Electrical Digital Twin Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437343 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Electrical Digital Twin Software Market Size

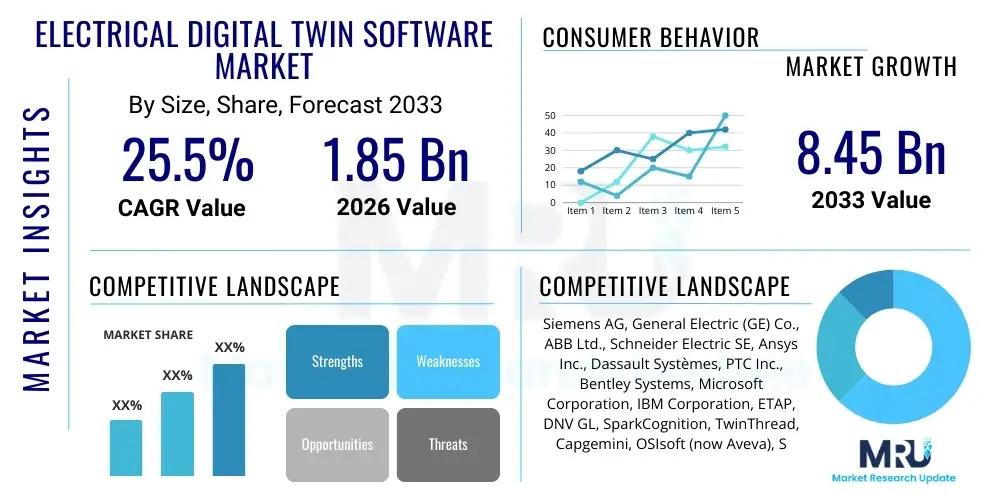

The Electrical Digital Twin Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $8.45 Billion by the end of the forecast period in 2033.

Electrical Digital Twin Software Market introduction

The Electrical Digital Twin Software Market encompasses advanced modeling and simulation tools that create virtual replicas of physical electrical assets, systems, and processes. These digital counterparts, or twins, are continuously updated with real-time data from sensors and operational systems, allowing engineers and operators to monitor, analyze, predict, and optimize the performance of electrical infrastructure, including power grids, transmission systems, industrial motors, and renewable energy assets. The core purpose of this technology is to enhance reliability, minimize downtime, and improve the efficiency of complex electrical ecosystems by providing a risk-free environment for testing scenarios, identifying potential failures, and optimizing control strategies before implementation in the physical world. This capability is paramount in the context of aging infrastructure and the increasing complexity introduced by decentralized energy resources (DERs).

Product description centers on high-fidelity simulation engines capable of integrating multi-physics models, often including electromagnetic, thermal, and mechanical interactions alongside purely electrical load flow analysis. These software solutions offer features such as predictive maintenance scheduling, virtual commissioning, root cause analysis, and detailed scenario planning for grid resilience studies. Major applications span across the entire energy value chain, from power generation (conventional and renewable) and transmission/distribution (T&D) utilities to heavy manufacturing and smart building management systems. The integration with Industrial Internet of Things (IIoT) platforms and SCADA systems is a fundamental characteristic, enabling the seamless flow of operational technology (OT) and information technology (IT) data required for twin synchronization.

Key benefits driving market adoption include significant reductions in operational expenditures (OpEx) through optimized maintenance strategies, improved capital expenditure (CapEx) efficiency via enhanced design validation, and crucial enhancements in grid stability and resilience against physical and cyber threats. Driving factors are deeply rooted in the global energy transition—specifically, the need for intelligent management of intermittent renewable sources, the rapid deployment of smart grid infrastructure, stringent regulatory demands for energy efficiency, and the necessity to manage the massive data streams generated by connected electrical devices. The ability of digital twins to handle transient analysis and dynamic system response modeling makes them indispensable for modern electrical engineering challenges.

Electrical Digital Twin Software Market Executive Summary

The Electrical Digital Twin Software Market is experiencing accelerated growth driven by global initiatives toward smart grid implementation and widespread industrial digitization. Business trends indicate a strong move towards subscription-based software-as-a-service (SaaS) models, facilitating easier adoption for utilities and industrial enterprises while ensuring continuous software updates and scalability. Strategic mergers and acquisitions are common, as major established engineering software providers integrate specialized digital twin startups to consolidate capabilities, particularly in areas like high-voltage transmission modeling and renewable energy asset optimization. Furthermore, platform standardization and interoperability are emerging as critical business requirements, pushing vendors to develop open APIs that allow twins to communicate seamlessly with diverse enterprise resource planning (ERP) and asset management systems (AMS).

Regional trends highlight North America and Europe as early adopters, primarily due to aging T&D infrastructure requiring modernization and significant regulatory pressure favoring renewable energy integration. Asia Pacific (APAC) is projected to exhibit the fastest growth, fueled by massive investments in new smart city projects, rapid industrialization, and the construction of extensive new power generation facilities, particularly in China and India. Latin America and the Middle East & Africa (MEA) are also showing promising growth, albeit starting from a smaller base, driven by the expansion of mining operations, oil and gas electrical infrastructure optimization, and foundational smart grid projects aimed at reducing transmission losses and improving electrification rates.

Segment trends emphasize the increasing dominance of the cloud-based deployment model, favored for its flexibility, lower initial CapEx, and capability to process vast amounts of sensor data required for highly accurate twin maintenance. In terms of application, Asset Performance Management (APM) remains the leading segment, as utilities prioritize maximizing the lifespan and reliability of expensive electrical apparatus. However, the Predictive Maintenance segment is experiencing the highest growth trajectory, directly leveraging AI and machine learning integrated within the twin to forecast component failures long before they occur. The Power & Utilities sector maintains its position as the largest end-user segment, but heavy manufacturing, focusing on optimizing large electrical machine performance and factory floor energy consumption, is quickly becoming a critical vertical market.

AI Impact Analysis on Electrical Digital Twin Software Market

User inquiries about the impact of AI on the Electrical Digital Twin Software Market frequently revolve around themes of autonomous operation, predictive accuracy, and the handling of massive data complexity generated by modern electrical systems. Common user questions probe whether AI integration will make traditional simulation expertise obsolete, how AI can improve the fidelity of anomaly detection in real-time grid operations, and the role of machine learning in optimizing transient response modeling. Users are keen to understand if AI can move the digital twin from a purely diagnostic tool to a proactive, prescriptive controller capable of executing self-healing grid functionalities. The consensus expectation is that AI acts as an essential accelerator, moving the digital twin paradigm beyond static modeling toward dynamic, self-learning, and highly automated operational control systems, significantly enhancing the twin's value proposition across maintenance, design verification, and system optimization tasks.

The convergence of AI/ML with electrical digital twin technology fundamentally changes the software's capabilities, particularly in predictive analytics. AI algorithms are employed to automatically calibrate the twin model, ensuring the virtual representation accurately reflects the physical asset’s current state, a process known as 'twin synchronization'. Furthermore, deep learning techniques are being applied to analyze complex, high-dimensional sensor data (e.g., vibration, acoustic, thermal signatures) that traditional physics-based models might overlook, significantly improving the precision of fault prediction, especially for subtle incipient failures in transformers, circuit breakers, and rotating machinery. This integration enhances the efficiency of energy management by applying reinforcement learning to optimize load balancing and renewable energy dispatch schedules in real-time within the twin environment.

This integration transforms the digital twin into an intelligent decision support system. AI handles the complexity of pattern recognition in non-linear electrical systems, enabling the twin to recommend optimal maintenance actions, identify potential cascading failures across the grid, and even automate the creation of synthetic datasets for training further AI models without risking the physical system. The long-term impact points towards the development of truly autonomous electrical systems, where the digital twin serves as the 'brain,' constantly running simulations, evaluating future scenarios, and autonomously sending prescriptive control commands back to the physical assets, subject to human oversight in critical infrastructure environments. This capability is paramount for achieving high levels of reliability and efficiency in complex, decentralized grids.

- AI-Driven Model Calibration and Synchronization: Automated adjustment of twin parameters using real-time operational data to ensure high fidelity.

- Enhanced Predictive Maintenance: Use of machine learning (ML) for anomaly detection and forecasting incipient failures in high-value electrical assets (e.g., transformers, turbines).

- Autonomous Optimization: Application of reinforcement learning for real-time load balancing, reactive power compensation, and optimal resource scheduling within the simulated environment.

- Advanced Scenario Planning: Rapid generation and testing of thousands of operational scenarios (e.g., cyberattacks, extreme weather events) using AI to determine optimal grid resilience strategies.

- Synthetic Data Generation: Creation of high-quality, labeled synthetic datasets from the digital twin to train external AI systems for smart grid management.

- Self-Healing Grid Capabilities: Enabling the digital twin to identify faults, isolate affected segments, and automatically reroute power flow, guided by AI-prescribed actions.

- Improved Energy Forecasting: Leveraging predictive AI to enhance the accuracy of renewable energy generation forecasts, crucial for grid stability and market participation.

DRO & Impact Forces Of Electrical Digital Twin Software Market

The Electrical Digital Twin Software Market is primarily propelled by the imperative for grid modernization and asset optimization across the energy and industrial sectors. Drivers include the global proliferation of IoT and advanced sensor technologies, which supply the necessary data backbone for twin creation, alongside regulatory mandates promoting energy efficiency and decarbonization. Restraints largely center on the high initial capital investment required for software licenses and the extensive integration with legacy operational technology (OT) systems, posing significant challenges for smaller utilities or older industrial plants. Furthermore, data security concerns regarding the real-time transmission of sensitive electrical infrastructure data act as a persistent impediment to broad cloud-based deployment. Opportunities are vast, driven by the emergence of microgrids, the expansion of electric vehicle (EV) charging infrastructure requiring complex load management, and the increasing demand for virtual testing and commissioning in complex industrial automation projects, allowing vendors to offer specialized, high-margin solutions.

The primary impact forces driving growth stem from the energy transition, specifically the transition toward renewable energy sources like wind and solar, which introduces unprecedented variability and complexity into grid management. Digital twins are essential tools for integrating these volatile sources effectively while maintaining system stability, thereby acting as a powerful mitigating force against energy volatility risks. The second major force is the push for operational efficiency (OpEx reduction) in heavy industries where electrical consumption is a dominant cost factor. By simulating and optimizing electrical flows and equipment utilization, digital twins offer quantifiable financial returns, establishing a clear return on investment (ROI) which further accelerates adoption. Conversely, the limiting force often relates to the scarcity of skilled personnel proficient in both electrical engineering and digital twin simulation platforms, creating a talent gap that slows down deployment, necessitating simplified user interfaces and more automated setup processes from software vendors.

Market dynamics are also heavily influenced by standardization efforts, or the lack thereof, in data protocols for industrial and utility assets. Open standards represent an opportunity to reduce integration costs and foster greater interoperability, thereby accelerating market growth. The risk associated with vendor lock-in, however, restrains some potential buyers who seek assurance that their digital twin investments can be leveraged across multiple hardware and software platforms over time. The competitive landscape is characterized by established engineering giants focusing on comprehensive platform solutions and niche players offering highly specialized modeling tools for specific electrical assets (e.g., high-voltage direct current (HVDC) systems). The overall impact force matrix suggests that strong drivers related to global energy shifts and industrial demand for operational resilience significantly outweigh the prevailing restraints, forecasting robust and sustained market expansion throughout the forecast period.

Segmentation Analysis

The Electrical Digital Twin Software Market is structurally segmented across multiple dimensions, including component type, deployment model, application focus, and end-user vertical. This stratification allows vendors to tailor specialized offerings that meet the distinct operational and regulatory requirements of specific industries. Component segmentation differentiates between the core simulation software platforms, which contain the physics-based models and visualization layers, and the crucial professional services segment, which involves implementation, integration with legacy systems, custom model development, and ongoing maintenance support. The evolution of this market shows a strong correlation between application complexity (such as transient stability analysis) and the demand for high-end professional services, particularly for large-scale utility deployments.

Deployment methodologies are categorized into on-premise solutions and cloud-based solutions. On-premise deployment is typically favored by large utilities and critical infrastructure operators who have strict data sovereignty and security regulations or possess extensive legacy IT infrastructure. Conversely, cloud deployment, primarily offered via SaaS models, appeals to smaller industrial users and organizations prioritizing scalability, accessibility, and reduced upfront CapEx. The shift toward hybrid cloud models is gaining traction, allowing sensitive control data to remain on-premise while leveraging the cloud's computational power for complex physics simulation and AI/ML processing, balancing security and performance requirements.

Application-based segmentation highlights the distinct use cases where digital twins deliver measurable value. While Asset Performance Management (APM) focuses on optimizing the long-term health and lifespan of equipment, Design & Simulation targets the pre-operational phase, validating design choices and reducing costly physical prototypes. End-user categorization clearly delineates the market demand sources, with the Power & Utilities sector demanding highly scalable, resilient grid models, while the Manufacturing sector seeks specialized twins for robotics, heavy machinery, and efficient factory energy consumption. This multifaceted segmentation underscores the market's maturity and the necessity for highly targeted product development and marketing strategies.

- By Component:

- Software (Platform and Application Specific Modules)

- Services (Implementation, Consulting, Integration, Maintenance, Support)

- By Deployment:

- On-Premise

- Cloud (SaaS, PaaS)

- By Application:

- Asset Performance Management (APM)

- Predictive Maintenance

- Design and Simulation

- Energy Management and Optimization

- Grid Planning and Modernization

- Virtual Commissioning

- By End-User:

- Power and Utilities (Generation, Transmission, Distribution)

- Manufacturing (Heavy Industry, Automotive, Electronics)

- Oil and Gas

- Infrastructure and Construction (Smart Cities, Commercial Buildings)

- Mining and Metals

- Renewable Energy

Value Chain Analysis For Electrical Digital Twin Software Market

The value chain for the Electrical Digital Twin Software Market begins with the upstream suppliers responsible for core technologies and components, primarily consisting of sensor manufacturers (for real-time data input), software developers specializing in physics-based modeling libraries (e.g., finite element analysis libraries), and foundational cloud computing providers (Azure, AWS, Google Cloud). This stage is characterized by high R&D intensity and the need for precision engineering to ensure data accuracy and computational efficiency. Key activities at this stage focus on integrating proprietary physics engines with standardized communication protocols like MQTT and OPC UA to ensure reliable data ingestion from diverse industrial assets. The bargaining power of major cloud providers is substantial, influencing pricing structures and deployment flexibility for downstream software vendors.

The midstream segment involves the core Digital Twin Software Vendors, who develop the platform solutions, user interfaces, data integration layers, and specialized analytical modules (e.g., transient stability modules). These vendors focus on transforming raw operational data into actionable insights through visualization and predictive models. Distribution channels are typically a mix of direct sales engagement, especially for large enterprise accounts like national utilities, and indirect sales through channel partners and system integrators (SIs). System integrators play a crucial role in customizing the generic twin platforms to meet specific end-user environments, including interfacing the twin with existing legacy SCADA systems and Enterprise Asset Management (EAM) platforms. The selection of the distribution channel often depends on the target end-user; direct sales ensure deeper client relationships for critical infrastructure projects, while SIs facilitate wider geographical reach and sector-specific expertise.

Downstream analysis focuses on the end-users, which primarily consist of Power Utilities, large Manufacturing firms, and Engineering, Procurement, and Construction (EPC) companies. These entities are the consumers of the software and services, utilizing the twins for operational intelligence, maintenance scheduling, and design validation. Direct feedback from these end-users is vital for continuous software refinement and adaptation to evolving industry standards and regulatory changes. The value chain concludes with the resulting benefits: optimized asset lifespan, reduced operational risk, improved energy efficiency, and faster time-to-market for new electrical system designs. The increasing complexity of electrical systems means that the services component—integration and consulting—holds a disproportionately high value share in the overall transaction, underscoring the need for specialized human expertise alongside the software.

Electrical Digital Twin Software Market Potential Customers

The primary potential customers for Electrical Digital Twin Software are organizations managing critical, high-value, and complex electrical assets where system failure or operational inefficiency leads to significant financial losses or safety risks. The largest segment remains the Power and Utilities sector, encompassing generation companies (GenCos), transmission system operators (TSOs), and distribution system operators (DSOs). These customers require digital twins for sophisticated grid modeling, handling the intermittency of renewable energy sources, managing aging physical assets, and planning future grid expansion under strict regulatory scrutiny. Their investment motivation is centered on resilience, regulatory compliance, and minimizing technical losses across the T&D network.

The second major group consists of organizations within the Heavy Manufacturing and Process Industries, such as steel mills, chemical plants, and semiconductor fabs, where electrical power quality and reliable machine operation are non-negotiable. These customers leverage digital twins to model large electrical motors, drive systems, and complex internal microgrids to optimize energy consumption and implement condition-based monitoring, moving away from time-based maintenance. The focus here is directly on reducing energy costs, increasing machine uptime, and ensuring worker safety in proximity to high-voltage equipment. Specific applications often involve modeling the dynamic response of large loads to ensure system stability during operational transients.

Emerging buyers include large infrastructure developers, smart city planners, and major data center operators. Data centers, in particular, demand high-fidelity electrical digital twins to ensure Tier IV redundancy requirements are met and to simulate complex power switching scenarios without impacting operations. Furthermore, EPC firms utilize these tools extensively during the construction and commissioning phases of large industrial and power projects, using the twin for virtual testing and reducing the need for costly physical mockups and on-site changes. The common theme across all potential customers is the need for enhanced predictability and optimized control over highly intricate and capital-intensive electrical systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $8.45 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, General Electric (GE) Co., ABB Ltd., Schneider Electric SE, Ansys Inc., Dassault Systèmes, PTC Inc., Bentley Systems, Microsoft Corporation, IBM Corporation, ETAP, DNV GL, SparkCognition, TwinThread, Capgemini, OSIsoft (now Aveva), SAS Institute, Rockwell Automation, Honeywell International Inc., Emerson Electric Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Digital Twin Software Market Key Technology Landscape

The technological core of the Electrical Digital Twin Software market relies on the seamless integration of advanced simulation science with modern data processing infrastructures. Physics-based modeling, which includes techniques like Finite Element Method (FEM) and computational fluid dynamics (CFD) adapted for electrical systems (e.g., modeling heat dissipation in transformers or electromagnetic forces in motors), forms the foundation, ensuring that the digital replica adheres accurately to real-world physical laws. This modeling capability is combined with system-level simulation tools (like dynamic load flow and transient stability analysis) essential for large utility applications. A major evolution involves moving these computationally intensive tasks from traditional desktop workstations to high-performance cloud computing environments, leveraging parallel processing capabilities to run complex, long-duration simulations rapidly.

Crucially, the connectivity and data layer technologies define the real-time functionality of the twin. The adoption of Industrial Internet of Things (IIoT) platforms is paramount, enabling the ingestion of high-frequency time-series data from smart meters, protection relays, sensors embedded in circuit breakers, and Supervisory Control and Data Acquisition (SCADA) systems. Data governance and integration technologies, utilizing industrial protocols such as IEC 61850 and DNP3, ensure data integrity and security between the physical asset and its digital counterpart. Furthermore, the technology landscape is being significantly shaped by advancements in Artificial Intelligence (AI) and Machine Learning (ML), which are employed for pattern recognition, anomaly detection, predictive maintenance scheduling, and enhancing the self-calibration routines of the twin model.

Other vital enabling technologies include augmented reality (AR) and virtual reality (VR) interfaces, which are used to visualize the digital twin data in a spatial context, enhancing operator training, maintenance execution, and remote diagnostics. Cybersecurity technology is also foundational, as electrical digital twins handle critical infrastructure data. Secure, encrypted data links and robust identity access management (IAM) systems are mandatory to prevent unauthorized access and potential system manipulation. Looking forward, the emergence of edge computing is enabling faster processing of low-latency control loops directly at the substation or factory floor, allowing for near-real-time prescriptive actions based on twin outputs without reliance on constant centralized cloud communication.

Regional Highlights

Regional dynamics within the Electrical Digital Twin Software Market are highly differentiated by the maturity of the power infrastructure, regulatory environment, and the pace of industrial automation. North America, encompassing the United States and Canada, represents a mature but high-value market segment. Driven by the critical need to modernize aging transmission and distribution (T&D) infrastructure and increasing pressure for grid resilience against severe weather events, this region shows high adoption, particularly among large investor-owned utilities. Significant governmental funding for smart grid initiatives and the proliferation of distributed energy resources (DERs) are key accelerators here. Companies in this region focus heavily on advanced applications like transient stability analysis and cyber-physical security simulation using digital twins.

Europe stands as a leading region, largely due to stringent decarbonization targets and established renewable energy integration mandates set by the European Union. Countries like Germany, the UK, and Nordic nations are heavy investors in digital twin technology to manage complex, multi-directional power flows stemming from high penetration of wind and solar power. The region benefits from strong collaboration between industrial firms, research institutions, and utility operators, fostering rapid technological adoption. The European market places a strong emphasis on regulatory compliance modeling and optimizing energy efficiency within industrial facilities and smart cities, driving demand for specialized energy management modules within the twin software.

Asia Pacific (APAC) is forecasted to be the fastest-growing region, characterized by massive greenfield investment in power generation and T&D networks, alongside aggressive industrial expansion, particularly in China, India, Japan, and South Korea. While the initial driver was focused on new build optimization and virtual commissioning, the increasing complexity of urban grids and the deployment of massive smart city initiatives now fuel significant demand for operational twins. China’s extensive national grid modernization and India’s focus on reducing power transmission losses provide significant market opportunities. Latin America and the Middle East & Africa (MEA) represent emerging markets. MEA growth is concentrated in the Oil & Gas sector for optimizing complex electrical substations in remote areas, and in the Gulf Cooperation Council (GCC) countries for massive infrastructure and smart city projects (like NEOM), while Latin America’s adoption is tied to mining operations and improving regional grid stability.

- North America: High adoption due to aging infrastructure replacement, significant investment in grid resilience, and regulatory push for DER integration; focus on T&D modeling and cyber security simulations. Key Countries: USA, Canada.

- Europe: Leading market driven by stringent EU decarbonization mandates, high renewable energy penetration, and advanced smart city projects; emphasis on energy efficiency and regulatory compliance modeling. Key Countries: Germany, UK, France, Nordic Countries.

- Asia Pacific (APAC): Fastest-growing region driven by rapid industrialization, large-scale new power plant construction, and aggressive smart grid deployment in emerging economies; high demand for virtual commissioning and new asset optimization. Key Countries: China, India, Japan, South Korea.

- Middle East & Africa (MEA): Emerging growth tied to large-scale infrastructure mega-projects, optimization of oil and gas electrical operations, and early smart grid trials. Key Countries: UAE, Saudi Arabia, South Africa.

- Latin America: Growth concentrated in the mining sector for electrical equipment optimization and regional efforts to reduce technical and non-technical power losses across established grids. Key Countries: Brazil, Mexico, Chile.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Digital Twin Software Market.- Siemens AG

- General Electric (GE) Co. (GE Digital)

- ABB Ltd.

- Schneider Electric SE

- Ansys Inc.

- Dassault Systèmes

- PTC Inc.

- Bentley Systems

- Microsoft Corporation

- IBM Corporation

- ETAP (Operation Technology, Inc.)

- DNV GL

- SparkCognition

- TwinThread

- Capgemini

- Aveva (formerly OSIsoft)

- SAS Institute

- Rockwell Automation

- Honeywell International Inc.

- Emerson Electric Co.

Frequently Asked Questions

Analyze common user questions about the Electrical Digital Twin Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of deploying Electrical Digital Twin Software in utility operations?

The primary benefit is enabling predictive asset performance management (APM) and enhancing grid resilience. By simulating failure scenarios and operational stresses in a virtual environment, utilities can proactively optimize maintenance schedules, minimize unplanned outages, extend the lifespan of high-value assets (like transformers), and ensure stable integration of intermittent renewable energy sources, ultimately reducing operational costs (OpEx) significantly.

How does Electrical Digital Twin Software differ from traditional electrical simulation tools?

Electrical Digital Twin Software differs fundamentally by its real-time, bidirectional connectivity to the physical asset. Unlike traditional, static simulation tools used for initial design, the digital twin is continuously synchronized with live operational data (IIoT, SCADA), allowing it to reflect the current state, health, and behavior of the physical system dynamically. This capability supports continuous monitoring, predictive forecasting, and prescriptive control actions.

Which industry vertical is currently the largest consumer of Electrical Digital Twin solutions?

The Power and Utilities sector, encompassing generation, transmission, and distribution entities, remains the largest consumer. This dominance is driven by the massive scale of their electrical infrastructure, the critical need for regulatory compliance, the ongoing challenge of managing aging assets, and the complex integration challenges posed by the decentralized nature of modern smart grids.

Is cloud deployment or on-premise deployment preferred for critical electrical infrastructure twins?

While cloud (SaaS) deployment is rapidly gaining traction due to scalability and cost-efficiency for processing high volumes of data, large critical infrastructure operators often prefer hybrid or strictly on-premise solutions. This preference stems from stringent data sovereignty requirements, cybersecurity concerns related to sensitive control data, and the need for low-latency operational control that is not dependent on external internet connectivity.

What role does Artificial Intelligence (AI) play in advancing Electrical Digital Twins?

AI plays a transformative role by enhancing the predictive and autonomous capabilities of the twin. AI/ML algorithms are used for automated model calibration, advanced anomaly detection in sensor data, optimizing real-time energy flow management (reinforcement learning), and conducting complex scenario analysis, moving the twin from a diagnostic tool to a proactive, prescriptive operational controller.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager