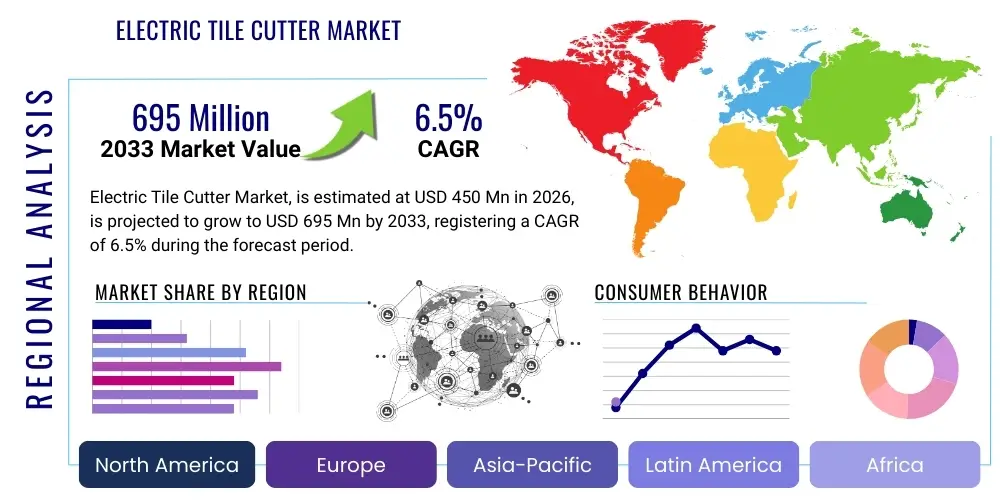

Electric Tile Cutter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439185 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Electric Tile Cutter Market Size

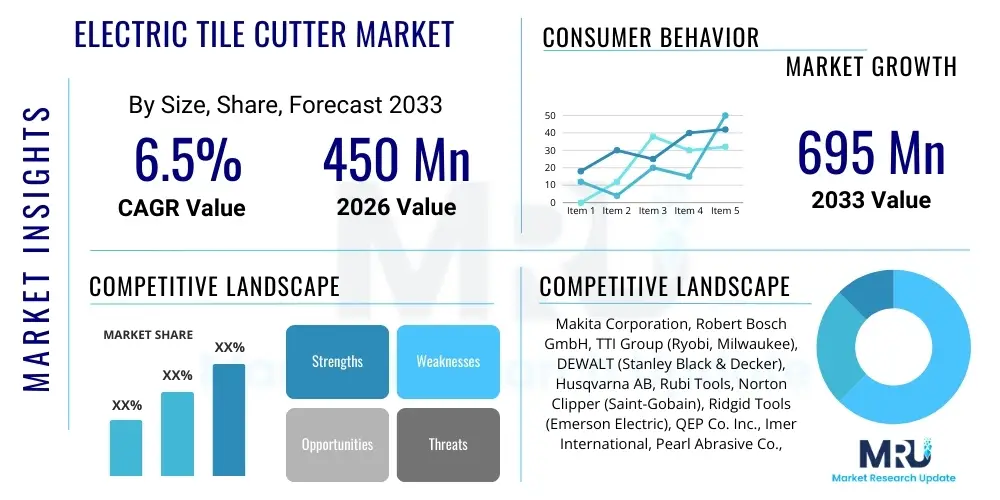

The Electric Tile Cutter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 695 Million by the end of the forecast period in 2033.

Electric Tile Cutter Market introduction

The Electric Tile Cutter Market encompasses the global trade and utilization of specialized power tools designed for precision cutting of ceramic, porcelain, natural stone, and glass tiles. These devices are essential in both professional construction and DIY sectors, offering superior speed, accuracy, and efficiency compared to manual methods. Modern electric tile cutters often incorporate wet cutting systems, utilizing water circulation to minimize dust generation, cool the blade, and ensure clean cuts, thereby enhancing user safety and material integrity. Key product types include tabletop cutters, which are robust and suitable for high-volume work, and handheld or bridge saws, preferred for large-format tile projects requiring deep cuts and long rip lengths.

Major applications of electric tile cutters span across new residential construction, commercial infrastructure development (hotels, retail spaces, hospitals), and, most significantly, the massive global renovation and remodeling industry. The product’s utility extends beyond basic square cuts to intricate angles, bevels, and plunge cuts necessary for fitting around fixtures or decorative patterns. The rising aesthetic preference for larger format tiles, which require high torque and stable cutting platforms, is fundamentally driving demand for professional-grade electric cutting equipment. Furthermore, advancements in blade technology and motor efficiency are improving the overall user experience and expanding the range of materials that can be processed effectively.

Key benefits driving market adoption include significant time savings on large projects, superior edge quality essential for seamless installation, and enhanced safety features like residual current devices (RCDs) and enclosed blade guards. The market is also heavily influenced by regulatory standards concerning dust exposure (especially crystalline silica), pushing manufacturers toward integrated wet-cutting and dust extraction solutions. The primary driving factors are the booming global construction industry, particularly in emerging economies, the sustained trend of residential upgrades, and the continuous innovation in flooring and wall tile materials requiring specialized cutting instruments.

Electric Tile Cutter Market Executive Summary

The Electric Tile Cutter Market is characterized by robust growth, primarily fueled by global urbanization trends and increasing investments in commercial and residential infrastructure, particularly in the Asia Pacific region. Business trends indicate a strong competitive focus on product differentiation through cordless technology, brushless motor integration, and advanced portability features tailored for professional contractors who prioritize mobility and efficiency on job sites. Manufacturers are increasingly emphasizing digital integration, such as laser guides and automated depth settings, to enhance precision and reduce material wastage, which is a significant cost factor for end-users. Strategic alliances and mergers, focused on consolidating market share and expanding distribution networks, remain prominent activities among key industry participants.

Regional trends highlight APAC as the dominant and fastest-growing region, driven by large-scale housing projects in China and India and rapid infrastructure expansion across Southeast Asia. North America and Europe maintain stable demand, characterized by high adoption rates of premium, technologically advanced cutters focused on ergonomic design and compliance with stringent environmental health and safety (EHS) regulations, especially regarding noise and silica dust mitigation. The shift towards lightweight composite materials and larger slab tiles is compelling tool manufacturers to develop heavy-duty, yet transportable, bridge saws capable of handling substantial weight and dimensions, influencing regional product portfolios significantly.

Segmentation trends indicate that the tabletop cutter segment, offering a balance of performance and versatility, holds the largest market share, while the cordless segment is projected to exhibit the highest CAGR due to increasing demand for flexibility and reduction of trip hazards on construction sites. Application-wise, the commercial sector remains a key revenue generator, driven by extensive tiling requirements in institutional and large retail buildings. However, the residential renovation segment shows accelerated growth, supported by global DIY culture expansion and the rising availability of semi-professional electric cutters designed for ease of use and affordability, catering to homeowners and small-scale contractors.

AI Impact Analysis on Electric Tile Cutter Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) in the Electric Tile Cutter Market typically revolve around operational efficiency, maintenance prediction, and potential for full automation. Users frequently ask if AI can optimize cutting paths to minimize tile waste, how predictive maintenance (PdM) powered by machine learning can extend tool lifespan, and whether AI-driven quality control systems can verify cut accuracy instantly. Key themes emerging from this analysis include the expectation for AI to enhance precision beyond human capability, reduce downtime associated with equipment failure, and streamline inventory and supply chain logistics for replacement parts (like blades and pumps). There is also interest in AI algorithms being used within manufacturing processes to identify defects in tile cutter components, ensuring higher quality tools are distributed.

While the actual cutting process remains mechanical, AI is beginning to influence peripheral and back-end operations significantly. In manufacturing, AI algorithms analyze sensor data from production lines to detect anomalies in motor winding or assembly tolerances, ensuring that every tool meets rigorous performance standards before shipment. This proactive quality assurance minimizes warranty claims and builds manufacturer reputation. Furthermore, in the field, telemetry data collected from high-end connected tile cutters can be processed by AI models to determine optimal usage patterns, inform ergonomic design changes, and provide customized tips to professional users via accompanying mobile applications, thereby improving on-site productivity.

Looking ahead, the integration of basic machine vision systems, powered by deep learning, into advanced bridge saws could automate the alignment of complex patterns or irregularly shaped natural stone tiles. This means the cutter could dynamically adjust the blade trajectory based on real-time visual assessment of the tile's texture or defects, leading to true 'smart cutting.' For the aftermarket, AI analyzes consumption data to predict regional demand spikes for consumables, allowing distributors to optimize stock levels, reducing lead times, and ensuring that contractors have immediate access to necessary blades and accessories, fundamentally transforming the supply chain efficiency.

- AI enhances manufacturing quality control via anomaly detection in assembly data.

- Predictive maintenance (PdM) algorithms analyze motor temperature and vibration to forecast component failure.

- Supply chain optimization utilizes AI to forecast regional demand for consumables and spare parts.

- Machine vision integration may automate pattern matching and real-time adjustment of cutting paths in industrial settings.

- AI-driven user interfaces provide real-time performance feedback and personalized maintenance alerts to operators.

DRO & Impact Forces Of Electric Tile Cutter Market

The Electric Tile Cutter Market is primarily driven by the consistent expansion of the global construction and renovation sectors, particularly the accelerating demand for high-end ceramic and large-format porcelain tiles that necessitate precision power tools. Restraints predominantly revolve around the cyclical nature of the construction industry, which causes fluctuating demand, and regulatory hurdles concerning occupational health, specifically noise pollution and mandatory silica dust mitigation measures, compelling manufacturers to invest heavily in compliance technology, which increases product costs. Opportunities are vast, centered on the swift adoption of cordless technology, leveraging advanced battery systems (like lithium-ion) to deliver performance comparable to corded units, alongside exploring emerging markets in Africa and South America where infrastructure development is accelerating rapidly.

Drivers are strongly influenced by technological advancements, such as the increasing utilization of brushless motors, which offer higher efficiency, longer tool life, and reduced maintenance requirements compared to traditional brushed motors, thereby attracting professional users. Furthermore, the growing consumer preference for durable, aesthetically pleasing tiled surfaces in both residential and commercial settings ensures a sustained need for efficient cutting equipment. The trend toward urbanization in densely populated regions necessitates vertical construction, which inherently demands high-volume tiling work, directly benefiting the market. These demand-side forces create a perpetual cycle of innovation, prompting manufacturers to continuously enhance product portability, stability, and cutting depth capacity.

Restraints also include intense price competition, particularly from low-cost manufacturers in Asia, which pressures profit margins for established premium brands, forcing them to rely heavily on proprietary technology and strong brand loyalty. The safety aspect remains a crucial impact force; stringent regulations necessitate expensive design changes, such as integrating advanced water management systems and zero-voltage switches, impacting the affordability of entry-level professional tools. Opportunities are created by the trend towards modular construction, where pre-cut and fitted components are required, enhancing the need for highly accurate, sometimes automated, cutting systems. Additionally, the increasing focus on sustainable construction practices encourages demand for durable, energy-efficient tools, creating a niche for premium eco-friendly electric tile cutters.

Segmentation Analysis

The Electric Tile Cutter Market segmentation provides a detailed structure for understanding market dynamics based on tool design, power source, and end-user application. Analyzing these segments helps stakeholders tailor their marketing strategies and product development efforts to specific user requirements. The primary dimensions of segmentation include the type of machine (such as bridge saws for industrial use versus handheld cutters for versatility), the power source (corded being traditional and cordless rapidly gaining momentum), and the application (residential renovation, large-scale commercial projects, or specialized industrial tiling). Each segment responds uniquely to economic shifts, technological progress, and regional construction activity, making granular analysis essential for strategic planning.

The segmentation by product type reveals distinct preferences among different professional tiers; for instance, large commercial tiling firms heavily invest in fixed bridge saws for their stability and capacity for long cuts, whereas mobile contractors favor portable tabletop models or high-powered handheld cutters for flexibility across multiple job sites. The corded segment currently dominates revenue generation due to the sustained power required for heavy-duty, continuous operation, but the cordless segment is undeniably the fastest-growing category. This rapid growth is directly linked to the massive improvement in battery technology, specifically high-capacity lithium-ion packs that deliver comparable performance without the hassle and safety risks associated with power cords.

Furthermore, the end-user segmentation underscores the difference in demand characteristics. Commercial applications necessitate cutters designed for extreme durability and continuous run-time, capable of handling materials like thick granite and dense porcelain. Conversely, the residential segment requires tools that balance performance with user-friendliness, safety features, and often, a lower price point, catering to DIY enthusiasts and small-scale remodeling contractors. This distinction guides manufacturers in developing parallel product lines, optimizing features like weight, noise reduction, and water tray capacity specifically for the target user environment, ensuring maximum market penetration across various economic tiers and project scales.

- By Type

- Tabletop Cutters (Wet/Dry)

- Bridge Saws

- Handheld Wet Cutters

- Rail/Manual Feed Cutters

- By Operation

- Corded

- Cordless (Battery-Powered)

- By Application

- Residential (Renovation and New Construction)

- Commercial (Hotels, Offices, Retail, Healthcare)

- Industrial and Infrastructure Projects

- By Power Output

- Low Power (Under 1500 W)

- High Power (1500 W and Above)

Value Chain Analysis For Electric Tile Cutter Market

The value chain for the Electric Tile Cutter Market starts with the upstream activities of raw material procurement, encompassing specialized materials such as high-grade steel for machine frames, copper for motor windings, advanced plastics for housing components, and crucial diamond segments for cutting blades. Suppliers specializing in brushless motors and high-capacity lithium-ion battery cells form a vital component of the modern upstream supply chain, dictating the performance metrics and cost structure of the final product. Manufacturers focus intensely on precision engineering, adhering to stringent quality checks, and managing complex inventory of hundreds of specialized components to ensure tools meet industry standards for durability and safety.

Midstream activities involve core manufacturing, assembly, and quality assurance processes, followed by the strategic establishment of distribution channels. Distribution is typically a dual system: direct sales to major construction companies and specialized industrial suppliers, and indirect sales through a vast network of hardware stores, specialized tool distributors, and large e-commerce platforms. Effective inventory management and robust logistics are critical at this stage, particularly for international shipments, ensuring tools and spare parts reach diverse global markets promptly. The competitive advantage here often rests on the efficiency of the supply chain and the reliability of after-sales service provided through these distribution points.

Downstream analysis focuses on reaching the end-users: professional tiling contractors, general construction workers, and DIY consumers. Indirect channels, such as retail home improvement giants (e.g., Home Depot, Lowe's) and specialized tool resellers, dominate sales to the residential and small-to-medium contractor segment, providing product visibility and accessibility. Direct channels, involving manufacturer representatives and specialized equipment dealers, are crucial for securing large volume orders from major commercial construction firms who often require specific tool specifications, customized support, and training. Post-sale activities, including warranties, technical support, and the supply of specialized consumables like diamond blades, significantly influence brand loyalty and repeat purchases in this market.

Electric Tile Cutter Market Potential Customers

The primary consumers (end-users/buyers) of electric tile cutters are professional contractors specializing in flooring, wall tiling, and stonework, who demand high-performance, durable, and reliable equipment for daily, continuous use on large construction projects. These customers prioritize tools with high-wattage motors, stable cutting platforms (like bridge saws), superior dust and water management systems, and readily available, high-quality replacement parts. Their purchasing decisions are heavily influenced by return on investment, tool longevity, and the speed at which the tool can complete complex cuts, often preferring premium brands known for robust engineering and comprehensive warranties.

A rapidly expanding segment of potential customers includes residential remodeling contractors and serious DIY (Do-It-Yourself) enthusiasts. While residential contractors require versatile, moderately priced tools that are easy to transport and set up, DIY users seek entry-level, safe, and portable tabletop models suitable for sporadic use on smaller home projects. E-commerce platforms and large home improvement retailers cater specifically to this segment, offering competitive pricing, user-friendly features, and sufficient power for ceramic and smaller porcelain tiles, making tool accessibility a key purchasing factor for this group.

Furthermore, specialized industrial facilities, such as those involved in manufacturing custom countertops, pre-fabricated construction components, or dealing with large quantities of stone or industrial ceramics, represent a niche but high-value customer base. These entities often purchase industrial-grade equipment, potentially integrated with automated or semi-automated cutting systems, requiring exceptionally high precision and the capacity to handle non-standard materials and thicknesses. Sales to this group are often direct or via highly specialized machinery distributors who offer tailored installation, training, and maintenance contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 695 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Makita Corporation, Robert Bosch GmbH, TTI Group (Ryobi, Milwaukee), DEWALT (Stanley Black & Decker), Husqvarna AB, Rubi Tools, Norton Clipper (Saint-Gobain), Ridgid Tools (Emerson Electric), QEP Co. Inc., Imer International, Pearl Abrasive Co., Montolit, Dremel (Bosch subsidiary), Masterpiuma P3 (Breton), Raimondi S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Tile Cutter Market Key Technology Landscape

The technology landscape of the Electric Tile Cutter Market is dominated by innovations aimed at enhancing precision, durability, and user safety, with motor technology being a central focus. The transition from traditional brushed motors to advanced brushless DC motors (BLDC) has been pivotal, offering numerous advantages, including significantly extended motor lifespan, higher energy efficiency, reduced heat generation, and superior torque delivery, which is essential for cutting dense materials like porcelain and natural stone. Furthermore, electronic control systems, such as soft-start features and constant speed monitoring under load, are becoming standard, ensuring smoother operation and preventing motor burnout, which translates directly into higher productivity on job sites.

Another crucial technological development lies in battery and cordless systems. Modern lithium-ion battery platforms (e.g., 18V, 36V, and 54V systems) now provide sufficient power density and runtime to make cordless tile cutters viable alternatives to corded models, particularly for medium-duty applications and remodeling work where portability is paramount. Manufacturers are investing heavily in intelligent battery management systems that optimize charge cycles and monitor cell health, maximizing the investment for professional users. This focus on cordless technology is directly linked to AEO needs, as users frequently search for powerful tile cutters that offer freedom from power outlets and reduced hazard risks.

Safety and cutting technology also define the landscape. Advanced water management systems, including highly efficient recirculating pumps and large, easy-to-clean water trays, are critical for maintaining the dust-free environment mandated by many regulations. Diamond blade technology is also continually evolving, with specialized segment designs (e.g., turbo rims, segmented rims) optimized for material types, from extremely hard porcelain to delicate glass tile, ensuring minimal chipping and maximum cutting speed. The integration of high-precision laser guides and LED work lights further aids in achieving accurate cuts, especially in poorly lit construction environments, thereby improving overall job quality and reducing material waste.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by massive infrastructure spending, rapid urbanization, and a burgeoning middle class demanding higher quality housing and commercial spaces. Countries like China, India, and Indonesia are major hubs for both consumption and low-cost manufacturing, fueling high-volume adoption across the region.

- North America: Characterized by high adoption of premium and technologically advanced equipment, North America maintains robust demand, primarily driven by the strong residential remodeling sector and stringent occupational safety standards, favoring manufacturers who incorporate advanced features like dust suppression and ergonomic design.

- Europe: The European market demonstrates steady growth, highly influenced by sustainability standards and noise regulations. Demand is particularly strong in professional segments in Western Europe (Germany, UK, France), favoring high-quality, durable, and energy-efficient tile cutters, often with high IP ratings for water resistance.

- Latin America (LATAM): LATAM is an emerging market showing promising growth due to increasing foreign investment in infrastructure projects and rising housing development in Brazil and Mexico. The market here is price-sensitive but shows increasing preference for intermediate-level professional tools offering durability at a moderate cost.

- Middle East and Africa (MEA): Growth in the MEA region is sporadic but significant, heavily reliant on large-scale government-backed construction projects (e.g., Saudi Arabia’s Vision 2030 and UAE's development initiatives). The demand centers on heavy-duty, industrial-grade equipment capable of handling extreme conditions and continuous operation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Tile Cutter Market.- Makita Corporation

- Robert Bosch GmbH

- Stanley Black & Decker (DEWALT, Black+Decker)

- Techtronic Industries Co. Ltd. (TTI) (Ryobi, Milwaukee)

- Husqvarna AB

- Rubi Tools (Germán Boada S.A.)

- Saint-Gobain (Norton Clipper)

- QEP Co. Inc.

- Imer International S.p.A.

- Ridgid Tools (Emerson Electric)

- Pearl Abrasive Co.

- Montolit S.p.A.

- Raimondi S.p.A.

- Wacker Neuson SE

- Cangzhou Huasheng Pipe Fitting Co., Ltd. (OEM focus)

- Shanghai Xiangli Power Tools Co., Ltd.

- Breton S.p.A. (Masterpiuma)

- Hitachi Koki Co., Ltd. (now HiKOKI Power Tools)

- Gomart Tools

- Taurus Tools

Frequently Asked Questions

Analyze common user questions about the Electric Tile Cutter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for cordless electric tile cutters?

Demand for cordless electric tile cutters is primarily driven by significant advancements in lithium-ion battery technology, offering comparable power and runtime to corded models. Professionals value the enhanced portability, freedom from electrical outlets, and improved job site safety due to the elimination of trip hazards associated with extension cords. This shift supports efficient tiling across varied locations, boosting productivity in residential and remodeling sectors.

How does the Electric Tile Cutter Market contribute to construction efficiency?

Electric tile cutters significantly enhance construction efficiency by providing high precision and speed necessary for cutting modern, large-format, and dense tile materials like porcelain and natural stone. The use of specialized diamond blades and stable platforms minimizes material waste and ensures clean, accurate edges required for quick, professional installations, directly reducing labor time compared to manual or low-power alternatives.

What are the key differences between bridge saws and tabletop tile cutters?

Bridge saws are typically larger, designed for industrial or large commercial projects, offering superior stability, capacity for very long rip cuts (over 1000mm), and the ability to handle extremely thick materials. Tabletop cutters are smaller, more portable, and ideal for medium-sized residential and light commercial work, prioritizing ease of transport and quick setup, though their cutting capacity is generally limited compared to bridge saws.

What role do safety regulations play in shaping electric tile cutter design?

Safety regulations, particularly those regarding the exposure to crystalline silica dust and noise limits, heavily influence tile cutter design. Manufacturers are integrating advanced wet-cutting systems with highly efficient pumps and containment shrouds to minimize airborne dust. Additionally, features like RCD (Residual Current Device) protection, thermal overload systems, and enclosed blade guards are mandatory components ensuring user safety and regulatory compliance globally.

Which geographic region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential. This growth is underpinned by rapid urbanization, massive government investment in infrastructure development across Southeast Asia, and escalating residential construction in densely populated countries like China and India. The increasing affordability and availability of professional-grade tools are accelerating market penetration in this region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager