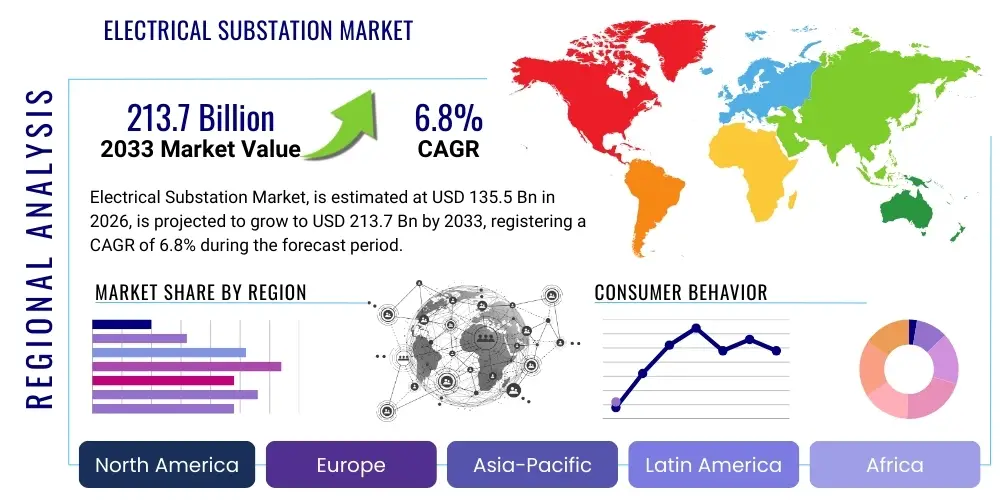

Electrical Substation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439155 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electrical Substation Market Size

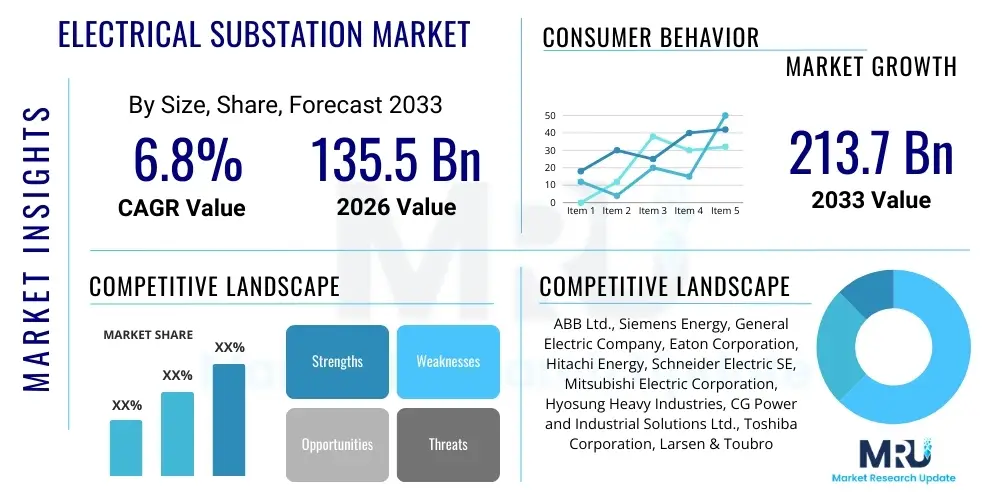

The Electrical Substation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $135.5 Billion in 2026 and is projected to reach $213.7 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the global necessity for grid modernization, integration of massive renewable energy sources, and the exponential rise in electricity demand across developing economies. Substations are the critical infrastructure nodes facilitating the transmission, distribution, and voltage transformation of electrical power, making their deployment essential for stable and efficient power networks.

Electrical Substation Market introduction

The Electrical Substation Market encompasses the design, engineering, construction, and maintenance of facilities required to step up or step down voltage levels within the electrical grid. These complex systems include power transformers, switchgear (circuit breakers, disconnect switches), busbars, control and protection systems, and communication equipment. Modern substations are shifting from conventional air-insulated switchgear (AIS) to more compact and reliable gas-insulated switchgear (GIS) and, increasingly, to fully digitized solutions that enhance monitoring and control capabilities.

The primary applications of substations span the entire power value chain, from generation step-up substations near power plants to transmission substations connecting regional grids, and distribution substations serving localized residential, commercial, and industrial loads. Key benefits derived from these installations include voltage stabilization, protection against faults, efficient power transfer over long distances, and the necessary interface for integrating decentralized renewable generation, such as solar farms and wind parks, into the centralized grid infrastructure. The driving factors behind market expansion include rapid urbanization, stringent government mandates for carbon reduction necessitating grid flexibility, and substantial capital investments in smart grid deployment to enhance operational efficiency and reliability.

Electrical Substation Market Executive Summary

The Electrical Substation Market is characterized by robust investment driven by global decarbonization efforts and infrastructural development, particularly in the Asia Pacific region. Business trends indicate a strong shift towards modular and prefabricated substations, reducing installation time and site requirements, alongside increased adoption of hybrid switchgear solutions. Technological innovation is centered on digitalization, integrating advanced sensors, Internet of Things (IoT) devices, and data analytics platforms to enable predictive maintenance and real-time fault detection, fundamentally transforming traditional operations into highly efficient smart substations.

Regionally, Asia Pacific (APAC) commands the largest market share due to massive electrification projects in countries like China and India, coupled with significant investments in ultra-high voltage (UHV) transmission infrastructure. North America and Europe, while slower in new grid expansion, are major markets for retrofit, modernization, and replacement of aging infrastructure, focusing heavily on integrating advanced cyber security measures and implementing digital substation technologies to improve grid resilience and comply with evolving environmental regulations. The Middle East and Africa (MEA) are also emerging as critical growth pockets, propelled by substantial investments in oil and gas infrastructure and large-scale renewable energy projects.

Segmentation trends highlight the dominance of the transmission segment, requiring high-voltage equipment to manage bulk power transfer over long distances. However, the distribution segment is poised for the fastest growth, primarily due to the localized requirement for managing bi-directional power flow caused by decentralized renewable energy resources and the need for reliable power delivery to end consumers. The Gas-Insulated Switchgear (GIS) technology segment is seeing increasing preference over Air-Insulated Switchgear (AIS) owing to its compact footprint, enhanced safety features, and reduced maintenance requirements, especially in densely populated urban centers or space-constrained environments.

AI Impact Analysis on Electrical Substation Market

User queries regarding AI's influence in the substation domain primarily focus on enhancing operational efficiency, improving predictive maintenance strategies, and safeguarding critical infrastructure against cyber threats. Common concerns revolve around how AI can process the massive data streams generated by digital substations to optimize load management and detect subtle anomalies before they lead to catastrophic failures. Users are highly interested in AI-driven solutions that automate fault isolation, minimize downtime, and ensure resilient grid operation, particularly in managing the inherent variability introduced by renewable energy sources. This analysis indicates a strong expectation that AI will move substations beyond simple monitoring into intelligent, autonomous operational centers, fundamentally reducing operational expenditures (OpEx) and extending asset lifecycles.

- AI enhances predictive maintenance by analyzing sensor data (vibration, temperature, partial discharge) to forecast equipment failure.

- Optimizes reactive power control and voltage regulation autonomously, improving overall power quality.

- Facilitates intelligent load forecasting, enabling proactive grid adjustments and preventing overloading.

- Improves cybersecurity posture by rapidly identifying and mitigating abnormal network behavior and intrusion attempts.

- Automates control room operations and decision-making processes, reducing human error and response time during disturbances.

- Enables digital twinning applications for real-time simulation and optimization of substation performance.

DRO & Impact Forces Of Electrical Substation Market

The dynamics of the Electrical Substation Market are profoundly shaped by accelerating global infrastructure demands, driven by population growth and industrialization, creating a massive driver for new construction and capacity expansion. Simultaneously, technological inertia and high initial capital expenditure associated with advanced digital solutions, such as Gas-Insulated Switchgear and fully automated systems, act as significant restraints, particularly in markets with limited financial access or regulatory support. The transition to fully integrated smart grids, mandated by climate change mitigation goals, presents a powerful opportunity for stakeholders to deploy advanced sensing, control, and communication technologies, differentiating their offerings and capturing value in the modernization wave.

Impact forces are currently pushing the market towards greater resilience and efficiency. Regulatory mandates promoting grid stability and reliability force utilities to accelerate the replacement of aging infrastructure with modern, fault-tolerant equipment. Environmental regulations favoring compact, SF6-free solutions are also significant, compelling manufacturers to invest heavily in alternative insulating gases and compact designs. These forces collectively dictate capital allocation and procurement decisions, prioritizing solutions that offer long-term operational savings and compliance with increasingly strict performance standards. The critical nature of electrical infrastructure means security, both physical and cyber, is a paramount impact force shaping design requirements and vendor selection.

The long operational lifecycles of substation assets mean that upgrade and replacement cycles are crucial market determinants. Opportunities exist in retrofitting existing Air-Insulated Substations (AIS) with advanced monitoring and digital capabilities, extending their life while enhancing performance. Furthermore, the burgeoning electric vehicle (EV) charging network necessitates dedicated power infrastructure upgrades at the distribution level, presenting a new, high-growth niche for tailored substation solutions. Successful navigation of the market requires addressing high capital costs through flexible financing models and demonstrating clear return on investment (ROI) via reduced operational expenses and improved reliability metrics.

Segmentation Analysis

The Electrical Substation Market is highly segmented based on crucial attributes including the component installed, the insulation medium used, the operating voltage level, and the primary application area. Understanding these segments is vital for analyzing market dynamics, as technology preference varies significantly across different applications—for instance, high voltage transmission lines predominantly use robust high-capacity transformers, while urban distribution networks prioritize compact, aesthetically pleasing, and safe switchgear like GIS. This detailed segmentation allows manufacturers to tailor their product offerings, focusing on specific regional infrastructure needs and regulatory requirements, such as focusing on SF6-free alternatives in environmentally sensitive European markets.

- By Component:

- Transformers (Power Transformers, Distribution Transformers)

- Switchgear (Circuit Breakers, Disconnectors, Load Break Switches)

- Busbars

- Control & Protection Systems

- Monitoring & Communication Devices

- By Insulation Type:

- Air-Insulated Substation (AIS)

- Gas-Insulated Substation (GIS)

- Hybrid Switchgear Substation

- By Voltage Level:

- Low (Below 66 kV)

- Medium (66 kV to 220 kV)

- High (220 kV to 550 kV)

- Extra/Ultra-High Voltage (Above 550 kV)

- By Application:

- Transmission Substation

- Distribution Substation

- Collector Substation (Renewables)

Value Chain Analysis For Electrical Substation Market

The value chain for the Electrical Substation Market begins with upstream activities involving raw material suppliers, predominantly focusing on critical components such as high-grade steel, copper, electrical insulation materials, and specialized semiconductor components for control systems. Key manufacturers of core equipment like transformers, circuit breakers, and protective relays form the central stage of the chain, engaging in complex engineering, design, and fabrication processes. These suppliers often differentiate themselves through patented technology, manufacturing scale, and adherence to stringent international standards (e.g., IEC and ANSI).

Downstream activities are dominated by Engineering, Procurement, and Construction (EPC) contractors, who manage the physical site preparation, installation, integration, and commissioning of the entire substation facility. These EPC firms are crucial integrators, connecting equipment manufacturers with the end-user utilities. The distribution channels are primarily direct, involving high-value, long-term contracts between manufacturers/EPCs and large electric utilities, industrial consumers, or governmental agencies responsible for grid infrastructure. Indirect channels are less common but exist for standard replacement parts and lower-voltage distribution components, often utilizing specialized electrical distributors and system integrators.

The nature of substation projects demands a highly collaborative and consultative sales approach, emphasizing technical capability and post-installation service. Post-sales services, including long-term maintenance contracts, software updates for control systems, and asset management advisory, form a rapidly growing part of the value chain. Cybersecurity service providers are also becoming integral downstream partners, ensuring the operational technology (OT) network within digital substations remains protected, reflecting the increasing convergence of IT and OT environments within the power sector.

Electrical Substation Market Potential Customers

The primary customers for electrical substations are large public and private sector entities requiring robust, high-capacity electrical infrastructure for power delivery. These customers are highly sensitive to reliability, regulatory compliance, and long-term operating costs. Electric utilities (both Transmission System Operators (TSOs) and Distribution System Operators (DSOs)) constitute the largest segment of end-users, constantly investing in new capacity to meet growing demand or modernizing existing assets to integrate renewables and enhance grid resilience against natural disasters and cyber threats.

Beyond traditional utilities, large industrial consumers represent a significant market segment. Industries such as metallurgy, heavy manufacturing, oil and gas, and data centers require dedicated, high-voltage substations to ensure uninterrupted and high-quality power supply for their operations. The demand for substations serving data centers, specifically, is surging globally due to the exponential growth in cloud computing and AI processing infrastructure, necessitating gigawatt-scale power installations near metropolitan hubs.

Furthermore, independent power producers (IPPs), particularly those operating large-scale renewable energy farms (solar, wind, hydroelectric), are crucial buyers. These IPPs require specialized collector substations to aggregate the generated power, convert it to transmission voltage, and inject it efficiently into the main grid. Governmental and municipal bodies, especially those overseeing public infrastructure like mass transit systems (railways, metros), also purchase specialized traction substations tailored to meet the dynamic load requirements of electric transportation networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135.5 Billion |

| Market Forecast in 2033 | $213.7 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy, General Electric Company, Eaton Corporation, Hitachi Energy, Schneider Electric SE, Mitsubishi Electric Corporation, Hyosung Heavy Industries, CG Power and Industrial Solutions Ltd., Toshiba Corporation, Larsen & Toubro (L&T), Bharat Heavy Electricals Limited (BHEL), Legrand, NARI Group Corporation, Lucy Electric, TBEA Co. Ltd., Shandong Electrical Engineering & Equipment Group, Arteche, Crompton Greaves, TE Connectivity. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Substation Market Key Technology Landscape

The technological evolution of substations is rapidly shifting towards digitization and modularization, moving away from purely mechanical and analog systems. Gas-Insulated Switchgear (GIS) remains a pivotal technology, offering enhanced safety, reliability, and compactness compared to traditional Air-Insulated Switchgear (AIS), making it indispensable for high-voltage installations in space-constrained urban environments. Furthermore, a critical trend involves the development and deployment of environmentally friendly alternatives to Sulfur Hexafluoride (SF6) gas, the potent greenhouse gas traditionally used in GIS. Manufacturers are heavily investing in gases like g3 (developed by Hitachi Energy) and mixtures utilizing fluoronitriles and perfluoroketones to meet strict climate targets, significantly altering the competitive landscape and product development focus.

The concept of the Digital Substation represents the most transformative technological advancement. This involves replacing traditional copper control wiring with fiber optic cables and implementing process bus and station bus architectures based on the IEC 61850 standard. This transition enables the integration of advanced technologies such as Merging Units (MUs) for digitalizing analog signals, sophisticated Intelligent Electronic Devices (IEDs), and centralized protection and control systems. The digital approach drastically improves data acquisition, enables remote monitoring and control, and supports complex automation schemes, preparing the grid for the complexities of renewable energy management and decentralized generation sources (Distributed Energy Resources or DERs).

Moreover, the integration of advanced data analytics, including the use of Artificial Intelligence (AI) and Machine Learning (ML), is defining the future of asset management within substations. Technologies such as Digital Twins—virtual replicas of physical substations—allow utilities to simulate operational scenarios, test new settings, and predict equipment degradation with high accuracy. Cybersecurity technologies are also becoming intrinsic to substation design, requiring secure communication protocols, robust access controls, and threat detection systems to protect against malicious attacks targeting critical infrastructure. The convergence of operational technology (OT) and information technology (IT) demands constant innovation in secure networking and data segregation within these vital electrical nodes.

Regional Highlights

The global Electrical Substation Market exhibits heterogeneous growth patterns, heavily influenced by regional investment cycles, regulatory frameworks, and demographic trends. Asia Pacific (APAC) currently dominates the market, characterized by immense demand for new transmission and distribution infrastructure driven by industrial expansion, urbanization, and large-scale government initiatives to connect remote populations to the national grid. Countries like China and India are leaders in adopting Ultra-High Voltage (UHV) transmission technology, demanding large capacity substations to transmit power efficiently from remote generation hubs (e.g., hydro and solar parks) to coastal industrial centers.

North America and Europe represent mature markets where the emphasis is shifting from new construction to modernization and replacement. Aging infrastructure across the U.S. and key European nations requires substantial upgrades to enhance reliability and accommodate bidirectional power flow from rooftop solar and other distributed sources. These regions are pioneering the implementation of fully digital substations and adopting stringent environmental standards, promoting technologies like GIS and SF6-free switchgear. Government incentives, particularly those focused on grid resilience and climate goals (like the European Green Deal), are fueling significant capital expenditure here.

Latin America and the Middle East & Africa (MEA) are emerging as high-potential growth regions. Latin America's market growth is supported by cross-border energy projects and the development of hydro and wind power generation, requiring new high-voltage substations for integration. MEA is witnessing explosive growth, primarily driven by massive renewable energy projects (e.g., solar parks in the UAE and Saudi Arabia), coupled with infrastructure development in burgeoning urban centers and investments to secure reliable power supply for critical industries, particularly in the oil and gas sector.

- Asia Pacific (APAC): Highest growth driver due to rapid industrialization, extensive grid expansion projects (UHV lines), and large-scale renewable energy integration in China and India.

- North America: Focus on grid modernization, replacement of aging assets, cybersecurity enhancements, and investments spurred by federal infrastructure bills supporting grid resilience.

- Europe: Driven by strict environmental regulations mandating SF6-free solutions, rapid adoption of digital substations (IEC 61850), and large-scale deployment of offshore wind farm collector substations.

- Middle East & Africa (MEA): Emerging market characterized by significant investment in large solar and wind energy projects and infrastructure development tied to urbanization and industrial zones (e.g., smart cities).

- Latin America (LATAM): Growth fueled by investments in cross-border transmission networks and development of regional renewable energy resources, particularly hydro and solar power.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Substation Market.- ABB Ltd.

- Siemens Energy

- General Electric Company

- Eaton Corporation

- Hitachi Energy

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- CG Power and Industrial Solutions Ltd.

- Toshiba Corporation

- Larsen & Toubro (L&T)

- Bharat Heavy Electricals Limited (BHEL)

- Legrand

- NARI Group Corporation

- Lucy Electric

- TBEA Co. Ltd.

- Shandong Electrical Engineering & Equipment Group

- Arteche

- Crompton Greaves

- TE Connectivity

Frequently Asked Questions

Analyze common user questions about the Electrical Substation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards digital substations?

The primary drivers are the need for enhanced operational efficiency, improved reliability, and seamless integration of intermittent renewable energy sources (DERs). Digital substations use standardized communication protocols (IEC 61850) and fiber optics, replacing analog systems to allow for centralized control, real-time monitoring, and advanced automation, reducing installation costs and maintenance complexities.

How does the integration of renewables affect substation requirements?

Renewable integration creates complexity by introducing bi-directional power flow and high variability, requiring substations to be highly flexible, intelligent, and capable of fast protection and control. This demands advanced switchgear, smart transformers, and sophisticated control systems to manage fluctuating power inputs and maintain overall grid stability and power quality.

What role does Gas-Insulated Switchgear (GIS) play in market growth?

GIS is crucial for market growth, especially in urban and congested areas, because it significantly reduces the physical footprint required for a substation compared to Air-Insulated Switchgear (AIS). GIS offers superior performance, enhanced safety, and lower maintenance costs due to the use of pressurized insulating gas (often SF6, or increasingly, eco-friendly alternatives) that enables compact equipment design.

What are the main cybersecurity concerns for modern electrical substations?

As substations become increasingly digitized and connected via smart grid architectures, they are vulnerable to sophisticated cyberattacks targeting Supervisory Control and Data Acquisition (SCADA) systems and Intelligent Electronic Devices (IEDs). Key concerns include unauthorized access, manipulation of protection settings, and disruption of critical operational technology (OT), necessitating robust network segmentation and continuous monitoring.

Which region holds the highest potential for new substation infrastructure development?

Asia Pacific (APAC) holds the highest potential, primarily due to continued high rates of urbanization, massive government investment in expanding national and regional grids (e.g., UHV projects), and the urgent need to build collector substations required for large-scale solar and wind power generation projects across the region.

What is a hybrid switchgear substation and what are its main advantages?

A hybrid switchgear substation combines the features of both Air-Insulated Switchgear (AIS) and Gas-Insulated Switchgear (GIS) within a single functional unit. It typically uses GIS components for critical parts like the circuit breaker and disconnector, while retaining air-insulated bushings and connections. The main advantages are reduced footprint compared to pure AIS, lower cost and easier maintenance compared to pure GIS, offering a balance of space efficiency and accessibility.

How are environmental regulations impacting transformer technology in substations?

Environmental regulations are increasingly restricting the use of mineral oil in transformers due to flammability and ecological risks. This is driving the adoption of alternatives such as ester fluids (natural and synthetic) in distribution and power transformers. Ester fluids offer higher flash points, biodegradability, and enhanced moisture tolerance, contributing to increased safety and extended equipment life while meeting stringent environmental compliance standards.

Explain the significance of IEC 61850 standard in the substation market.

IEC 61850 is a global standard defining the communication protocols and architecture for electrical substation automation. Its significance lies in enabling interoperability between equipment from different vendors, facilitating the implementation of digital substations by standardizing the communication of protection, control, and monitoring data, thereby accelerating the transition from traditional hardwired systems to modern, flexible digital networks.

What is the primary differentiation between transmission and distribution substations?

Transmission substations operate at higher voltages (typically 220 kV and above) and are designed for bulk power transfer over long distances, focusing on stepping up voltage from generators or stepping down for regional distribution. Distribution substations operate at lower voltages (typically below 66 kV) and are located closer to end-users, focusing on final voltage reduction and ensuring reliable, localized power delivery to residential, commercial, and light industrial consumers.

What are the key challenges faced by EPC contractors in substation construction?

EPC contractors face several challenges, including managing complex regulatory approvals, securing skilled labor for specialized electrical work, dealing with long lead times for high-voltage equipment like transformers, and ensuring strict adherence to project schedules and budget constraints. Integrating diverse components from multiple international suppliers while maintaining rigorous safety and quality standards adds significant complexity to project management.

How does AI contribute to asset management within substations?

AI algorithms analyze vast datasets collected from sensors, including temperature, partial discharge, vibration, and oil quality readings, to develop highly accurate predictive maintenance models. This allows utilities to move away from time-based or reactive maintenance to condition-based maintenance, optimizing resource allocation, reducing unexpected failures, and maximizing the operational lifespan of expensive assets like transformers and circuit breakers.

What factors are restraining the widespread adoption of digital substations globally?

Restraints include the high initial investment cost required for advanced fiber optic infrastructure and Intelligent Electronic Devices (IEDs), the need for specialized training for utility personnel to operate and maintain these systems, and the technical complexity of integrating new digital components with legacy analog infrastructure during retrofit projects. Cybersecurity concerns also necessitate substantial protective investment, increasing overall project complexity and cost.

What role do monitoring and communication devices play in substation efficiency?

Monitoring devices (sensors, smart meters) collect crucial operational data on temperature, voltage, and current, while communication devices (fiber optic links, secure routers) transmit this data instantly to control centers. This real-time data flow is essential for implementing Supervisory Control and Data Acquisition (SCADA) systems, enabling immediate fault response, optimizing power flow, and supporting automated load shedding and restoration processes.

Why are developing economies heavily investing in UHV substation technology?

Developing economies, particularly in APAC, are investing in Ultra-High Voltage (UHV) technology (above 550 kV) to overcome the challenge of transmitting bulk power efficiently over vast distances. UHV minimizes transmission losses, which is critical when major generation centers (e.g., remote hydro or massive solar parks) are geographically far from densely populated industrial and consumption centers, making it the most economical solution for large-scale grid build-out.

How is modularization changing the substation construction market?

Modularization involves manufacturing and pre-assembling substation components (like switchgear modules and control houses) off-site under controlled factory conditions. This approach drastically reduces construction time on site, enhances quality control, simplifies logistics, and is particularly beneficial for rapid deployment in remote locations or for temporary substations needed during large infrastructure projects.

What is the primary function of a busbar system within a substation?

The busbar system is a critical component acting as a common collection point for incoming and outgoing feeders, distributing electrical power to various circuits within the substation. It allows multiple circuits to be connected to the same source, providing flexibility for connecting power lines, transformers, and switchgear, and enabling safe circuit isolation for maintenance or fault clearance procedures.

How do substation control and protection systems differ in modern installations?

Modern control and protection systems utilize Intelligent Electronic Devices (IEDs) that integrate protection, monitoring, control, and automation functions into single digital units. Unlike older electromechanical relays, IEDs offer enhanced speed, selectivity, and communication capabilities through the IEC 61850 standard, allowing for faster fault isolation and more sophisticated system automation logic.

What is the impact of urbanization on substation design and location?

Urbanization increases power density demand in confined spaces, driving the necessity for compact, aesthetically pleasing, and safe substation designs. This trend accelerates the adoption of Gas-Insulated Substations (GIS) and underground installations, which minimize land use and mitigate visual and noise pollution, while maintaining high power capacity in metropolitan centers.

What are the key market opportunities associated with Electric Vehicle (EV) infrastructure?

The rapid proliferation of EV charging stations demands substantial upgrades to the distribution network and localized substations to manage the high, concentrated electrical load. Opportunities exist in supplying specialized, high-capacity distribution transformers and compact substations capable of managing the dynamic and increasing power demands from large-scale EV charging hubs.

What competitive advantages do Asian manufacturers hold in the global substation market?

Asian manufacturers, particularly those in China and India, benefit from large domestic market demand, robust government backing for infrastructure development, and significant expertise in Ultra-High Voltage (UHV) technology. Their ability to achieve economies of scale and often offer cost-competitive solutions gives them a strong edge, particularly in procurement processes across emerging markets in MEA and LATAM.

What is the difference between a Power Transformer and a Distribution Transformer?

Power Transformers are utilized in transmission substations to step up voltage for efficient long-distance transmission or step it down for regional grids, operating at high loads throughout the day. Distribution Transformers are smaller, used in distribution substations near end-users to step down the medium voltage to consumer-level low voltage, operating based on localized fluctuating load patterns.

How does AI use digital twins to optimize substation performance?

Digital twins create a virtual replica of a physical substation, continuously fed with real-time operational data. AI processes this data within the twin to simulate "what-if" scenarios, optimize control settings, predict the impact of maintenance actions, and proactively identify equipment stress points, allowing utilities to maximize efficiency and minimize the risk of operational failures without affecting the physical system.

What is the primary restraint caused by the long project timelines in the substation market?

Long project timelines, often spanning several years for high-voltage transmission substations, increase financial risk and exposure to regulatory changes and fluctuations in raw material prices. Furthermore, delays impede the integration of new generation capacity, particularly renewables, impacting utility goals for timely grid upgrades and decarbonization targets.

Define the Upstream analysis segment of the Substation Value Chain.

Upstream analysis focuses on the sourcing and supply of fundamental raw materials and specialized components essential for manufacturing substation equipment. This includes high-conductivity copper and aluminum for conductors, high-grade silicon steel cores for transformers, specialized insulators (porcelain or composite), and electronic components for protective relays and communication systems.

What are the implications of SF6 regulation on future substation market trends?

Strict regulation and potential bans on Sulfur Hexafluoride (SF6) due to its extremely high Global Warming Potential (GWP) are forcing manufacturers to rapidly develop and commercialize SF6-free switchgear. This trend is creating a new segment focused on eco-efficient solutions, driving R&D investment, and fundamentally changing product portfolios, particularly in highly regulated markets like the European Union.

How do utilities ensure the physical security of substations?

Physical security involves comprehensive measures including high-security fencing, electronic access control systems, 24/7 video surveillance (often equipped with AI-powered analytics for intrusion detection), and drone monitoring capabilities. Given their criticality, substations require stringent physical hardening against sabotage and vandalism to maintain grid stability.

What is the function of a collector substation in a renewable energy project?

A collector substation aggregates the power generated from numerous individual sources (e.g., wind turbines or solar inverters) within a large farm, steps up the aggregated voltage to the necessary transmission level, and delivers the power reliably and synchronously into the main electric grid or transmission system operator (TSO) network.

Why is retrofitting existing substations a major market trend in mature economies?

Retrofitting allows utilities in mature economies (like North America and Europe) to extend the operational life of decades-old Air-Insulated Switchgear (AIS) substations by integrating modern digital components, enhancing control, improving communication, and adding advanced sensor-based monitoring without incurring the massive capital expense and disruption of a full replacement, thereby improving efficiency cost-effectively.

How does modular design benefit the installation process of a substation?

Modular design streamlines the installation process by allowing large, complex components to be manufactured and factory-tested as complete units before delivery. This significantly reduces the amount of complex civil work and interconnection required on-site, decreasing overall project risk, improving worker safety, and cutting commissioning time from months to weeks.

What influence does the growing demand for data centers have on the substation market?

Data centers are exceptionally power-hungry facilities requiring high-capacity, highly reliable substations to manage gigawatt-scale power inputs. Their rapid global proliferation, particularly near urban and cloud hubs, creates intense localized demand for large, dedicated substations that can guarantee uninterrupted power supply, driving growth in the high-voltage component segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager