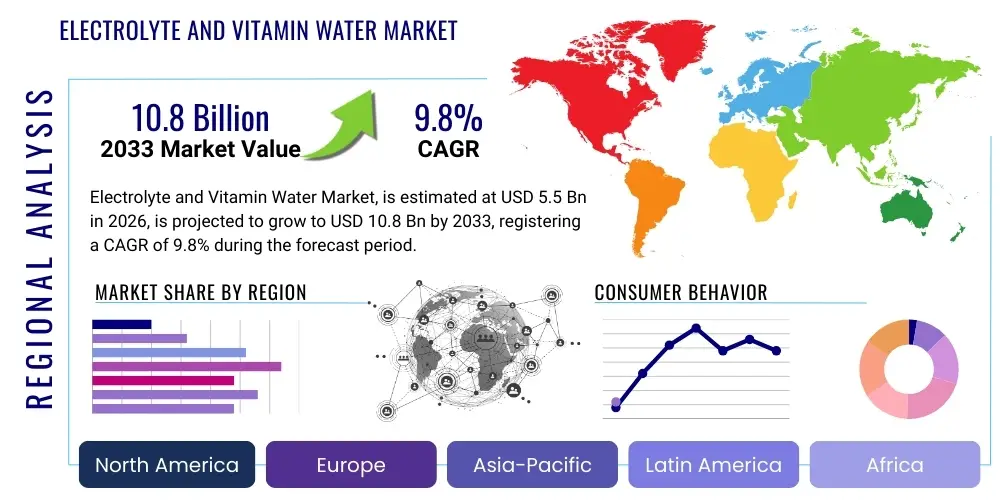

Electrolyte and Vitamin Water Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439106 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Electrolyte and Vitamin Water Market Size

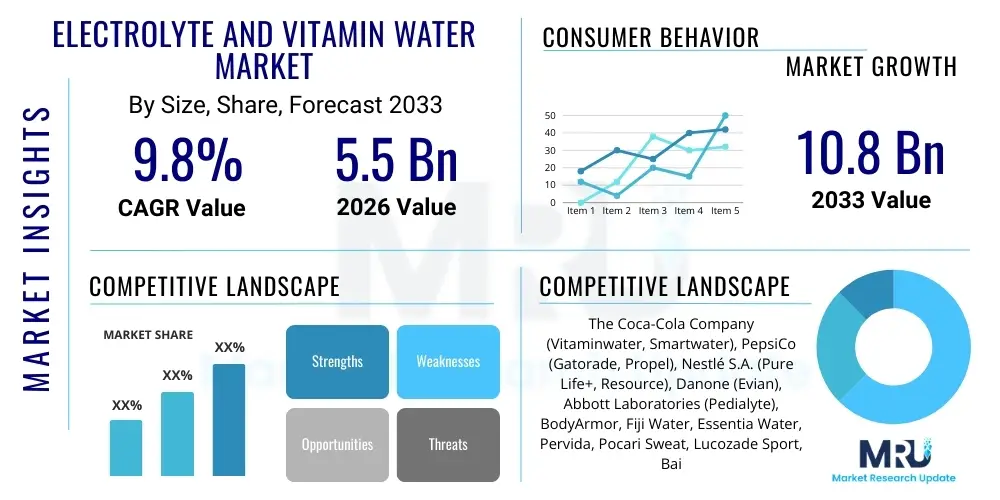

The Electrolyte and Vitamin Water Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 10.8 Billion by the end of the forecast period in 2033. This significant expansion is primarily driven by heightened consumer awareness regarding proactive health management, shifting preferences away from high-sugar carbonated soft drinks, and the increasing adoption of functional beverages tailored for specific physiological benefits, such as enhanced hydration and nutrient replenishment.

Electrolyte and Vitamin Water Market introduction

The Electrolyte and Vitamin Water Market encompasses ready-to-drink (RTD) beverages formulated to provide essential micronutrients, primarily vitamins (B complex, C, D) and electrolytes (sodium, potassium, magnesium, chloride). These products bridge the gap between plain water and high-calorie sports drinks, offering hydration combined with functional health benefits. Vitamin water typically focuses on general wellness and immunity support, while electrolyte beverages are centered on rapid rehydration and mineral balance, crucial after physical exertion or illness. Major applications span daily wellness routines, sports and fitness recovery, and medically supervised rehydration therapy. The primary benefit these beverages offer is convenient access to micronutrients necessary for optimal bodily function, supporting energy metabolism, nerve signaling, and fluid regulation.

Driving factors propelling market growth include the global wellness movement, where consumers actively seek nutrient-dense foods and beverages to enhance longevity and quality of life. The perceived health halo surrounding ‘natural’ or ‘functional’ ingredients further encourages consumption. Furthermore, changing demographic profiles, specifically the growing population of fitness enthusiasts and aging consumers requiring enhanced nutritional support, contribute significantly to demand. The market is also heavily influenced by continuous product innovation, introducing natural sweeteners, exotic flavors, and condition-specific formulations (e.g., focus, relaxation, immune boost).

The product landscape is characterized by continuous differentiation. Electrolyte waters are evolving beyond basic salt solutions, incorporating trace minerals and lower sodium profiles to appeal to general consumers rather than just athletes. Vitamin waters are moving towards clean labels, eliminating artificial colors and preservatives, and emphasizing high bioavailability of added vitamins. This focus on purity and functional efficacy is critical for maintaining consumer trust in a highly competitive and often scrutinized beverage category. The accessibility through various distribution channels, including e-commerce, supermarkets, and specialty fitness stores, further solidifies market penetration globally.

Electrolyte and Vitamin Water Market Executive Summary

The global Electrolyte and Vitamin Water Market is experiencing robust growth driven by converging trends in health consciousness and convenience. Business trends indicate a strong shift towards premiumization, with consumers willing to pay higher prices for products featuring organic ingredients, low sugar content, and specialized functional additives like nootropics or adaptogens. Key players are heavily investing in sustainable packaging solutions, particularly recycled polyethylene terephthalate (rPET) and aluminum cans, aligning with growing environmental, social, and governance (ESG) investor interest. Strategic mergers, acquisitions, and collaborations between major beverage conglomerates and niche functional drink startups are intensifying competition and accelerating innovation cycles, especially in personalized nutrition.

Regionally, North America and Europe remain the dominant markets due to high disposable income, well-established retail infrastructure, and mature health and fitness industries. However, the Asia Pacific (APAC) region is projected to register the fastest growth, fueled by rapid urbanization, increasing middle-class expenditure on health products, and rising incidence of non-communicable diseases prompting preventive consumption habits. Governments in emerging economies are also promoting hydration and nutritional awareness campaigns, indirectly boosting demand for fortified beverages. Latin America and MEA show nascent growth, focusing primarily on affordable, basic rehydration solutions, but are gradually introducing premium vitamin-fortified options.

Segment trends highlight the dominance of the electrolyte water segment, particularly in high-performance sports hydration, though vitamin water maintains a strong foothold in the general wellness category. The shift from synthetic to natural flavors and sweeteners (like stevia and monk fruit) is paramount across all segments. Distribution channel analysis shows e-commerce platforms gaining significant traction, offering consumers unprecedented access to niche and international brands, challenging the traditional dominance of supermarket and hypermarket channels. The increasing demand for pediatric and senior-specific formulations represents an emerging, high-potential segment.

AI Impact Analysis on Electrolyte and Vitamin Water Market

User queries regarding AI’s influence on the functional beverage market center predominantly on three areas: personalized hydration recommendations, supply chain optimization for volatile fresh ingredients, and AI-driven flavor and formulation development. Consumers are keen to understand how AI can move beyond generic products to offer hyper-personalized hydration based on real-time biometric data (e.g., activity levels, sweat rate, location, diet). Manufacturers are focused on leveraging machine learning to predict consumer flavor preferences across different demographics and regions, significantly reducing product development cycles and associated costs. Furthermore, stakeholders are concerned with how AI can enhance transparency and traceability within the complex supply chain of specialty vitamins and natural extracts, ensuring ingredient quality and authenticity.

- AI-driven personalized hydration protocols based on wearable technology data.

- Machine learning algorithms optimizing flavor pairings and ingredient matrices for improved palatability and efficacy.

- Predictive demand forecasting and inventory management reducing spoilage of natural ingredients and maintaining shelf life.

- Automated quality control systems (QC) utilizing computer vision to detect inconsistencies in bottling and labeling processes.

- Enhanced consumer experience through AI chatbots providing instant nutritional information and usage guidance.

- Optimization of agricultural practices for sourcing natural vitamins and electrolytes, utilizing smart farming techniques.

- Targeted digital marketing campaigns identifying micronutrient deficiencies prevalent in specific consumer groups.

- Supply chain traceability enhanced by blockchain integrated with AI monitoring systems.

DRO & Impact Forces Of Electrolyte and Vitamin Water Market

The market dynamics are shaped by a powerful interplay of drivers, restraints, and opportunities, which collectively determine the impact forces on industry growth. Key drivers include the global epidemic of lifestyle diseases, necessitating proactive nutritional intervention, and the escalating trend of fitness and sporting participation globally, creating a constant need for effective rehydration products. The high level of innovation in ingredient science, allowing for better bioavailability and clean-label solutions, further pushes demand. Conversely, significant restraints include the regulatory scrutiny over health claims, particularly regarding vitamin fortification levels and sugar content, and the high cost associated with premium functional ingredients, which can make the final product inaccessible to lower-income segments.

Opportunities abound in developing specialized formulations targeting niche health concerns such as cognitive function (nootropics), sleep quality (magnesium and L-theanine), and gastrointestinal health (prebiotics combined with electrolytes). Emerging markets, particularly in Asia, offer immense untapped consumer bases, provided companies can adapt packaging and flavor profiles to local preferences. The shift toward sustainable, plant-based electrolyte sources (like coconut water and maple water) also presents a significant premiumization opportunity. The collective impact forces show a positive trajectory, where the strong drivers, particularly consumer health mandates and product innovation, outweigh the existing restraints, propelling the market forward at a substantial CAGR.

Segmentation Analysis

The Electrolyte and Vitamin Water Market is highly segmented based on product type, packaging format, distribution channel, and application, allowing manufacturers to tailor offerings to specific consumer needs. Product type segmentation distinguishes between pure electrolyte solutions primarily focused on mineral replenishment and vitamin-fortified waters targeting general wellness and immunity. The growing preference for personalized health solutions is driving granular sub-segmentation based on specific ingredients, such as beverages fortified exclusively with B vitamins for energy or those emphasizing Vitamin D and calcium for bone health. Understanding these segments is crucial for market entry and competitive positioning.

- Product Type:

- Electrolyte Water

- Vitamin Water

- Fortified Functional Water (e.g., Protein, Collagen)

- Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Specialty Stores (e.g., Fitness Centers, Pharmacies)

- Packaging Format:

- Bottles (PET, Glass)

- Cans

- Pouches/Cartons

- Application:

- Sports & Fitness Hydration

- General Wellness & Health

- Pediatric Rehydration

- Medical/Clinical Rehydration

Value Chain Analysis For Electrolyte and Vitamin Water Market

The value chain for the Electrolyte and Vitamin Water Market starts with upstream activities involving the sourcing of highly specialized ingredients. This includes the extraction and purification of essential mineral salts (potassium chloride, sodium citrate), high-grade water purification processes (reverse osmosis, deionization), and the synthesis or natural extraction of vitamins (e.g., B vitamins, ascorbic acid). Quality assurance and regulatory compliance at the sourcing stage are paramount, as the efficacy and safety of the final product depend heavily on the purity of these inputs. Competition in this upstream segment is driven by cost efficiency and the ability to source sustainable, clean-label raw materials, often requiring proprietary agreements with specialized nutrient suppliers.

The midstream involves manufacturing, blending, bottling, and packaging. This stage is capital-intensive, requiring advanced aseptic processing technologies to maintain the integrity and bioavailability of the vitamins and electrolytes. Efficiency in blending and precise dosing of micronutrients are critical quality metrics. Packaging involves significant logistics planning, utilizing materials such as PET, rPET, and aluminum, where sustainability metrics heavily influence material selection. Direct distribution often involves the use of specialized temperature-controlled logistics, especially for products with natural ingredients or shorter shelf lives, ensuring product freshness upon reaching the end consumer.

Downstream activities focus on reaching the consumer through a multi-channel distribution network. Direct distribution to large retailers and hypermarkets allows for high-volume movement, while indirect channels leverage third-party logistics (3PLs) and e-commerce aggregators. E-commerce platforms are increasingly vital, offering market access to smaller, specialized brands and enabling personalized subscription services. The success downstream depends on effective shelf placement, high-impact marketing, and strategic pricing tailored to regional purchasing power. Consumer feedback mechanisms and real-time sales data analysis complete the loop, informing future product formulation and supply planning.

Electrolyte and Vitamin Water Market Potential Customers

The potential customers for the Electrolyte and Vitamin Water Market are diverse, ranging from high-performance athletes to general health-conscious individuals and specific demographic groups requiring targeted nutritional support. Athletes and fitness enthusiasts constitute a primary consumer base, relying on electrolyte water for rapid recovery from intense training, optimizing performance, and preventing dehydration-related injuries. This segment demands products with scientifically proven mineral ratios and low caloric content.

The second major group includes general wellness consumers, often office workers or active seniors, who use vitamin water as a daily functional beverage replacement for sugary sodas or juices. These buyers prioritize clean labels, immune-boosting ingredients (like Vitamin C and Zinc), and convenience, viewing the product as a proactive investment in long-term health. A rapidly growing segment includes millennials and Gen Z, who are highly influenced by social media health trends and prefer aesthetically pleasing, sustainable packaging coupled with specific functional claims (e.g., focus, beauty, sleep).

Niche customers include individuals recovering from illness (pediatric and adult clinical use), where electrolyte solutions are medically necessary to restore fluid balance, and consumers following specific dietary regimes (e.g., keto, vegan), who seek fortified waters to address potential micronutrient deficiencies inherent in restrictive diets. Marketing efforts must be segmented to address the unique drivers and purchasing criteria of each customer group, whether it be performance enhancement, general vitality, or clinical necessity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Coca-Cola Company (Vitaminwater, Smartwater), PepsiCo (Gatorade, Propel), Nestlé S.A. (Pure Life+, Resource), Danone (Evian), Abbott Laboratories (Pedialyte), BodyArmor, Fiji Water, Essentia Water, Pervida, Pocari Sweat, Lucozade Sport, Bai Brands, Sparkling Ice, HALO Hydration, SOS Hydration, Liquid I.V., Keurig Dr Pepper (CORE Hydration), Nuun, Electrolit. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrolyte and Vitamin Water Market Key Technology Landscape

The technological landscape driving the Electrolyte and Vitamin Water Market is centered around advanced purification, nutrient stabilization, and customized formulation capabilities. Water purification technologies, specifically multi-stage reverse osmosis (RO) and sophisticated filtration methods, are crucial to ensure a clean base product free of contaminants before mineral and vitamin fortification. A key innovation area is micronutrient encapsulation and stabilization technology, which protects sensitive vitamins (like Vitamin C and B vitamins) from degradation due due to light, heat, or oxidation, thereby ensuring a longer shelf life and maintaining high bioavailability when consumed. Manufacturers utilize micro-encapsulation techniques to mask undesirable tastes associated with certain vitamins or mineral salts, enhancing consumer acceptance.

Furthermore, aseptic and high-speed bottling technologies are standard, enabling the mass production of fortified beverages without the need for excessive preservatives, supporting the clean-label trend. Advanced sensor technology and inline monitoring systems are integrated into manufacturing lines to ensure precise blending ratios of electrolytes and vitamins, which is critical for meeting regulatory standards and achieving consistent product quality. The integration of IoT devices in the production environment allows for predictive maintenance and real-time anomaly detection, maximizing operational efficiency and reducing downtime.

In terms of product development, computational fluid dynamics (CFD) and AI-driven predictive modeling are increasingly used to simulate how new ingredient combinations interact within a liquid matrix, predicting stability and potential flavor degradation before costly physical prototypes are created. This accelerates time-to-market for innovative functional blends. Additionally, personalized hydration technology, often involving algorithms analyzing data from wearables, is the frontier of technology application, enabling companies to develop highly specialized supplement powders or liquid concentrates tailored to individual physiological needs, moving beyond mass-market products.

Regional Highlights

The geographical analysis of the Electrolyte and Vitamin Water Market reveals distinct patterns of consumption, regulatory environments, and growth potential across major global regions. North America holds the largest market share, characterized by high consumer awareness, widespread adoption of premium sports and fitness culture, and aggressive marketing by established global brands. The region benefits from high consumer spending on functional food and beverages, driven by pervasive lifestyle trends emphasizing health and preventative medicine. Innovation in the U.S. market often sets global trends, particularly concerning low-sugar, natural ingredient formulations, and personalized nutrition platforms.

Europe represents a mature yet dynamic market, with stringent regulations governing nutritional claims and ingredient sourcing, forcing manufacturers to emphasize organic certification and minimal processing. Western European countries, notably Germany, the UK, and France, exhibit high demand for electrolyte water focusing on post-exercise recovery and digestive health. The market growth in Europe is steady, supported by environmental concerns that drive demand for products packaged in sustainable, reusable, or highly recyclable materials. Clean-label requirements are particularly strong, favoring naturally sourced electrolytes like mineral salts from pristine environments.

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the forecast period. This explosive growth is attributed to rising disposable incomes in countries like China and India, shifting dietary habits influenced by Western culture, and severe climatic conditions necessitating efficient rehydration solutions. While Japan and South Korea already have sophisticated functional beverage markets, the rapid expansion of organized retail and e-commerce in developing APAC nations is unlocking immense potential. Localized flavor preferences and the incorporation of traditional Asian ingredients (e.g., ginseng, ginger) into functional water formulations are key strategies for market success in this diverse region. Government health initiatives targeting malnutrition and hydration also play a supportive role.

- North America: Dominant market share; driven by robust fitness culture, high prevalence of premium brands, and substantial investment in functional ingredients research.

- Europe: Characterized by strict regulatory standards; strong preference for organic, clean-label, and sustainably packaged electrolyte solutions focused on daily health.

- Asia Pacific (APAC): Highest projected CAGR; fueled by urbanization, rising health expenditure, and rapid e-commerce penetration, with high demand for accessible rehydration products.

- Latin America (LATAM): Growing market focused on affordability and basic rehydration needs, with potential for premiumization in urban centers like Brazil and Mexico.

- Middle East & Africa (MEA): Nascent market primarily driven by extreme climatic conditions (heat) necessitating electrolyte replenishment, alongside increasing influence of international brands in affluent Gulf Cooperation Council (GCC) nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrolyte and Vitamin Water Market.- The Coca-Cola Company (Vitaminwater, Smartwater)

- PepsiCo (Gatorade, Propel)

- Nestlé S.A. (Pure Life+, Resource)

- Danone (Evian)

- Abbott Laboratories (Pedialyte)

- BodyArmor (Acquired by Coca-Cola)

- Fiji Water

- Essentia Water

- Pervida

- Pocari Sweat (Otsuka Pharmaceutical)

- Lucozade Sport (Suntory)

- Bai Brands (Acquired by Dr Pepper Snapple Group)

- Sparkling Ice (Talking Rain Beverage Company)

- HALO Hydration

- SOS Hydration

- Liquid I.V. (Acquired by Unilever)

- Keurig Dr Pepper (CORE Hydration)

- Nuun (Acquired by Nestlé Health Science)

- Electrolit (Grupo Pisa)

- Powerade (The Coca-Cola Company)

Frequently Asked Questions

Analyze common user questions about the Electrolyte and Vitamin Water market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between electrolyte water and vitamin water?

Electrolyte water is formulated primarily for rapid mineral replenishment and hydration balance, containing essential salts like sodium and potassium, often targeting post-exercise recovery. Vitamin water focuses on delivering specific micronutrients (e.g., B vitamins, Vitamin C) to support general wellness, energy, and immunity, typically consumed as a daily functional beverage.

What are the key factors driving the growth of the Electrolyte and Vitamin Water Market?

Key growth drivers include escalating global consumer interest in proactive health management, the expanding fitness and sports culture, increasing awareness of hydration benefits, and a persistent consumer shift away from high-sugar carbonated beverages towards functional, low-calorie alternatives with perceived nutritional benefits.

Which region currently dominates the Electrolyte and Vitamin Water market share?

North America currently holds the largest market share, driven by strong consumer purchasing power, extensive functional beverage penetration, advanced retail infrastructure, and high levels of participation in sports and fitness activities, which necessitate specialized hydration products.

How is technology impacting the development of functional water products?

Technology primarily impacts functional water through advanced micronutrient stabilization techniques (like encapsulation) to maintain vitamin efficacy, aseptic bottling for cleaner labels, and increasingly, AI and data analytics used for predicting ideal personalized formulations and optimizing complex supply chains for natural ingredients.

What challenges does the market face regarding sugar and ingredient transparency?

The market faces challenges regarding consumer perception of sugar content, leading to strong pressure to adopt natural, low-calorie sweeteners (stevia, monk fruit). Additionally, regulatory bodies and consumers demand higher ingredient transparency concerning the sourcing, purity, and scientific validation of specific functional claims made by manufacturers.

The market analysis reveals a complex yet highly opportune landscape, characterized by continuous innovation aimed at addressing nuanced consumer health requirements. The future of the electrolyte and vitamin water segment is heavily reliant on clean-label integrity, sustainable practices, and the successful integration of technology to deliver truly personalized hydration experiences. Manufacturers are increasingly prioritizing ingredient provenance, ensuring that electrolytes are sourced from natural mineral deposits or plant-based sources, thereby strengthening the product’s position in the premium segment. This commitment to transparency and natural sourcing is a non-negotiable requirement for capturing the loyalty of health-conscious millennials and Gen Z consumers globally.

Furthermore, regulatory compliance is becoming an even more rigorous area, particularly in regions like the EU, where health claims are subject to strict scientific scrutiny. Companies must invest heavily in clinical trials and nutritional research to substantiate the benefits claimed for vitamin absorption and electrolyte efficacy. Failure to adhere to these standards can result in significant market penalties and loss of consumer trust. The strategic response from industry leaders involves preemptive self-regulation and collaboration with nutritional science experts to ensure that product development is ethically and scientifically grounded, moving away from past instances of exaggerated marketing claims.

The segmentation based on application is witnessing dynamic shifts, especially within the medical and clinical space. While traditionally, pediatric rehydration solutions dominated the clinical segment, there is an increasing adoption of specialized adult electrolyte formulas designed for managing chronic conditions or post-operative recovery, highlighting the therapeutic potential beyond basic sports hydration. This shift necessitates specialized distribution channels, often involving pharmacies and healthcare facilities, requiring higher standards of quality control and medical endorsement. Investment in specialized medical food certifications represents a significant barrier to entry but offers high-margin opportunities for focused players.

The packaging format segment is undergoing a significant transformation driven by sustainability mandates. The transition from standard PET bottles to 100% rPET or aluminum cans is accelerating, often incurring higher initial costs but providing substantial brand equity due to improved environmental performance. Consumers, particularly in developed markets, are actively seeking out brands that minimize plastic waste. This environmental consciousness extends to labeling, with brands adopting minimalist, easily recyclable labels and utilizing water-soluble inks to further enhance the sustainability profile of their packaging solutions.

Considering the competitive landscape, strategic acquisitions are expected to continue, allowing large beverage corporations to instantly gain access to specialized technology and unique ingredient intellectual property held by innovative startups. For instance, the acquisition of brands specializing in oral rehydration solutions (ORS) or mineral-rich waters provides incumbents with immediate access to rapidly growing, high-margin segments. This strategy also serves to diversify the product portfolio against the backdrop of fluctuating consumer tastes and increasing competition from niche functional beverage categories like enhanced sparkling water and kombucha.

The role of digital marketing and e-commerce platforms cannot be overstated in this market. Online sales channels facilitate direct-to-consumer (D2C) models, allowing smaller brands to bypass traditional retail gatekeepers and build strong community engagement. Personalized advertising, leveraging data on consumer fitness habits and nutrient search history, enables highly effective micro-targeting. Subscription box services specializing in functional beverages are gaining popularity, offering consumers convenience and consistent access to their preferred hydration and wellness products, further solidifying the importance of digital retail infrastructure.

Finally, the influence of macro-environmental factors, such as climate change and urbanization, plays a critical role. Increasing global temperatures lead to greater physiological demands for efficient hydration, particularly in densely populated urban environments. This provides a long-term, non-cyclical driver for the electrolyte water segment. Public health authorities are beginning to recognize the importance of accessible and effective rehydration products, potentially leading to supportive policies or procurement programs in certain jurisdictions, especially in regions prone to extreme heat waves or poor sanitation conditions, further bolstering institutional demand.

The detailed regional dynamics show that while North America leads in innovation volume, the future growth epicenter resides in the Asia Pacific region. Companies must navigate diverse regulatory requirements—from the strict ingredient purity mandates in Europe to the market scale demands in China and India. The development of specialized regional supply chains capable of efficiently delivering sensitive functional ingredients across varying climates is key to capitalizing on APAC's projected market expansion. Furthermore, building localized partnerships with traditional distribution networks remains crucial, especially in regions where modern retail penetration is still developing.

In conclusion, the Electrolyte and Vitamin Water Market is poised for sustained, high-value growth, driven by fundamental shifts in global health perceptions and enabled by technological advancements in formulation and distribution. Success in this evolving market hinges upon a deep commitment to ingredient quality, rapid response to sustainability demands, and the strategic deployment of personalized, functional beverage solutions across global consumer touchpoints.

The investment in research and development remains a cornerstone for competitive advantage. Companies are focusing on integrating adaptogens (like ashwagandha and rhodiola) and nootropics (like L-theanine and caffeine derivatives) into their functional water lines, blurring the lines between traditional hydration and performance-enhancing supplements. This 'fusion' approach appeals to consumers seeking holistic benefits from a single beverage. The challenge lies in ensuring that these complex formulations maintain stability and taste appeal over their shelf life, requiring sophisticated flavor chemistry and stabilization techniques, pushing the boundaries of beverage science significantly.

Understanding consumer psychology regarding perceived value is also vital. The market differentiates itself through sensory appeal, health narrative, and brand authenticity. Consumers often associate higher prices with superior ingredient quality, especially concerning organically sourced vitamins or electrolytes derived from exotic locations. Marketing narratives that highlight the 'clean energy' or 'natural immunity boost' derived from the product, supported by transparent sourcing information, effectively justify premium pricing tiers, distinguishing top-tier brands from generic offerings in the competitive middle ground.

Regarding market segmentation by packaging format, the move towards smaller, single-serve aluminum cans is gaining traction, particularly for vitamin water. Cans offer superior protection against UV light, which degrades many vitamins, ensuring better nutrient retention. This format also aligns better with the portability and grab-and-go convenience demanded by the millennial and Gen Z demographic, fitting seamlessly into active, fast-paced urban lifestyles. Conversely, bulk-sized multi-liter bottles remain popular in value-conscious segments and for household consumption, primarily focused on basic electrolyte replenishment.

The competitive landscape is marked by continuous price wars in the entry-level segments, pressuring manufacturers to optimize operational efficiencies. However, the premium segment operates largely based on brand loyalty and functional efficacy, insulating it somewhat from price volatility. Niche players often succeed by focusing on specific dietary needs, such as products optimized for intermittent fasting, ketogenic diets, or specific allergies, thereby cultivating a dedicated and less price-sensitive consumer base that values specialized formulation over mass-market appeal. Strategic patenting of unique mineral blends or proprietary stabilization methods is a crucial defensive strategy against rapid imitation.

Finally, the integration of health metrics via digital platforms represents a massive future opportunity. Imagine electrolyte water bottles equipped with smart caps that monitor consumption rates and communicate with a fitness app, adjusting recommended intake based on real-time sweat loss predictions. This level of connectivity transforms the product from a static commodity into an interactive health solution. Companies that successfully bridge the gap between product consumption and personalized digital health monitoring will secure a dominant competitive advantage in the next decade of functional beverage evolution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager