetration, faces varied regulatory landscapes across different states and cities, impacting scalability and deployment speed. Emerging economies in Latin America and the Middle East are rapidly adopting e-rideables as governments seek quick, scalable solutions to urban congestion, often through direct governmental contracts for municipal services or regulated shared schemes.

Segmentation trends indicate a strong consumer preference shift towards high-performance, long-range Lithium-Ion powered devices, replacing older, heavier SLA battery models. Within product types, e-bikes continue to hold the largest market share globally due to their established regulatory framework and utility for longer commutes and cargo transport. However, e-scooters are exhibiting the fastest growth rate, propelled by the ubiquity of dockless shared systems that cater specifically to ultra-short, last-mile journeys. The application segment is witnessing rapid expansion in commercial logistics; small, agile electric rideables are becoming indispensable tools for fast delivery services in congested zones, improving speed and efficiency compared to traditional vehicles. This segment diversification ensures market resilience, minimizing dependence on any single application or geographic area and guaranteeing sustained investment in associated infrastructure, such as advanced charging stations and repair hubs.

AI Impact Analysis on Electric Rideable Market

Common user questions regarding AI's impact on the Electric Rideable Market frequently revolve around safety enhancement, fleet efficiency, and the development of truly autonomous micro-mobility. Users are concerned about how AI can mitigate collision risks in complex urban environments, particularly regarding pedestrian and cyclist interactions. They also keenly inquire about how machine learning algorithms optimize dynamic pricing, predict maintenance needs, and manage geofencing restrictions to ensure regulatory compliance and profitability for shared service operators. A significant theme is the expectation that AI will be the backbone of next-generation features, moving beyond simple tracking to include predictive battery life estimation, personalized routing based on congestion data, and potentially enabling semi-autonomous parking capabilities to solve the common issue of haphazardly parked scooters. The overall anticipation is that AI integration will transform electric rideables from simple transportation tools into smart, self-optimizing urban assets.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamental to the continued optimization and scalability of the Electric Rideable Market, particularly in the realm of shared mobility. AI algorithms are crucial for analyzing vast datasets generated by connected devices regarding usage patterns, congestion levels, and infrastructure quality. This data intelligence allows operators to dynamically reposition fleets to areas of peak demand, minimize downtime, and maximize utilization rates. Predictive maintenance, driven by ML models, monitors component stress (e.g., battery degradation, tire wear, brake performance) in real-time, scheduling repairs proactively rather than reactively, which significantly boosts vehicle uptime and lowers operational expenditure, ensuring higher customer satisfaction through better device availability and reliability.

Furthermore, AI plays a pivotal role in enhancing rider safety and ensuring regulatory compliance. Advanced computer vision systems embedded within rideables or utilized by monitoring software can detect unsafe riding behavior, such as riding on sidewalks or exceeding speed limits in designated zones, triggering immediate alerts or speed reduction. For autonomous rideables, currently in early stages of development, AI is essential for navigation, object recognition, and complex decision-making required for self-parking or assisted docking. The future trajectory involves integrating rideable data with broader Smart City platforms, using AI to manage traffic flow and coordinate micro-mobility services seamlessly with public transit schedules, creating a truly integrated urban mobility solution that minimizes environmental impact and maximizes efficiency for commuters.

- AI-driven Dynamic Fleet Rebalancing: Optimizing the geographic distribution of shared scooters and bikes based on predictive demand modeling derived from historical data, weather, and real-time events.

- Predictive Maintenance Protocols: Utilizing Machine Learning (ML) to monitor component health indicators (e.g., battery cycle count, vibration patterns) and forecast required servicing before failures occur, dramatically increasing asset lifespan.

- Enhanced Safety Features via Computer Vision: Implementing AI vision systems to detect rider behavior violations (e.g., dual riding) and automatically enforce geofencing restrictions, such as slowing down in designated pedestrian areas.

- Autonomous Parking and Docking: Developing self-driving capabilities that allow the vehicle to autonomously navigate short distances to designated parking zones, solving the prevalent clutter issue in cities.

- Personalized Routing and Efficiency: Offering riders AI-optimized routes considering factors like gradient, current congestion, air quality, and battery range for the most efficient journey.

- Fraud Detection and Security: Using behavioral analytics powered by AI to identify and flag unauthorized usage, tampering, or potential theft attempts on shared vehicles.

DRO & Impact Forces Of Electric Rideable Market

The Electric Rideable Market is significantly shaped by a powerful confluence of Driving forces (D), Restraints (R), and Opportunities (O), whose cumulative interaction defines the Impact Forces on market growth. The core drivers stem from global urban dynamics, including severe traffic congestion, environmental consciousness leading to demand for low-emission alternatives, and strong governmental backing for sustainable transport infrastructure. These drivers create an undeniable tailwind for market penetration. However, the market faces structural restraints, primarily complex and often inconsistent regulatory frameworks across different municipalities, safety concerns related to rider behavior and accidents, and the persistent challenge of battery lifespan and recycling logistics. These restraints necessitate innovative policy and technological solutions to mitigate risk and ensure long-term viability. Opportunities abound in expanding into untapped suburban and peripheral urban areas, developing specialized commercial delivery fleets, and advancing autonomous technology for safer and more efficient fleet management. The interplay between these factors determines the market's velocity and direction, demanding careful navigation by manufacturers and operators alike.

Specifically, the primary driving force remains the economic utility and convenience offered by micro-mobility solutions, which provide a compelling, time-saving alternative to cars or overcrowded public transport for short distances. The rapid technological advancement in lithium-ion battery energy density and corresponding cost reductions have made the ownership and operation of electric rideables increasingly affordable and practical for the mass market. Furthermore, the pervasive integration of IoT technologies enables seamless payment, tracking, and operational efficiency, making shared services highly accessible and user-friendly. These drivers continually push the market toward greater volume and operational sophistication, compelling both traditional automotive companies and new technology startups to invest heavily in the sector's expansion, particularly in developing countries where infrastructure development is prioritizing electrification and digital connectivity.

Conversely, the impact of regulatory fragmentation is a significant impediment. Rules governing speed limits, sidewalk usage, parking restrictions, and mandatory licensing vary widely, creating high operational complexity and risk for shared service providers trying to scale regionally or nationally. Safety and liability concerns, often highlighted by high-profile media coverage of accidents, also exert downward pressure on consumer confidence and can lead to restrictive bans in certain cities. The opportunity landscape is robust, centered on the pivot towards subscription models and long-term rentals, ensuring stable recurring revenue streams. Moreover, the urgent global focus on establishing robust battery recycling infrastructure and adopting swappable battery systems presents a crucial opportunity for sustainable innovation that, if successfully executed, could entirely eliminate range anxiety and reduce the environmental footprint associated with device disposal, solidifying the market’s green credentials.

- Drivers:

- Increasing traffic congestion and urbanization demanding last-mile solutions.

- Favorable government policies and subsidies promoting electric vehicle adoption.

- Technological advancements in battery energy density and longevity.

- Growing consumer preference for sustainable and cost-effective transportation.

- Restraints:

- Lack of standardized and complex regulatory frameworks across diverse regions.

- Durability issues and high maintenance costs associated with shared fleet operations.

- Safety concerns, accident rates, and poor rider education/discipline.

- Infrastructure deficits, including limited dedicated lanes and charging stations.

- Opportunities:

- Expansion into specialized commercial logistics and delivery services.

- Development and deployment of autonomous and semi-autonomous rideable technologies.

- Introduction of subscription, long-term rental, and MaaS (Mobility as a Service) business models.

- Focus on battery swapping technology and circular economy initiatives for device recycling.

- Impact Forces:

- High bargaining power of municipalities in shared scheme contracts.

- Intense competitive rivalry among global shared service operators, driving innovation in safety and durability.

- Significant threat of substitution from other micro-mobility options (e.g., traditional cycling, walking, light rail).

- Strong influence of raw material suppliers (especially lithium and cobalt) on production costs and supply chain stability.

Segmentation Analysis

The Electric Rideable Market is segmented based on product type, battery type, and application, each reflecting unique growth trajectories and market maturity. Product segmentation highlights the dominance of e-bikes globally, driven by their versatility for commuting and recreation, followed closely by the high-growth segment of e-scooters, which are central to the shared mobility revolution. Battery segmentation is undergoing a critical transition, with high-performance Lithium-Ion cells rapidly replacing older Sealed Lead Acid variants due to superior energy density, lighter weight, and longer cycle life, a factor crucial for maintaining competitive operational costs. The application segmentation demonstrates the diversification beyond traditional personal use, showing robust expansion in commercial logistics and the pervasive impact of dedicated shared mobility platforms that have fundamentally altered urban transit patterns across major cities worldwide.

This detailed market segmentation allows stakeholders to tailor their product development and market entry strategies effectively. For instance, manufacturers targeting the commercial application segment must prioritize durability, weather resistance, and integrated tracking software, focusing on total cost of ownership rather than initial price point. Conversely, companies focused on personal luxury e-bikes prioritize aesthetic design, premium componentry, and advanced connectivity features. The evolution of battery technology is perhaps the most critical segmentation differentiator; ongoing improvements in solid-state batteries or alternative chemistries promise to disrupt the status quo, offering even greater range and faster charging, thereby widening the appeal of electric rideables to a broader commuter base who currently rely on traditional automobiles for longer trips.

Understanding the interplay between these segments is vital for predicting future regulatory movements and consumer demand shifts. As urban environments become more restrictive toward larger vehicles, the demand for compact and efficient devices like foldable e-scooters accelerates. Simultaneously, the rise of specialized e-cargo bikes addresses the last-mile delivery challenges for businesses, creating a lucrative B2B sub-segment within the commercial application category. This segmented growth demonstrates the market's inherent adaptability and its crucial role in meeting diverse urban transportation needs, from the rapid, short hop provided by a shared scooter to the medium-distance, moderate-load capacity of an e-bike.

- By Product Type:

- E-Bikes (Pedelec, Throttle-on-Demand, Speed Pedelec)

- E-Scooters (Stand-up Scooters, Mopeds/Motor Scooters)

- Hoverboards/Self-Balancing Scooters

- E-Skateboards

- E-Unicycles and Other Specialized Rideables

- By Battery Type:

- Lithium-Ion (Li-ion)

- Sealed Lead Acid (SLA)

- Nickel Metal Hydride (NiMH)

- By Application:

- Personal Mobility (Leisure and Commuting)

- Shared Mobility Services (Dockless and Station-Based)

- Commercial Logistics (Food Delivery, Parcel Service)

- Recreational and Off-Road Use

Value Chain Analysis For Electric Rideable Market

The value chain for the Electric Rideable Market is complex and geographically dispersed, starting from the upstream sourcing of critical raw materials, primarily lithium, cobalt, nickel, and electronic components, and extending through manufacturing, assembly, distribution, and consumption. Upstream analysis highlights the critical reliance on Asian suppliers for battery cells (mostly from China, South Korea, and Japan) and integrated circuit boards. The high volatility and concentration risks associated with these raw materials and specialized components significantly influence the final product cost and supply chain resilience. Manufacturers often form long-term contracts or vertical integration strategies to secure a stable supply of high-quality Li-ion battery packs, which represent the single most expensive component of an electric rideable. Design and engineering activities, often centralized in Europe and North America for premium brands, focus on optimizing aerodynamics, ergonomics, and integrating smart technology features.

The midstream involves actual manufacturing and assembly, predominantly concentrated in low-cost regions of Asia, leveraging established supply chain ecosystems for mass production and scalable assembly processes. Quality control and modular design innovation occur at this stage, aiming to produce devices that are durable enough for shared urban use and compliant with various international safety standards (e.g., CE, UL). Distribution channels are bifurcated: direct and indirect. Direct channels include manufacturer-owned online stores and flagship retail outlets, particularly favored by premium e-bike brands focusing on a high-touch customer experience. The shared mobility segment utilizes a highly specialized direct distribution model where vehicles are acquired in massive bulk orders and deployed directly into urban operational hubs, bypassing traditional retail intermediaries. This bulk purchasing power gives shared operators significant leverage over manufacturers, impacting pricing and specification adherence.

Downstream analysis focuses on customer acquisition, sales, after-sales service, and end-of-life management. Indirect distribution relies heavily on large e-commerce platforms, third-party dealers, and sporting goods retailers, which are crucial for reaching personal mobility consumers in diverse geographical locations. Maintenance and repair form a vital, often costly, part of the downstream value chain, particularly for shared fleets where daily wear and tear is substantial. The future of the value chain is moving towards circularity, requiring manufacturers to integrate reverse logistics for battery refurbishment and material recycling, addressing the environmental impact associated with short product lifecycles. This shift necessitates stronger collaboration between manufacturers, specialized recyclers, and regulatory bodies to ensure responsible end-of-life handling and sustainable resource management.

Electric Rideable Market Potential Customers

Potential customers for the Electric Rideable Market fall into distinct categories defined by their needs, usage patterns, and motivations. The largest demographic remains the urban commuter, spanning working professionals and students seeking a fast, reliable, and inexpensive alternative to traditional public or private transport for daily short-to-medium distance journeys (typically 1 to 10 kilometers). These end-users prioritize devices that offer convenience, portability, and strong battery range. A rapidly growing segment is the recreational user, comprising individuals who utilize e-bikes or e-skateboards for leisure activities, fitness, and tourism, often preferring higher performance characteristics, integrated smart features, and aesthetically appealing designs over pure utility.

The second major category involves institutional and commercial buyers, particularly Shared Mobility Service Operators (e.g., Lime, Bird, Voi). These entities are the largest volume purchasers, driven by the requirement for durable, GPS-enabled, and easily maintained fleet assets. Their purchasing decisions hinge on TCO, vehicle longevity, integrated security features, and manufacturer guarantees regarding long-term spare parts availability. Furthermore, businesses engaged in last-mile delivery, ranging from local restaurants to global logistics giants (e.g., Amazon, FedEx), constitute a critical B2B customer base, demanding specialized e-cargo bikes and ruggedized e-scooters designed for heavy payloads and extensive daily operational hours, valuing uptime and efficiency above all else.

Finally, governmental and quasi-governmental agencies represent an emerging but crucial customer segment. This includes municipal transit authorities, law enforcement agencies, and campus management (university or corporate). These organizations often procure electric rideables for internal operational purposes, such as patrolling large areas, or partner with private operators to subsidize or manage municipal bike-share schemes designed to improve public health and reduce traffic congestion. The focus for these buyers is public safety compliance, integration with existing infrastructure, and contributing to city-wide sustainability targets, often requiring customized software integration and data reporting capabilities aligned with smart city mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $28.5 Billion USD |

| Market Forecast in 2033 | $65.8 Billion USD |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ninebot (Segway-Ninebot), Xiaomi, Lime, Bird, Yadea, Niu Technologies, Gocycle, Swagtron, Razor, Superpedestrian (Link), Voi Technology, Tier Mobility, BMW (Micro-mobility solutions), Honda (Micro-mobility), Super73, Rad Power Bikes, VanMoof, Gogoro, Ola Electric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Rideable Market Key Technology Landscape

The technological landscape of the Electric Rideable Market is rapidly evolving, driven primarily by innovations in battery chemistry, advanced motor design, and ubiquitous connectivity through the Internet of Things (IoT). The fundamental shift is toward lighter, more powerful, and safer Lithium-Ion battery packs, moving away from conventional cylindrical cells to customized pouch or prismatic cell formats that optimize space utilization and enhance thermal management, thereby minimizing the risk of thermal runaway and improving overall device longevity. Furthermore, motor technology is transitioning toward highly efficient, gearless hub motors or mid-drive systems, particularly in e-bikes, which offer better torque delivery, reduced maintenance requirements, and regenerative braking capabilities that marginally extend range, appealing strongly to both performance-oriented personal users and maintenance-sensitive fleet operators.

IoT and connected technologies are non-negotiable for modern electric rideables, forming the backbone of shared mobility services. Every device is now integrated with GPS, GSM/cellular communication modules, and sophisticated onboard processors that enable remote diagnostics, real-time tracking, anti-theft measures (remote locking/unlocking), and detailed usage data collection. This data is critical for dynamic fleet management, optimizing asset utilization, and generating insights for urban planners. The convergence of these technologies facilitates seamless user interaction through mobile applications, which are essential for mapping, payment processing, and communicating critical safety alerts. Advanced sensor fusion, combining accelerometer, gyroscope, and potentially radar inputs, is becoming standard practice to improve stability control and enhance collision avoidance features, addressing prominent safety concerns raised by regulatory bodies and consumers.

Looking ahead, the market is positioned for significant disruption through the adoption of standardized swappable battery architectures, led by initiatives like those seen in Southeast Asia and parts of Europe, which drastically reduce downtime and solve charging infrastructure issues in dense urban areas. Material science innovations are focusing on utilizing lighter and more durable composites (e.g., carbon fiber, high-strength aluminum alloys) to lower the total vehicle weight, enhancing portability and range efficiency. Moreover, software-defined control systems allow for over-the-air (OTA) updates, enabling continuous improvement of firmware, performance parameters, and safety compliance without physical intervention. This advanced software capability transforms the electric rideable into an adaptable, evolving platform, rather than a static piece of hardware, ensuring long-term relevance in a fast-changing regulatory and technological environment.

Regional Highlights

The global Electric Rideable Market exhibits distinct growth patterns and maturity levels across key geographical regions, dictated by regulatory landscapes, infrastructure investment, and cultural acceptance of micro-mobility. Asia Pacific (APAC) stands as the dominant market in terms of volume, primarily due to China's massive manufacturing base and high domestic adoption rates of affordable e-bikes and e-scooters for personal ownership. Southeast Asian countries, such as Vietnam and Indonesia, are experiencing explosive growth, driven by urbanization and the urgent need for congestion-relief solutions. Government policies in many APAC nations heavily favor electrification, further spurring market growth, although regulatory enforcement remains a variable factor across different cities.

Europe represents the market leader in terms of shared mobility deployment and regulatory innovation, particularly in Western Europe (Germany, France, UK). European cities are actively integrating e-rideables into their multimodal transport systems, investing in dedicated cycling and micro-mobility infrastructure, such as protected lanes and charging hubs. The region is characterized by high demand for premium, high-quality, and safety-certified e-bikes (Pedelecs), reflecting a cultural commitment to sustainability and strict EU standards regarding product liability and battery recycling. The maturity of the shared ecosystem means that competition is fierce, driving operators to offer superior services and better-maintained fleets.

North America, led by the United States, is a primary innovator in the deployment of shared dockless electric scooters. While uptake is high, the market faces significant geographical segmentation, with regulations varying widely between cities regarding speed, parking, and operational permits, creating a barrier to homogenous national scale. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by high growth potential but also facing infrastructure challenges, including poor road quality and security concerns. However, rapid urbanization and governmental commitment to smart city projects in the UAE, Saudi Arabia, and major Latin American capitals (e.g., São Paulo, Mexico City) are catalyzing the initial deployment of both private and shared micro-mobility solutions, often with high growth in the delivery logistics segment.

- Asia Pacific (APAC): Largest volume market, dominated by personal ownership of e-bikes and e-scooters; China is the primary manufacturing hub; strong policy push for electrification in India and Southeast Asia.

- Europe: Fastest growing segment for shared mobility and premium e-bikes; high infrastructure investment; strict regulatory focus on safety, quality, and environmental sustainability (WEEE Directive implications for batteries).

- North America: Leader in dockless e-scooter shared services innovation; market growth often constrained by inconsistent state and municipal regulatory fragmentation; high demand for recreational e-bikes.

- Latin America (LATAM): High potential due to rapid urbanization and chronic traffic congestion; emerging shared services segment focused on adapting technology to challenging local infrastructure; growing reliance on micro-mobility for commercial delivery.

- Middle East & Africa (MEA): Emerging market driven by smart city initiatives in the GCC states (UAE, Saudi Arabia); focus on shared fleets deployed in controlled environments (e.g., business parks, specialized transit zones); limited penetration in broader African countries due to economic constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Rideable Market.- Ninebot (Segway-Ninebot)

- Xiaomi Corporation

- Lime (Neutron Holdings, Inc.)

- Bird Global, Inc.

- Yadea Group Holdings Ltd.

- Niu Technologies

- Gocycle (Karbon Kinetics Ltd)

- Swagtron (SWAGWAY)

- Razor USA LLC

- Superpedestrian (Link)

- Voi Technology AB

- Tier Mobility SE

- BMW Motorrad (Micro-mobility solutions division)

- Honda Motor Co., Ltd. (Micro-mobility initiatives)

- Super73, Inc.

- Rad Power Bikes

- VanMoof (Bankrupt but influential design legacy)

- Gogoro Inc.

- Ola Electric Mobility Pvt Ltd.

- Inokim (Myway Inc.)

Frequently Asked Questions

Analyze common user questions about the Electric Rideable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current exponential growth of the Electric Rideable Market?

The exponential growth is fundamentally driven by the critical need for efficient last-mile transportation solutions in increasingly congested urban centers globally, coupled with strong consumer and governmental mandates favoring sustainable, low-carbon mobility alternatives. The accessibility and low operational cost of shared micro-mobility services significantly accelerate adoption.

How is battery technology evolution impacting the feasibility of electric rideables?

Battery technology, specifically the shift towards high-energy-density Lithium-Ion cells and the implementation of swappable battery systems, is improving range, reducing charging downtime, and enhancing safety. These improvements are crucial for making electric rideables practical for daily commuting and economically viable for large-scale shared fleet operations.

What are the greatest regulatory challenges facing shared e-scooter and e-bike operators?

The greatest challenge is the lack of regulatory standardization. Operators must navigate disparate and rapidly changing rules across different municipalities concerning speed limits, designated riding areas (sidewalk restrictions), parking requirements (geofencing), and operating permits, which complicates scaling and fleet management efficiency.

Which product segment holds the largest market share in the global Electric Rideable Market?

Electric Bicycles (E-Bikes) currently hold the largest market share by revenue, attributed to their established regulatory framework, versatility for longer commuting distances, recreational use, and growing application in the B2B segment for cargo and commercial deliveries across North America, Europe, and Asia Pacific.

How does Artificial Intelligence (AI) contribute to the operational efficiency of shared electric rideables?

AI is vital for dynamic fleet optimization, enabling predictive maintenance to reduce vehicle downtime, real-time demand forecasting for optimal deployment (rebalancing), and enhancing rider safety through integrated systems that enforce geofencing and detect unsafe riding behaviors automatically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager