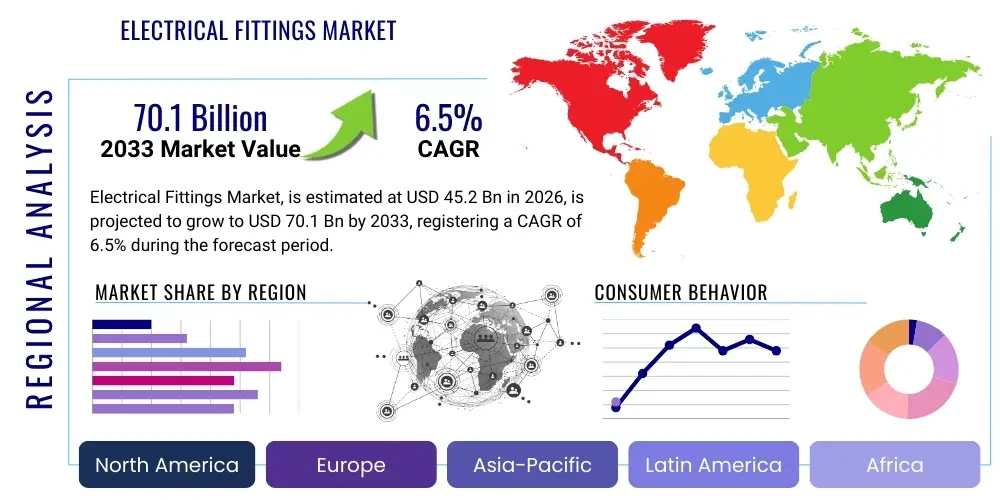

Electrical Fittings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438854 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electrical Fittings Market Size

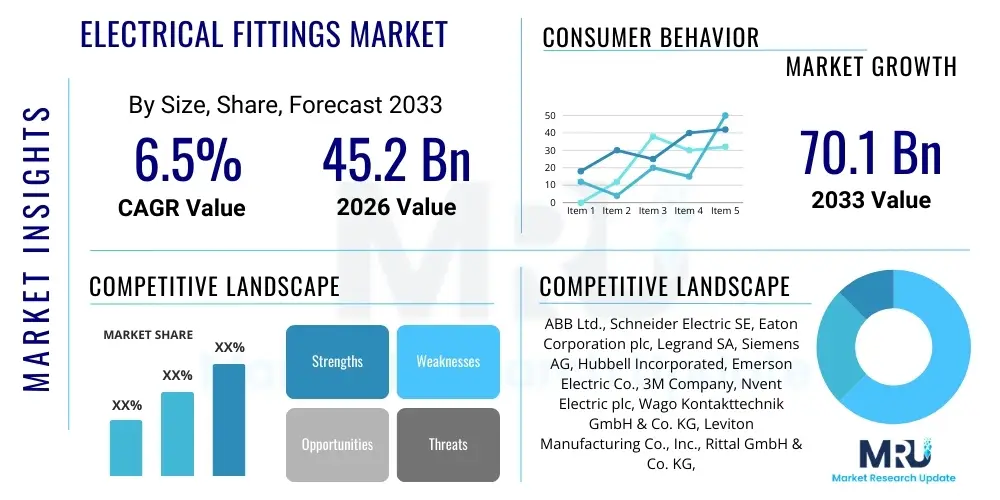

The Electrical Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 70.1 Billion by the end of the forecast period in 2033.

Electrical Fittings Market introduction

The Electrical Fittings Market encompasses a broad range of components essential for securing, connecting, insulating, and completing electrical circuits within residential, commercial, and industrial infrastructure. These fittings are crucial for ensuring the safety, reliability, and efficient distribution of electrical power and signals. Products within this market segment include, but are not limited to, conduits, connectors, junction boxes, switchgear enclosures, cable glands, and wiring accessories. The fundamental requirement for standardized and certified fittings, compliant with international safety codes (such as NEC, IEC, and local jurisdiction standards), drives continuous demand and innovation in material science and design methodologies. The functionality of these components extends beyond mere connectivity; they provide protection against environmental factors, mechanical stress, and potential fire hazards, making them indispensable elements in all construction and renovation projects globally. The increasing focus on smart infrastructure and sustainable building practices is reshaping product requirements, favoring modular and easily installable fittings.

The major applications of electrical fittings span across the entire built environment. In the residential sector, fittings are used extensively for installing lighting fixtures, power outlets, and home automation systems, requiring aesthetics alongside safety compliance. Commercial applications, such as offices, retail spaces, and healthcare facilities, demand high-reliability, fire-resistant, and flexible fitting solutions to manage complex wiring layouts and higher power loads. Industrial settings, including manufacturing plants, chemical processing facilities, and heavy machinery operations, necessitate ruggedized, explosion-proof, and corrosion-resistant fittings, often made from specialized metals or high-grade polymers, capable of withstanding extreme operational conditions. Furthermore, the utilities sector relies on robust fittings for power generation, transmission, and distribution infrastructure, where durability against harsh outdoor environments is paramount.

The market growth is primarily driven by global urbanization trends, aggressive infrastructure spending on smart cities, and the persistent need for grid modernization, particularly in developing economies. Benefits derived from modern electrical fittings include improved system reliability, enhanced safety through superior insulation and grounding capabilities, reduced installation time due to modular designs, and long-term cost savings by minimizing maintenance requirements. Technological advancements, such as the integration of IoT sensors into enclosures for monitoring environmental conditions and preventative maintenance, are further boosting the market. The mandatory requirement for regular upgrades of aging electrical infrastructure in mature markets also provides a sustained revenue stream, ensuring the market's resilience against cyclical economic downturns in the construction sector.

Electrical Fittings Market Executive Summary

The Electrical Fittings Market is experiencing robust growth fueled by several macroeconomic and technological drivers. Key business trends include the consolidation of suppliers to offer integrated electrical infrastructure solutions, shifting customer preferences towards standardized, plug-and-play components that reduce labor costs, and a strong emphasis on sustainability, leading to increased demand for halogen-free and recyclable polymer fittings. Major industry players are focusing on developing fittings compliant with high-efficiency building standards (like LEED and BREEAM) and are investing heavily in digital tools, such as Building Information Modeling (BIM) components, to facilitate easier specification and integration by engineering firms. Furthermore, the rising proliferation of data centers and electric vehicle (EV) charging infrastructure necessitates specialized high-capacity fittings capable of handling continuous, high-current loads, representing a high-value growth niche.

Regionally, the Asia Pacific (APAC) continues to dominate the market growth trajectory due to massive investments in residential housing, rapid industrialization, and expansive government infrastructure projects, particularly in China, India, and Southeast Asia. North America and Europe, while being mature markets, exhibit strong demand driven by infrastructure replacement cycles, stringent safety regulations mandating material upgrades, and the widespread adoption of smart building technologies. Specifically, European markets show a preference for modular and aesthetic fittings due to stricter architectural integration requirements. In contrast, the Middle East and Africa (MEA) are emerging as significant high-growth regions, spurred by large-scale commercial construction (e.g., smart city projects) and oil and gas sector investments requiring specialized hazardous location fittings.

Segmentation trends highlight the increasing demand for plastic fittings, particularly PVC and Nylon, driven by their cost-effectiveness, lightweight nature, and resistance to corrosion in non-hazardous applications. However, the metal fittings segment, comprising galvanized steel and aluminum, remains critical for heavy industrial and outdoor utility applications requiring superior mechanical strength and electromagnetic shielding. By application, the industrial segment is anticipated to witness the fastest value growth due to complex wiring needs in automation and process control environments. The market is also seeing a shift towards pre-wired and modular enclosure systems, simplifying installation and ensuring consistent quality across large construction portfolios, ultimately enhancing operational efficiency for electrical contractors.

AI Impact Analysis on Electrical Fittings Market

User queries regarding AI's influence on the Electrical Fittings Market frequently center on automation in manufacturing, predictive maintenance of installed fittings, and optimization of supply chain logistics. Common concerns include whether AI-driven design tools will lead to radical standardization, the role of AI in quality control during mass production (e.g., defect detection in molded plastics or machined metal components), and how smart fittings (integrating sensors) will feed data back into maintenance systems. Users also seek information on AI's ability to forecast demand for specific fitting types based on regional construction projections and regulatory changes. The overarching themes are efficiency gains, quality assurance improvements, and the transition from passive components to data-aware infrastructure elements.

The immediate impact of Artificial Intelligence is largely concentrated in optimizing the entire lifecycle of electrical fittings, starting from design and continuing through deployment and operation. In the design phase, generative AI tools are used to simulate stress tests, thermal performance, and fluid dynamics within enclosures, leading to optimized material use and enhanced product longevity. Manufacturers are deploying machine learning algorithms in their production lines to monitor quality in real-time. High-speed vision systems powered by AI analyze every manufactured unit, instantly identifying microscopic defects in thread integrity, plating consistency, or dimensional accuracy—a level of precision unattainable through traditional manual or fixed-logic quality checks. This enhanced quality control significantly reduces product recalls and improves overall brand reliability, which is critical in safety-sensitive electrical infrastructure.

Furthermore, AI significantly enhances the operational effectiveness of electrical systems where fittings are installed. Smart enclosures and junction boxes equipped with rudimentary sensors generate data streams (e.g., temperature, humidity, vibration). AI platforms analyze this data to predict component failure or overheating issues before they occur. This transition from reactive repair to predictive maintenance minimizes downtime, particularly in critical infrastructure such as data centers and continuous manufacturing processes. In supply chain management, AI optimizes inventory levels, predicting regional demand shifts with greater accuracy than traditional methods, thereby ensuring that specialized fittings are available precisely when and where needed for large-scale construction projects, reducing logistic costs and project delays.

- AI-powered generative design optimizes fitting geometry for material reduction and thermal dissipation.

- Machine Vision systems utilize AI for 100% automated, high-precision quality control during manufacturing.

- Predictive maintenance platforms integrate data from sensor-equipped fittings to forecast potential failures (e.g., loose connections, thermal stress).

- AI optimizes complex production schedules, enhancing throughput and reducing manufacturing lead times for customized orders.

- Advanced supply chain analytics leverage machine learning to accurately forecast regional demand for specific fitting types (e.g., conduit sizes, box depths).

- Integration of AI-ready sensors transforms passive fittings into integral parts of a smart, monitored electrical grid.

- Natural Language Processing (NLP) aids in analyzing regulatory documents globally, ensuring rapid compliance updates for product specifications.

DRO & Impact Forces Of Electrical Fittings Market

The Electrical Fittings Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively define the Impact Forces shaping its future trajectory. Key drivers include rapid global infrastructure development, especially in emerging economies, and the continuous push for renewable energy integration (solar, wind), which requires extensive new electrical interconnection hardware. Furthermore, stringent global safety regulations (e.g., fire codes, grounding requirements) consistently mandate the replacement of older, non-compliant fittings with certified, higher-performance alternatives. Conversely, the market faces restraints such as significant fluctuations in raw material prices (metals and specialty plastics), which impact manufacturing margins, and the challenge posed by counterfeit products that undermine legitimate market quality and safety standards. Opportunities lie in the shift towards modular and pre-fabricated construction, demanding specialized quick-connect fittings, and the expansion into the rapidly growing market for EV charging infrastructure components.

Impact forces stemming from technological adoption and regulatory shifts are particularly potent. The increasing prevalence of high-speed data transmission infrastructure demands fittings with enhanced electromagnetic interference (EMI) shielding capabilities, pushing manufacturers toward advanced metal and composite materials. The rising cost of skilled labor in installation drives the demand for contractor-friendly, tool-less, and modular fittings that accelerate on-site deployment, shifting value from installation labor to product innovation. Environmental mandates, emphasizing sustainability and the circular economy, pressure manufacturers to develop fittings made from recycled or bio-based polymers and to ensure product designs facilitate easy end-of-life recycling. These factors create both competitive pressure to innovate and substantial market potential for firms that successfully align their product portfolios with evolving sustainability criteria.

The impact of economic volatility, particularly in the construction sector, also plays a crucial role. While short-term economic downturns can delay large capital projects, the essential nature of electrical fittings in maintenance and refurbishment activities provides a degree of stability. Long-term demographic trends, particularly urbanization, guarantee a sustained foundational demand base. The consolidation among end-users and large engineering procurement and construction (EPC) firms increases the bargaining power of buyers, requiring fitting suppliers to maintain competitive pricing while continually enhancing product quality and service levels. Successfully navigating these forces requires a strategic focus on patent protection, robust supply chain resilience, and continuous investment in product testing and certification to maintain regulatory compliance across diverse global markets.

Segmentation Analysis

The Electrical Fittings Market is comprehensively segmented based on product type, material, application, and distribution channel, providing granular insights into demand patterns and growth areas. The segmentation analysis reveals distinct performance characteristics across different market niches. For instance, metal fittings dominate hazardous and high-stress industrial environments due to superior durability and shielding properties, while plastic fittings capture the vast majority of residential and light commercial segments based on cost-efficiency and corrosion resistance. The fastest growth is expected in highly specialized segments suchating to data centers and renewable energy installations, which require unique thermal management and high-reliability solutions. Understanding these segment dynamics is vital for manufacturers to tailor their production capabilities and market entry strategies effectively, focusing resources on areas promising the highest returns and competitive differentiation.

- By Product Type:

- Conduits and Raceways (Rigid Metal, Intermediate Metal, Electrical Metallic Tubing (EMT), Flexible Conduits, Non-metallic Conduits)

- Junction Boxes and Enclosures (Metallic, Non-metallic, Explosion-proof, Weatherproof)

- Connectors and Couplings (Set Screw, Compression, Threaded, Quick-Connect)

- Cable Glands and Cord Grips (Metal, Plastic, Explosion-proof, Strain Relief)

- Trunking and Ducting Systems

- Switches, Sockets, and Accessories

- By Material:

- Metal (Galvanized Steel, Stainless Steel, Aluminum, Cast Iron)

- Plastic/Polymer (PVC, Polycarbonate, Nylon, HDPE, ABS)

- Composite Materials

- By Application:

- Residential

- Commercial (Offices, Retail, Data Centers, Healthcare)

- Industrial (Manufacturing, Oil & Gas, Mining, Chemical)

- Utilities and Infrastructure (Power Generation, Transmission, Distribution)

- By Distribution Channel:

- Wholesalers and Distributors

- Retail Outlets and Hardware Stores

- Direct Sales (OEMs and Large Contractors)

- Online Sales Platforms

Value Chain Analysis For Electrical Fittings Market

The value chain for the Electrical Fittings Market begins with upstream activities involving the sourcing and processing of core raw materials, predominantly metals (steel, aluminum) and various petrochemical-derived plastics (PVC, polycarbonate). This upstream phase is characterized by high price volatility and reliance on global commodity markets. Key suppliers in this stage include specialized metal rolling mills and chemical companies providing plastic resins and additives necessary for fire resistance and UV stability. Manufacturers often implement sophisticated inventory management and hedging strategies to mitigate the financial risks associated with material price swings, ensuring continuity of supply while maintaining competitive pricing for finished goods. The quality and consistency of these raw materials directly impact the final performance specifications and safety certifications of the electrical fittings.

The core manufacturing and fabrication stage involves several critical processes, including die-casting, injection molding, stamping, machining, and surface treatments (like galvanization or powder coating). Modern manufacturing facilities utilize high levels of automation and precision tooling to meet the tight tolerances required for threaded components and coupling mechanisms, which must ensure perfect electrical continuity and seal integrity. Manufacturers differentiate themselves through product innovation, focusing on modularity, quick-installation features, and compliance with high-level safety standards (e.g., IP ratings for ingress protection). Direct product development often involves deep collaboration with regulatory bodies and major end-users to preemptively integrate future safety and performance requirements into new designs, thus establishing a competitive advantage.

The downstream segment encompasses the distribution and installation of the finished fittings. The distribution channel is highly fragmented but primarily relies on a network of established wholesalers and specialized electrical distributors who manage large inventories and provide essential logistical support and local availability for contractors. Direct sales often target large Original Equipment Manufacturers (OEMs) or major Engineering, Procurement, and Construction (EPC) firms executing extensive industrial or utility projects. Installation is carried out by licensed electrical contractors, whose preferences heavily influence purchasing decisions, favoring brands that offer ease of use and reliability. Indirect channels, including online platforms and specialized electrical supply e-commerce sites, are rapidly gaining prominence, particularly for standardized, high-volume fittings, offering improved transparency and efficiency in procurement.

Electrical Fittings Market Potential Customers

Potential customers for electrical fittings are exceptionally diverse, spanning nearly every sector of the economy that utilizes fixed electrical power infrastructure. The largest and most consistent end-users are within the construction industry, specifically residential builders, commercial property developers, and civil engineering firms involved in infrastructure projects. These buyers rely on the products for basic power and lighting installations. Within the commercial sector, specialized facilities such as data centers, hospitals, educational institutions, and large retail chains represent high-value customers, requiring premium, highly compliant, and robust fittings due to the critical nature of their operations and stringent safety mandates.

The industrial sector constitutes another major customer segment, encompassing manufacturing plants, chemical processors, refineries, and mining operations. These environments often necessitate fittings designed for hazardous locations (hazardous area classifications), demanding explosion-proof enclosures, intrinsically safe conduits, and components capable of resisting severe corrosion and mechanical abuse. Original Equipment Manufacturers (OEMs) specializing in industrial machinery, HVAC systems, and control panels also represent crucial buyers, integrating standardized fittings into their final products before delivery to the end-client. Procurement decisions in this segment are highly technical, prioritizing product certification, longevity, and material specification over cost alone.

Furthermore, government and utility organizations are substantial end-users. Electrical utilities purchase high volumes of heavy-duty fittings for power substations, transmission lines, and distribution networks, where reliability under severe weather conditions is paramount. Public sector entities, involved in public works, transport infrastructure (e.g., rail systems, airports), and municipal building maintenance, consistently drive demand for fittings that meet rigorous public procurement standards and longevity expectations. The rising global focus on integrating renewable energy infrastructure, such as solar farms and wind turbine installations, creates a specialized subset of utility customers requiring highly durable, UV-resistant, and weather-sealed connectivity solutions for outdoor environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 70.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Schneider Electric SE, Eaton Corporation plc, Legrand SA, Siemens AG, Hubbell Incorporated, Emerson Electric Co., 3M Company, Nvent Electric plc, Wago Kontakttechnik GmbH & Co. KG, Leviton Manufacturing Co., Inc., Rittal GmbH & Co. KG, Chint Group, Gewiss S.p.A., HellermannTyton Group PLC, Panduit Corp., Cooper Industries (now part of Eaton), Atkore International Group Inc., Southwire Company, LLC, TE Connectivity Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Fittings Market Key Technology Landscape

The technology landscape in the Electrical Fittings Market is rapidly evolving, driven primarily by the need for increased safety, faster installation, and integration into smart infrastructure systems. A core technological trend is the proliferation of modular and quick-connect technology. This includes tool-less conduit connectors, push-in terminal blocks, and prefabricated wiring harnesses integrated with specialized fittings. These innovations drastically reduce the time and skill level required for electrical installation, addressing the increasing shortage of qualified labor globally. Furthermore, advancements in material science are critical, particularly the development of high-performance engineering plastics that offer superior flame retardancy (meeting strict halogen-free standards) and improved mechanical strength, often rivaling traditional metal fittings while offering better corrosion resistance and reduced weight.

Another significant technological focus is on enhancing the protective features of electrical enclosures and fittings. This involves advanced sealing technologies to achieve higher Ingress Protection (IP) ratings, ensuring robustness against dust and moisture, which is vital for outdoor and industrial applications. Explosion-proof technology, essential for fittings used in hazardous locations (like petrochemical processing and grain elevators), continuously evolves, incorporating better heat dissipation techniques and more robust sealing materials to prevent internal arcing from igniting external explosive atmospheres. The adoption of advanced computer-aided design (CAD) and simulation software (FEA - Finite Element Analysis) allows manufacturers to rapidly prototype and test thermal performance and structural integrity, ensuring compliance with global standards before physical production, thereby accelerating time-to-market for complex fittings.

The integration of Information Technology (IT) with Operational Technology (OT) is creating "smart" fittings. This includes embedded IoT sensors within junction boxes and enclosures designed to monitor environmental factors such as temperature, vibration, and humidity. These sensors communicate data wirelessly to facility management systems, enabling predictive maintenance protocols and optimizing system efficiency. Furthermore, the standardization of Building Information Modeling (BIM) ready components is a major technological shift. Manufacturers are providing detailed digital twins of their fittings, allowing architects and engineers to seamlessly integrate them into complex virtual models, improving accuracy, reducing installation errors, and facilitating long-term asset management. This digital integration is crucial for participating in large, modern construction projects.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by rapid urbanization, massive government investments in infrastructure (including high-speed rail and smart city projects), and robust expansion in the manufacturing sector (particularly electronics and automotive). Countries like China and India are central to this growth due to huge domestic construction demands and increasing regulatory emphasis on electrical safety standards, fueling the replacement of substandard older components with high-quality certified fittings.

- North America: North America is characterized by mature infrastructure and high regulatory compliance. Market growth is primarily driven by grid modernization initiatives, significant investment in data centers (requiring specialized high-density power fittings), and the rapid build-out of electric vehicle charging infrastructure. Demand here focuses heavily on UL-certified products and specialized metal conduits for commercial and industrial applications to meet stringent safety codes.

- Europe: The European market demonstrates steady, quality-focused growth, heavily influenced by sustainability mandates (e.g., circular economy policies and REACH compliance) and energy efficiency standards (e.g., nearly Zero Energy Buildings - nZEB). European consumers and contractors favor aesthetic, modular, and concealed wiring systems, leading to high demand for sophisticated trunking, decorative switches, and halogen-free installation materials. Germany, France, and the UK are key markets driven by industrial automation and building renovation cycles.

- Latin America (LATAM): LATAM presents significant growth opportunities, particularly in Brazil and Mexico, due to increased foreign direct investment in manufacturing and necessary upgrades to antiquated power distribution systems. Challenges remain concerning varying local standards and economic volatility, but the long-term trend favors market expansion driven by affordable housing projects and commercial expansion.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, propelled by mega-projects in construction, tourism, and oil and gas (O&G). The O&G sector requires highly specialized, corrosion-resistant, and explosion-proof fittings. African markets show potential, driven by rural electrification projects and urbanization, though constrained by infrastructure financing challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Fittings Market.- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation plc

- Legrand SA

- Siemens AG

- Hubbell Incorporated

- Emerson Electric Co.

- 3M Company

- Nvent Electric plc

- Wago Kontakttechnik GmbH & Co. KG

- Leviton Manufacturing Co., Inc.

- Rittal GmbH & Co. KG

- Chint Group

- Gewiss S.p.A.

- HellermannTyton Group PLC

- Panduit Corp.

- Cooper Industries (now part of Eaton)

- Atkore International Group Inc.

- Southwire Company, LLC

- TE Connectivity Ltd.

Frequently Asked Questions

Analyze common user questions about the Electrical Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Electrical Fittings Market?

The primary drivers are escalating global infrastructure spending, rapid urbanization particularly in Asia Pacific, the mandatory modernization of aging power grids in mature economies, and the increasing global regulatory focus on electrical safety and fire protection standards. Furthermore, the expansion of data centers and renewable energy projects demands specialized high-performance fittings, sustaining market momentum.

How does the segmentation by material impact product selection and market share?

Segmentation by material divides the market primarily between metal (galvanized steel, aluminum) and plastic (PVC, polycarbonate). Metal fittings dominate applications requiring high mechanical protection, electromagnetic shielding, and hazardous area compliance, ensuring superior durability. Plastic fittings hold significant market share in residential and light commercial areas due to their lower cost, corrosion resistance, and ease of installation, driving volume growth in standard applications.

What role does digitalization play in the future development of electrical fittings?

Digitalization is transforming fittings from passive components into active, smart infrastructure elements. Future fittings incorporate IoT sensors for real-time monitoring of temperature and vibration, enabling predictive maintenance. Additionally, digital tools like BIM models accelerate specification and integration into complex construction designs, optimizing workflow and enhancing asset management capabilities post-installation.

Which application segment is expected to exhibit the highest growth rate during the forecast period?

The Industrial Application segment, specifically focusing on advanced manufacturing automation, specialized data centers, and the energy sector (Oil & Gas and Renewables), is expected to register the highest value growth. These sectors require continuous system reliability, superior protective characteristics (e.g., explosion-proof and high IP ratings), and are less price-sensitive compared to the residential market.

What are the major restraints affecting the profitability and growth of electrical fittings manufacturers?

The primary restraints include the significant volatility of key raw material prices, particularly steel, copper, and specialized polymers, which squeeze manufacturing margins. Additionally, the proliferation of low-quality, non-compliant counterfeit products, especially in developing markets, undermines legitimate manufacturers' market share and poses serious safety risks to end-users, requiring continuous protective measures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager