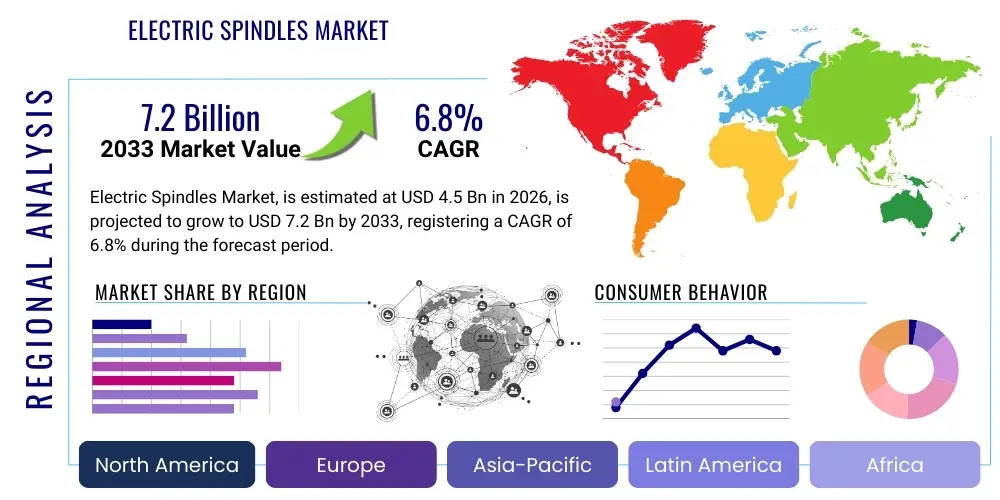

Electric Spindles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436548 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electric Spindles Market Size

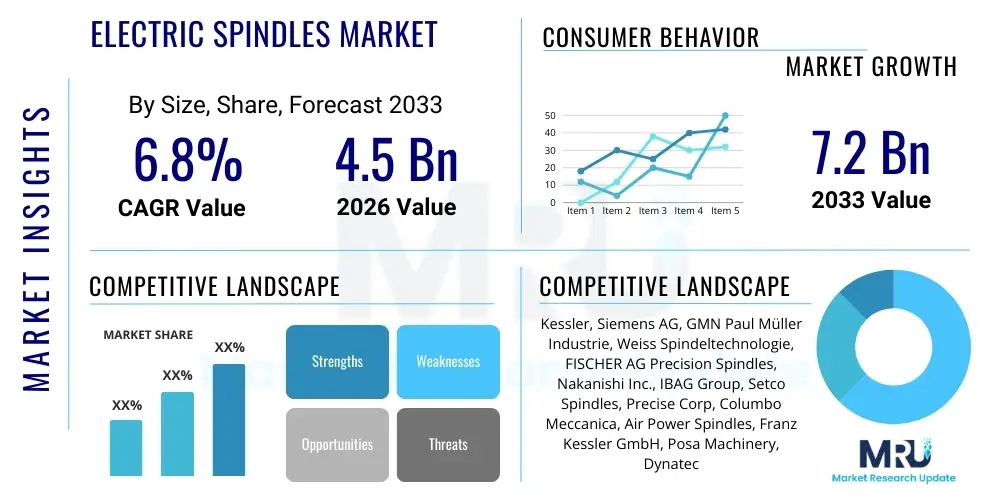

The Electric Spindles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This substantial growth trajectory is driven by the increasing global demand for high-precision, high-speed machining solutions across critical manufacturing sectors such as aerospace, automotive, and medical devices. The shift towards automation and digitalization in production environments necessitates reliable and efficient core components like electric spindles, which offer superior rotational accuracy and thermal stability compared to traditional systems. The adoption of advanced materials requiring intricate machining processes further cements the market's positive outlook.

Electric Spindles Market introduction

The Electric Spindles Market encompasses specialized motorized devices designed to hold and rotate cutting tools or workpieces at high speeds and high precision, integrating the motor and the spindle mechanism into a single, compact unit. These components are fundamental to modern Computer Numerical Control (CNC) machine tools, offering distinct advantages over belt-driven systems, primarily due to their superior power density, reduced vibration, and maintenance-free operation over extended periods. Electric spindles are crucial for applications demanding tight tolerances and flawless surface finishes, particularly in High-Speed Machining (HSM) operations. Their design often incorporates sophisticated elements such as ceramic bearings, advanced cooling systems (liquid or air), and integrated sensors for real-time performance monitoring, which are essential for maintaining thermal stability and operational integrity during intensive industrial usage.

Major applications of electric spindles span across diverse manufacturing verticals, including milling, turning, grinding, drilling, and tapping processes. In the automotive industry, they are vital for machining engine components and molds, ensuring high throughput and repeatability. For the aerospace sector, electric spindles handle complex materials like titanium and specialized alloys, requiring extreme precision for critical structural and engine parts. Furthermore, the proliferation of miniaturization in electronics and the rise of medical device manufacturing necessitate ultra-high-speed, small-diameter spindles capable of micro-machining operations. The key benefits driving their adoption include enhanced productivity due to higher rotational speeds (often exceeding 60,000 RPM), improved part quality stemming from minimal runout and vibration, and overall energy efficiency compared to older mechanical drive systems, aligning with global initiatives toward sustainable manufacturing practices.

The primary driving factors for the Electric Spindles Market include the accelerating pace of industrial automation, marked by the widespread implementation of Industry 4.0 paradigms and smart factory concepts. This technological convergence requires machine tools to be equipped with components capable of higher levels of integration and data exchange, capabilities inherent in modern electric spindle designs. Moreover, the robust capital expenditure in developing economies, particularly in Asia Pacific, focusing on expanding domestic manufacturing capabilities and modernizing existing production lines, fuels demand. Restraints often center on the high initial investment cost associated with premium, high-speed spindles and the technical complexity involved in their specialized maintenance and precise installation. Nevertheless, the continuous development of cost-effective permanent magnet motor technology and modular spindle designs is expected to mitigate these restraints, paving the way for sustained market expansion.

Electric Spindles Market Executive Summary

The Electric Spindles Market is positioned for robust expansion, reflecting significant business trends driven by technological convergence and globalization of manufacturing supply chains. A critical business trend is the increasing vertical integration among spindle manufacturers and machine tool builders, leading to optimized system integration and enhanced performance guarantees for end-users. Furthermore, the market is witnessing a strong shift towards intelligent spindles equipped with integrated sensor technology for predictive maintenance and condition monitoring, transforming them from passive mechanical components into active data-generating assets crucial for maximizing machine uptime. Investment in research and development focuses heavily on thermal compensation algorithms and dynamic balancing systems, essential for achieving unparalleled accuracy in highly variable operating environments, thereby ensuring competitive differentiation among key market players.

Regionally, the market dynamics are heavily influenced by the manufacturing prowess of Asia Pacific (APAC), particularly China, Japan, and South Korea, which serve as global hubs for electronics, automotive, and heavy machinery production. APAC exhibits the highest consumption rate and is projected to maintain the fastest growth, largely due to government initiatives supporting advanced manufacturing and high levels of foreign direct investment in automation infrastructure. Europe, led by Germany and Italy, remains a stronghold for high-end, precision engineering and aerospace applications, focusing on specialized, customized spindle solutions. North America demonstrates consistent demand, primarily driven by the modernization of its industrial base and significant capital investment in defense and aerospace manufacturing, pushing demand for robust, high-power spindles suitable for demanding materials.

Segmentation trends indicate that motor type, cooling system, and application are the most impactful differentiating factors. Synchronous motor-based spindles are gaining traction over asynchronous counterparts due to their higher efficiency and power density, particularly in ultra-high-speed applications. In terms of cooling, liquid-cooled spindles maintain dominance in high-power continuous operation settings due to their superior heat dissipation capabilities, while air-cooled variants are preferred for cost-sensitive or lower-duty cycle operations. Application segmentation highlights the growing dominance of high-speed milling and drilling in the total revenue, reflecting the broader market shift towards maximizing material removal rates and shortening production cycles. The increasing sophistication required for semiconductor manufacturing equipment also creates a niche, high-value segment demanding extreme rotational precision and zero contamination tolerance.

AI Impact Analysis on Electric Spindles Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Electric Spindles Market primarily revolve around how AI can enhance operational efficiency, improve predictive maintenance capabilities, and facilitate self-optimizing machining processes. Users are keenly interested in understanding how data generated by smart spindles—such as vibration patterns, temperature fluctuations, and load profiles—can be leveraged using machine learning algorithms to forecast potential failures accurately, moving beyond rudimentary threshold-based alerts. Key concerns often address the integration challenges associated with retrofitting existing machine fleets with AI-capable monitoring systems and the standardization of data formats required for cross-platform AI analysis. Expectations are high regarding AI's potential to significantly reduce unplanned downtime, optimize energy consumption dynamically based on machining tasks, and ultimately extend the useful life of these critical, high-investment components.

AI's influence is transforming electric spindles from static pieces of hardware into adaptive, intelligent assets. By analyzing complex, multi-dimensional sensor data streams (e.g., thermal sensors, accelerometers, current monitors), AI models can detect subtle anomalies indicative of bearing wear, balancing degradation, or imminent motor failure long before these issues manifest as performance degradation or catastrophic breakdown. This advanced diagnostic capability allows manufacturers to schedule maintenance precisely when needed, transitioning the industry fully into a condition-based maintenance (CBM) model. Furthermore, AI algorithms are instrumental in thermal compensation; by modeling the thermal drift characteristics of the spindle under varying loads and ambient conditions, AI can generate real-time offsets for the CNC controller, ensuring consistent machining accuracy despite temperature-induced expansion.

The long-term impact of AI extends to generative design and manufacturing process optimization. Machine learning is now being employed to correlate machining parameters (feed rate, depth of cut, speed) with spindle health metrics. This enables the development of AI-driven optimization loops that suggest or automatically adjust parameters to maximize material removal rates while simultaneously minimizing stress on the spindle components. This level of process control ensures that the spindle operates within its optimal efficiency window, significantly enhancing overall equipment effectiveness (OEE). The integration of robust edge computing capabilities within the spindle's drive system further enables faster decision-making and response times, solidifying the role of AI as a cornerstone of future high-performance electric spindle technology.

- AI enables predictive failure forecasting through machine learning analysis of vibration and temperature data.

- Optimization of machining parameters (speed, feed) in real-time to extend spindle life and maximize efficiency.

- Enhancement of thermal compensation systems, ensuring consistent geometric accuracy across varying operating conditions.

- Facilitation of Condition-Based Maintenance (CBM), drastically reducing unplanned downtime.

- Development of self-diagnosing and self-calibrating spindle systems integrated with edge computing architecture.

DRO & Impact Forces Of Electric Spindles Market

The Electric Spindles Market is primarily propelled by significant drivers centered on the global need for enhanced manufacturing precision and speed, alongside the relentless push for automation across industrial sectors. Drivers include the rapid expansion of complex manufacturing sectors such as electric vehicle production, requiring high-throughput machining of battery casings and motor components, and the growing demand for smaller, more precise components in the consumer electronics and semiconductor industries. Restraints, however, pose challenges, notably the high initial capital expenditure required for high-frequency precision spindles and the inherent complexity of integrating and maintaining highly specialized, temperature-sensitive components. Furthermore, the market faces constraints related to the need for highly skilled technicians for repair and reconditioning, limiting operational flexibility in regions with labor shortages in advanced manufacturing.

Opportunities are vast, particularly in the development of intelligent, digitally connected spindles conforming to Industry 4.0 standards. The growing market for spindle refurbishment and retrofitting offers lucrative prospects, enabling older machinery to adopt modern high-speed capabilities without full machine replacement. Furthermore, innovation in specialized materials, such as hybrid ceramic bearings and advanced composites for spindle housings, offers pathways to reduce weight, increase speed capabilities, and improve dampening characteristics. The rapid technological advancements in direct-drive motor technology and the increasing adoption of magnetic bearings for frictionless operation in ultra-high-speed environments present significant future growth avenues, especially in highly specialized fields like optical component grinding and wafer processing, where traditional bearing systems introduce unacceptable levels of vibration and thermal noise.

The impact forces influencing the market dynamics are multifaceted. The pervasive force of technological obsolescence demands continuous innovation, as manufacturers must consistently upgrade spindle power, speed, and intelligence features to keep pace with evolving machining requirements, especially the demand for dry and minimum quantity lubrication (MQL) machining. Economic impact forces, such as fluctuating raw material costs (e.g., specialized steel, rare-earth magnets) and global trade tariffs, directly influence production costs and pricing strategies. Regulatory impact forces, particularly those related to energy efficiency standards and worker safety in high-speed machinery environments, also shape design specifications. Ultimately, the cumulative effect of these forces drives manufacturers towards vertically integrated, technologically advanced solutions that maximize lifecycle value while meeting stringent performance benchmarks required by advanced end-user industries.

Segmentation Analysis

The Electric Spindles Market segmentation is crucial for understanding the diverse applications and technological requirements across various industrial landscapes. The market is primarily dissected based on the key technical specifications that define the spindle's operational capability and suitability for specific tasks, including motor technology, cooling mechanism, bearing type, and the end-user industry. This granular analysis allows stakeholders to target investment, product development, and marketing strategies towards segments exhibiting the highest growth potential or requiring specialized engineering solutions. The high degree of customization inherent in the electric spindles market often necessitates cross-segment integration, where a spindle may be categorized by its high-speed capability (application) and its reliance on ceramic bearings (bearing type) simultaneously.

Key segmentation methodologies reflect the shift towards high-performance requirements in modern manufacturing. By Motor Type, the distinction between asynchronous (induction) and synchronous (permanent magnet) motors determines power efficiency and speed range; synchronous motors are gaining share due to their superior power density and efficiency critical for HSM. Segmentation by Bearing Type highlights the performance hierarchy, ranging from standard steel bearings for general tasks to advanced hybrid ceramic bearings and non-contact magnetic or hydrostatic bearings for extreme precision applications. Furthermore, the crucial distinction based on the Cooling System (air-cooled, liquid-cooled, and oil-mist/oil-air lubrication) determines the thermal load capacity and continuous operational resilience, with liquid cooling being dominant in heavy-duty, continuous milling operations where temperature stability is non-negotiable for maintaining machining accuracy and extending bearing life.

- By Type:

- Grinding Spindles

- Milling Spindles

- Drilling Spindles

- Turning Spindles

- Specialized Spindles (e.g., Laser, Etching)

- By Motor Type:

- Asynchronous Motor Spindles

- Synchronous Motor Spindles (Permanent Magnet)

- By Speed (RPM):

- Low Speed (Under 10,000 RPM)

- Medium Speed (10,000 – 30,000 RPM)

- High Speed (30,000 – 60,000 RPM)

- Ultra-High Speed (Over 60,000 RPM)

- By Bearing Type:

- Steel Bearings

- Hybrid Ceramic Bearings

- Magnetic Bearings

- Hydrostatic Bearings

- By Cooling System:

- Air Cooled

- Liquid Cooled

- Oil Mist/Air Lubricated

- By Application/End-User Industry:

- Automotive & Transportation

- Aerospace & Defense

- Electronics & Semiconductor Manufacturing

- Medical Device Manufacturing

- Mold & Die Making

- Woodworking & Stone Processing

Value Chain Analysis For Electric Spindles Market

The value chain for the Electric Spindles Market begins with upstream suppliers providing highly specialized raw materials and precision components essential for spindle manufacturing. This upstream segment is dominated by suppliers of high-grade steel alloys for shafts and housings, specialized materials for motor windings (copper, rare earth magnets), and, critically, high-performance bearing manufacturers who supply angular contact ball bearings, predominantly in hybrid ceramic configurations for high-speed capabilities. The quality, consistency, and cost of these specialized components directly impact the final product's performance and profitability. Efficient supply chain management in this segment is vital, as fluctuations in the cost or availability of ceramic materials or neodymium magnets can destabilize the pricing structure of finished spindles. Furthermore, the integration of advanced sensor technologies requires reliable upstream partners specializing in microelectronics and vibration monitoring systems.

The core of the value chain is the manufacturing and assembly phase, where electric spindle producers utilize highly specialized precision grinding and balancing equipment to integrate the motor, shaft, and bearing elements into a single, cohesive unit. This stage involves complex engineering tasks such as dynamic balancing at operational speeds and precision assembly in controlled environments (cleanrooms) to ensure geometric accuracy and minimal runout—factors paramount to the spindle’s performance. Manufacturers often specialize in certain types, such as high-frequency spindles or large-scale boring spindles, requiring tailored production lines. After manufacturing, distribution channels vary between direct sales, especially for large machine tool OEMs who purchase in bulk and require custom specifications, and indirect channels, utilizing specialized industrial distributors and system integrators who provide localized technical support and installation services to smaller end-users or for retrofitting projects.

The downstream segment involves the end-users, primarily CNC machine tool builders (OEMs) who integrate the spindles into their complete machinery systems, and various manufacturing facilities (MRO market) that purchase spindles for maintenance, repair, and overhaul purposes. The selection criteria for downstream buyers are rigorous, focusing on technical specifications such as power curve, thermal stability, tool clamping mechanism reliability, and life cycle cost. Post-sale services, including highly specialized repair, reconditioning, and preventative maintenance contracts, form a critical element of the downstream value proposition. Due to the high investment and specialized nature of electric spindles, the lifecycle support provided by manufacturers or certified third-party service centers significantly influences customer loyalty and repeat business. The indirect distribution channel, involving regional technical sales representatives and value-added resellers, plays a crucial role in providing immediate technical consultation and ensuring prompt resolution of complex operational issues.

Electric Spindles Market Potential Customers

The potential customers for electric spindles are predominantly sophisticated industrial entities engaged in high-precision, automated manufacturing processes where machining speed, accuracy, and surface finish quality are critical determinants of final product success. These end-users are primarily concentrated in the capital-intensive sectors that utilize advanced CNC machinery as the core of their production infrastructure. The largest buying segment comprises Original Equipment Manufacturers (OEMs) of CNC machine tools (e.g., vertical machining centers, 5-axis routers, precision grinding machines), which integrate electric spindles as essential subsystems. These OEMs demand high reliability, compatibility with sophisticated drive electronics, and specific physical interfaces, often entering into long-term procurement contracts with leading spindle suppliers for standardization across their product lines.

Beyond the OEMs, a significant and rapidly growing customer base exists in various specific end-user industries that utilize these machine tools directly. The aerospace and defense industry represents a high-value customer segment, requiring specialized, robust spindles capable of handling tough, abrasive, and heat-resistant materials such as Inconel and composites with zero defects. Similarly, the automotive sector, especially manufacturers transitioning to Electric Vehicle (EV) production, constitutes a major consumer, needing high-speed spindles for battery housing fabrication and precision component machining. These buyers prioritize uptime and efficiency, driving demand for intelligent, sensor-equipped spindles that facilitate predictive maintenance protocols and reduce total cost of ownership.

Furthermore, the electronics and semiconductor manufacturing industries are pivotal potential customers, demanding specialized, ultra-high-speed spindles (often exceeding 100,000 RPM) for operations like drilling printed circuit boards (PCBs) and handling silicon wafer processing equipment. These applications require extremely low vibration and minimal thermal expansion, necessitating the use of advanced magnetic bearing or hydrostatic bearing spindles—a niche, but highly profitable, customer segment. Mold and die makers, vital for consumer goods and automotive tooling, also constitute a core customer group, relying on high-torque, high-speed spindles for machining intricate geometries and achieving mirror-like surface finishes required for injection molds. These diverse buyer requirements necessitate that spindle manufacturers maintain a broad product portfolio catering to variations in size, power, speed, and environmental tolerance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kessler, Siemens AG, GMN Paul Müller Industrie, Weiss Spindeltechnologie, FISCHER AG Precision Spindles, Nakanishi Inc., IBAG Group, Setco Spindles, Precise Corp, Columbo Meccanica, Air Power Spindles, Franz Kessler GmbH, Posa Machinery, Dynatec, Jäger Spindle Technology, Hefei Hantang Spindle, Donaldson Company, Kellenberger, ZYS Spindle, Hitachi Metals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Spindles Market Key Technology Landscape

The Electric Spindles Market is defined by continuous technological advancement, primarily focusing on enhancing rotational accuracy, thermal stability, and speed capabilities while ensuring extended operational lifespans. A foundational technology is the shift towards integrated motor spindle design, where the motor windings are directly built into the spindle housing (or stator), eliminating the need for belts and pulleys and allowing for far higher rotational speeds and greater power transfer efficiency (Direct Drive Technology). This integration necessitates sophisticated electronic commutation and precise sensor feedback, managed by specialized vector control drives, often utilizing permanent magnet synchronous motors (PMSM) for optimal torque delivery and speed control across a wide operating range. The mechanical integrity relies heavily on advanced bearing technology, with hybrid ceramic bearings (ceramic balls and steel races) being the industry standard for high-speed spindles due to their lower density, higher stiffness, and superior thermal characteristics compared to traditional all-steel bearings, minimizing heat generation and dynamic runout.

Thermal management constitutes another critical technological pillar, as heat generation directly impacts machining accuracy (thermal drift) and bearing life. Modern spindles employ highly efficient liquid-cooling systems, circulating coolant through dedicated passages integrated into the motor casing and sometimes directly around the bearings. Coupled with this are sophisticated thermal compensation algorithms, utilizing embedded temperature sensors and AI models to predict and counteract thermal expansion in real-time. Furthermore, high-frequency electric spindles utilize automatic tool clamping systems (e.g., HSK, steep taper) that ensure high repeatability and rigidity under dynamic loads. The drive electronics often incorporate capabilities for dynamic balancing adjustments and condition monitoring via integrated accelerometers and acoustic emission sensors, allowing for sophisticated analysis of bearing health and vibration patterns.

The emerging technological landscape is increasingly focused on the integration of smart features and non-contact technology. Magnetic bearing spindles represent the pinnacle of current technology for ultra-high-speed and contamination-sensitive environments (like semiconductor manufacturing), as they use electromagnets to suspend the shaft, eliminating mechanical friction, wear, and the need for conventional lubrication systems. Additionally, sensor fusion—combining data from multiple sources (current, voltage, vibration, temperature, acoustic emissions)—is leveraging edge computing capabilities within the spindle's control unit. This allows the spindle itself to conduct initial data processing and anomaly detection, facilitating rapid response to detrimental operational conditions and ensuring seamless integration into the factory's overall digital infrastructure as a vital component of the Industrial Internet of Things (IIoT).

Regional Highlights

Regional dynamics play a significant role in shaping the Electric Spindles Market, reflecting global manufacturing activity, capital investment trends, and technological adoption rates. Asia Pacific (APAC) stands as the dominant and fastest-growing region globally, primarily driven by massive manufacturing scale in China, which serves as the world's largest producer and consumer of CNC machine tools. The rapid development of the electronics, automotive (including EV), and consumer goods industries across South Korea, Japan, and Taiwan demands continuous investment in high-precision, high-speed machining capabilities, consequently boosting the electric spindle market. Government support for modernizing industrial infrastructure through initiatives like "Made in China 2025" further solidifies APAC's leading position, driving demand particularly for cost-competitive, high-performance milling and drilling spindles.

Europe represents the second-largest market, characterized by demand for high-value, specialized, and often custom-engineered spindles, particularly from Germany, Switzerland, and Italy—countries recognized globally for their excellence in precision engineering and machine tool manufacturing. This region dominates the high-end segment, focusing heavily on spindles for aerospace, power generation, and specialized mold & die applications where quality, reliability, and precision trump cost considerations. European manufacturers are leaders in developing advanced technologies like high-frequency magnetic bearing spindles and integrating sophisticated condition monitoring compliant with Industry 4.0 standards.

North America, led by the United States, exhibits stable growth, fueled by strong investment in high-technology sectors, including aerospace & defense, medical devices, and the reshoring of manufacturing activities emphasizing automation and quality control. Demand in this region is typically concentrated in robust, high-power spindles capable of heavy-duty machining of hard metals required for critical components. The focus on reducing reliance on foreign supply chains and modernizing aging infrastructure ensures sustained capital expenditure on advanced CNC equipment equipped with state-of-the-art electric spindles. Latin America and the Middle East & Africa (MEA) currently represent smaller markets, but are projected to experience accelerating growth as industrialization and diversification efforts in countries like Brazil, Mexico, and Saudi Arabia drive localized demand for basic and medium-speed machining capabilities, facilitated by infrastructure development and foreign manufacturing investment.

- Asia Pacific (APAC): Highest volume market, rapid growth driven by China’s manufacturing dominance, strong demand from electronics and automotive (EV) sectors. Focus on high-speed milling and cost-effective solutions.

- Europe: High-value market, leadership in precision engineering (Germany, Italy). Strong demand for customized, high-end, and specialized spindles for aerospace and luxury automotive tooling.

- North America: Stable growth, driven by aerospace, defense, and medical device manufacturing. Emphasis on powerful, robust spindles and advanced integration technology for modernization projects.

- Latin America (LATAM): Emerging market, growing due to industrial modernization in countries like Brazil and Mexico, focusing initially on general-purpose machining and automotive component manufacturing.

- Middle East & Africa (MEA): Nascent growth, primarily linked to infrastructure development, oil & gas related industrial operations, and increasing localized manufacturing capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Spindles Market.- Kessler

- Siemens AG

- GMN Paul Müller Industrie

- Weiss Spindeltechnologie

- FISCHER AG Precision Spindles

- Nakanishi Inc.

- IBAG Group

- Setco Spindles

- Precise Corp

- Columbo Meccanica

- Air Power Spindles

- Franz Kessler GmbH

- Posa Machinery

- Dynatec

- Jäger Spindle Technology

- Hefei Hantang Spindle

- Donaldson Company

- Kellenberger

- ZYS Spindle

- Hitachi Metals

- Parker Hannifin Corp

- SKF Group

- TDM Systems GmbH

- Haas Automation

Frequently Asked Questions

Analyze common user questions about the Electric Spindles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a belt-driven spindle and an electric spindle?

Electric spindles (or motorized spindles) integrate the motor directly onto the spindle shaft, eliminating belts and pulleys. This direct drive results in higher rotational speeds, reduced vibration, enhanced power density, and superior thermal stability, making them essential for high-speed, high-precision CNC machining operations.

Why are ceramic bearings preferred over steel bearings in high-speed electric spindles?

Hybrid ceramic bearings (ceramic balls, steel races) are preferred because ceramic materials are lighter, stiffer, and less prone to thermal expansion than steel. This reduces centrifugal force at high RPMs, minimizes heat generation, and significantly extends the spindle's operating life while improving precision and damping capabilities.

How does the implementation of Industry 4.0 affect the design of modern electric spindles?

Industry 4.0 necessitates the integration of smart components. Modern electric spindles incorporate multiple sensors (for temperature, vibration, load) and use integrated control systems to gather real-time performance data. This data enables predictive maintenance, thermal compensation, and seamless communication with overall factory monitoring systems (IIoT infrastructure).

Which application segment holds the largest share in the Electric Spindles Market?

The high-speed milling and drilling segments, primarily driven by the automotive (especially EV components), aerospace, and mold & die industries, account for the largest market share. These applications require the high power and precision capabilities inherent in advanced liquid-cooled electric spindles to maximize material removal rates and ensure surface quality.

What are the key technical constraints limiting the speed and power of electric spindles?

Key technical constraints include managing thermal expansion (thermal drift), preventing dynamic unbalance at ultra-high rotational speeds, and ensuring the longevity of bearings under high G-forces and temperature fluctuations. Advanced cooling systems, dynamic balancing, and non-contact bearing technologies (magnetic, hydrostatic) are continuously being developed to overcome these physical limitations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager