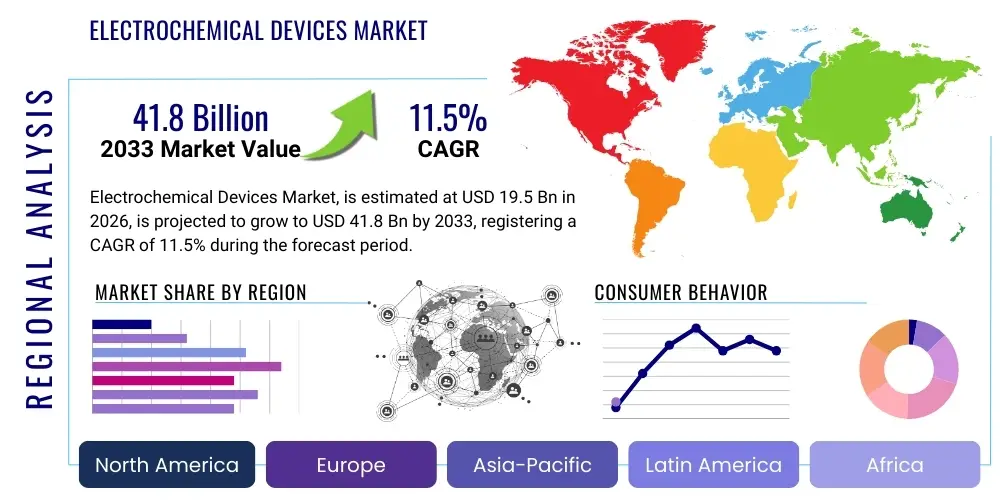

Electrochemical Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437346 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Electrochemical Devices Market Size

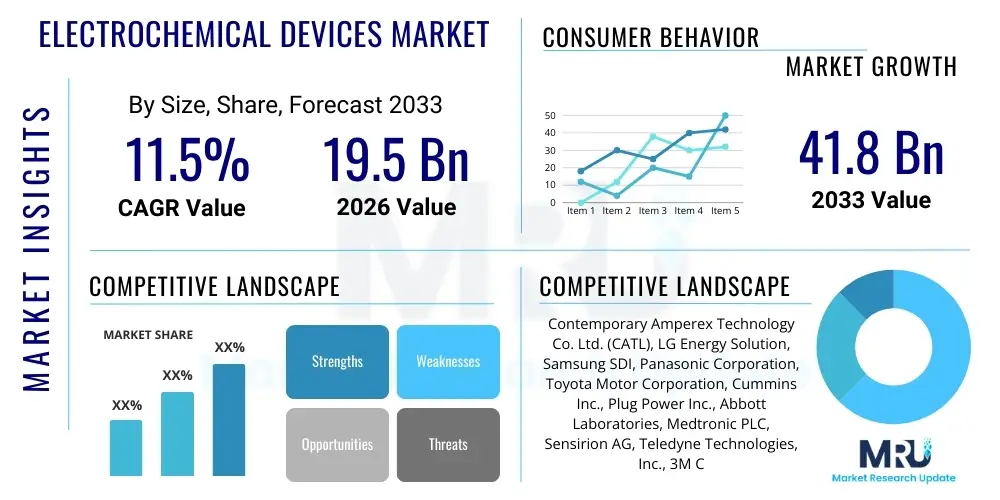

The Electrochemical Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 41.8 Billion by the end of the forecast period in 2033.

Electrochemical Devices Market introduction

Electrochemical devices represent a class of technology utilizing chemical reactions involving electron transfer (redox reactions) to either produce electrical energy (as in batteries and fuel cells) or to measure chemical parameters (as in sensors and biosensors). The market encompasses a diverse range of products, from micro-scale diagnostic biosensors critical for healthcare monitoring to massive grid-scale energy storage solutions like flow batteries. These devices are fundamentally essential for the modern electrified economy, driving efficiency and sustainability across multiple industrial sectors. Their core functionality lies in their ability to offer high sensitivity, fast response times, and often, miniaturization capabilities, making them irreplaceable in fields requiring precise chemical or biological measurements or efficient energy conversion.

The primary applications driving the proliferation of electrochemical devices are centered around the global energy transition and personalized healthcare. In the energy sector, electrochemical batteries, particularly lithium-ion and emerging solid-state chemistries, are foundational to electric vehicles (EVs) and renewable energy integration, addressing the intermittent nature of solar and wind power. Simultaneously, the proliferation of portable medical devices and continuous glucose monitoring (CGM) systems depends heavily on advanced electrochemical sensor technology. The growing global focus on environmental sustainability further boosts demand, as electrochemical devices are crucial for monitoring water quality, air pollution, and industrial effluent levels, providing real-time, accurate data necessary for regulatory compliance and environmental protection.

Major benefits derived from these technologies include enhanced energy efficiency, reduced carbon footprints, and improved diagnostic capabilities. The market is propelled by key driving factors such as stringent government mandates for carbon reduction, massive investments in electric mobility infrastructure globally, and rapid advancements in materials science allowing for higher energy density and improved device longevity. Furthermore, the convergence of nanotechnology and electrochemistry is opening new avenues for ultra-sensitive and highly selective devices, particularly in the point-of-care (PoC) diagnostics space, consolidating the electrochemical device market as a cornerstone of future technological innovation.

Electrochemical Devices Market Executive Summary

The Electrochemical Devices Market is characterized by intense innovation driven primarily by global energy needs and increasing technological miniaturization. Business trends indicate a strong shift towards solid-state electrochemistry, specifically in battery technology, aiming to address safety and energy density limitations of current liquid electrolyte systems. There is also a significant market consolidation trend among manufacturers seeking economies of scale, particularly those supplying the automotive EV sector, coupled with emerging partnerships between traditional chemical companies and advanced semiconductor firms focused on integrating electrochemical sensing into consumer electronics and IoT platforms. Supply chain resilience remains a central concern, pushing companies to diversify raw material sourcing, particularly for critical elements like lithium, cobalt, and nickel, while simultaneously exploring sustainable, earth-abundant alternatives to mitigate geopolitical risks and cost volatility.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in both manufacturing capacity and market consumption, predominantly due to the established electric vehicle and consumer electronics manufacturing ecosystems in China, South Korea, and Japan. North America and Europe, however, exhibit rapid growth driven by substantial governmental subsidies aimed at bolstering domestic battery gigafactories and fostering advanced research in fuel cells and hydrogen technologies. The competitive landscape in these Western regions is focusing heavily on intellectual property and regulatory compliance, particularly concerning device safety and end-of-life recycling requirements. Emerging economies in Latin America and MEA are seeing growth focused on basic energy storage solutions for grid stabilization and adopting localized sensor manufacturing for environmental and water management applications.

Segment trends reveal that the energy storage segment, encompassing batteries, remains the largest and fastest-growing sector, fueled by the accelerating adoption of EVs and utility-scale energy storage systems (ESS). Within the sensor segment, biosensors for continuous monitoring, especially glucose monitoring and rapid diagnostics, are exhibiting explosive growth, driven by aging populations and increasing prevalence of chronic diseases. The fuel cell segment, while smaller, is gaining momentum due to large-scale decarbonization efforts in heavy-duty transport (trucks, marine shipping) and stationary power generation. Technological focus across all segments is on enhancing operational lifespan, improving charge/discharge cycles, and ensuring cost-effectiveness through optimized manufacturing processes, emphasizing scalability and modularity in design.

AI Impact Analysis on Electrochemical Devices Market

Users frequently inquire about how Artificial Intelligence (AI) can accelerate the discovery of new electrode materials, optimize battery management systems (BMS), and enhance the predictive accuracy of electrochemical sensors. Key concerns revolve around the integration complexity of AI models with existing legacy hardware, the vast data requirements for training reliable electrochemical models, and the trustworthiness of AI-driven decisions regarding device safety and lifespan prediction. Users expect AI to revolutionize the R&D cycle, dramatically shortening the time taken from theoretical material concept to practical application, leading to higher-performance, safer, and longer-lasting electrochemical devices, particularly in high-stakes applications like aviation batteries or medical implants. The consensus expectation is that AI will move electrochemical engineering from purely empirical testing towards a data-driven predictive science, thereby significantly lowering manufacturing costs and accelerating market deployment.

The impact of AI is primarily centered on managing complexity and optimizing performance in real-time. For energy storage, AI algorithms are becoming indispensable for advanced Battery Management Systems (BMS), analyzing vast streams of operational data—temperature, voltage fluctuations, current rates—to predict degradation pathways, optimize charging profiles, and ultimately extend the useful life of battery packs. This predictive maintenance capability minimizes downtime and enhances safety, especially crucial for large-scale grid storage and electric vehicle fleets. Furthermore, AI-driven simulations and machine learning are being used in synthetic electrochemistry, where they predict the performance of novel electrode materials or electrolyte formulations before costly lab synthesis, significantly streamlining the development process for next-generation devices like solid-state batteries or high-efficiency electrocatalysts.

In the sensing domain, AI integration is transforming the analytical capabilities of electrochemical sensors. Machine learning models process raw sensor signals to filter noise, compensate for environmental interference, and significantly improve specificity and selectivity, allowing these sensors to distinguish between chemically similar analytes in complex matrices (like blood or environmental samples). This is crucial for applications such as multi-analyte biosensors and advanced industrial process control. The adoption of federated learning techniques is also emerging, allowing multiple sensors in a distributed network (e.g., environmental monitoring networks) to collaboratively improve diagnostic accuracy without compromising data privacy, fundamentally changing how large-scale monitoring and predictive analytics are executed.

- AI-driven acceleration of materials discovery for novel electrodes and electrolytes, reducing R&D cycles by up to 50%.

- Enhanced Battery Management Systems (BMS) utilizing Machine Learning for real-time state-of-health (SOH) and state-of-charge (SOC) prediction.

- Optimization of manufacturing parameters through predictive analytics, leading to higher yield and reduced production variability.

- Improved selectivity and accuracy of electrochemical sensors through complex signal processing and noise filtering using neural networks.

- Implementation of digital twins for simulating electrochemical device performance under various operational stress conditions.

- Enabling autonomous lab automation for high-throughput screening of electrochemical reactions and cell designs.

DRO & Impact Forces Of Electrochemical Devices Market

The Electrochemical Devices Market is powerfully influenced by regulatory push for decarbonization (Driver) and the persistent challenges associated with raw material sourcing and volatility (Restraint), while the emergence of next-generation battery chemistries (Opportunity) offers a path to overcoming current energy density limitations. The primary driver is the unprecedented global shift toward electrification, manifesting through stringent emissions targets set by major governmental bodies and corresponding mandates for zero-emission vehicles and renewable energy storage infrastructure. This sustained public policy pressure ensures consistent, high-volume demand for electrochemical storage and conversion technologies. Counterbalancing this strong positive force are significant restraints, notably the high initial cost of deployment, particularly for large-scale grid energy storage, and the inherent safety concerns associated with certain battery chemistries, such as thermal runaway risks in high-energy density cells, which necessitates complex thermal management systems and contributes to overall system cost.

Opportunities within this dynamic market are centered on technological advancements that address cost and performance gaps. The transition toward solid-state batteries (SSBs) represents a pivotal opportunity, promising higher energy density, faster charging speeds, and significantly improved safety profiles compared to conventional liquid lithium-ion cells, potentially unlocking mass adoption in previously inaccessible application areas like aviation. Furthermore, the burgeoning hydrogen economy presents a major market opening for high-efficiency Polymer Electrolyte Membrane (PEM) fuel cells and electrolyzers. The impact forces acting on this market are characterized by an extreme level of technological obsolescence risk, where a breakthrough in a competing technology (e.g., advanced capacitors or nuclear power miniaturization) could rapidly disrupt established battery markets. Regulatory frameworks, particularly regarding battery recycling and critical mineral sourcing transparency, also exert significant pressure, forcing manufacturers to adopt circular economy principles early in the product lifecycle.

The combined effect of these forces creates a high-growth, high-risk environment. The underlying societal shift towards sustainable energy provides robust market traction, yet the market's dependence on geopolitically sensitive raw materials introduces inherent instability. Successful market players must navigate this by investing simultaneously in vertical integration to control supply chains, and in technological diversification, exploring alternatives like sodium-ion or zinc-based batteries to hedge against lithium supply risks. The imperative for safety and environmental stewardship, driven by regulatory and consumer demand, acts as a continuous force, elevating the standards for product quality and sustainable manufacturing practices across the entire value chain, demanding continuous innovation in device packaging, thermal management, and end-of-life processing.

Segmentation Analysis

The Electrochemical Devices Market is comprehensively segmented across device Type, Application, and End-User, reflecting the breadth of technological deployment from micro-diagnostics to utility-scale power solutions. Analyzing these segments is critical for understanding specific growth vectors. The Type segmentation primarily differentiates between energy storage devices (batteries, supercapacitors) and analytical/conversion devices (sensors, fuel cells). The massive scale required by the automotive and grid sectors heavily dictates the dominance of the battery segment, whereas the sensor segment, though smaller in volume, excels in high-margin, specialized areas like medical diagnostics and industrial monitoring, demonstrating superior growth in terms of technological sophistication and value per unit.

Application segmentation clarifies the 'why' behind demand, with Electric Vehicles (EVs) representing the single most crucial driver, demanding constant innovation in battery pack design for extended range and faster charging. Concurrently, the healthcare application segment is rapidly advancing, focusing on non-invasive or minimally invasive monitoring, utilizing advanced biosensors for continuous data collection. The industrial sector utilizes electrochemical sensors for critical process control, monitoring parameters like pH, conductivity, and dissolved oxygen, ensuring efficiency and safety in chemical and manufacturing plants. This diversity ensures market resilience, as downturns in one application area (e.g., consumer electronics battery demand) may be offset by acceleration in another (e.g., grid storage deployment).

End-user segmentation focuses on the ultimate consumer of the technology, differentiating between B2B sectors like Automotive and Utility, and B2C segments like Consumer Electronics and Medical. The Automotive sector is characterized by long-term contracts, high volume requirements, and extremely stringent quality and safety standards, acting as a powerful determinant for technological validation. Conversely, the Medical end-user segment demands specialized, highly accurate, and biocompatible devices, often produced in lower volumes but commanding premium pricing. Understanding the specific procurement needs, regulatory hurdles, and performance metrics relevant to each end-user is fundamental for market strategy development and targeted product innovation.

- By Type:

- Batteries (Lithium-ion, Flow Batteries, Sodium-ion, Solid-State)

- Fuel Cells (PEMFC, SOFC, PAFC)

- Electrochemical Sensors (Biosensors, Gas Sensors, pH/Ion Sensors)

- Supercapacitors/Electrochemical Capacitors

- Electrolyzers

- By Application:

- Energy Storage Systems (Grid & Residential)

- Automotive (EVs, Hybrid Electric Vehicles)

- Portable Electronics

- Medical Diagnostics and Monitoring (CGM, PoC testing)

- Environmental Monitoring (Air & Water Quality)

- Industrial Process Control

- By End-User:

- Automotive

- Consumer Electronics

- Healthcare/Medical

- Utilities & Energy

- Industrial Manufacturing

- Defense & Aerospace

Value Chain Analysis For Electrochemical Devices Market

The value chain for electrochemical devices is complex and resource-intensive, beginning with the upstream sourcing of highly purified raw materials such as lithium salts, cobalt, nickel, specialized carbon materials, and platinum-group metals. The upstream segment is defined by global mining operations, chemical processing, and material refinement, which is currently dominated by a few major geopolitical regions, introducing significant supply chain risks and cost volatility. Manufacturers in this space focus heavily on achieving material consistency and developing advanced chemical processes to meet the ultra-high purity requirements demanded by high-performance electrochemical cells. Efficiency and sustainability in this initial stage directly impact the eventual cost and performance characteristics of the final device, driving vertical integration strategies among large battery and fuel cell manufacturers seeking to secure long-term, stable access to these foundational inputs.

The midstream phase involves the sophisticated manufacturing of core components: electrodes (anodes and cathodes), separators, and electrolytes. This is where proprietary intellectual property in cell chemistry and fabrication processes creates competitive differentiation. Device assembly and packaging follow, ranging from micro-assembly for medical sensors to large-scale, automated gigafactories for battery cell production. Distribution channels in this market are bifurcated: high-volume energy storage devices often move directly or through highly managed supply chains to original equipment manufacturers (OEMs) in the automotive and utility sectors (direct distribution), requiring specialized logistics for handling potentially hazardous materials. Conversely, electrochemical sensors and smaller batteries often pass through specialized industrial distributors and medical supply chains (indirect distribution) that offer localized technical support and inventory management.

The downstream segment is focused on integration, deployment, and crucial end-of-life management. For energy storage, integration involves packaging cells into modules and packs (requiring advanced BMS and thermal management) and installation in EVs or grid systems. The end-user utilization generates vast amounts of performance data, which increasingly feeds back into the upstream R&D process (a closed-loop value chain). A critical element emerging downstream is the requirement for robust recycling infrastructure and second-life applications for battery packs. This push for a circular economy, driven by impending regulatory mandates, is transforming the downstream landscape, making recovery of critical materials an essential part of the total cost of ownership and future supply stability. Overall profitability is highly sensitive to efficiency gains in the midstream manufacturing process and stability in upstream raw material costs.

Electrochemical Devices Market Potential Customers

Potential customers for electrochemical devices span numerous high-value sectors, driven by the global imperatives of energy independence, health monitoring, and environmental compliance. The largest and most influential customer segment is the Automotive industry, encompassing major global Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers, who are rapidly transitioning their vehicle portfolios entirely towards battery electric vehicles (BEVs) and hydrogen fuel cell electric vehicles (FCEVs). These buyers prioritize energy density, cycle life, safety certifications (e.g., UN 38.3, ISO standards), and scalable supply contracts, often engaging in long-term strategic partnerships with cell manufacturers to ensure supply consistency and technological co-development.

The second major group consists of Utility and Energy providers, including Independent Power Producers (IPPs) and grid operators, who require large-scale Battery Energy Storage Systems (BESS) for grid balancing, peak shaving, and integrating intermittent renewable energy sources (solar, wind). These customers prioritize low capital expenditure (CapEx) per kWh, system reliability, lifespan (measured in years of operation), and compliance with strict grid codes and safety regulations. The adoption of flow batteries and large-format lithium-ion chemistries is particularly high in this segment due to the demand for extended duration storage and robust, stationary operation.

Furthermore, the Healthcare sector, including hospitals, diagnostic labs, and medical device manufacturers, represents a high-growth customer segment focused on biosensors and miniaturized power sources. Key buyers include companies specializing in Continuous Glucose Monitoring (CGM) systems, Point-of-Care (PoC) diagnostic platforms, and implantable medical devices. These customers demand devices with extreme sensitivity, biocompatibility, long shelf life, and robust performance under clinical conditions, often requiring FDA or regional regulatory approval. Other significant buyer segments include Consumer Electronics manufacturers (for portable devices), and industrial entities that require advanced sensors for real-time monitoring in harsh chemical processing environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 41.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution, Samsung SDI, Panasonic Corporation, Toyota Motor Corporation, Cummins Inc., Plug Power Inc., Abbott Laboratories, Medtronic PLC, Sensirion AG, Teledyne Technologies, Inc., 3M Company, Siemens AG, Ballard Power Systems, SENSATA Technologies, General Electric (GE), Johnson Matthey, AEM Electrolysers, Ambri, QuantumScape. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrochemical Devices Market Key Technology Landscape

The technological landscape of the Electrochemical Devices Market is characterized by intense research and development focused on overcoming the inherent trade-offs between energy density, power output, safety, and cost. In the energy storage domain, the key technological thrust is the transition from conventional liquid electrolyte lithium-ion batteries (LIBs) to next-generation chemistries. Solid-State Batteries (SSBs) represent the leading edge, utilizing solid ceramic or polymer electrolytes to replace flammable liquid components, which promises safer operation and significantly higher energy densities exceeding 500 Wh/kg. Parallel advancements include the development of cheaper alternatives like Sodium-ion (Na-ion) batteries, which leverage abundant raw materials and are gaining traction for stationary storage applications where energy density is less critical than cost and longevity, providing a crucial hedge against lithium market volatility.

Beyond storage, fuel cell technology is witnessing major refinement, particularly within Polymer Electrolyte Membrane Fuel Cells (PEMFCs) used in automotive and heavy-duty transport. Innovations are focused on reducing the Platinum Group Metal (PGM) loading in the catalysts to lower production costs, improving the durability of the membrane electrode assembly (MEA), and enhancing cold-start capabilities, which are critical for widespread adoption in colder climates. Furthermore, the development of highly efficient electrolyzers, specifically Solid Oxide Electrolysis Cells (SOECs) and PEM Electrolyzers, is crucial for the green hydrogen production pathway. These technologies aim to achieve higher conversion efficiencies (approaching 80%) while ensuring operational stability over thousands of hours, which is necessary for economically viable hydrogen production linked to renewable energy sources.

In the sensing segment, the confluence of microfabrication techniques (MEMS) and advanced materials science is driving innovation. Third-generation biosensors are moving towards non-enzymatic sensing platforms and aptamer-based recognition elements, offering increased stability, lower manufacturing complexity, and superior selectivity for complex biomarkers. The integration of electrochemical sensors into wearable and implantable devices requires ultra-low power consumption and exceptional miniaturization, achieved through specialized chip design and printed electronics. The future technological trajectory is moving toward integrated, multifunctional platforms—for example, a single chip capable of simultaneously monitoring multiple gases and biological markers—leveraging advanced nanomaterials like graphene and carbon nanotubes to enhance electron transfer kinetics and surface area, thereby maximizing sensitivity at the molecular level.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC, particularly led by China, South Korea, and Japan, commands the largest share of the Electrochemical Devices Market. This dominance is attributed to robust domestic manufacturing ecosystems for lithium-ion batteries, supported by high raw material processing capacity and massive demand from the electric vehicle (EV) sector. China alone holds significant control over the global battery supply chain and manufacturing output. The region is also a key center for consumer electronics production, driving demand for advanced small-format batteries and electrochemical sensors. Future growth in APAC will be fueled by expanding utility-scale storage projects and the continued rapid urbanization requiring enhanced environmental monitoring devices.

- North America (NA) Growth Acceleration: North America is experiencing rapid market acceleration, primarily driven by substantial government policies such as the Inflation Reduction Act (IRA) in the US, providing significant tax credits and incentives for domestic manufacturing of EVs, batteries, and renewable energy components. This has triggered a massive influx of investment into building gigafactories and establishing localized supply chains for critical minerals and cell components. NA is a global leader in high-tech application segments, particularly in aerospace, defense, and advanced medical devices, leading to strong demand for specialized, high-performance fuel cells and biosensors. The region focuses heavily on advanced materials research and solid-state technology commercialization.

- Europe Market Focus on Decarbonization and Hydrogen: Europe is characterized by stringent emission standards and an aggressive commitment to the European Green Deal, fueling high demand for electrochemical solutions. While building domestic battery production capacity (the ‘European Battery Alliance’), the continent is also a pioneer in the deployment of hydrogen infrastructure. This focus drives the growth of the fuel cell and electrolyzer segments for heavy-duty transport, industrial decarbonization, and renewable energy storage. Regulatory mandates regarding battery recycling and sustainability (e.g., the EU Battery Regulation) are shaping the market structure, forcing manufacturers to adopt circular economy practices ahead of other regions.

- Latin America (LATAM) Infrastructure Development: The LATAM market represents an emerging opportunity, mainly concentrated on grid infrastructure stabilization and utilizing its rich natural resources, particularly lithium reserves in the ‘Lithium Triangle’ (Chile, Argentina, Bolivia). Market growth is currently focused on renewable energy integration projects and demand for energy access in remote areas, utilizing solar power coupled with cost-effective stationary storage solutions. While manufacturing is less mature, investment in raw material extraction and basic assembly is increasing, often driven by international partnerships seeking resource security.

- Middle East and Africa (MEA) Energy Diversification: The MEA region is primarily focused on energy diversification away from hydrocarbons, leading to significant investments in large-scale solar power projects in the Middle East, requiring vast battery energy storage systems (BESS). The region’s growth is concentrated in utility-scale projects and industrial applications (oil & gas monitoring). In Africa, decentralized power solutions and off-grid electrification initiatives drive demand for robust, reliable, and often solar-charged electrochemical batteries. There is also rising demand for environmental sensors for water management and air quality monitoring in rapidly expanding urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrochemical Devices Market.- Contemporary Amperex Technology Co. Ltd. (CATL)

- LG Energy Solution

- Samsung SDI

- Panasonic Corporation

- Toyota Motor Corporation

- Cummins Inc.

- Plug Power Inc.

- Ballard Power Systems

- Abbott Laboratories

- Medtronic PLC

- Sensirion AG

- Teledyne Technologies, Inc.

- 3M Company

- Siemens AG

- SENSATA Technologies

- General Electric (GE)

- Johnson Matthey

- QuantumScape

- Ambri (Liquid Metal Batteries)

- AEM Electrolysers

Frequently Asked Questions

Analyze common user questions about the Electrochemical Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Electrochemical Devices Market?

The market is primarily driven by the global energy transition, specifically the exponential increase in demand for Electric Vehicles (EVs) and large-scale renewable energy storage systems (ESS). Regulatory mandates promoting decarbonization and significant advancements in healthcare diagnostics, particularly continuous patient monitoring systems utilizing biosensors, also provide substantial market impetus.

How is the rise of solid-state batteries impacting traditional lithium-ion technology?

Solid-state batteries (SSBs) are positioned as the disruptive successor to traditional liquid lithium-ion (LIBs), promising higher energy density, faster charging rates, and vastly superior safety profiles due to the elimination of flammable liquid electrolytes. While LIBs remain dominant currently, SSB development is pushing manufacturers to accelerate research and production, fundamentally changing the competitive landscape over the next decade.

Which geographical region dominates the manufacturing and consumption of electrochemical devices?

Asia Pacific (APAC), led predominantly by China, South Korea, and Japan, currently dominates both the manufacturing capacity and market consumption of electrochemical devices, particularly in the critical battery and consumer electronics segments. However, North America and Europe are rapidly increasing their domestic manufacturing capabilities through strategic investment and policy support.

What role do electrochemical devices play in the emerging hydrogen economy?

Electrochemical devices are central to the hydrogen economy. Fuel cells (like PEMFCs) convert hydrogen into electricity efficiently for transport and stationary power, while advanced electrolyzers utilize electrochemical processes to split water, producing ‘green’ hydrogen using renewable electricity, thereby establishing the key components necessary for a sustainable, carbon-neutral energy system.

What are the major challenges related to the supply chain for electrochemical devices?

The primary supply chain challenges involve the significant price volatility and geopolitical risks associated with sourcing critical raw materials, including lithium, cobalt, and nickel. Manufacturers face intense pressure to secure stable, sustainable supply lines and invest in recycling technologies to mitigate dependence on environmentally and ethically sensitive mining operations and volatile global commodity markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager