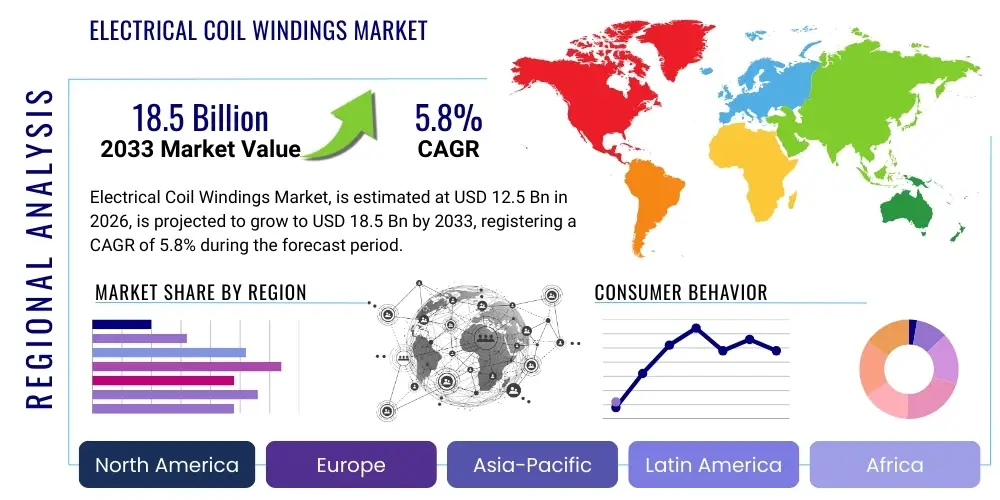

Electrical Coil Windings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437491 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Electrical Coil Windings Market Size

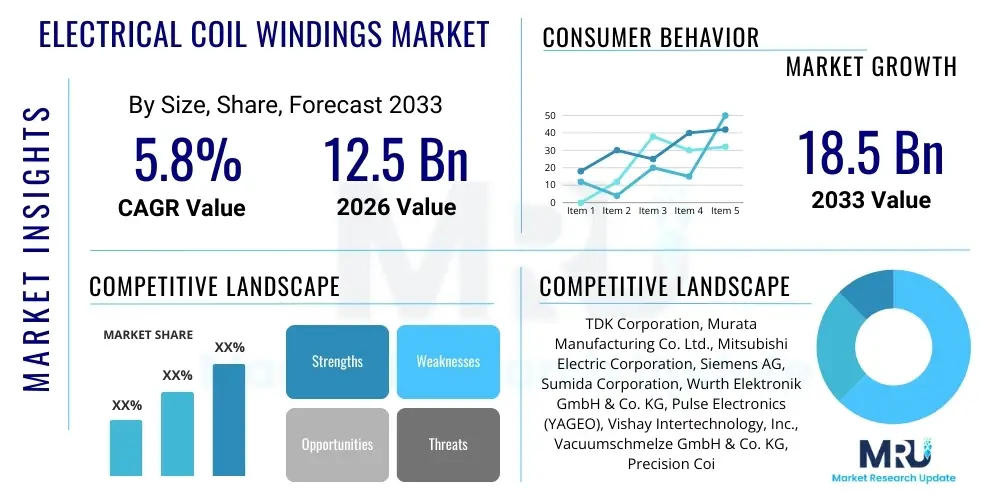

The Electrical Coil Windings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2033. This steady expansion is primarily driven by the accelerating global transition towards electric vehicles, increased demand for high-efficiency power electronics, and widespread application of advanced magnetic components in renewable energy infrastructure, particularly solar and wind power generation systems. The requirement for custom, precision-wound coils for miniaturized devices in consumer electronics and medical equipment also contributes significantly to this projected market growth trajectory.

Electrical Coil Windings Market introduction

The Electrical Coil Windings Market encompasses the design, manufacture, and distribution of components that utilize coiled conductive wire to generate electromagnetic fields or store energy. These essential components are fundamental to virtually all electrical systems, converting electrical energy into magnetic energy (and vice versa) for applications ranging from power transmission and distribution to complex signal processing. Key products within this market include stator coils, rotor coils, transformer windings, solenoid coils, relays, and inductors, serving as critical enablers for modern technological advancements and infrastructural development.

The operational necessity of coil windings spans numerous heavy industries and consumer sectors. Major applications include electric motors used in industrial machinery and automotive drivetrains, power transformers vital for utility grids, and inductive components critical for filtering and energy storage in electronic circuits. The inherent benefits derived from high-quality coil windings—such as superior energy efficiency, reliable performance under varying load conditions, and compact design integration—drive consistent demand across global markets, fostering innovation in materials science and winding precision.

The market is predominantly driven by global electrification trends, stringent energy efficiency standards imposed by regulatory bodies worldwide, and the burgeoning expansion of data centers requiring advanced cooling and power management systems. Specifically, the massive investment into renewable energy capacity necessitates highly efficient power conversion systems, all of which rely heavily on specialized coil windings. Furthermore, the relentless miniaturization of electronic components in sectors like IoT and wearables is pushing manufacturers to develop ultra-fine wire winding techniques and high-density magnetic components.

Electrical Coil Windings Market Executive Summary

The Electrical Coil Windings Market is characterized by robust business trends focusing on automation, vertical integration, and specialization in high-performance coils for niche applications. Key industry players are investing heavily in automated coil winding machinery to reduce manufacturing variance, increase throughput, and address skilled labor shortages, thereby improving overall cost efficiency and product quality. Furthermore, strategic alliances between coil manufacturers and specialized material suppliers (e.g., high-temperature insulation or amorphous/nanocrystalline core materials) are becoming crucial to meet the demanding specifications of next-generation power electronics and high-frequency applications, particularly in EV fast-charging infrastructure.

Regionally, the Asia Pacific (APAC) continues to dominate the market, propelled by massive manufacturing capabilities in China, South Korea, and Japan, coupled with rapid adoption of electric vehicles and extensive deployment of utility-scale renewable energy projects. North America and Europe, while slower in pure volume growth, lead in innovation and demand for highly customized, high-reliability coil windings, primarily driven by aerospace and defense, advanced industrial automation, and stringent requirements for high-voltage DC (HVDC) power transmission. Emerging economies in Latin America and MEA are exhibiting high growth potential, fueled by infrastructure modernization and increasing industrialization, necessitating foundational electrical components.

In terms of segmentation, the market shows a significant shift towards dry-type transformers and high-frequency inductors, reflecting the move away from traditional oil-filled systems where feasible, due to safety and environmental concerns. The application segment dominated by electric vehicle motors and charging infrastructure is anticipated to record the highest Compound Annual Growth Rate (CAGR) through 2033. Coil windings utilizing Litz wire technology are also seeing increased adoption, particularly in high-frequency power supplies and resonant converters, reflecting a broader trend towards minimizing power losses and optimizing thermal management within magnetic components.

AI Impact Analysis on Electrical Coil Windings Market

User queries regarding AI's influence in the Electrical Coil Windings Market frequently revolve around two core themes: optimization and automation. Common questions include whether AI can autonomously design more efficient coils (e.g., complex geometries, thermal modeling), how machine learning enhances predictive maintenance for winding machinery, and the feasibility of integrating AI-powered quality inspection systems to detect micro-defects in insulation and winding patterns. Users are highly concerned about the role of AI in moving coil winding from a labor-intensive, precision craft toward a fully automated, digitally simulated process, focusing on maximizing efficiency and reducing design iteration cycles. These inquiries summarize a demand for actionable insights into how AI-driven tools streamline the design-to-manufacturing pipeline and elevate the performance characteristics of electromagnetic components.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the R&D and manufacturing phases of electrical coil windings. In design, AI algorithms can rapidly simulate and optimize complex winding patterns, core shapes, and material combinations to achieve specified performance targets, such as minimizing eddy current losses or optimizing thermal dissipation, significantly faster than traditional iterative methods. This capability accelerates the development of highly customized and energy-efficient coils essential for demanding applications like high-power density inverters and specialized medical imaging equipment, offering a substantial competitive advantage to early adopters.

Furthermore, AI-driven solutions are instrumental in enhancing manufacturing efficiency and quality control. Predictive maintenance systems utilize ML models to analyze sensor data from winding machines, identifying potential mechanical failures or process deviations before they lead to downtime or quality lapses. In quality assurance, AI vision systems automatically inspect completed windings for uniformity, insulation integrity, and structural defects that are invisible or difficult to detect through human inspection, ensuring that coils meet stringent reliability standards required by the automotive and aerospace sectors, thereby reducing scrap rates and improving overall operational reliability.

- AI-powered Generative Design: Optimization of coil geometry and wire placement to maximize magnetic field uniformity and minimize thermal hotspots.

- Predictive Maintenance: Use of ML on machine data (tension, speed, temperature) to forecast equipment failure and schedule preventative service for winding machines.

- Automated Quality Inspection: Deployment of computer vision systems to detect minor insulation damage or winding pattern irregularities in real-time during production.

- Supply Chain Optimization: ML algorithms predicting fluctuations in copper and magnetic material pricing, aiding in strategic procurement decisions.

- Simulation Acceleration: AI reducing computational time required for complex Finite Element Analysis (FEA) of electromagnetic and thermal performance of new coil designs.

DRO & Impact Forces Of Electrical Coil Windings Market

The dynamics of the Electrical Coil Windings Market are shaped by powerful Drivers, inherent Restraints, and significant Opportunities, which collectively exert considerable Impact Forces on market progression. The core drivers revolve around global infrastructural development and the widespread adoption of electrification, particularly in transportation (EVs) and energy generation (renewables). Counteracting these drivers are critical restraints, notably the volatile pricing of key raw materials like copper and specialty magnetic steel, and the requirement for substantial initial investment in high-precision automated winding equipment. These forces mandate strategic navigation for manufacturers aiming for sustainable growth.

Drivers: The global mandate for reduced carbon emissions is accelerating the adoption of electric motors and high-efficiency transformers, directly fueling demand for specialized coil windings. Government incentives for renewable energy projects, coupled with infrastructural upgrades to handle smart grid technologies and high-voltage DC transmission, necessitate reliable, high-specification coils. Furthermore, advancements in 5G infrastructure and data center expansion require advanced power filtering components, increasing the complexity and volume of inductor and transformer coils produced.

Restraints: The primary restraint remains the extreme volatility in the price of magnet wire (copper and aluminum) and insulation materials, which directly impacts manufacturing costs and profit margins. Technical challenges associated with developing ultra-fine wire coils for miniaturized devices, and the need to meet stringent thermal management requirements in high-power applications (like EV traction motors), also restrict market growth velocity. Additionally, the proliferation of counterfeiting, particularly in lower-grade replacement coils, poses a risk to market reputation and legitimate sales channels.

Opportunities: Significant growth opportunities exist in the development of coil windings utilizing advanced, lightweight materials (e.g., composite conductors), and in the expansion into high-frequency applications enabled by wide-bandgap semiconductors (SiC and GaN), which require specialized Litz wire and planar coils. Customization services for niche markets, such as aerospace, medical implants, and industrial robotics, offer higher margins and competitive differentiation. Investment in fully integrated smart factory solutions, leveraging IoT and AI for precision manufacturing, presents a substantial opportunity for operational efficiency gains.

Segmentation Analysis

The Electrical Coil Windings Market is extensively segmented based on criteria such as the type of winding technology, the material used, the application, and the end-use industry. This segmentation reveals distinct growth trajectories and competitive landscapes within the broader market. The primary categorization focuses on product types, including standard inductors, solenoids, transformers (power and distribution), motor coils (stator and rotor), and specialized RF/magnetic components. Analyzing these segments provides crucial insights into targeted R&D efforts and strategic capacity expansion required to meet diverse industrial demands, ranging from high-volume consumer electronics to high-reliability utility infrastructure.

- By Type:

- Air Core Coils

- Iron Core Coils

- Toroidal Coils

- Solenoid Coils

- Transformer Windings (Primary, Secondary, Tertiary)

- Motor Stator/Rotor Windings

- By Application:

- Transformers (Power, Distribution, Specialty)

- Electric Motors (AC, DC, BLDC, Stepper)

- Inductors and Chokes

- Relays and Contactors

- Solenoids and Actuators

- Sensors and Detection Systems

- By Wire Material:

- Copper Wire Coils

- Aluminum Wire Coils

- Litz Wire Coils

- Specialty Alloy Wire Coils

- By End-Use Industry:

- Automotive (EVs, HEVs, Charging Infrastructure)

- Power Generation and Distribution (Utilities)

- Industrial Automation and Robotics

- Consumer Electronics and Appliances

- Healthcare and Medical Devices (MRI, Surgical Tools)

- Aerospace and Defense

Value Chain Analysis For Electrical Coil Windings Market

The value chain for the Electrical Coil Windings Market is complex, beginning with raw material procurement and extending through specialized manufacturing, distribution, and final integration into complex electrical systems. Upstream analysis focuses heavily on the procurement of high-purity conductive materials (copper and aluminum) and magnetic core materials (ferrites, silicon steel laminations). Volatility and concentration risks in the global supply of magnet wire, which requires precise insulation coating, are critical factors influencing manufacturing costs and lead times. Strategic long-term contracts with major wire drawing and enamel coating suppliers are essential for ensuring stable input costs and material quality consistency.

The midstream segment involves the core manufacturing processes: coil design, precision winding (using automated or semi-automated machinery), insulation application (varnishing, potting, taping), and rigorous quality testing. Manufacturers often differentiate themselves through proprietary winding techniques, superior thermal management capabilities, and stringent adherence to quality certifications (e.g., ISO/TS 16949 for automotive). Automation, particularly in high-volume segments like consumer electronics and simple inductors, is crucial for maintaining cost competitiveness, while high-mix, low-volume coils for aerospace or medical applications rely more on highly skilled technicians and advanced measurement systems.

Downstream distribution channels are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs)—especially in the automotive and industrial machinery sectors—and indirect sales through specialized electrical distributors, stocking various standard coils and components for MRO (Maintenance, Repair, and Operations) needs. The trend leans towards direct collaboration with key customers, allowing coil manufacturers to participate early in the product design cycle, ensuring optimized performance and seamless integration. Efficient logistics and inventory management are critical, as coil windings are often built-to-order components vital for the timely assembly of finished goods across numerous industries.

Electrical Coil Windings Market Potential Customers

The potential customer base for the Electrical Coil Windings Market is highly diversified, spanning nearly every sector that utilizes electricity for power, control, or signal processing. The primary buyers are large, multinational Original Equipment Manufacturers (OEMs) who integrate these coils directly into their final products. This includes leading automotive manufacturers requiring specialized coils for high-performance traction motors and onboard chargers in electric vehicles, and major utility companies procuring windings for large-scale power transformers and grid stabilization equipment.

Other significant buyers include industrial automation firms utilizing coils in advanced robotics, solenoids, and specialized induction heating equipment. Furthermore, the consumer electronics sector demands high volumes of miniature inductor and transformer coils for power supplies, battery management systems, and communication devices. The market also serves highly regulated sectors such as aerospace (actuators, radar systems) and healthcare (MRI machines, surgical instruments), where performance, reliability, and precision are paramount purchasing criteria, driving demand for premium, custom-engineered windings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 18.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TDK Corporation, Murata Manufacturing Co. Ltd., Mitsubishi Electric Corporation, Siemens AG, Sumida Corporation, Wurth Elektronik GmbH & Co. KG, Pulse Electronics (YAGEO), Vishay Intertechnology, Inc., Vacuumschmelze GmbH & Co. KG, Precision Coil Inc., Custom Coils, Inc., Spang & Company, Abracon LLC, Electromech Technologies, Kemet Corporation, Phoenix Mecano AG, Hammond Manufacturing Co. Ltd., TT Electronics, Schaffner Holding AG, Laird Performance Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Coil Windings Market Key Technology Landscape

The technological landscape of the Electrical Coil Windings Market is dominated by advancements aimed at increasing winding precision, enhancing thermal management, and enabling higher power density. One of the most critical technologies is high-precision automated winding machinery, including multi-spindle and fly-winding systems, which reduce human error and facilitate the rapid production of complex coil geometries, such as those required for segmented motor stators (hairpin windings) crucial for maximizing EV motor efficiency. These machines incorporate tension control and automated testing systems to ensure uniform winding pitch and insulation integrity, thereby minimizing partial discharge risks in high-voltage environments.

Material innovation represents another cornerstone of technological advancement. The adoption of specialized magnet wires, particularly Litz wire, is growing significantly in high-frequency applications, minimizing proximity and skin effects that lead to energy loss. Furthermore, improved insulation systems, including advanced varnishes, resins, and thin-film insulation papers (such as high-temperature polyimides), are essential for allowing coils to operate reliably at elevated temperatures required by smaller, higher-power-density designs. The shift towards lightweight materials, such as aluminum conductors, is also being explored, though it necessitates careful engineering to compensate for aluminum's lower conductivity compared to copper.

The integration of Planar Magnetic Technology is also gaining traction, particularly for low-profile, high-efficiency power supplies used in telecommunications and data centers. Planar coils, often manufactured using etched copper foils laminated into PCBs, offer excellent repeatability, exceptional thermal dissipation due to their flat surface area, and inherently low leakage inductance. While not suitable for all applications, the ability of planar magnetics to integrate seamlessly into compact electronic assemblies positions them as a key disruptive technology, especially in combination with the high-switching frequencies enabled by silicon carbide (SiC) and gallium nitride (GaN) power semiconductors.

Regional Highlights

The global market for electrical coil windings demonstrates significant regional disparities in both production volume and technological demand, reflecting localized industrial maturity and regulatory environments.

- Asia Pacific (APAC): APAC is the global manufacturing powerhouse and primary consumer, driven by immense production capacity in China, Taiwan, and South Korea for consumer electronics, industrial automation equipment, and electric vehicles. Government support for electric mobility and renewable energy deployment in countries like India and Southeast Asia further solidifies APAC's dominant market share and high growth rate.

- North America: Characterized by high R&D intensity and stringent quality requirements, North America focuses on specialized, high-reliability coils for aerospace, defense, and advanced medical equipment. The region is seeing rapid growth spurred by domestic electric vehicle production mandates and significant investment in modernizing aging utility infrastructure.

- Europe: Europe is a leader in high-efficiency industrial motors and advanced energy systems. Regulatory pressures, such as the European Union’s ecodesign directives, mandate superior energy efficiency, driving demand for optimized, low-loss coil windings. Germany and Italy remain crucial hubs for high-quality industrial magnetics and transformer manufacturing.

- Latin America (LATAM): LATAM represents an emerging market segment fueled by increasing industrialization, urbanization, and infrastructural development, particularly in Brazil and Mexico. Demand is concentrated in utility distribution transformers and standardized motor coils for manufacturing and resource extraction industries.

- Middle East and Africa (MEA): Growth in MEA is primarily associated with large-scale energy projects, including significant investment in renewable solar energy and oil and gas infrastructure. Coil demand is centered on robust, reliable transformers and customized motors capable of operating efficiently in harsh, high-temperature environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Coil Windings Market.- TDK Corporation

- Murata Manufacturing Co. Ltd.

- Mitsubishi Electric Corporation

- Siemens AG

- Sumida Corporation

- Wurth Elektronik GmbH & Co. KG

- Pulse Electronics (YAGEO)

- Vishay Intertechnology, Inc.

- Vacuumschmelze GmbH & Co. KG

- Precision Coil Inc.

- Custom Coils, Inc.

- Spang & Company

- Abracon LLC

- Electromech Technologies

- Kemet Corporation

- Phoenix Mecano AG

- Hammond Manufacturing Co. Ltd.

- TT Electronics

- Schaffner Holding AG

- Laird Performance Materials

Frequently Asked Questions

Analyze common user questions about the Electrical Coil Windings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major technological advancements are driving coil winding efficiency?

The market is increasingly adopting high-precision automated winding systems, such as advanced robotic and fly-winding techniques, paired with high-frequency Litz wire and superior high-temperature insulation materials, crucial for boosting efficiency in compact, high-power density applications like electric vehicle motors.

How is the rise of electric vehicles impacting the demand for coil windings?

EV adoption is a primary market driver, necessitating massive production of specialized, high-reliability stator and rotor coils for traction motors, and high-frequency inductive components for onboard chargers and DC-DC converters. These components require higher thermal stability and lower losses than traditional coils.

What are the primary raw material concerns affecting market profitability?

Price volatility and supply chain stability for high-purity copper and specialty magnetic core materials (like grain-oriented electrical steel) are major concerns. Manufacturers are actively exploring alternatives such as aluminum windings and advanced composite core materials to mitigate these risks and stabilize manufacturing costs.

Which end-use industry holds the largest market share for electrical coil windings?

The Power Generation and Distribution segment historically holds a dominant share due to the continuous need for large-scale power and distribution transformers. However, the Automotive sector, driven by EV production, is projected to exhibit the highest growth rate during the forecast period.

How does quality control in coil winding relate to overall product reliability?

Quality control, particularly precise winding tension and flaw detection in insulation, is paramount. Defects can lead to premature failure due to partial discharge or overheating. Advanced quality systems utilize AI-powered vision inspection and automated testing to ensure the longevity and required performance of critical magnetic components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager