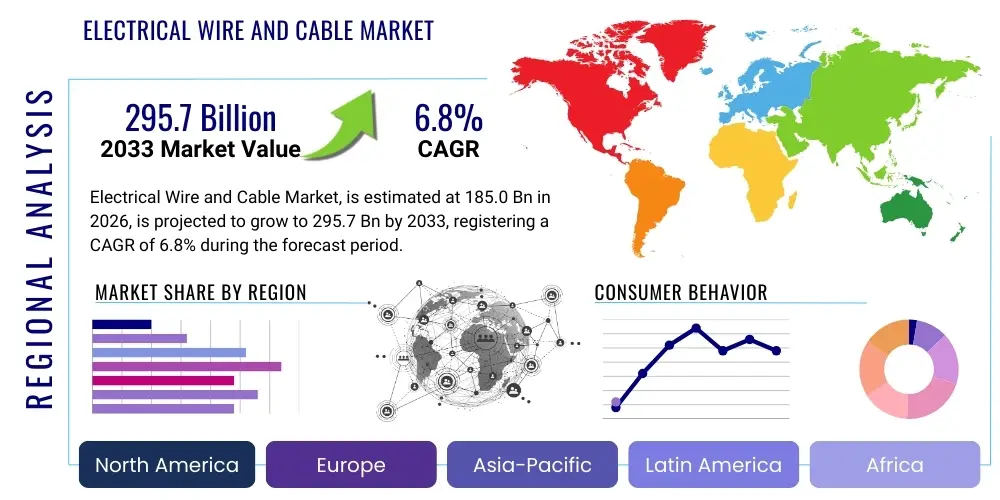

Electrical Wire and Cable Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440436 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Electrical Wire and Cable Market Size

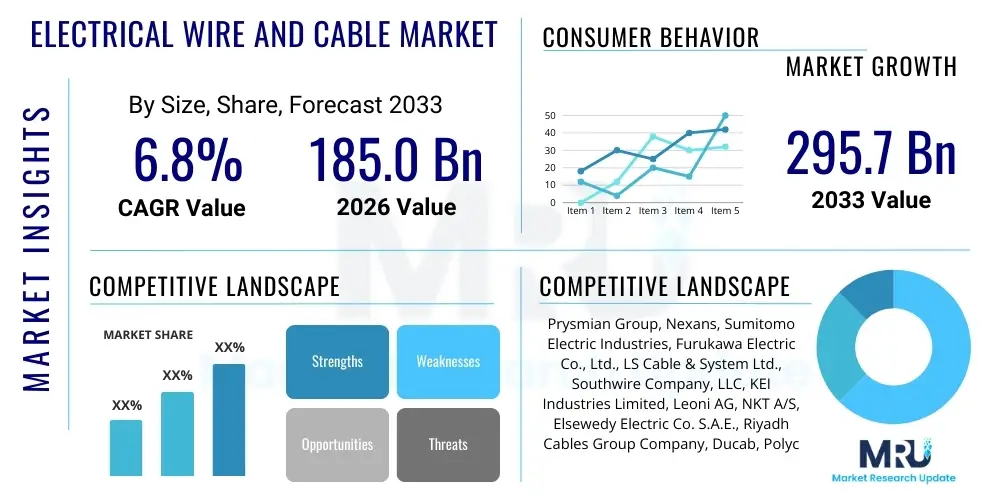

The Electrical Wire and Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 185.0 billion in 2026 and is projected to reach USD 295.7 billion by the end of the forecast period in 2033.

Electrical Wire and Cable Market introduction

The Electrical Wire and Cable Market stands as a fundamental bedrock of global infrastructure, encompassing a diverse and critical range of products essential for the transmission of electrical power and signals across nearly every facet of modern society. This expansive market involves the sophisticated manufacturing and intricate distribution of wires and cables crafted from various conductive materials, predominantly copper and aluminum, complemented by advanced fiber optics for data transmission. These components are meticulously engineered to meet stringent voltage requirements, withstand varying environmental conditions, and adhere to rigorous safety standards, ensuring optimal performance and longevity. Functioning as the indispensable arteries of electrical systems, these products facilitate the efficient and reliable flow of electricity from generation sources, through intricate grids, and ultimately to a myriad of end-use applications, while also forming the invisible backbone of global communication networks. Their pervasive use underscores their role as enablers of economic progress, technological advancement, and societal connectivity, with innovation constantly driving improvements in efficiency, capacity, and resilience.

The applications for electrical wires and cables are extraordinarily broad and deeply integrated into the fabric of daily life and industrial operations. In the power sector, they are paramount for the entire electricity value chain, from high-voltage transmission lines that carry power across vast distances, to medium and low-voltage distribution networks that deliver it to homes and businesses. The building and construction industry relies heavily on these cables for internal wiring in residential complexes, commercial skyscrapers, and industrial facilities, powering everything from basic lighting and heating, ventilation, and air conditioning (HVAC) systems to complex security and smart building technologies. Within the industrial landscape, specialized wires and cables connect motors, control panels, robotics, and advanced manufacturing equipment, supporting automation and enabling sophisticated production processes. The rapid evolution of the telecommunications sector has propelled the demand for high-performance fiber optic cables, which form the core infrastructure for high-speed internet, cloud computing, and the burgeoning 5G networks, facilitating instant global communication and data exchange. Furthermore, the automotive industry, particularly with the accelerating transition to electric vehicles (EVs), presents a significant and growing demand for specialized high-voltage and lightweight cables for charging infrastructure and internal vehicle wiring, which must meet stringent safety and performance criteria.

The sustained growth of this market is underpinned by a confluence of powerful macroeconomic and technological driving factors. Rapid urbanization in emerging economies, coupled with ongoing industrialization and population growth, necessitates continuous investment in expanding and upgrading power grids, transportation networks, and residential and commercial infrastructure. The global imperative to transition towards sustainable energy sources is a monumental driver, with the proliferation of solar farms, wind power installations, and other renewable energy projects requiring extensive new cabling for energy harvesting, grid integration, and power evacuation. Moreover, the worldwide expansion of digital infrastructure, fueled by the relentless demand for higher bandwidth, increased connectivity, and the rollout of next-generation communication technologies like 5G, continues to significantly boost the demand for fiber optic cables. The intrinsic benefits provided by a robust and modern electrical wire and cable infrastructure are manifold, including enhanced energy efficiency, substantial reductions in transmission losses, elevated safety standards through improved insulation and fire retardancy, and consistently reliable access to both electrical power and advanced communication services. These advantages collectively contribute to fostering robust economic development, supporting innovation, and improving the overall quality of life across diverse communities globally.

Electrical Wire and Cable Market Executive Summary

The Electrical Wire and Cable Market is navigating a period of profound transformation, characterized by dynamic business trends, distinct regional growth patterns, and evolving segmentation demands. From a business perspective, a pronounced shift towards sustainability is evident, with leading manufacturers intensifying investments in environmentally friendly production processes, incorporating recyclable materials, and developing products with reduced carbon footprints. The burgeoning adoption of smart grid technologies and the integration of advanced material science for superior conductivity, enhanced durability, and improved resilience are critically reshaping product development roadmaps and competitive strategies. Market consolidation is also a prominent trend, as companies actively pursue strategic mergers, acquisitions, and partnerships to augment their technological capabilities, broaden their product portfolios, and strategically expand their geographical presence, particularly within high-potential emerging markets. Furthermore, the lessons learned from recent global disruptions have underscored the imperative of supply chain resilience, prompting a strategic diversification of raw material sourcing and a greater emphasis on localized manufacturing hubs to mitigate geopolitical risks, reduce lead times, and stabilize against raw material price volatility.

Regionally, the market landscape presents a mosaic of opportunities and challenges. Asia Pacific continues its trajectory as the undeniable powerhouse, spearheading market growth due to unparalleled rates of infrastructure development, rapid industrialization, and substantial governmental investments in critical sectors such as power grid expansion, the development of smart cities, and large-scale renewable energy projects, particularly in economic giants like China and India. In stark contrast, North America and Europe represent mature yet highly innovative markets, where the focus is increasingly on grid modernization initiatives, the strategic replacement and upgrading of aging infrastructure, and the widespread adoption of high-performance and specialized cables tailored for advanced applications, including sophisticated data centers and electric vehicle charging networks. Meanwhile, Latin America, the Middle East, and Africa are collectively demonstrating promising growth trajectories, propelled by ambitious electrification programs, significant expansion within the oil and gas sector, and increasing inflows of foreign direct investment directed towards vital infrastructure projects. The influence of governmental policies, particularly those championing renewable energy targets, energy efficiency, and rural electrification, plays an instrumental role in meticulously shaping regional demand patterns, thereby necessitating highly tailored product offerings and agile distribution strategies that are responsive to local market nuances.

Analysis of market segmentation reveals several compelling trends that are redefining demand across product categories and end-use applications. There is an accelerating demand for medium and high-voltage cables, directly linked to countries bolstering their power transmission capacities, modernizing existing grids, and integrating expansive, utility-scale renewable energy farms into national networks. The fiber optic segment is experiencing an unprecedented surge in growth, primarily fueled by the aggressive global rollout of 5G mobile networks, the exponential expansion of hyperscale data centers, and the pervasive and increasing consumer and commercial demand for ubiquitous, high-bandwidth internet connectivity. While copper steadfastly retains its position as a dominant conductive material due to its superior electrical properties, aluminum cables are steadily gaining traction, particularly in certain high-voltage transmission applications, owing to their distinct advantages in terms of lighter weight and enhanced cost-effectiveness. End-use sectors such as construction and power utilities traditionally constitute the largest segments in terms of volume, yet industrial automation, the automotive industry, and telecommunications are exhibiting notably higher growth rates, a phenomenon directly attributable to continuous technological advancements and the increasingly specialized requirements of these dynamic application areas.

AI Impact Analysis on Electrical Wire and Cable Market

The transformative integration of Artificial Intelligence (AI) is poised to fundamentally reshape the Electrical Wire and Cable market, directly addressing and alleviating prevalent user concerns related to operational efficiency, system reliability, and overall cost optimization. Industry stakeholders and end-users frequently pose critical questions regarding how AI can strategically optimize complex manufacturing processes, significantly enhance the resilience and management of electrical grids, and enable highly sophisticated predictive maintenance protocols for critical cable infrastructure. There is also substantial and growing interest in understanding AI's multifaceted role in improving worker safety, minimizing energy losses across transmission networks, and significantly accelerating the seamless deployment and operational effectiveness of smart grid technologies. The overarching expectation is that AI will introduce unprecedented levels of embedded intelligence, analytical capability, and autonomous automation into both the intricate production methodologies and the diverse application domains of electrical wires and cables, culminating in the creation of more robust, inherently sustainable, and high-performance electrical systems that are better equipped to meet future demands.

- AI-powered predictive maintenance sophisticatedly analyzes real-time sensor data from cable networks to accurately anticipate potential failures, significantly reducing unplanned downtime and extending the operational lifespan of existing infrastructure.

- Optimized manufacturing processes leverage AI for ultra-precise quality control, early detection of material defects, and intelligent resource allocation, leading to enhanced product consistency, minimized waste, and improved production throughput.

- Smart grid integration actively utilizes AI algorithms for dynamic real-time load balancing, rapid fault identification, and granular energy flow optimization, thereby substantially improving grid stability, efficiency, and resilience against disturbances.

- Enhanced demand forecasting capabilities, driven by AI analytics, provide more accurate predictions for raw materials (copper, aluminum) and finished products, leading to optimized inventory management, reduced holding costs, and a more responsive supply chain.

- AI-driven automation in various aspects of cable installation, inspection, and maintenance processes elevates safety standards for field personnel, reduces reliance on intensive manual labor, and significantly accelerates project completion timelines.

- Development of advanced AI-enabled "smart cables" that feature integrated sensors for continuous performance monitoring, self-diagnosis of potential issues, and proactive resolution, enabling a new paradigm of intelligent infrastructure.

- Improved design and rigorous simulation of novel cable types utilize AI to optimize material composition, conductor geometry, and structural integrity, specifically tailoring products for demanding application requirements and environmental conditions.

- AI plays a crucial role in conducting comprehensive environmental impact assessments and optimizing the efficiency of cable recycling processes, actively supporting circular economy initiatives and reducing ecological footprints throughout the product lifecycle.

- Advanced analytics platforms, powered by AI, provide invaluable insights for precise market trend prediction, nuanced customer behavior analysis, and robust competitive intelligence, empowering strategic business decision-making and fostering adaptive market positioning.

DRO & Impact Forces Of Electrical Wire and Cable Market

The Electrical Wire and Cable Market operates within a complex ecosystem, meticulously shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, all of which are continuously influenced by overarching Impact Forces. Predominant drivers fueling market expansion include the accelerating pace of urbanization and comprehensive industrialization across developing economies, which inherently translate into a burgeoning demand for new and upgraded power transmission and distribution infrastructure. Furthermore, the global imperative to transition towards cleaner energy sources, specifically the widespread adoption of renewable energy technologies such as solar and wind power, necessitates extensive cabling for effective grid integration and efficient power evacuation from generation sites. Government initiatives worldwide, focused on ambitious rural electrification programs, the creation of sophisticated smart cities, and the aggressive expansion of cutting-edge communication networks like the 5G rollout, also provide significant impetus for sustained market growth. Beyond grid applications, the escalating global adoption of electric vehicles (EVs) is creating a rapidly expanding demand for specialized high-voltage charging infrastructure and lightweight internal automotive wiring solutions, designed to meet the unique requirements of this evolving transport sector.

Conversely, the market is confronted with several notable restraints that could potentially moderate its growth trajectory and profitability. The inherent volatility in raw material prices, particularly for critical commodities such as copper and aluminum, poses a perennial challenge, leading to unpredictable cost fluctuations for manufacturers and directly impacting profit margins. An intensely competitive landscape, characterized by numerous established global players and a steady influx of new entrants, often results in significant price pressures and can erode market profitability. Moreover, the industry operates under increasingly stringent environmental regulations concerning material sourcing, manufacturing processes, and the responsible disposal of end-of-life cables, which present complex compliance hurdles and necessitate substantial, ongoing investments in sustainable practices and technologies. The high capital expenditure required for establishing and continuously upgrading manufacturing facilities, particularly those incorporating advanced automation and specialized production lines, acts as a considerable barrier to market entry and expansion, especially for smaller or emerging participants. Adding to these challenges, geopolitical tensions, trade disputes, and economic protectionism can severely disrupt intricate global supply chains, affecting the reliable availability and stable pricing of essential raw materials and finished products.

Despite these formidable challenges, the market is replete with significant opportunities for strategic expansion, technological innovation, and new market penetration. The burgeoning smart grid market, driven by the need for enhanced grid resilience, efficiency, and distributed energy management, offers substantial potential for high-performance and intelligent cables capable of real-time data monitoring and advanced communication. The ongoing global investment in electric vehicle charging infrastructure represents a monumental growth avenue, requiring specialized high-power cables. The expansion of large-scale offshore wind farms necessitates the deployment of highly engineered submarine cables for power transmission, while the relentless global rollout of 5G networks and fiber-to-the-home (FTTH) initiatives continues to fuel an insatiable demand for advanced fiber optic cables with higher bandwidth capabilities. Moreover, emerging economies across Asia, Africa, and Latin America continue to present vast untapped potential for fundamental infrastructure development, rural electrification projects, and industrial growth, offering fertile ground for market expansion. Furthermore, continuous technological advancements in insulation materials, conductor designs, fire-retardant properties, and advanced shielding are consistently creating new product categories with superior safety, efficiency, and performance characteristics, opening up niche markets and premium segments.

The overall impact forces exerting influence on this dynamic market are diverse, pervasive, and intricately interconnected. Sustained global economic growth, particularly within rapidly industrializing regions, directly correlates with increased energy demand and a corresponding uptick in infrastructure investment, driving the fundamental need for wires and cables. Relentless technological advancements are the primary catalysts for innovation in cable design, manufacturing efficiency, and the expansion into novel application areas. Evolving environmental policies, especially those promoting renewable energy integration, energy efficiency standards, and the adoption of sustainable materials, critically dictate product development directions and operational practices across the industry. Geopolitical stability or instability profoundly impacts supply chain reliability, foreign direct investment flows, and overall market confidence. Lastly, the global energy transition trends, marked by a decisive shift away from fossil fuels towards cleaner, renewable energy sources, fundamentally alter the demand landscape for various types of wires and cables, strongly favoring solutions that actively support grid modernization, enhance energy storage capabilities, and facilitate seamless renewable energy integration.

Segmentation Analysis

The Electrical Wire and Cable Market is characterized by a sophisticated and highly diversified segmentation structure, which accurately reflects the intricate array of product offerings, myriad application areas, and distinct end-user requirements that define its operational landscape. This granular level of segmentation provides industry stakeholders with an unparalleled, detailed perspective on the underlying market dynamics, enabling a comprehensive understanding of the specific demand drivers, competitive forces, and technological nuances prevalent within various niche markets. By meticulously analyzing these segments, manufacturers, investors, and policymakers can strategically identify key growth pockets, precisely tailor their product development and innovation strategies, and optimize their market entry and expansion approaches to achieve maximum impact. The market can be broadly categorized along several key dimensions, including product type, voltage level, application area, and end-use sector, each possessing unique characteristics and demonstrating distinct growth trajectories influenced by specific industrial needs and technological advancements.

- By Type: This segment differentiates products based on their conductive and material composition, dictating their primary use and performance characteristics.

- Copper Cable: Renowned for its superior conductivity and reliability, extensively used in power transmission, building wiring, and electronic applications.

- Aluminum Cable: Favored for its lighter weight and cost-effectiveness, commonly used in overhead transmission lines and large-scale power distribution.

- Fiber Optic Cable: Essential for high-speed data transmission, forming the backbone of telecommunication networks and internet infrastructure.

- Other Cables: Includes specialized cables such as composite cables, superconducting cables for advanced applications, and various custom-engineered solutions for specific industrial requirements.

- By Voltage: Categorization by the maximum voltage a cable is designed to safely carry, impacting insulation, construction, and application.

- Low Voltage (up to 1 kV): Primarily used in residential, commercial buildings, and industrial control systems for internal wiring and short-distance power distribution.

- Medium Voltage (1 kV to 36 kV): Employed in power distribution networks, industrial facilities, and connecting substations.

- High Voltage (36 kV to 230 kV): Crucial for long-distance power transmission lines and connecting major power generation sources to substations.

- Extra-High Voltage (above 230 kV): Utilized for ultra-long-distance bulk power transmission and interconnecting national grids, often in remote or challenging terrains.

- By Application: This segment focuses on the specific environments or systems where the cables are deployed.

- Residential: Wiring for homes, apartments, and domestic appliances, prioritizing safety and basic power distribution.

- Commercial: Used in offices, retail spaces, hospitals, and educational institutions for lighting, HVAC, and data networks.

- Industrial: Heavy-duty cables for factories, manufacturing plants, and processing units, often requiring resistance to harsh conditions.

- Energy & Utility (Power Transmission & Distribution): Core cables for national grids, substations, and local distribution networks.

- Telecommunications: Fiber optic and copper cables for phone lines, internet, and data centers.

- Automotive: Specialized wiring for vehicle electrical systems, ranging from infotainment to engine control and EV charging.

- Infrastructure (Railways, Airports, Ports): Robust cables for signaling, power supply, and control systems in critical public infrastructure.

- Oil & Gas: Resistant and durable cables for drilling rigs, refineries, and offshore platforms, designed for extreme environments.

- By End-Use Sector: This segment categorizes customers based on their primary industry or business.

- Construction (Residential, Commercial, Industrial Buildings): The largest consumer, driven by new builds and renovations.

- Power Transmission & Distribution: Utilities and grid operators for maintaining and expanding power networks.

- Industrial Manufacturing (Machinery, Automation): Factories using cables for machinery, control systems, and robotics.

- Telecommunications: Internet service providers, mobile network operators, and data center operators.

- Automotive & Transportation: Vehicle manufacturers, public transport operators, and EV charging infrastructure providers.

- Renewable Energy: Solar panel installers, wind farm developers, and hydroelectric power producers.

- Mining: Rugged cables for excavation equipment, power distribution, and communication in harsh mining environments.

Value Chain Analysis For Electrical Wire and Cable Market

The value chain for the Electrical Wire and Cable Market is an intricate and multi-layered system, meticulously structured from the foundational sourcing of raw materials to the ultimate installation and end-use applications. Upstream activities constitute the initial and crucial phase, involving the extraction, refining, and processing of primary raw materials that form the core components of wires and cables. Key materials include high-purity copper and aluminum for conductors, various types of plastics and polymers (such as PVC, XLPE, EPR) for insulation and protective sheathing, and specialized silica glass for fiber optic cables. Essential suppliers in this foundational stage typically comprise large-scale mining corporations, sophisticated metal refineries, and advanced petrochemical industries. The intrinsic quality, consistent availability, and volatile cost of these raw materials exert a profound influence on the final product's performance characteristics, manufacturing feasibility, and overall market price. Consequently, establishing highly efficient procurement strategies, cultivating robust and long-term relationships with reliable suppliers, and adeptly managing commodity price risks are paramount for manufacturers to sustain competitive pricing structures and ensure unwavering product quality, effectively mitigating the inherent risks associated with unpredictable global commodity markets.

Midstream operations represent the core manufacturing processes where these raw materials undergo a complex transformation into finished electrical wires and cables. This highly specialized phase encompasses several critical steps: drawing and stranding conductors to achieve desired flexibility and conductivity, applying precise layers of insulation, cabling multiple insulated conductors together, and finally, extruding robust protective sheaths. Manufacturers are compelled to invest significantly in extensive research and development (R&D) to continuously innovate and develop advanced material formulations, drastically improve production efficiencies through automation and lean manufacturing principles, and enhance crucial product characteristics such as superior fire resistance, improved flexibility, enhanced data transmission capabilities, and extended operational lifespans. Rigorous quality control protocols and steadfast adherence to globally recognized international standards (e.g., IEC, ASTM, UL, VDE) are non-negotiable at every stage of this process, ensuring product safety and performance integrity. Market differentiation in this competitive landscape often stems from the ability to design highly specialized cables for niche applications, leverage cutting-edge technological innovations in insulation and conductor technology, and maintain scalable production capacities that can flexibly meet a diverse spectrum of market demands, ranging from standard residential building wires to highly complex and robust submarine power cables. The integration of Industry 4.0 principles, including IoT sensors and data analytics, is increasingly optimizing these manufacturing stages for greater precision and responsiveness.

Downstream activities encompass the critical stages of distribution, sales, marketing, and the ultimate installation of electrical wires and cables. The distribution network is highly variegated, employing a blend of channels: direct sales to large-scale industrial clients, national utility companies, and major infrastructure project developers, alongside indirect channels that leverage extensive networks of wholesalers, specialized distributors, and retail outlets for smaller projects, individual contractors, and consumer markets. The overall effectiveness of the distribution infrastructure, coupled with high logistical efficiency and a rapid responsiveness to evolving customer needs, are decisive factors for achieving widespread market penetration and ensuring high levels of customer satisfaction. Direct distribution strategies facilitate closer, more collaborative client relationships and often involve the provision of value-added services such as bespoke product customization, technical consulting, and comprehensive after-sales support. Conversely, indirect channels capitalize on the broad geographical reach and established market access of channel partners, rendering products widely accessible to a much broader customer base. Installation services are typically provided by a vast network of qualified electrical contractors, specialized construction firms, and certified electricians, all of whom critically rely on the inherent reliability, ease of handling, and consistent quality of the cables supplied by manufacturers and distributors. Robust post-sales support, comprehensive warranty provisions, and continuous technical assistance further solidify customer loyalty and significantly enhance brand reputation within the market, fostering long-term relationships and repeat business.

Electrical Wire and Cable Market Potential Customers

The potential customer base for the Electrical Wire and Cable Market is extraordinarily broad and inherently diverse, encompassing a multitude of sectors and entities that are fundamentally reliant on robust, efficient, and highly reliable electrical power and data transmission infrastructure. At the forefront are large-scale utility companies, including national grids, regional power corporations, and independent power transmission and distribution network operators. These entities represent a crucial segment, requiring an extensive array of high-voltage and medium-voltage cables for the expansion of their grids, essential maintenance, and ambitious modernization projects aimed at enhancing reliability and capacity. Another profoundly significant customer base resides within the dynamic construction industry, which includes residential, commercial, and industrial building developers. These stakeholders continuously demand a wide spectrum of low-voltage and medium-voltage wiring for internal electrical systems, external connections, and specialized applications within new builds, extensive renovations, and large-scale urban development projects. The relentless pace of global urbanization, coupled with the ongoing development of smart cities and intelligent building technologies, consistently generates a substantial and growing demand from this pivotal segment, requiring sophisticated, high-performance cabling solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.0 Billion |

| Market Forecast in 2033 | USD 295.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans, Sumitomo Electric Industries, Furukawa Electric Co., Ltd., LS Cable & System Ltd., Southwire Company, LLC, KEI Industries Limited, Leoni AG, NKT A/S, Elsewedy Electric Co. S.A.E., Riyadh Cables Group Company, Ducab, Polycab India Limited, ZTT International Limited, Belden Inc., Orient Cable (Nanjing) Co., Ltd., Amphenol Corporation, CommScope, Inc., TE Connectivity Ltd., Encore Wire Corporation, Qingdao Hanhe Cable Co. Ltd., Bahra Cables Company, Okonite Company Inc., Havells India Ltd., Finolex Cables Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Wire and Cable Market Key Technology Landscape

The Electrical Wire and Cable market is undergoing continuous and rapid evolution, driven by significant technological advancements that are reshaping product capabilities, operational efficiencies, and overall sustainability. A crucial and dynamic area of innovation resides within material science, where manufacturers are intensively developing and adopting advanced insulation materials such as Cross-Linked Polyethylene (XLPE), Ethylene Propylene Rubber (EPR), and various high-performance polymer compounds. These materials offer substantial improvements over traditional PVC, providing superior thermal resistance, enhanced dielectric strength, extended operational longevity, and improved resistance to environmental stressors like moisture and UV radiation. Concurrently, groundbreaking research into nanomaterials and advanced composite materials is progressing at a swift pace, promising future generations of wires and cables that are lighter, inherently stronger, possess even greater electrical conductivity, and exhibit enhanced thermal management properties. For the rapidly expanding fiber optic cable segment, continuous advancements in silica glass purity, intricate waveguide design, and sophisticated fiber drawing techniques are enabling dramatically higher data transmission capacities, significantly lower attenuation losses over long distances, and increased resilience to mechanical stress and environmental factors, which are all paramount for supporting cutting-edge, high-bandwidth applications like 5G infrastructure, hyperscale data center interconnects, and ultra-fast broadband networks.

Regional Highlights

- Asia Pacific (APAC): This region unequivocally dominates the global electrical wire and cable market, characterized by unparalleled rates of rapid urbanization, large-scale industrialization, and massive government-led investments in critical infrastructure development. Countries such as China and India are the primary growth engines, experiencing explosive demand driven by extensive power grid expansion, the creation of sophisticated smart cities, and the aggressive deployment of renewable energy projects. APAC is also at the vanguard of 5G network rollout, further boosting insatiable demand for high-capacity fiber optic cables and associated infrastructure. The region's robust manufacturing base and burgeoning consumer market underscore its pivotal role in market expansion.

- North America: Representing a mature yet highly dynamic market, North America is distinguished by substantial ongoing investments in grid modernization, the strategic replacement of aging electrical infrastructure, and the accelerated integration of renewable energy sources across the continent. There is a particularly strong and growing demand for high-performance specialty cables tailored for cutting-edge applications such as hyperscale data centers, rapidly expanding electric vehicle charging networks, and sophisticated industrial automation systems. The region's stringent safety and environmental regulations also act as a catalyst, driving the demand for advanced, eco-friendly, and highly durable cable products.

- Europe: The European market is sharply focused on upgrading its extensive existing power infrastructure, seamlessly integrating large-scale renewable energy sources into national grids, and developing advanced smart energy solutions aimed at enhancing efficiency and reliability. European nations are significantly investing in monumental offshore wind farms, necessitating the deployment of highly specialized and resilient submarine cables. Furthermore, the region's pioneering and rigorous environmental policies actively encourage the widespread adoption of halogen-free and highly sustainable cable solutions, with an overarching emphasis on achieving superior energy efficiency across all applications.

- Latin America: This region exhibits promising and consistent growth, primarily driven by expansive electrification initiatives, large-scale infrastructure development projects, and increasing inflows of foreign direct investment across various industrial sectors. Brazil and Mexico stand out as key markets within Latin America, benefiting significantly from continued industrial expansion and rapid urban development. The region's rich natural resources also necessitate robust and specialized cabling solutions for critical mining operations and the burgeoning oil & gas sector, demanding durable and high-performance products capable of operating in challenging environments.

- Middle East and Africa (MEA): The MEA region is experiencing substantial market growth, propelled by ambitious government-backed mega-projects in infrastructure, large-scale construction, and significant power generation capacity expansion, particularly evident in the Gulf Cooperation Council (GCC) countries. Strategic diversification away from traditional oil and gas economies, coupled with determined efforts towards sustainable development and renewable energy adoption, is driving a strong demand for advanced and intelligent cable solutions. Additionally, extensive rural electrification programs across various African nations are playing a crucial role in expanding market access and increasing overall demand for basic and medium-voltage electrical cables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Wire and Cable Market.- Prysmian Group

- Nexans

- Sumitomo Electric Industries

- Furukawa Electric Co., Ltd.

- LS Cable & System Ltd.

- Southwire Company, LLC

- KEI Industries Limited

- Leoni AG

- NKT A/S

- Elsewedy Electric Co. S.A.E.

- Riyadh Cables Group Company

- Ducab

- Polycab India Limited

- ZTT International Limited

- Belden Inc.

- Orient Cable (Nanjing) Co., Ltd.

- Amphenol Corporation

- CommScope, Inc.

- TE Connectivity Ltd.

- Encore Wire Corporation

- Qingdao Hanhe Cable Co. Ltd.

- Bahra Cables Company

- Okonite Company Inc.

- Havells India Ltd.

- Finolex Cables Ltd.

Frequently Asked Questions

What are the primary drivers for growth in the Electrical Wire and Cable Market?

The primary drivers for growth in the Electrical Wire and Cable Market are multifaceted, stemming largely from global infrastructure development. This includes the rapid pace of urbanization and industrialization in emerging economies, which necessitates extensive new power transmission and distribution infrastructure. Significant investments in renewable energy integration, such as large-scale solar and wind farms, inherently demand new cabling for grid connection and power evacuation. Furthermore, the global expansion of smart grids, the aggressive rollout of 5G networks, and the increasing adoption of electric vehicles (EVs) are creating substantial and diverse demands for both power and specialized communication cables, making these key accelerators for market expansion.

How is the market segmented, and which segments are experiencing the most significant growth?

The Electrical Wire and Cable Market is comprehensively segmented by product type (e.g., copper, aluminum, fiber optic), voltage level (low, medium, high, extra-high), application (e.g., residential, industrial, telecommunications, energy & utility), and end-use sector (e.g., construction, power T&D, automotive, renewable energy). Among these, the fiber optic cable segment is demonstrating the most significant growth, driven by the global deployment of 5G networks, massive data center expansions, and the pervasive demand for high-speed internet. Additionally, medium and high-voltage cables are experiencing robust growth due to extensive grid modernization efforts and the integration of large-scale renewable energy projects worldwide.

What technological advancements are shaping the future of electrical wires and cables?

Key technological advancements are profoundly shaping the future of electrical wires and cables. Innovations in material science are leading to high-performance insulation materials like XLPE and EPR, offering enhanced durability and thermal resistance. The emergence of "smart cables" with embedded sensors for real-time monitoring and predictive maintenance is revolutionizing grid management and reliability. Advances in High-Voltage Direct Current (HVDC) cable technology are crucial for efficient long-distance power transmission and renewable energy integration. Moreover, manufacturing processes are becoming highly automated with robotics and digital twin technologies, while the industry is increasingly focused on sustainable, halogen-free, and recyclable cable solutions to meet environmental demands.

Which geographical regions are expected to be key contributors to market growth?

Asia Pacific is projected to remain the dominant and fastest-growing region, primarily driven by its rapid urbanization, industrialization, and extensive infrastructure investments in countries like China and India, alongside significant renewable energy and 5G deployment projects. North America and Europe will continue to be vital contributors, fueled by grid modernization and advanced technology adoption. Latin America, the Middle East, and Africa are also emerging as significant growth regions, propelled by electrification initiatives, large-scale construction, and increasing foreign direct investment in infrastructure development across various crucial sectors, expanding the global market footprint.

What are the main challenges faced by manufacturers in the Electrical Wire and Cable Market?

Manufacturers in the Electrical Wire and Cable Market contend with several significant challenges. Foremost among these is the inherent volatility of raw material prices, particularly for critical commodities such as copper and aluminum, which directly impact production costs and profit margins. An intensely competitive landscape often leads to significant price pressures. Additionally, increasingly stringent environmental regulations regarding materials and disposal methods necessitate continuous investment in sustainable manufacturing practices. High capital expenditure required for facility upgrades and technological advancements presents a substantial barrier, while geopolitical instability and trade disputes further complicate global supply chain management and material sourcing, adding layers of complexity to market operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager