Electricity Trading Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438056 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electricity Trading Market Size

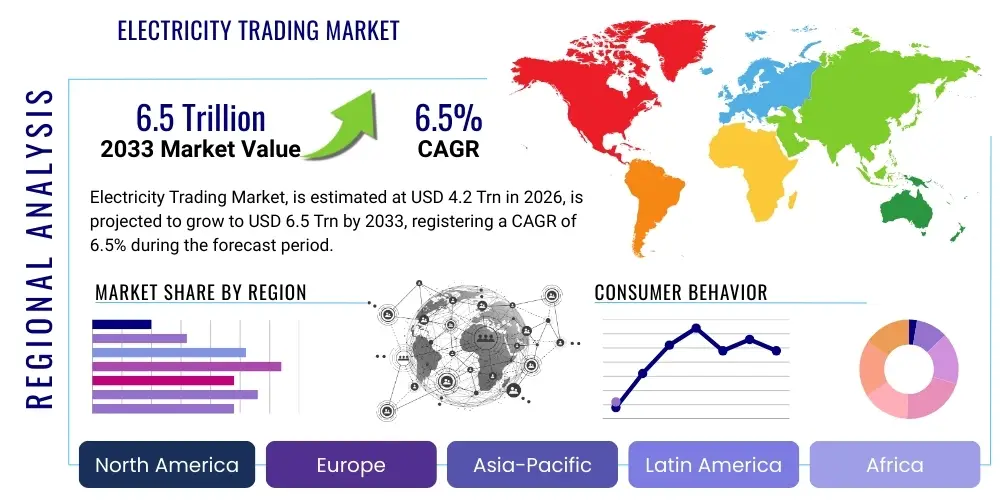

The Electricity Trading Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.2 Trillion in 2026 and is projected to reach USD 6.5 Trillion by the end of the forecast period in 2033.

Electricity Trading Market introduction

The Electricity Trading Market represents a vital component of the global energy infrastructure, serving as the financial nexus where power generators, consumers, and intermediaries engage in the transactional exchange of electrical energy. This market operates through highly specialized platforms and mechanisms, ranging from long-term bilateral agreements guaranteeing capacity supply to rapid, short-term transactions executed on organized spot exchanges like the Day-Ahead and Intraday markets. The nature of electricity as a non-storable commodity that must be consumed the moment it is generated introduces unique complexities, mandating sophisticated trading strategies focused on managing real-time physical balance and mitigating price exposure. The primary product is electricity delivered at specific nodal points within a transmission system, defined by specific time blocks (e.g., hourly, half-hourly, or five-minute intervals). The integrity and efficiency of these trading activities are paramount for maintaining the stability and reliability of interconnected power grids worldwide.

The diverse applications within this market extend beyond mere physical delivery; they encompass critical risk management functions essential for stabilizing the financial viability of energy producers and consumers. Major applications include portfolio optimization for utilities, where trading desks manage a mix of generating assets and purchased power contracts to minimize average cost and guarantee supply sufficiency. Furthermore, sophisticated financial instruments like electricity futures and options are heavily utilized to hedge against the severe price volatility inherent in this sector, particularly in response to fluctuating natural gas prices or unexpected weather events affecting renewable output. The core benefits derived from a well-functioning electricity trading environment include significant economic efficiency gains, achieved through transparent price discovery that incentivizes the lowest-cost generation dispatch, and enhanced energy security, facilitated by liquid markets that allow for rapid sourcing of replacement power during outages or system stress.

Market expansion is fundamentally driven by robust governmental policies advocating for rapid decarbonization and the subsequent massive deployment of intermittent renewable energy technologies, specifically solar and wind power. This structural shift necessitates greater market flexibility and sophisticated trading systems capable of handling frequent changes in supply. Concurrently, the global trend towards market liberalization—dismantling traditional utility monopolies and introducing competition—has broadened market participation, increasing transaction liquidity and fostering innovation in trading practices. Additional driving factors include breakthroughs in digital technology, such as smart grid implementations, which provide the high-resolution, real-time data required for instantaneous decision-making in fast-paced intraday and balancing markets, cementing the market’s transition toward automated, algorithm-driven trading processes across major developed economies.

Electricity Trading Market Executive Summary

Current business trends in the global Electricity Trading Market emphasize deep integration across energy supply chains, moving towards 'all-in-one' energy management platforms that seamlessly combine generation dispatch, battery storage optimization, risk modeling, and trade execution. The competitive landscape is increasingly defined by technological superiority, where firms capable of deploying advanced predictive models, high-frequency algorithms, and cloud-based ETRM systems gain a substantial competitive advantage in capturing fleeting arbitrage opportunities. A critical trend involves the democratization of the market via decentralized energy resources (DERs); as regulatory barriers fall, smaller players, including VPPs and specialized technology providers, are aggregating small-scale capacity to compete directly with traditional utility traders, thereby dispersing market control and increasing competition.

Regional dynamics illustrate a clear division between mature, highly interconnected markets and emerging, rapidly liberalizing ones. Europe continues its pioneering role, pushing the boundaries of market coupling and developing complex mechanisms for ancillary services and cross-border balancing, underpinned by stringent climate targets and the necessity of managing massive installed renewable capacity. North America, particularly within its RTO/ISO structures, focuses intensely on capacity markets and the integration of storage assets, addressing localized congestion and reliability issues. Conversely, the Asia Pacific region's growth narrative is defined by sheer volume and infrastructure build-out; substantial investment in transmission grids and the foundational establishment of competitive pool markets in major industrial nations promises exponential market value growth over the forecast period as regulatory frameworks mature.

Segmentation analysis confirms that the Financial Trading segment, covering futures and swaps, remains the backbone for long-term price certainty and risk hedging, securing the largest share of transactional value. However, the Physical Trading segment, specifically the Intraday and Balancing markets, is exhibiting the highest Compound Annual Growth Rate (CAGR), directly correlated with the rise of intermittent renewable generation. Furthermore, the End-User shift is significant: while utilities remain the largest consumer segment, the rapid increase in sophisticated trading engagement by large C&I entities highlights a move toward direct market participation, facilitated by robust software solutions tailored for non-utility portfolio management and PPA execution, reflecting a fundamental change in customer behavior.

AI Impact Analysis on Electricity Trading Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are enhancing predictive accuracy, especially concerning volatile inputs like solar and wind generation, and how these technologies are being deployed to optimize bidding strategies and risk management in complex market structures. Key themes consistently revolve around the displacement of human traders by algorithmic execution, the necessity of securing sensitive market data against cyber threats amplified by interconnected AI systems, and the regulatory challenges posed by highly automated trading environments. Expectations are high regarding AI's ability to unlock hidden efficiencies in grid optimization, potentially leading to lower consumer prices and significantly improved resilience against supply shocks through highly automated, data-driven operational decisions.

- AI-driven Price Forecasting: Utilizes complex ML models to predict short-term and long-term electricity prices with greater accuracy, incorporating real-time grid data, weather patterns, load profiles, and cross-commodity price correlations.

- Optimized Bidding Strategies: Algorithms automatically determine optimal bid/offer volumes and prices in day-ahead and intraday markets, utilizing instantaneous data feeds to maximize profitability under real-time network constraints and balancing requirements.

- Enhanced Risk Management: AI systems rapidly analyze market volatility, forecast potential system imbalances, and assess counterparty credit risk, enabling faster execution of sophisticated hedging strategies and optimized portfolio rebalancing across diverse assets.

- Grid Stability and Balancing: Machine learning supports Transmission System Operators (TSOs) by predicting and identifying imbalances caused by intermittent renewables, facilitating automated dispatch decisions and dynamic activation of reserve capacity and ancillary services.

- Algorithmic Trading Execution: Automation of high-frequency trading strategies, capitalizing on minute price spreads (arbitrage) across multiple interconnected energy exchanges with ultra-low latency requirements.

- Identification of Market Manipulation: AI tools monitor complex trading patterns and behavioral anomalies across vast transaction histories to detect and flag potential manipulative behavior, bolstering regulatory compliance and ensuring market integrity and fairness.

DRO & Impact Forces Of Electricity Trading Market

The Electricity Trading Market is primarily driven by the global imperative for energy transition, compelling large-scale integration of renewables and the consequent need for highly liquid and flexible markets to handle intermittency. However, market growth is often constrained by significant infrastructural bottlenecks, particularly insufficient transmission capacity between regions, limiting cross-border trade potential and amplifying localized price differentials. Opportunities lie profoundly in the development of sophisticated decentralized market structures utilizing blockchain and smart contracts, especially for facilitating trading among prosumers and local energy communities. These forces collectively shape the competitive landscape, emphasizing the requirement for technological agility and regulatory adaptability among market participants to mitigate volatility and capitalize on evolving power generation mixes.

Key drivers include substantial regulatory liberalization efforts across established and emerging economies, transitioning from vertically integrated utilities to competitive wholesale markets. This liberalization encourages diverse participation, increases liquidity, and sharpens price signals. Furthermore, the massive investment in digital infrastructure—smart grids, advanced metering infrastructure (AMI), and energy management systems (EMS)—provides the necessary data backbone for sophisticated, real-time trading activities. The accelerating retirement of conventional fossil fuel plants also serves as a strong driver, necessitating immediate investment in flexible generation and storage, all of which must be efficiently coordinated through advanced trading mechanisms that rely on short-term market efficiency.

Restraints center around regulatory uncertainty, particularly concerning shifting carbon pricing mechanisms and rapidly changing subsidies for renewable technologies, which can introduce policy risk that dampens long-term trading confidence and investment in large-scale infrastructure projects. High capital expenditure required for sophisticated IT infrastructure, regulatory compliance systems, and cybersecurity defenses also acts as a significant barrier to entry for smaller market players and new entrants. The primary impact force is the inherent and increasing volatility of electricity prices resulting from variable renewable input; this necessitates constant re-evaluation of market design to ensure reliability, leading to increased complexity in risk modeling and operational management, making trading expertise a high-value asset. Opportunities are highly concentrated in the proliferation of energy storage solutions (battery storage), which fundamentally change market dynamics by enabling temporal arbitrage and enhancing system resilience, thus providing lucrative new trading avenues.

Segmentation Analysis

The Electricity Trading Market is rigorously segmented based on the nature of the transaction (Physical vs. Financial), the source of the power (Conventional vs. Renewable), the market mechanism utilized (Day-Ahead, Intraday, Futures), and the various end-user categories (Utilities, IPPs, C&I). This segmentation is crucial as it dictates the regulatory environment, risk profile, and required technological infrastructure for participation. The growth trajectory of each segment is highly dependent on regional policy initiatives favoring decarbonization and market deregulation, making the Renewable and Intraday Market segments the fastest-growing areas within the overall trading ecosystem, attracting specialized capital and technological development.

Segmentation by type highlights the duality of the market: Physical Trading involves the exchange of power for actual delivery, focusing heavily on operational logistics and grid constraints, whereas Financial Trading utilizes derivatives to hedge price risk and speculate, primarily concerned with financial settlement and counterparty risk. The segmentation by mechanism is particularly vital; Day-Ahead markets remain the largest by volume, providing foundational price signals and securing base load, while the rapid growth in Intraday and Real-Time markets reflects the increasing, minute-by-minute need for operational flexibility to balance supply. These short-term markets are essential for managing the unpredictable output from solar and wind farms.

Furthermore, the segmentation by source underscores the shift in trading priorities; while conventional sources (gas, nuclear) still dominate total traded volume in many regions, renewable energy trading requires specialized, fast-paced algorithms and shorter trading horizons due to their inherent intermittency and reliance on weather inputs. Analyzing these distinct segments allows market participants and investors to tailor strategies, identify high-growth niches, and allocate capital towards the most profitable trading platforms and infrastructural developments that support the transition to a low-carbon, highly flexible energy system, crucial for long-term strategic positioning.

- By Type:

- Physical Trading (e.g., Bilateral Contracts, Spot Delivery)

- Financial Trading (e.g., Futures, Forwards, Options, Swaps)

- By Source:

- Conventional Sources (Coal, Natural Gas, Nuclear)

- Renewable Sources (Solar, Wind, Hydro, Geothermal, Biomass)

- By Mechanism:

- Day-Ahead Market (DAM)

- Intraday Market (IDM)

- Futures and Forwards Market

- Ancillary Services Market (AS)

- By End-User:

- Utilities and Grid Operators

- Independent Power Producers (IPPs)

- Large Commercial & Industrial (C&I) Consumers

- Financial Institutions and Energy Trading Houses

Value Chain Analysis For Electricity Trading Market

The value chain of the Electricity Trading Market is highly complex, starting with the Upstream Generation and Procurement phase, which involves independent power producers (IPPs) and regulated utilities generating power from various sources (conventional and renewable). Generators must accurately forecast their available capacity and strategically offer this power into the wholesale market, a process optimized by sophisticated internal scheduling and risk mitigation software. Effective management at this stage involves mitigating fuel price risk, managing operational availability, and fulfilling binding obligations to the grid operator, setting the initial supply parameters for the subsequent trading phases.

Midstream activities are central to the trading process and encompass Market Operation, Trading Execution, and System Management. Market operators, such as Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) in North America, or formalized Energy Exchanges in Europe, provide the regulated infrastructure for transparent price discovery, order matching, and trade execution. Sophisticated trading desks employ advanced ETRM systems and proprietary algorithms to determine optimal bidding strategies and manage large portfolios across multiple markets. Simultaneously, Transmission System Operators (TSOs) manage the physical grid, ensuring the technical feasibility of trades by monitoring congestion and maintaining system stability, acting as the critical link between financial commitment and physical realization.

Downstream activities involve the Physical Transmission, Distribution, and ultimate End-Consumption. Distribution System Operators (DSOs) deliver the power to the residential, commercial, and industrial consumers. The evolution here centers on leveraging smart grid technology and Advanced Metering Infrastructure (AMI) to gather high-resolution, real-time consumption data, which feeds back into the upstream trading activities, improving load forecasting and enabling rapid demand response programs. Distribution channels are predominantly indirect, utilizing the centralized, regulated grid infrastructure. However, the emerging trend of localized microgrids, peer-to-peer trading platforms, and large-scale corporate Power Purchase Agreements (PPAs) represents a growing direct channel, allowing large consumers to secure supply straight from specific generators, minimizing exposure to wholesale spot market volatility.

Electricity Trading Market Potential Customers

The core potential customers and buyers in the Electricity Trading Market are highly institutionalized entities requiring secure, flexible, and cost-effective energy supply or seeking highly liquid venues for arbitrage opportunities. Utilities and regulated Local Distribution Companies (LDCs) are primary buyers, constantly purchasing power in the wholesale market to meet their franchised customer base load requirements. They focus heavily on securing long-term capacity contracts and utilizing financial hedging tools to stabilize consumer tariffs and manage regulatory exposure. Independent Power Producers (IPPs), while primarily sellers of generated power, frequently act as strategic buyers when optimizing their portfolio, covering unexpected generation shortfalls, or managing maintenance schedules.

The rapidly growing segment of large Commercial and Industrial (C&I) consumers represents a significant shift, as these entities increasingly bypass traditional retail channels to directly engage in the wholesale market, either through direct purchases or corporate PPAs. This direct market engagement is driven by corporate sustainability goals, the demand for verifiable renewable energy sources, and the desire for greater cost certainty and control over energy procurement. High energy-intensive operations, such such as data centers, large manufacturing facilities, and electric vehicle charging network operators, are prime examples of this increasingly sophisticated consumer segment.

Furthermore, specialized financial institutions, hedge funds, and dedicated commodity trading houses represent pure financial customers, utilizing the market solely for proprietary trading, liquidity provision, and risk management purposes without taking physical delivery of the commodity. Energy aggregators and Virtual Power Plants (VPPs) are emerging institutional customers, acting on behalf of decentralized resources (like rooftop solar, small storage units, and demand response assets) and small industrial users. These entities purchase electricity when prices are low and sell when demand is high, requiring sophisticated software tools to optimize their collective participation in short-term balancing markets and ancillary services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Trillion |

| Market Forecast in 2033 | USD 6.5 Trillion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RWE AG, Engie, E.ON SE, EDF Group, Vattenfall AB, Iberdrola, NextEra Energy, Mercuria Energy Group, Vitol Group, Glencore plc, TotalEnergies SE, Shell Energy, BP plc, Cheniere Energy, SSE plc, Uniper SE, Enel SpA, Constellation Energy, Drax Group, JERA Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electricity Trading Market Key Technology Landscape

The essential technological infrastructure for modern electricity trading is anchored by Energy Trading and Risk Management (ETRM) systems, which have evolved into comprehensive platforms capable of managing complex, high-volume transactions across multiple commodities (power, gas, carbon). These systems must provide real-time valuation, accurate credit risk assessment, and automated regulatory reporting (e.g., adherence to REMIT or Dodd-Frank requirements). The reliance on secure, scalable cloud computing has become crucial, offering the necessary computational power to run complex Monte Carlo simulations and proprietary pricing models that accurately account for grid dynamics and meteorological variables, facilitating instantaneous decision-making under high-stress, volatile market conditions across geographically dispersed operations.

A second critical pillar is the pervasive application of Artificial Intelligence (AI) and Machine Learning (ML), particularly for high-accuracy forecasting and automated execution. These technologies utilize deep learning and neural networks to predict volatile generation output from intermittent sources and model sophisticated load curves, significantly reducing balancing costs for grid operators and traders. Beyond forecasting, AI is instrumental in developing and executing algorithmic trading strategies, which exploit short-term price differentials and liquidity pockets in fragmented, high-speed markets. This level of automation allows large trading firms to manage exponentially larger portfolios with minimal human latency, defining the competitive frontier in proprietary and systematic trading.

Furthermore, technology enabling interoperability and decentralization is rapidly gaining traction. This includes the development of standardized APIs for seamless integration with external data providers, meteorological services, and multiple distinct energy exchanges. Distributed Ledger Technology (DLT), specifically blockchain, is being piloted for applications in peer-to-peer (P2P) trading, where smart contracts automate micro-transactions within local energy communities or virtual power plants. This DLT application promises enhanced data immutability, greater transparency in the settlement process, and the potential to vastly reduce the reliance on central clearinghouses for small, high-frequency transactions, especially beneficial for managing the complex interplay of consumer-generators (prosumers) in future smart grids.

Regional Highlights

- Europe: Characterized by highly integrated and liberalized markets through mechanisms like market coupling, Europe is the global leader in sophisticated electricity trading. Driven by the EU's ambitious decarbonization targets, the region boasts established cross-border exchange platforms (EPEX SPOT, Nord Pool) and complex regulatory frameworks. Europe's focus on linking markets ensures high liquidity and rapid adoption of advanced trading technologies necessary for managing massive installed intermittent renewable capacity efficiently.

- North America (US and Canada): Dominated by independent system operators (ISOs) and regional transmission organizations (RTOs) such as PJM, ERCOT, and CAISO, which manage competitive wholesale energy, capacity, and ancillary services markets. Growth is heavily influenced by rapid natural gas supply, increasing deployment of utility-scale renewables, and substantial regulatory efforts to integrate energy storage assets. The market here is geographically diverse and relies on highly tailored regional market rules to address localized grid constraints.

- Asia Pacific (APAC): Represents the fastest-growing region in terms of energy consumption and market reform. Fueled by massive industrialization and urbanization, countries like China and India are undertaking foundational efforts to liberalize and modernize their power sectors. While market maturity varies, massive investment in transmission infrastructure and the sheer volume of new renewable energy projects are poised to create immense trading opportunities as competitive pool markets become fully operational.

- Latin America: Market maturity is highly stratified; countries like Brazil and Chile have established sophisticated wholesale power and capacity markets, often relying on hydrological risk models due to significant reliance on hydropower. Challenges include grid infrastructure vulnerability and political instability, but increasing regional integration efforts (e.g., the Central American Electrical Interconnection System) are gradually enhancing cross-border trading volumes and market resilience.

- Middle East and Africa (MEA): This region is characterized by nascent or historically state-controlled markets, though significant regulatory reforms are progressing rapidly, particularly in the Gulf Cooperation Council (GCC) nations. The market driver here is the strategic necessity to diversify energy mixes away from oil and gas and the corresponding development of massive solar energy parks, which will necessitate the future development of competitive trading exchanges for effective dispatch and integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electricity Trading Market.- RWE AG

- Engie

- E.ON SE

- EDF Group

- Vattenfall AB

- Iberdrola

- NextEra Energy

- Mercuria Energy Group

- Vitol Group

- Glencore plc

- TotalEnergies SE

- Shell Energy

- BP plc

- Cheniere Energy

- SSE plc

- Uniper SE

- Enel SpA

- Constellation Energy

- Drax Group

- JERA Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Electricity Trading market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Electricity Trading Market?

The primary growth drivers are global energy transition mandates, which necessitate the large-scale integration of intermittent renewable energy sources (solar and wind), and the widespread liberalization of wholesale power markets, fostering competition and significantly increasing the complexity and volume of transactions, particularly in short-term markets.

How does AI impact risk management in electricity trading?

AI significantly enhances risk management by utilizing machine learning models to analyze vast datasets, predict price volatility, and instantaneously assess portfolio exposures to market events. This capability allows algorithmic systems to execute precise hedging strategies and rebalance portfolios automatically, minimizing financial loss due to unpredictable supply or demand swings.

Which market mechanism segment is expected to show the fastest growth?

The Intraday Market (IDM) segment is expected to exhibit the fastest growth. This acceleration is driven directly by the increasing penetration of volatile renewables, which requires real-time balancing and trading closer to the actual time of delivery to ensure continuous grid stability and optimize flexible asset utilization.

What role does blockchain technology play in electricity trading?

Blockchain technology, specifically Distributed Ledger Technology (DLT), is being implemented to improve transaction transparency, reduce counterparty risk, and accelerate the settlement process. It facilitates peer-to-peer energy trading and the secure, verifiable tracking of Renewable Energy Certificates (RECs) using immutable smart contracts.

What are the main restraints affecting the market expansion?

Key restraints include significant physical infrastructure limitations, notably insufficient transmission capacity to move power efficiently between regions, and persistent regulatory uncertainty regarding market design, carbon policies, and rapidly shifting subsidies, which substantially increases investment risk for market participants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager