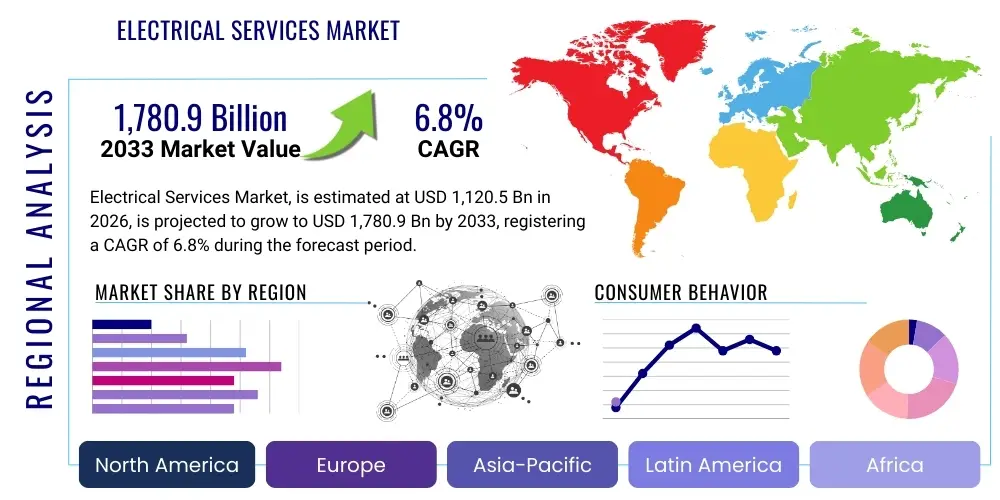

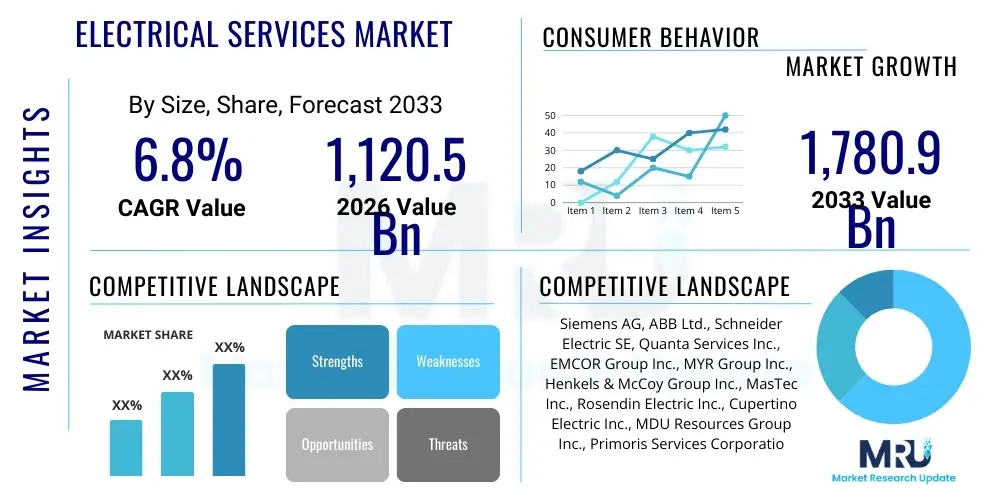

Electrical Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436786 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electrical Services Market Size

The Electrical Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1,120.5 Billion in 2026 and is projected to reach USD 1,780.9 Billion by the end of the forecast period in 2033.

Electrical Services Market introduction

The Electrical Services Market encompasses a wide range of activities related to the design, installation, maintenance, repair, and upgrade of electrical infrastructure across residential, commercial, and industrial sectors. This market is fundamentally driven by continuous urbanization, robust industrialization, and the global transition towards sustainable energy sources. Key offerings include wiring installation for new constructions, complex system integration for industrial facilities, routine preventive maintenance, and specialized services like smart home integration and electric vehicle (EV) charging station deployment. These services are essential for ensuring the reliable, safe, and efficient transmission and utilization of electrical power.

Product descriptions within this market are diverse, spanning high-voltage transmission line maintenance, medium-voltage distribution system setup, and low-voltage end-user wiring. Major applications involve providing power solutions for large-scale data centers, ensuring operational continuity in manufacturing plants, and improving energy efficiency in commercial buildings through lighting and power management systems. The integration of renewable energy sources, such as solar and wind power, requires specialized electrical services for grid connection and system optimization, further broadening the market scope and technical complexity.

The primary benefits of professional electrical services include adherence to stringent safety regulations, optimization of energy consumption, prevention of costly power outages, and extension of asset lifespan. Driving factors fueling market expansion are the rapid development of smart city initiatives, massive government investments in aging power grid modernization (Smart Grid technologies), and the escalating demand for reliable power supply driven by the proliferation of digital devices and automated industrial processes globally. Additionally, mandatory updates to building codes focusing on energy conservation and fire safety are compelling businesses and homeowners to invest in updated electrical systems.

Electrical Services Market Executive Summary

The Electrical Services Market exhibits significant upward business trends, predominantly characterized by high merger and acquisition activity among regional providers seeking specialized capabilities in areas such as renewable energy hookups and advanced metering infrastructure (AMI) installation. Technological integration, particularly IoT sensors for predictive maintenance and digital twins for system design, is transforming service delivery, shifting the focus from reactive repairs to proactive asset management. Key business challenges revolve around navigating complex regulatory environments and addressing the severe shortage of certified electrical technicians capable of handling sophisticated modern electrical systems. However, the consistent need for infrastructural upgrades in mature economies and rapid infrastructure development in emerging markets ensures stable long-term growth.

Regionally, North America and Europe maintain dominance, driven by extensive grid modernization projects and substantial investments in EV infrastructure and smart building automation. The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by accelerated urbanization, massive industrial expansion, particularly in manufacturing hubs like China and India, and governmental mandates promoting renewable energy adoption and rural electrification. Latin America and the Middle East & Africa (MEA) are seeing sustained growth driven by oil and gas infrastructure power requirements and nascent smart city developments, though market stability can be sensitive to commodity price fluctuations and geopolitical factors.

Segment trends indicate that the Maintenance & Repair segment is achieving superior growth, largely due to the increasing complexity and age of existing electrical infrastructure, necessitating specialized preventive and corrective service contracts. Within the End-User segmentation, the Industrial sector remains the largest revenue generator, driven by high power demands and the need for zero downtime in automated facilities. However, the Commercial sector is experiencing rapid expansion due to the boom in data center construction and the widespread implementation of energy-efficient retrofitting services across retail and office spaces. The shift toward sustainable practices is notably boosting demand for services related to battery storage integration and microgrid development.

AI Impact Analysis on Electrical Services Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Electrical Services Market primarily revolve around predictive maintenance capabilities, efficiency gains in complex diagnostics, and the future role of human electricians. Users are highly interested in how AI algorithms can analyze real-time data from smart grids and building management systems to anticipate equipment failures, thereby reducing unplanned downtime and optimizing maintenance schedules. Concerns often focus on data privacy when deploying AI-driven monitoring systems and the required upskilling of the existing workforce to manage and interpret AI outputs. There is a clear expectation that AI will standardize complex diagnostic procedures and significantly improve the energy efficiency management capabilities offered by electrical service providers, driving a shift towards "smart" servicing models rather than traditional manual labor-intensive approaches.

The integration of AI technologies promises revolutionary changes in operational efficiency and service quality within the electrical services domain. AI algorithms are being leveraged to process vast datasets originating from IoT sensors embedded in transformers, switchgear, and wiring systems, enabling highly accurate anomaly detection far exceeding human capacity. This capability allows service providers to execute condition-based maintenance (CBM), significantly reducing operational expenditure (OPEX) for asset owners and increasing the reliability of critical power infrastructure. Furthermore, AI is crucial in optimizing demand-side management (DSM) and microgrid balancing, ensuring electrical systems respond dynamically to fluctuating supply from intermittent renewable sources.

AI's influence extends deeply into the design and planning phases of electrical projects. Generative design AI tools can rapidly produce optimized wiring diagrams and load distribution plans for large commercial and industrial complexes, factoring in energy efficiency targets and regulatory compliance simultaneously. In field operations, AI-powered diagnostic tools integrated into mobile platforms guide technicians through complex troubleshooting steps, standardizing expertise across the workforce. This digital transformation, driven by AI, is fundamentally restructuring the market towards highly technological, data-centric service offerings, favoring companies that can successfully merge physical electrical expertise with sophisticated analytical capabilities.

- AI-driven predictive maintenance reduces unplanned outages by up to 40%.

- Optimization of energy consumption through real-time load forecasting and adjustment.

- AI enhances field diagnostics via augmented reality (AR) guided troubleshooting workflows.

- Automated compliance checking against local and international electrical safety codes.

- Improved resource allocation and scheduling for service technicians using machine learning algorithms.

- Enhanced security monitoring and anomaly detection in smart grid operational technology (OT) systems.

- Accelerated design and simulation of complex industrial power distribution networks.

DRO & Impact Forces Of Electrical Services Market

The Electrical Services Market is propelled by significant drivers, primarily the ongoing global push for electrification and the necessity for grid modernization to accommodate intermittent renewable energy sources. Restraints include the high upfront capital expenditure required for advanced technological integration (like sensor networks and AI platforms) and the pervasive shortage of highly skilled, certified electrical labor capable of installing and maintaining sophisticated systems such as microgrids and complex industrial automation wiring. Opportunities abound in the burgeoning Electric Vehicle (EV) infrastructure sector, which requires extensive specialized electrical installation services, and the growing focus on energy efficiency retrofits in aging commercial and residential buildings to meet evolving sustainability targets. These dynamic forces shape the competitive landscape and strategic direction of service providers.

Key drivers include substantial governmental incentives for sustainable energy infrastructure, leading to massive projects involving solar farms, offshore wind connectivity, and battery storage integration—all demanding specialized electrical hookup and service work. The relentless expansion of data centers globally, requiring unparalleled levels of power reliability and complex cooling system wiring, also acts as a critical demand driver. Conversely, market growth is hampered by delays in regulatory approvals for large infrastructure projects and fluctuating raw material costs (particularly copper and specialized components), which introduce project cost volatility and affect profit margins for contractors. The cyclical nature of the construction industry also indirectly influences demand for new installation services.

The major impact forces currently reshaping the market are the urgent regulatory mandates surrounding climate change mitigation and the rapid technological evolution toward intelligent infrastructure. These forces compel service providers to invest heavily in digital tools and training. The transition to decentralized power generation (microgrids) mandates a fundamental shift in service architecture from centralized maintenance to localized, specialized support. Furthermore, increasing consumer awareness regarding energy costs and environmental impact is creating massive market opportunities for specialized auditing and optimization services. Companies that leverage digital twin technology for rapid system assessment and deployment gain a substantial competitive edge in managing these complex, interconnected systems efficiently.

Segmentation Analysis

The Electrical Services Market is extensively segmented across several dimensions, including Service Type, End-User, and Voltage. Service Type segmentation differentiates between installation/upgrades, maintenance/repair, and professional consulting/design services, reflecting the lifecycle stages of electrical infrastructure. End-User segmentation categorizes demand based on specific sector needs, spanning Residential, Commercial (including retail, healthcare, data centers), and Industrial (manufacturing, utilities, oil & gas). Analyzing these segments is crucial for service providers to tailor specialized offerings, such as high-voltage expertise for industrial clients versus low-voltage smart integration for residential consumers. Geographic segmentation ensures regional regulatory and infrastructural differences are addressed effectively.

The Installation & Upgrade segment holds a significant share, driven primarily by continuous new construction activities in commercial and residential real estate markets, alongside essential infrastructure projects like airport and highway expansions. However, the Maintenance & Repair segment is forecast to show the highest CAGR, propelled by the need to sustain aging utility infrastructure and the mandatory scheduled servicing of complex, digitally integrated systems to ensure operational continuity. Within the Industrial End-User segment, specific sub-segments like utilities and heavy manufacturing demand highly specialized, often preventive, service contracts due to the catastrophic financial implications of downtime. The Commercial segment is diversifying rapidly, with data centers emerging as critical consumers requiring redundancy and high-quality electrical setup.

Segmentation by Voltage Level (Low, Medium, High) determines the required level of certification and specialized equipment. High-voltage services are monopolized by highly specialized contractors serving transmission utilities and major heavy industry clients. Conversely, low-voltage services are highly fragmented, focusing on end-user premises wiring and smart device integration. Understanding this stratification allows market players to position themselves effectively, focusing resources either on high-margin, technically demanding industrial work or high-volume, standardized commercial and residential services. The increasing complexity across all segments mandates continuous professional development and strategic partnerships across the value chain.

- By Service Type:

- Installation and Upgrades (New construction, System expansion)

- Maintenance and Repair (Preventive maintenance, Emergency breakdown service)

- Professional Consulting and Design (Energy auditing, Compliance assessment, System planning)

- By End-User:

- Residential (Single-family, Multi-family dwellings, Home automation)

- Commercial (Office buildings, Retail complexes, Data Centers, Healthcare facilities)

- Industrial (Manufacturing, Utilities, Oil & Gas, Mining)

- By Voltage:

- Low Voltage (Below 1 kV)

- Medium Voltage (1 kV to 36 kV)

- High Voltage (Above 36 kV)

Value Chain Analysis For Electrical Services Market

The value chain for the Electrical Services Market is robust and multi-layered, starting with the upstream suppliers of raw materials and manufactured electrical components. Upstream analysis involves sourcing critical components such as copper wire, circuit breakers, transformers, and specialized industrial control panels. The performance and cost stability of this segment heavily influence the operational margins of service providers. Key relationships at this stage involve long-term procurement contracts with manufacturers like Siemens, ABB, and Schneider Electric, ensuring the timely availability of certified, high-quality equipment compliant with strict industry standards. Technological innovation in component efficiency, driven by IoT integration capabilities, is a major upstream development.

The middle segment of the chain is dominated by electrical service providers, encompassing large Engineering, Procurement, and Construction (EPC) firms, specialized industrial contractors, and local residential/commercial firms. These providers are responsible for design, installation, integration, testing, and subsequent maintenance. Distribution channels are critical; while direct contracts are typical for large industrial and utility projects, residential and smaller commercial services often rely on indirect channels, utilizing electrical wholesalers, distributors, and online service marketplaces. Efficiency in the middle segment is heavily dependent on skilled labor management, project coordination software, and adherence to project timelines and safety protocols.

Downstream analysis focuses on the end-users—utilities, industrial operators, commercial facility managers, and homeowners—who consume the services. The downstream relationship often extends beyond initial installation into long-term service agreements (LSAs) for ongoing maintenance and future upgrades. Direct engagement is standard for high-value industrial contracts, fostering collaborative partnerships aimed at asset optimization. Indirect distribution, leveraging channels like facility management companies, is often used to access fragmented markets such as multi-family residential complexes or small commercial businesses. Ensuring customer satisfaction through rapid response times and adherence to warranties is paramount for securing repeat business and referrals in this highly competitive service industry.

Electrical Services Market Potential Customers

Potential customers for the Electrical Services Market are highly diversified, reflecting the universal reliance on electricity across all economic activities. The most significant segment of end-users consists of utility companies, which require constant high-voltage services for transmission infrastructure maintenance, sub-station upgrades, and the integration of new generation sources like solar and wind farms. Industrial manufacturers, particularly those in continuous process industries (chemicals, automotive, pulp & paper), represent critical buyers due to their zero-downtime requirements and specialized power needs for heavy machinery and industrial automation systems. These customers frequently engage in multi-year service contracts focused on predictive maintenance and system optimization to ensure peak operational efficiency.

The commercial sector serves as a massive and rapidly growing customer base, driven primarily by the proliferation of data centers, which require unparalleled levels of power redundancy, cooling system wiring, and backup generator integration. Furthermore, institutional customers such as educational campuses, hospitals, and government facilities are major buyers, often requiring highly reliable, complex electrical systems compliant with strict health and safety standards. The trend toward energy efficiency and smart building management systems (BMS) mandates regular auditing and retrofitting services, making commercial facility managers recurring customers focused on minimizing operating expenses and achieving sustainability certifications.

Finally, the residential sector, although individually fragmented, collectively represents a substantial customer base, primarily for low-voltage installation in new housing developments and critical services like safety inspections, panel upgrades (to support EV charging and increased appliance loads), and smart home technology integration. This segment relies heavily on localized, trustworthy contractors. The emergence of microgeneration (rooftop solar installations and home battery storage) is increasingly transforming residential customers into complex buyers requiring specialized electrical services for interconnection with the main utility grid, further professionalizing the service requirements for this historically simpler segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,120.5 Billion |

| Market Forecast in 2033 | USD 1,780.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Schneider Electric SE, Quanta Services Inc., EMCOR Group Inc., MYR Group Inc., Henkels & McCoy Group Inc., MasTec Inc., Rosendin Electric Inc., Cupertino Electric Inc., MDU Resources Group Inc., Primoris Services Corporation, Newmont Mining Corporation (Electrical Services Unit), IES Holdings Inc., Team Fishel, Wilson Electric, The Electric Company, Comfort Systems USA, Helix Electric, PowerSecure International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Services Market Key Technology Landscape

The Electrical Services Market is undergoing rapid technological transformation, shifting from traditional manual methods to digitized, data-driven service delivery models. Key technologies driving this change include the widespread implementation of Building Information Modeling (BIM) and digital twin technology. BIM allows for highly accurate, collaborative planning and visualization of complex electrical layouts before physical construction begins, minimizing errors and reducing costly rework on-site. Digital twins, which are virtual replicas of physical electrical infrastructure, enable real-time performance monitoring, scenario testing, and predictive failure analysis, fundamentally enhancing the quality and longevity of maintenance services offered to industrial and utility clients.

Another crucial technological advancement is the adoption of the Internet of Things (IoT) sensors and Advanced Metering Infrastructure (AMI). IoT devices embedded in electrical components (e.g., thermal sensors on switchgear, vibration monitors on motors) feed continuous operational data into cloud-based analytical platforms. This real-time data underpins predictive maintenance strategies, allowing service providers to identify impending component failures before they escalate into outages, thereby maximizing asset uptime. Furthermore, specialized diagnostic tools, including thermal imaging cameras integrated with mobile applications, and sophisticated cable fault location equipment, are becoming standard practice, increasing the efficiency and safety of field technicians.

The integration of robotics and drones is also emerging, particularly in high-risk or difficult-to-access environments such as high-voltage transmission lines or remote solar farm installations. Drones equipped with high-resolution cameras and Lidar technology perform rapid inspection and surveying, reducing the need for manual inspection and improving safety dramatically. Furthermore, Augmented Reality (AR) tools are increasingly used on-site, providing technicians with visual overlays of electrical schematics and step-by-step repair instructions directly in their field of vision, enhancing the consistency and speed of complex installations and repairs, and bridging the knowledge gap for less experienced staff members.

Regional Highlights

- North America: The region maintains a leading market share, driven by extensive investment in smart grid infrastructure and the rapid expansion of data center complexes in the US. Robust regulatory frameworks, particularly those mandating energy efficiency and grid resilience, compel utilities and commercial entities to engage in continuous modernization projects. The high adoption rate of electric vehicles necessitates massive localized electrical service contracts for charging station installation and grid integration across major cities and highways.

- Europe: Characterized by strong governmental commitments to renewable energy targets (Fit for 55 agenda), resulting in high demand for electrical services related to integrating offshore wind farms and expanding battery energy storage systems (BESS). Germany, the UK, and France are spearheading retrofitting services for older commercial and residential stock to improve energy performance. Strict EU safety and environmental regulations ensure a high barrier to entry and premium pricing for compliant services.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by unprecedented infrastructure investment, particularly in China, India, and Southeast Asian nations. Rapid urbanization and industrial expansion necessitate massive new capacity installation services. While the market is highly fragmented, large government utility projects, especially in rural electrification and modernizing outdated grids, offer significant opportunities for large international contractors capable of scaling operations quickly.

- Latin America: Growth is primarily centered around capitalizing on abundant renewable resources (hydro, solar) and improving power transmission reliability across diverse geographical landscapes. Brazil and Mexico are key markets, driven by mining and industrial sectors requiring specialized high-voltage installation and maintenance. Economic volatility and dependency on commodity prices can sometimes restrain large-scale infrastructure spending, making project cycles longer.

- Middle East and Africa (MEA): Growth is tied heavily to oil and gas infrastructure expansion, requiring specialized explosion-proof electrical system installations, and ambitious smart city projects (e.g., NEOM in Saudi Arabia). High solar potential drives utility-scale photovoltaic (PV) projects, demanding specialized high-voltage service contracts. However, infrastructural deficits in many African nations limit market size, though significant long-term potential exists in electrification and grid development initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Services Market.- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Quanta Services Inc.

- EMCOR Group Inc.

- MYR Group Inc.

- Henkels & McCoy Group Inc.

- MasTec Inc.

- Rosendin Electric Inc.

- Cupertino Electric Inc.

- MDU Resources Group Inc.

- Primoris Services Corporation

- Newmont Mining Corporation (Electrical Services Unit)

- IES Holdings Inc.

- Team Fishel

- Wilson Electric

- The Electric Company

- Comfort Systems USA

- Helix Electric

- PowerSecure International Inc.

Frequently Asked Questions

Analyze common user questions about the Electrical Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers for growth in the Electrical Services Market?

The key drivers include massive global investments in grid modernization and smart grid technologies, the rapid integration of intermittent renewable energy sources (solar, wind), expansive infrastructure development in APAC and MEA, and the proliferation of electric vehicle (EV) charging infrastructure requiring specialized electrical installations.

How is AI transforming electrical maintenance and service delivery?

AI is transforming service delivery by enabling sophisticated predictive maintenance, allowing service providers to anticipate and prevent equipment failures using real-time data from IoT sensors. This minimizes unplanned outages, optimizes system efficiency, and shifts the industry from reactive repairs to proactive asset management through data-driven insights.

Which end-user segment is experiencing the fastest growth rate?

The Commercial end-user segment, specifically the data center sub-segment, is experiencing the fastest demand growth. This is due to the exponential rise in digital data consumption requiring continuous construction of new, high-redundancy, and power-intensive data facilities globally, driving substantial demand for complex electrical installation and integration services.

What is the greatest challenge facing electrical service providers today?

The most significant challenge is the pervasive shortage of certified, skilled electrical labor capable of handling the increasing complexity of modern systems, such as microgrids, industrial control systems, and integrated smart building technologies. This shortage constrains project scalability and increases operational costs for service firms.

What role does the push for energy efficiency play in the Electrical Services Market?

The demand for energy efficiency plays a critical role by driving the high growth of the professional consulting and retrofitting segments. Customers, particularly commercial and industrial entities, require specialized electrical services for energy auditing, lighting upgrades (LED conversions), and the installation of energy management systems to comply with mandates and reduce long-term operational costs.

How is the adoption of distributed energy resources affecting the market?

The shift towards Distributed Energy Resources (DERs), including rooftop solar and battery storage, significantly increases demand for specialized electrical services related to interconnection studies, microgrid installation, and bidirectional power flow management. This necessitates higher technical expertise for safe and reliable grid integration, creating new, high-value service niches.

What is the significance of the Maintenance and Repair segment in the forecast period?

The Maintenance and Repair segment is projected to show the highest CAGR because existing electrical infrastructure, especially utility grids and industrial setups, is aging rapidly while becoming more complex due to digitization. This requires mandatory, proactive preventive service contracts utilizing advanced diagnostics to ensure asset reliability and compliance.

In which region are public-private partnerships most crucial for market expansion?

Public-private partnerships (PPPs) are most crucial in the Asia Pacific (APAC) and emerging MEA markets. Due to the scale of required infrastructure investment—specifically large-scale transmission projects, smart city development, and extensive rural electrification efforts—governments rely heavily on PPPs to finance and execute complex, long-term electrical service and construction contracts.

How do fluctuations in raw material prices impact electrical service contractors?

Fluctuations in the prices of key raw materials, especially copper and specialized steel components, directly impact the cost of installation projects. Contractors mitigate this risk through short-term pricing clauses in long-term contracts and strategic inventory management, though high volatility can compress profit margins, particularly in fixed-price bids.

What are the primary safety considerations within the high-voltage electrical services segment?

Safety considerations in high-voltage services are paramount, focusing on strict adherence to NFPA 70E standards, mandatory use of specialized personal protective equipment (PPE), and rigorous procedural training for arc flash mitigation and lockout/tagout procedures. Compliance is non-negotiable and requires continuous auditing and specialized contractor certification.

How does Building Information Modeling (BIM) affect electrical service project execution?

BIM significantly improves project execution by allowing electrical designers to create highly detailed, accurate 3D models of electrical systems integrated within the overall building structure. This facilitates clash detection, improves prefabrication opportunities, and ensures better coordination with other trades, resulting in faster installation times and reduced on-site errors.

What is the typical value chain structure for a major industrial electrical services project?

The industrial value chain starts with upstream material suppliers, flows through engineering and design firms, then to the specialized EPC or electrical contractor (the middle segment), and finally concludes with the industrial operator or utility (downstream end-user) who often holds a long-term maintenance contract with the service provider.

Describe the market relevance of low-voltage services in the residential sector.

Low-voltage services in the residential sector are highly relevant, driven by smart home integration (IoT lighting, security, automation), panel upgrades to support higher power demands, and the critical installation of dedicated circuits for modern high-efficiency appliances and home EV chargers. This segment is characterized by high volume and localized competition.

How do sustainability mandates in Europe affect demand for electrical services?

Sustainability mandates in Europe, such as energy performance directives, drastically increase demand for electrical services focused on energy auditing, building retrofitting (e.g., HVAC and lighting control systems integration), and the installation of local generation assets. These services help entities achieve compliance and access financial incentives for green investments.

What distinguishes the services offered to the Utilities segment from the Commercial segment?

Utility services are characterized by high-voltage expertise, focus on grid transmission and distribution reliability, large-scale asset management (substations, transmission lines), and regulatory compliance for power delivery. Commercial services primarily focus on medium- to low-voltage infrastructure within premises, emphasizing system redundancy, energy efficiency, and tenant power quality.

How are remote monitoring and diagnostic capabilities impacting the service contract models?

Remote monitoring capabilities, enabled by IoT and cloud platforms, are driving a shift toward performance-based and predictive service contract models. Instead of fixed schedule maintenance, contracts now offer guaranteed uptime and energy performance, with service calls triggered by system analytics rather than calendar dates, ensuring greater efficiency for the customer.

What is the expected trajectory for the Industrial sector's demand for specialized electrical services?

Demand from the Industrial sector is expected to remain robust, driven by the continuous global trend of automation (Industry 4.0). This requires highly specialized electrical services for sophisticated robotics integration, high-capacity motor control centers, and the implementation of robust, high-availability power quality systems to protect sensitive manufacturing equipment.

How do regulations regarding carbon neutrality influence service offerings?

Regulations aimed at carbon neutrality compel service providers to specialize in carbon-reducing solutions, including the installation of highly efficient power electronics, BESS, solar integration, and conducting detailed energy audits focused on decarbonization pathways. Service firms must become partners in helping clients meet their net-zero commitments.

What is the primary function of professional consulting and design services?

Professional consulting and design services focus on pre-installation activities, including feasibility studies, load flow analysis, system sizing, regulatory compliance review, and the creation of detailed electrical blueprints. Their primary function is ensuring the proposed electrical infrastructure is safe, efficient, scalable, and fully compliant with local codes and client operational needs before physical work commences.

Why is project management expertise crucial in the Electrical Services Market?

Project management expertise is crucial due to the complexity, scale, and multi-trade coordination required for modern electrical installations. Effective project managers ensure adherence to strict safety standards, manage tight deadlines, control budget overruns, and coordinate seamlessly with general contractors, minimizing delays and ensuring high quality project delivery.

How is cybersecurity becoming relevant in the operational technology (OT) segment of electrical services?

Cybersecurity is increasingly relevant as electrical systems become digitized and networked (OT systems). Service providers must offer installation and maintenance protocols that secure industrial control systems (ICS) and smart grid components against cyber threats, requiring specialized expertise in network segmentation and secure remote access implementation.

What role do warranties and service level agreements (SLAs) play in the competitive landscape?

Warranties and SLAs are vital competitive tools, offering customers assurance regarding system reliability and service quality. Comprehensive SLAs covering guaranteed response times and uptime penalties incentivize service providers to invest in high-quality equipment and superior maintenance practices, thereby enhancing customer loyalty and market reputation.

How does geopolitical instability affect the global electrical services market?

Geopolitical instability can disrupt supply chains for critical electrical components and deter foreign investment in large infrastructure projects, particularly in emerging markets. This instability increases project risk, delays tenders, and causes volatility in project financing, potentially skewing regional growth forecasts.

What is the impact of urbanization on residential electrical service demand?

Urbanization drives residential demand through the construction of dense multi-family housing and the need to upgrade existing, aging municipal infrastructure within cities. This focuses demand on specialized services for high-rise residential wiring, complex power distribution within concentrated areas, and ensuring system safety and capacity for increased population density.

How are service providers adapting to the need for advanced battery energy storage system (BESS) integration?

Service providers are adapting by developing highly specialized teams trained in BESS integration, including DC wiring, thermal management systems, and inverter synchronization with the grid. They are investing in specialized software tools for BESS performance optimization and safety compliance related to large-scale energy storage deployments.

What are the key differences between planned preventive maintenance and corrective maintenance?

Planned preventive maintenance (PPM) is scheduled, non-intrusive service based on time or usage metrics to prevent failure (e.g., annual inspections, calibration). Corrective maintenance (CM) is reactive work performed to restore a failed component to operation after a breakdown event. PPM is increasingly favored due to lower overall lifecycle costs and reduced downtime risks.

Which technological trend is most beneficial for managing large-scale electrical infrastructure remotely?

The deployment of digital twin technology, combined with IoT and AI analytics, is most beneficial for remote management. Digital twins provide a comprehensive, real-time virtual representation of the physical assets, enabling operators to remotely diagnose issues, simulate repair scenarios, and deploy updates without requiring immediate physical presence.

How does the fragmentation of the low-voltage residential market influence business strategy?

The fragmentation of the residential market necessitates business strategies focused on strong local branding, high reliance on customer reviews and digital marketing, efficient service routing optimization, and specialized training in smart home integration, as scale is often achieved through high-volume, localized transactions rather than multi-million-dollar contracts.

What regulatory trends are impacting electrical services in North America?

Key regulatory trends include updated national electrical codes (NEC) mandating higher safety standards and greater use of arc-fault and ground-fault protection devices, alongside state-level mandates promoting grid resilience against climate events and incentivizing the construction of extensive EV charging networks.

Explain the concept of utility-scale electrical services.

Utility-scale electrical services involve the massive deployment, connection, and long-term maintenance of large generation assets (e.g., gigawatt-scale power plants, major solar/wind farms) and high-voltage transmission and distribution infrastructure. These services require specialized heavy equipment, high-level engineering expertise, and adherence to stringent utility commission regulations.

What is the primary role of drones in modern electrical line inspection?

Drones are primarily used for rapid, non-contact inspection of high-voltage transmission lines and remote infrastructure. Equipped with thermal and visual sensors, they detect anomalies, structural damage, vegetation encroachment, and hot spots, significantly improving safety and reducing the time and cost associated with manual aerial or ground-based patrols.

How do market players secure talent amidst the skilled labor shortage?

Market players secure talent through aggressive recruitment from vocational and technical schools, offering comprehensive apprenticeship programs, investing heavily in continuous employee upskilling in digital technologies (AI, IoT), and leveraging technology like AR tools to augment the capabilities of the existing, experienced workforce.

What are the implications of the "electrification of everything" trend for the market?

The "electrification of everything" trend implies a massive increase in demand across all segments, requiring service providers to install capacity for heat pumps, induction cooking, and electric vehicles, necessitating widespread upgrades to existing building panels and utility infrastructure, creating sustained, long-term installation and maintenance revenue streams.

Why are oil and gas facilities considered high-value customers for electrical services?

Oil and gas facilities are high-value customers because they require highly specialized, often hazardous-area certified, explosion-proof electrical installations (ATEX/IECEx compliance), complex power generation solutions for remote sites, and zero-tolerance for downtime, leading to substantial, premium-priced long-term service contracts.

What is the current trend regarding service providers specializing versus offering comprehensive services?

The trend is twofold: while large national firms move toward comprehensive, end-to-end service portfolios (design, install, maintain) to capture market share, smaller firms increasingly specialize in niche, high-demand areas like solar interconnection, EV charging, or complex industrial controls to compete effectively on expertise and premium technical capability.

How critical is standardization of service protocols across different geographic locations?

Standardization is critical for large multinational contractors to ensure consistent quality, safety, and compliance regardless of location. However, service protocols must remain flexible enough to incorporate variations mandated by local building codes, licensure requirements, and specific utility connection standards in different regions.

What role does digital documentation play in the lifecycle of electrical infrastructure?

Digital documentation (e.g., electronic schematics, cloud-stored maintenance records, digital twin models) plays a vital role in efficient asset lifecycle management. It enables faster troubleshooting, simplifies regulatory audits, ensures accurate historical reference for upgrades, and reduces the time technicians spend searching for physical blueprints.

How is the need for power quality services affecting market demand?

The proliferation of sensitive electronic equipment (in data centers and automated factories) increases demand for power quality services, including the installation and maintenance of uninterruptible power supplies (UPS), harmonic filters, and surge protection devices. This ensures electrical systems provide clean, stable power essential for operational continuity.

What is the significance of acquiring smaller firms with specialized renewable energy expertise?

Major market players are strategically acquiring smaller firms that possess niche expertise in solar, wind, and battery storage integration. This strategy allows the larger companies to rapidly scale their capabilities in the fast-growing clean energy sector, bypass internal development costs, and acquire certified staff instantly to meet new market demands.

How are financing options influencing customer decision-making for energy-efficient retrofits?

Innovative financing options, such as Energy Service Company (ESCO) models and Power Purchase Agreements (PPAs), are crucial. They allow customers (especially commercial) to implement costly energy-efficient electrical retrofits without significant upfront capital, making the decision easier by guaranteeing energy savings that often exceed the monthly financing payments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager