Electroforming Molds Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432644 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Electroforming Molds Market Size

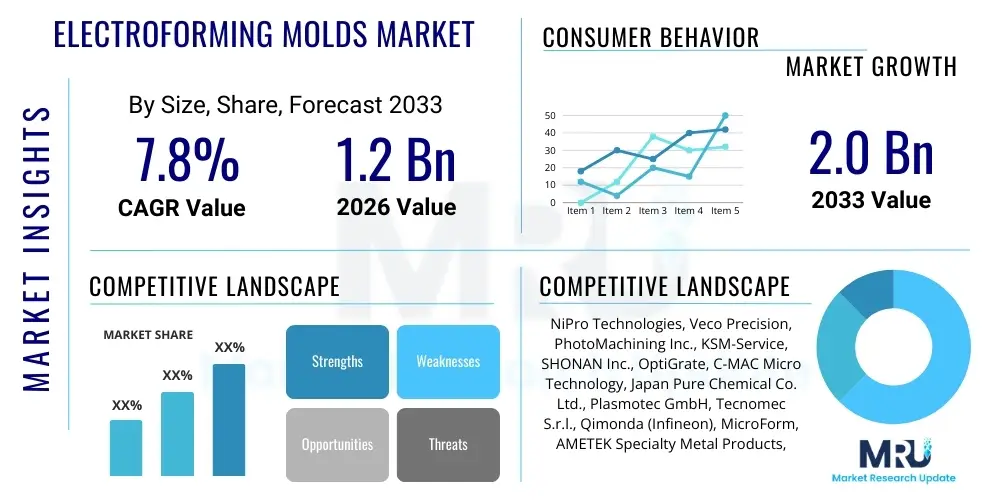

The Electroforming Molds Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.0 Billion by the end of the forecast period in 2033.

Electroforming Molds Market introduction

The Electroforming Molds Market encompasses the design, manufacturing, and distribution of highly precise molds created through the process of electrodeposition, primarily utilizing metals such as nickel. Electroforming is an additive manufacturing process that allows for the creation of intricate, stress-free metal structures, often with micron-level tolerances and superior surface finishes compared to traditional machining or molding techniques. These molds, also known as tools or masters, are crucial intermediates in the production of complex micro-structures, optical components, medical devices, and high-fidelity consumer electronics parts. The core advantage of electroforming molds lies in their ability to replicate mandrels (templates) with extreme accuracy, enabling mass production of parts with geometries that are otherwise challenging or impossible to achieve using conventional molding methods.

The primary applications driving the demand for electroforming molds include the manufacturing of compact disc and digital versatile disc stampers, microfluidic chips, large-area diffractive optical elements (DOEs), and molds for precision injection molding, particularly in the automotive and medical sectors. The product description of electroforming molds emphasizes their robustness, chemical inertness (depending on the deposited metal), and exceptional thermal conductivity, which are vital properties for maintaining consistency and efficiency in downstream manufacturing processes like UV roll-to-roll processing or hot embossing. The increasing miniaturization trend across industries, coupled with the rising complexity of product designs requiring ultra-fine features, fundamentally fuels the adoption of electroforming as a mold fabrication technique.

Key benefits associated with using electroformed molds involve achieving high aspect ratios, superior feature definition, and reduced tooling costs for prototypes or low-volume specialized production, where traditional hard tooling might be prohibitively expensive or time-consuming. Driving factors for market expansion include the exponential growth in the demand for sophisticated optical films used in flat-panel displays, the accelerated development of advanced medical diagnostics requiring disposable micro-scale components, and the continuous innovation within the semiconductor industry for patterning and etching tools. Furthermore, sustainability considerations, as electroforming often results in less material waste compared to subtractive techniques, are also positioning it favorably in modern manufacturing ecosystems.

Electroforming Molds Market Executive Summary

The Electroforming Molds Market is characterized by robust growth, primarily driven by the increasing integration of micro- and nano-structures across high-technology sectors. Business trends show a significant shift toward automated electroforming systems that offer enhanced process control, repeatability, and larger substrate capabilities, moving beyond traditional batch processing. Strategic alliances between electroforming service providers and end-product manufacturers (especially in optics and medical devices) are becoming common to streamline supply chains and customize tooling specifications. Furthermore, the development of new alloy systems for electrodeposition, moving beyond standard pure nickel to include nickel-cobalt or composite layers, enhances the durability and functional lifespan of the resultant molds, thus attracting investments in R&D aimed at material science improvements within this niche.

Regionally, Asia Pacific maintains dominance in consumption, primarily due to the massive concentration of consumer electronics, display panel, and precision manufacturing hubs in countries like China, South Korea, and Japan. This region is exhibiting the fastest growth rates, spurred by governmental support for advanced manufacturing techniques and substantial investments in fabrication infrastructure necessary for high-volume production of optical films and semiconductor components. North America and Europe, while growing slower in volume terms, demonstrate high value adoption, focusing heavily on complex, highly regulated applications such as advanced medical implants, aerospace components, and specialized microfluidic devices, where stringent quality control and certification requirements necessitate the superior precision offered by electroforming molds.

Segment trends highlight the dominance of the Precision Micro-components segment, encompassing tools for stamping, embossing, and injection molding of components like micro-lenses, encoders, and sensor housing parts. Within the material type segmentation, nickel remains the most prevalent material due to its ductility and cost-effectiveness, although gold and copper electroforming are gaining traction for specialized electronic and thermal management applications. The market is also witnessing rapid expansion in the Application segment related to roll-to-roll processing molds, which are essential for the continuous, high-throughput manufacturing of flexible electronics and large-area optical films, signifying a crucial industry shift towards scalable production methodologies for next-generation products.

AI Impact Analysis on Electroforming Molds Market

User inquiries concerning AI's influence on the electroforming molds market frequently center on how artificial intelligence can optimize the notoriously complex and sensitive electrodeposition process, enhance mold inspection fidelity, and accelerate the design-to-production cycle. Common themes include the application of machine learning for predictive modeling of bath chemistry, current density distribution, and mechanical stress within the deposited layer, which are critical variables affecting mold quality and lifespan. Users are highly interested in understanding how AI can address the challenge of achieving uniformity across large-area molds and mitigating defects inherent to the electrochemical process, thereby reducing waste and improving yield rates, which currently represent significant operational challenges in high-precision electroforming operations.

The integration of AI algorithms, particularly deep learning models, is poised to revolutionize the operational efficiency of electroforming facilities. These systems analyze vast datasets generated by real-time sensor monitoring—including temperature, pH, conductivity, and electrochemical potential—to autonomously adjust process parameters, ensuring the desired physical properties and thickness uniformity of the mold material. Furthermore, AI-driven computer vision systems are drastically improving Quality Control (QC) by automatically scanning the finished molds for micro-defects such as pitting, nodulation, or internal stress cracks, offering faster, more consistent, and objective inspection feedback than human operators, which is vital for maintaining the micron-level precision required by advanced applications.

From a strategic standpoint, AI is also influencing the mold design phase. Generative design tools, powered by AI, can explore a wider array of mandrel geometries and predict the resulting electrodeposition behavior before physical tooling commences, optimizing the initial mold design for manufacturability and performance. This capability drastically shortens the design iteration loop, lowers R&D costs, and allows for the creation of molds for increasingly complex and previously unachievable micro-features, enabling faster commercialization of next-generation micro-structured products across the optical, medical, and semiconductor fields.

- AI-enhanced bath parameter optimization for predictive control of plating chemistry.

- Machine learning algorithms utilized for predicting internal stress and dimensional accuracy in real-time.

- Deep learning vision systems for automated, high-resolution defect inspection and quality assurance of finished molds.

- Generative design application assisting in optimal mandrel and electrical field configuration modeling.

- Predictive maintenance schedules for electroforming equipment based on operational data analysis, minimizing downtime.

- Improved material utilization and reduced scrap rates through precise, AI-guided process adjustments.

DRO & Impact Forces Of Electroforming Molds Market

The market dynamics of Electroforming Molds are shaped by a delicate balance of strong technological drivers, significant regulatory restraints, abundant application opportunities, and pervasive impact forces influencing supply and demand. The primary drivers revolve around the relentless demand for miniaturization in consumer electronics and medical devices, necessitating tools that can replicate nano-scale features with high fidelity. Restraints largely stem from the inherent complexity of the electroforming process, which requires highly specialized expertise, stringent chemical management, and long lead times compared to faster tooling methods like CNC machining. Opportunities are vast, particularly in emerging fields such as flexible electronics, augmented reality (AR) optics, and advanced micro-batteries, all demanding custom, ultra-precision tooling, while the primary impact force remains the fluctuation in raw material (nickel, gold, copper) costs and the competitive pressure from alternative micro-replication technologies such as specialized etching or 3D printing.

Key drivers include the proliferation of optical display components requiring large-area patterned films, such as brightness enhancement films (BEFs) and micro-lens arrays, where electroforming molds offer unmatched cost-efficiency for large-scale replication. The medical sector's shift towards high-volume disposable diagnostics (e.g., lab-on-a-chip devices) further strengthens demand for electroformed microfluidic tools. However, the market faces significant restraints related to scalability and material choice limitations; while electroforming excels at precision, the deposition rate can be slow, limiting high-volume throughput, and the reliance on specific conductive mandrel materials restricts design freedom. Furthermore, strict environmental regulations governing the disposal and management of specialized electroplating chemicals pose operational and financial burdens on mold manufacturers, especially in developed regions like Europe.

The market is rich with opportunities arising from advancements in nanotechnology and the integration of micro-structured surfaces for functional purposes, such as drag reduction in aerospace or anti-reflective coatings on solar panels. The ongoing transition from traditional injection molding to advanced replication techniques like UV nanoimprint lithography (UV-NIL), where electroformed nickel shims act as masters, represents a crucial growth avenue. The internal impact forces include the constant need for technological innovation to improve the anti-stick properties and durability of the molds themselves, while external forces involve intense competition from established mold fabrication methods that are rapidly improving their own precision capabilities, forcing electroforming providers to maintain a distinct competitive edge through unmatched resolution and surface smoothness.

Segmentation Analysis

The Electroforming Molds Market is systematically segmented based on Material Type, Application, End-Use Industry, and Region, providing a granular view of market dynamics and value pools. The Material Type classification is crucial as it determines the mechanical, thermal, and chemical properties of the resulting mold, directly impacting its suitability for various replication processes. Nickel, due to its favorable combination of hardness, stability, and cost, holds the largest share, yet specialty metals are seeing increasing adoption. The Application segmentation delineates the specific uses of the molds, with Micro-Replication and Microfluidics being the most significant segments, driven by consumer electronics and biotech demands respectively.

The End-Use Industry segmentation highlights where the final products manufactured using these molds are deployed, with Electronics and Optics dominating due to the extensive need for patterned surfaces and micro-structures in displays and sensors. The Pharmaceutical and Medical Device sector is rapidly expanding, focusing on precision drug delivery systems and point-of-care diagnostics tools that rely on electroformed tooling. Understanding these segments is vital for suppliers to tailor material specifications and production capacities to the specific requirements, such as the need for biocompatibility in medical molds or high throughput capacity in consumer electronics tools.

The high-precision nature of the final products manufactured using electroforming molds dictates specialized handling and quality assurance protocols within each segment. For instance, molds used in the semiconductor industry require contamination control far exceeding those used for general tooling. This structured segmentation allows market participants to identify lucrative sub-niches, such as the demand for large-format electroformed tools (e.g., for automotive lighting or architectural glass patterns) versus micro-scale tools (e.g., for diffractive optical elements in smart glasses), enabling targeted strategic investments in R&D and manufacturing capacity expansion across geographical areas identified as high-growth hubs.

- By Material Type:

- Nickel Molds

- Nickel-Cobalt Alloys

- Copper Molds

- Gold Molds (Specialized applications)

- Other Alloys and Composites

- By Application:

- Micro-Replication (CD/DVD Stampers, Holographic Films)

- Injection Molding Inserts (Precision tools)

- Microfluidic Devices and Chips

- Printing and Embossing Cylinders

- Semiconductor/Wafer Manufacturing Tools (Masks, Templates)

- Advanced Optics and Displays

- By End-Use Industry:

- Electronics and Optics (Displays, Sensors, Consumer Devices)

- Medical and Pharmaceutical (Diagnostics, Drug Delivery Systems)

- Automotive (Lighting components, Interior finishes)

- Aerospace and Defense

- Renewable Energy (Solar cell patterning)

- Consumer Goods

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Electroforming Molds Market

The value chain for the Electroforming Molds Market is characterized by a high degree of specialization and technical integration, starting from upstream raw material sourcing to downstream distribution channels reaching the end-users. Upstream activities involve the procurement of high-purity metal salts (like nickel sulfamate, copper sulfate) and specialized chemicals necessary for the electroplating bath, alongside the acquisition of ultra-smooth and precise mandrel materials (often silicon wafers, photopolymer resins, or stainless steel). The performance of the final mold is critically dependent on the purity and stability of these raw materials, necessitating strict quality control at the initial stages. Suppliers of these high-grade chemicals and specialized tooling materials exert moderate influence on the overall cost structure due to the stringent quality requirements unique to electroforming.

The core midstream activity is the electroforming process itself, undertaken by specialized contract manufacturers or in-house facilities of large component producers. This stage involves complex technical steps: mandrel preparation, seeding, controlled electrodeposition (the growth phase), and separation (demolding). Direct distribution channels are prevalent here, as the molds are often custom-designed and necessitate close consultation between the mold maker and the client's manufacturing engineering team to ensure compatibility with replication equipment (e.g., injection molders or roll-to-roll coaters). Indirect distribution, involving agents or distributors, is less common but exists for standardized molds or consumable components like CD stampers, where design specifications are standardized.

Downstream analysis focuses on the end-use industries, which utilize the electroformed molds as critical tools for mass replication. The primary buyers are manufacturers of optical films, microfluidic devices, and precision plastic components. The market structure dictates that the performance and longevity of the mold directly impact the end-user’s production yield and cost-efficiency. Therefore, the value realized downstream is high. Direct channels facilitate technical support and rapid iterations for bespoke projects, ensuring that the highly sensitive tooling is correctly integrated into the production line. The relationship between mold supplier and end-user is often a long-term technical partnership rather than a transactional sale, especially in medical and aerospace sectors where validation and certification are mandatory steps requiring continuous collaboration throughout the product lifecycle.

Electroforming Molds Market Potential Customers

The primary customers and buyers of electroforming molds are categorized into sectors that require high-precision replication of micro- or nano-scale features in materials such as polymers, glass, or metals. These customers typically operate high-volume manufacturing facilities where the cost per part is heavily dependent on the tool's durability and fidelity. Major end-users include manufacturers in the electronics sector, particularly those producing advanced display panels, smartphone cameras, and light-emitting diode (LED) components, all of which require complex micro-lenses, diffusers, or patterned surfaces created using electroformed masters. These customers prioritize geometric accuracy, surface roughness control, and mold repeatability over tens of thousands of cycles.

Another significant customer base resides in the medical and life sciences industry. Companies specializing in disposable diagnostics, micro-pumps, lab-on-a-chip (LOC) devices, and specialized medical implants are critical buyers. In this context, electroformed molds are valued for their ability to create highly precise channels, reservoirs, and micro-structures necessary for fluid manipulation and biological sample handling. For these customers, factors such as material inertness (if the mold is used directly or as a shim), biocompatibility of the final product, and extremely tight dimensional tolerances are paramount, often overriding cost considerations due to regulatory requirements and the necessity of failure-free operation in sensitive applications.

Furthermore, the automotive lighting industry, which increasingly uses complex optical systems (e.g., adaptive matrix headlights), and the renewable energy sector, focusing on patterned solar films for efficiency enhancement, represent growing customer segments. These industries require larger format electroformed tools that still maintain high surface quality and feature depth. Finally, specialty component manufacturers serving the aerospace and defense sectors, needing precision waveguides, antennas, or thermal management components with intricately detailed internal features, represent high-value, albeit lower-volume, potential customers for highly customized electroformed molds and tooling solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NiPro Technologies, Veco Precision, PhotoMachining Inc., KSM-Service, SHONAN Inc., OptiGrate, C-MAC Micro Technology, Japan Pure Chemical Co. Ltd., Plasmotec GmbH, Tecnomec S.r.l., Qimonda (Infineon), MicroForm, AMETEK Specialty Metal Products, Heidenhain, Micro-Precision Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electroforming Molds Market Key Technology Landscape

The technological landscape of the Electroforming Molds Market is characterized by continuous advancements focused on improving dimensional accuracy, reducing internal stress in the deposited metal, and enhancing the scalability of the process, particularly for large-area applications. A key technological development is the shift towards advanced electrolyte formulations and specialized additive packages designed to control the mechanical properties of the electrodeposited layer, ensuring uniform hardness, low grain size, and minimized residual stress, which is crucial for preventing mold deformation or cracking during the demanding demolding process. Furthermore, pulse plating techniques, where current is applied intermittently, are replacing traditional direct current (DC) plating, allowing for better control over the crystal structure and resulting in superior surface finish and higher fidelity replication of the mandrel features, particularly those with high aspect ratios common in microfluidics.

Another area of intense technological focus involves mandrel fabrication and surface preparation. High-resolution lithography, including electron beam lithography (EBL) and deep UV (DUV) lithography, are vital for creating the initial master patterns with nano-scale precision. Subsequent technological steps involve implementing sophisticated anti-adhesion layers, such as atomic layer deposition (ALD) coatings or specialized sacrificial polymer layers, which facilitate the clean and damage-free separation of the electroformed mold from the mandrel. This separation step, known as demolding, is often the most sensitive part of the process, and technological improvements in release layer integrity are crucial for preserving the integrity of the delicate micro-features on both the mold and the potentially reusable mandrel. Continuous research is also directed at developing conductive polymer mandrels that offer more design flexibility and lower cost compared to traditional silicon masters.

The integration of automated process monitoring and control systems represents a significant technological leap. Modern electroforming systems incorporate sophisticated sensors for continuous monitoring of key variables, including bath temperature, metal ion concentration, pH, and flow dynamics, often coupled with Finite Element Analysis (FEA) software to model and predict current distribution across complex mandrel geometries. This technological integration allows operators to mitigate edge effects and achieve uniformity, especially important for molds exceeding several hundred millimeters in dimension, such as those used in large-area optical films. The use of advanced computational fluid dynamics (CFD) modeling helps optimize the positioning of anodes and the circulation of the electrolyte, minimizing concentration polarization and ensuring precise, defect-free deposition across the entire surface area of the mold.

Regional Highlights

Regional dynamics within the Electroforming Molds Market show pronounced differences in adoption rates, technological maturity, and application focus, largely dictated by the existing manufacturing infrastructure and regulatory environments. Asia Pacific (APAC) dominates the global market, both in terms of production volume and consumption value. This supremacy is attributable to the region hosting the majority of the world's consumer electronics, display panel manufacturing (OLED/LCD), and high-volume optical component assembly facilities, particularly in countries like South Korea, Taiwan, Japan, and China. The aggressive expansion of R&D investments in flexible electronics and nanoimprint lithography (NIL) in APAC further solidifies its position as the engine of market growth. Demand here is characterized by the need for high-throughput, standardized nickel shims and stampers for mass replication processes.

North America holds a substantial market share, focused primarily on high-value, specialized, and technically demanding applications. The region exhibits high adoption in the aerospace and defense sectors, where electroforming molds are used for mission-critical components requiring extreme precision and low mass. Furthermore, the burgeoning biotechnology and advanced medical device sectors in the U.S. and Canada rely heavily on electroforming for microfluidic chips, sensor arrays, and precision tooling for drug delivery systems. Unlike APAC's focus on volume, North American demand emphasizes customized solutions, complex geometry capabilities, stringent material traceability, and compliance with rigorous regulatory frameworks (e.g., FDA requirements), leading to higher average mold costs and strong demand for R&D services alongside manufacturing.

Europe represents a mature market characterized by technological leadership in certain niche segments, particularly automotive lighting optics and complex industrial tooling. Germany, France, and the UK are key contributors, driven by a strong precision engineering base and high environmental standards, which foster innovation in cleaner electroforming processes. The European market sees steady demand from the automotive sector for molds used in advanced headlamp reflectors and aesthetic interior trim, often requiring large, flawless surfaces. Additionally, European research institutions and SMEs are pushing the boundaries in areas like micro-optics for augmented reality (AR) headsets and specialized tooling for advanced materials processing, often collaborating closely with regional academic centers to develop next-generation electroforming techniques and materials.

Latin America and the Middle East & Africa (LAMEA) currently account for a smaller portion of the global market but are exhibiting potential growth, primarily tied to localizing manufacturing capabilities, especially in medical devices and basic consumer goods production. Growth in MEA is largely concentrated in industrialized zones like the UAE and Saudi Arabia, driven by investments in high-tech infrastructure aimed at economic diversification away from oil dependence, which includes establishing manufacturing bases for electronics and healthcare components. Latin America’s potential growth is tied to the expansion of regional automotive manufacturing hubs and increasing local capacity for pharmaceutical packaging and generic drug production, where cost-effective precision tooling is becoming necessary to meet regional quality standards and compete globally.

- Asia Pacific (APAC): Dominates due to extensive presence of consumer electronics and display manufacturing; highest growth rate driven by nanoimprint lithography adoption. Key applications include optical films and semiconductor stampers.

- North America: High-value market segment focusing on medical devices (microfluidics), aerospace, and advanced R&D projects. Emphasis on stringent quality control and custom solutions.

- Europe: Mature market with strong capabilities in precision engineering, specialized automotive optics, and industrial tooling. Focus on high environmental compliance and innovation in electroforming materials.

- Latin America (LATAM): Emerging demand linked to expansion in regional automotive component production and pharmaceutical packaging.

- Middle East and Africa (MEA): Growth potential driven by economic diversification efforts and investments in localizing basic high-tech manufacturing and healthcare infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electroforming Molds Market.- NiPro Technologies

- Veco Precision

- PhotoMachining Inc.

- KSM-Service

- SHONAN Inc.

- OptiGrate

- C-MAC Micro Technology

- Japan Pure Chemical Co. Ltd.

- Plasmotec GmbH

- Tecnomec S.r.l.

- Qimonda (Infineon)

- MicroForm

- AMETEK Specialty Metal Products

- Heidenhain

- Micro-Precision Technologies

- Struers ApS

- Precision Engineering Inc.

- Metaldyne International

- Midas Molds

- Precision Electroforming Services

Frequently Asked Questions

Analyze common user questions about the Electroforming Molds market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of electroforming molds over CNC machining or etching for micro-features?

Electroforming offers superior advantages in replicating high-aspect ratio features and complex 3D micro-geometries with micron or nano-scale precision. It yields ultra-low surface roughness and stress-free metal structures, which are critical for high-fidelity replication in optics and microfluidics, often surpassing the practical limits of traditional subtractive techniques.

Which industries are the largest consumers of electroforming molds globally?

The largest consumer industries are Electronics and Optics, driven by the massive demand for patterned films in display technology (like BEFs and micro-lens arrays) and advanced sensor components. The Medical and Pharmaceutical sector is the second major consumer, requiring high-precision tools for microfluidic and diagnostic devices.

How does the choice of material affect the performance and lifespan of an electroformed mold?

The material, predominantly nickel or nickel alloys, dictates the mold's performance attributes such as hardness, chemical resistance, and thermal conductivity. Nickel offers an optimal balance of durability and cost for general use, while alloys like nickel-cobalt are often chosen when higher wear resistance and extended service life are required for demanding replication processes like injection molding.

What are the main technical challenges restraining the broader adoption of electroforming technology?

Key technical restraints include the lengthy processing time required for electrodeposition, difficulty in controlling internal stress across large mold areas, and the necessity for highly specialized chemical expertise and infrastructure. These factors contribute to higher capital expenditure and longer lead times compared to faster tooling methods.

What role does nanoimprint lithography (NIL) play in driving the demand for electroforming molds?

NIL relies on high-fidelity master templates (shims) for contact replication of nano-patterns onto substrates. Electroforming is the preferred method for manufacturing these durable nickel shims due to its unmatched ability to replicate the complex features of the initial master wafer, making it a foundational enabling technology for the rapidly growing NIL market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager