Electrode Slurry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431468 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Electrode Slurry Market Size

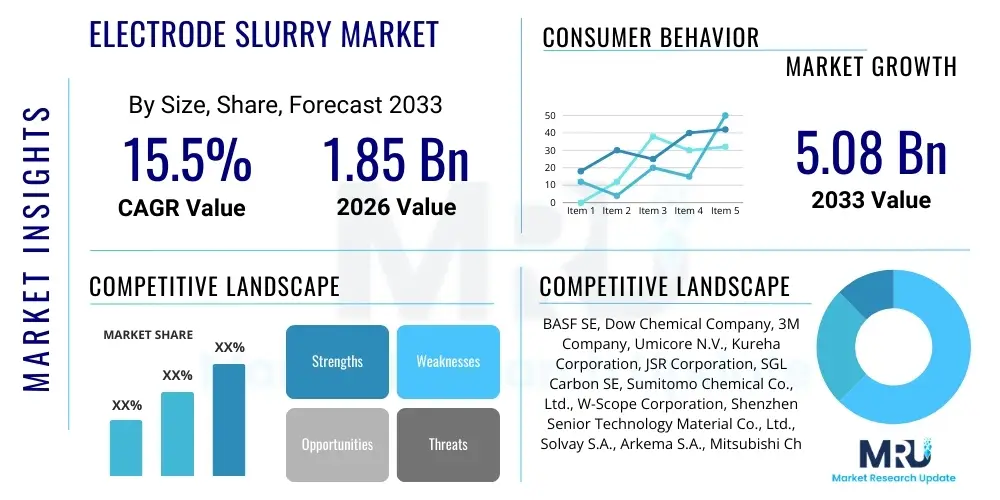

The Electrode Slurry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 5.08 Billion by the end of the forecast period in 2033.

Electrode Slurry Market introduction

The Electrode Slurry Market encompasses the production and supply of specialized chemical mixtures crucial for manufacturing advanced battery electrodes, particularly for lithium-ion batteries. Electrode slurry is a carefully formulated suspension of active materials (such as cathode materials like NMC or LFP, and anode materials like graphite), conductive additives (like carbon black), and polymeric binders, all dispersed uniformly in a volatile solvent. This homogeneous mixture is meticulously coated onto metal current collectors (aluminum foil for cathodes, copper foil for anodes) during the battery manufacturing process. The quality, stability, and rheology of the slurry directly dictate the performance characteristics, energy density, cycle life, and safety profile of the final battery cell. As such, it represents a core strategic material in the global transition towards electrified transportation and renewable energy storage.

Major applications driving the demand for high-quality electrode slurries include Electric Vehicles (EVs), grid-scale Energy Storage Systems (ESS), and high-performance Consumer Electronics. The intrinsic benefit of a well-formulated slurry lies in its ability to maximize the interfacial contact between active materials and conductive pathways, reducing internal resistance and improving charge/discharge rates. Driving factors for market expansion include escalating global demand for high-energy density batteries required by major automakers, stringent governmental policies promoting zero-emission vehicles, and significant investments in giga-factories across Asia Pacific, Europe, and North America. Furthermore, ongoing research into solid-state electrolytes and silicon-based anodes necessitates continuous innovation in slurry formulation and mixing technology to accommodate novel materials.

Electrode Slurry Market Executive Summary

The Electrode Slurry Market is characterized by robust expansion fueled primarily by the exponential growth of the Electric Vehicle sector and corresponding governmental mandates pushing battery production capacities. Business trends indicate a strong focus on localization of supply chains, driven by geopolitical risks and the need for optimized logistics for heavy, specialized chemical inputs. Strategic alliances and joint ventures between material suppliers and major battery manufacturers (Cell makers) are becoming increasingly common, ensuring stable off-take agreements and collaborative research on next-generation slurry formulations compatible with high-nickel cathodes and silicon-rich anodes. Furthermore, the industry is witnessing a shift towards dry electrode manufacturing processes, though wet slurry processing remains the dominant method due to established infrastructure and high manufacturing stability, compelling suppliers to optimize solvent recovery and minimize environmental impact.

Regional trends highlight the Asia Pacific region, particularly China, South Korea, and Japan, as the undisputed leaders in both consumption and production, benefiting from the presence of world-leading battery manufacturers like CATL, LG Energy Solution, and Samsung SDI. However, Europe and North America are experiencing rapid capacity build-out, supported by initiatives such as the US Inflation Reduction Act (IRA) and EU Green Deal, accelerating the demand for local slurry preparation facilities. Segment trends indicate the Cathode Slurry segment dominates the market by value, given the higher cost and complexity of cathode active materials, with Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP) formulations commanding significant shares. The Lithium-ion battery application segment remains the primary growth catalyst, requiring increasingly specialized slurries capable of ultra-fast charging and extended cycle life, thereby driving premium pricing for advanced materials.

AI Impact Analysis on Electrode Slurry Market

Common user questions regarding AI’s influence on the Electrode Slurry Market frequently center on its role in optimizing complex manufacturing parameters, accelerating new material discovery, and enhancing quality control. Users often inquire whether AI can predict slurry aging, determine optimal mixing sequences, or model the precise rheological behavior needed for high-speed coating lines. Key themes summarized from these inquiries reveal high expectations for AI to solve persistent challenges related to batch-to-batch inconsistency, high waste rates in experimental R&D, and the bottleneck associated with manual inspection processes. Users anticipate AI will provide predictive maintenance for mixing equipment and significantly reduce the time required to commercialize novel electrode formulations, thereby driving efficiency and reducing the capital expenditure associated with trial-and-error experimentation in battery manufacturing.

The application of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize several critical stages within the electrode slurry value chain. In the research and development phase, ML models can analyze vast datasets of material properties, formulation compositions, and resulting battery performance metrics, allowing researchers to predict the optimal ratios of active materials, binders, and solvents without extensive physical testing. This drastically speeds up the discovery of formulations suitable for next-generation chemistries, such as those incorporating silicon or solid electrolytes. Furthermore, AI is crucial in predictive quality control on the production floor. By continuously monitoring real-time sensor data from mixers, pumps, and coaters—including viscosity, temperature, shear rate, and dispersion particle size distribution—AI algorithms can detect subtle deviations that might lead to coating defects or uneven electrode structures, allowing for immediate process adjustments before an entire batch is compromised, thus reducing waste and improving yield consistency.

Beyond formulation and quality, AI enhances manufacturing efficiency through sophisticated control systems. Complex physical processes, such as high-shear mixing and solvent evaporation during the coating and drying stages, are difficult to manage traditionally. AI systems can develop adaptive control strategies that optimize mixing energy input based on the specific material load and desired rheology, ensuring uniform particle dispersion (a core determinant of electrode performance). Similarly, AI models can precisely control the drying curve based on the real-time solvent concentration and ambient conditions, preventing crack formation or binder migration, which are detrimental to electrode integrity. This shift toward intelligent, self-optimizing production lines is critical for meeting the high-volume, high-quality demands imposed by the rapidly expanding global battery Giga-factory network.

- AI optimizes R&D by predicting novel slurry compositions, reducing physical testing cycles.

- Machine Learning algorithms enable predictive quality control, ensuring batch-to-batch consistency.

- AI monitors real-time rheological data (viscosity, particle size) to prevent coating defects.

- Predictive maintenance schedules for high-shear mixers and pumps are generated by AI, minimizing downtime.

- Generative AI assists in modeling solvent interaction kinetics, enhancing sustainability and recovery processes.

DRO & Impact Forces Of Electrode Slurry Market

The Electrode Slurry Market is fundamentally driven by the exponential global proliferation of Electric Vehicles (EVs) and large-scale renewable energy integration projects necessitating high-capacity battery storage. Key Drivers (D) include aggressive government decarbonization mandates, significant advancements in battery energy density demanding specialized material chemistries, and the rapidly decreasing cost of lithium-ion battery production, which makes downstream applications more economically viable. Restraints (R) primarily revolve around the high capital expenditure required for establishing advanced mixing and coating facilities, volatility in the pricing and supply of critical raw materials (especially lithium salts and key precursors), and the complex intellectual property landscape surrounding advanced binder and dispersant technologies. Opportunities (O) are concentrated in the development of solid-state battery electrolytes requiring unique preparation methods, the integration of high-capacity silicon anodes, and the potential for greater process efficiency through automation and continuous manufacturing techniques, moving away from traditional batch processing.

The major Impact Forces influencing the market trajectory include technological shifts, regulatory pressures, and raw material economics. The shift toward solvent-free or dry electrode manufacturing techniques presents a disruptive force, potentially reducing the need for traditional solvent-based slurries, although this technology is currently limited in large-scale commercial viability for high-performance cells. Regulatory forces, particularly the push for greater domestic content and sustainability standards in North America and Europe, compel suppliers to rapidly establish regionalized production hubs and focus on environmentally friendlier solvents and binding agents. The economic impact force is characterized by severe competition and cost pressures from downstream battery manufacturers, forcing slurry producers to seek highly optimized, low-cost formulations while maintaining stringent quality control, leading to high investment in advanced mixing equipment and proprietary processing know-how.

Segmentation Analysis

The Electrode Slurry Market is systematically segmented based on the type of electrode (cathode or anode), the type of battery chemistry being utilized (e.g., lithium-ion, lead-acid, flow battery), and the final application area (such as automotive, consumer electronics, or grid storage). This segmentation is crucial for understanding specific technological demands, regional consumption patterns, and competitive landscapes. The performance requirements for a cathode slurry used in an automotive EV battery—demanding extremely high cycle stability and energy density—are vastly different from those required for a slurry used in a standard consumer electronic device, driving differentiation in material selection, solvent type (NMP vs. aqueous), and binder composition (PVDF, CMC/SBR). Furthermore, the distinct rheological properties needed for different coating methods (e.g., slot die coating versus doctor blade coating) further segment the product offering within each material type.

- By Electrode Type:

- Cathode Slurry (Higher cost due to complexity of active materials like NMC, NCA, LFP)

- Anode Slurry (Predominantly graphite and emerging silicon-based materials)

- By Battery Type:

- Lithium-ion Batteries (Dominant Segment)

- Lead-Acid Batteries

- Other Batteries (e.g., Sodium-ion, Flow Batteries)

- By Application:

- Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs)

- Energy Storage Systems (ESS) / Grid Storage

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Industrial Equipment

- By Chemistry (Specific to Li-ion):

- NMC/NCA Slurry

- LFP Slurry

- Graphite/Silicon Slurry

- By Solvent Type:

- Aqueous Slurry (Water-based, environmentally preferred)

- NMP-based Slurry (High performance, regulated solvent)

Value Chain Analysis For Electrode Slurry Market

The value chain for the Electrode Slurry Market is intricate, starting with the synthesis of raw chemical materials and culminating in the highly specialized manufacturing of battery electrodes. The Upstream Analysis begins with the sourcing and refinement of key precursors: lithium, nickel, cobalt, manganese for cathode active materials (CAM); purified graphite and synthetic graphite for anode active materials (AAM); and the manufacturing of specialized conductive additives (e.g., carbon nanotubes, carbon black) and polymeric binders (e.g., PVDF, SBR, CMC). These raw materials are highly concentrated geographically, creating supply chain vulnerability. Major chemical companies and material specialists are key players at this initial stage, often involving capital-intensive refining and chemical synthesis processes to meet stringent purity requirements necessary for battery grade materials.

The Midstream component is the core focus of the Electrode Slurry market, involving the high-precision mixing and dispersion of these components into a stable slurry form. This requires specialized, sealed mixing equipment (planetary mixers, dispersion mills) and meticulous process control over rheology. Slurry manufacturers often work closely with battery cell producers to tailor formulations. The Downstream Analysis involves the application of the slurry—coating it onto current collectors, drying, calendaring, and subsequent cell assembly. Battery manufacturers (e.g., Gigafactories) represent the immediate buyer and the most critical link in the chain. Distribution channels are typically direct, given the volume, sensitivity, and specific performance requirements of the slurry. The specialized nature of the product often necessitates direct technical consultation and supply chain integration between the slurry producer (or the material supplier who prepares the slurry) and the battery factory, minimizing the role of traditional indirect distributors for bulk supply.

Electrode Slurry Market Potential Customers

The primary consumers and end-users of electrode slurry are the large-scale manufacturers of rechargeable batteries, often referred to as cell makers or Giga-factories. These entities require massive volumes of consistently high-quality electrode slurry formulations to produce lithium-ion batteries utilized across various sectors. The automotive industry represents the largest buyer segment through their captive battery partners or independent cell suppliers, driving demand for high-energy density and robust cycle life performance necessary for Electric Vehicles. Energy Storage System (ESS) providers and grid operators, demanding long-duration and high-throughput battery installations, form the second major customer base, requiring slurries optimized for longevity and cost efficiency rather than absolute energy density.

Beyond the core battery cell producers, secondary customer segments include specialized manufacturers of high-end consumer electronics (e.g., premium smartphone and laptop companies requiring custom battery geometries and high power output) and research institutions focused on next-generation battery technologies. These customers often purchase smaller volumes of specialized or experimental slurry formulations. The decision-makers within these customer organizations are typically high-level procurement managers and battery materials R&D directors, focused on minimizing materials cost, ensuring security of supply, and achieving specific electrochemical performance targets dictated by their application requirements. Given the technical complexity, relationships are often long-term and anchored by extensive qualification processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 5.08 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, 3M Company, Umicore N.V., Kureha Corporation, JSR Corporation, SGL Carbon SE, Sumitomo Chemical Co., Ltd., W-Scope Corporation, Shenzhen Senior Technology Material Co., Ltd., Solvay S.A., Arkema S.A., Mitsubishi Chemical Corporation, Pulead Technology Industry Co., Ltd., BTR New Material Group, Hitachi Chemical Co., Ltd., Toda Kogyo Corporation, Resonac Holdings (formerly Showa Denko), POSCO Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrode Slurry Market Key Technology Landscape

The technology landscape in the Electrode Slurry Market is characterized by continuous innovation focused on achieving superior dispersion quality, optimized rheology, and environmental sustainability. A core technological focus is the evolution of high-energy dispersion and mixing techniques, moving from conventional planetary mixers to advanced continuous mixers and sophisticated ultrasonic dispersion systems. These technologies aim to ensure highly homogeneous distribution of primary particles (active materials) and secondary particles (conductive additives) within the solvent/binder matrix, preventing agglomeration which severely limits battery performance. Achieving precise control over the shear rate and temperature during the mixing process is paramount to maintain the integrity of delicate materials like silicon nanoparticles or certain conductive carbon structures, demanding high-precision sensor integration and closed-loop control systems.

Another critical area of technological advancement is the shift towards environmentally benign formulations, specifically the adoption of aqueous (water-based) slurries for anode materials. While aqueous processing is preferred for its lower environmental impact and reduced operating costs compared to the highly regulated NMP (N-methyl-2-pyrrolidone) solvent used predominantly for cathodes, it introduces significant challenges related to material compatibility, corrosion, and hydrogen gas evolution when handling certain lithium precursors. Innovators are developing novel water-soluble binders and surface modification techniques for active materials to stabilize aqueous dispersions without sacrificing electrochemical performance. Furthermore, the development of in-situ rheology measurement tools allows manufacturers to instantaneously assess slurry characteristics during mixing, ensuring the final product meets the exact viscosity profile required for high-speed, defect-free electrode coating.

The future technology landscape is heavily influenced by the emergence of dry electrode manufacturing (DEM) techniques, most notably practiced by Tesla and others. While DEM aims to eliminate solvents entirely, reducing cost and footprint, the technology relies on highly specialized mechanical fibrillation or electrostatic spray techniques to bind active materials, significantly altering the demand for traditional liquid slurries. However, until DEM is proven scalable and universally applicable across all chemistries, incremental advancements in traditional wet processing—such as advanced solvent recovery systems that achieve greater than 99% efficiency and sophisticated particle engineering to improve packing density in the slurry—will continue to define the current technological forefront. The use of advanced analytics, including AI and digital twin modeling, to predict and control the complex interactions within the multi-component slurry system represents the bleeding edge of process technology optimization.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market leader, driven by China, South Korea, and Japan, which collectively host the vast majority of global battery production capacity. China alone controls over 70% of global battery manufacturing and a corresponding share of electrode slurry consumption. This region benefits from established, integrated supply chains, competitive manufacturing costs, and substantial government support for the EV and renewable energy sectors. Significant investments in capacity expansion by players like CATL, LG Energy Solution, and BYD ensure that APAC will remain the primary hub for both production and technological development in the forecast period.

- Europe: Europe is the fastest-growing market, propelled by the European Green Deal and massive investments in localized Giga-factories (e.g., Northvolt, Verkor, ACC). The focus here is on securing sustainable, local supply chains (critical for compliance with local content rules) and transitioning rapidly to high-performance, high-nickel cathode chemistries requiring advanced slurry formulations. Demand is high for high-efficiency mixing solutions and NMP recovery systems to meet strict environmental regulations.

- North America: Driven by the US Inflation Reduction Act (IRA), North America is undergoing a massive build-out of battery manufacturing capacity, creating immense demand for local slurry production. Automotive original equipment manufacturers (OEMs) are partnering directly with material suppliers to ensure reliable, high-volume supply, emphasizing LFP and increasingly, high-performance NMC chemistries for the rapidly expanding domestic EV market. Canada and Mexico also play supporting roles in the raw material extraction and processing upstream.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets. Latin America benefits from vast raw material reserves (e.g., lithium in the Lithium Triangle) and is starting to see early-stage investment in localized cell production. The MEA region is primarily focused on adopting ESS solutions for grid stabilization and renewable energy projects, creating nascent demand for industrialized battery components, including slurries, often sourced via imports or specialized regional joint ventures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrode Slurry Market.- BASF SE

- Dow Chemical Company

- 3M Company

- Umicore N.V.

- Kureha Corporation

- JSR Corporation

- SGL Carbon SE

- Sumitomo Chemical Co., Ltd.

- W-Scope Corporation

- Shenzhen Senior Technology Material Co., Ltd.

- Solvay S.A.

- Arkema S.A.

- Mitsubishi Chemical Corporation

- Pulead Technology Industry Co., Ltd.

- BTR New Material Group

- Hitachi Chemical Co., Ltd.

- Toda Kogyo Corporation

- Resonac Holdings (formerly Showa Denko)

- POSCO Chemical

- Fuji Film Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the Electrode Slurry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is electrode slurry and why is its quality critical for battery performance?

Electrode slurry is a crucial suspension of active materials, conductive additives, and binders in a solvent, coated onto current collectors to form battery electrodes. Its quality, specifically its rheology and dispersion homogeneity, directly determines the battery's energy density, cycle life, charge rate capability, and safety profile.

Which factors are driving the demand for advanced electrode slurry formulations?

The primary drivers are the exponential growth in Electric Vehicle (EV) production, the global build-out of Giga-factories, and the continuous requirement for higher energy density in batteries, necessitating specialized slurries compatible with novel materials like silicon anodes and high-nickel cathodes (NMC 811, NCA).

How is the market segmented by electrode type and which segment holds the largest share?

The market is segmented into Cathode Slurry and Anode Slurry. The Cathode Slurry segment typically holds the largest market share by value due to the high cost, complexity, and specialized chemical requirements of cathode active materials such such as Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP).

What are the primary technological challenges facing electrode slurry manufacturers?

Key challenges include achieving perfect dispersion of nano-sized particles to prevent agglomeration, maintaining complex rheological stability during high-speed coating, minimizing the use of environmentally harmful solvents like NMP, and adapting formulations for emerging dry electrode manufacturing techniques.

How does the adoption of silicon anodes impact current slurry processing technologies?

Silicon anodes swell significantly during lithiation, requiring specialized, elastic binders and highly stable slurry formulations (often aqueous-based) to maintain electrode structural integrity and particle contact, moving manufacturers towards novel polymer chemistries and advanced mixing techniques.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager