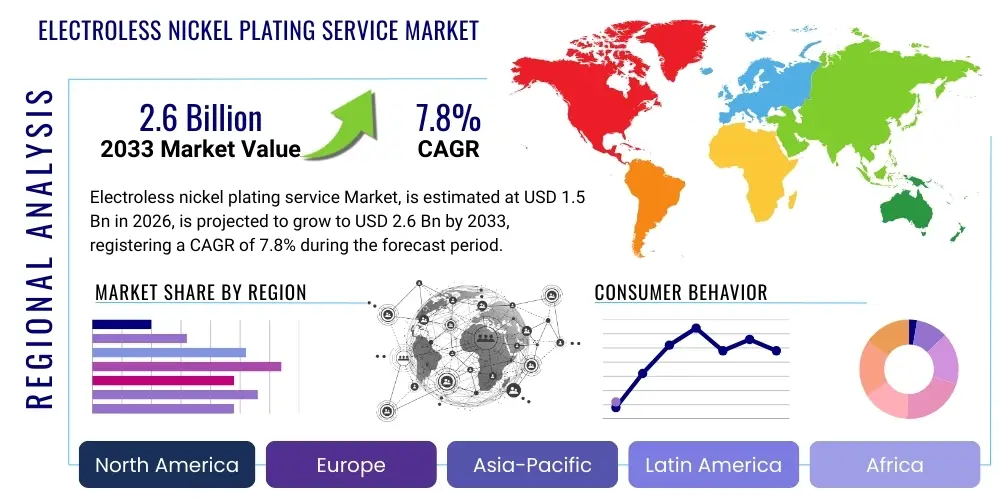

Electroless nickel plating service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439009 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Electroless nickel plating service Market Size

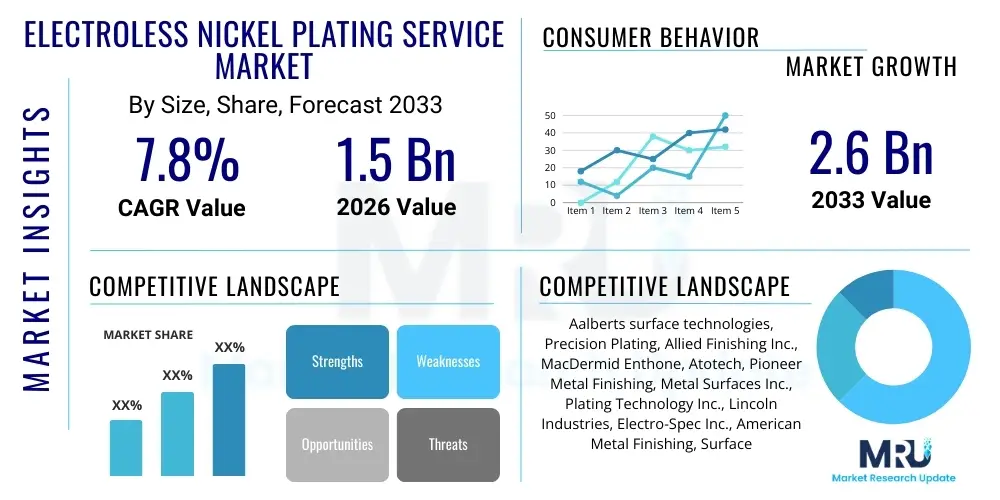

The Electroless nickel plating service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Electroless nickel plating service Market introduction

The Electroless Nickel Plating (ENP) service market is defined by the provision of surface treatment services utilizing the auto-catalytic reduction of nickel ions onto various substrate materials, predominantly steel, aluminum, and brass, without requiring an external electrical current. This process yields coatings that are highly uniform, offering superior wear resistance, exceptional corrosion protection, and lubricity, making it crucial for precision engineering applications. The primary types of ENP services offered include low, medium, and high phosphorus deposits, each catering to distinct functional requirements such as hardness, magnetism, and ductility. The demand is heavily concentrated in sectors requiring high reliability and durability under extreme operating conditions, such as aerospace and defense, automotive manufacturing, and the demanding environments of the oil and gas industry.

A major application driver for ENP services is the stringent requirements for component longevity in complex machinery. In the automotive sector, ENP enhances components like brake pistons, pump housings, and gears, minimizing friction and mitigating damage from harsh fluids and environmental exposures. Similarly, the electronics industry relies on ENP for non-magnetic properties and solderability enhancements on connectors and heat management systems. The inherent ability of ENP to coat intricate geometries, delivering uniform thickness across internal surfaces and sharp corners—a critical limitation for traditional electroplating—solidifies its necessity in modern manufacturing workflows that prioritize miniaturization and complex part design.

The consistent technological evolution in material science, particularly the development of composite ENP layers incorporating PTFE or silicon carbide, is further expanding the market's penetration. These advanced coatings offer customized tribological properties, such such as improved anti-galling characteristics and enhanced abrasion resistance, which are particularly valuable in industries like medical device manufacturing and advanced robotics. The growing global focus on sustainable manufacturing practices is also subtly benefiting ENP, as certain processes are being refined to minimize chemical waste and improve resource efficiency, positioning specialized service providers at the forefront of surface engineering innovation.

Electroless nickel plating service Market Executive Summary

The Electroless Nickel Plating service market is experiencing robust growth, driven by increasing manufacturing complexity across primary industrial sectors, particularly aerospace and automotive, where performance and reliability are non-negotiable prerequisites. Current business trends indicate a significant shift towards outsourcing specialized surface finishing services, enabling OEMs to streamline production and leverage the specialized expertise of dedicated plating firms. This outsourcing trend is coupled with an escalating demand for high-phosphorus ENP alloys, valued for their superior corrosion resistance in acidic and saline environments, which is critical for oil and gas infrastructure maintenance and marine applications. Furthermore, market competition is intensifying, prompting service providers to invest heavily in automated processing lines, advanced quality control instrumentation, and certification adherence, particularly Nadcap for aerospace and IATF 16949 for automotive components.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in domestic automotive and electronics manufacturing capabilities, particularly in China, India, and South Korea. North America and Europe, while mature, maintain strong market share due to their established aerospace and defense manufacturing bases, which demand the highest specification and regulatory compliance for ENP services. Trends within these regions also include a pronounced focus on environmental sustainability, pressuring platers to adopt trivalent chromium passivation alternatives and closed-loop rinsing systems to minimize regulatory risks and enhance corporate social responsibility profiles. This geographic diversification ensures market stability, mitigating risks associated with reliance on a single manufacturing hub or end-user industry.

Segmentation trends highlight the dominance of medium-phosphorus ENP by volume, balancing desirable hardness and corrosion resistance for general engineering components. However, the high-phosphorus segment is projected to exhibit the fastest growth rate, reflecting the critical need for premium corrosion protection in severe service conditions. Regarding end-users, the machinery and equipment sector remains foundational, but the electronics segment is rapidly evolving, driven by the expansion of 5G infrastructure, electric vehicle battery management systems, and advanced semiconductor packaging, all requiring reliable, non-magnetic, and dimensionally stable coatings. This segmentation analysis suggests a future characterized by premiumization of services and increasing specification requirements for specialized ENP formulations.

AI Impact Analysis on Electroless nickel plating service Market

User inquiries concerning AI's influence on the Electroless Nickel Plating service market primarily revolve around automation efficacy, quality assurance protocols, and the potential for optimizing complex chemical bath compositions. Users frequently ask if AI-driven systems can fully replace human monitoring of chemical parameters, how machine learning algorithms improve first-pass yield rates, and the economic viability of implementing vision systems for defect detection on intricate geometries. There is strong user expectation that AI will dramatically reduce variability inherent in chemical processing, standardize surface quality across batches, and enable predictive maintenance for plating equipment, thereby minimizing costly downtime and ensuring regulatory compliance through meticulous data logging and anomaly detection. These themes underscore a market desire for enhanced operational efficiency and flawless quality output driven by intelligent systems.

AI’s influence is manifesting most significantly in process control and quality inspection, areas traditionally susceptible to human error and inconsistency. Machine learning models are being deployed to analyze real-time sensor data—including pH levels, temperature, metal concentration, and stabilizer concentration—to autonomously adjust chemical feed rates, ensuring the ENP bath operates within optimal parameters continuously. This shift from reactive adjustments to proactive, predictive control maximizes bath life and dramatically improves deposition consistency, directly impacting the final coating performance and adhesion characteristics. Furthermore, AI-powered predictive analytics forecast potential equipment failure or bath instability hours or days in advance, allowing for scheduled maintenance and preventing catastrophic batch losses, enhancing the reliability of the plating service provider.

The integration of deep learning algorithms into Automated Optical Inspection (AOI) systems is revolutionizing quality control for plated parts, especially those with complex features such as internal threads or sharp edges. Traditional visual inspection is slow and subjective; AI-enabled vision systems can rapidly scan 100% of parts, identifying microscopic defects like pits, porosity, and non-uniform thickness deviations that human eyes often miss. By correlating detected defects with preceding process parameters, the AI system provides actionable feedback loops, leading to continuous improvement in the plating recipe and technique. This not only elevates the quality benchmark for ENP services but also generates comprehensive digital records necessary for high-stakes regulatory environments like aerospace certification.

- AI optimizes bath chemistry through real-time predictive analytics, maintaining precise plating parameters.

- Machine learning enhances Automated Optical Inspection (AOI) for rapid, high-accuracy defect detection on finished parts.

- Predictive maintenance algorithms minimize equipment downtime and maximize bath operational longevity.

- Data logging and correlation capabilities provide robust traceability required for regulatory compliance and auditing.

- AI-driven robotics integration automates part handling, reducing human contact and ensuring consistent racking density.

DRO & Impact Forces Of Electroless nickel plating service Market

The Electroless Nickel Plating market dynamics are critically influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global demand for high-performance, corrosion-resistant components in critical industries such as aerospace, defense, and oil & gas, coupled with the process's inherent advantage of uniform thickness deposition on geometrically challenging parts. The proliferation of electric vehicles (EVs) also acts as a significant driver, requiring ENP coatings for battery components and thermal management systems due to nickel’s reliability and stability. Conversely, market restraints largely stem from the environmental and regulatory pressures surrounding the use of nickel salts and associated hazardous chemicals, leading to increased disposal costs and the necessity for sophisticated wastewater treatment infrastructure. The complexity and high capital expenditure required for maintaining state-of-the-art plating lines also restrict the entry of new market participants.

Key opportunities within the market are centered around technological advancements and material innovation. The development of specialized composite ENP coatings, incorporating materials like boron nitride or diamonds, offers superior lubricity and hardness, opening up niche applications in advanced robotics and medical devices. Furthermore, service providers who successfully integrate Industry 4.0 principles, including comprehensive automation, sensor technology, and AI-driven process optimization, will gain a competitive edge by offering higher yield rates and superior quality assurance. Addressing the high environmental barrier to entry by pioneering cost-effective, environmentally benign ENP chemistries—specifically those minimizing heavy metal usage or simplifying waste remediation—represents a substantial long-term market opportunity.

The impact forces within this market are shaped by both macroeconomic shifts and technological necessity. Demand elasticity is relatively low in critical end-user sectors, as ENP coatings are essential functional requirements, not optional aesthetic additions, providing market resilience against minor economic downturns. However, supply chain volatility for key raw materials, particularly nickel sulfate and hypophosphite, poses a persistent impact force affecting operational costs and pricing strategies. Regulatory compliance, particularly REACH in Europe and similar regional regulations, exerts a powerful external force, compelling continuous investment in environmental controls and process optimization to sustain market access, thus favoring large, established service providers with robust compliance frameworks.

Segmentation Analysis

The Electroless Nickel Plating service market is broadly segmented based on the type of coating phosphorus content, the nature of the substrate material treated, and the specific end-use industry utilizing the service. The phosphorus content is the most crucial differentiator, defining the coating’s properties such as hardness, magnetism, and corrosion resistance. Segmentation by substrate reflects the complexity and specialized pre-treatment required for materials like aluminum alloys, ferrous metals, and plastics. This segmentation allows service providers to tailor their offerings and expertise to specific industrial needs, driving differentiated service quality and pricing structures across the market.

- By Phosphorus Content:

- Low Phosphorus Electroless Nickel (1-5% P): Characterized by high hardness and abrasion resistance; often used in wear applications.

- Medium Phosphorus Electroless Nickel (6-9% P): The most common type, offering a balance of corrosion resistance and hardness.

- High Phosphorus Electroless Nickel (10-14% P): Offers the highest corrosion resistance, often non-magnetic; critical for marine and chemical processing environments.

- By Substrate Material:

- Ferrous Metals (Steel, Cast Iron)

- Aluminum Alloys

- Copper and Brass

- Plastics and Composites

- By End-Use Industry:

- Automotive

- Aerospace and Defense

- Oil and Gas

- Machinery and Equipment

- Electronics and Telecommunications

- Chemical Processing

- Medical Devices

- By Service Type:

- Rack Plating Services

- Barrel Plating Services

- Vibratory Plating Services

Value Chain Analysis For Electroless nickel plating service Market

The value chain for the Electroless Nickel Plating market begins upstream with the procurement of critical raw materials, primarily nickel salts (sulfate, chloride), reducing agents (sodium hypophosphite or borohydrides), stabilizers, and complexing agents. The quality and stable supply of these specialty chemicals are paramount, as they directly dictate the performance and consistency of the plating bath. Upstream analysis focuses on managing commodity price volatility and securing reliable, high-purity chemical suppliers. Key relationships are formed with major chemical producers that can guarantee consistent specifications necessary for high-precision ENP applications, especially those serving regulatory-sensitive industries like aerospace and medical manufacturing.

The core of the value chain involves the plating service provider, which handles the complex process steps: preparation (cleaning and etching), plating (bath chemistry management and deposition), and post-treatment (baking, passivation, and quality inspection). This phase requires significant capital investment in specialized tanks, filtration systems, analytical equipment, and environmental waste treatment facilities. Distribution channels for the plating service are predominantly direct, involving a close contractual relationship between the OEM or component manufacturer and the plating shop. Given the specialized nature and logistic requirements for handling precision parts, indirect channels are rare, although some larger plating conglomerates utilize regional hubs to centralize processing for multinational clients.

Downstream analysis centers on the end-user industries where the plated components are integrated, such as automotive assembly plants, aerospace component integrators, and electronics manufacturers. The value added at this stage is the critical functional enhancement—corrosion resistance, lubricity, and hardness—which contributes significantly to the final product's reliability and lifespan. This dependency means that plating service providers are often integrated early into the design cycle (Design for Manufacturability, or DFM) of critical components, necessitating a collaborative and quality-focused partnership. The overall value chain is highly reliant on compliance and certification, where successful completion of the plating step is a gateway requirement for the component to enter the final assembly line, emphasizing the high-value, non-commodity nature of the ENP service.

Electroless nickel plating service Market Potential Customers

Potential customers for Electroless Nickel Plating services are diverse but consistently belong to sectors where component durability, dimensional accuracy, and corrosion resistance are essential performance characteristics. The primary buyers are manufacturers of precision mechanical and electronic components that operate in harsh or demanding conditions. This encompasses firms producing hydraulic cylinders, internal engine components, military hardware, specialized electronics housings, and deep-sea drilling equipment. These customers prioritize vendors who can demonstrate exceptional quality control, possess necessary industrial certifications (e.g., ISO, Nadcap), and maintain strict compliance with material specifications and turnaround times, as delays in plating can halt major assembly lines.

The automotive industry represents a high-volume customer segment, particularly with the transition to Electric Vehicles (EVs). ENP is vital for coating battery connectors, bus bars, and various components within the thermal management and power delivery systems, where reliable electrical conductivity and corrosion protection are paramount. This customer base seeks high throughput capabilities combined with tight process control to ensure uniformity across millions of identical parts. Similarly, the oil and gas sector demands plating services for downhole tools, valves, and pumps which are constantly exposed to high pressures, high temperatures, and corrosive sulfur compounds, making high-phosphorus ENP a mandatory requirement for component survival.

Beyond these heavy industries, the medical device sector and the high-tech electronics market constitute critical, high-value customer segments. Medical device manufacturers require biocompatible ENP coatings for instruments and implants, prioritizing cleanliness and precision. Electronics companies, especially those dealing with advanced sensor technology and telecommunications infrastructure, are customers seeking specific properties like non-magnetic coatings, uniform soldering surfaces, and protection against fretting corrosion. These diverse customer needs underscore the specialization required by ENP service providers, necessitating tailored chemistries and quality assurance protocols for each distinct end-use application.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aalberts surface technologies, Precision Plating, Allied Finishing Inc., MacDermid Enthone, Atotech, Pioneer Metal Finishing, Metal Surfaces Inc., Plating Technology Inc., Lincoln Industries, Electro-Spec Inc., American Metal Finishing, Surface Technology Inc., KCH Engineered Systems, Asterion, Coventya, Okuno Chemical Industries, Columbia Chemical, Advanced Plating Technologies, TWR Service Corp., Technic Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electroless nickel plating service Market Key Technology Landscape

The technological landscape of the Electroless Nickel Plating service market is continually evolving, driven by the need for enhanced deposit performance, greater process efficiency, and stringent environmental compliance. A fundamental technology shift involves the refinement of bath chemistry to produce high-performance composite coatings. Advanced ENP baths now frequently incorporate non-metallic particles—such as PTFE (Teflon) for enhanced lubricity and reduced friction, or ceramic particulates like silicon carbide (SiC) and aluminum oxide (Al2O3) for superior abrasion resistance and extreme hardness. This composite technology allows service providers to offer highly customized surface solutions that traditional ENP could not match, directly addressing the demanding specifications of aerospace and advanced manufacturing sectors seeking superior wear characteristics without sacrificing corrosion resistance.

Process control technology constitutes another major area of innovation. Modern plating operations are increasingly adopting closed-loop systems utilizing advanced sensors (ion-selective electrodes, spectrophotometers) combined with sophisticated data processing capabilities. These systems enable real-time monitoring and automated dosing of bath components, moving away from time-based or scheduled manual additions. This technological integration ensures bath consistency, reduces chemical consumption, minimizes waste generation, and, most importantly, stabilizes the plating rate and deposit quality across extended operational periods. The implementation of spectrophotometry, in particular, allows for rapid, accurate analysis of complexing agents and stabilizers, preventing premature bath breakdown, a significant operational challenge in ENP.

Furthermore, wastewater treatment and environmental technology are integral to the modern ENP landscape. Regulatory pressure necessitates the deployment of advanced ion exchange, membrane filtration, and electrochemical treatment technologies to remove heavy metals like nickel and copper from effluent streams efficiently. Service providers are increasingly investing in zero liquid discharge (ZLD) systems and regeneration technologies that reclaim and reuse bath constituents, reducing both operational costs and environmental footprint. This focus on sustainable chemistry and waste minimization is not only a regulatory requirement but is rapidly becoming a competitive necessity, positioning environmentally conscious firms as preferred partners for globally operating OEMs.

Regional Highlights

The global Electroless Nickel Plating service market exhibits distinct regional dynamics, influenced primarily by industrial concentration, regulatory frameworks, and technological adoption rates.

- Asia Pacific (APAC): APAC dominates the market both in terms of volume growth and investment potential. Driven by massive manufacturing output in automotive components, consumer electronics (smartphones, semiconductor packaging), and machinery in China, South Korea, and India, the demand for ENP services is accelerating. The region benefits from lower operating costs and burgeoning domestic demand, though adherence to international quality standards (e.g., Nadcap) is becoming a competitive differentiator for exporters. This region is a major hub for medium-phosphorus ENP services.

- North America: North America holds a mature but high-value segment of the market, driven fundamentally by the aerospace and defense (A&D) industries and advanced oil and gas operations. The demand here is concentrated in high-specification, critical applications, often requiring high-phosphorus and composite ENP for extreme durability and precise compliance with military and aerospace specifications. Technological innovation, especially in automation and AI-driven quality assurance, is high among service providers in this region.

- Europe: Europe represents a highly regulated market, where ENP services are governed by stringent environmental policies like REACH. The market is supported by the automotive (especially luxury and performance vehicles), industrial machinery, and medical device sectors. European demand focuses heavily on quality, traceability, and the use of environmentally preferred chemistries. Germany, France, and the UK are key contributors, emphasizing highly specialized, certified plating services.

- Latin America (LATAM): The LATAM market, while smaller, shows potential tied to localized automotive production (Brazil, Mexico) and resource extraction industries. Growth is contingent on foreign direct investment in manufacturing capabilities, leading to intermittent demand spikes. Service providers often focus on cost-effective medium-phosphorus solutions for local industrial requirements.

- Middle East and Africa (MEA): This region is primarily driven by the massive oil and gas and petrochemical industries. The extreme corrosive environments inherent in these operations necessitate premium ENP services, especially high-phosphorus coatings for downhole tools and pipeline components, ensuring reliable operation and mitigating expensive failures. Regional development of manufacturing infrastructure is also slowly broadening the demand base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electroless nickel plating service Market.- Aalberts surface technologies

- Precision Plating

- Allied Finishing Inc.

- MacDermid Enthone (now Element Solutions Inc.)

- Atotech (now MKS Instruments)

- Pioneer Metal Finishing

- Metal Surfaces Inc.

- Plating Technology Inc.

- Lincoln Industries

- Electro-Spec Inc.

- American Metal Finishing

- Surface Technology Inc.

- KCH Engineered Systems

- Asterion

- Coventya

- Okuno Chemical Industries

- Columbia Chemical

- Advanced Plating Technologies

- TWR Service Corp.

- Technic Inc.

Frequently Asked Questions

Analyze common user questions about the Electroless nickel plating service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Electroless Nickel Plating over traditional electroplating?

The main advantage of ENP is its ability to deposit a coating of uniform thickness across complex part geometries, including internal bores and sharp edges, without the use of electricity. It also provides superior corrosion resistance, high hardness, and controllable magnetic properties through phosphorus content variation.

How does the phosphorus content influence the performance of ENP coatings?

Phosphorus content dictates key coating properties: Low phosphorus (1–5% P) results in high hardness and excellent wear resistance. Medium phosphorus (6–9% P) offers a balance of hardness and corrosion resistance. High phosphorus (10–14% P) provides maximum corrosion protection and is non-magnetic, ideal for electronic and chemical processing environments.

Which industry sectors are the largest consumers of high-specification ENP services?

The largest consumers are the Aerospace and Defense sector, requiring Nadcap-certified, high-reliability coatings for critical components (e.g., landing gear, actuators), and the Oil and Gas industry, demanding high-phosphorus coatings for extreme corrosion protection on downhole tools and valves.

What is the role of automation and AI in modern Electroless Nickel Plating facilities?

Automation and AI are crucial for maintaining consistent quality and efficiency. They are used for real-time monitoring and automated adjustment of bath chemistry (process control), optimizing part handling, and implementing advanced automated optical inspection (AOI) for defect detection and quality assurance.

What are the major environmental and regulatory challenges facing ENP service providers?

Key challenges include complying with strict regulations such as REACH regarding hazardous chemicals, managing the disposal of nickel-containing wastewater, and reducing overall chemical consumption. Investment in closed-loop systems and sustainable, alternative chemistries is mandatory for long-term viability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager