Electrically Operated Oil Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434527 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Electrically Operated Oil Pump Market Size

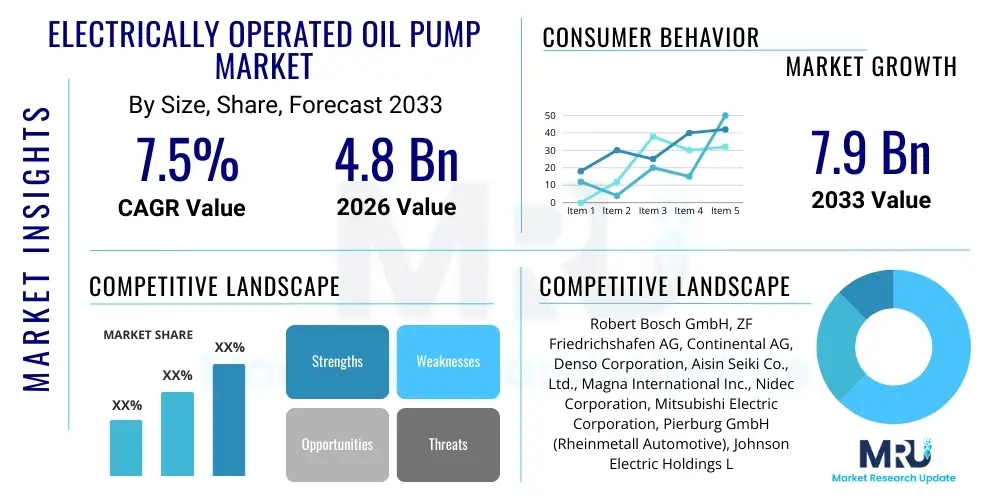

The Electrically Operated Oil Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 billion in 2026 and is projected to reach USD 7.9 billion by the end of the forecast period in 2033.

Electrically Operated Oil Pump Market introduction

The Electrically Operated Oil Pump (EOP) Market encompasses sophisticated lubrication and thermal management solutions crucial for modern vehicle architectures, particularly hybrid and battery electric vehicles (BEVs), as well as advanced internal combustion engine (ICE) applications utilizing start-stop technology. EOPs replace traditional, mechanically driven pumps, offering independent control over flow and pressure, thereby reducing parasitic losses on the engine, enhancing fuel efficiency, and facilitating crucial thermal management for high-performance components like transmissions, turbos, and battery systems. These pumps are pivotal in ensuring optimal operating temperatures and continuous lubrication during idling or coasting phases, which mechanical pumps cannot adequately address, driving their rapid adoption across the global automotive sector.

The core product description revolves around a pump assembly integrated with an electric motor (often a Brushless DC motor) and an electronic control unit (ECU) that modulates the pump’s performance based on real-time vehicle dynamics and thermal requirements. Major applications span engine lubrication, transmission fluid circulation (essential for automatic and dual-clutch transmissions), and increasingly, battery cooling circuits in EVs. The primary benefit derived from EOPs is enhanced energy efficiency and compliance with stringent global emission standards, such as Euro 7 and CAFE regulations, which necessitate every possible reduction in vehicle power consumption. Furthermore, EOPs provide flexibility in component layout, allowing engineers to decouple the pump location from the prime mover.

Driving factors for this market are fundamentally linked to the global transition toward vehicle electrification and the increasing complexity of powertrain systems. The proliferation of hybrid vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) requires auxiliary oil circulation during electric-only driving modes, a necessity perfectly met by EOPs. Concurrently, the increasing demand for high-performance thermal management in BEVs—where cooling the high-voltage battery pack and electric motor is paramount for safety and longevity—is generating significant demand for high-voltage, high-flow EOPs. This transition mandates advancements in pump reliability, noise, vibration, and harshness (NVH) characteristics, and integration capability with complex vehicle network systems, solidifying the EOP's status as a critical automotive component.

Electrically Operated Oil Pump Market Executive Summary

The Electrically Operated Oil Pump market is characterized by robust growth, primarily propelled by global regulatory pressures favoring reduced vehicular emissions and the aggressive expansion of the electric vehicle landscape. Current business trends indicate a strong focus on developing 48V and high-voltage (>300V) systems tailored specifically for mild hybrids (MHEVs) and full battery electric architectures, respectively. Key technological advancements center on optimizing pump control units with sophisticated software algorithms to minimize energy consumption while maintaining precise fluid pressure and flow. Suppliers are investing heavily in material science to enhance durability, reduce weight, and improve the thermal dissipation capabilities of the pumps, meeting the rigorous demands of OEMs for extended operational lifespan and silent operation across varying climate conditions globally.

Regional trends clearly delineate Asia Pacific (APAC), particularly China, as the primary growth engine due to its overwhelming dominance in EV manufacturing and governmental subsidies supporting new energy vehicles (NEVs). Europe follows closely, driven by stringent CO2 reduction mandates and high penetration rates of HEVs and PHEVs, necessitating efficient thermal management across powertrain components. North America exhibits steady demand, influenced by tightening fuel economy standards and increasing consumer acceptance of electric and hybrid light-duty vehicles. These geographical dynamics are leading to localized manufacturing expansion and the formation of strategic partnerships between global Tier 1 suppliers and local automotive producers to stabilize and shorten complex supply chains.

Segmentation trends highlight the dominance of the automotive application segment, specifically within Passenger Vehicles, where EOPs are essential for maintaining lubrication during engine start-stop cycles and managing advanced transmission systems. By type, DC pumps (12V/24V) remain fundamental in conventional and low-voltage hybrid systems, but the 48V segment is experiencing the fastest growth rate as it bridges the gap toward full electrification by supporting high-load auxiliary systems. Future growth is anticipated in specialized EOPs designed for industrial machinery and stationary power generation, where efficiency and quiet operation are becoming increasingly valued, though the automotive sector will continue to dictate the overall trajectory of the market size and technological development.

AI Impact Analysis on Electrically Operated Oil Pump Market

Common user questions regarding AI’s influence in the Electrically Operated Oil Pump Market often center on its role in predictive maintenance, optimization of system efficiency, and automation within manufacturing. Users are keen to understand how AI algorithms can leverage real-time data from integrated pump sensors (flow, pressure, temperature) to predict potential component failures before they occur, thereby minimizing vehicle downtime and maintenance costs. Another key area of interest is the use of machine learning to dynamically adjust pump speed and fluid flow rates based on driving patterns, load conditions, and ambient temperature, optimizing energy expenditure which is critical for extending EV range. Furthermore, questions arise concerning AI's application in streamlining the highly complex supply chain and quality control processes involved in producing precision components like EOPs.

The application of Artificial Intelligence is fundamentally transforming EOP operations from a purely mechanical control mechanism to an intelligent, data-driven auxiliary system. AI algorithms can be implemented directly within the pump’s Electronic Control Unit (ECU) or integrated at the Vehicle Control Unit level. By continuously processing data streams—including bearing wear indicators, motor current draw anomalies, and minor pressure fluctuations—AI enables highly accurate diagnostics. This shift from reactive maintenance to prescriptive maintenance enhances the pump’s reliability, a crucial selling point for OEMs facing consumer demands for high reliability in electrified vehicles. This intelligence also allows the pump to communicate its health status, enabling over-the-air updates or proactive scheduling of service.

Beyond maintenance, AI is critical for optimizing the operational efficiency of EOPs, particularly in complex thermal loops involving battery and motor cooling. Machine learning models can be trained on millions of miles of driving data to determine the absolute minimum energy required to maintain thermal equilibrium under all conditions. This precision tuning prevents unnecessary energy wastage caused by operating the pump at flow rates higher than required, directly translating into improved fuel efficiency for hybrids and extended range for BEVs. In the manufacturing domain, AI-driven visual inspection systems enhance quality control during assembly, identifying microscopic defects in rotors or seals, thereby improving overall product consistency and reliability while reducing scrap rates, which is vital for high-volume, precision automotive components.

- AI-powered predictive maintenance reduces component failure rates by analyzing operational data patterns.

- Machine learning algorithms optimize pump control for minimal energy consumption, extending electric vehicle range.

- AI enhances manufacturing quality control through advanced defect detection in the assembly line.

- Optimization of thermal management loops via AI ensures peak efficiency of batteries and motors.

- Improved integration with vehicle network systems allows for dynamic, real-time adjustments based on driving conditions.

DRO & Impact Forces Of Electrically Operated Oil Pump Market

The Electrically Operated Oil Pump Market is influenced by a strong interplay of Drivers, Restraints, and Opportunities, collectively summarized as the Impact Forces. Key drivers include the overwhelming global push toward vehicle electrification, mandating sophisticated thermal management systems for batteries and power electronics, and the necessity of independent fluid circulation in start-stop and coasting modes of ICE and hybrid vehicles. Restraints primarily involve the higher manufacturing cost and complexity associated with integrating electronic controls, electric motors, and specialized materials compared to conventional mechanical pumps. Opportunities lie in the penetration of EOPs into non-automotive sectors like specialized industrial machinery and renewable energy systems requiring precise fluid lubrication and cooling.

The primary impact force remains regulatory pressure, specifically stringent emission standards globally. These standards compel automotive manufacturers to adopt every technology available to improve energy efficiency, making the shift from mechanical pumps (which incur parasitic losses) to EOPs a technological necessity. The growth in the 48V mild hybrid architecture further accelerates this adoption, as EOPs are high-load auxiliaries perfectly suited for 48V systems. However, the market faces significant restraint regarding standardization. Integrating EOPs across various OEM platforms requires complex calibration and system validation, increasing development timelines and costs. Furthermore, ensuring the long-term reliability of power electronics exposed to harsh under-hood conditions presents a technical hurdle that suppliers must continually overcome to maintain market confidence.

Opportunities are emerging through technological convergence, particularly the integration of EOP functionality into multi-fluid management modules. Manufacturers are looking to create single units that handle transmission, engine, and thermal oil circulation, reducing weight and simplifying assembly. The market also benefits significantly from the increasing prevalence of autonomous driving systems, which require enhanced reliability and redundancy in all critical systems, including lubrication and cooling, thereby driving demand for high-quality, electronically monitored EOPs. These collective forces underscore a market trending toward sophistication, high efficiency, and deep electronic integration, fundamentally restructuring the supply chain away from traditional mechanical suppliers.

Segmentation Analysis

The Electrically Operated Oil Pump Market segmentation provides a granular view of demand based on pump specifications, end-user applications, and underlying technology. The market is primarily segmented by Type (AC Pump, DC Pump), Application (Automotive, Industrial Machinery, Power Generation), Vehicle Type (BEVs, PHEVs, MHEVs, ICE), and Voltage (12V, 24V, 48V, High Voltage). The automotive sector dominates the application landscape, driven by the indispensable role EOPs play in hybrid and electric powertrain components, including dedicated pumps for transmission actuation, engine lubrication, and critical battery thermal management.

Segmentation by voltage is highly reflective of the current trends in vehicle electrification. While 12V and 24V DC pumps remain standard for auxiliary functions in legacy and small commercial vehicles, the 48V segment is experiencing exponential growth, directly correlating with the rapid adoption of mild-hybrid electric vehicles (MHEVs). These 48V systems provide the necessary power to run higher-load auxiliaries like EOPs efficiently. Concurrently, the High Voltage segment (typically >200V) is growing aggressively, driven purely by the increasing sales volume of high-performance BEVs and PHEVs, where pumps are essential for high-flow cooling of motors and battery packs to prevent thermal runaway and maximize performance and longevity.

From a technological standpoint (Type segmentation), Brushless DC (BLDC) pumps are becoming the standard choice due to their superior efficiency, compact design, and extended lifespan compared to older brushed motor designs. The shift towards electronically commutated motors minimizes wear and reduces the overall noise profile, crucial for passenger comfort in silent EVs. Furthermore, within the application segment, specialized EOPs are emerging for heavy-duty industrial applications requiring reliable lubrication in remote or demanding environments, demonstrating the technology's versatility beyond its automotive core. This intricate segmentation allows suppliers to tailor products precisely to regulatory requirements and power architecture needs across different vehicle and industrial platforms globally.

- By Type: DC Pumps, AC Pumps (BLDC dominating DC)

- By Application: Automotive (Passenger Vehicles, Commercial Vehicles), Industrial Machinery, Power Generation, Hydraulics

- By Vehicle Type: Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Mild Hybrid Electric Vehicles (MHEVs), Internal Combustion Engine (ICE) Vehicles (Start-Stop Systems)

- By Voltage: 11V-14V (12V), 22V-28V (24V), 48V, High Voltage (>200V)

Value Chain Analysis For Electrically Operated Oil Pump Market

The value chain for the Electrically Operated Oil Pump market commences with the Upstream analysis, focusing on the sourcing of critical raw materials and specialized components. Key inputs include high-grade permanent magnets (often rare earth elements like Neodymium) for electric motors, specialized composite materials and plastics (PEEK, PPS) resistant to high temperatures and corrosive fluids for pump casings and impellers, and sophisticated semiconductors for the Electronic Control Units (ECUs) and power electronics. Dependence on specialized magnet suppliers and the volatile pricing of rare earth minerals represent a significant upstream risk, driving suppliers to seek diversification and design optimization to minimize material content while maximizing magnetic flux and motor efficiency.

The midstream phase involves manufacturing and assembly, where Tier 1 suppliers dominate the intellectual property and production processes. This stage is highly capital-intensive, requiring specialized machinery for precision machining of pump elements, automated winding and assembly of BLDC motors, and complex soldering and encapsulation of control electronics. Strict quality control and compliance with automotive safety standards (like ISO/TS 16949 and functional safety standards like ISO 26262) are critical here. The value added in this segment includes the development of proprietary software algorithms for pump control, integration testing, and tailoring the pump’s hydrodynamic properties to specific fluid types and temperature ranges required by different OEM specifications, creating substantial barriers to entry.

Downstream analysis focuses on distribution channels and end-user integration. Distribution is predominantly direct, with Tier 1 suppliers selling sophisticated EOP systems directly to Original Equipment Manufacturers (OEMs) in the automotive sector (e.g., Ford, VW, Tesla) for integration into new vehicle platforms. The aftermarket channel, though smaller, is growing as older vehicles equipped with EOPs require maintenance and replacement parts. OEMs are the ultimate buyers, integrating EOPs into complex sub-systems (transmissions, cooling loops). The distribution channel relies heavily on robust logistics and synchronized delivery (Just-In-Time) systems to support high-volume automotive production lines, necessitating close technical collaboration between the supplier and the manufacturer throughout the product lifecycle.

Electrically Operated Oil Pump Market Potential Customers

The primary customers in the Electrically Operated Oil Pump market are large-scale automotive Original Equipment Manufacturers (OEMs), encompassing manufacturers of passenger cars, light commercial vehicles, and heavy-duty trucks. Within this sector, the adoption is highest among companies aggressively pursuing vehicle electrification, including manufacturers focusing on BEVs, PHEVs, and advanced MHEVs. These OEMs require pumps not only for engine and transmission lubrication but critically for the thermal management systems of high-voltage battery packs and power electronics, demanding high reliability, specific voltage compatibility (48V or high voltage), and integration capability with vehicle ECUs. The purchasing decision is heavily influenced by pump efficiency, weight, noise profile, and the supplier's capacity for global mass production.

A second major customer base comprises manufacturers of specialized industrial machinery and equipment. This includes producers of large hydraulic systems, heavy construction equipment, specialized machining centers, and gearboxes for wind turbines. In these non-automotive applications, EOPs offer advantages in terms of precise flow control, operational flexibility (independent of a central prime mover), and enhanced efficiency, particularly in intermittent operations or demanding duty cycles where mechanical pumps might be oversized or inefficient. While the volume is lower than the automotive segment, the requirements often involve higher durability and resilience to extreme operating conditions, providing a niche but highly profitable market segment for specialized pump suppliers.

Furthermore, the Aftermarket and maintenance service providers constitute a growing segment of potential customers. As the global fleet of vehicles equipped with advanced EOPs ages, there will be an increasing demand for replacement units and system diagnostics tools. Fleet managers, independent garages, and franchised dealership service centers require reliable, certified replacement EOPs. This segment is driven by price competitiveness and product availability, often relying on Tier 2 suppliers or specialized aftermarket manufacturers. For these buyers, the focus shifts slightly from cutting-edge innovation to cost-effectiveness and backward compatibility with existing vehicle architectures, ensuring continued market penetration even after the initial vehicle sale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, Denso Corporation, Aisin Seiki Co., Ltd., Magna International Inc., Nidec Corporation, Mitsubishi Electric Corporation, Pierburg GmbH (Rheinmetall Automotive), Johnson Electric Holdings Ltd., TI Fluid Systems, FTE automotive, KSPG Automotive, Shindengen Electric Manufacturing Co., Ltd., Mikuni Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrically Operated Oil Pump Market Key Technology Landscape

The technology landscape for the Electrically Operated Oil Pump market is dominated by advancements in motor efficiency, power electronics, and sensor integration, all aimed at maximizing the efficiency and reliability necessary for electrified powertrains. Brushless DC (BLDC) motor technology is the foundational element, offering higher torque density, better control characteristics, and significantly longer operational life compared to traditional brushed motors, essential for meeting OEM durability requirements. Innovation focuses on high-speed motor designs and optimizing the winding patterns and magnetic material utilization to achieve maximum flow rates within minimal packaging constraints, crucial for densely packed engine bays and EV chassis. Suppliers are actively patenting advanced commutation strategies and motor control algorithms to further reduce switching losses and thermal generation within the motor itself.

Power electronics represent the second critical technological pillar. EOPs require sophisticated inverters and control units (ECUs) to manage speed, pressure, and communicate with the broader vehicle network (CAN or LIN bus). The shift to higher voltages (48V and >200V) necessitates the use of advanced semiconductor materials, such as Silicon Carbide (SiC) or Gallium Nitride (GaN), in the ECUs. These wide-bandgap semiconductors allow for higher switching frequencies, leading to smaller, lighter, and more efficient control packages with reduced thermal management needs for the electronics themselves. Integration of these robust power modules directly onto the pump housing (smart pumps) is a major trend, reducing cabling complexity and enhancing electromagnetic compatibility (EMC) in the noisy electrical environment of an EV.

Furthermore, sensor fusion and diagnostic capabilities are defining the cutting edge of EOP technology. Modern pumps are equipped with integrated pressure and temperature sensors, enabling the ECU to perform sophisticated, real-time diagnostics and condition monitoring. Acoustic noise reduction technologies, including specialized housing designs and advanced vibration dampening materials, are critical, especially in quiet electric vehicles where pump noise is more noticeable. Future advancements are expected in variable displacement EOPs, which combine electric control with mechanical adjustment of the displacement volume, offering an unparalleled level of efficiency and control across the entire operating range, further cementing the technology’s role in future lubrication and thermal management systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Electrically Operated Oil Pumps, primarily driven by China's dominant position in the global electric vehicle production and sales market. Government policies, robust subsidies for New Energy Vehicles (NEVs), and the concentration of major battery and vehicle manufacturers (OEMs) here create unparalleled demand for high-voltage EOPs for thermal management and drivetrain lubrication. Japan and South Korea also contribute significantly, driven by their established hybrid vehicle market, where EOPs are essential for maintaining lubrication during pure electric or start-stop operations. The region benefits from a maturing supply chain, localizing production and reducing logistics costs.

- Europe: Europe represents a technologically mature and highly regulated market. The demand for EOPs here is fueled by stringent EU emissions targets (Euro 7) and the high penetration rate of hybrid electric vehicles (HEVs) and 48V mild hybrids. EOPs are essential for reducing parasitic engine losses to meet mandated CO2 reduction goals. Germany, France, and the UK are key markets, characterized by high investment in advanced automotive technologies and a strong presence of global Tier 1 suppliers specializing in powertrain components and complex thermal management solutions, focusing heavily on precision and reliability.

- North America: The North American market is characterized by increasing demand stemming from tightening Corporate Average Fuel Economy (CAFE) standards and the rapid scaling of EV production, particularly in the United States, supported by federal incentives. While historically dominated by larger ICE vehicles, the market is quickly adopting EOPs for advanced transmission systems and increasingly for light-duty electric trucks and SUVs, which require robust high-flow cooling systems for large battery packs. Manufacturers in this region prioritize durability and performance across extreme temperature variations inherent to the geography.

- Latin America & Middle East and Africa (LAMEA): LAMEA currently accounts for a smaller share of the global EOP market, largely due to slower adoption rates of high-voltage electrification technologies and a stronger reliance on traditional ICE vehicles. However, growth is anticipated in specialized segments, such as mining and heavy industrial machinery in Latin America, where the durability and independent control offered by EOPs are highly valued. In the Middle East, while EV adoption is nascent, the focus on high-performance vehicles and efficient energy management could drive future EOP implementation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrically Operated Oil Pump Market.- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Denso Corporation

- Aisin Seiki Co., Ltd.

- Magna International Inc.

- Nidec Corporation

- Mitsubishi Electric Corporation

- Pierburg GmbH (Rheinmetall Automotive)

- Johnson Electric Holdings Ltd.

- TI Fluid Systems

- FTE automotive

- KSPG Automotive

- Shindengen Electric Manufacturing Co., Ltd.

- Mikuni Corporation

- Schaeffler AG

- Vitesco Technologies (Continental spin-off)

- Huayu Automotive Systems Co., Ltd. (HASCO)

- Eaton Corporation plc

- Hanon Systems

Frequently Asked Questions

Analyze common user questions about the Electrically Operated Oil Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Electrically Operated Oil Pumps (EOPs)?

The primary factor is the global acceleration of vehicle electrification, particularly the mass adoption of hybrid (HEV/PHEV) and battery electric vehicles (BEVs), which require EOPs for precise thermal management of battery packs and independent fluid circulation during electric-only driving modes to maximize energy efficiency.

How do EOPs contribute to the overall fuel economy of internal combustion engine (ICE) vehicles?

EOPs improve ICE fuel economy by eliminating parasitic losses associated with mechanically driven pumps and enabling start-stop systems. They ensure lubrication and cooling are maintained efficiently only when required, decoupling pump speed from engine speed, leading to measurable reductions in energy consumption.

What is the role of 48V technology in the growth of the EOP market?

The 48V mild hybrid architecture is critical as it provides the necessary power platform to efficiently run high-load auxiliaries like EOPs. These pumps are essential components in 48V systems, managing engine and transmission fluids, thereby facilitating the adoption of cost-effective electrification solutions globally.

Which technology type is currently favored by OEMs in new EOP designs?

Brushless DC (BLDC) motor technology is highly favored due to its superior efficiency, reliability, compact size, and low noise operation. BLDC EOPs offer better control and a longer lifespan, crucial for meeting the stringent durability standards of modern automotive powertrain systems.

What are the main segments of the Electrically Operated Oil Pump market by application?

The market is primarily segmented by application into Automotive (which includes passenger and commercial vehicles, encompassing lubrication and thermal management), Industrial Machinery, and Power Generation, with the automotive segment accounting for the vast majority of current market demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager