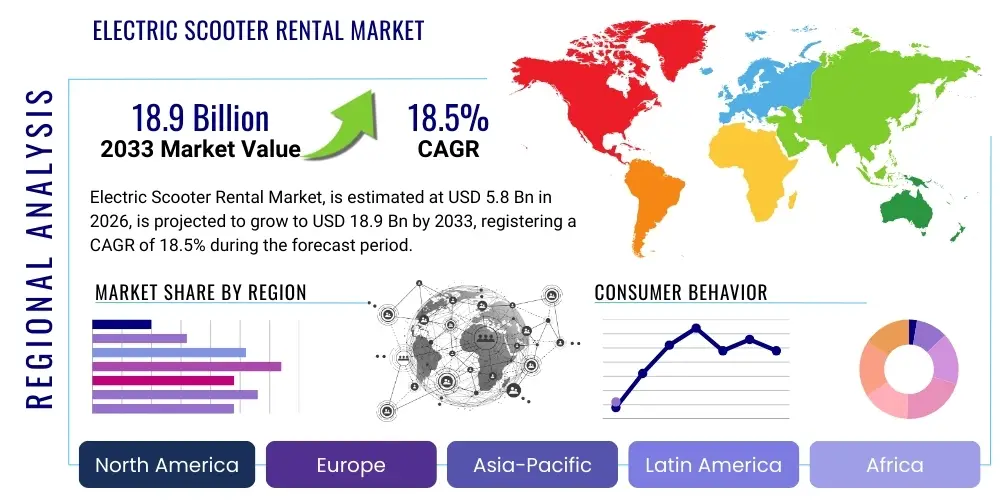

Electric Scooter Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435573 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electric Scooter Rental Market Size

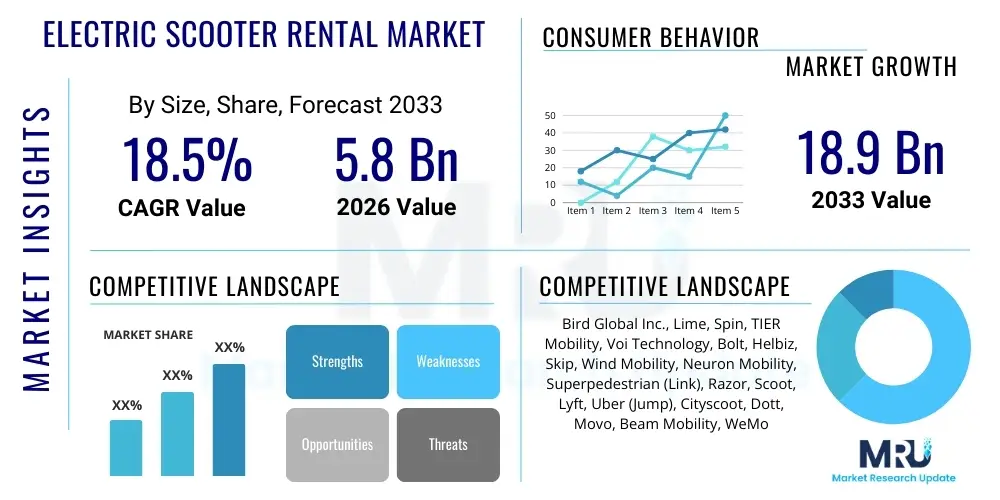

The Electric Scooter Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $18.9 Billion by the end of the forecast period in 2033.

Electric Scooter Rental Market introduction

The Electric Scooter Rental Market encompasses micro-mobility services provided through mobile applications, allowing users to locate, unlock, and rent electric scooters for short-distance travel, typically within urban environments. These services address the persistent challenge of last-mile connectivity, bridging the gap between major public transit hubs and final destinations. The core product involves robust, shared-use electric scooters integrated with sophisticated IoT (Internet of Things) technology, including GPS tracking, telematics, and standardized payment gateways. These scooters are specifically designed for durability in high-frequency rental environments, prioritizing features like swappable batteries and enhanced suspension systems.

Major applications of electric scooter rentals span commuter travel, tourism, and general leisure trips within dense metropolitan areas and university campuses. They serve as an efficient, environmentally friendly alternative to short car trips, reducing traffic congestion and lowering carbon footprints. The convenience of dockless systems, which allow users to park scooters virtually anywhere, significantly boosts adoption rates, particularly among younger demographics accustomed to on-demand digital services. However, regulatory frameworks regarding sidewalk usage and designated parking zones remain crucial variables influencing market maturity.

Key driving factors accelerating market growth include increasing urbanization, government initiatives supporting sustainable transportation, and continuous advancements in battery technology that extend vehicle range and reduce charging downtime. Furthermore, the post-pandemic shift toward personalized, open-air transit options has reinforced the demand for single-rider micro-mobility solutions. Benefits to consumers include affordability, speed in congested areas, and zero tailpipe emissions, positioning electric scooter rental as a vital component of future Smart City infrastructure planning and multimodal transportation networks worldwide.

Electric Scooter Rental Market Executive Summary

The Electric Scooter Rental Market is characterized by intense competition, rapid technological iteration, and evolving regulatory landscapes, driving significant business model shifts toward profitability and sustainability. Current business trends emphasize operational efficiency through improved fleet management logistics, leveraging predictive maintenance powered by AI, and transitioning to swappable battery architectures to reduce labor costs and scooter downtime. Consolidation remains a prominent feature, with larger operators acquiring smaller regional players or competitors to achieve economies of scale and expand geographical footprints rapidly. Furthermore, diversification into integrated mobility platforms, combining e-scooters with e-bikes and mopeds, is becoming standard practice to capture a broader spectrum of consumer transport needs.

Regional trends indicate Europe and North America as the primary revenue generators, driven by established regulatory acceptance and high consumer adoption rates in major urban centers such as Paris, Berlin, and San Francisco. However, the Asia Pacific (APAC) region, particularly emerging markets like India and Southeast Asia, is projected to exhibit the highest future growth rate, fueled by dense populations, severe traffic congestion, and increasing smartphone penetration facilitating app-based usage. Latin America is also emerging as a high-potential market, although challenges related to infrastructure quality and safety perceptions must be addressed for scalable operations.

Segmentation trends highlight the increasing dominance of the dockless segment due to superior user convenience and flexibility, although regulatory bodies are increasingly pushing for mandatory designated parking zones (virtual docking) to mitigate clutter. In terms of application, last-mile connectivity remains the core revenue driver, but the integration of scooter rental services into corporate wellness programs and university campus commuting solutions represents a burgeoning, stable revenue stream. The market’s future stability heavily relies on operators proving long-term vehicle durability, securing favorable municipal contracts, and effectively managing the transition to renewable energy sources for recharging operations.

AI Impact Analysis on Electric Scooter Rental Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Electric Scooter Rental Market primarily revolve around operational efficiency, safety enhancements, and dynamic pricing strategies. Key themes emerging from common user questions include: "How does AI prevent scooter vandalism or theft?", "Can AI predict when and where demand surges will occur?", "How is maintenance scheduled using machine learning?", and "Are AI-driven geofencing controls better at ensuring safe riding areas?" These concerns highlight a collective expectation that AI should resolve the primary operational challenges—fleet imbalance, maintenance unpredictability, and safety compliance—which currently erode profitability and strain municipal relations. Users anticipate that sophisticated data analysis will transform the reactive nature of current fleet management into a highly proactive and automated system, ensuring higher scooter availability, reduced operational expenditure, and a safer public environment through dynamic regulatory enforcement.

- AI-Powered Demand Forecasting: Utilizing historical ride data, weather patterns, and local event schedules to predict high-demand areas and times, optimizing the deployment and redistribution of fleets (rebalancing).

- Predictive Maintenance (PdM): Machine learning algorithms analyze sensor data (battery health, vibration levels, component wear) in real-time to schedule proactive maintenance before mechanical failures occur, maximizing scooter uptime.

- Dynamic Pricing Models: Implementing real-time algorithmic pricing based on localized demand, supply availability, time of day, and environmental factors to maximize revenue per ride while managing fleet utilization efficiently.

- Enhanced Safety Monitoring: Using AI vision systems and accelerometer data to detect unsafe riding behaviors (e.g., sidewalk riding, tandem riding) and trigger immediate feedback mechanisms or automated speed reductions (geofencing enforcement).

- Optimized Charging Logistics: Determining the most energy-efficient routes and scheduling for mobile charging teams or battery swapping operations, minimizing logistical costs and battery degradation.

- Fraud and Abuse Detection: Identifying suspicious user accounts, unauthorized vehicle modifications, or misuse patterns (e.g., holding scooters without riding) through behavioral analytics and anomaly detection.

- Customer Service Automation: Deploying natural language processing (NLP) chatbots and AI-driven support systems to handle routine inquiries regarding parking, billing, and technical issues, improving response times.

DRO & Impact Forces Of Electric Scooter Rental Market

The Electric Scooter Rental Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces dictating market trajectory. Key Drivers, such as persistent urban congestion and the global push toward sustainable micro-mobility solutions, continue to generate baseline demand. Simultaneously, Restraints, primarily regulatory uncertainty, high vandalism rates, and the substantial operational expense associated with battery management and fleet rebalancing, temper growth potential and challenge operators' financial viability. Opportunities largely reside in technological innovation—specifically in AI-driven efficiency and the integration of these services into comprehensive MaaS (Mobility as a Service) platforms—offering pathways to overcome current operational bottlenecks and secure long-term governmental partnerships.

Impact Forces are predominantly weighted toward regulatory adaptability and capital availability. Municipal governments exert significant control over market entry, operational density, and pricing freedom; positive regulatory frameworks that provide clear guidelines and long-term operating licenses act as powerful catalysts for growth and stability. Conversely, overly restrictive caps on fleet size or unpredictable regulatory changes introduce market volatility, deterring new investment. Furthermore, the operational force exerted by battery technology is paramount; advancements that increase range, decrease weight, and standardize swappable interfaces directly translate into lower operating costs and higher customer satisfaction, thus accelerating adoption.

The competitive landscape also acts as a major impact force. High capital requirements initially limited the field, but intense price competition among leading players forces continuous operational optimization and innovation in hardware design. The ability of companies to effectively manage insurance liabilities and public safety perceptions—often through education campaigns and technology solutions like mandatory helmets or advanced braking systems—is critical for securing and retaining crucial municipal contracts, ultimately determining regional market dominance and overall industry growth metrics throughout the forecast period.

Segmentation Analysis

The Electric Scooter Rental Market is comprehensively segmented based on Model, Application, and Operation, providing crucial insights into consumer behavior and operational preferences across different geographies. This segmentation structure helps operators tailor their fleet design and deployment strategies to maximize usage rates and profitability. Analyzing the differences between docked and dockless operations is particularly vital for regulatory compliance, while understanding the application split (e.g., last-mile vs. short trip) guides pricing strategies and marketing efforts aimed at specific demographic groups within urban centers, ensuring services meet localized transport demands efficiently.

- By Model

- Foldable

- Non-foldable (Standard Rental Grade)

- By Application

- Short Trip (Under 3 km)

- Long Distance (3 km to 10 km)

- Last-Mile Connectivity

- Campus Commute

- By Operation

- Docked (Fixed Stations)

- Dockless (Free-Floating)

Value Chain Analysis For Electric Scooter Rental Market

The value chain for the Electric Scooter Rental Market begins with upstream activities focused on hardware manufacturing, primarily centered in East Asia, involving the procurement of raw materials (lithium-ion cells, aluminum frames, plastics) and the assembly of highly durable, rental-grade scooters. Key components, particularly the proprietary IoT units and battery packs, represent significant value-add stages, requiring specialized R&D and quality control. Upstream consolidation is evident as rental companies often partner directly with specialized manufacturers (OEMs) to customize designs that prioritize longevity, safety features, and swappable battery systems, moving away from off-the-shelf consumer models.

The midstream activity centers around logistics, fleet deployment, and the proprietary software platform development. This stage involves transporting scooters to urban markets, setting up local warehousing for maintenance, and crucially, developing the robust mobile application and backend server infrastructure required for user authentication, GPS tracking, and payment processing. The software platform, which manages rebalancing algorithms, predictive maintenance scheduling, and real-time geofencing, is arguably the highest value driver, differentiating successful operators through efficiency and user experience. Operators may choose between direct ownership of these platforms or licensing white-label solutions.

Downstream activities involve direct and indirect distribution channels to the end-user. The primary channel is direct-to-consumer via the mobile application (a direct digital channel), where the rental transaction occurs instantly. Indirect distribution occurs through strategic partnerships, such as integrating the rental service into existing MaaS platforms (e.g., public transit apps) or hotel concierge services. Customer support, maintenance crews, and charging logistics (often outsourced to gig economy workers, or "juicers") form the final crucial link, ensuring scooter availability and regulatory compliance in the operational zone, thereby completing the value cycle from manufacturer to rider and back to maintenance.

Electric Scooter Rental Market Potential Customers

Potential customers for the Electric Scooter Rental Market are broadly categorized into urban commuters, tourists, and university students seeking convenient, fast, and affordable short-distance travel alternatives. Urban commuters, particularly those relying on multimodal transportation, utilize these services heavily for the "last-mile" segment—the gap between a bus stop or subway station and their final destination. This demographic values speed, predictability, and low cost relative to taxis or rideshares, often using the service during peak commuting hours.

Tourists represent a key secondary segment, using e-scooters for localized sightseeing and movement within crowded city centers. Their usage patterns are typically concentrated during daytime and weekends, emphasizing ease of use and accessibility to popular sites. University and large corporate campus populations form a third distinct segment, relying on these services for quick transit across large, often restricted, geographical areas, valuing the ability to bypass congested campus roads and parking hassles.

The common denominator among all successful end-users/buyers is familiarity with smartphone technology and a preference for flexible, on-demand services. Operators increasingly target young professionals (ages 20-40) residing in dense, walkable, or bike-friendly neighborhoods who are actively seeking sustainable lifestyle choices. These consumers are less reliant on private car ownership and are comfortable integrating various micro-mobility options into their daily routines, making them ideal repeat users who drive sustained revenue generation for the rental companies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $18.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bird Global Inc., Lime, Spin, TIER Mobility, Voi Technology, Bolt, Helbiz, Skip, Wind Mobility, Neuron Mobility, Superpedestrian (Link), Razor, Scoot, Lyft, Uber (Jump), Cityscoot, Dott, Movo, Beam Mobility, WeMo |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Scooter Rental Market Key Technology Landscape

The Electric Scooter Rental Market is fundamentally underpinned by a suite of interconnected technologies that enable scalability, tracking, and operational efficiency, defining the competitive landscape. At the core is the Internet of Things (IoT) hardware embedded within the scooter itself, which includes GPS modules, cellular connectivity, and sophisticated onboard controllers (telematics). These systems are crucial for real-time location tracking, remote locking/unlocking capabilities, and continuous data transmission regarding speed, battery charge level, and component health. The quality and reliability of the IoT unit directly impact service uptime and user security, requiring robust, proprietary firmware developed specifically for harsh rental environments.

Battery technology is another critical differentiator. The transition from integrated, non-removable batteries to modular, swappable battery packs (standardized cartridges) has significantly improved operational economics. Swappable batteries allow operators to bypass the costly and inefficient logistics of physically transporting scooters to charging depots, instead facilitating quick battery exchanges in the field. This technological shift, coupled with advances in lithium-ion chemistry that improve energy density and longevity, addresses one of the primary historical restraints of the market: high charging logistics costs and vehicle downtime. Furthermore, companies are investing in proprietary Battery Management Systems (BMS) to monitor temperature, prevent overcharging, and mitigate the risk of thermal events.

Finally, the operational efficiency is governed by proprietary Software-as-a-Service (SaaS) platforms and leveraging geospatial data analysis. These platforms utilize advanced mapping and geofencing technologies to enforce municipal regulations, such as speed caps in pedestrian zones or restricted parking areas, thereby ensuring regulatory compliance. Furthermore, the integration of real-time machine learning (a form of AI) into these platforms optimizes fleet rebalancing, using algorithms to predict where scooters need to be moved to meet anticipated demand, minimizing the labor required for manual redistribution and maximizing the usage rate of the available fleet. Effective utilization of these technologies ensures profitability and secures long-term operating licenses.

Regional Highlights

Regional dynamics play a crucial role in shaping the Electric Scooter Rental Market, dictated by varying regulatory environments, public infrastructure, and consumer adoption rates. North America, particularly the United States, represents a highly competitive and mature market characterized by large, often subsidized, municipal pilot programs and aggressive expansion efforts by global leaders. Key states and cities, especially those with significant tech hubs and established bicycle lane infrastructure, drive demand. However, operational costs are often high due to labor expenses and complex insurance liabilities.

Europe stands as the global frontrunner in terms of comprehensive regulatory acceptance and integration into public transport systems. Countries like Germany, France, and the UK have established clear, albeit often strict, guidelines for speed limits, parking zones, and safety features. This regulatory clarity fosters a stable environment conducive to long-term investment. European markets benefit significantly from governmental mandates promoting sustainable urban mobility, often resulting in exclusive operating licenses being granted to operators demonstrating strong operational track records and compliance with environmental standards.

The Asia Pacific (APAC) market presents the highest potential for future expansion, driven by urbanization in mega-cities like Seoul, Singapore, and various Indian metropolitan areas where traffic congestion is severe. Growth is currently bottlenecked by fragmented regulatory frameworks and competition from traditional, low-cost two-wheeler rentals. However, specific countries, such as Singapore and South Korea, are rapidly adopting structured micro-mobility policies, investing heavily in smart city infrastructure, and showing high rates of technology adoption, positioning APAC as the fastest-growing region in the medium to long term, focusing primarily on last-mile connectivity within high-density residential and commercial clusters.

Latin America and the Middle East & Africa (MEA) are emerging markets experiencing nascent growth. In Latin America, adoption is driven by the necessity for quicker intra-city travel, but faces challenges related to safety concerns, infrastructure deficits, and high maintenance costs due to road conditions. The MEA region, particularly the UAE and Saudi Arabia, is seeing structured growth linked to large-scale smart city development projects (e.g., NEOM, Dubai), where e-scooter rentals are planned as integral, high-tech components of future urban transit networks, often starting with dedicated zones like large university campuses and tourist areas.

- North America: Highly mature market dominated by dockless operations; focus on profitability metrics and overcoming regulatory pushback in secondary cities.

- Europe: Strongest regulatory support; emphasis on safety features, sustainability, and seamless integration into Mobility as a Service (MaaS) platforms.

- Asia Pacific (APAC): Fastest growing region; driven by high population density and severe traffic congestion; key markets include South Korea, Singapore, and Australia, focusing on standardized fleet designs.

- Latin America: High potential driven by necessity, facing infrastructure and security challenges; growth concentrated in major metropolitan hubs like São Paulo and Mexico City.

- Middle East and Africa (MEA): Emerging growth tied to specific high-investment smart city projects and tourism sectors, demanding premium, well-managed services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Scooter Rental Market.- Bird Global Inc.

- Lime

- Spin (acquired by TIER Mobility)

- TIER Mobility

- Voi Technology

- Bolt

- Helbiz

- Skip

- Wind Mobility

- Neuron Mobility

- Superpedestrian (Link)

- Razor

- Scoot

- Lyft

- Uber (Jump)

- Cityscoot

- Dott

- Movo

- Beam Mobility

- WeMo

Frequently Asked Questions

Analyze common user questions about the Electric Scooter Rental market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth in the Electric Scooter Rental Market?

Market growth is primarily driven by increasing urbanization leading to traffic congestion, the expanding need for efficient last-mile connectivity solutions, and government mandates promoting sustainable, low-emission transportation alternatives within dense urban environments. Technological improvements in battery life and IoT tracking further enhance operational scalability.

How does the shift towards swappable battery technology affect operational costs for operators?

The adoption of swappable battery technology significantly reduces operational costs by eliminating the need to transport entire scooters back to central charging depots. This enables faster, decentralized battery exchanges in the field, minimizing labor hours, decreasing vehicle downtime, and maximizing fleet utilization, leading directly to improved profitability.

Which regional market holds the highest growth potential for electric scooter rentals?

The Asia Pacific (APAC) region is projected to exhibit the highest future growth potential, driven by rapid urbanization, vast population density in metropolitan areas, and the necessity for effective short-distance travel solutions to bypass severe traffic congestion. Specific markets in Southeast Asia and South Korea are key areas of expansion.

What role does Artificial Intelligence (AI) play in improving fleet management efficiency?

AI plays a critical role through predictive maintenance, which schedules repairs before component failure, and demand forecasting, which uses machine learning to predict peak usage times and locations. This optimizes fleet rebalancing, ensuring the right number of scooters are available in high-demand areas, thereby boosting revenue and user satisfaction.

What are the main regulatory challenges currently facing the Electric Scooter Rental Market?

The primary regulatory challenges include managing public safety concerns related to sidewalk riding and speeding, establishing clear rules for designated parking zones (often through mandated geofencing), and navigating inconsistent municipal licensing requirements and fleet size restrictions, which can vary significantly even between neighboring cities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager