Electrical Water Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436364 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Electrical Water Pump Market Size

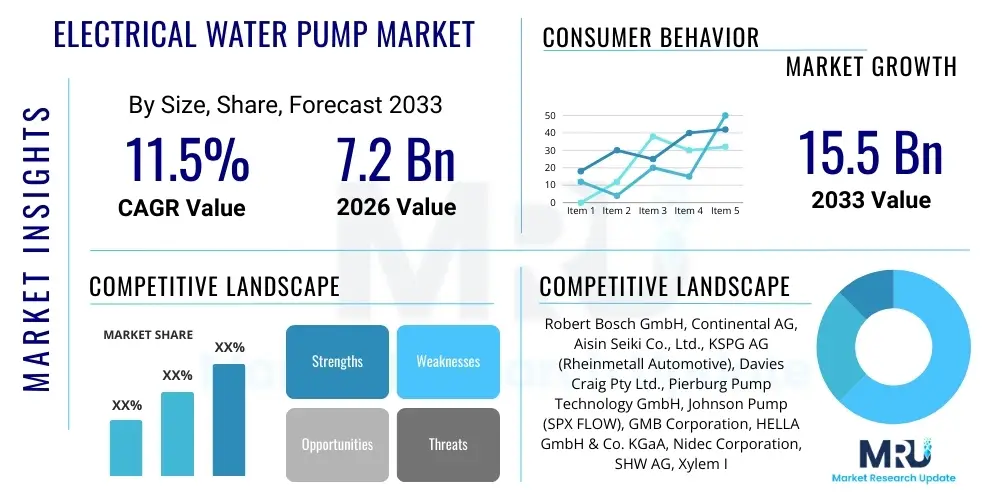

The Electrical Water Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $7.2 Billion in 2026 and is projected to reach $15.5 Billion by the end of the forecast period in 2033.

Electrical Water Pump Market introduction

The Electrical Water Pump Market encompasses devices designed to circulate fluids, predominantly water or coolants, using an electrical motor rather than being mechanically driven by an engine or external power source like traditional belt-driven pumps. These modern pumps are critical components in a wide array of applications, offering enhanced efficiency, precise flow control, and superior integration capabilities, especially in high-efficiency and electric systems. The core product definition revolves around a pump mechanism coupled with a Brushless DC (BLDC) motor and an integrated electronic controller, allowing for variable speed operation tailored to real-time system demands. This shift from fixed-speed, mechanical dependency represents a significant technological evolution.

Major applications for electrical water pumps span critical sectors, most notably the automotive industry, where they are essential for engine cooling, turbocharger cooling, and increasingly, battery thermal management in Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). Beyond transportation, these pumps find extensive use in industrial processes requiring controlled fluid movement, such as precise chemical dosing, water treatment plants, and sophisticated heating, ventilation, and air conditioning (HVAC) systems in commercial and residential buildings. Their ability to operate independently of the main power train offers significant flexibility in system design and energy conservation.

The primary benefits driving market adoption include substantial improvements in fuel economy and reduced emissions in conventional vehicles, optimized thermal management crucial for battery longevity in EVs, and lower energy consumption across industrial applications due to variable flow control. Key driving factors propelling market growth are the rigorous global mandates promoting vehicle electrification, escalating demand for energy-efficient fluid management solutions, and continuous advancements in motor and control electronics that enhance pump reliability and longevity. Furthermore, the push towards smart infrastructure and decentralized water systems is fostering new opportunities for high-precision electrical pump deployment globally, reinforcing the market's robust trajectory.

Electrical Water Pump Market Executive Summary

The Electrical Water Pump Market is undergoing rapid transformation, fueled primarily by the aggressive transition of the global automotive sector towards electrification and stringent environmental regulations promoting energy efficiency across all end-use industries. Current business trends indicate a strong move toward high-voltage (48V and above) pumps designed specifically for battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) platforms, emphasizing reliability under varying thermal loads and minimal noise production. Strategic partnerships between pump manufacturers and major automotive OEMs are increasing, focusing on co-developing integrated thermal management modules that consolidate multiple pumping and cooling functions into single, efficient units. The aftermarket is also witnessing growth, driven by the replacement cycle of earlier generations of electric pumps and the increasing complexity of vehicle cooling systems.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, attributed to the massive production and adoption rates of EVs in countries like China and India, coupled with significant investments in smart industrial and agricultural water management infrastructure. Europe follows closely, driven by strict EU emission standards (Euro 7 pending) and pioneering policies supporting sustainable building technologies, necessitating the use of highly efficient electrical pumps in HVAC and heat recovery systems. North America is experiencing steady growth, supported by governmental incentives for EV adoption and industrial modernization projects focused on energy conservation, though infrastructure investment pace remains a variable factor affecting localized market penetration rates.

Segment trends highlight the dominance of centrifugal pumps due to their high flow rate capabilities essential for main circulation loops in both automotive and industrial cooling. In terms of voltage, the segment encompassing 48V and systems greater than 48V is expected to demonstrate the highest CAGR, reflecting the industry standard shift towards robust electrical architectures required by advanced EV powertrains and high-capacity industrial machinery. Application-wise, the automotive sector remains the primary revenue generator, with battery and cabin heating/cooling applications rapidly eclipsing traditional engine cooling applications, signaling a fundamental shift in product design priorities towards electric thermal management specialization. The convergence of IoT and advanced diagnostics is also enabling new service models centered around predictive maintenance and remote monitoring of pump health.

AI Impact Analysis on Electrical Water Pump Market

Common user questions regarding AI's influence on the Electrical Water Pump Market often revolve around predictive maintenance capabilities, optimal energy consumption achieved through smart controllers, and how AI can improve manufacturing quality and reduce downtime. Users are concerned with whether AI integration will significantly increase the unit cost and the complexity of integration into existing industrial systems. The analysis reveals a strong user expectation for AI to fundamentally enhance the operational lifespan and efficiency of these pumps. Key themes emerging are the desire for self-diagnosing pumps, algorithms that dynamically adjust flow rates based on anticipated cooling demands (e.g., anticipating traffic patterns for EV cooling), and the optimization of supply chain logistics for high-demand components like advanced motor magnets and integrated circuits.

- Predictive Maintenance Optimization: AI algorithms analyze real-time vibration, temperature, and current draw data to forecast potential pump failures, significantly reducing unplanned downtime and enabling proactive replacement strategies, thereby extending Mean Time Between Failures (MTBF).

- Energy Consumption Regulation: Machine learning models optimize pump speed and flow control by learning system dynamics and external variables (ambient temperature, load demands), ensuring the pump uses only the minimum required power, resulting in substantial energy savings, particularly in large industrial HVAC systems.

- Advanced Manufacturing and Quality Control: AI vision systems and process control tools are utilized during production to monitor assembly tolerances and material integrity, ensuring zero-defect manufacturing of critical pump components and electronics, leading to higher product reliability.

- Supply Chain Resilience: AI tools forecast component demand fluctuations, manage inventory levels, and identify potential risks in the sourcing of specialized materials (e.g., rare earth magnets), enhancing the resilience and efficiency of the global supply chain for electrical water pumps.

- Autonomous Thermal Management: In automotive applications, AI controllers utilize external data (navigation, weather) to intelligently pre-condition the battery or cabin environment, optimizing cooling cycles even before peak demand occurs, maximizing battery life and vehicle range.

DRO & Impact Forces Of Electrical Water Pump Market

The dynamics of the Electrical Water Pump Market are dictated by a powerful combination of drivers, restraints, and opportunities, collectively shaped by impactful market forces. Key drivers include the exponential growth in electric vehicle production globally, necessitating complex and highly reliable thermal management systems powered exclusively by electrical pumps. Furthermore, escalating industrial and regulatory pressure to reduce energy consumption in fluid transfer applications and the rapid modernization of infrastructure, especially in developing economies, substantially bolster demand. These factors collectively push manufacturers toward producing smarter, more durable, and highly integrated pump solutions capable of continuous variable operation, meeting the stringent requirements of new applications in battery cooling and industrial processing where precision is paramount.

Conversely, significant restraints hinder market potential. The high initial manufacturing cost associated with incorporating advanced components like BLDC motors, integrated electronic control units (ECUs), and specialized materials presents a barrier, especially when competing with traditional, less expensive mechanical pumps in lower-tier markets. Standardization challenges, particularly regarding voltage requirements, communication protocols (like CAN bus interfaces for automotive use), and physical integration dimensions across diverse OEM platforms, complicate large-scale manufacturing and market fragmentation. Moreover, the complexity of diagnosing and repairing electronic faults in these integrated pumps requires specialized technical training and infrastructure, posing maintenance challenges for end-users and the aftermarket supply chain, thereby impacting total cost of ownership perception.

Opportunities for growth are vast, particularly within the nascent sectors of hydrogen fuel cell vehicles (which require highly specialized thermal control), decentralized solar thermal systems in residential areas, and smart agriculture, where electrical pumps enable precise, localized irrigation control using renewable energy sources. The potential for integrating pumps with IoT platforms for remote monitoring and data analytics offers manufacturers a pathway to transition towards service-oriented business models. The overall impact forces are overwhelmingly positive, driven by technological necessity (electrification) and environmental mandates (efficiency), compelling the industry to overcome cost and standardization hurdles through innovation and economies of scale. These forces are rapidly accelerating the displacement of mechanical alternatives, particularly in mission-critical applications where efficiency and control are non-negotiable performance parameters.

Segmentation Analysis

The Electrical Water Pump Market is comprehensively segmented based on product type, voltage requirements, and the primary application area, providing a nuanced view of market dynamics and targeted growth pockets. Product segmentation differentiates the market based on the fundamental mechanism used for fluid transfer, reflecting distinct performance characteristics tailored for specific environments—from high-flow centrifugal designs suitable for main cooling loops to positive displacement pumps offering precise volumetric control. Voltage segmentation is crucial, particularly in the automotive and high-capacity industrial sectors, as it reflects the power architecture necessary for handling the increasing thermal load demands of advanced systems, marking a clear delineation between auxiliary pumps in traditional vehicles and primary pumps in BEVs. The application segmentation, spanning Automotive, Industrial, and Residential, dictates design parameters such as durability, operating temperature range, and communication integration complexity.

Analyzing these segments reveals shifts in demand towards higher complexity and higher voltage specifications. Within the product type, Electric Centrifugal Pumps dominate due to their efficiency and scalability for large fluid volume movement, essential for EV battery cooling and extensive industrial cooling towers. However, Electric Diaphragm Pumps and Electric Gear Pumps are gaining traction in niche, high-precision applications like medical equipment cooling or chemical metering. The rapid scaling of the 48V and >48V voltage segments directly correlates with the increasing energy demands of contemporary hybrid and pure electric vehicle platforms, requiring pump systems that can handle substantial power outputs reliably and safely, moving away from legacy 12V systems.

The Application segment highlights the automotive industry as the clear market leader, driven by regulatory shifts and consumer preference for electrified transport. Within automotive applications, the sub-segment focusing on battery thermal management systems (BTMS) is exhibiting hyper-growth, significantly outpacing traditional engine cooling applications. This shift demands pumps with higher corrosion resistance, specialized noise reduction features, and seamless integration with complex vehicle control units (VCUs). Furthermore, the industrial application segment, particularly water treatment and chemical processing, continues to demand high-reliability electrical pumps that integrate with IoT protocols for remote process optimization, underpinning sustained, consistent growth outside of the automotive dependency.

- By Product Type:

- Electric Centrifugal Pump

- Electric Diaphragm Pump

- Electric Submersible Pump

- Electric Gear Pump

- By Voltage:

- 12V

- 24V

- 48V

- >48V (High Voltage Systems)

- By Application:

- Automotive

- Engine Cooling

- Turbocharger Cooling

- Battery Thermal Management Systems (BTMS)

- HVAC and Cabin Heating

- Industrial

- Chemical Processing

- Water and Wastewater Treatment

- Oil and Gas

- HVAC and Refrigeration

- Residential

- Solar Thermal Systems

- Boiler Systems

- Residential HVAC

Value Chain Analysis For Electrical Water Pump Market

The value chain for the Electrical Water Pump Market is complex, stretching from the sourcing of specialized raw materials to final integration into Original Equipment Manufacturer (OEM) systems or distribution through the aftermarket. Upstream activities involve the procurement of high-grade materials, particularly critical components such as rare earth magnets (Neodymium Iron Boron) essential for efficient BLDC motor manufacturing, high-quality plastics and alloys for pump housings resistant to corrosion and high temperatures, and sophisticated electronic components including microcontrollers and power MOSFETs for the integrated control unit. Efficiency in this phase is highly dependent on managing global commodity price volatility and ensuring the security of the supply of critical electronics, which often involves Tier 2 and Tier 3 suppliers specializing in magnetics and semiconductors. Manufacturing involves high-precision molding, motor winding, electronic assembly, and rigorous testing, requiring substantial capital investment in automated assembly lines and quality assurance protocols.

Midstream processes focus on the distribution channel, which is distinctly split into OEM supply and the aftermarket. For OEM supply, large pump manufacturers engage in long-term contracts, often requiring strict just-in-time (JIT) delivery and adherence to customized design specifications dictated by vehicle or industrial system integrators. This channel is characterized by high volume and lower margins but ensures stable, continuous demand. The aftermarket distribution involves independent distributors, local parts retailers, and specialized service centers, characterized by higher pricing variability and a focus on stock availability and localized support, demanding efficient logistics networks capable of handling a broad catalog of replacement parts tailored to various model years and pump specifications. The shift towards integrated modules often reduces simple component replacement, pushing the aftermarket toward entire assembly replacements.

Downstream analysis highlights the end-user interaction. In the automotive sector, pump integration is managed by Tier 1 automotive suppliers or the OEMs themselves, requiring deep technical collaboration during the vehicle development cycle. Direct sales are rare outside of specialized industrial projects. Indirect distribution through authorized partners or large-scale wholesale distributors dominates the industrial and residential segments, where installation and maintenance are typically handled by certified contractors or service providers. The emerging trend towards IoT-enabled pumps is introducing a new service dimension downstream, where manufacturers can offer data-driven diagnostic and maintenance subscriptions, moving the value focus beyond the initial hardware sale and improving customer retention and lifecycle profitability. Ensuring robust cybersecurity for these connected devices is becoming a critical downstream activity.

Electrical Water Pump Market Potential Customers

The primary end-users and buyers of electrical water pumps are highly specialized entities operating across distinct market verticals, all sharing the requirement for high-efficiency, reliable, and precisely controlled fluid circulation. In the automotive industry, the immediate potential customers are global Original Equipment Manufacturers (OEMs) such as BMW, Tesla, Volkswagen Group, and Toyota, alongside Tier 1 suppliers like Continental and Bosch, who integrate these pumps into complex subsystems for internal combustion engine cooling, turbocharging, and crucially, Battery Thermal Management Systems (BTMS) for electric vehicles. These customers prioritize long lifespan, integration capabilities (e.g., CAN communication), size and weight minimization, and adherence to stringent automotive quality standards (e.g., IATF 16949). The surge in EV production has created an enormous, non-negotiable demand for these components, positioning OEMs as the highest-value customer segment.

The industrial sector represents the second major customer base, encompassing municipal water and wastewater treatment facilities, large chemical and pharmaceutical manufacturers, and general heavy machinery operators. These customers utilize electrical water pumps for applications requiring continuous, high-duty cycle operation, precise chemical dosing, process cooling, and filtration. Their purchasing decisions are primarily driven by Total Cost of Ownership (TCO), focusing heavily on energy efficiency, robustness, material compatibility (especially for corrosive fluids), and the availability of advanced monitoring and diagnostic features. Furthermore, specialized industrial OEMs that manufacture large-scale HVAC systems, power generation equipment, and sophisticated cooling units (e.g., data center cooling infrastructure) are also significant buyers, integrating pumps into their final products before distribution.

In the residential and commercial building segment, potential customers include large-scale commercial property developers, specialized HVAC installation companies, and distributors focused on home energy systems. Applications here typically involve domestic hot water circulation, boiler systems, and integration with solar thermal energy solutions. While volume per unit purchase is smaller than in the OEM sector, the aggregate demand from ongoing construction and home modernization projects provides a steady revenue stream. These customers value simplicity of installation, low noise levels, and compliance with local energy efficiency building codes. The convergence of smart home technology further increases demand for electrical pumps that can communicate with central home automation systems, offering enhanced control and energy savings to the final homeowner or facility manager.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.2 Billion |

| Market Forecast in 2033 | $15.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Aisin Seiki Co., Ltd., KSPG AG (Rheinmetall Automotive), Davies Craig Pty Ltd., Pierburg Pump Technology GmbH, Johnson Pump (SPX FLOW), GMB Corporation, HELLA GmbH & Co. KGaA, Nidec Corporation, SHW AG, Xylem Inc., Grundfos Holding A/S, Flowserve Corporation, Tuthill Corporation, Sulzer Ltd., Ebara Corporation, Mikuni Corporation, C&U Group, Delphi Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Water Pump Market Key Technology Landscape

The technological landscape of the Electrical Water Pump Market is dominated by advancements focused on maximizing energy efficiency, enhancing reliability, and facilitating seamless integration into complex digital control systems. Central to this evolution is the widespread adoption of Brushless DC (BLDC) motor technology. BLDC motors offer significantly higher efficiency and longer operational life compared to traditional brushed motors, largely due to the elimination of physical commutation components which reduces wear and thermal losses. The shift to BLDC necessitates sophisticated electronic control units (ECUs) which manage variable speed operation, crucial for optimizing flow rates based on real-time thermal demands in applications like EV battery cooling, ensuring precise and instantaneous adjustments that enhance overall system performance and energy conservation.

Another critical area of technological innovation involves sensor integration and communication protocols. Modern electrical water pumps are increasingly embedded with pressure, temperature, and vibration sensors that feed diagnostic data directly back to the vehicle control unit (VCU) or industrial programmable logic controller (PLC) via robust digital interfaces such as the Controller Area Network (CAN) bus. This enables closed-loop control and highly accurate monitoring of pump health, facilitating predictive maintenance strategies. The standardization of these communication protocols is vital for interoperability across different OEM platforms, significantly reducing integration time and complexity for end-users and component suppliers alike, thereby driving technological efficiency and system reliability.

Furthermore, material science advancements play a key role in improving pump durability and operational limits. Manufacturers are utilizing advanced thermoplastic polymers and specialized metal alloys that exhibit superior resistance to corrosion, cavitation, and high-temperature coolants, including glycol-water mixtures and specialized low-conductivity fluids required for battery cooling systems. These materials not only extend the pump's service life but also contribute to weight reduction, a crucial factor in the design optimization of electric vehicles. Ongoing research into magnetic materials and winding techniques further aims to increase the power density of the electrical motors, allowing smaller, lighter pumps to handle equivalent or greater fluid circulation requirements, continuously pushing the boundaries of miniaturization and performance optimization within the competitive market landscape.

Regional Highlights

The global Electrical Water Pump Market exhibits significant regional variations in growth and market maturity, heavily influenced by local regulatory frameworks, the pace of automotive electrification, and infrastructure investment trends.

- Asia Pacific (APAC): APAC is the fastest-growing and largest regional market, primarily driven by China's dominant position in electric vehicle manufacturing and adoption. Government subsidies, coupled with a massive internal consumer market, have accelerated the transition to e-mobility, creating immense demand for high-voltage, specialized thermal management pumps. India and South Korea are also contributing significantly through rapidly expanding industrial sectors and increased adoption of energy-efficient solutions in commercial building infrastructure.

- Europe: Europe represents a mature but rapidly evolving market, characterized by stringent environmental regulations (EU emissions targets) and strong political support for electric and hybrid vehicle integration. The region is a leader in implementing advanced heat pump technologies for residential and commercial heating, bolstering demand for high-efficiency electrical circulation pumps. Germany, France, and the Nordic countries are central to this growth, focusing heavily on premium, high-performance pump systems.

- North America: The North American market is experiencing steady growth, propelled by increasing production capacity for electric trucks and SUVs, especially in the United States. Federal and state incentives promoting vehicle electrification and investments in renewable energy infrastructure are key drivers. Demand is high for robust industrial pumps for oil and gas processing and municipal water systems, in addition to the expanding automotive requirements.

- Latin America (LATAM): LATAM is an emerging market with potential, though growth is currently slower, constrained by economic volatility and slower EV adoption rates compared to other regions. Demand is primarily concentrated in industrial applications, particularly mining and agriculture, where reliable, low-maintenance electrical pumping solutions are valued. Brazil and Mexico lead regional market development.

- Middle East and Africa (MEA): The MEA region is characterized by steady, infrastructure-driven demand. Investments in water desalination plants, district cooling systems in major urban centers (e.g., UAE, Saudi Arabia), and nascent efforts toward sustainable energy projects drive the need for robust, high-durability electrical pumps capable of operating in extreme temperatures and harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Water Pump Market.- Robert Bosch GmbH

- Continental AG

- Aisin Seiki Co., Ltd.

- KSPG AG (Rheinmetall Automotive)

- Davies Craig Pty Ltd.

- Pierburg Pump Technology GmbH

- Johnson Pump (SPX FLOW)

- GMB Corporation

- HELLA GmbH & Co. KGaA

- Nidec Corporation

- SHW AG

- Xylem Inc.

- Grundfos Holding A/S

- Flowserve Corporation

- Tuthill Corporation

- Sulzer Ltd.

- Ebara Corporation

- Mikuni Corporation

- C&U Group

- Delphi Technologies

Frequently Asked Questions

Analyze common user questions about the Electrical Water Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of electrical water pumps over traditional mechanical pumps?

The primary advantage is variable flow control independent of engine speed, which significantly enhances energy efficiency and allows for precise thermal management. This independence is critical in electric vehicles (EVs) for optimizing battery temperature and maximizing overall vehicle range and battery life.

How is the growth of Electric Vehicles (EVs) impacting the Electrical Water Pump Market?

EV growth is the single largest market driver. It necessitates multiple, specialized electrical pumps per vehicle for battery thermal management systems (BTMS), cabin heating/cooling, and power electronics cooling, shifting demand heavily toward high-voltage (48V and >48V), highly integrated pump solutions with digital communication capabilities.

What key technology is essential for the high efficiency of modern electrical water pumps?

Brushless DC (BLDC) motor technology is essential. BLDC motors, coupled with integrated electronic control units (ECUs), minimize friction and heat losses compared to older brushed motors, enabling higher power density, longer service life, and precise variable speed operation required for modern, energy-sensitive applications.

Which application segment holds the largest market share for electrical water pumps?

The Automotive application segment currently holds the largest market share. Within this segment, the demand for Battery Thermal Management Systems (BTMS) cooling pumps is experiencing the fastest growth rate, surpassing traditional internal combustion engine cooling as electrification accelerates globally.

What are the main regional growth drivers for the Electrical Water Pump Market?

Asia Pacific (APAC), particularly China, drives global growth due to aggressive EV manufacturing and adoption. Europe is driven by stringent environmental standards and a strong focus on high-efficiency HVAC and solar thermal systems, while North America is supported by rising EV production and industrial modernization initiatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager