Electrocatalytic Oxidation Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438994 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Electrocatalytic Oxidation Equipment Market Size

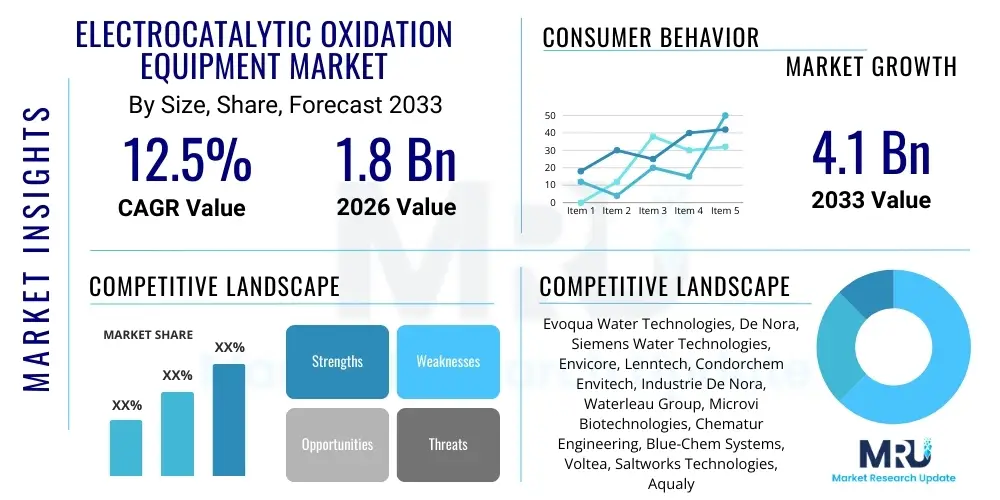

The Electrocatalytic Oxidation Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $4.1 Billion by the end of the forecast period in 2033.

Electrocatalytic Oxidation Equipment Market introduction

The Electrocatalytic Oxidation (EO) Equipment Market encompasses advanced wastewater treatment systems designed to mineralize recalcitrant organic pollutants that conventional biological and physical processes fail to eliminate. These systems utilize specialized electrodes and an applied electrical current to generate potent oxidizing agents, primarily hydroxyl radicals (•OH), directly at the electrode surface. This highly efficient, chemical-free process enables the destruction of complex compounds, making it indispensable for industries dealing with non-biodegradable, toxic, or high-concentration wastewater streams, thereby satisfying increasingly stringent global discharge regulations.

Major applications for electrocatalytic oxidation equipment span diverse industrial sectors, including pharmaceuticals, textiles, petrochemicals, pulp and paper, and municipal wastewater treatment (specifically tertiary treatment for micropollutants). The primary benefit of EO technology lies in its high efficiency, low sludge production, potential for automation, and ability to achieve complete mineralization of organic matter into carbon dioxide and water. The equipment architecture typically ranges from batch reactors to continuous flow electrochemical cells, tailored to specific wastewater characteristics and flow rates. Furthermore, the modular design often preferred by manufacturers allows for easy scalability and integration into existing treatment trains.

Driving factors sustaining market expansion include the escalating global water scarcity crisis, which necessitates effective reuse and recycling of industrial wastewater, and the widespread legislative push in developed and rapidly industrializing nations for zero liquid discharge (ZLD) or near-ZLD mandates. Additionally, technological advancements in electrode materials, such as the adoption of dimensionally stable anodes (DSA) and Boron-Doped Diamond (BDD) electrodes, which offer superior stability, higher current efficiency, and longer operational lifespan, are significantly lowering the operational expenditure (OPEX) and improving the economic feasibility of EO systems, further accelerating their adoption across various industrial verticals seeking sustainable and environmentally compliant solutions.

Electrocatalytic Oxidation Equipment Market Executive Summary

The Electrocatalytic Oxidation Equipment Market is defined by rapid technological maturation and strong underlying environmental regulatory support, positioning it for robust growth, particularly in specialized industrial applications. Business trends emphasize the shift toward integrated, hybrid systems that combine EO with membrane filtration or biological processes to optimize energy consumption and enhance overall treatment efficacy for complex matrices. Key industry players are focusing heavily on developing smart, modular units featuring real-time monitoring and control, leveraging IoT capabilities to provide predictive maintenance and optimize current density application, thereby enhancing process stability and reducing downtime across decentralized treatment facilities.

Regionally, the Asia Pacific (APAC) market is forecast to exhibit the fastest growth, primarily driven by rapid industrialization, high levels of water pollution from manufacturing sectors (especially China and India), and aggressive governmental investments in environmental infrastructure and remediation projects. While North America and Europe remain foundational markets due to stringent governmental directives like the EU Water Framework Directive and strong adoption of advanced tertiary treatment methods, Latin America and the Middle East & Africa (MEA) are emerging as significant growth centers, propelled by investments in mining, oil and gas, and pharmaceutical manufacturing wastewater treatment infrastructure, demanding robust solutions for highly toxic effluents.

Segment trends reveal a pronounced preference for equipment utilizing advanced electrode materials, particularly BDD electrodes, owing to their unparalleled efficiency in generating hydroxyl radicals and superior electrochemical stability, despite their higher initial cost. The industrial application segment, dominated by the pharmaceutical and chemical sectors, maintains the largest market share due to the necessity of treating highly refractory and concentrated effluents. Furthermore, system type segmentation shows increasing demand for continuous flow reactors over batch systems, reflecting the industry's need for high throughput and consistent operational performance required in large-scale industrial processing and municipal tertiary treatment facilities.

AI Impact Analysis on Electrocatalytic Oxidation Equipment Market

User queries regarding the intersection of AI and Electrocatalytic Oxidation (EO) equipment typically center on themes of operational efficiency, system reliability, and optimization of resource consumption, specifically electrical energy and electrode lifespan. Users are highly interested in how AI, particularly Machine Learning (ML) algorithms, can move EO systems beyond simple feedback loops to truly predictive and adaptive control mechanisms. Key concerns often revolve around the complexity of integrating diverse sensor data (flow, pH, conductivity, pollutant concentration) and the need for standardized data protocols to effectively train robust ML models specific to the highly variable nature of industrial wastewater streams. Expectations are high that AI will deliver significant reductions in operational expenditure (OPEX) by optimizing crucial variables such as applied current density and flow rates in real-time to maintain target pollutant degradation rates while minimizing energy penalties and premature electrode wear, thereby making EO a more economically viable alternative to traditional Advanced Oxidation Processes (AOPs).

- AI enables real-time monitoring and adaptive control of current density, maximizing energy efficiency (kWh per pollutant mass removed).

- Predictive maintenance schedules for electrode replacement and system component failure detection utilizing sensor data analytics.

- Optimization of reaction kinetics and contaminant removal pathways based on varying influent composition using Machine Learning models.

- Enhanced safety and regulatory compliance through automated anomaly detection and immediate system adjustments.

- Development of digital twins for simulating and optimizing reactor design and scaling-up processes before physical deployment.

- Improved process understanding and material science innovation through AI-driven analysis of electrode performance data under various electrochemical conditions.

- Automated chemical dosing (if used in hybrid systems) and pH control for optimal hydroxyl radical generation efficiency.

DRO & Impact Forces Of Electrocatalytic Oxidation Equipment Market

The Electrocatalytic Oxidation Equipment Market is shaped by a critical interplay of powerful drivers, structural restraints, and evolving market opportunities, collectively defining the impact forces that dictate its trajectory. The primary driver is the pervasive and increasing pressure from global environmental regulations mandating higher purity standards for industrial discharge and wastewater reuse. Simultaneously, significant restraints, particularly the high capital expenditure associated with advanced electrode materials like BDD and the substantial operational energy demand inherent in electrochemical processes, limit rapid, large-scale adoption, especially in price-sensitive developing economies. However, this restraint is being countered by substantial opportunities, including the growing demand for decentralized, point-of-source treatment solutions and technological breakthroughs in energy recovery and low-cost, high-efficiency electrode manufacturing, leading to a dynamic market characterized by rapid innovation cycles and shifting cost-performance curves, particularly for treating challenging emerging contaminants (CECs).

The overarching impact force is the necessity for sustainable industrial practices. Drivers, such as technological maturity enabling stable long-term operation, coupled with the proven efficacy of EO in eliminating highly refractory compounds that evade biological treatment (e.g., PFAS, endocrine disruptors), create a compelling business case for industries aiming for circular water management. The perceived high operating cost (restraint) is actively being addressed through process intensification research, integration with renewable energy sources, and the aforementioned AI-driven optimization, transforming the economic landscape of EO adoption. This delicate balance of high performance capability versus system economics defines the competitive environment.

Furthermore, global initiatives promoting resource efficiency and industrial symbiosis generate key opportunities for market growth, especially in regions facing acute water stress. EO equipment supports these goals by facilitating high-quality water recovery suitable for reuse in non-potable applications or industrial processes, thus reducing reliance on freshwater sources. The ongoing research into next-generation electrode materials (e.g., metal oxide composites, carbon felts) that promise reduced cost and improved specific surface area will gradually mitigate the current material-based investment restraints, ensuring that the market's trajectory remains steeply inclined towards innovation and wider commercial deployment across both centralized municipal and distributed industrial water infrastructure projects globally.

Segmentation Analysis

The Electrocatalytic Oxidation Equipment Market is systematically segmented based on criteria essential for operational deployment and strategic market analysis: Electrode Type, Application, and System Type. These segmentations provide a granular view of technological preferences, end-user demand patterns, and the favored structural solutions within the industry. Electrode type segmentation is critical as it directly influences efficiency, lifespan, and capital expenditure, differentiating high-performance, high-cost materials (like BDD) from more economically accessible, yet highly capable alternatives (like DSA). Application segmentation delineates the primary demand centers, showing the dominance of industrial wastewater treatment driven by the complexity of effluents over municipal tertiary treatment. System type segmentation highlights the trade-off between the high throughput of continuous flow reactors essential for large facilities and the flexibility offered by smaller, modular batch reactors utilized in smaller operations or pilot studies.

- By Electrode Type:

- Boron-Doped Diamond (BDD) Electrodes

- Dimensionally Stable Anodes (DSA)

- Mixed Metal Oxide (MMO) Electrodes

- Graphite and Carbon Felt Electrodes

- By Application:

- Industrial Wastewater Treatment

- Pharmaceuticals and Healthcare

- Textile and Dyeing Industry

- Chemical and Petrochemical Processing

- Pulp and Paper Industry

- Food and Beverage Processing

- Mining and Metallurgy

- Municipal Wastewater Treatment (Tertiary/Micropollutants Removal)

- By System Type:

- Batch Reactors

- Continuous Flow Reactors (CFR)

- Modular and Skid-Mounted Systems

Value Chain Analysis For Electrocatalytic Oxidation Equipment Market

The value chain for Electrocatalytic Oxidation Equipment is fundamentally structured, starting with highly specialized material sourcing and culminating in complex, long-term operational services for the end-user. The upstream segment is dominated by the manufacturing and supply of high-purity electrode precursors and specialized electrode fabrication (e.g., coating titanium substrates with MMO or synthesizing BDD films). These material suppliers hold significant leverage due to the proprietary nature and high-technology barrier of electrode production, which dictates the core efficiency and cost of the final equipment. Downstream activities involve the engineering, procurement, and construction (EPC) of complete electrochemical reactor systems, integrating electrodes with power supplies, pumps, and sophisticated control systems. This stage often involves collaboration between electrochemical specialists and general water infrastructure contractors to deliver customized solutions tailored to specific industrial effluent characteristics and operational scale.

The distribution channel is generally bifurcated into direct sales and indirect channels. Direct sales are common for large, customized industrial projects where manufacturers engage directly with large end-users (e.g., multinational chemical companies) to ensure precise specification matching and seamless integration. Indirect channels primarily involve partnerships with regional system integrators, environmental consulting firms, and specialized water technology distributors who provide local installation, maintenance, and after-sales support. Given the complexity of the technology, after-sales service, including electrode replacement contracts and performance monitoring, constitutes a crucial long-term revenue stream. The successful integration of these channels requires high technical proficiency and effective lifecycle management support to maintain system efficiency and guarantee regulatory compliance for the potential customers.

Electrocatalytic Oxidation Equipment Market Potential Customers

Potential customers for Electrocatalytic Oxidation Equipment are predominantly defined by the complexity and toxicity of their wastewater effluent, coupled with a strong regulatory imperative for advanced treatment. The primary buyers are large industrial operations in sectors known for generating highly concentrated, non-biodegradable, or persistent organic pollutants (POPs). Pharmaceutical manufacturers are key consumers, seeking to eliminate active pharmaceutical ingredients (APIs) and their metabolites which often resist conventional biological degradation, ensuring compliance with strict discharge limits on micropollutants. Similarly, textile and dyeing industries represent a major buyer segment, where EO systems are critical for decolorization and degradation of complex organic dyes that are highly refractory and aesthetically polluting.

Beyond these high-pollutant industries, the chemical and petrochemical sectors utilize EO for treating process wastewater containing complex refractory solvents, phenols, and surfactants, often as a pre-treatment step before biological systems or as a polishing step for water reuse. Furthermore, municipal wastewater treatment plants, particularly those in densely populated or environmentally sensitive areas, are emerging customers, utilizing EO as a tertiary polishing unit specifically for the removal of trace contaminants, emerging pollutants, and endocrine-disrupting chemicals (EDCs) that pose risks to aquatic ecosystems and human health, positioning the technology as a key component in future urban water recycling schemes. The decision to purchase is heavily influenced by total cost of ownership (TCO) assessments, regulatory pressure, and the proven ability of the equipment to handle fluctuating pollutant loads efficiently and reliably over extended operational periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $4.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evoqua Water Technologies, De Nora, Siemens Water Technologies, Envicore, Lenntech, Condorchem Envitech, Industrie De Nora, Waterleau Group, Microvi Biotechnologies, Chematur Engineering, Blue-Chem Systems, Voltea, Saltworks Technologies, Aqualyng, Electro Water Technologies, CleanTeQ Water, Pure Aqua Inc., Suez, Veolia Water Technologies, Xylem Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrocatalytic Oxidation Equipment Market Key Technology Landscape

The Electrocatalytic Oxidation Equipment market is characterized by a sophisticated technological landscape centered on maximizing the kinetic efficiency of pollutant destruction while minimizing energy input and material degradation. A pivotal technological area is the continuous innovation in anode materials. Dimensionally Stable Anodes (DSA), typically based on mixed metal oxides (MMO) like IrO2 or RuO2 coated on titanium substrates, remain widely used due to their relatively lower cost and good chlorine evolution capabilities, which are often leveraged for indirect oxidation mechanisms. However, the rapidly advancing technology of Boron-Doped Diamond (BDD) electrodes represents the frontier, offering superior oxygen evolution over potential, meaning they efficiently generate a higher concentration of the highly reactive hydroxyl radical (•OH) with fewer side reactions, enabling complete mineralization of the most resilient organic contaminants, albeit at a higher material and fabrication expense.

Reactor design and system integration constitute another critical technological domain. Modern EO systems are increasingly adopting three-dimensional (3D) electrode configurations, such as packed-bed or fluidized-bed electrochemical reactors, to maximize the specific surface area and improve mass transfer kinetics between the effluent and the electrode surface, thereby enhancing overall system performance and throughput compared to traditional two-dimensional parallel plate reactors. Furthermore, there is a strong push towards modular, skid-mounted designs incorporating advanced automation and sensor technology. These systems integrate electrochemical cells with high-precision power control units (rectifiers) that manage current pulsing and polarity reversal, which is vital for preventing electrode fouling and ensuring sustained, optimized operation, directly addressing the industry's demand for plug-and-play, decentralized treatment solutions.

The convergence of EO with other treatment modalities forms the third major technological trend. Hybrid systems—such as electro-Fenton, photoelectrocatalysis, and combinations with membrane bioreactors (MBR)—are gaining traction as they offer synergistic benefits, optimizing the treatment train for complex, high-volume wastewater. For instance, combining EO with advanced filtration can tackle both dissolved and particulate pollutants effectively. The development of specialized electrolyte solutions and non-traditional supporting electrolytes to enhance conductivity while minimizing unwanted reactions (like chlorate formation) is also crucial. These technological innovations collectively aim to lower the electrochemical window requirement, reduce energy footprint, extend component lifespan, and solidify EO’s position as a cost-effective, high-performance solution for the challenging field of advanced persistent pollutant removal and industrial water purification.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by expansive industrialization, particularly in chemical manufacturing, textiles, and electronics production across nations like China, India, and Southeast Asia. Severe water pollution issues and the resultant implementation of stricter governmental environmental standards (e.g., China's "Water Ten Plan") necessitate the adoption of advanced tertiary treatment technologies like EO, driving substantial investment in large-scale remediation and water recycling projects.

- North America: This region maintains a mature market characterized by high regulatory enforcement (e.g., US EPA regulations on PFAS and other emerging contaminants) and a strong focus on technological integration and R&D. Market growth is driven by the need for advanced municipal water reuse, coupled with specialized industrial applications in oil and gas production, where EO offers an effective solution for treating produced water and complex industrial brine streams to meet stringent discharge and recycling protocols.

- Europe: Europe is a key early adopter, strongly influenced by ambitious environmental directives such as the EU Water Framework Directive and evolving mandates on micropollutant removal. The market emphasizes sustainable engineering and energy efficiency, leading to high demand for BDD-based systems and innovative hybrid EO processes that integrate with renewable energy sources to achieve a lower carbon footprint in water management, particularly in Germany, the Netherlands, and France.

- Latin America (LATAM): This region is an emerging market, driven by rapid urbanization and significant investment in the mining and metallurgy sectors (Chile, Peru) which generate highly contaminated, often acidic, wastewater. The market growth is focused on modular, robust systems capable of handling remote deployment and highly fluctuating industrial loads, often requiring solutions for heavy metal removal alongside organic contaminant destruction.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in regions facing severe water scarcity, pushing countries like Saudi Arabia and the UAE to invest heavily in industrial water recycling and reuse infrastructure, particularly in the petrochemical and power generation sectors. EO equipment is valued here for its reliability in treating complex cooling tower blowdown and process effluents to meet high purity standards for water conservation efforts and industrial self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrocatalytic Oxidation Equipment Market.- De Nora

- Evoqua Water Technologies

- Suez

- Veolia Water Technologies

- Xylem Inc.

- Lenntech B.V.

- Condorchem Envitech S.L.

- Industrie De Nora S.p.A.

- Waterleau Group

- Microvi Biotechnologies

- Chematur Engineering AB

- Blue-Chem Systems

- Voltea B.V.

- Saltworks Technologies Inc.

- Aqualyng AS

- Electro Water Technologies

- CleanTeQ Water

- C-Tech Innovation Ltd.

- Enviro-Chemie GmbH

- Process Engineering and Equipment Co. (PEECO)

Frequently Asked Questions

Analyze common user questions about the Electrocatalytic Oxidation Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Electrocatalytic Oxidation (EO) over conventional Advanced Oxidation Processes (AOPs)?

EO systems offer several advantages, including the in-situ generation of hydroxyl radicals without the need for chemical addition (like hydrogen peroxide or ozone), resulting in lower chemical storage and handling risks. Furthermore, EO is highly effective at mineralizing recalcitrant organic pollutants (such as APIs and dyes) that resist traditional chemical oxidation, and the process typically generates less secondary sludge compared to chemical precipitation methods, simplifying sludge management and disposal.

What is the main factor driving the high operational cost of Electrocatalytic Oxidation equipment?

The principal operational expenditure (OPEX) driver for EO systems is electricity consumption, specifically the energy required per cubic meter of treated water to sustain the applied current density necessary for effective pollutant mineralization. This energy intensity is highly dependent on the water matrix (conductivity, flow rate) and the desired degree of pollutant removal, making energy optimization through advanced reactor design and AI control critical for minimizing TCO.

How do Boron-Doped Diamond (BDD) electrodes compare to Dimensionally Stable Anodes (DSA)?

BDD electrodes offer superior electrochemical performance, characterized by a wide operating potential window and high oxygen overpotential, which maximizes the generation of the highly oxidizing hydroxyl radical, leading to faster and more complete mineralization. DSA electrodes, typically Mixed Metal Oxide (MMO) coatings, are less expensive and more specialized for indirect oxidation processes (e.g., chlorine evolution) but are generally less effective for complete mineralization of highly refractory compounds than BDD, thus dictating material choice based on target pollutant composition and budget.

In which industrial sectors is Electrocatalytic Oxidation equipment most commonly utilized?

EO equipment sees its highest adoption rate in industrial sectors characterized by difficult-to-treat, non-biodegradable effluents. These include the pharmaceutical manufacturing sector (for APIs), the textile industry (for synthetic dyes), and the chemical and petrochemical industries (for refractory organic solvents). These applications require robust tertiary treatment to meet stringent regulatory limits on chemical oxygen demand (COD) and specific micropollutants.

Is Electrocatalytic Oxidation considered an environmentally sustainable technology?

Yes, EO is fundamentally considered sustainable because it relies on electricity rather than consumable chemicals, minimizing the transport and storage of hazardous substances. When powered by renewable energy sources, the system achieves a near-zero carbon footprint for the oxidation process. Furthermore, its ability to achieve complete mineralization and facilitate water reuse directly supports circular economy principles and sustainable water management goals by closing industrial water loops effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager