Electrical Wholesalers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431465 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Electrical Wholesalers Market Size

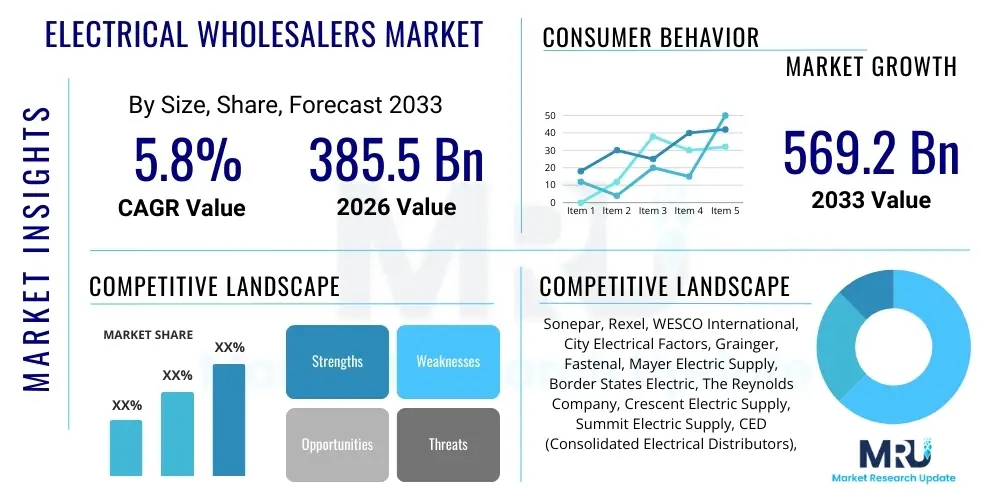

The Electrical Wholesalers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $385.5 Billion in 2026 and is projected to reach $569.2 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating pace of global infrastructure development, rapid urbanization, and the continuous necessity for upgrading aging electrical grids across developed economies.

Electrical Wholesalers Market introduction

The Electrical Wholesalers Market encompasses the distribution network responsible for supplying electrical products, components, and equipment from manufacturers to contractors, industrial users, utilities, and retailers. This critical intermediary sector ensures the smooth flow of essential items, ranging from basic wiring and conduits to complex distribution equipment, lighting solutions, and sophisticated automation controls. The market acts as a vital link facilitating construction, maintenance, and operational activities across residential, commercial, and industrial domains, serving as the backbone for infrastructural resilience and development globally.

Key applications of products distributed by electrical wholesalers include new construction projects, renovation and retrofit initiatives aimed at enhancing energy efficiency, integrating renewable energy sources (like solar and wind components), and maintaining existing power distribution systems. Benefits derived from a robust wholesaling sector include optimized inventory management, specialized technical support, streamlined procurement processes for contractors, and rapid access to a diverse array of products necessary for compliance with increasingly stringent electrical and safety standards. Driving factors for market growth involve substantial government spending on smart city initiatives, the global push towards decarbonization necessitating electrical infrastructure upgrades, and the explosive demand for IoT-enabled and smart building technologies.

Electrical Wholesalers Market Executive Summary

The Electrical Wholesalers Market is undergoing a significant transformation driven by digitization and supply chain recalibration. Business trends indicate a strong shift towards hybrid distribution models, where traditional brick-and-mortar outlets integrate advanced e-commerce capabilities to cater to the speed and convenience demands of modern contractors. Operational efficiency is paramount, leading to widespread adoption of warehouse automation and predictive inventory management systems. Simultaneously, there is an increasing consolidation among key players seeking to leverage economies of scale and expand geographic reach, particularly into high-growth emerging economies.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, propelled by massive urbanization, industrial expansion in countries like China and India, and significant investment in renewable energy generation capacity. North America and Europe maintain leading positions in terms of market maturity and technological adoption, focusing heavily on smart grid components and energy-efficient retrofitting projects. These developed regions are driving demand for premium, value-added services such as pre-assembly and logistics support, moving wholesalers beyond mere transactional roles to becoming integral project partners.

Segmentation trends reveal substantial growth within the lighting segment, particularly for LED and smart lighting systems, driven by global energy efficiency mandates. Furthermore, the industrial application segment, focused on specialized equipment for manufacturing and utilities, shows robust and stable growth, bolstered by industrial automation trends (Industry 4.0). Distribution channels are diversifying, with online sales capturing a growing share, especially for standardized products, while complex, high-value, or bespoke electrical distribution equipment remains primarily routed through traditional, relationship-driven offline channels, emphasizing the need for multichannel strategies.

AI Impact Analysis on Electrical Wholesalers Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the historically manual processes of electrical wholesaling, specifically regarding inventory accuracy, demand volatility prediction, and optimizing complex logistics networks. The key themes revolve around expectations for AI to solve persistent operational challenges, such as handling thousands of unique SKUs, minimizing obsolescence risk, and providing personalized, instant quoting for diverse customer segments (from large utilities to independent contractors). Concerns center on the cost of implementation, the availability of clean historical data needed to train effective AI models, and the necessary upskilling of the existing sales and warehouse workforce to utilize AI-driven tools effectively. Overall, the market expects AI to transition wholesalers from reactive order fulfillment to proactive, data-driven supply partners.

- AI-Powered Demand Forecasting: Enhances accuracy in predicting fluctuating demand patterns for seasonal construction cycles and specific electrical components, significantly reducing stockouts and excess inventory.

- Optimized Inventory Management: Utilizes machine learning to analyze transaction history, lead times, and storage costs, providing real-time recommendations for optimal warehouse stock levels.

- Automated Pricing and Quoting: AI algorithms rapidly generate complex, project-specific quotes tailored to contractor purchasing history and current market dynamics, improving sales efficiency and margin capture.

- Warehouse Robotics and Logistics: AI orchestrates autonomous mobile robots (AMRs) and automated storage and retrieval systems (AS/RS) within distribution centers, accelerating picking, packing, and sorting processes.

- Predictive Maintenance for Equipment: Applies AI to monitor the performance of heavy electrical equipment (like transformers or switchgear) in the utility segment, allowing wholesalers to offer predictive replacement and service contracts.

- Personalized Customer Service: AI chatbots and virtual assistants provide 24/7 technical support and order tracking, improving the overall digital customer experience for contractors.

DRO & Impact Forces Of Electrical Wholesalers Market

The dynamics of the Electrical Wholesalers Market are fundamentally shaped by a combination of global macroeconomic trends, technological disruption, and inherent industry constraints. The market is primarily driven by massive global investment in critical infrastructure, spanning transportation networks, renewable energy farms, and residential housing complexes, all requiring vast quantities of electrical components. Simultaneously, the pervasive movement towards adopting smart building technologies and industrial automation (Industry 4.0) mandates higher-value, more complex products, pushing wholesalers to expand their technical expertise and product range significantly. These core drivers ensure consistent base demand regardless of minor economic fluctuations.

However, the market faces structural restraints, notably persistent volatility in commodity prices, particularly copper and aluminum, which directly impacts the cost of crucial products like cables and conductors, challenging margin stability for wholesalers. Additionally, the increasing complexity of global supply chains, exemplified by geopolitical tensions and logistics bottlenecks, creates uncertainty regarding product availability and delivery timelines. Finding and retaining a skilled workforce, particularly those capable of managing complex digitized inventory systems and providing specialized technical sales support, remains a significant constraint across developed markets.

Opportunities abound, centering on the vast potential of e-commerce expansion, allowing wholesalers to reach smaller or more remote customers efficiently while reducing operational overhead associated with physical branches. Furthermore, the global adoption of stringent energy efficiency standards presents lucrative growth pathways in supplying high-efficiency components, such as LED lighting and advanced motor controls. Impact forces—the factors that amplify or mitigate the effects of DRO—include the rapid pace of regulatory changes (e.g., green building codes), the increasing influence of manufacturer direct-to-consumer models (bypassing traditional wholesalers), and the emergence of specialized niche distributors focusing solely on high-tech segments like EV charging infrastructure.

Segmentation Analysis

The Electrical Wholesalers Market is segmented based on the type of product distributed, the specific end-use application of those products, and the channel through which they are sold. This intricate segmentation allows market players to tailor their inventory, logistics, and sales strategies to highly specific customer needs, from bulk commodity suppliers for utilities to specialized high-margin component providers for commercial integration projects. The product segmentation, covering foundational elements like wiring alongside highly complex switchgear, dictates inventory holding strategies and the level of technical knowledge required by the sales force. The application segmentation, ranging across residential, commercial, industrial, and utility sectors, determines volume purchasing power and regulatory compliance requirements.

Analysis by end-use application confirms that the Industrial and Utility sectors typically demand larger, more consistent volumes of specialized equipment, often requiring stringent quality assurance and long-term contracts. Conversely, the Residential and Commercial segments exhibit higher transaction frequency but lower average order values, necessitating highly efficient fulfillment processes suitable for contractor job site delivery. The shift in distribution channels, specifically the ascent of online platforms, reflects a broader digital transformation where customers demand 24/7 access to pricing, inventory status, and order placement capabilities, pressuring traditional wholesalers to invest heavily in robust digital infrastructure to maintain relevance and competitive advantage across all segments.

- By Product Type:

- Cables and Wires

- Wiring Devices (Switches, Sockets, Connectors)

- Lighting Fixtures and Controls (LED, Smart Lighting)

- Distribution Equipment (Circuit Breakers, Switchgear, Transformers)

- Control and Automation Products (PLCs, Sensors, Relays)

- Installation Materials and Tools

- By Application:

- Residential

- Commercial (Office Buildings, Retail, Healthcare)

- Industrial (Manufacturing, Processing Plants)

- Utility and Infrastructure (Power Generation, Transmission, Public Works)

- By Distribution Channel:

- Offline (Branch Networks, Physical Stores)

- Online (E-commerce Platforms, B2B Portals)

Value Chain Analysis For Electrical Wholesalers Market

The value chain for the Electrical Wholesalers Market starts significantly upstream with raw material providers, primarily supplying copper, aluminum, and plastics, followed by the original equipment manufacturers (OEMs) who transform these materials into finished electrical components and equipment. Upstream analysis involves assessing commodity price volatility and managing complex relationships with diverse manufacturers across geographies, ensuring consistent quality and adherence to global safety standards. Effective supplier relationship management and sophisticated contract negotiation are crucial at this stage to secure favorable pricing and reliable supply, particularly for high-demand items.

The core function of the wholesaler lies in mid-chain activities, including procurement, inventory holding, value-added services (such as cutting wire to length, bundling materials, kitting, and pre-assembly), and sophisticated logistics management. The efficiency of the wholesaler's distribution centers and the sophistication of its inventory planning systems directly determine profitability. Downstream analysis focuses on delivering products to the diverse customer base—including electricians, contractors, facility managers, and industrial procurement departments—through appropriate distribution channels, which include large branch networks, specialized sales teams, and rapidly evolving direct e-commerce platforms. The ability to offer fast, reliable, and accurate job-site delivery is a key differentiator in the highly competitive downstream environment.

Distribution channels are categorized into direct and indirect methods. Direct channels involve the wholesaler’s own extensive network of physical branches, where contractors visit to purchase or collect ordered goods, often relying on counter staff for immediate technical advice. Indirect channels increasingly utilize digital platforms and third-party logistics providers (3PLs) for fulfillment. The strategic challenge for wholesalers is balancing the high service level demanded by direct channels (relationship-based sales) with the cost efficiencies and extended reach offered by indirect, digitally optimized fulfillment models. The integration of advanced ERP and CRM systems across all distribution points is essential for providing a seamless, omni-channel customer experience.

Electrical Wholesalers Market Potential Customers

The potential customers and end-users of the Electrical Wholesalers Market are broadly diversified across all segments of the economy that rely on powered infrastructure. The largest and most frequent buyers are electrical contractors and installation companies, ranging from small independent electricians handling residential wiring to massive multinational firms executing complex industrial or utility projects. These buyers rely on wholesalers for prompt access to standardized and specialized materials required daily to maintain project timelines and budgetary constraints. Their needs focus primarily on speed of delivery, reliability of stock, and competitive pricing across a high volume of SKUs.

Beyond professional contractors, significant end-user segments include industrial maintenance departments, utility companies (focused on grid infrastructure and generation plant upkeep), and institutional buyers such as government entities, educational facilities, and healthcare organizations. Industrial customers typically require specialized, heavy-duty equipment and high-level technical support for automation and control components. Utility companies are critical customers for high-voltage cables, transformers, and large switchgear, where procurement is often dictated by stringent regulatory compliance and long-term supply contracts. The increasing demand for efficient and compliant components by commercial property managers engaged in green retrofitting also represents a rapidly growing customer base, focused on energy management systems and smart building controls.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385.5 Billion |

| Market Forecast in 2033 | $569.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sonepar, Rexel, WESCO International, City Electrical Factors, Grainger, Fastenal, Mayer Electric Supply, Border States Electric, The Reynolds Company, Crescent Electric Supply, Summit Electric Supply, CED (Consolidated Electrical Distributors), Platt Electric Supply, Accu-Tech, Gexpro, AD (Affiliated Distributors), Dakota Supply Group, EESCO, Anixter (Wesco), McNaughton-McKay Electric Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Wholesalers Market Key Technology Landscape

The technological evolution of the Electrical Wholesalers Market is centered on achieving operational excellence, optimizing the supply chain, and enhancing the digital customer interface. Central to this transformation is the adoption of advanced Enterprise Resource Planning (ERP) systems, specifically customized to handle the complexities of electrical distribution, which often involves thousands of highly specific SKUs, variable pricing tiers, and diverse regulatory requirements. Modern ERP solutions integrate inventory management, financial tracking, procurement, and sales data into a unified platform, enabling real-time decision-making regarding stock allocation and margin analysis, moving beyond traditional, fragmented legacy systems.

E-commerce and digital presence platforms represent the crucial customer-facing technologies. Wholesalers are rapidly deploying sophisticated B2B portals that mimic the user experience of B2C platforms while incorporating B2B specific functionalities, such as multi-user accounts, negotiated contract pricing displays, detailed product specification sheets, and digital quote request management. These platforms are increasingly supported by Product Information Management (PIM) systems, which ensure the accuracy and consistency of technical data across all digital and print media, addressing the common industry challenge of complex product specifications and compatibility issues.

Furthermore, operational technologies are becoming indispensable within distribution centers. This includes the implementation of automated storage and retrieval systems (AS/RS), robotics for palletizing and sorting, and extensive use of Radio-Frequency Identification (RFID) tags and barcode scanning for rapid and highly accurate inventory tracking and fulfillment. The integration of telematics and route optimization software ensures efficient, last-mile delivery to job sites, minimizing transportation costs and improving customer satisfaction through precise delivery window management. Investment in these technologies is critical for wholesalers seeking to compete effectively against pure-play digital distributors and maintain high service levels in a volume-driven market.

Regional Highlights

- North America: This region represents a mature and technologically advanced market characterized by high demand for smart home technology, industrial automation components, and significant investment in modernizing utility infrastructure, particularly in grid resilience and cybersecurity. The U.S. market, driven by construction spending and federal infrastructure legislation, dominates regional growth. Wholesalers here prioritize rapid fulfillment and value-added services like kitting and pre-assembly to serve large contractor bases.

- Europe: Driven by stringent energy efficiency directives (like the European Green Deal) and the mandated transition to renewable energy sources, Europe exhibits strong demand for energy management systems, advanced LED lighting, and components related to electric vehicle (EV) charging infrastructure. Germany, the UK, and France are pivotal markets, focusing on digitalization of the supply chain and integrating specialized services for complex retrofit projects within aging commercial and residential buildings.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC is fueled by massive urbanization, rapid industrialization, and unprecedented infrastructural spending, especially in China, India, and Southeast Asia. The region exhibits high demand for foundational products (cables, wires) alongside rapid uptake of advanced solutions necessary for new city planning and industrial expansion. Price competition is intense, but the sheer scale of construction projects offers immense volume opportunities for regional and global wholesalers.

- Latin America (LATAM): Growth in LATAM is more variable, highly correlated with specific country economic stability and investment cycles in mining, oil and gas, and public works. Brazil and Mexico are the primary drivers, showing increasing interest in commercial automation and efficient lighting solutions. Challenges include complex logistics and regulatory hurdles, necessitating strong local partnerships for effective distribution.

- Middle East and Africa (MEA): Growth is concentrated in the GCC states (UAE, Saudi Arabia) due to ambitious mega-projects (e.g., NEOM) and diversification away from oil dependence, leading to high investment in smart infrastructure and sustainable energy projects. Demand is premium-oriented, focusing on high-specification, reliable electrical distribution equipment suitable for harsh climate conditions. The African market remains highly fragmented, with opportunities concentrated in select high-growth urban hubs where infrastructure development is prioritized.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Wholesalers Market.- Sonepar

- Rexel

- WESCO International

- City Electrical Factors (CEF)

- Grainger

- Fastenal

- Mayer Electric Supply

- Border States Electric

- The Reynolds Company

- Crescent Electric Supply

- Summit Electric Supply

- CED (Consolidated Electrical Distributors)

- Platt Electric Supply

- Accu-Tech

- Gexpro

- AD (Affiliated Distributors)

- Dakota Supply Group

- EESCO

- Anixter (Wesco subsidiary)

- McNaughton-McKay Electric Company

Frequently Asked Questions

Analyze common user questions about the Electrical Wholesalers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary trends are driving revenue growth for electrical wholesalers?

The key drivers of revenue growth are the global transition to smart infrastructure and renewable energy integration, requiring specialized components for solar, wind, and smart grid systems. Additionally, the increasing demand for energy-efficient retrofitting in commercial buildings fuels high-margin sales of LED lighting and advanced control systems.

How is digital transformation affecting traditional electrical wholesalers?

Digital transformation is forcing traditional wholesalers to adopt omni-channel strategies, integrating robust B2B e-commerce platforms with their physical branch networks. This shift optimizes the procurement experience for contractors, allowing 24/7 ordering, real-time inventory checks, and highly efficient job-site delivery scheduling.

Which geographical region offers the highest growth potential in this market?

The Asia Pacific (APAC) region, specifically driven by large-scale infrastructure projects, rapid urbanization, and industrial expansion in emerging economies like India and Southeast Asia, is projected to offer the highest Compound Annual Growth Rate (CAGR) and volume opportunities throughout the forecast period.

What is the main challenge related to supply chain management in the electrical wholesaling industry?

The primary challenge is managing extreme price volatility in key commodities, such as copper and aluminum, coupled with geopolitical risks that cause global logistics bottlenecks. This instability severely impacts inventory costs, necessitates complex hedging strategies, and makes long-term fixed-price contracting difficult for wholesalers.

What role does kitting and pre-assembly play in the wholesaler value proposition?

Kitting and pre-assembly are value-added services that enhance the wholesaler’s proposition by grouping and pre-packaging all necessary components for a specific task (e.g., lighting installation or control panel wiring). This reduces labor time and complexity for contractors on the job site, transforming the wholesaler into a more strategic project logistics partner.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager