Electrical Construction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435020 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Electrical Construction Market Size

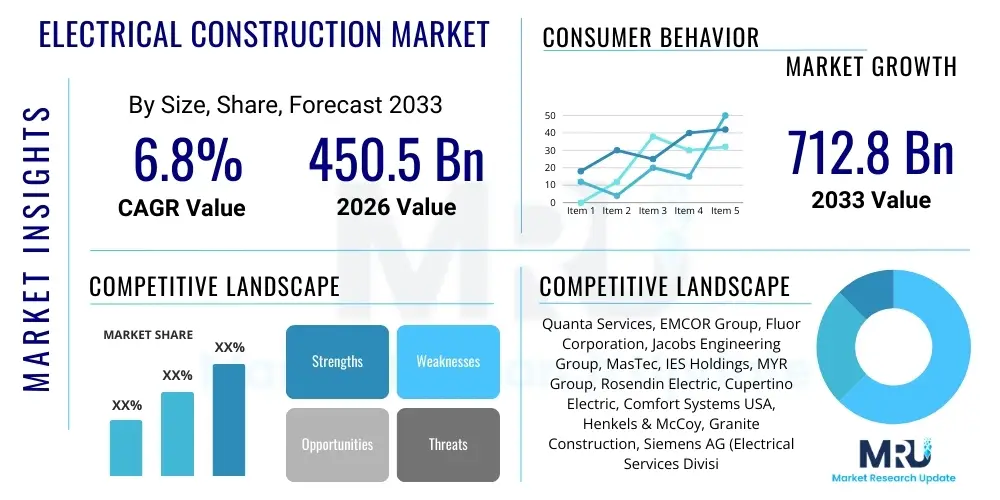

The Electrical Construction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $450.5 Billion USD in 2026 and is projected to reach $712.8 Billion USD by the end of the forecast period in 2033.

Electrical Construction Market introduction

The Electrical Construction Market encompasses the planning, installation, maintenance, and upgrade of electrical infrastructure across residential, commercial, industrial, and utility sectors. This includes wiring, power distribution systems, lighting, security installations, telecommunication networks, and integration of renewable energy sources. Key drivers propelling market expansion include rapid global urbanization, significant infrastructure investment in smart cities and transportation networks, and the accelerating transition towards electrification of various end-use sectors, especially in automotive and heating. Furthermore, the mandatory implementation of rigorous safety codes and energy efficiency standards across developed nations mandates continuous system upgrades and new construction methodologies. Major applications span data centers requiring high-density power supply, large-scale utility projects focusing on grid modernization, and commercial building retrofits aimed at optimizing energy consumption. The inherent benefits of modern electrical construction include enhanced energy security, improved operational efficiency, and reduced long-term maintenance costs through the use of durable and smart components.

Electrical Construction Market Executive Summary

The Electrical Construction Market is characterized by robust growth driven by sustained governmental and private sector investments in infrastructure modernization and renewable energy integration. Key business trends include the consolidation of services toward integrated project delivery (IPD) models, increased adoption of prefabrication techniques to enhance project efficiency and safety, and a growing emphasis on specialized services such related to complex installations like electric vehicle (EV) charging infrastructure and smart grid interconnection. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive population growth, large-scale industrialization in countries like China and India, and expansive smart city initiatives. North America and Europe demonstrate growth stability, primarily driven by grid resiliency projects, stringent environmental regulations necessitating retrofits, and the proliferation of hyperscale data centers. Segmentally, the non-residential sector, particularly commercial and industrial construction, remains the largest revenue contributor, though the utility segment is experiencing the fastest growth rate owing to the global energy transition and grid overhaul requirements. Technology integration, specifically Building Information Modeling (BIM) and Artificial Intelligence (AI) for predictive maintenance, is defining competitive advantage across all segments.

AI Impact Analysis on Electrical Construction Market

User inquiries concerning the impact of AI in electrical construction predominantly revolve around optimizing project timelines, ensuring site safety, enhancing predictive maintenance capabilities, and automating complex design tasks. Users frequently express concerns about the necessary skills shift for electricians and engineers, the initial investment in AI-powered software, and data security related to integrated smart building systems. The central expectation is that AI will dramatically improve efficiency by automating routine planning and documentation, leading to reduced labor costs and fewer construction delays. Furthermore, there is significant interest in how machine learning algorithms can analyze vast datasets from installed sensors to predict equipment failure before it occurs, thereby shifting the industry from reactive repairs to proactive maintenance schedules, ultimately maximizing the operational lifespan of electrical assets and improving overall grid stability. The integration of AI into design phases, utilizing generative design for optimal wiring layouts based on energy consumption simulations, is also a key area of inquiry and development.

- AI-powered Generative Design: Optimizing complex routing and system layouts, reducing material waste, and improving energy efficiency calculations during the design phase.

- Predictive Maintenance (PdM): Analyzing operational data from installed components (e.g., transformers, breakers) to forecast potential failures, minimizing unplanned downtime.

- Project Management Automation: Utilizing machine learning to optimize scheduling, manage supply chain logistics, and track real-time progress, ensuring adherence to tight deadlines.

- Enhanced Safety Protocols: AI-driven visual analytics using site cameras to monitor compliance with safety regulations and instantly detect high-risk behaviors or hazards.

- Automated Quality Control: Employing robotics and computer vision systems for real-time inspection of wiring integrity and adherence to stringent code requirements.

- Smart Grid Integration: AI algorithms enabling seamless integration of distributed energy resources (DERs) and managing bidirectional power flow within smart infrastructure projects.

DRO & Impact Forces Of Electrical Construction Market

The Electrical Construction Market is influenced by strong drivers, counterbalanced by significant restraints, while presenting substantial long-term opportunities, all governed by powerful external and internal impact forces. Key drivers include accelerating governmental investment in critical national infrastructure such as high-speed rail and smart road networks, coupled with the global shift towards renewable energy sources requiring massive grid modernization and interconnection projects. However, the market faces significant restraints, primarily the persistent shortage of skilled labor, increasing volatility in raw material prices (especially copper and steel), and the time-consuming and complex regulatory approval processes often associated with large-scale utility projects. Opportunities arise mainly from the rapid expansion of hyperscale and edge data centers globally, the mandated transition to building electrification (phasing out natural gas reliance in buildings), and the burgeoning need for robust electric vehicle charging infrastructure. These forces collectively shape the competitive landscape, dictating project viability and innovation priorities.

The dominant driving force remains the global commitment to decarbonization, compelling utility providers and governments to invest heavily in modernizing aging transmission and distribution (T&D) systems. This requires specialized electrical construction services for substation automation, microgrid development, and the integration of intermittent energy sources like solar and wind power. Further market momentum is provided by the continuous evolution of building codes demanding higher levels of energy efficiency, such as net-zero ready buildings, which necessitate the installation of advanced electrical control systems, smart lighting, and energy storage solutions. The demand for reliable power in emerging economies, driven by industrial expansion, provides a massive untapped segment for foundational electrical construction.

Conversely, the high capital expenditure required for adopting advanced technologies like specialized BIM software, robotics for installation, and comprehensive digital project management systems acts as a deterrent, particularly for smaller and medium-sized enterprises (SMEs). Furthermore, project delays caused by stringent environmental impact assessments and bureaucratic roadblocks can significantly increase operational costs and risk exposure. The impact forces affecting the market include technological advancements, such as the deployment of IoT sensors for system monitoring (pushing demand for complex wiring), economic conditions influencing construction financing rates, and regulatory changes (e.g., stricter fire safety and electromagnetic compatibility standards) that continuously redefine the scope and complexity of electrical construction projects.

- Drivers:

- Global shift toward electrification and renewable energy integration.

- Rapid expansion of digital infrastructure (data centers, 5G networks).

- Increased governmental spending on smart city development and critical infrastructure modernization.

- Mandatory adoption of stringent energy efficiency and safety building codes.

- Restraints:

- Persistent shortage and aging workforce of skilled electrical technicians and engineers.

- High and volatile prices of key raw materials (copper, aluminum, PVC).

- Regulatory complexity and lengthy approval processes for large utility projects.

- Cybersecurity risks associated with networked smart building systems.

- Opportunities:

- Exponential growth in demand for EV charging infrastructure installation.

- Expansion of microgrids and decentralized power generation projects.

- Retrofitting existing commercial and residential buildings with smart, energy-efficient systems.

- Adoption of modular and prefabricated electrical components (e-houses, skid systems).

- Impact Forces:

- Technological advancements in automation and IoT integration.

- Global economic cycles influencing infrastructure investment.

- Shifts in regulatory enforcement and sustainability mandates (ESG goals).

- Climate change accelerating demand for resilient electrical systems.

Segmentation Analysis

The Electrical Construction Market is segmented primarily based on end-use sector, offering type, and system installed. This segmentation is critical for understanding the diverse demands placed on electrical contractors, ranging from low-voltage data transmission systems in commercial offices to high-voltage power distribution networks in utility settings. The End-Use segment distinguishes between Residential (single and multi-family units), Commercial (offices, retail, hospitals), Industrial (manufacturing plants, mining), and Utility (T&D systems, power generation facilities). Analyzing these segments reveals varying growth dynamics, with Utility and Commercial sectors showing robust capital expenditure driven by large-scale decarbonization and digital transformation projects, respectively. The Offering segment, which includes Installation, Maintenance, and Upgrade services, highlights the growing importance of recurring revenue streams derived from preventive maintenance and necessary regulatory compliance upgrades, particularly in mature markets.

- By End-Use Sector:

- Residential

- Commercial

- Industrial

- Utility

- By Offering:

- Installation Services

- Maintenance and Repair Services

- Upgrade and Retrofit Services

- By System Type:

- Power Distribution Systems (High-Voltage, Medium-Voltage, Low-Voltage)

- Lighting Systems (Interior, Exterior, Specialized)

- Communication and Data Transmission Systems

- Safety and Security Systems (Fire Alarms, Access Control)

- Renewable Energy Integration Systems (Solar PV, Wind)

- By Project Type:

- New Construction

- Renovation and Maintenance

Value Chain Analysis For Electrical Construction Market

The value chain for the Electrical Construction Market begins with upstream activities involving the sourcing and manufacturing of essential components, extending through the crucial phases of project design, installation, and concluding with downstream activities centered on post-installation maintenance and system lifecycle management. Upstream analysis focuses on suppliers of critical materials such as copper wire, conduit, transformers, switchgear, and control systems. Manufacturers play a pivotal role in ensuring component standardization, quality control, and integration capability (e.g., smart components). Price fluctuations and supply chain resilience within this segment directly impact construction project profitability and timelines. Leading manufacturers often integrate vertically or establish strategic partnerships to secure consistent supply of high-grade, code-compliant materials necessary for large-scale utility and industrial projects.

The middle segment of the value chain is dominated by specialized electrical contractors and engineering procurement construction (EPC) firms, which handle project management, system design (often utilizing BIM), labor coordination, and physical installation. Efficiency in this stage is increasingly driven by adopting digital tools for collaboration and utilizing prefabrication techniques to minimize on-site labor and accelerate deployment. Distribution channels are varied, including direct sales from large manufacturers to utility clients, and indirect channels relying on electrical wholesalers and distributors who stock and supply components to smaller contractors. The efficiency and geographic reach of these distributors are essential for supporting numerous regional residential and commercial projects.

Downstream activities center on the operational phase of the constructed electrical system. This involves routine preventative maintenance, emergency repair services, and system upgrades required due to technological obsolescence or changes in regulatory standards. Direct relationships between contractors and end-users (owners/operators of facilities) are crucial here, often leading to long-term service contracts. The trend toward smart buildings and IoT integration means that downstream services are increasingly data-driven, utilizing sensors and analytics to optimize system performance and schedule maintenance proactively. The effectiveness of the overall value chain relies heavily on seamless information flow and coordination, especially concerning quality checks and adherence to rigorous safety standards.

Electrical Construction Market Potential Customers

Potential customers, or end-users, of the Electrical Construction Market are broadly categorized by the four main segments: Residential, Commercial, Industrial, and Utility. Each category possesses distinct needs regarding voltage requirements, scale of infrastructure, project complexity, and regulatory compliance. The Commercial sector, including healthcare facilities, educational institutions, retail complexes, and especially data centers, represents a highly demanding customer base that requires sophisticated, highly reliable electrical systems with redundancy built-in, focusing heavily on power quality and uninterruptible power supplies (UPS). These clients often prioritize energy efficiency and smart building integration to manage large operational costs effectively.

The Utility sector, encompassing municipal power providers and private energy companies, represents the largest single capital expenditure segment. Their requirements focus on high-voltage transmission projects, substation construction, and the integration of large-scale renewable energy farms into the existing grid infrastructure. These projects are characterized by long timelines, stringent safety requirements, and significant governmental oversight. For utility customers, contractors offering specialized expertise in grid hardening, smart grid technology deployment, and fiber optic communication integration are highly valued partners.

Industrial clients, such as manufacturing plants, mining operations, and refineries, require highly customized electrical systems designed to withstand harsh operating environments and support specialized heavy machinery. Reliability and robust power delivery are paramount, necessitating expert installation of motor controls, complex machinery wiring, and explosion-proof electrical systems in hazardous locations. Conversely, the Residential market, while smaller in individual project size, relies on volume and standardization, driven by housing starts and renovation cycles, focusing on services related to home automation, efficient lighting, and now increasingly, dedicated EV charging circuit installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Billion USD |

| Market Forecast in 2033 | $712.8 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Quanta Services, EMCOR Group, Fluor Corporation, Jacobs Engineering Group, MasTec, IES Holdings, MYR Group, Rosendin Electric, Cupertino Electric, Comfort Systems USA, Henkels & McCoy, Granite Construction, Siemens AG (Electrical Services Division), ABB (Installation Products), Schneider Electric (Services Division) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Construction Market Key Technology Landscape

The Electrical Construction Market is undergoing a rapid technological transformation driven by the need for greater efficiency, precision, and data integration. Building Information Modeling (BIM) is perhaps the most significant technology impacting the design and coordination phase. BIM allows contractors and engineers to create detailed 3D models of electrical systems, detecting spatial conflicts before construction begins, thus minimizing costly rework on site and enhancing coordination with other trades (e.g., HVAC, plumbing). Furthermore, the integration of BIM with construction management software facilitates better planning, material procurement, and scheduling, moving electrical work towards a highly optimized, data-centric workflow. The use of digital twins, an extension of BIM, is emerging, allowing owners to simulate system performance and train maintenance staff before physical construction is complete.

Prefabrication and modular construction techniques are fundamentally changing how electrical systems are assembled. Instead of time-consuming, manual wiring on site, components such as electrical rooms, riser assemblies, and complex rack systems are assembled in controlled factory environments. This not only drastically improves quality and consistency by reducing exposure to adverse weather conditions but also mitigates the risk associated with skilled labor shortages by moving complex tasks indoors. These modular assemblies are then shipped and quickly installed on site, significantly reducing project schedules and improving site safety metrics. The adoption of robotic total stations for layout and measurement, coupled with automated cable pulling systems, further supports the drive toward industrializing the installation process, ensuring high levels of accuracy and speed.

The deployment of Internet of Things (IoT) devices and smart components across electrical infrastructure is transforming the maintenance and operational phases. Smart switchgear, sensors embedded in conduits, and networked lighting controls generate continuous data streams that inform asset management decisions. This facilitates the implementation of condition-based maintenance strategies rather than time-based schedules, extending the lifespan of critical equipment while reducing operational expenditure. Moreover, advanced power monitoring systems, coupled with machine learning, are essential for managing complex loads associated with renewable energy sources and battery storage systems, ensuring power quality and grid reliability, thereby demanding specialized technical expertise in integrating these data-rich technologies during the construction phase.

- Digitalization and Modeling:

- Building Information Modeling (BIM) for clash detection and coordination.

- Digital Twin technology for lifecycle simulation and asset management.

- Cloud-based project management platforms for real-time collaboration.

- Prefabrication and Automation:

- Modular Wiring Systems (MWS) and pre-wired assemblies.

- Off-site fabrication of skid-mounted electrical rooms (E-houses).

- Robotics and automated total stations for precise site layout and cable routing.

- Smart Systems and Connectivity:

- IoT sensors embedded in electrical infrastructure for continuous monitoring.

- Advanced Power Monitoring (APM) systems and Energy Management Systems (EMS).

- Augmented Reality (AR) tools for on-site installation guidance and maintenance troubleshooting.

- Safety and Compliance Technology:

- AI-driven safety monitoring via site cameras.

- Integrated circuit protection and fault detection systems.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market due to rapid urbanization, massive infrastructure development funded by governments (e.g., India's National Infrastructure Pipeline, China's Belt and Road Initiative), and booming demand for commercial and industrial space. The region is characterized by high adoption rates in utility-scale renewable energy projects and substantial investment in new data center construction, particularly in Southeast Asia and North Asia.

- North America: This region is mature but stable, with growth concentrated in grid modernization, renewable energy interconnection standards, and the construction of hyperscale data centers. Stringent energy efficiency mandates (e.g., Title 24 in California) drive significant demand for sophisticated retrofit and upgrade services in commercial buildings. The focus here is heavily on resiliency, smart grid technology, and EV infrastructure deployment.

- Europe: Growth is primarily fueled by the EU's Green Deal initiatives, emphasizing building decarbonization and the deployment of offshore wind and solar power. The market is highly regulated, driving demand for specialized contractors proficient in complex, low-carbon building systems and energy storage integration. Germany, the UK, and the Nordics lead in terms of sustainable construction practices and smart technology adoption.

- Middle East and Africa (MEA): Large-scale, government-backed mega-projects (e.g., Saudi Arabia's NEOM, UAE's long-term energy strategies) are the primary drivers. The demand centers around new utility infrastructure, large commercial complexes, and significant investments in desalination and heavy industry, necessitating robust and reliable high-voltage electrical construction services.

- Latin America (LATAM): Market expansion is moderate, driven by urbanization and mining sector activity, particularly in Chile and Peru. Challenges include economic volatility and inconsistent regulatory environments. Opportunities are strongest in localized renewable energy projects and improvements to existing, often aging, power distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Construction Market.- Quanta Services Inc.

- EMCOR Group Inc.

- Fluor Corporation

- Jacobs Engineering Group Inc.

- MasTec Inc.

- IES Holdings Inc.

- MYR Group Inc.

- Rosendin Electric Inc.

- Cupertino Electric Inc.

- Comfort Systems USA Inc.

- Henkels & McCoy Group Inc. (now part of MasTec)

- Granite Construction Inc.

- Siemens AG (Electrical Services Division)

- ABB (Installation Products & Systems)

- Schneider Electric SE (Field Services)

- Power Design Inc.

- Dynalectric Company

- BrandSafway (Infrastructure Services)

- T&D Power Group

- Primoris Services Corporation

Frequently Asked Questions

Analyze common user questions about the Electrical Construction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are currently driving demand in the Electrical Construction Market?

The primary drivers are the global energy transition, which necessitates vast grid modernization and integration of renewable energy sources, and the exponential growth of digitalization infrastructure, specifically the construction of hyperscale and edge data centers requiring robust and redundant power solutions. Furthermore, widespread government mandates concerning building electrification and energy efficiency standards fuel retrofit demands.

How is the skilled labor shortage impacting the profitability of electrical construction projects?

The skilled labor shortage is increasing wage costs, extending project timelines, and raising the risk of construction delays. In response, the industry is increasingly adopting technology such as prefabrication, robotics, and Building Information Modeling (BIM) to optimize labor utilization, improve consistency, and reduce the reliance on traditional on-site manual execution.

Which end-use sector is expected to show the fastest growth rate in electrical construction services?

The Utility sector is projected to exhibit the fastest growth, driven by substantial capital expenditure on modernizing aging transmission and distribution (T&D) systems. This includes deploying smart grid technology, constructing new high-voltage infrastructure for long-distance power transmission, and managing the interconnection of decentralized renewable power generation assets.

What role does digitalization play in the planning and execution of complex electrical construction?

Digitalization, particularly through the use of BIM and digital twins, allows for highly accurate pre-construction visualization, clash detection, and sequencing optimization. This dramatically reduces material waste, enhances cross-trade collaboration, and enables off-site prefabrication, leading to significant improvements in on-site efficiency and project quality compliance.

What are the key technological advancements shaping future electrical construction maintenance?

Future maintenance is being shaped by the integration of IoT sensors and Artificial Intelligence (AI) for predictive maintenance (PdM). These technologies allow facility managers to monitor the real-time condition of switchgear, cables, and transformers, enabling scheduled maintenance based on actual need rather than arbitrary timelines, thus maximizing asset longevity and minimizing disruptive, unplanned outages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager