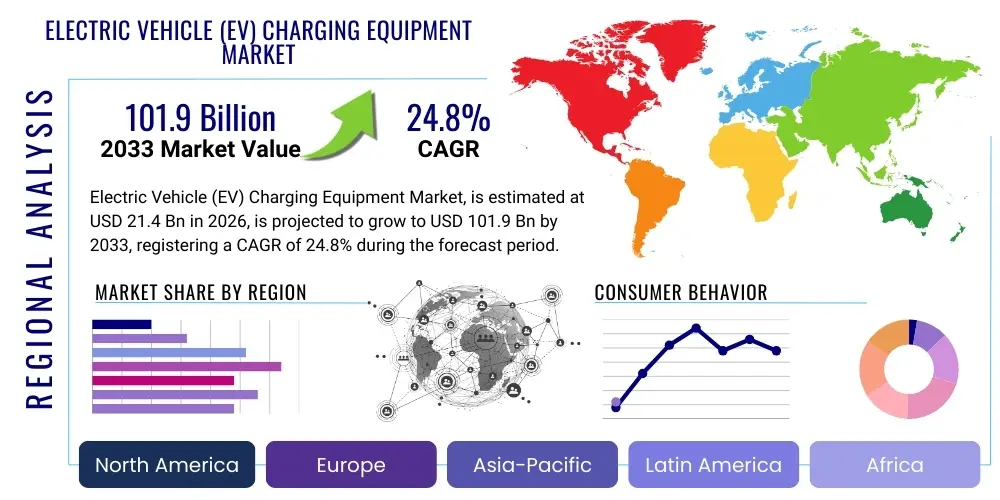

Electric Vehicle (EV) Charging Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439175 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Electric Vehicle (EV) Charging Equipment Market Size

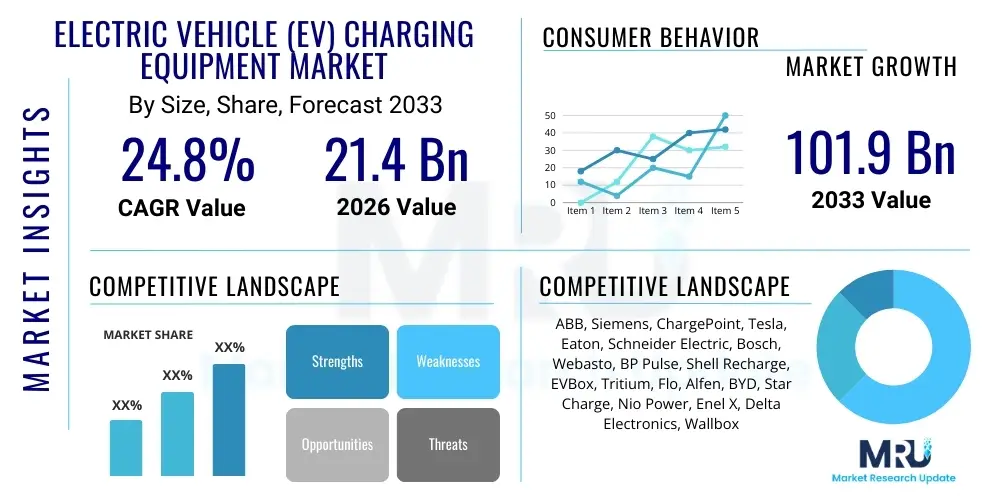

The Electric Vehicle (EV) Charging Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 24.8% between 2026 and 2033. The market is estimated at USD 21.4 Billion in 2026 and is projected to reach USD 101.9 Billion by the end of the forecast period in 2033.

The substantial growth trajectory is underpinned by aggressive global electrification goals and mandatory regulatory shifts phasing out Internal Combustion Engine (ICE) vehicles. Increasing consumer adoption of EVs, driven by environmental concerns and decreasing battery costs, necessitates a robust, widespread charging infrastructure. This rapid expansion demands significant investment in both public charging networks, particularly DC fast charging stations along major transit routes, and residential charging solutions, solidifying the market’s high growth potential through the forecast period.

Electric Vehicle (EV) Charging Equipment Market introduction

The Electric Vehicle (EV) Charging Equipment Market encompasses the essential hardware, software, and services required to replenish the batteries of electric vehicles. This infrastructure is critical for the mass adoption of EVs, providing connectivity between the power grid and the vehicle's battery management system. Key products include AC chargers (Level 1 and Level 2) predominantly used in residential and workplace settings, and DC fast chargers (Level 3) crucial for public, high-speed charging requirements, mitigating range anxiety and enabling long-distance travel. The development and deployment of this equipment are vital for supporting governmental mandates and achieving net-zero emission targets globally.

Major applications of EV charging equipment span residential homes, commercial parking facilities, public charging stations managed by Charging Point Operators (CPOs), and dedicated fleet depots for logistics and public transport vehicles. The core benefits include enabling sustainable transportation, reducing reliance on fossil fuels, improving air quality in urban centers, and creating new opportunities for utility grid management and smart city integration. The rapid technological advancements in power electronics and communication protocols (such as OCPP and ISO 15118) are making charging solutions more efficient, interoperable, and secure.

Driving factors for this market include supportive governmental incentives, such as tax credits and subsidies for both EV purchases and charging infrastructure installation, coupled with mandates for zero-emission vehicle sales. Furthermore, significant investments by automotive OEMs in establishing proprietary charging networks and the standardization efforts across North America, Europe, and Asia Pacific are fueling market expansion. The integration of smart grid features, dynamic load management, and Vehicle-to-Grid (V2G) capabilities further enhances the value proposition of modern charging equipment, ensuring sustainable scaling of the infrastructure in line with grid capacity.

Electric Vehicle (EV) Charging Equipment Market Executive Summary

The EV Charging Equipment Market is experiencing transformative growth, characterized by significant business model diversification and technological acceleration, predominantly centered on high-power DC fast charging and advanced software integration. Business trends highlight a strong shift toward comprehensive Energy-as-a-Service (EaaS) models, where Charging Point Operators (CPOs) collaborate with utilities and fleet operators to provide optimized charging solutions, leveraging smart charging and dynamic pricing. Consolidation and strategic partnerships among hardware manufacturers, software providers, and major energy companies are defining the competitive landscape, focused on achieving standardization and scale across different geographies.

Regionally, Asia Pacific maintains market dominance due to aggressive electrification targets in China and burgeoning demand in India and South Korea, driving massive installations of public Level 2 and DC fast chargers. North America is poised for high growth, fueled by substantial federal funding (such as the NEVI program) aimed at building a robust national corridor charging network. Europe emphasizes interoperability and sustainable sourcing, with countries like Germany and the Nordics leading the push for smart grid integration and V2G technologies, ensuring charging infrastructure complements renewable energy sources.

Segment trends underscore the rising importance of DC fast chargers (Level 3) for commercial and public applications, significantly outpacing the growth rate of slower AC chargers, reflecting the need for expedited charging times. Within the component segment, software and services are growing fastest, driven by the need for advanced Charging Station Management Systems (CSMS), sophisticated billing solutions, and predictive maintenance services. The residential segment remains foundational but increasingly incorporates smart features, while commercial fleets represent the most lucrative near-term opportunity for high-utilization charging solutions and integrated fleet management software.

AI Impact Analysis on Electric Vehicle (EV) Charging Equipment Market

User inquiries regarding AI's influence on the EV charging sector frequently revolve around optimization, efficiency, and predictive capabilities. Common questions focus on how AI can manage grid load during peak EV charging events, improve charging reliability through predictive maintenance, and personalize charging experiences based on driver behavior and energy costs. Users are particularly concerned about the transition to smarter infrastructure, querying the role of AI in Vehicle-to-Grid (V2G) implementation and the security implications of autonomous charging systems. The central expectation is that AI will be the key enabler for scaling charging infrastructure without destabilizing existing electrical grids, ensuring optimal energy flow and minimizing operational downtime.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the operational efficiency of EV charging networks. AI algorithms are deployed for sophisticated dynamic load balancing, optimizing the distribution of available power across multiple charging stations based on real-time grid constraints, forecasted renewable energy availability, and prioritized charging needs of specific vehicles (e.g., high-priority fleet vehicles). This intelligence minimizes infrastructure upgrade costs for CPOs and prevents localized grid overload, making the network inherently scalable and resilient against energy price fluctuations.

Furthermore, AI is crucial for enhancing the user experience and improving system reliability. Predictive maintenance models, driven by ML analysis of operational data (temperature, voltage anomalies, usage patterns), allow CPOs to anticipate hardware failures before they occur, drastically reducing out-of-service time and improving customer satisfaction. AI-driven recommendation engines can also personalize charging schedules and suggest the most cost-effective and convenient charging locations based on traffic, battery state of charge, and utility tariffs, moving the industry toward truly autonomous and highly efficient energy management.

- AI-Driven Dynamic Load Management: Optimizing power flow to prevent grid overloads and maximize the number of simultaneous charging sessions.

- Predictive Maintenance: Analyzing operational data streams to anticipate equipment failures, reducing downtime and maintenance costs.

- Optimized Energy Procurement: Using ML models to forecast charging demand and coordinate with utility providers for low-cost, off-peak energy sourcing.

- Personalized Charging Experience: Utilizing user behavior and tariff data to recommend optimal charging times and locations.

- Vehicle-to-Grid (V2G) Optimization: Managing bi-directional energy flow to stabilize the grid and monetize battery capacity through intelligent discharging schedules.

- Fraud Detection and Security: Implementing AI algorithms to monitor transaction patterns and detect anomalies in billing and usage data.

- Enhanced Site Selection: Employing geospatial AI analysis to determine optimal locations for new charging stations based on traffic density, demographics, and power availability.

DRO & Impact Forces Of Electric Vehicle (EV) Charging Equipment Market

The EV Charging Equipment Market is shaped by powerful Drivers (D) such as stringent global emission regulations and supportive governmental subsidies, countered by significant Restraints (R) including the high initial capital expenditure for DC fast charging deployment and persistent concerns regarding grid infrastructure readiness. Opportunities (O) abound in the development of Vehicle-to-Everything (V2X) technologies, particularly V2G integration, and the expansion into emerging markets requiring rapid infrastructure deployment. These forces collectively dictate the pace and direction of market growth, prioritizing scalable and smart charging solutions to overcome inherent infrastructure challenges.

The primary drivers include the massive commitments by major automotive manufacturers to fully electrify their fleets, creating guaranteed demand for charging solutions. This is amplified by consumer preference shifts toward sustainability and the declining total cost of ownership (TCO) for EVs. However, the market faces significant restraints related to standardization fragmentation (different connector types like CCS, CHAdeMO, NACS, and regional variations in regulatory compliance) and the complexity associated with acquiring permits and integrating charging stations with localized utility infrastructure, which often causes project delays.

Opportunities are largely focused on innovation in ultra-fast charging technology (350kW+) and the penetration of charging solutions into previously underserved sectors, such as heavy-duty trucking and marine transport. Furthermore, the convergence of charging infrastructure with renewable energy generation (solar canopies, battery storage) presents an opportunity for CPOs to create sustainable, off-grid or grid-independent charging hubs. The impact forces indicate a strong positive market momentum driven by sustained policy support and technological convergence, though profitability is still highly sensitive to utility costs and utilization rates.

- Drivers:

- Increasing governmental mandates and incentives promoting EV adoption globally.

- Rising public and private investment in establishing robust charging networks.

- Technological advancements leading to faster charging speeds and improved interoperability.

- Declining battery costs and rising consumer interest in sustainable mobility.

- Restraints:

- High upfront installation costs and long payback periods for DC fast chargers.

- Lack of widespread standardization across charging protocols and connectors.

- Challenges associated with large-scale grid integration and local power capacity constraints.

- Opportunities:

- Growth in the development and deployment of Vehicle-to-Grid (V2G) technology.

- Expansion into fleet electrification (buses, trucks, logistics) requiring specialized charging depots.

- Integration of battery energy storage systems (BESS) with charging hubs for peak shaving.

- Impact Forces:

- High positive impact from continuous government regulatory push.

- Moderate negative impact from initial infrastructure investment hurdles, mitigated by subsidies.

- Strong long-term positive impact driven by technological leaps in charging efficiency and smart grid integration.

Segmentation Analysis

The EV Charging Equipment Market is comprehensively segmented across several key dimensions including the type of charger (AC vs. DC), the application environment (commercial vs. residential), the components offered (hardware, software, services), and the connector standard. This segmentation provides a granular view of market dynamics, revealing that growth is disproportionately driven by commercial applications requiring high-power DC charging, which necessitates advanced software management for utilization optimization and billing efficiency. Understanding these segments is crucial for stakeholders to tailor investment strategies towards the highest-growth areas, particularly smart charging and public access networks.

The segmentation by charging level is fundamental, differentiating between Level 1/Level 2 AC charging (slower, typically <22kW) and Level 3 DC fast charging (rapid, often 50kW to 350kW+). While AC charging dominates installation volume in residential settings, DC fast charging commands higher market revenue due to its complexity, capital intensity, and critical role in public charging infrastructure. The component segmentation highlights the increasing value contribution of software, moving the industry beyond simple hardware sales toward subscription-based, recurring revenue models centered on Charging Station Management Systems (CSMS) and energy data analytics.

- By Charging Type:

- Level 1 AC Charging

- Level 2 AC Charging

- DC Fast Charging (Level 3)

- By Application:

- Commercial Charging Stations (Public, Fleets, Workplace)

- Residential Charging Stations (Home Garages, Multi-unit Dwellings)

- By Component:

- Hardware (EV Supply Equipment (EVSE), Power Modules, Cables, Connectors)

- Software (Charging Station Management Systems (CSMS), Billing and Payment Platforms, Energy Management Software)

- Services (Installation, Maintenance, Cloud Services, Consulting)

- By Connector Standard:

- Combined Charging System (CCS)

- CHAdeMO

- Tesla Supercharger/North American Charging Standard (NACS)

- GB/T (China)

Value Chain Analysis For Electric Vehicle (EV) Charging Equipment Market

The value chain for EV charging equipment is complex and involves multiple highly specialized stages, beginning with upstream raw material suppliers and power component manufacturers. Upstream activities include the production of power semiconductors (IGBTs, MOSFETs), specialized cables, smart meter components, and enclosures. This stage is crucial as the quality and efficiency of these components directly impact the charger's reliability and charging speed. Key challenges upstream involve securing stable supply chains for semiconductor chips and ensuring compliance with rapidly evolving safety and electrical standards.

Midstream activities involve the core manufacturing, integration, and software development. Manufacturers assemble power modules, integrate communication hardware, and develop proprietary Charging Station Management Software (CSMS). This stage requires significant R&D investment to enhance power density, thermal management, and connectivity features (OCPP compliance, V2G capabilities). The integration of robust cybersecurity features is paramount here, given the system's connection to both the vehicle and the smart grid.

Downstream analysis focuses on distribution, installation, operation, and maintenance. Distribution channels are highly varied, involving direct sales to fleet operators and utilities, and indirect sales through authorized electrical distributors, CPOs, and specialized system integrators. The final installation and activation process, often handled by certified electricians, must be tightly coordinated with local utilities. The ongoing operation and maintenance (O&M) and provision of cloud-based services generate long-term recurring revenue for CPOs and software providers, marking the highest value-added activity in the downstream segment.

Electric Vehicle (EV) Charging Equipment Market Potential Customers

Potential customers for EV charging equipment are broadly categorized into entities responsible for vehicle ownership, energy management, and public access provision. Charging Point Operators (CPOs), such as ChargePoint or BP Pulse, are primary high-volume buyers, investing in large networks of public charging stations and requiring robust hardware and comprehensive, scalable management software. Utilities and grid operators constitute another major customer segment, purchasing equipment for grid integration, load balancing projects, and sometimes operating their own charging assets to manage local power distribution and implement V2G pilot programs.

Automotive Original Equipment Manufacturers (OEMs), including Tesla, Ford, and VW, are significant customers, either establishing proprietary charging networks to support their vehicle sales or partnering with CPOs to ensure customer access. Fleet operators, encompassing last-mile delivery, taxi services, and municipal bus agencies, represent a fast-growing segment requiring bespoke, high-utilization charging depots with advanced energy management software to minimize operational costs and ensure optimal route scheduling. Lastly, residential homeowners and multi-unit dwelling (MUD) owners form the base customer segment for Level 1 and Level 2 AC chargers, prioritizing ease of use, smart connectivity, and installation simplicity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 21.4 Billion |

| Market Forecast in 2033 | USD 101.9 Billion |

| Growth Rate | 24.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, Siemens, ChargePoint, Tesla, Eaton, Schneider Electric, Bosch, Webasto, BP Pulse, Shell Recharge, EVBox, Tritium, Flo, Alfen, BYD, Star Charge, Nio Power, Enel X, Delta Electronics, Wallbox |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Vehicle (EV) Charging Equipment Market Key Technology Landscape

The technological landscape of the EV charging market is rapidly evolving, driven primarily by the need for faster, more efficient, and smarter power delivery. A major area of innovation is in power electronics, specifically the transition from silicon-based semiconductors to wide bandgap materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). These materials enable the creation of smaller, lighter, and significantly more efficient power conversion modules for DC fast chargers, allowing for ultra-high power output (350kW and above) while minimizing energy loss and improving thermal management, crucial for high-utilization environments.

Another pivotal technology is the development of advanced communication and standardization protocols. ISO 15118 is becoming the standard for Plug and Charge functionality, enabling automated authentication and billing simply by plugging the vehicle in, significantly enhancing the user experience and security. Concurrently, the growth of the Open Charge Point Protocol (OCPP), particularly OCPP 2.0.1, is essential for enabling smart charging capabilities, including sophisticated remote management, detailed transaction logging, and crucial support for V2G communication and smart energy grid interactions, fostering interoperability across different vendor hardware and software.

Inductive (wireless) charging technology, although still nascent, is gaining traction, particularly for fleet applications like autonomous shuttles and buses where manual plug-in is inefficient. Furthermore, the integration of energy storage systems (BESS) directly into charging hubs is a growing trend. BESS allows charging stations to draw power from the grid slowly during off-peak hours and deliver it quickly to EVs during peak times, effectively decoupling the fast charging demand from instantaneous grid capacity, thereby enabling the deployment of ultra-fast chargers in locations with weak grid connections and optimizing operational costs.

Regional Highlights

Regional dynamics heavily influence the type and scale of EV charging deployment, with Asia Pacific (APAC) maintaining the largest market share, driven overwhelmingly by China's aggressive national electrification strategy. China has established the world’s most extensive public charging network, focusing heavily on both high-volume public Level 2 chargers and dense deployments of DC fast chargers to support its massive domestic EV production. Other significant APAC growth markets include South Korea and Japan, focusing on technological innovation (like high-power CHAdeMO and CCS integration), and India, which is rapidly scaling up its infrastructure to support its nascent but explosive two and three-wheeler EV segments.

North America is characterized by robust regulatory support and unprecedented federal investment, notably through the Infrastructure Investment and Jobs Act (IIJA) and the NEVI program, which mandate a standardized, interoperable network across major highway corridors. This region is focused on deploying reliable DC fast charging to address range anxiety, with a critical emphasis on high reliability and seamless payment systems. The recent adoption of the North American Charging Standard (NACS) by major OEMs is simplifying the future infrastructure rollout, though harmonization with existing CCS infrastructure remains a critical short-term challenge.

Europe stands out for its strong emphasis on sustainability, interoperability, and smart grid integration. The region is governed by the Alternative Fuels Infrastructure Regulation (AFIR), pushing for denser public charging infrastructure and mandatory minimum power outputs. European markets, particularly in Nordic countries and Germany, lead in V2G pilot projects, positioning charging equipment not just as a consumer necessity but as an active component of the future energy grid, supporting renewable energy penetration and ensuring energy security.

- Asia Pacific (APAC): Market leader due to overwhelming EV sales and rapid infrastructure deployment in China; strong focus on public charging network density and high-volume manufacturing of components.

- North America: High growth region driven by substantial government funding (NEVI) aimed at establishing a standardized national corridor of DC fast chargers; significant shift towards the NACS connector standard.

- Europe: Focus on smart charging, V2G technology, and high interoperability driven by AFIR mandates; emphasis on charging solutions integrated with renewable energy sources and robust cybersecurity standards.

- Latin America: Emerging market with increasing penetration, particularly in Brazil and Mexico, driven by urban fleet electrification and growing governmental recognition of EV benefits, though infrastructure development remains localized and highly capital-intensive.

- Middle East and Africa (MEA): Nascent market primarily driven by high-income Gulf Cooperation Council (GCC) countries investing in smart cities and sustainable energy projects (e.g., UAE, Saudi Arabia); infrastructure deployment is currently concentrated in metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Vehicle (EV) Charging Equipment Market.- ABB Ltd.

- Siemens AG

- ChargePoint Holdings, Inc.

- Tesla, Inc.

- Eaton Corporation plc

- Schneider Electric SE

- Robert Bosch GmbH

- Webasto Group

- BP Pulse

- Shell Recharge Solutions (NewMotion)

- EVBox Group

- Tritium DCFC Limited

- Flo (AddEnergie)

- Alfen NV

- BYD Company Limited

- Star Charge (Wanbang Digital Energy)

- Nio Power

- Enel X Way

- Delta Electronics, Inc.

- Wallbox N.V.

Frequently Asked Questions

Analyze common user questions about the Electric Vehicle (EV) Charging Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the explosive growth of the EV charging equipment market?

The explosive growth is primarily driven by massive governmental mandates worldwide focused on phasing out fossil fuel vehicles and substantial subsidies for both EV purchases and infrastructure development. Technological advancements leading to faster, more reliable DC charging, coupled with major automotive OEM investments in electrification, are also core accelerators.

How will V2G technology fundamentally change the role of EV charging equipment?

V2G (Vehicle-to-Grid) technology transforms charging equipment from a passive energy consumer to an active grid resource. V2G-enabled equipment allows parked EVs to feed excess stored energy back into the power grid during peak demand, stabilizing the grid, minimizing reliance on fossil-fuel peaking plants, and potentially offering revenue streams for EV owners and CPOs.

Which charging type—AC Level 2 or DC Fast Charging—dominates market revenue, and why?

DC Fast Charging (Level 3) dominates market revenue despite lower unit volumes compared to AC Level 2. This is because DC fast chargers require significantly higher capital investment due to complex power electronics (rectifiers, transformers), robust thermal management systems, and high-power grid connections, resulting in a much higher average selling price (ASP) per unit.

What role does Artificial Intelligence (AI) play in improving EV charging network reliability and efficiency?

AI is crucial for enhancing efficiency through dynamic load management, optimizing power distribution in real-time based on grid constraints and demand forecasts. For reliability, AI utilizes predictive maintenance algorithms, analyzing operational data to anticipate component failures, thereby reducing station downtime and improving overall network utilization rates.

What are the main regional challenges concerning charging connector standardization?

The main regional challenges involve the coexistence and competition among various connector standards: CCS in North America and Europe, CHAdeMO (prevalent in older Japanese models), and GB/T in China. North America is currently undergoing a significant transition toward the Tesla-developed North American Charging Standard (NACS), creating a short-term challenge for CPOs needing to rapidly adapt hardware to support multiple connection types.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager