Electro Pneumatic Positioners Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436633 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Electro Pneumatic Positioners Market Size

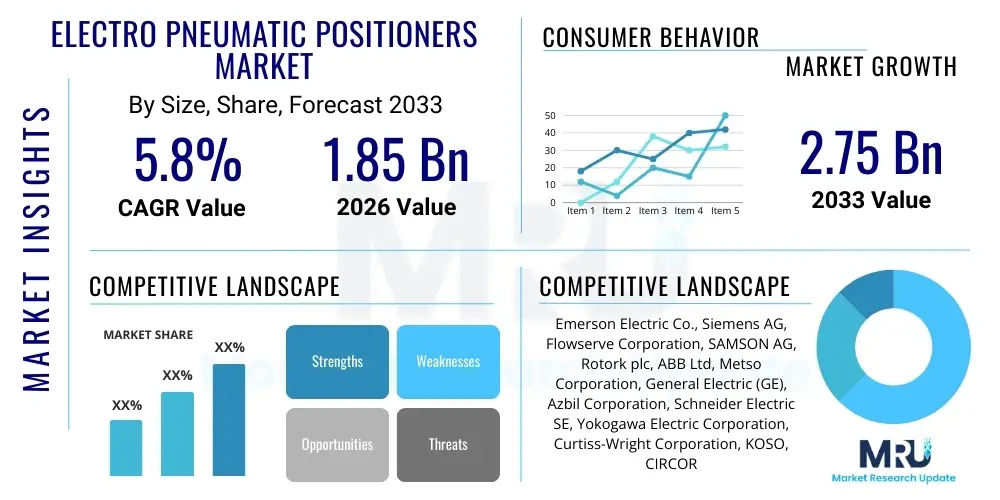

The Electro Pneumatic Positioners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.75 Billion by the end of the forecast period in 2033.

Electro Pneumatic Positioners Market introduction

Electro Pneumatic Positioners are essential components in industrial control systems, primarily used to accurately position control valves or actuators in response to an electrical control signal, typically 4-20 mA DC. These devices translate electrical command signals into proportional pneumatic output pressures, ensuring precise and reliable regulation of flow, pressure, temperature, or liquid level within complex process environments. They bridge the gap between digital control systems (like DCS or PLCs) and pneumatic final control elements, offering robust performance in harsh industrial settings where intrinsic safety and high reliability are paramount.

The primary applications of these positioners span across high-stakes industries including oil and gas, petrochemicals, chemical processing, power generation, and water treatment, where slight deviations in control parameters can lead to significant safety risks or production losses. The increasing adoption of automation technologies, particularly driven by Industry 4.0 initiatives, necessitates the deployment of highly accurate and responsive control instruments, thereby fueling the demand for sophisticated electro pneumatic positioners that offer diagnostics and communication capabilities, such as HART protocol integration.

Key benefits driving market growth include enhanced process control precision, reduced energy consumption through optimized actuator movement, improved system stability, and facilitation of advanced diagnostics for predictive maintenance. These positioners allow operators to remotely monitor valve performance and status, significantly reducing manual intervention and minimizing downtime. Furthermore, their inherent design provides a level of explosion protection, making them suitable for hazardous areas common in the energy and chemical sectors.

Electro Pneumatic Positioners Market Executive Summary

The Electro Pneumatic Positioners Market is experiencing robust expansion driven by the global imperative for enhanced process efficiency, stringent regulatory requirements for operational safety, and the massive ongoing capital expenditure in chemical processing and petrochemical infrastructure across emerging economies. Business trends indicate a strong shift toward smart positioners equipped with advanced digitalization features, capable of providing detailed diagnostic data and supporting Fieldbus communication standards. Manufacturers are prioritizing product miniaturization, modular design, and simplified calibration processes to reduce total cost of ownership (TCO) for end-users. The competition is centered on developing positioners with higher flow capacity, faster response times, and superior resistance to vibrations and temperature extremes, ensuring reliability in demanding operational environments.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, extensive investments in new refinery and power plant capacity, particularly in China and India, and increasing government focus on modernizing outdated industrial control systems. North America and Europe maintain a mature but steady market share, driven primarily by replacement demand, modernization projects focused on energy efficiency, and the integration of IoT-enabled control solutions. The focus in these developed regions is heavily skewed towards digital positioners that facilitate remote monitoring and compliance with strict environmental regulations.

Segment trends reveal that the use of positioners in the Oil and Gas sector, specifically upstream and midstream operations, remains the largest application segment due to the critical nature of valve control in pipeline management and extraction processes. In terms of technology, the non-contact sensing mechanism segment is gaining traction due to its superior durability and reduced maintenance requirements compared to traditional mechanical feedback systems. The market is increasingly adopting devices compatible with complex digital protocols like Profibus and Foundation Fieldbus, moving away from purely analog control loops to leverage the benefits of interconnected automation architectures.

AI Impact Analysis on Electro Pneumatic Positioners Market

User inquiries frequently center on how Artificial Intelligence (AI) can move electro pneumatic positioners beyond simple control loops into predictive and self-optimizing mechanisms. Common questions revolve around the integration of AI-powered diagnostics to predict valve failure, the potential for machine learning algorithms to fine-tune positioner performance based on real-time process variability, and the shift from reactive or scheduled maintenance to true condition-based monitoring. Users are concerned about the investment required for AI infrastructure, data security implications, and the interoperability of new smart positioners with legacy Distributed Control Systems (DCS). The overarching theme is the expectation that AI will transform the positioner from a passive control element into an active, intelligent asset contributing significantly to overall plant operational expenditure (OPEX) reduction and uptime maximization.

- AI-driven predictive maintenance models reduce unplanned downtime by anticipating mechanical or pneumatic failure in positioners.

- Machine learning algorithms optimize valve response time and overshoot based on varying fluid properties and process demands.

- Integration with advanced sensor data allows AI to perform self-calibration and drift compensation, enhancing long-term accuracy.

- AI facilitates enhanced fault detection and isolation, instantly diagnosing issues like air leakage or excessive friction.

- Generative modeling is utilized to simulate optimal positioner configurations for complex, non-linear control loops, improving tuning efficiency.

DRO & Impact Forces Of Electro Pneumatic Positioners Market

The market for electro pneumatic positioners is shaped by a critical balance of demand for advanced automation capabilities against inherent operational challenges and cost sensitivity. Key drivers include the global push towards industrial IoT (IIoT) integration and Industry 4.0 standards, mandating connected control devices capable of bi-directional communication and remote diagnostics. This need for operational transparency, coupled with continuous capacity expansions in core process industries such as chemical and pharmaceutical manufacturing, solidifies market momentum. Conversely, significant restraints arise from the high initial capital investment required for upgrading legacy pneumatic infrastructure to digital positioner systems, and the technical complexity involved in integrating diverse proprietary communication protocols across large industrial plants. Furthermore, market vulnerability to fluctuating raw material prices, particularly for metals used in housing and internal components, imposes financial pressure on manufacturers.

Opportunities in the market are abundant, especially in the development of highly specialized positioners for extreme environments, such as cryogenic applications or ultra-high pressure processes, areas where component reliability is non-negotiable. Furthermore, the emerging market for modular and retrofit solutions designed to integrate seamlessly with existing analog systems presents a lower-cost entry point for small to medium enterprises (SMEs) to adopt automation. The growing focus on sustainable operations and fugitive emissions reduction provides a strong impetus for positioners that offer superior sealing and control integrity, aligning with environmental compliance objectives globally.

The primary impact force remains technological evolution, particularly the transition from analog to smart digital positioners, which offer enhanced communication standards (HART, Foundation Fieldbus, Profibus). This shift is amplified by regulatory impact, where stricter safety standards (like SIL certification) necessitate the use of positioners with verifiable performance characteristics and advanced diagnostic capabilities. Economic growth in key manufacturing nations dictates capital expenditure on new plants, directly influencing procurement cycles for these critical control elements, while competitive intensity drives innovation in terms of miniaturization and energy efficiency.

Segmentation Analysis

The Electro Pneumatic Positioners market is strategically segmented based on factors critical to industrial application, technological complexity, and operational environment. The primary segmentation revolves around the Type of Positioner (Single Acting and Double Acting), the Communication Protocol employed (Standard Analog, HART, and Fieldbus), and the critical end-user applications. This segmentation allows manufacturers to tailor products precisely to the specific control requirements of different industries, such as high-volume flow control in petrochemicals versus highly precise dosage control in pharmaceuticals. The increasing sophistication of industrial processes demands positioners that are not just accurate but also compatible with complex networking architectures and centralized diagnostic platforms.

Further analysis considers segmentation by End-User Industry, recognizing that the demands of the Oil and Gas sector—where devices must withstand extreme temperatures and pressures—differ significantly from the requirements of the Food and Beverage sector, which prioritizes sanitation and rapid control loops. The fastest-growing segments are generally those incorporating advanced digital communication, as these smart devices enable the optimization and integration crucial for modern industrial ecosystems, moving beyond simple proportional control to offering a suite of diagnostic data points for predictive maintenance regimes. This complexity drives differentiated pricing and feature sets across the market landscape.

- By Type:

- Single Acting Positioners

- Double Acting Positioners

- By Technology:

- Analog Positioners

- Smart Positioners (Digital)

- By Operating Principle:

- Mechanical Feedback

- Non-Contact Sensing

- By Communication Protocol:

- 4-20 mA (Standard Analog)

- HART Protocol

- Foundation Fieldbus

- Profibus

- By End-User Industry:

- Oil and Gas

- Chemical and Petrochemical

- Power Generation (Thermal, Nuclear)

- Water and Wastewater Treatment

- Pulp and Paper

- Pharmaceuticals and Biotechnology

- Food and Beverage

Value Chain Analysis For Electro Pneumatic Positioners Market

The value chain for Electro Pneumatic Positioners commences with the upstream activities dominated by raw material procurement, encompassing specialized metals (stainless steel, aluminum alloys for housing) and electronic components (microcontrollers, sensors, and PCB manufacturing). Strategic sourcing and quality control at this stage are crucial, as the performance and durability of the final product depend heavily on the resilience of these base materials against harsh industrial environments, including corrosion and vibration. The midstream involves core manufacturing, focusing on precision machining, assembly, calibration, and rigorous testing processes to achieve certification (e.g., SIL, ATEX). Leading manufacturers leverage advanced manufacturing techniques, including cleanroom assembly for sensitive internal electronics, to ensure high Mean Time Between Failures (MTBF) and operational accuracy.

Downstream activities include distribution, sales, and aftermarket services. Distribution channels are typically bifurcated into direct sales for large, customized industrial projects (e.g., greenfield chemical plants) and indirect sales through a network of specialized industrial distributors, system integrators, and value-added resellers (VARs) who provide local technical support and application expertise. System integrators play a pivotal role, often packaging positioners with control valves, actuators, and associated monitoring software into complete, ready-to-install control loop solutions. This segment requires extensive technical training and robust inventory management capabilities.

Aftermarket services, including calibration, repair, maintenance contracts, and software updates for smart positioners, represent a significant and growing portion of the total value realization. Direct channels are vital for complex services requiring proprietary knowledge, whereas indirect channels handle routine replacement and maintenance parts. The efficiency of the downstream operations, particularly the availability of rapid local support, is a key competitive differentiator, particularly in highly regulated industries where prompt servicing is necessary to maintain continuous operations and compliance.

Electro Pneumatic Positioners Market Potential Customers

Potential customers for Electro Pneumatic Positioners are predominantly large-scale industrial operators and utility providers whose core processes rely on precise, automated regulation of media flow. Key buyers include major international oil companies (IOCs) and national oil companies (NOCs) involved in exploration, refining, and transportation, as control valves equipped with these positioners are critical for safety and operational throughput in highly volatile environments. Similarly, chemical manufacturers, especially those involved in continuous flow processes like polymerization or fertilizer production, constitute a major customer base due to the imperative for tight control over reaction variables.

The power generation sector, encompassing thermal, hydro, and nuclear plants, is another core clientele, utilizing positioners extensively in boiler feedwater systems, turbine control, and steam regulation valves where reliability under high thermal stress is mandatory. Furthermore, municipal bodies and private water treatment corporations are increasing their procurement of smart positioners to automate large networks of flow control valves, aiming for optimized resource utilization and reduced leakage in complex piping infrastructures. These institutional buyers focus on devices offering long-term reliability and low lifecycle maintenance costs, prioritizing products with robust warranties and strong regional service support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Siemens AG, Flowserve Corporation, SAMSON AG, Rotork plc, ABB Ltd, Metso Corporation, General Electric (GE), Azbil Corporation, Schneider Electric SE, Yokogawa Electric Corporation, Curtiss-Wright Corporation, KOSO, CIRCOR International, Inc., Parker Hannifin Corporation, ControlAir Inc., Valmet Corporation, Max-Tork Controls, Inc., Bürkert Fluid Control Systems, Watson McDaniel |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electro Pneumatic Positioners Market Key Technology Landscape

The technological landscape of the Electro Pneumatic Positioners market is rapidly evolving, driven primarily by the transition from purely mechanical and analog devices to sophisticated smart positioners featuring integrated diagnostics and digital communication capabilities. The primary enabling technology is the integration of advanced microprocessors and high-resolution, non-contact position sensors, which eliminate the mechanical wear and tear associated with traditional linkages, significantly improving long-term reliability and accuracy. Smart positioners now incorporate embedded software that performs automatic calibration, self-tuning, and continuous monitoring of critical parameters such as actuator pressure, air consumption, and stem friction, providing unprecedented insight into valve health.

A central pillar of the current technology shift is enhanced connectivity through established industrial protocols. The adoption of the HART (Highway Addressable Remote Transducer) protocol allows for simultaneous analog control and digital communication over the same wiring pair, offering diagnostics without requiring a full system overhaul. Furthermore, increasing penetration of Fieldbus protocols, including Foundation Fieldbus H1 and Profibus PA, is facilitating truly distributed control architectures. These digital platforms enable complete remote configuration, condition-based monitoring, and seamless integration into plant-wide asset management systems, reducing the need for personnel to access potentially hazardous field locations for maintenance or calibration checks.

Future technological advancements are focused on improving energy efficiency by minimizing steady-state air consumption, which is a major operational cost for large pneumatic systems. Manufacturers are developing piezoelectric technology and optimized pneumatic boosters to reduce air consumption drastically. Furthermore, there is a push towards enhanced cybersecurity features within smart positioners, ensuring that control devices are protected against unauthorized access and manipulation, a critical requirement as these instruments become increasingly interconnected within the broader Industrial IoT (IIoT) framework.

Regional Highlights

The global demand dynamics for Electro Pneumatic Positioners exhibit distinct regional characteristics influenced by industrial maturity, regulatory environment, and investment cycles.

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, fueled by massive government and private sector investments in infrastructural development, petrochemical expansion, and new power generation capacity, particularly in emerging economies like China, India, and Southeast Asia. The focus is on implementing cost-effective automation solutions and adopting digital positioners in new greenfield projects to meet surging domestic energy and chemical demands.

- North America: This region holds a significant market share, driven primarily by stringent safety standards and high adoption rates of advanced diagnostics in the mature oil and gas sector, particularly unconventional resource extraction (shale). The market is characterized by replacement demand and modernization projects aimed at compliance with Safety Integrity Level (SIL) requirements and maximizing operational efficiency through smart positioners.

- Europe: Europe represents a technologically advanced but moderately growing market. Growth is sustained by the highly regulated chemical, pharmaceutical, and water industries, which prioritize precision and reliability. The region leads in adopting energy-efficient positioners and adherence to environmental regulations, promoting investment in highly accurate, low air-consumption devices for sustainable operations.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries due to massive capital expenditures in crude oil refining, storage, and natural gas processing facilities. The need for robust, high-performance positioners capable of operating reliably under extreme heat and corrosive desert conditions is a key driver.

- Latin America: This region shows stable growth, primarily driven by upstream oil and gas operations in countries like Brazil and Mexico, and modernization efforts in aging infrastructure within the chemical and mining sectors. Market growth is sensitive to global commodity price fluctuations impacting national capital expenditure decisions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electro Pneumatic Positioners Market.- Emerson Electric Co. (Fisher)

- Siemens AG

- Flowserve Corporation

- SAMSON AG

- Rotork plc

- ABB Ltd

- Metso Corporation (Neles)

- General Electric (GE)

- Azbil Corporation

- Schneider Electric SE

- Yokogawa Electric Corporation

- Curtiss-Wright Corporation

- KOSO (Mascot)

- CIRCOR International, Inc.

- Parker Hannifin Corporation

- ControlAir Inc.

- Valmet Corporation

- Max-Tork Controls, Inc.

- Bürkert Fluid Control Systems

- Watson McDaniel

Frequently Asked Questions

Analyze common user questions about the Electro Pneumatic Positioners market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between analog and smart electro pneumatic positioners?

Analog positioners operate purely based on a 4-20 mA current signal and mechanical feedback, providing basic control. Smart (digital) positioners incorporate microprocessors, offer integrated diagnostics, perform self-calibration, and utilize digital communication protocols like HART or Fieldbus for enhanced performance monitoring and remote configuration.

Which industries are the largest consumers of electro pneumatic positioners?

The Oil and Gas industry (both upstream and downstream), Chemical and Petrochemical manufacturing, and the Power Generation sector are the largest consumers. These industries require high precision, reliability, and robust control devices certified for use in hazardous, high-pressure, and high-temperature operational environments.

How does the integration of HART protocol benefit positioner performance?

HART protocol integration allows for simultaneous analog control and digital data communication over existing wiring. This enables advanced diagnostics, remote configuration, and real-time monitoring of critical parameters like temperature, cycle count, and valve stroke, significantly improving predictive maintenance capabilities without disrupting the control signal.

What are the key drivers for market growth in the Asia Pacific region?

Market growth in APAC is primarily driven by rapid industrialization, extensive governmental and private sector investments in building new petrochemical refineries and chemical plants, and the region's increasing focus on adopting Industry 4.0 technologies to modernize outdated control infrastructure and enhance manufacturing output efficiency.

What role does SIL certification play in the selection of modern positioners?

Safety Integrity Level (SIL) certification confirms that a positioner meets rigorous reliability standards required for use in Safety Instrumented Systems (SIS). High SIL ratings are essential for critical applications in hazardous industries (like refining and nuclear) where device failure could lead to catastrophic safety events, making it a non-negotiable requirement for procurement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager