Electrical Power Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437743 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Electrical Power Transformer Market Size

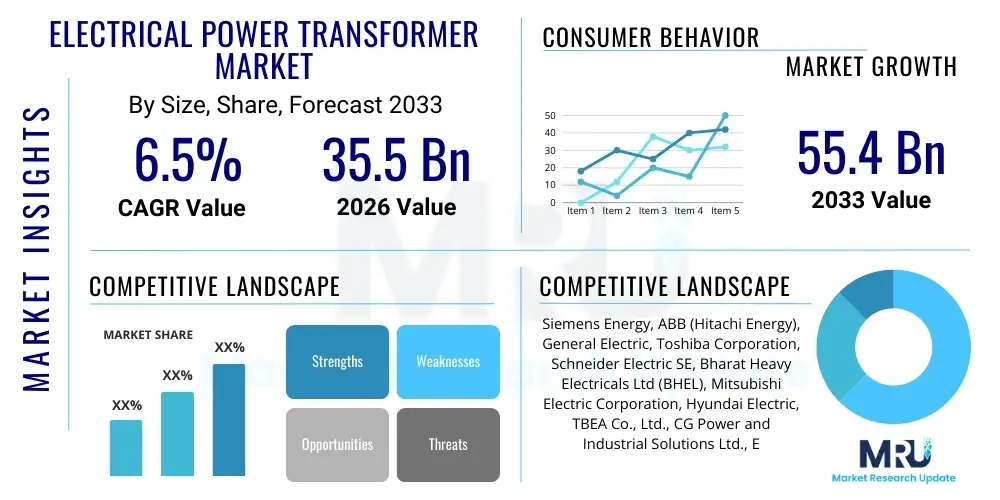

The Electrical Power Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 55.4 Billion by the end of the forecast period in 2033.

Electrical Power Transformer Market introduction

The Electrical Power Transformer Market encompasses the manufacturing, distribution, and maintenance of devices essential for efficiently transferring electrical energy between circuits at different voltage levels. Power transformers are critical components within the electricity infrastructure, primarily used in generation, transmission, and distribution networks to step up or step down voltage levels, minimizing transmission losses and ensuring safe delivery of electricity to end-users. The core product categories include power transformers (used primarily in high-voltage transmission), distribution transformers (used in local distribution grids), and specialty transformers designed for specific industrial applications.

Major applications of these transformers span across utility sectors, where they facilitate the integration of diverse energy sources, and large industrial facilities, such as manufacturing plants, oil and gas operations, and mining sites, which require stable, high-capacity power supplies. Key benefits derived from modern transformers include improved energy efficiency, increased operational lifespan, enhanced grid reliability, and compliance with stringent environmental regulations, particularly concerning insulating fluids and noise reduction. The inherent robustness and scalability of power transformer technology are pivotal in supporting global electrification goals and urbanization trends.

The market is predominantly driven by significant investments in grid modernization and expansion, particularly in developing economies experiencing rapid industrialization and escalating power demand. The global push toward renewable energy integration—including solar farms and wind power facilities—necessitates corresponding infrastructure upgrades, specifically high-voltage direct current (HVDC) systems and specialized converter transformers. Furthermore, the rising adoption of smart grid technologies, which require intelligent, monitored transformers for optimal performance and fault detection, provides substantial impetus for market expansion and technological innovation across all geographical regions.

Electrical Power Transformer Market Executive Summary

The Electrical Power Transformer Market demonstrates robust growth, primarily fueled by global energy transition efforts and critical infrastructure replacement cycles. Business trends highlight a strong shift toward high-efficiency, environmentally friendly transformers, such as amorphous core and biodegradable fluid-filled units, driven by regulatory mandates focused on minimizing carbon footprint and optimizing energy throughput. Strategic mergers and acquisitions are common as large players seek to consolidate manufacturing capabilities and secure key technological patents, particularly in high-voltage transformer segments. Furthermore, the increasing complexity of grid architectures necessitates advanced manufacturing processes and digital integration capabilities among leading manufacturers.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, propelled by massive investments in new transmission lines, rural electrification programs, and rapid urbanization, notably in China, India, and Southeast Asian nations. North America and Europe, while mature markets, exhibit strong demand driven by grid digitalization, aging infrastructure replacement, and the need to integrate intermittent renewable energy sources, which require flexible and highly resilient transformer systems. Regulatory stability and government support for infrastructure spending further reinforce investment confidence in these developed regions.

Segment trends underscore the rising preference for power transformers rated above 100 MVA due to the expansion of ultra-high voltage (UHV) transmission corridors designed to move bulk power from remote generation sites (like large solar or hydro projects) to urban load centers. In terms of cooling methods, dry-type transformers are gaining momentum in urban and indoor industrial settings where fire safety and environmental constraints are paramount. However, oil-immersed transformers, particularly those using advanced insulating oils, maintain their dominance in high-rating applications due to superior cooling and cost-effectiveness, emphasizing efficiency gains across all major product categories.

AI Impact Analysis on Electrical Power Transformer Market

User inquiries regarding AI's influence on the Electrical Power Transformer Market often revolve around predictive maintenance capabilities, optimized asset utilization, and enhanced operational security. Key themes include how AI algorithms can predict imminent failures based on sensor data (temperature, vibration, partial discharge), thereby reducing costly downtime and extending asset life. Users are also concerned about the implementation complexity and the security implications of integrating AI-driven monitoring systems into legacy grid infrastructure. The general expectation is that AI will transform transformers from static components into intelligent assets capable of self-diagnosis and dynamic load management, moving the industry toward condition-based and prescriptive maintenance models.

- Predictive Maintenance & Health Monitoring: AI and machine learning analyze continuous operational data (e.g., Dissolved Gas Analysis, temperature readings) from transformer sensors to predict failure patterns, significantly reducing unscheduled outages and optimizing maintenance schedules.

- Optimized Load Management: AI systems dynamically adjust transformer load tap changer operations based on real-time grid conditions and predictive load forecasts, ensuring optimal voltage profiles and minimizing energy losses.

- Manufacturing Efficiency: AI is integrated into the manufacturing process for quality control, detecting material defects, and optimizing core winding patterns, leading to faster production cycles and higher reliability of new units.

- Design Optimization: Generative AI algorithms assist engineers in designing lighter, smaller, and more efficient transformers by exploring vast parameter spaces related to cooling techniques, core geometry, and insulation placement.

- Cybersecurity Enhancements: AI-driven anomaly detection monitors communications and operational technology (OT) networks connected to smart transformers, identifying and mitigating sophisticated cyber threats targeting grid assets.

DRO & Impact Forces Of Electrical Power Transformer Market

The Electrical Power Transformer Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively manifesting as significant Impact Forces influencing strategic decisions across the industry. The primary drivers include the urgent necessity for grid modernization and reinforcement globally, driven by aging infrastructure in developed nations and burgeoning energy demand in developing regions. Coupled with this is the substantial requirement to accommodate distributed and intermittent renewable energy sources, which mandates flexible and high-capacity transmission infrastructure, thus increasing demand for high-voltage and ultra-high voltage (UHV) transformers. The global shift toward electrification of transport and industry further solidifies this market demand trajectory.

However, the market faces notable restraints, including the significant capital expenditure required for transformer replacement and installation projects, often coupled with long lead times for specialized high-rating units. Fluctuations in raw material prices, particularly steel, copper, and insulating materials, introduce volatility into manufacturing costs, affecting profit margins and procurement strategies. Furthermore, the global shortage of skilled labor specializing in high-voltage installation and maintenance presents operational challenges, slowing down infrastructure development schedules in several key regions. Adherence to increasingly complex and strict international efficiency standards (like the EU’s Ecodesign requirements) also requires substantial R&D investment.

Opportunities abound, primarily centered on technological innovation, such as the development and deployment of smart transformers equipped with advanced IoT sensors, communication capabilities, and diagnostic algorithms to enable active grid management. The growing market for specialized transformers used in niche applications, including offshore wind farms, electric vehicle charging infrastructure, and HVDC converter stations, offers high-margin potential. Furthermore, sustainable manufacturing practices, focusing on recyclable materials and the adoption of natural or synthetic ester fluids as environmentally friendly alternatives to mineral oil, create a clear competitive advantage and open doors to green financing options, ensuring long-term market resilience and growth.

Segmentation Analysis

The Electrical Power Transformer Market is meticulously segmented based on key criteria including Type, Rating, Cooling Method, and Application, providing a granular view of market dynamics and tailored demand patterns. The segmentation by Type delineates between traditional Power Transformers used in large transmission networks and Distribution Transformers handling final voltage reduction near end-users, alongside specialty units designed for specific industrial frequency and voltage requirements. This structure allows manufacturers to align their production capabilities with the specific technical demands of different utility and industrial consumers. The segmentation highlights the differentiated growth rates, with Distribution Transformers often seeing higher volume sales due to smart city initiatives and decentralized energy grids, while high-rating Power Transformers command higher average selling prices and cater to capital-intensive transmission projects.

- By Type:

- Power Transformer

- Distribution Transformer

- Specialty Transformer

- Instrument Transformer (Current and Potential)

- By Rating:

- Small (Up to 5 MVA)

- Medium (5 MVA to 100 MVA)

- Large (Above 100 MVA)

- By Cooling Method:

- Oil-Immersed (ONAN, ONAF, OFAF, ODWF)

- Dry Type (AN, AF)

- By Application:

- Utility (Generation, Transmission, Distribution)

- Industrial (Oil & Gas, Mining, Manufacturing, Data Centers)

- Residential & Commercial

Value Chain Analysis For Electrical Power Transformer Market

The value chain for the Electrical Power Transformer Market begins with upstream activities involving the sourcing and processing of critical raw materials, primarily high-grade electrical steel (core material), copper/aluminum (winding conductors), and specialized insulation materials (cellulose, porcelain, polymers). Efficiency in this stage is highly dependent on global commodity prices and strategic supplier relationships, given that raw materials constitute a significant portion of the total manufacturing cost. Key upstream challenges involve ensuring the consistent quality of grain-oriented electrical steel (GOES) and mitigating supply chain risks associated with global trade policies and geopolitical volatility. Innovation in this phase often focuses on developing advanced core materials with lower magnetostriction and improved insulation systems.

Midstream activities encompass the complex manufacturing and assembly process, including core cutting, coil winding, tank fabrication, and final testing. Modern manufacturing emphasizes lean techniques, precision engineering, and adherence to stringent quality control standards (like ISO and IEC). The shift towards modular design and smart manufacturing facilities incorporating automation and digital twins is becoming crucial for high-volume producers. Distribution channels involve both direct sales to major utilities and EPC contractors, particularly for large, customized power transformers, and indirect sales through specialized distributors and integrators for standardized distribution and specialty units. Aftermarket services, including installation, commissioning, maintenance contracts, and spare parts supply, represent a rapidly growing and high-margin segment of the value chain.

Downstream analysis focuses on the end-users—primarily electric utilities (accounting for the largest share), heavy industrial consumers, and infrastructure developers. Demand generation is inherently linked to government infrastructure spending and regulatory environments promoting grid efficiency and resilience. Direct procurement dominates the high-voltage segment, ensuring close collaboration between manufacturers and utility engineers to meet specific network requirements. The increasing complexity of the grid, driven by decentralized generation, necessitates highly skilled downstream installation and commissioning teams capable of integrating sophisticated monitoring systems (IoT and AI components) into the installed base, thereby emphasizing the importance of robust service agreements and long-term customer partnerships.

Electrical Power Transformer Market Potential Customers

The primary end-users and buyers in the Electrical Power Transformer Market are broadly classified into utility companies (power generation, transmission, and distribution entities), and various industrial and commercial sectors requiring reliable power infrastructure. Utility companies represent the most significant segment, as they are responsible for the entire electricity network infrastructure, requiring large power transformers for transmission substations and numerous distribution transformers to serve localized demand centers. Investments by utilities are typically large-scale, driven by long-term strategic plans for grid capacity expansion, resilience enhancement against climate events, and regulatory mandates for improved efficiency and smart grid deployment.

Industrial customers form the second critical group, encompassing energy-intensive sectors such as oil and gas processing, mining, metals manufacturing, and chemicals production. These sectors require robust, often custom-designed, specialty transformers to handle specific loads, voltages, and harsh operating environments, ensuring uninterrupted operation of critical machinery. The rapidly expanding data center market also constitutes a high-growth customer segment, demanding highly efficient, dry-type transformers due to their need for reliability, compactness, and stringent fire safety regulations within enclosed environments. Furthermore, infrastructure developers engaged in massive projects like railways, metros, and large-scale renewable energy farms (solar and wind), frequently act as major buyers of both power and distribution transformers through EPC contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 55.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, ABB (Hitachi Energy), General Electric, Toshiba Corporation, Schneider Electric SE, Bharat Heavy Electricals Ltd (BHEL), Mitsubishi Electric Corporation, Hyundai Electric, TBEA Co., Ltd., CG Power and Industrial Solutions Ltd., Eaton Corporation PLC, Jiangsu Huapeng Transformer Co., Ltd., SPX Transformer Solutions, Wilson Transformer Company, China XD Group, Delta Star, Inc., Hammond Power Solutions Inc., EMCO Ltd., Vantem. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Power Transformer Market Key Technology Landscape

The technology landscape of the Electrical Power Transformer Market is undergoing rapid evolution, driven primarily by the need for higher efficiency, enhanced digitalization, and improved environmental sustainability. A pivotal trend is the widespread adoption of smart transformer technology, which integrates advanced sensors (IoT capabilities) for real-time monitoring of critical parameters like temperature, moisture, and partial discharge. This enables predictive maintenance strategies, moving away from time-based scheduling to condition-based assessments, significantly extending asset life and reducing operational expenditures. Furthermore, the integration of Fiber Optic Sensing (FOS) technology is improving the accuracy and immunity of monitoring systems against electromagnetic interference, providing more reliable data for AI-driven analytics.

Another major technological focus is materials science, specifically the development of advanced core materials and insulating fluids. Amorphous metal cores, while initially more expensive, offer significantly lower no-load losses compared to traditional grain-oriented electrical steel, making them highly desirable for energy-efficient distribution transformers. Concurrently, the transition from mineral oil to environmentally friendly insulating liquids, such as natural and synthetic esters, is a growing requirement, particularly in sensitive urban and indoor installations. These ester fluids possess higher flash points and are biodegradable, substantially improving fire safety and reducing environmental risk, aligning with increasingly strict global regulatory mandates.

Furthermore, innovations in specialized high-voltage infrastructure, particularly High-Voltage Direct Current (HVDC) converter transformers, are crucial for long-distance bulk power transmission and the integration of large-scale remote renewable generation. HVDC technology requires specialized transformer designs capable of handling unique harmonic stresses and DC offset voltages. On the manufacturing front, modularization and standardization techniques are being applied to reduce production complexity and lead times for high-volume segments. The utilization of digital twin technology in design and simulation is also advancing, allowing manufacturers to model and test transformer performance virtually before physical production, ensuring optimal specifications and accelerated deployment timelines.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, characterized by unparalleled investments in grid expansion, rural electrification, and ambitious renewable energy targets in China and India. The rapid pace of industrialization and urbanization across Southeast Asia drives sustained high demand for both power and distribution transformers. Government initiatives like India's UDAY scheme and China's "New Infrastructure" plan continue to inject substantial capital into transmission and distribution upgrades, positioning the region as the epicenter of global transformer manufacturing and consumption.

- North America: This region is defined by critical infrastructure replacement cycles, necessitated by an aging grid (average age of transformers often exceeding 40 years) and the necessity to harden networks against severe weather events. Significant investments are focused on smart grid deployment, digitalization, and integration of utility-scale solar and wind generation, driving demand for intelligent, flexible, and high-efficiency transformers, particularly in Texas, California, and the Northeast corridor.

- Europe: Growth in Europe is primarily compliance-driven, focusing heavily on achieving net-zero emission goals, which requires extensive upgrades to transmission infrastructure (often cross-border interconnection) and mass adoption of environmentally friendly fluids (ester transformers). Strict efficiency standards mandated by the EU's Ecodesign Directive compel utilities to replace older, less efficient units, thereby ensuring steady demand for advanced, low-loss transformers across the continent.

- Middle East and Africa (MEA): This region is experiencing a surge in infrastructure development tied to large oil and gas projects, smart city construction (e.g., NEOM in Saudi Arabia), and increasing electrification rates in rapidly developing African nations. Demand is highly concentrated on high-capacity power transformers to support bulk transmission and specialized industrial transformers for energy and utility expansion projects.

- Latin America: Market growth here is stimulated by investments in renewable hydroelectric and solar projects, necessitating new transmission lines and substations, particularly in Brazil, Mexico, and Chile. Political and economic stability remains a challenge, but ongoing privatization efforts and energy sector reforms are attracting foreign investment for infrastructure development, supporting demand, especially in the distribution segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Power Transformer Market.- Siemens Energy AG

- ABB (Hitachi Energy Ltd.)

- General Electric Company

- Toshiba Corporation

- Schneider Electric SE

- Bharat Heavy Electricals Ltd (BHEL)

- Mitsubishi Electric Corporation

- Hyundai Electric Co., Ltd.

- TBEA Co., Ltd.

- CG Power and Industrial Solutions Ltd.

- Eaton Corporation PLC

- Jiangsu Huapeng Transformer Co., Ltd.

- SPX Transformer Solutions, Inc.

- Wilson Transformer Company

- China XD Group

- Delta Star, Inc.

- Hammond Power Solutions Inc.

- EMCO Ltd.

- Vantem Corporation

- Alstom Grid (acquired by GE/Hitachi Energy components)

Frequently Asked Questions

Analyze common user questions about the Electrical Power Transformer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the demand for electrical power transformers globally?

Demand is primarily driven by essential grid modernization initiatives in mature economies, massive infrastructure development and electrification programs in developing regions (especially APAC), and the critical need to integrate decentralized renewable energy sources like wind and solar power into existing transmission networks, requiring high-voltage flexibility.

How is smart grid technology impacting the design and function of power transformers?

Smart grid technology mandates the integration of advanced sensors and communication modules (IoT) into transformers, creating 'smart transformers.' This shift enables real-time performance monitoring, dynamic load management, remote diagnostics, and predictive maintenance, enhancing grid resilience and minimizing operational downtime for utilities.

What is the competitive landscape regarding dry-type versus oil-immersed transformers?

Oil-immersed transformers remain dominant for high-rating power transmission applications due to their superior cooling efficiency and cost profile. However, dry-type transformers are rapidly gaining market share in distribution and industrial settings where fire safety, environmental considerations, and minimal maintenance requirements in urban or enclosed areas are paramount.

Which geographical region holds the largest market share and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to rapid industrialization, massive government investment in transmission and distribution network expansion (UHV and HVDC), and extensive electrification efforts to meet the escalating energy demands of countries such as China and India.

What is the significance of utilizing natural ester fluids in modern transformers?

Natural ester fluids are critical for market growth due to their high fire resistance (higher flash point than mineral oil) and biodegradability. Their adoption minimizes environmental risk and improves safety in substations, aligning transformers with increasingly strict global environmental and safety regulations, particularly in urban and environmentally sensitive areas.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager