Electric Vehicle Motor Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434899 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Electric Vehicle Motor Controller Market Size

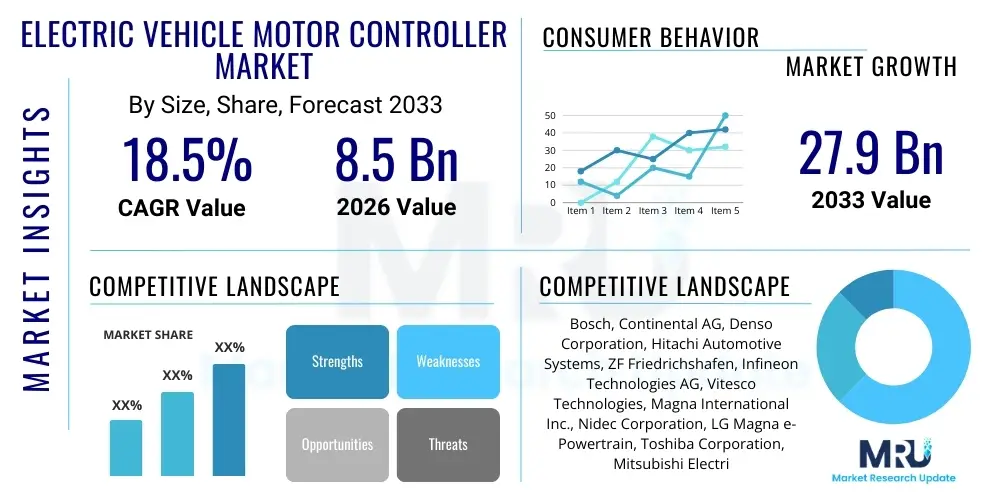

The Electric Vehicle Motor Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 27.9 Billion by the end of the forecast period in 2033.

This robust expansion is primarily fueled by the accelerating global transition towards sustainable transportation solutions, underpinned by stringent governmental emissions regulations and increasing consumer adoption of electric vehicles (EVs). Motor controllers are the critical component dictating the efficiency, performance, and reliability of the electric powertrain, managing the flow of electrical energy from the battery to the electric motor. As manufacturers focus on enhancing range and reducing charging times, the demand for high-performance, compact, and thermally efficient motor control units utilizing advanced semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) is intensifying, driving significant market valuation gains over the forecast horizon. Investment in power electronics R&D is therefore a key determinant of competitive advantage in this rapidly evolving sector.

Electric Vehicle Motor Controller Market introduction

The Electric Vehicle Motor Controller Market encompasses the design, manufacturing, and distribution of electronic devices responsible for controlling the speed, torque, and direction of the electric motors within Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). These controllers, often integrated as part of the inverter system, act as the brain of the electric drivetrain, converting direct current (DC) power from the battery into alternating current (AC) power needed by synchronous or asynchronous motors, while also managing regenerative braking functionality to maximize energy recovery. The core function is to ensure optimal motor efficiency under varying load conditions, directly influencing the vehicle's driving performance and overall energy consumption metrics. The transition toward high-voltage architectures (800V and above) is pushing the boundaries of current controller technology, demanding innovation in thermal management and electromagnetic compatibility (EMC) to handle increased power density effectively.

Major applications of these controllers span across various vehicle types, including passenger cars, commercial vehicles (buses and trucks), and two-wheelers. In passenger vehicles, compactness and efficiency are prioritized, often leading to integrated controller designs that utilize advanced cooling mechanisms. For commercial heavy-duty vehicles, robustness, high power output handling capabilities, and durability under demanding operational cycles are paramount design considerations. The increasing standardization of communication protocols, such as CAN and Ethernet, allows motor controllers to seamlessly interface with other critical vehicular systems, including the Battery Management System (BMS) and vehicle control unit (VCU), facilitating sophisticated energy management strategies. The benefit of utilizing modern motor controllers includes improved vehicle efficiency, enhanced torque control precision, and quieter operation compared to traditional internal combustion engine (ICE) powertrains.

Key driving factors accelerating the market include substantial government subsidies and policy support promoting zero-emission vehicles, coupled with continuous technological advancements in power semiconductor materials, notably SiC. SiC-based controllers offer superior switching speeds and reduced power losses, enabling smaller, lighter, and more efficient powertrain designs, thereby extending EV range and reducing overall system weight. Furthermore, the global expansion of EV manufacturing capabilities, particularly in the Asia Pacific region, and the commitments by major automotive original equipment manufacturers (OEMs) to electrify their entire fleets by specific deadlines are creating massive scalability requirements for motor controller suppliers. These systemic industry shifts confirm the long-term, structural growth trajectory of the EV motor controller segment.

Electric Vehicle Motor Controller Market Executive Summary

The global Electric Vehicle Motor Controller Market is characterized by intense technological competition and rapid adoption driven by unprecedented governmental mandates and favorable environmental policies worldwide. Business trends indicate a strong move toward vertical integration among OEMs, with several major players now investing heavily in developing proprietary motor control hardware and software to gain a competitive edge in powertrain performance and cost control. Simultaneously, established Tier 1 suppliers are forming strategic partnerships with specialized semiconductor manufacturers to secure long-term access to high-demand components like SiC modules, recognizing their critical role in next-generation 800V systems. The market is also witnessing consolidation among smaller specialized firms providing high-density power electronics, as larger automotive suppliers seek to acquire cutting-edge miniaturization and thermal management expertise.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, dominates the volume landscape due to massive domestic EV production and favorable policies, positioning it as the primary manufacturing hub for these components. Europe is demonstrating high value growth, largely attributed to strict CO2 emission standards and a strong focus on high-performance premium and luxury EVs, which demand the highest specification controllers. North America is experiencing accelerated growth, propelled by significant infrastructure investments and government stimulus packages, such as the Inflation Reduction Act (IRA), which incentivize domestic manufacturing and EV deployment. These regional dynamics mean that suppliers must tailor their product offerings—from cost-efficient controllers for mass-market vehicles in APAC to ultra-efficient, high-voltage controllers for the Western markets.

Segment trends reveal that controllers designed for BEVs maintain the largest market share, directly correlating with the phase-out of hybrid models in favor of purely electric architectures in key markets. However, the adoption of high-power controllers in the commercial vehicle segment (especially heavy-duty trucks and electric buses) is anticipated to exhibit the highest CAGR, reflecting the early stages of commercial fleet electrification requiring robust, high-amperage control units. Furthermore, technology segmentation highlights the irreversible shift towards SiC-based controllers, which are rapidly replacing traditional IGBT (Insulated-Gate Bipolar Transistor) modules in high-end and long-range vehicles, driving superior performance benchmarks and system reliability across the entire industry spectrum.

AI Impact Analysis on Electric Vehicle Motor Controller Market

Common user questions regarding AI’s impact on the EV motor controller market frequently center on optimizing real-time performance, predicting component failure, and enabling sophisticated energy management. Users are concerned about how AI can enhance efficiency beyond the limitations of classical control algorithms, specifically asking if Machine Learning (ML) can dynamically adjust switching frequencies and vector control parameters to compensate for changing battery states, temperature fluctuations, and varying motor wear over time. There is also significant interest in the role of AI in quality control and manufacturing, seeking automated inspection systems and predictive maintenance protocols for complex power electronics assemblies. The key themes revolve around achieving ultra-efficiency, ensuring long-term reliability through predictive diagnostics, and simplifying the complex calibration processes traditionally required for new controller designs.

AI is fundamentally transforming the operational paradigm of motor controllers by moving beyond fixed-parameter control systems to adaptive, learning-based methodologies. Integrating AI algorithms allows the motor control unit (MCU) to analyze vast amounts of operational data—including driver behavior, road conditions, and thermal stress—to adjust power delivery instantaneously. For instance, reinforcement learning models can refine torque estimation and current control accuracy, minimizing energy waste and heat generation, thereby extending both the motor and battery lifespan. This level of granular, predictive control is unattainable using conventional methods and represents a significant step forward in maximizing overall powertrain efficiency, directly contributing to extended vehicle range, a primary consumer requirement.

Furthermore, AI plays a crucial role in the design and validation phases of new motor controllers. Generative design techniques coupled with high-fidelity simulation environments allow engineers to optimize the placement and sizing of power components, capacitors, and cooling elements, accelerating the development cycle and reducing prototyping costs. During manufacturing, Computer Vision systems powered by AI are employed for automated solder joint inspection and component alignment, ensuring zero-defect production crucial for high-voltage power electronics reliability. The resultant controllers are not only more efficient but also inherently smarter, capable of self-diagnostics and over-the-air (OTA) software updates that further refine their control logic based on fleet-wide performance data gathered through cloud connectivity.

- AI algorithms enable predictive maintenance, anticipating potential IGBT or SiC module failures based on real-time voltage and temperature anomalies.

- Machine Learning optimizes inverter switching patterns dynamically to reduce harmonic distortion and increase energy conversion efficiency across different driving cycles.

- AI-driven thermal management systems precisely regulate coolant flow and component temperature, allowing for higher power density and reduced controller size.

- Reinforcement Learning (RL) is used to refine torque vector control accuracy, leading to smoother driving experiences and maximized regenerative braking energy capture.

- Integration of AI in manufacturing streamlines quality assurance through automated visual inspection of complex multilayer PCBs and power modules.

- AI aids in optimizing electromagnetic compatibility (EMC) design by simulating and mitigating noise interference, crucial for robust high-frequency operation.

DRO & Impact Forces Of Electric Vehicle Motor Controller Market

The Electric Vehicle Motor Controller Market is shaped by powerful Drivers and substantial Opportunities, counterbalanced by significant Restraints, all interacting to create high-impact forces that determine market direction. Key drivers include rigorous global decarbonization policies and massive OEM investments in EV platforms. These are complemented by opportunities arising from the commercialization of ultra-high-efficiency semiconductor materials (SiC/GaN) and the push toward 800V fast-charging architectures, which necessitates sophisticated controller redesigns. However, the market is restrained by the high initial cost of advanced SiC components, significant R&D expenditure required for integrating new materials, and persistent supply chain bottlenecks, particularly concerning semiconductor fabrication capacity. These dynamic forces result in rapid technological iteration and a constant focus on achieving cost parity while maintaining performance improvements.

The primary impact forces driving growth stem from regulatory pressures, particularly in the EU and China, forcing automakers to accelerate electrification timelines, thereby creating immediate, large-scale demand for controllers. Furthermore, consumer demand for extended driving range mandates continuous improvement in controller efficiency, serving as a powerful force for technological innovation. On the restraint side, the current technological complexity in thermal management for highly dense controllers poses a significant hurdle; maximizing power output while preventing overheating remains a core engineering challenge. Moreover, achieving software robustness and security in complex embedded systems, given the critical safety implications of motor control, exerts pressure on manufacturers to adhere to stringent functional safety standards like ISO 26262, increasing development time and cost.

The market opportunity lies significantly in the underserved segments, specifically electric heavy-duty trucks and off-highway vehicles, which demand highly rugged and powerful controllers capable of sustained high-power output in harsh environments. The continuous decline in battery pack prices is also an indirect opportunity, making EVs more affordable and accelerating overall adoption, subsequently boosting controller volumes. Conversely, a major restraining force is the intellectual property landscape; key patents related to power module design and advanced control algorithms create barriers to entry for new players and necessitate extensive licensing agreements or unique technological breakthroughs for sustainable market penetration.

Segmentation Analysis

The Electric Vehicle Motor Controller Market is segmented based on critical factors including vehicle type, motor type, power output, voltage, and component technology, reflecting the diverse requirements across the entire spectrum of electrified mobility. Analyzing these segments provides strategic insights into high-growth areas and technology adoption rates. The segmentation by vehicle type shows that controllers for passenger cars currently account for the largest volume share, but commercial vehicles represent the fastest-growing segment in terms of revenue due to their need for higher-power, premium components. Technological segmentation, particularly the transition from IGBT to SiC, is the most crucial factor influencing market evolution, determining performance benchmarks and future cost structures across all applications.

Segmentation by voltage architecture distinguishes between standard 400V systems, which dominate current mass-market vehicles, and the emerging 800V systems, which are increasingly adopted in premium and high-performance EVs to facilitate ultra-fast charging capabilities and reduce component weight. This voltage migration dictates fundamental changes in controller design, requiring new insulation techniques and highly efficient power semiconductors specifically rated for higher voltages. Furthermore, segmenting by motor type—Permanent Magnet Synchronous Motor (PMSM) controllers versus Induction Motor (IM) controllers—shows PMSM dominating due to its superior power density and efficiency, although IMs retain a niche presence in cost-sensitive or certain high-speed applications.

The complexity and diversity within the market necessitate this granular segmentation for strategic planning. The power output segmentation is particularly important for commercial suppliers, differentiating between low-power controllers for two-wheelers and high-power traction controllers exceeding 200 kW for heavy-duty applications. Understanding the precise demands of each segment allows manufacturers to optimize their product portfolios, focusing R&D efforts where the highest returns and competitive advantages can be secured, such as developing highly integrated, modular solutions that can be easily adapted across various vehicle platforms to achieve economies of scale.

- By Vehicle Type:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

- By Component Technology:

- Insulated-Gate Bipolar Transistors (IGBT)

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- By Motor Type:

- Permanent Magnet Synchronous Motors (PMSM)

- AC Induction Motors (ACIM)

- By Voltage Architecture:

- Less than 400V

- 400V to 800V

- Above 800V

- By Power Output:

- Less than 100 kW

- 100 kW to 200 kW

- Above 200 kW

Value Chain Analysis For Electric Vehicle Motor Controller Market

The value chain for the Electric Vehicle Motor Controller Market is complex and highly specialized, beginning with the upstream supply of raw materials and critical electronic components. The upstream phase involves the mining and processing of silicon, aluminum, and copper, alongside the specialized production of high-purity SiC or GaN substrates, which are essential for advanced power modules. Key upstream activities include the manufacturing of printed circuit boards (PCBs), passive components (capacitors, inductors), microcontrollers, and specialized cooling solutions. Reliability in the upstream supply chain is paramount, as quality issues in semiconductor components directly affect the efficiency and safety of the final controller unit. Vertical integration by large semiconductor companies entering the automotive sector is increasingly characterizing this phase, aiming to secure capacity and control quality from the substrate level up.

Midstream activities involve the design, assembly, and testing of the motor controller module itself. This stage is dominated by Tier 1 automotive suppliers and specialized power electronics manufacturers who integrate the various components, develop proprietary control software, and house them within robust enclosures with sophisticated thermal management systems. Research and development is heavily concentrated here, focusing on improving power density, reducing electromagnetic interference (EMI), and ensuring compliance with stringent automotive functional safety standards (ASIL ratings). The distribution channel is bifurcated: direct distribution involves specialized suppliers providing controllers directly to EV Original Equipment Manufacturers (OEMs) for integration into new vehicle platforms, a model favored by customized, high-volume contracts. The indirect channel involves supplying standardized modules to smaller EV makers or to the aftermarket through authorized distributors and system integrators.

The downstream segment encompasses the final installation of the motor controller into the EV chassis during vehicle assembly, followed by validation and commissioning. After the vehicle is sold, the aftermarket distribution channel becomes important for replacement units, spare parts, and system upgrades. Direct feedback from OEMs and end-users regarding controller performance, durability, and failure rates is crucial for continuous product improvement. As EVs age, the availability and security of replacement parts, especially firmware updates and diagnostics, form a significant part of the downstream service provision. Successful players optimize their distribution strategy by leveraging both direct OEM relationships for scale and robust aftermarket networks for long-term customer support and penetration.

Electric Vehicle Motor Controller Market Potential Customers

The primary customers for Electric Vehicle Motor Controllers fall into three distinct categories: Original Equipment Manufacturers (OEMs), component Tier 1 suppliers engaged in system integration, and specialized fleet operators requiring retrofitting or heavy-duty solutions. Automotive OEMs, including established global players (e.g., Volkswagen, Toyota, General Motors) and new dedicated EV manufacturers (e.g., Tesla, BYD, Rivian), represent the largest and most strategically important customer base. These customers demand highly customized, high-reliability controllers that meet specific volumetric, performance, and cost targets for their proprietary EV platforms. The negotiation cycles are long, heavily influenced by performance validation, ability to meet high-volume production schedules, and competitive pricing strategies tied to long-term supply agreements. OEMs are increasingly looking for suppliers capable of providing integrated E-Axle solutions, bundling the motor, gearbox, and controller into one compact unit.

Tier 1 automotive suppliers (e.g., Bosch, Continental, Denso) also constitute a critical segment, acting as system integrators who purchase advanced semiconductor modules and raw components to manufacture their own branded controllers or E-Axle systems, which they then supply to multiple smaller OEMs or use in collaboration with larger manufacturers. These customers prioritize consistency, technological leadership in power electronics, and scalability, often serving as a gateway for component manufacturers to enter the complex automotive supply chain. Their demand centers on securing access to the latest SiC technology and partnering with firms offering sophisticated software control algorithms that minimize system integration complexity and accelerate time-to-market for new vehicle models. The ability to offer strong technical support and co-development services is often a deciding factor for this customer group.

The third major segment involves niche potential customers, predominantly specialized commercial fleet operators (e.g., municipal bus services, last-mile delivery fleets) and industrial vehicle manufacturers (e.g., construction and mining equipment). These customers require extremely rugged, high-torque controllers designed to withstand severe duty cycles and harsh environmental conditions, where reliability often trumps absolute efficiency in priority. The growth in specialized EV conversions and retrofitting projects, especially in the trucking sector driven by sustainability mandates, also creates a smaller but highly profitable demand stream for modular, high-power traction inverters. For these segments, product longevity, ease of maintenance, and compliance with heavy-duty operational standards are the key purchasing criteria, often necessitating bespoke product adaptations from the controller manufacturer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 27.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Denso Corporation, Hitachi Automotive Systems, ZF Friedrichshafen, Infineon Technologies AG, Vitesco Technologies, Magna International Inc., Nidec Corporation, LG Magna e-Powertrain, Toshiba Corporation, Mitsubishi Electric Corporation, Texas Instruments, BYD Auto Co. Ltd., Tesla Motors, United Automotive Electronic Systems Co., Ltd., Fuji Electric Co., Ltd., TDK Corporation, Rohm Co., Ltd., SemiCube Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Vehicle Motor Controller Market Key Technology Landscape

The core of the Electric Vehicle Motor Controller technology landscape is defined by the ongoing transition in power semiconductor materials, specifically the shift from traditional Silicon (Si) based IGBT modules towards wide bandgap materials like Silicon Carbide (SiC) and, to a lesser extent, Gallium Nitride (GaN). SiC technology offers significantly higher switching speeds, lower power losses, and superior thermal conductivity compared to IGBTs, enabling controllers to operate at higher efficiencies and higher temperatures. This allows manufacturers to design smaller, lighter inverters with less complex cooling systems, directly contributing to extended EV range and reduced manufacturing costs in the long term. The adoption rate of SiC is accelerating across premium and high-performance vehicle segments, and it is expected to become the standard for 800V architectures, driving intense technological rivalry among semiconductor suppliers vying for automotive qualification and capacity dominance.

Another crucial technological development involves integration and modularization. The industry is moving towards highly integrated power modules and E-Axle systems where the motor controller, gearbox, and motor are combined into a single, compact unit. This integration reduces cabling, weight, and installation complexity, while optimizing the electromagnetic and thermal interfaces between components. Advanced thermal management systems, utilizing sophisticated liquid cooling techniques such as direct fluid cooling over power modules or advanced heat pipe technology, are integral to these high-density designs. Manufacturers are also heavily investing in control software algorithms, leveraging Field-Oriented Control (FOC) and predictive control techniques to maximize torque response and energy efficiency under all operating conditions, often incorporating sophisticated functional safety mechanisms to meet stringent global standards.

Furthermore, the focus on cyber security and connectivity is intensifying within the motor controller domain. As controllers become more complex embedded systems capable of receiving Over-The-Air (OTA) firmware updates, robust security protocols are required to protect against unauthorized access and manipulation that could compromise vehicle safety. Technology development also includes enhanced fault detection and diagnostic capabilities integrated into the hardware, using embedded microcontrollers with high processing power to monitor numerous system parameters simultaneously. The development of advanced sensing technologies, such as high-resolution current and voltage sensors, ensures the precision required for high-frequency switching operations and accurate torque control, reinforcing the reliability of these safety-critical components in next-generation electric vehicle platforms.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for EV production and consumption, making it the dominant region by volume in the motor controller market. China’s extensive governmental support for new energy vehicles (NEVs) and massive domestic manufacturing capacity drive scale. The region exhibits high demand for both cost-efficient controllers (for local mass-market vehicles) and high-performance units (driven by increasing sales of premium international brands). Japan and South Korea are key technology innovators, particularly in power semiconductor development (e.g., SiC commercialization). The high concentration of battery and component manufacturers in this region ensures robust supply chain logistics, attracting foreign direct investment in localized controller production facilities to serve high-growth markets like India and Southeast Asia.

- Europe: Europe is characterized by stringent emission standards and a pronounced shift toward high-voltage, high-efficiency EVs, resulting in superior average revenue per controller unit. The focus here is on performance, driving rapid adoption of 800V architectures and SiC technology, particularly in German premium automotive brands. Regulatory frameworks and initiatives like the European Green Deal accelerate the phase-out of ICE vehicles, creating sustained, structural demand. Key manufacturing hubs in Germany, France, and Eastern Europe are rapidly scaling up production capabilities, supported by strong institutional focus on energy transition and sustainable mobility solutions.

- North America (NA): The North American market is experiencing explosive growth, largely spurred by the US federal government’s support through tax credits, infrastructure funding, and the Inflation Reduction Act (IRA), which mandates local content sourcing. This region is a major consumer of high-power controllers, primarily driven by the demand for large EV trucks, SUVs, and high-performance passenger vehicles. The market is highly competitive, emphasizing domestic production capability and the integration of highly complex software solutions. Investment in manufacturing capacity within Mexico, Canada, and the US is high, aligning with policy goals to build a resilient and localized EV supply chain.

- Latin America (LATAM): While smaller than the major three, LATAM represents an emerging market focused primarily on electric bus fleets and urban mobility solutions. Brazil and Mexico lead the way in adopting electrification strategies. Demand is generally focused on robust, moderately priced controllers suitable for commercial vehicle applications, with gradual uptake in the passenger segment. Market growth is heavily influenced by local economic conditions and the pace of infrastructure deployment (e.g., public charging networks).

- Middle East and Africa (MEA): MEA is nascent but holds long-term potential, driven by oil-producing nations diversifying their economies (e.g., Saudi Arabia, UAE) and ambitious national electrification visions. The primary initial demand is concentrated in municipal electric bus fleets and high-end luxury EVs. Thermal management is a crucial factor in this region due to extreme heat conditions, necessitating specialized, highly robust motor controller designs and advanced cooling mechanisms tailored for sustained performance in elevated ambient temperatures.

The regional market analysis confirms that the Asia Pacific region, particularly China, maintains its quantitative lead by volume, serving as the global manufacturing core for mass-market EV components. However, the qualitative leadership, characterized by early and aggressive adoption of SiC technology and 800V architecture, resides predominantly in Europe and increasingly in North America. This bifurcation creates a strategic imperative for global suppliers to maintain dual product lines: high-cost, high-performance units for Western markets, and highly scalable, efficient volume products optimized for the cost-competitive Asian market. The regulatory environment in each region acts as a fundamental driver, shaping technology choices and investment patterns, forcing manufacturers to localize production to mitigate geopolitical risks and benefit from regional incentives.

Furthermore, infrastructural readiness dictates the pace of market maturation across these geographies. Regions rapidly developing robust charging infrastructure, particularly high-power DC fast charging (which relies directly on 800V architecture compatibility and high-performance controllers), are witnessing faster penetration of advanced controller units. The competition among regional suppliers is intense, focusing not just on hardware efficiency but increasingly on control software intellectual property, which is tailored to optimize driving dynamics based on regional driving cycles and power grid specifics. The sustained commitment from national governments worldwide to meeting net-zero targets ensures that regional demand for motor controllers will remain structurally positive throughout the forecast period, with growth rates varying based on local policy implementation and consumer purchasing power.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Vehicle Motor Controller Market.- Bosch

- Continental AG

- Denso Corporation

- Hitachi Automotive Systems

- ZF Friedrichshafen

- Infineon Technologies AG

- Vitesco Technologies

- Magna International Inc.

- Nidec Corporation

- LG Magna e-Powertrain

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Texas Instruments

- BYD Auto Co. Ltd.

- Tesla Motors

- United Automotive Electronic Systems Co., Ltd.

- Fuji Electric Co., Ltd.

- TDK Corporation

- Rohm Co., Ltd.

- SemiCube Inc.

Frequently Asked Questions

Analyze common user questions about the Electric Vehicle Motor Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Electric Vehicle Motor Controller and why is SiC technology crucial?

The motor controller, often integrated within the inverter, converts the DC power stored in the battery into the AC power required to drive the electric motor, precisely controlling speed, torque, and direction. It also manages regenerative braking. Silicon Carbide (SiC) technology is crucial because it allows the controller to switch power significantly faster and with lower energy loss than traditional Silicon-based Insulated-Gate Bipolar Transistors (IGBTs). This improved efficiency leads directly to reduced heat generation, allowing for smaller, lighter cooling systems and, most importantly, extending the overall vehicle range and supporting ultra-fast 800V charging architectures which are critical for market adoption.

How is the adoption of 800V architecture impacting the design requirements for motor controllers?

The shift to 800V architecture is fundamentally redesigning motor controllers by demanding components that can safely and efficiently handle higher voltages and currents, significantly reducing charging times and improving performance. Controllers designed for 800V systems must feature advanced insulation and packaging techniques, necessitating the use of high-voltage-rated SiC power modules exclusively, as IGBTs struggle to deliver necessary performance gains at this voltage level. This move drives complexity in thermal management and requires enhanced functional safety features (ASIL D compliance) to ensure reliability under high-stress operating conditions. It also pushes manufacturers toward integrating the controller more tightly with the battery management system (BMS).

Which geographic region dominates the Electric Vehicle Motor Controller Market, and why?

The Asia Pacific (APAC) region, specifically China, dominates the Electric Vehicle Motor Controller Market by volume. This dominance is attributed to China's massive domestic production and consumption of electric vehicles, fueled by extensive government subsidies and favorable New Energy Vehicle (NEV) policies. The high density of EV manufacturers and the rapid scaling of the automotive supply chain infrastructure within APAC facilitate large-scale, cost-effective manufacturing of controllers. While Europe and North America lead in the adoption of premium, high-efficiency SiC controllers, APAC dictates the global volume trends for mass-market applications, driving substantial market size figures.

What major restraints are currently hindering the widespread growth and cost reduction in the controller market?

Major restraints include the persistently high initial cost of advanced semiconductor materials, particularly SiC power modules, compared to traditional IGBTs. Although SiC offers long-term systemic cost savings through efficiency, the upfront component price remains a barrier for mass-market adoption. Additionally, the rapid pace of technological innovation necessitates huge, continuous R&D investments, and the specialized, highly technical nature of manufacturing these power modules leads to acute supply chain vulnerabilities and capacity constraints. Manufacturers also face significant engineering challenges related to advanced thermal management required to maintain reliability in increasingly compact, high-power-density designs, adding to overall system cost and complexity.

How does the integration of AI improve the performance and reliability of modern motor controllers?

AI improves controller performance by enabling dynamic, adaptive control algorithms that move beyond static pre-set parameters. Machine Learning (ML) analyzes real-time data (temperature, battery state, motor load) to adjust power switching patterns, optimizing energy efficiency instantaneously and minimizing power losses. Furthermore, AI enhances reliability through predictive maintenance; ML models can identify minute anomalies in current signatures or voltage ripple, allowing the system to predict potential component failures (e.g., in SiC modules or capacitors) before they occur. This proactive diagnostic capability reduces vehicle downtime, enhances overall functional safety, and extends the operational life of the entire electric powertrain system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager